Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 15 September 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 15 September 2015[font color=black][/font]

SMW for 14 September 2015

AT THE CLOSING BELL ON 14 September 2015

[center][font color=red]

Dow Jones 16,370.96 -62.13 (-0.38%)

S&P 500 1,953.03 -8.02 (-0.41%)

Nasdaq 4,805.76 -16.58 (-0.34%)

[font color=red]10 Year 2.18% +0.01 (0.46%)

30 Year 2.95% +0.02 (0.68%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)But I'd insist on composting the failed candidates---reduce them to fertilizer!

That way they can't come back like gassy food.

Demeter

(85,373 posts)and despite the lack of smell and taste, I had a piece of peach pie from the fruit I picked Thursday...it would have been even better if the Kid hadn't eaten all the vanilla ice cream...

Nearly well, but not quite. My ribs ache from coughing. The sinus infection is nearly gone...a couple more days should do it. But I worked anyway, so it's bedtime. When Demeter's eyes won't stay open, you get to see how badly she did in touch-typing class. (I got a D, lack of speed)

DemReadingDU

(16,000 posts)At least you are finally recovering!

Demeter

(85,373 posts)The daily improvement is noticeable....I just want it to be over!

Demeter

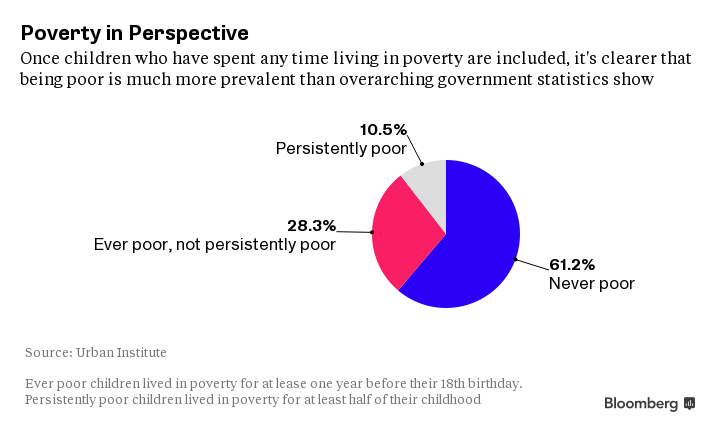

(85,373 posts)We already know that poverty disproportionately affects children, with about 20 percent of those younger than 18 impoverished versus about 13 percent of adults. New research from the Urban Institute in Washington shows child poverty is actually more common than those headline statistics suggest, and that has consequences for success in adulthood.

Some 39 percent of children are poor for at least one year before they reach their 18th birthday, according to Caroline Ratcliffe, a senior fellow and economist at Urban. For black children, that statistic is 75 percent, compared with 30 percent of whites.

A child is identified as poor if they live in a family whose gross annual money income is below the federal poverty level. For a family of three in 2015, that threshold is $20,090, according to the paper.

