Economy

Related: About this forumWeekend Economists Leave Autumn Leaves September 25-27, 2015

So this is an easy weekend for all of us:

Post anything that says "close of summer" or "start of fall" and live in the moment. The Earth is tilting and the sun is spending less and less time on our side of the planet. Make the most of these golden moments!

Here in Michigan the weather has been ideal: sunny, not too hot, not too cold, could have a little more rain, but that's coming next week...so here's a tribute or two for the season:

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)Brazil is experiencing a repeat of the kind of emerging-market financial dislocation that many hoped it had left behind in the 1980s and early 2000s. If unchecked by a circuit breaker, this self-sustaining cycle could gather further momentum, exposing the country to economic shocks that would hit the poor particularly hard and add to the political dysfunction.

Brazil's Highs and Lows

In response to an outflow of investment funds and accelerating capital flight, Brazil's three main financial markets are stuck in a mutually reinforcing process of value destruction. The result is a horrid combination of sharp currency devaluation, rising external borrowing costs and increasing domestic interest rates. These damaging trends exacerbate the threat of two additional vicious cycles, also of the self-feeding variety:

If left to fester, these sorts of linkages feed upon themselves, exposing the country to what economists call a "multiple equilibrium": the risk that, rather than being on course to revert to the mean (finding its way back to stability), Brazil's economy deteriorates further, enhancing the risk of a slide toward an even worse outcome. Brazil desperately needs a circuit breaker to eliminate the mounting threat of cascading negative outcomes. The best way to achieve this would be a series of official decisions, designed by the government and passed by the legislature, that restore the country's growth dynamic, contain its fiscal deterioration and reverse mounting inflationary pressures. Such measures would cause financial markets to normalize rather quickly, resulting in a currency appreciation and notably lower borrowing costs both domestically and internationally.

With this in mind, the government has submitted a series of fiscal proposals to the National Congress. Unfortunately, the country's political dysfunction makes the prospects for full passage less than comforting. History tells us that when a country delays putting in place a domestic circuit breaker, that potential role eventually will shift -- at least partially -- to external actors, including multilateral organizations spearheaded by the International Monetary Fund. And the longer it takes for this combination of foreign and domestic measures to coalesce, the harder the necessary reforms will be to accept for the country's political leaders and people. Without the rapid implementation of circuit breakers, a stabilization of Brazil's financial conditions would depend on the large-scale re-engagement of foreign capital and the return of flight capital. This is unlikely to happen until the prices of Brazilian assets, and the value of its currency, collapse to levels that are even lower and that offer foreign and domestic investors compelling risk-adjusted returns. That was the situation in the fourth quarter of 2002, when such circumstances almost tipped the country into a costly default, a multi-year recession and soaring poverty.

For those who closely follow Brazil, and wish it to live up to its considerable economic potential, this moment evokes both hope and anxiety. The hope is based on the knowledge that, with improved governance, it wouldn't take much to turn this promising economy around. The anxiety is that the country's political class again may fall short in properly serving citizens, risking misery for the most vulnerable segments of the population.

Demeter

(85,373 posts)Demeter

(85,373 posts)In September 2014, Darrell West published a Billionaire Political Power Index based on his Brookings Institution Press book, Billionaires: Reflections on the Upper Crust. It examined the political influence individuals of great wealth, ranking their power based on a number of factors including campaign expenditures, activism through nonprofit organizations and foundations, holding public office, media ownership, policy thought leadership, and behind-the-scenes influence.

He has updated this index to account for billionaires' more recent election activism, campaign donations, and influence leading up to the 2014 midterms. There are several individuals who have moved up the list: Peter Thiel, Bob Mercer, Joe Ricketts, Paul Singer, Jim Simons, and David Geffen. Others have seen their rankings drop: Penny Pritzker, Warren Buffett, Peter Peterson, Donald Trump, and Alice Walton.

24 MUG SHOTS AT LINK--HOVER YOUR CURSOR OVER ONE TO GET THE LOW-DOWN ON ANY PARTICULAR MEMBER OF THE OW! (OBSCENELY WEALTHY)

Demeter

(85,373 posts)Demeter

(85,373 posts)Late on Sunday evening, September 27, the Earth will slide precisely between the sun and the moon, throwing the satellite into a rusty red shadow. This’ll be the fourth total lunar eclipse in two years, but that doesn’t make it boring. Quite the opposite—this week’s event will be the last in this rare tetrad, and the most dramatic.

