Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 17 September 2015

[font size=3]STOCK MARKET WATCH, Thursday, 17 September 2015[font color=black][/font]

SMW for 16 September 2015

AT THE CLOSING BELL ON 16 September 2015

[center][font color=green]

Dow Jones 16,739.95 +140.10 (0.84%)

S&P 500 1,995.31 +17.22 (0.87%)

Nasdaq 4,889.24 +28.72 (0.59%)

[font color=red]10 Year 2.30% +0.01 (0.44%)

30 Year 3.08% +0.02 (0.65%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)Just dying to watch Faux Nooz to see what's really going on. The "rebels" are big Hannity fans.

Demeter

(85,373 posts)Fasten your seat belts, it's going to be a bumpy Thursday.

Demeter

(85,373 posts)Nine of the world’s biggest banks, including Goldman Sachs and Barclays, have joined forces with New York-based financial tech firm R3 to create a framework for using blockchain technology in the markets, the firm said on Tuesday.

It is the first time banks have come together to work on a shared way in which the technology that underpins bitcoin — a controversial, Web-based “cryptocurrency” — can be used in finance...Those that have signed up for the initiative so far are JP Morgan, State Street, UBS, Royal Bank of Scotland, Credit Suisse, BBVA and Commonwealth Bank of Australia...

Over the past year, interest in blockchain technology has grown rapidly. It has already attracted significant investment from many major banks, which reckon it could save them money by making their operations faster, more efficient and more transparent. The new project, the result of more than a year’s worth of consultations between R3, the banks and other members of the financial industry, will be led by R3 CEO David Rutter, formerly CEO of electronic trading at ICAP Electronic Trading, one of the world’s largest interdealer brokers.

“We held several roundtables … to deeply consider what the possible implications of the blockchain were, and what it could possibly do to save money and time, and to create a better paradigm for the world of Wall Street and finance,” Rutter told Reuters on Tuesday...

The blockchain works as a huge, decentralized ledger of every bitcoin transaction ever made that is verified and shared by a global network of computers and therefore is virtually tamper-proof. The Bank of England has a team dedicated to it and calls it a “key technological innovation.”

The data that can be secured using the technology is not restricted to bitcoin transactions. Two parties could use it to exchange any other information, within minutes and with no need for a third party to verify it...

“These new technologies could transform how financial transactions are recorded, reconciled and reported -– all with additional security, lower error rates and significant cost reductions,” said Hu Liang, senior vice president and head of emerging technologies at State Street, in a statement.

IF YOU CAN'T FIGURE OUT WHO THE SUCKER IS AT THE CON, IT'S YOU!

Demeter

(85,373 posts)I THINK IT WOULD TAKE A CONSTITUTIONAL REWRITE

AND I ALSO THINK WE ARE DUE FOR ONE TO BRING IT INTO THE 21ST CENTURY, AND PREVENT FASCISTS FROM TAKING US BACK TO FEUDALISM.

http://ringoffireradio.com/2015/09/could-the-fed-govt-be-forced-to-offer-publicly-funded-internet-service-rather-than-mail-service/

When the Framers of the US Constitution came up with Article I, Section 8, Clause 7 – the “Postal Clause” – their primary concern was to create an infrastructure for the new nation that would facilitate communications between various states and regions. It gave Congress the power to “establish Post Offices and Post Roads.” According to records made of the Constitutional Convention of September 1789, there was discussion of creating “post roads” and “a power to provide for cutting canals as necessary.” James Madison wanted to “secure easy communication between the States…the political obstacles being removed, a removal of the natural ones (i.e., geographic and geological barriers) as far as possible ought to follow.”

It goes without saying that the Framers could not have foreseen the development of the telegraph, the telephone, radio, television and now the Internet. For those living in the late 18th Century, “communications” consisted of written documents, carried by hand from one location to another.

Today, the Postal Clause of the Constitution simply says that Congress shall have the power “to establish Post Offices and Post Roads.” Today, the Constitution would be written to provide “establish servers and fiber optic cables.”