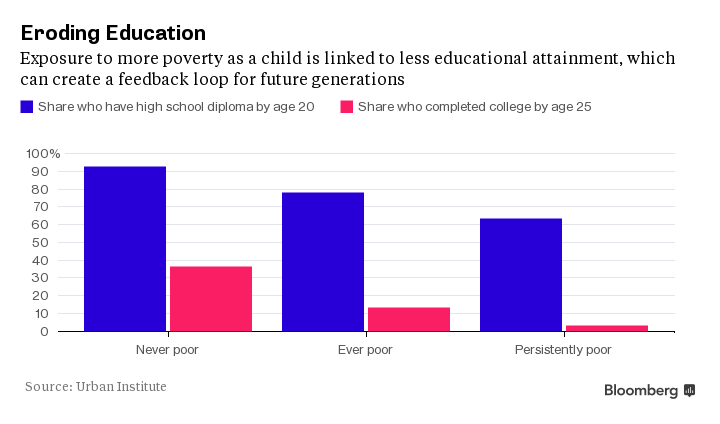

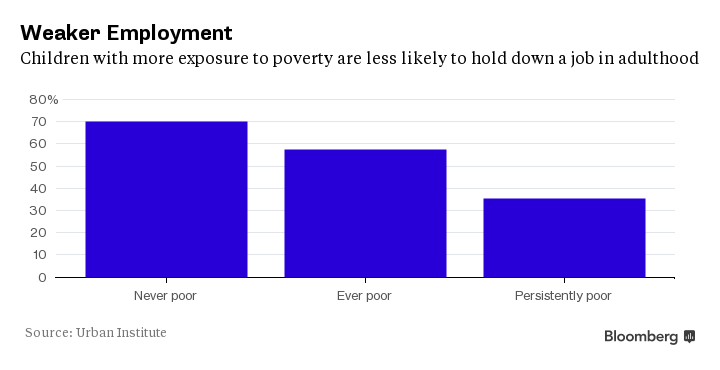

Poverty has huge implications for economic outcomes later in life, leaving children who experienced poverty "less likely to achieve important adult milestones," Ratcliffe wrote. Here are some of the things that tend to happen to Americans who grow up poor.

1. They have a harder time finishing high school and college

2. They struggle to get or keep jobs as young adults

3. They have higher rates of teen pregnancy

DETAILS AT LINK

Demeter

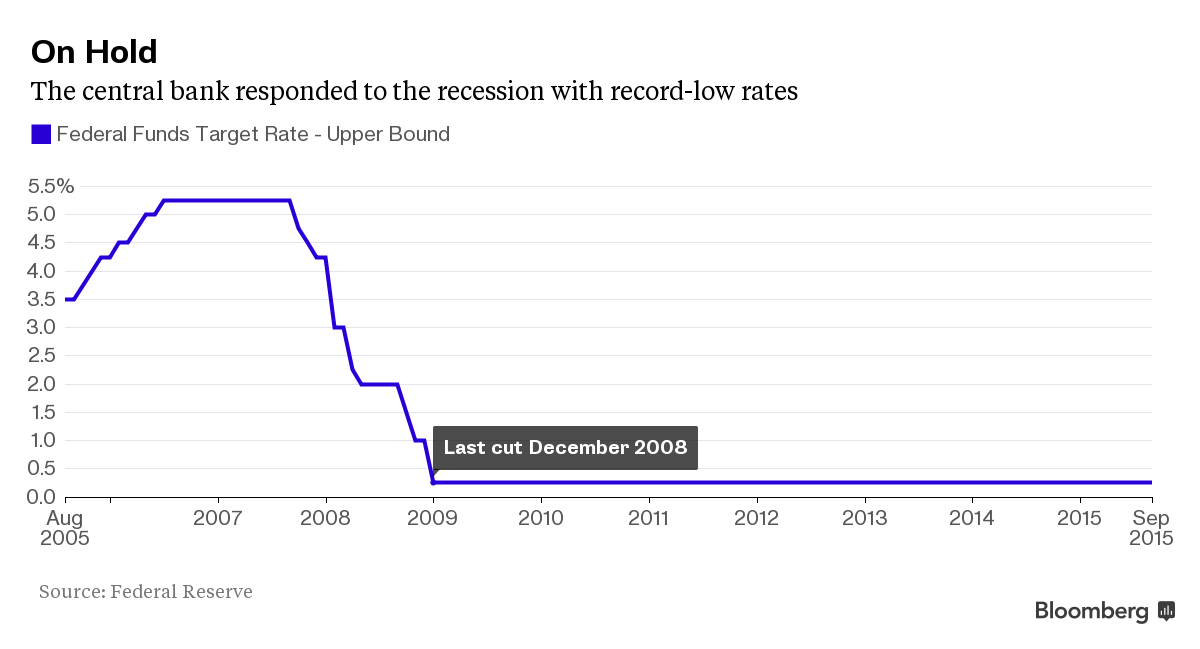

(85,373 posts)If the Federal Reserve doesn’t raise interest rates this week, Bill Loving may have to do it himself. The president and chief executive officer of Pendleton Community Bank, headquartered in Franklin, West Virginia, says he sees “increasing loan demand” that will heat up if the central bank keeps its record stimulus in place. Then he’ll have to boost his deposit rates to pull in more funds to lend.

“Customers feel more confident,” Loving says in an interview at O’Neill’s restaurant on North Main Street in Moorefield, West Virginia, about 130 miles west of Fed headquarters in Washington. “They are feeling better about where things are.”