That’s because this lunar eclipse coincides with another astronomical event: a supermoon. That’s what it’s called when the moon’s mostly elliptical orbit brings it closest to Earth’s surface—about 220,000 miles away instead of its average 240,000 miles. During this total lunar eclipse, the moon will appear about 14 percent larger and 30 percent brighter than Earthlings are used to seeing it.

And yes, it’ll also change color. The Earth doesn’t totally shade the moon; some sunlight trickles around the edges of the planet and gets filtered through the atmosphere, which only lets through light with longer wavelengths. That’s red. This eclipse also happens to coincide with the harvest moon, the full moon that falls closest to the autumnal equinox.

Taken together, all these astronomical events should make for a pretty special show—and a rare one. The last supermoon eclipse was in 1982, and it won’t happen again until 2033.

Point is, you’re going to want to watch it. Here’s how: Peak eclipse will be at 2:47 am UT on September 28th—so, 10:47 pm ET on Sunday, September 27th. If you’re in the eastern United States, that’s good news! You should be able to see the eclipse just fine. The moon will start darkening at 8:11 pm Eastern time, and it will start to pass through the Earth’s dark umbral shadow at 9:07 pm. It’ll be completely shaded for about an hour starting around 10 pm (the last total eclipse, on April 4, lasted for a mere five minutes). That means the fully eclipsed moon will just be rising as viewers on the west coast tune in. So, you know, squeeze your magickal rites in appropriately.

VIDEO AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)In the wake of a global stock-market sell-off triggered by economic turmoil in China, the US Federal Reserve has just decided to postpone raising interest rates. Indeed, China is facing the huge challenge of dealing with the risk of a global debt-deflation trap.

In 1933, Irving Fisher was the first to identify the dangers of over-indebtedness and deflation, demonstrating their contribution to the Great Depression in the United States. Forty years later, Charles Kindleberger applied the theory in a global context, emphasizing the problems that arise in a world lacking coordinated and consistent monetary, fiscal, and regulatory policies, as well as an international lender of last resort. In 2011, Richard Koo used Japan’s experience to highlight the risks of a prolonged balance-sheet recession, when over-stretched debtors deleverage in order to rebuild their balance sheets.

The debt-deflation cycle begins with an imbalance or displacement, which fuels excessive exuberance, over-borrowing, and speculative trading, and ends in bust, with procyclical liquidation of excess capacity and debt causing price deflation, unemployment, and economic stagnation. The result can be a deep depression.

In 2000, the imbalance was America’s large current-account deficit: the world’s largest economy was borrowing heavily on international capital markets, rather than lending, as one might expect. According to then-Fed Chairman Ben Bernanke, the problem was that countries running large surpluses were buying so many US Treasuries that they were negating the Fed’s monetary-policy efforts. But, as Claudio Borio, Hyun Shin, and others have pointed out, excessive off-balance-sheet and offshore lending by US and European banks also added procyclical pressure...

Demeter

(85,373 posts)Demeter

(85,373 posts)NO DOUBT FLAT-EARTHERS WHO HAVE NEVER VISITED CANADA, LIVE OVER 500 MILES FROM THE BORDER, AND ARE PARANOID, TO BOOT (THAT'S CANADIAN!)