Like the Post Office, which operates more efficiently and cheaply than any similar service in the world (despite what current corporate handmaidens in the federal legislature would have you believe), today’s Internet might have been a public utility – as it is in many countries. Instead, in the US, it is controlled primarily by private telecommunications companies such as Comcast. They charge more and provide slower and shoddier service – because they can. At the same time, right-wing corporatist lawmakers who would give control of the Internet (built with public funds, incidentally) over to Comcast, Verizon, AT&T and other major corporations to turn into their own propaganda and consumer advertising platform, continue to insist that the private sector does everything better and more efficiently...

Demeter

(85,373 posts)YES, BUT...CONSIDER THE ALTERNATIVES!

http://gizmodo.com/dont-have-sex-with-robots-say-ethicists-1730866985

Robot ethicists have launched the Campaign Against Sex Robots, seeking a ban on the development of robotic sexytimes.

The reality of pleasure bots is fast approaching. Mechanical toys for sexual pleasure already exist, of course, and hardware developers are working to incorporate A.I. into their designs. A company called True Companion claims to be producing “the world’s first sex robot,” Roxxxy, this year. Despite questions of technical readiness and ethics, Roxxxy, priced at $7000, has thousands of pre-orders.

Robot ethicists Kathleen Richardson of De Montfort University and Erik Billing from University of Skövde are the co-creators of the Campaign Against Sex Robots, which seeks to bring awareness to the issue and proposes a robot sex ban. They compare it to similar campaigns that seek to limit development of “killer” robots. Richardson and Billing believe that sex robots will degrade human relationships and reinforce a view of women as sexual objects...

HOW CAN ONE REINFORCE A VIEW THAT HAS WITHSTOOD EVERYTHING THROWN AT IT?

Demeter

(85,373 posts)And in the category of central bank leadership, this year’s number on bank governor is…

Pause for effect.

Elvira Nabiullina of the Central Bank of Russia. Euromoney awarded Nabiullina with the top central banker award on Wednesday. She will be featured in an interview with the magazine in their October issue. Last year, India’s Raghuram Rajan of the Reserve Bank of India was voted the world’s leading central banker.

Nabiullina oversaw massive turbulence in the ruble market last year when the government moved away from its fixed-trading band to a free-float system. The Russian ruble was crippled by a combination of economic sanctions, bad geopolitical news involving the east Ukraine-Russia battle field, and declining oil prices. It went from the mid-30s to 70 following back to back rate hikes by Nabiullina. The market saw the hikes as a Russian central bank panic attack and shorted the ruble. Many technocrats in Russia questioned whether she was wise to let the market dictate the direction of the ruble given the political crisis there, but she let the market have its way and short-sellers took it on the chin. Within a month, the ruble was heading back into the 60s. Nabiullina has managed the crisis well, Euromoney said.

Nabiullina made it harder for currency speculators to crush the ruble.

She expanded the banks currency liquidity facilities, adding new maturities and broadening the definition of eligible collateral in its foreign exchange auctions, while committing to recapitalize viable lenders.

“This shock therapy worked,” Euromoney editors wrote in a press release. “Bringing forward plans to abandon Russia’s failing band with the dollar allowed the Central Bank of Russia to intervene on an ad-hoc basis to stabilize financial conditions, but avoided wasteful interventions. It left the market to guess the size and frequency of interventions, thereby hiking the cost of forex speculation.”

WHAT IS THAT OMINOUS GRINDING NOISE COMING OUT OF DC?

Demeter

(85,373 posts)NO DOUBT OUT OF HIS LONG AND FAITHFUL MEMBERSHIP IN HOLY MOTHER CHURCH...

AND THE "GOD'S WORK" OF HIS JOB....

http://finance.yahoo.com/news/lloyd-blankfein-just-likened-finance-133432830.html

Goldman Sachs CEO Lloyd Blankfein has compared the financial sector to the Catholic Church and the Boy Scouts in a discussion over the distrust of institutions in the US. Speaking at an event hosted by The Wall Street Journal on Wednesday morning, Blankfein was asked by the paper's editor-in-chief, Gerard Baker, about Goldman's reputation as "the vampire squid" of capitalism, referring to the description coined by Rolling Stone journalist Matt Taibbi.