Loving is a country banker. Pendleton, a subsidiary of Allegheny Bancshares Inc., has five branches scattered among valley towns like Moorefield and Harrisonburg, Virginia. Clients include home-loan borrowers, shopkeepers, grade school students who bring pots of coins into a branch to open their first account, and cattle and poultry farmers trying to grow the herd or put weight on a bird. Sometimes his loan collateral is on the hoof. Loving’s credit analysts are from farm families and know how to trade stock -- the kind with four legs. The bank occasionally buys prize-winning sheep or pigs at fairs to help local 4-H kids, then it sells the animals at auction.

Loving says the economy in his area is picking up, reflected in the “help wanted” sign in front of cabinet-maker American Woodmark Corp.’s plant up the road.

Community banks rely substantially on deposits to fund loans, so a bidding war could erupt among Loving and his peers as demand picks up. The Fed has held its benchmark rate near zero since December 2008, and if it stays low, that will “impact our margins, forcing competition on the loan side and competition on the deposit side,” Loving says. So it’s time for the central bank to act, he believes, even though Wall Street traders see a less than one-third probability of that happening when Fed officials meet this week.

MORE

Demeter

(85,373 posts)The dollar is in the midst of its strongest rally since 1984 and -- unlike then -- there may be little anyone can do to stop it.

Thirty years ago this month, the U.S. was powerful enough to muscle its way out of a damaging trade imbalance when it took financial markets by surprise with the Plaza Accord. In that agreement, it persuaded Japan, Germany, France and the U.K. to join in coordinated action to help weaken the dollar.

Now, the Federal Reserve’s willingness to raise its interest-rate benchmark, along with currency-weakening stimulus from other central banks, has strengthened the dollar enough to risk crimping U.S. inflation and casting a cloud over corporate earnings. The greenback is already within 8 percent of a record high, according to the Fed’s Trade-Weighted Broad Dollar Index, and the danger is tighter monetary policy may supercharge its rally...

THEN DON'T RAISE RATES....RAISE EMPLOYMENT!

Demeter

(85,373 posts)Here's a look at some of the stocks that Goldman recommends in its "High Quality Stock basket."

Chipotle

Dollar Tree

Pepsi

Kinder Morgan

BlackRock

Apple

Priceline

Oracle

Wells Fargo

In terms of stocks to avoid, Kostin and his team say it's companies with lots of floating-rate debt, since their financing costs are likely to increase once the Fed finally moves away from zero-bound interest rates.

So which companies have the highest share of floating rate debt?

Here are some of the most notable names on Goldman's list.

Apple

eBay

MetLife

Coca-Cola

General Mills

Ford

McDonalds

General Motors

Time Warner

Chevron

Allergan

Johnson & Johnson

Monsanto

When the tightening cycle finally starts, the immediate impact will be felt by firms with high proportions of variable rate borrowing. Stocks with high floating rate debt as a share of total debt outstanding with Sell ratings by Goldman Sachs equity research analysts include CL [Colgate-Palmolive], COL [Rockwell Collins], and JNJ [Johnson & Johnson].

Goldman says that its list of 50 companies in the S&P 500 with the highest amount of floating-rate debt has lagged the GS Financial Conditions index by 300 basis points over the past year. In a sense, the analysts argue, tighter financial conditions brought about by the stronger U.S. dollar and all that recent market turmoil, are already acting like an official rate hike in that they create higher financing costs for companies...

MORE

REMEMBER, IT'S GOLDMAN SACHS, THE LOOKING GLASS COMPANY--EVERYTHING THEY SAY IS A LIE

Demeter

(85,373 posts)For a nation that doesn’t officially exist, Catalonia sure knows how to throw a national-day party. September 11, approximately 1.4 million people filled the streets of the region’s capital, Barcelona (urban population: 1.6 million), to commemorate La Diada, the fateful day 301 years ago when Catalonia was defeated during the War of the Spanish Succession.