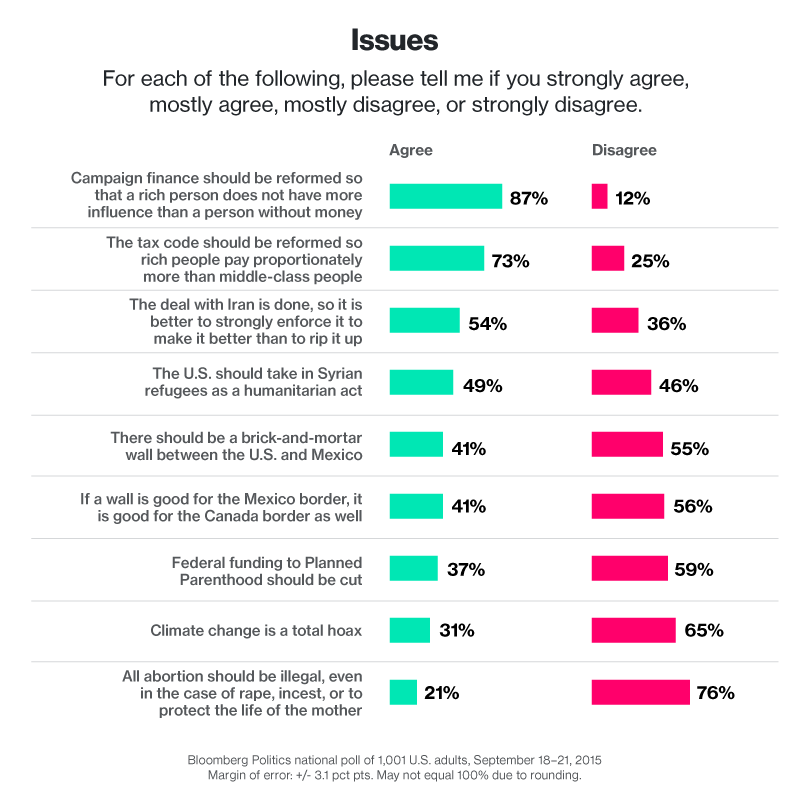

http://www.bloomberg.com/politics/articles/2015-09-24/oh-canada-four-in-ten-americans-want-wall-on-northern-border

What's good for Mexico should be good for neighbors to the north, they reason

...PROVING THAT REASON HAS NOTHING TO DO WITH EITHER MEXICO NOR CANADA...

Failed Republican presidential candidate Scott Walker may feel some vindication in this number: 41 percent of Americans say that if a wall is built along the Mexican border, one should also be erected on the Canadian one. And yes, the same percentage favors a wall erected along the nation's southern border.

Read the questions and methodology AT LINK.

The latest Bloomberg Politics poll also shows that immigration, a flashpoint in the 2016 presidential campaign thanks in large point to the incendiary rhetoric of Republican front-runner Donald Trump, is an issue that stirs strong emotions among Americans, some of them contradictory. While four in ten Americans favor border walls, overwhelming majorities also express positive feelings about immigration: 80 percent agree the U.S. economy has thrived historically because of new arrivals and 70 percent expressed approval for the efforts of Pope Francis to encourage nations to be more welcoming of immigrants.

Jake Crosan

It was a point the pontiff made almost immediately upon arriving in the U.S., telling a crowd at the White House: “As a son of an immigrant family, I am happy to be a guest in this country, which was largely built by such families.”

Trump has called for a physical wall to be completed along the border with Mexico, a concept that 41 percent of Americans support and 55 percent oppose; 56 percent disagree with the idea of building a wall along the Canadian border, a notion that became one of the gaffes that hurt Walker's candidacy, which the Wisconsin governor ended earlier this week. After initially indicating that he thought the idea was worth additional study, Walker later clarified that he didn't actually want to build a physical wall along the more than 5,000-mile border...

IF ONLY THEY WOULD STICK TO ALIEN ABDUCTIONS AND EXPERIMENTAL SURGERY...

Demeter

(85,373 posts)

haikugal

(6,476 posts)Crazy out! Canada feels like home to me...![]()

Thanks for the thread, music and information Demeter! Hope we both get to see the eclipse!

Demeter

(85,373 posts)Very hard to see any astronomical events when you live on the fast track for cold fronts.

haikugal

(6,476 posts)I can watch it online...NASA will be streaming it so that's probably what I'll do.

Demeter

(85,373 posts)Is there a link for it yet?

haikugal

(6,476 posts)NASA TV to Provide Live Feed of Sunday’s Supermoon Eclipse

For the first time in more than 30 years, you can witness a supermoon in combination with a lunar eclipse. Late on Sept. 27, 2015, in the U.S. and much of the world, a total lunar eclipse will mask the moon’s larger-than-life face.

Watch NASA’s live stream from 8:00 p.m. until at least 11:30 p.m. EDT broadcast from Marshall Space Flight Center in Huntsville, Ala., with a live feed from the Griffith Observatory, Los Angeles, Calif. Mitzi Adams, a NASA solar physicist at Marshall will discuss the eclipse and answer questions from Twitter. To ask a question, use #askNASA....snip.