Blankfein responded that there was a distrust of institutions in the US after the financial crisis, saying finance was like "the Boy Scouts or the Catholic Church."

"Someone in finance will get blamed for a predictable cycle," he added, referring to the potential for a downturn in the economy.

Blankfein has drawn fire before for drawing such comparisons. Though Goldman Sachs later said he didn't mean to be taken seriously, in 2009 he told the Sunday Times that bankers were doing "God's work."

STICK TO WHAT YOU KNOW BEST, LLOYD---FRAUD AND WHITE COLLAR CRIMES

PERHAPS HE'S REFERRING TO THE FRAUDS THAT THE CHURCH HAS OPERATED AT VARIOUS TIMES IN ITS 1900 YEARS....

Demeter

(85,373 posts)Goldman Sachs Group Inc. Chief Executive Officer Lloyd Blankfein said he hopes Donald Trump’s popularity indicates voters are looking for someone willing to negotiate across the aisle. That doesn’t mean he wants it to be Trump.

“I can find fault with some of the things that seem wacky to me that he says,” Blankfein, 60, said Wednesday at a breakfast in New York sponsored by the Wall Street Journal. “It’s hard to imagine his finger on the button. That blows my mind.”

Blankfein has long maintained that U.S. voters err by backing candidates who vow not to compromise. The self-proclaimed Democrat hasn’t said who he’ll support in 2016, only saying that he’s looking for a moderate who can be flexible in the pursuit of getting things accomplished.

“Trump comes along and talks the language of deals,” Blankfein said. “Nobody who is listening to him thinks he’s ideologically stuck on the most extreme position.”

Still, Blankfein said he may be allowing his hope for moderation to color his view of Trump’s appeal.

“I’d like it when somebody comes along and says ‘Hey, I’m going to go there, and I’m going to get the best deal for my set of positions, but I’m going to deal,”’ Blankfein said. “I don’t know that he’s saying that. In fact, I know he’s not saying that, so maybe I’m allowing my fantasy” to project onto Trump, he said.

While Blankfein said he thinks current election coverage is overdone given there’s still more than a year until votes are cast, he did say Wednesday’s Republican debate should be “much more interesting” than whether the Federal Reserve decides to raise interest rates Thursday.

Democratic candidate Hillary Clinton is suffering from voter fatigue with her front-runner status and may gain more support as the election approaches, Blankfein said.

Demeter

(85,373 posts)MAYBE HE'S TRYING TO DROWN OUT THIS:

SPECIFICALLY AT TIME: 3 minutes

Demeter

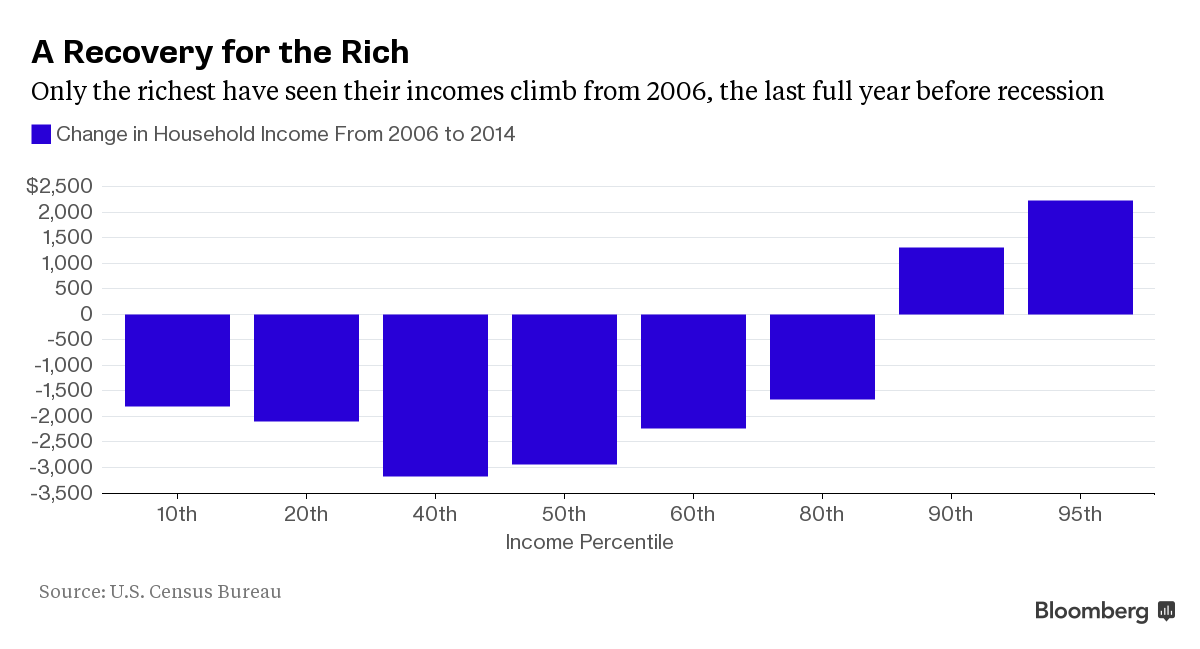

(85,373 posts)U.S. Census Bureau data out Wednesday underscore just how lousy the recovery has been if you aren't rich.

Looking at eight groups of household income selected by Census, only those whose incomes are already high to begin with have seen improvement since 2006, the last full year of expansion before the recession. Households at the 95th and 90th percentiles had larger earnings through 2014, the latest year for which data are available.

Income for all others was below 2006 levels, indicating they're still clawing their way out of the hole caused by the deepest recession in the post-World War II era.

"Each decade, it's taken longer for the poor to recover from recession, for the poverty rate to start turning around after the official end of the recession," said Arloc Sherman, a senior fellow at the Center on Budget and Policy Priorities in Washington. "There's quite a bit of work left to do."

Median household income is 6.5 percent lower than in 2007, the year the recession started. Overall, median income was $53,657 in 2014, not a statistically significant difference on an inflation-adjusted basis from 2013's median of $54,462. It's the third straight year that there's been no significant change, after two consecutive years of annual declines. That's happened even though the labor market has posted steady progress. The number of men working full time and year-round in 2014 increased by 1.2 million from a year earlier while the number of women gained 1.6 million. The changes in their real median earnings, however, weren't statistically significant.

Meanwhile, the official poverty rate was 14.8 percent, with some 46.7 million people in poverty—both little changed from 2013. The rate is 2.3 percentage points higher than it was in 2007.

Demeter

(85,373 posts)THEY FOUND THEIR EXCUSE TO RAISE RATES....

http://www.reuters.com/article/2015/09/15/us-usa-fed-labor-analysis-idUSKCN0RF2ES20150915

When the Federal Reserve considers whether the U.S. economy is ready for an interest rate hike on Thursday, policymakers will want to be confident the jobless rate, now at 5.1 percent, is as strong as it looks. There appear to be reasons for optimism as many poorer and less educated workers are finding jobs or receiving bigger raises. Improvements in the labor market for low-income Americans historically accelerate when the economy is closer to full output, which the U.S. central bank considers to be consistent with an unemployment rate between 5.0 percent and 5.2 percent.

DID EVERYBODY FORGET ABOUT THE MANDATED INCREASES IN MINIMUM WAGE RATES?

That suggests the Fed is running out of time to begin raising rates - it has kept its benchmark overnight lending rate at near zero since December 2008. The recent turmoil on global financial markets, however, has many investors betting the Fed's policy-setting committee will leave rates unchanged at the end of its two-day meeting on Thursday, choosing to hike instead in December. Traders are now pricing in a 27 percent probability of a rate hike on Thursday.