This year’s event was widely praised, even among some unionists, for its near flawless organization, and once again the atmosphere was one of peaceful joviality, resolute defiance and collective hope...A nation needs a viable economy, which Catalonia already has; it needs international acceptance and recognition, which could be a much higher mountain to climb, especially given the threat posed by separatist movements in other European countries (France, Italy, the UK, Belgium); and it needs the basic organs and institutions of state. According to Catalonia’s premier, Artur Mas, these are now under development.

“One crucial task for the next government will be to create the state structures that will succeed those of the Spanish state: the tax authority, for example, which we have already worked on for the past year and a half, or social security or the central bank,” he told the Financial Times.

In other words, it seems that Catalonia’s pro-independence coalition is now moving inexorably from the realm of fanciful words to the realm of determined action. Mas and his colleagues believe that for Catalonia to be a sovereign nation state, it needs its own central bank – which is probably true – but preferably one affiliated with the European Central Bank (ECB).

This is perhaps the ultimate paradox: Catalan separatists want to split from Madrid in the name of self-determination but most of them want to remain part of both the EU and the Eurozone, despite the obvious sacrifice this would require in terms of economic and political sovereignty. [As an aside, it’s worth noting that Mas’s party is also strongly in favor of the Transatlantic Trade and Investment Partnership (TTIP) which, together with similar trade treaties like TPP and TiSA, poses arguably the biggest threat to national sovereignty in today’s world).

The EU may have other ideas, anyway. The chairman of the European Central Bank (ECB), Mario Draghi, has already roundly rejected a petition to turn the Catalan Institute of Finance into an ECB-affiliated central bank. And according to the governor of the Bank of Spain, Luis María Linde, if Catalonia were to declare independence, Catalan-based banks such as CaixaBank, Banco Sabadell and Catalunya Banc would face serious problems and could even go under...

REFUSING TO ACCOMMODATE CATALONIA COULD THROW THEM INTO ANTI-EUROZONE CAMP....IF THAT'S WHAT DRAGHI REALLY WANTS!

Demeter

(85,373 posts)On Friday, during an interview with a Dutch TV network ,Eurogroup President Jeroen Dijsselbloem presented the choice he believes Greece must make.

“Ultimately, it is up to Greece whether it will become North or South Korea: absolute poverty or one of the richest countries in the world,” he said.

The Eurogroup president spoke on the corrupt and inefficient Greek governments that have ruled for decades and noted that it will take a different and honest government for Greece to recover.

Dijsselbloem also recognized that the implementation of the third bailout’s agreed reforms will be very tough....

WHAT A RIDICULOUS THING TO SAY! THE DIE IS ALREADY CAST, AND GREECE IS ASSIGNED THE ROLE OF BEGGAR...BY DJISSELBLOEN AND CO.

Demeter

(85,373 posts)What a difference two months make.

Back in July, things looked so bad for Greece that 71 percent of 31 economists polled by Bloomberg could see the country out of the euro by the end of 2016. Debt relief was a pipe dream for the EU's most indebted nation.

Fast forward to September, a similar survey shows that 94 percent of respondents think it's not only possible, but very likely. The sample of 36 economists was interviewed Sept. 4-11.

THE MAGIC 8-BALL SPEAKS

Demeter

(85,373 posts)WELL, IT WOULD BE A HANDY THING TO HAVE WHEN THE CRASH GOES DOWN...WHAT IS HE GOING TO WAIT FOR? STARVATION IN THE STREETS?

http://www.bloomberg.com/news/articles/2015-09-12/schaeuble-says-european-deposit-guarantee-plan-will-have-to-wait

A European deposit-guarantee system will have to wait until financial-stability measures already on the books, such as common bank resolution rules, are fully implemented, German Finance Minister Wolfgang Schaeuble said.

Starting a debate on a euro-area deposit-guarantee system now would “put the cart before the horse,” Schaeuble told reporters in Luxembourg on Saturday after a meeting of European Union finance ministers. “The important point now is to implement what has been agreed.”

One precondition for deposit-insurance talks is for all EU countries to enact the Bank Recovery and Resolution Directive, which sets out rules for saving or shuttering lenders, Schaeuble said. It’s “primarily a question of the correct sequencing,” he said. His comments echoed a position paper prepared by the German government for the meeting.