Demeter

(85,373 posts)CatholicEdHead

(9,740 posts)Talk about gullible or just scared of their own shadow. North Dakota has even more border, they are a mostly Republican state and they are not talking about this at all except laughing about it.

Demeter

(85,373 posts)Demeter

(85,373 posts)CLICK ON THE LINK JUST TO SEE THE AWESOME GRAPHICS GIF!

http://www.bloomberg.com/features/2015-click-fraud/

Ron Amram has been in the brand marketing business for about 20 years. In the 2000s he was media director for Sprint’s prepaid cellular group, mainly figuring out where the carrier should spend its ad dollars—print, outdoor, digital, or broadcast. TV was always at the top of the pyramid. A TV campaign was like “the Air Force,” Amram says. “You wanted to get your message out, you did carpet bombing.” But TV wasn’t cheap, nor did it solve “that age-old question: Half of my marketing is working, half of it is not, and I don’t know which half.”

About 10 years ago, not long after Google went public and Yahoo! was still worth upward of $50 billion, attitudes shifted. Digital search and display ads had the potential to reach TV-size audiences at a fraction of the price. “People thought it was going to change everything,” Amram says.

The euphoria escalated again around 2010 with the arrival of programmatic advertising, a typically banal industry term for what is, essentially, automation. The ideal programmatic transaction works like this: A user clicks on a website and suddenly her Internet address and browsing history are packaged and whisked off to an auction site, where software, on behalf of advertisers, scrutinizes her profile (or an anonymized version of it) and determines whether to bid to place an ad next to that article. Ford Motor could pay to put its ads on websites for car buffs, or, with the help of cookies, track car buffs wherever they may be online. Ford might want to target males age 25-40 for pickup-truck ads, or, better yet, anybody in that age group who’s even read about pickups in the past six months.

That’s a stunningly attractive proposition to advertisers: surgical strikes on a carpet bombing scale. Ominous for privacy advocates, sure, but nirvana for agencies, publishers, and advertisers. At long last, they’d know where every last dollar went and whether it did its job...

READ ON FOR THE HAPPY ENDING (AT LEAST IT MADE ME HAPPY!)

Demeter

(85,373 posts)

Demeter

(85,373 posts)Demeter

(85,373 posts)Cheap orbiting cameras and big-data software reveal hidden secrets of life down below ...

Some 250 miles above the Earth, a flock of shoebox-size Dove satellites is helping to change our understanding of economic life below. In Myanmar, night lights indicate slower growth than World Bank estimates. In Kenya, photos of homes with metal roofs can show transition from poverty. In China, trucks in factory parking lots can indicate industrial output. Images from these and other satellites, combined with big-data software, are helping to create what former NASA scientist James Crawford calls a “macroscope” to “see things that are too large to be taken in by the human eye.” Aid organizations can use the results to distribute donations. Investors can mine them to pick stocks.

“This is one of those really rare game changers that come along very infrequently but has the ability to remake the whole stock- and economic-research industry,” said Nicholas Colas, chief market strategist at Convergex Group, a New York-based brokerage. “We still make monetary policy in this country based on surveys of a few thousand households and businesses.”

For much of the nearly six decades since Sputnik first circled Earth, satellites have mainly been the exclusive domain of the richest governments and companies, costing billions and weighing tons. Now cheap orbiting cameras are becoming more ubiquitous. Planet Labs Inc., a San Francisco startup founded in a garage by former NASA engineers, has one of the largest-ever constellations. More than 50 of its Doves orbit the Earth every 90 minutes, snapping high-resolution photographs that image most of the planet each day. Seattle-based BlackSky Global, backed by Microsoft Corp. co-founder Paul Allen’s Vulcan Capital, plans to start launching its fleet of 60 satellites next year to scan most of the globe 40 to 70 times a day.

Millions of photos are useless, of course, until they become data. That transformation is the goal for startups such as San Francisco-based Spaceknow Inc. Chief Executive Officer Pavel Machalek says imagery eventually will track all the world’s trucks, ships, mines and warehouses to attain what he calls “radical economic transparency.” He created an index of China factory production using algorithms to monitor more than 6,000 industrial facilities, hoping to supplant survey-based purchasing-manager indexes with software that identifies signs of economic activity, such as transport vehicles in parking lots...