Low earners were the biggest losers when the jobless rate surged as high as 10 percent during the 2007-2009 Great Recession. In July, Fed Chair Janet Yellen said the downturn "was particularly punishing to African-Americans and to lower skilled workers more broadly." Between 2008 and 2009, 1.2 million blacks lost their jobs across the nation. By 2011, the unemployment rate in the black community was 16.5 percent, more than 7 percentage points above the national average. But it had dropped among blacks to just over 9 percent as of last July, about 4 percentage points above the national average, which is roughly where it was before the recession, according to U.S. labor statistics. A similar recovery has played out among those without a high school diploma, about half of whom are black or Hispanic. That group's unemployment rate fell to 7.7 percent in August, right where it was before the recession started.

"It's a sign that we're closer to full employment," said James Sweeney, chief economist at Credit Suisse in New York.

RIIIGHT! OF COURSE IT IS! PAY NO ATTENTION TO THE DISCOURAGED UNEMPLOYED, THE COLLEGE GRADS, THE RETIREES....

Demeter

(85,373 posts)General Motors Co (GM.N) has agreed to pay $900 million and sign a deferred-prosecution agreement to end a U.S. government investigation into its handling of an ignition-switch defect linked to 124 deaths, two sources told Reuters.

The deal means GM will be charged criminally with hiding the defect from regulators and in the process defrauding consumers, but the case will be put on hold while GM fulfills terms of the deal, one source said.

No individuals would be charged in the criminal case, one of the sources said.

The company's expected $900 million payment, confirmed by a second source, is less than the $1.2 billion that Toyota Motor Corp (7203.T) paid to resolve a similar case.

A BIT MORE...IT LIES THERE, LIKE A DEAD AND ROTTING FISH

Demeter

(85,373 posts)The local cinema is offering a buy one, get one deal on tickets to see the Mission Impossible film....

You want to know how bad the film business is? I've seen this show, and wouldn't do so again even for free. And that's the best of the lot this week, unless I want to watch Whitey Bulger. I left New England to get away from the Irish mafia....

and besides, the Kid would be lost and bored silly.

Demeter

(85,373 posts)The multi-million dollar pay raises for the chief executive officers of mortgage giants Fannie Mae and Freddie Mac will probably be short lived.

The Senate passed a bill Tuesday night capping CEO pay at $600,000, the level before plans were approved in July restoring compensation to more historic levels of about $4 million apiece. Representative Ed Royce, a California Republican, offered a similar measure that passed the House Financial Services Committee in July by a vote of 57-1. If the House passes the compensation legislation, it will be sent to President Barack Obama to become law.

The Senate bill, which passed unanimously, was sponsored by Senators David Vitter, a Louisiana Republican and Elizabeth Warren, a Massachusetts Democrat. Mel Watt, who oversees the mortgage companies as director of the Federal Housing Finance Agency, had approved plans raising pay for Fannie Mae’s Timothy Mayopoulos and Freddie Mac’s Don Layton, which led to opposition from Republican lawmakers and the Obama administration.

“Giving massive taxpayer-funded pay raises to Fannie Mae and Freddie Mac isn’t just out of touch – it’s downright offensive,” Vitter said in a statement.

AND SINCE IT ONLY AFFECTS TWO PEOPLE, THEY MIGHT BE ABLE TO GET IT PASSED

Demeter

(85,373 posts)Demeter

(85,373 posts)BAD MOVE, GE! NO TAX-PROFIT REPATRIATION HOLIDAY FOR YOU!

http://www.reuters.com/article/2015/09/15/us-usa-ge-eximbank-idUSKCN0RF1KF20150915

Flexing its muscles amid a bitter congressional fight over the U.S. Export-Import Bank, General Electric Co (GE.N) on Tuesday revealed plans to shift up to 500 U.S. manufacturing jobs to Europe and China because it can no longer access EXIM financing.

The largest U.S. industrial conglomerate said it will move production of some heavy duty gas turbines and 400 jobs to Belfort, France, in exchange for a credit line from France's COFACE (COFA.PA) export agency. The deal will support GE bids for international power projects.