This debate reignited on Sept. 9, when European Commission President Jean-Claude Juncker said “a more common deposit guarantee system is urgently needed,” and promised a “legislative proposal on the first steps” by year-end...

Demeter

(85,373 posts)The country that gave the world sushi now finds itself with too much fish.

Demand for seafood has been dropping in Japan for much of the past decade as people eat more pork and beef, forcing domestic fishermen to look for buyers abroad. With the help of a plunging yen, that strategy is working. Exports are surging, and companies like Yamato Holdings Co. and ANA Holdings Inc. are expanding a delivery network across Asia, a region that still gets most of its sushi salmon from Norway more than 5,000 miles (8,000 kilometers) away.

MAYBE IT'S BECAUSE THE JAPANESE DON'T WANT TO GLOW IN THE DARK

Demeter

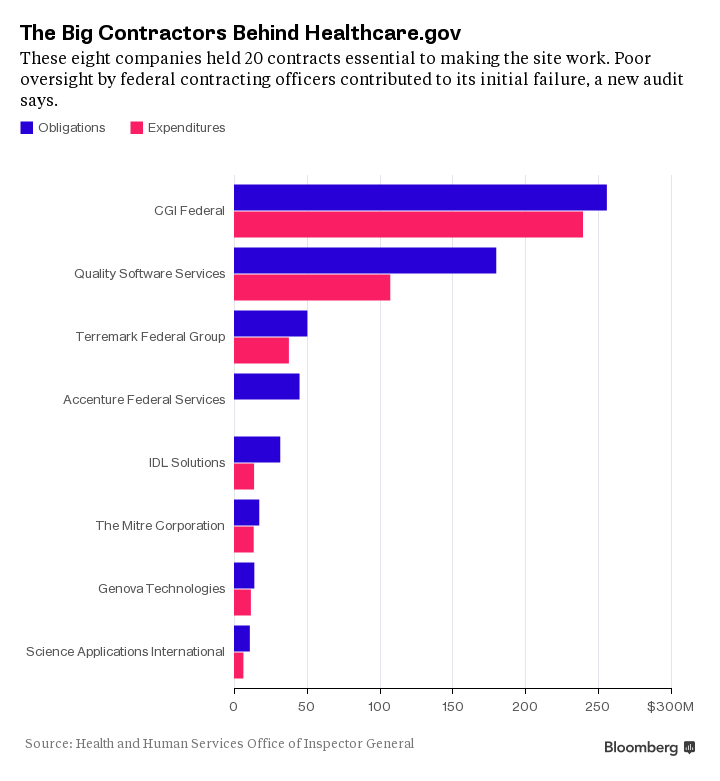

(85,373 posts)The public employees responsible for overseeing $600 million in contracts to build healthcare.gov were inadequately trained, kept sloppy records, and failed to identify delays and problems that contributed to millions in cost overruns.

That’s according to a new government audit, published today. It reveals widespread failures by the federal agency charged with managing the private contractors who built healthcare.gov. The audit is the first to document, in detail, how shoddy oversight by the Centers for Medicare and Medicaid Services (CMS), which manages federal health programs including Obamacare, contributed to the website’s early struggles.

To develop healthcare.gov, CMS hired and managed private companies to create vast, interlocking software systems that would allow consumers to shop for insurance policies. According to the report, issued by the agency’s inspector general, lapses in oversight of those companies started early on—well before the website’s limping debut, on Oct. 1, 2013. The site faltered for months, frustrating consumers until a scramble to repair it ultimately allowed millions to enroll in health plans.

The agency says it has already addressed some of the auditors' recommendations and is working on others. A spokeswoman for the Department of Health and Human Services, which oversees CMS, declined to say whether any employees had been terminated or disciplined over the lapses the inspector general identified.

MORE

Demeter

(85,373 posts)As banks try to clean up trading floors beset by benchmark-rigging scandals, not all fired workers are leaving quietly. London’s specialist employment courts offer a chance to get justice, recover lost bonuses, or just hurl dirt at former colleagues.

Six cases involving former currency traders at Citigroup Inc., HSBC Holdings Plc and Lloyds Banking Group Plc have emerged in the last month. Some of the traders say they were unfairly swept up in clear-outs of currency desks at the center of regulatory probes into the manipulation of foreign-exchange markets.