Demeter

(85,373 posts)Demeter

(85,373 posts)Inside Germany’s profligate (Greek-like!) fiasco called Berlin Brandenburg...The inspectors could hardly believe what they were seeing. Summoned from their headquarters near Munich, the team of logistics, safety, and aviation experts had arrived at newly constructed Berlin Brandenburg International Willy Brandt Airport in the fall of 2011 to begin a lengthy series of checks and approvals for the €600 million ($656 million) terminal on the outskirts of the German capital. Expected to open the following June, the airport, billed as Europe’s “most modern,” was intended to handle 27 million passengers a year and crown Berlin as the continent’s 21st century crossroads.

The team of inspectors, known as ORAT, for Operations Readiness and Airport Transfer, brought in a dummy plane and volunteers as test passengers. They examined everything from baggage carousels and security gates to the fire protection system. The last was an especially high priority: None could forget the 1996 fire that roared through Düsseldorf Airport’s passenger terminal, killing 17.

When they simulated a fire, though, the system went haywire. Some alarms failed to activate. Others indicated a fire, but in the wrong part of the terminal. The explanation was buried in the 55-mile tangle of wiring that had been laid, hastily, beneath the floors of the building where ORAT technicians soon discovered high-voltage power lines alongside data and heating cables—a fire hazard in its own right. That wasn’t all. Smoke evacuation canals designed to suck out smoke and replace it with fresh air failed to do either. In an actual fire, the inspectors determined, the main smoke vent might well implode....

IT'S THAT "GERMAN ENGINEERING"---ONLY WORKS FOR CHEATING AND BEATING THE TESTS...

SCHADENFREUDE! I'M POSITIVELY GIDDY!

Demeter

(85,373 posts)I'D LIKE TO THINK NO CHICKENS WERE HARMED IN THE MAKING OF THIS VIDEO...BUT I CAN NEITHER CONFIRM OR DENY...

Demeter

(85,373 posts)Cash is on track this year to outperform both stocks and bonds, something that hasn’t happened since 1990, according to Bank of America Merrill Lynch. And it might all be down to the notion that central bank-fueled liquidity has peaked.

Year-to-date annualized returns are negative 6% for global stocks and negative 2.9% for global government bonds, according to analysts led by Michael Hartnett in a Friday note. The dollar is up 6% and commodities are down 17%, while cash is flat.

Here’s what this has to do with the liquidity story:

Quantitative easing & zero rates reflated financial assets significantly. The only assets that QE did not reflate were cash, volatility, the US dollar and banks. Cash, volatility, the US dollar are all outperforming big-time in 2015, which tells you markets have been forced to discount peak of global liquidity/higher Fed funds. Frequent flash crashes (oil, UST, CHF, bunds, SPX) tell the same story. Peak in liquidity = peak of excess returns = trough in volatility.

The note speaks to what has become a very important theme for investors. While the Bank of Japan and the European Central Bank continue to provide quantitative easing, the Fed has stopped its asset purchases and is moving toward lifting rates from near zero, as is the Bank of England. The notion that liquidity has peaked and that financial markets must now adjust to that new dynamic.

Indeed, billionaire hedge-fund investor David Tepper earlier this month argued that as China and other emerging-market central banks shed foreign reserves, liquidity is no longer flowing one direction, making for more volatile conditions.

MORE BAFFLING WITH BS AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)IOKIYAAR!

http://www.rawstory.com/2015/09/ex-hp-ceo-fiorina-used-job-creating-tax-breaks-to-buy-back-stock-then-fired-thousands-of-workers/

Prior to being fired herself, former Hewlett-Packard CEO Carly Fiorina used tax incentives from the federal government, intended to increase research and development and employee hiring, to buy back stock before firing thousands of HP workers.

According to The Daily Beast, Fiorina — whose troubled tenure at HP has come under more scrutiny as she moves up in the polls for the GOP presidential nomination — was not the only high-ranking executive to take advantage of a corporate “tax holiday” and work it to her own advantage. In 2004 Congress passed the American Jobs Creation Act of 2004 — after high pressure lobbying from Hewlett-Packard among others — that included an incentive for companies to repatriate profits stashed overseas with the understanding the money would be invested in job-creating research and development.