U.S. plants in Greenville, South Carolina; Schenectady, New York; and Bangor, Maine, will lose out on those jobs if GE wins the power bids, a GE spokeswoman said.

GE also said 100 additional final assembly jobs for smaller turbine generator sets derived from aircraft engines will move next year from outside of Houston to Hungary and China. No U.S. facility will close, a GE spokeswoman said.

The company is bidding on $11 billion worth of international power projects that require export credit agency financing, including some in Indonesia.

The announcement rang alarm bells on Capitol Hill as lawmakers, still ramping up from a long summer recess, searched for a strategy to revive the trade bank after letting its charter expire on June 30...

WHY NOT USE THAT CASH FROM SELLING OFF YOUR BANK TO "FINANCE YOURSELF"?

Demeter

(85,373 posts)A group of more than 140 economists protested on Tuesday against the appointment of an former BNP Paribas banker to head the French central bank, saying it could raise conflict of interest issues. The economists, mostly academics, wrote in Le Monde newspaper that Francois Villeroy de Galhau was an excellent expert on the banking sector, but that his background risked jeopardising his independence at the central bank.

"It's a total illusion to say that one can serve the banking industry and several months later assume its regulation with impartiality and total independence," they wrote.

Villeroy de Galhau, 56, was one of two chief operating officers at BNP Paribas, the euro zone's biggest bank by assets, until he stood down in April to write a government report on financing corporate investment. President Francois Hollande named Villeroy de Galhau last week to run the Bank of France, subject to lawmakers' approval, after current governor Christian Noyer retires at the end of next month.

As head of the Bank of France he will also sit on the European Central Bank's rate-setting council.

The economists, which included inequality expert Thomas Piketty and ex-World Bank chief economist Francois Bourguignon, called on lawmakers to reject his nomination in confirmation hearings before the finance committees of both houses of parliament...MORE

Demeter

(85,373 posts)DAMN WHITE OF THEM, TOO!

http://www.reuters.com/article/2015/09/15/usa-china-cybersecurity-idUSL1N11L1LB20150915

The United States does not plan to impose sanctions on Chinese entities for economic cyber attacks ahead of next week's U.S. visit by Chinese President Xi Jinping, a U.S. official and a person briefed on the White House's thinking said on Tuesday.

The official, who spoke on condition of anonymity, suggested the reason was to avoid casting a shadow over Xi's visit rather than the emergence of any major agreement between the two sides over how to handle the issue...

YES, THE CHINESE ARE RATHER TOUCHY ABOUT STUFF LIKE THAT...

Demeter

(85,373 posts)Progressive populist Sen. Elizabeth Warren says checking prospective employees’ credit history is “discrimination” and is calling on American employers to end the practice, which she argues “bears no relationship to job performance and that can be riddled with inaccuracies.”

In a new Time op-ed, the Massachusetts senator, along with Tennessee Rep. Steve Cohen (D) warned that the common practice of employers checking the credit history of potential employees was wrongheadedly discriminatory against “hard working people,” noting that “one in five job-seekers could be rejected by an employer because their credit report lists a medical debt in default—even when they’ve paid off the debt in full and on time”:

MORE

kickysnana

(3,908 posts)November 27, 2000 by Karon Gibson. Copy sold out of the Mpls library and ended up in our Apartment Library that used to house a lot of retired Head Nurses when we first here 9 years ago.

: One crackerjack RN, heart of gold with a Chicago Policeman hubby that drank a little too much, married young, another RN a little younger who had raised her younger brothers as a teen who married another Chicago Policeman with a daughter never intending to have children. Both ended up together in 1968 in a brand new Psych ward. The younger Karon, Head Nurse with only 6 months experience so she was still idealistic. Ran a crackerjack department in a rapidly expanding hospital despite severe limitations that left the RNs with all the work and decisions and none of the money ($5.52 hr full time 10m yrs experience) and little of the respect except by the patients and their families.