More than 30 traders were fired, suspended or put on leave over the last two years since the foreign-exchange investigations started, with about $10 billion in fines levied against banks globally.

Legal conflicts often follow periods of upheaval in the finance sector. Lay-offs linked to the London interbank offered rate scandal triggered a spate of lawsuits. Most were settled out-of-court by banks keen to avoid dragging up historic allegations of misconduct. In the years after the 2008 financial crisis, fired bankers were telling London employment judges they had been made scapegoats for systemic failings.

Currency traders have little to lose by filing employment claims, according to James Davies, a London-based employment lawyer at Lewis Silkin...MORE

Demeter

(85,373 posts)The U.S. Federal Reserve takes centre stage in the coming week, eclipsing industry data from China, another grim inflation reading from the euro zone and rate decisions in Japan and Switzerland.

Guessing whether the Fed hikes rates on Thursday or opts for a later date, perhaps December, is something of a futile exercise because even the rate setters appear to be wavering and the decision will probably come down to the wire.

An unexpected drop in the jobless rate to 5.1 percent and an upward revision in second quarter growth to 3.7 percent support calls for a hike as the labour market tightens and utilization is at its best level since the global financial crisis.

Yet, futures only price a 24 percent chance of a hike as emerging markets, particularly China, struggle, inflation remains benign and some notable Fed watchers, like former Treasury Secretary Larry Summers, argue against a hike...MORE

Demeter

(85,373 posts)Investors haven’t benefited from changes in the way the market functions, according to Dick Grasso, the former head of the New York Stock Exchange.

“The structure of the market today for major securities has been terribly hurt,” Grasso said in a taped interview for the television program “Wall Street Week” that also was streamed online. “A fast market is not necessarily a fair market.”

Since Grasso stepped down as the NYSE’s chief executive officer in 2003, the dominance of the Big Board and its rival, Nasdaq OMX Group Inc., has waned as regulations spurred competitors. Though both NYSE and Nasdaq handle about a fifth of U.S. trading volume, that’s a fraction of their former heft.

Grasso singled out high-frequency trading firms, whose advantage relative to the retail investor is “bad for the country, bad for the market and bad for your business.”

Current regulation has been a “sad, sad experiment,” Grasso said. He recommends a wholesale review of the rules of the markets involving participants from across the exchanges and regulatory agencies.

Demeter

(85,373 posts)NOW THERE'S A DOG-BITES-MAN KIND OF STORY!

http://www.bloomberg.com/news/articles/2015-09-15/boj-forgoes-additional-easing-betting-economy-will-turn-around

The Bank of Japan refrained from boosting stimulus even after the economy shrank last quarter, betting that a resumption in growth will be enough to rekindle inflation...

Demeter

(85,373 posts)Malcolm Turnbull was sworn in as Australia’s sixth prime minister in eight years Tuesday after ousting Tony Abbott, pledging to revitalize an economy battered by the slowdown in China.

The 60-year-old former investment banker takes charge of a post-mining boom economy suffering its weakest run of growth since the 1991 recession. He beat Abbott, 57, in a late-night ballot of ruling Liberal Party lawmakers, concerned the government was heading for defeat in elections next year after trailing in opinion polls for more than 12 months.

While Turnbull, a former Goldman Sachs Group Inc. executive, enjoys strong public support, he may struggle to reunite his party after the leadership ballot in which nearly half the lawmakers picked Abbott to stay, and with some senior ministers expected to step aside...

GOLDMAN SACHS TAKES OVER YET ANOTHER GOVERNMENT...THIS ONE CAN BE THROWN OUT OF OFFICE BY THE VOTERS, AT LEAST....

I DIDN'T REALIZE AUSTRALIA WAS THAT UNSTABLE...

Demeter

(85,373 posts)Finance Minister Joaquim Levy proposed a new round of spending cuts and tax increases that are designed to close the budget gap and protect Brazil from further credit downgrades.

The government will reduce expenditures by 26 billion reais ($6.8 billion) next year in large part by capping salaries of civil servants and trimming social programs, Levy said Monday. Brazil also plans to raise 28 billion reais in revenue by boosting taxes, including a levy on financial transactions.