Instead, under Fiorina’s stewardship, HP took $4 billion of the $4.3 billion in tax breaks and funneled the money into a stock buyback program that enriched shareholders including herself. The move was done despite the fact that the act specifically prohibited the stock manipulation. Instead of hiring more workers, HP laid off 14,500 workers due to plummeting share prices following Fiorina’s disastrous decision to purchase Compaq that caused profits to plummet. The following year, Fiorina was fired by the HP after an acrimonious fight, but still managed to depart with a $21 million severance package.

This is not the only time Fiorina has been accused of skirting the law...

AND PROBABLY WON'T BE THE LAST, EITHER

Demeter

(85,373 posts)...The clearest measure of her performance — and the report card preferred by Wall Street — is H.P.’s stock price, which dropped by 52 percent during her tenure of almost six years. Yes, Mrs. Fiorina served during the worst fall in technology shares in history. But she managed to underperform her key competitors; IBM’s shares declined by 27.5 percent and Dell’s fell by 3 percent.

The most ruinous aspect of Mrs. Fiorina’s tenure was her decision to acquire another “old tech” hardware company, Compaq Computer Corporation, instead of moving more heavily into services and software, as IBM did. The proposed merger — Mrs. Fiorina pronounced that the two companies “fit together like a zipper” — bitterly divided directors and shareholders and was approved with just a 51.4 percent majority, a split I cannot recall seeing elsewhere during my 33-year Wall Street career. To be fair, Mrs. Fiorina was saddled with a dysfunctional board. But that was well known, so taking the job with that added complexity was her eyes-wide-open choice.

Investors were so down on her that H.P.’s shares jumped by almost 7 percent on the day of her firing. And in ensuing years, she appeared on several “worst C.E.O.” lists, including those of CBS News and USA Today. In 2009, Portfolio magazine ranked her the 19th worst C.E.O. of all time and described her as a “consummate self-promoter” who was “busy pontificating on the lecture circuit and posing for magazine covers while her company floundered.” (That sounds like good preparation for running for president.) Mrs. Fiorina tries to obscure these harsh realities with a blizzard of her own “facts.” On the campaign trail, for example, she speaks of having doubled her company’s revenues. However, most of that increase came from adding in Compaq’s sales, which is a misleading way to calculate revenue growth. While some of the intricacies of Mrs. Fiorina’s performance may elude voters amid the dust storm that she has kicked up, her compensation won’t. She banked $21 million in severance payments as part of the more than $100 million in compensation she received during what one critic called her “destructive reign of terror” (which included pushing for H.P. to acquire five corporate jets.) In the course of her losing Senate run in 2010, she was also attacked for the 30,000 layoffs that occurred at H.P. during her tenure. That’s not entirely fair — the entire technology industry was going through a downsizing and H.P.’s total employment ultimately climbed back up — but it was deadly effective politics that could doubtless be repeated in 2016.

Less attention has been paid to her time at Lucent Technologies, where she rose through the marketing ranks, learning the sales techniques that she is now putting to good use on the stump. Soon after she left, Lucent veered off a cliff, and while she was never the chief executive, part of the company’s collapse stemmed from overly aggressive sales and loans to financially shaky customers made under her supervision.

Strikingly few former colleagues have come to Mrs. Fiorina’s defense. And her most prominent advocate, the venture capitalist Tom Perkins, has his own challenges; last year, he compared the criticisms of wealthy Americans to the attacks on Jews during Kristallnacht...

Demeter

(85,373 posts)Earlier this week, Hillary Clinton threw down the gauntlet on rival candidate Bernie Sanders's tuition-free college plan, implying that it was wrong to pay for a student's tuition unless they did some sort of side job in addition to their studies, which her plan requires:

"I am not going to give free college to wealthy kids," she said. "I'm not going to give free college to kids who don't work some hours to try to put their own effort into their education.

Clinton's view highlights the main difference between the two candidates: Sanders views college as a right that cannot be denied or tied to a student's income or ability to work a job alongside their studies. To Clinton, it's a commodity, that the government can make cheaper under certain circumstances. Her work requirement would mostly impact poor students, whose parents could not simply offer up the support needed to pay tuition.