Looking for more money, better working conditions. They started one of only a handful of private nursing services as HMOs were dumping sick people out of hospital much sooner, much more often. They had to get an OK from the hospital they worked for, their husbands, the nursing board, and a bunch of other medical boards. Initially they wanted to continue to work their Hospital job that had steady days and hours and cooperation and put in approx 20 hrs on the Private Duty. Even though Karon was a natural she had been conditioned not to defer, not succeed and was far too naive about other people's motives and fighting back but she learned. When the down sizing of hospital staff with the increase in work load caused a list of grievances to be sent in by the nurses in the following years the hospital clamped down and fired them lying about cause. Uppity RNS! They had deliberately stayed away from the direct organizing because they had enough battle with their start up. The nurses all folded and the only help they got was from a branch of NOW with advice and picketing which did help on the most egregious problems in the hospital they had been with. It took 4 years for the federal government to give them the right to sue and another 36 mos to win the suit gaining the right to have their excellent record put forward for future jobs, with guaranteed no negative feedback and back pay. It allowed them to finally be successful in the business. They helped other Private Nursing companies start.

It paralleled my fight to work in bio-medical electronics in Hospitals. I was able to work in the electronics industry but was systematically shut out of area hospitals as were those that followed me for a while. The worst disappointment was when I had the needed rank, clearance and experience at the local VA hosp position and they oops made a mistake and gave it to someone's nephew who had none of the above. Unfortunately my health conditions overtook my determination and I had to step back tilting at windmills hoping to connect as these ladies eventually did.

Speaking of nursing. Auntie took a tumble out of her power chair today trying to pick up something she had dropped. I had to call the local police to get volunteers to get her back in her chair and to be looked over for damage (egg size bruise under her right eye) and then all the folks that help to keep her here, PCA agency, separate visiting nursing agency, Community Drs. She was much more embarrassed than hurt because she knew she should have grabbed her Grabber instead of trying to reach down and pick it up. Not bad for 80 and her first real tumble.

Demeter

(85,373 posts)

Demeter

(85,373 posts)THE FULLEST ACCOUNT OF HIS LIFE IN RUSSIA I'VE SEEN

Demeter

(85,373 posts)2014 must have been a really bad year, for the world as well as me personally. So much craziness going down....

I'm in the last dregs of this virus attack. When breathing is no longer compromised, I can start to rebuild my strength. It took a lot out of me, three weeks of not being able to be active because it triggered coughing....

Hold tight! The Fed pronounces our doom at: 2 PM, more or less. Odds are either way...for those without a special "in" with the players.

Watch the markets and see if you can predict the outcome of the Fed. Reserve's meeting.

mahatmakanejeeves

(57,393 posts)Associated Press

WASHINGTON (AP) — The number of Americans seeking unemployment benefits fell last week to the lowest level in two months, suggesting employers remain confident enough in the economy to hold onto their workers.

The Labor Department says weekly applications for unemployment aid dropped 11,000 to a seasonally adjusted 264,000. That's the lowest level since July, when applications plunged to a 41-year low.

DemReadingDU

(16,000 posts)9/17/15 Fed leaves rates unchanged

Following the conclusion of a closely watched meeting, the Federal Reserve is keeping interest rates at record lows, citing a weak global economy, low inflation and instability in financial markets.

"Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term," the FOMC said in a statement released at the conclusion of its two-day meeting.

Still, the Fed in its statement noted that the U.S. economy continues to expand at a moderate pace and that inflation expectations have been muted. It also said the housing sector has shown further improvement. It also noted improvedments in the labor market saying "On balance, labor market indicators show that underutilization of labor resources has diminished since early this year."

U.S. Treasury bonds rallied after the Fed announcement. The 2-year yield was the standout, plunging 11%, or 0.089 percentage point, to 0.722%. Bond yields move in the opposite direction of prices.

Richmond Federal Reserve President Jeffrey Lacker, a hawk, was the lone dissenting voice to the Fed decision, preferring the Fed would have increased rates by 25 basis points.

http://finance.yahoo.com/news/breaking-news--fed-announcement-on-interest-rates-154848233.html

Demeter

(85,373 posts)I think we are safe for a few months.