“We know this effort to cut spending will only take us so far, so as would happen in any country in the world in a moment of reduced economic activity and tax income, you have to seek out other resources,” Levy told reporters. “We’re trying to find that balance.”

MR. LEVY COMES OUT OF THE IMF...NOT GOLDMAN. SHOULD BE INTERESTING

MORE

Demeter

(85,373 posts)Credit Suisse Group AG will pay more than $80 million to settle state and federal authorities’ allegations that it didn’t fully disclose to its clients how it operated its dark pool, according to a person familiar with the matter.

The Swiss bank will pay more than $50 million in fines and disgorgement in what would be a record dark-pool settlement with the Securities and Exchange Commission, as well as around $30 million to the New York Attorney General, said the person, who asked not to be named because the discussions are private.

Dark pools, where supply and demand is kept private and only details of executed trades are made public, account for nearly one-fifth of trading in the $23 trillion U.S. stock market. Credit Suisse’s Crossfinder platform is the largest alternative trading system in the U.S.

An accord is expected by early October, the person said, to settle claims that the Zurich-based bank misrepresented certain aspects of how it managed its platform...MORE

Demeter

(85,373 posts)Demeter

(85,373 posts)There are gaps totaling five months in the Hillary Clinton emails released by the State Department, the watchdog group Judicial Watch announced Monday morning. The gap in emails received from Clinton run from Jan. 21, 2009 to April 12, 2009, and from Dec. 30, 2012 to Feb. 1, 2013.

Among the newly obtained documents is an internal appraisal by the State Department which determined that none of Clinton’s emails should have been excluded for examination as to whether they were personal or government business.

The document, titled “Secretary of State Hillary Clinton’s Email Appraisal Report,” dated Feb. 9, 2015, concluded: “As the person holding the highest level job in the Department, any email message maintained by or for the immediate use of the secretary of state is ‘appropriate for preservation.’ This record series cannot be considered personal papers based on the definition of a record in 44 U.S.C. 3301 or Department policy found in 5 FAM 443.”

The documents also revealed for the first time the private email account that top Clinton aide Cheryl Mills apparently used to conduct government business, cherylmills@gmail.com

http://www.wnd.com/2015/09/5-month-gap-in-hillary-emails/

Demeter

(85,373 posts)Jesus College, Cambridge, hosted once more the world’s leading Symposium on Economic Crime, and over 500 distinguished speakers and panelists drawn from the widest possible international fora, gathered to make presentations to the many hundreds of delegates and attendees.

What became very quickly clear this year was the general sense of deep disgust and repugnance that was demonstrated towards the global banking industry.

I can say with some degree of certainty now that a very large number of academics, law enforcement agencies, and financial compliance consultants are now joined, as one, in their total condemnation of significant elements of the global banking sector for their organised criminal activities.

Many banks are widely identified now as nothing more than enterprise criminal organisations, who engage in widespread criminal practice and dishonest conduct as a matter of course and deliberate commercial policy.

http://libertyblitzkrieg.com/2015/09/14/bankers-will-be-jailed-in-the-next-financial-crisis/#more-27156

Demeter

(85,373 posts)TWO WORDS: SCOTT WALKER!

http://journaltimes.com/why-are-people-leaving-wisconsin-state-ranked-in-top-for/article_645ab909-b2ca-5067-875a-e0c78b123b3a.html

Blame the weather.

Blame the economy.

Blame Scott Walker.

No matter the reason, Wisconsin is among the top 10 states for people moving out, according to the annual survey from United Van Lines. Forbes reported the story recently and it has been widely circulated — although probably not by many chambers of commerce.

The moving company United Van Lines has been doing the survey for 36 years and analyzed some 125,000 residential moves in the continental U.S. last year. While not scientific, it does provide a nice snapshot of migration patterns, along with fodder for social media chatter.

“I think people see Wisconsin as a dead end,” says George Dreckmann, longtime city of Madison recycling coordinator. “The paper industry is near death, the auto industry is gone. Our flagship university is closed to most of the state’s kids. The government under both Walker and (former Gov. Jim) Doyle showed no initiative or imagination. If I wasn’t 62, I’d be leaving, too.”

MORE

Demeter

(85,373 posts)A library in a small New Hampshire town started to help Internet users around the world surf anonymously using Tor. Until the Department of Homeland Security raised a red flag...

https://www.propublica.org/article/library-support-anonymous-internet-browsing-effort-stops-after-dhs-email

DemReadingDU

(16,000 posts)audio at link, appx 7.5 minutes

9/15/15 When Cyber Fraud Hits Businesses, Banks May Not Offer Protection

Cyberthieves steal hundreds of millions of dollars a year from the bank accounts of U.S. businesses. And many business owners are surprised to find out their bank is not obliged to make them whole.

Dr. David Krier's Volunteer Voyages is one of the victims. Krier says he lost over $14,000 through fraudulent withdrawals from his business account, and he says his bank "refused to cover any of my losses."

Individuals are pretty well protected when it comes to fraudulent transfers from their bank accounts. Regulation E of the Electronic Fund Transfer Act requires banks to bear the burden in most circumstances. That's not the case for small businesses, even if they're owned by a single person, like Volunteer Voyages.

Krier's company, in Wilsonville, Ore., leads volunteer trips to developing countries for humanitarian projects. After he returned from a trip to Peru in 2013, his bookkeeper told him his bank account was overdrawn. Krier says he told her, "Well, that has to be nonsense because there's thousands of dollars in there."

It turned out a cyber crook had commandeered the debit card he used to cover the costs of foreign trips. Krier expected that his bank would reimburse him.

At first, he says, the staff at the local bank said, "Not a problem." But later, Krier says, that bank told him, "It's a business account, so you're out of luck."

lots more...

http://www.npr.org/sections/alltechconsidered/2015/09/15/440252972/when-cyber-fraud-hits-businesses-banks-may-not-offer-protection

Demeter

(85,373 posts)You'd have to be insane to put any more than a week's worth of money in one.

mother earth

(6,002 posts)A coalition of eight progressive organizations, using material previously published at The Intercept, have challenged Hillary Clinton to disavow the use of “golden parachute” bonuses for former Wall Street executives who enter government service.

In a letter to the Clinton campaign delivered today, the organizations, including Rootstrikers, Democracy for America, CREDO and MoveOn.org Political Action, refer to two top aides to Clinton when she served as secretary of state, Thomas Nides and Robert Hormats. As The Intercept reported in July, Nides and Hormats received millions of dollars in golden parachute payments from their respective ex-employers, investment banks Morgan Stanley and Goldman Sachs, after becoming Clinton’s deputies.

Goldman Sachs paid out Hormats’ unvested restricted stock units, valued between $250,000 and $500,000. Morgan Stanley’s accelerated payout for Nides of restricted stock units was worth between $5 million and $25 million. Deferred compensation awards like these would have been forfeited, had the executives left their jobs for somewhere other than the government.

Bonuses are typically granted to executives who stay with a company rather than leave it. “Awarding outsized bonuses and gifts of equity to Wall Street executives who temporarily leave to go into public service is either a breach of a public corporation’s fiduciary duty to its stockholders, or a down payment on future services rendered,” the progressive groups write to Clinton. They describe the practice as “a barely legal, backdoor form of bribery.”

MORE: https://theintercept.com/2015/08/26/progressives-demand-answers-clinton-golden-parachutes-wall-streeters-turned-government-officials/

mahatmakanejeeves

(57,395 posts)Published: Sept 15, 2015 8:30 a.m. ET

WASHINGTON (MarketWatch) -Sales at U.S. retailers rose a modest 0.2% in August, with consumers spending far less on gasoline but more on new cars and trucks. That matched the forecast of economists polled by MarketWatch. Sales minus autos rose 0.1%, but they were up a healthier 0.4% excluding gasoline, the Commerce Department said Tuesday. A closely watched number known as core retail sales, or the control group, also increased 0.4% in August. Sales in July were revised up a touch to show a 0.7% gain. Over the past 12 months retail sales have risen a lackluster 2.2%, though the year-over-year gain is a solid but not spectacular 4.4% if gasoline is omitted.

Read the full story: Retail sales strong for auto dealers, weak for gas stations