Except that Clinton was not required to complete a work requirement to have her tuition and room and board paid for. Here's how she explained how she attended Wellesly College, in a speech she gave in 2007:

Clinton's plan would make US higher education uncompetitive with our European and Asian rivals, many of which fully subsidize school for their students and do not have a work requirement that distracts students from their studies. It also is a much more conservative plan than that followed by much of the United States for most of the 20th century, where states fully subsidized public colleges. But Clinton's self-righteous tone about not giving free college to kids who “don't work some hours” seems to be somewhat undermined by the fact her father paid for her college.

Demeter

(85,373 posts)Budget hawks in Congress may stand their ground on wasteful spending, but shutting down the government is no example of fiscal frugality. Lost work, back pay and wiped-out jobs for federal contractors and other private-sector workers loom as just some of the costs of a closure that will happen in six days unless Democrats and Republicans in Congress break their impasse over abortion, military spending and other issues to pass a new budget.

The last time this happened, for 16 days in October 2013, the White House put a price on it: 6.6 million days of lost work, $2 billion in back pay for 850,000 federal employees who did no work and 120,000 private-sector jobs gone.

The effects, according to an accounting by the Office of Management and Budget and later by the Government Accountability Office, also added up to less effective government services as federal agencies spent much of their time ramping up for a closure before it happened, then recovering afterward from delays to their operations.

Closing the government has macroeconomic effects on economic output, and forecasters had varying estimates two years ago on how significant that was. Much clearer, though, were the direct costs to taxpayers.

The budget office concluded that the furloughs of roughly 40 percent of the civilian workforce — from the Defense Department to the Environmental Protection Agency — hit $2 billion, or $2.5 billion if you add in benefits. The shutdown led to a total of 6.6 million days of lost work when employees were at home, many of them wanting to work but not even permitted to check their iPhones and BlackBerrys. Many federal contractors had to furlough employees as well and even fire some. And for the most part, those workers were not paid at all. Other direct costs came from missed fees from national parks, interest due on late payments, missed revenue from tax enforcement and some stop-work orders, among other money that normally flows to government agencies.

The reports run through a lengthy list of disruptions in 2013. They include a backlog in veterans’ disability claims, nearly 6,300 children left out of Head Start, patients left out of cancer studies at the National Institutes of Health, halted consumer-safety work, delays in tax refunds. The Food and Drug Administration delayed “nearly 500 food and feed domestic inspections and roughly 355 food safety inspections under state contracts,” the budget office said...

Demeter

(85,373 posts)OVER THE TOP GRAPHICS AT THIS LINK, TOO!

http://fusion.net/story/200487/obama-nudge-department/

Last year, more students went to college and more graduates managed to make student loan payments than in previous years. If you were among these responsible citizens, pat yourself on the back… but not too hard. Your good decisions might not have been entirely your own. Your financial maturity may have been the result of a government ‘nudge,’ in the form of a well-timed text message about college matriculation forms you needed to fill out or an email alerting you that your loan payment was overdue. Those prompts were part of an experiment by the Social and Behavioral Science Team, a group started in February 2014 by President Barack Obama. The team of behavioral science experts are using inexpensive techniques drawn from psychology, criminology, economics and cognitive science to manipulate people into making better decisions. (They prefer the term “nudge.”) The goal is to save money.

In its first year tackling 15 government programs, the team says it ‘nudged’ more veterans into taking advantage of their benefits, more farms into getting loans, and more families into signing up for health insurance coverage. The team’s text-messaging campaign to remind low-income high school grads to fill out paperwork for colleges to which they were already accepted upped enrollment from roughly 66% to 72%. The group’s first annual report, released this month, is basically a victory lap, saying their efforts have led to billions of dollar in economic value (calculated by adding up nudges that, for example, got people to pay their taxes and save for retirement).

Now, thanks to these early successes, the government’s ‘nudge’ department is expanding. Last week, President Obama issued an executive order directing government agencies to adopt findings from behavioral sciences in their daily operations, with the goal of “deliver[ing] better results at a lower cost for the American people.” Obama elevated the Team from an experimental novelty to an integral part of the White House and the 2016 budget.

Not everyone loves a good nudge. Critics have called the program a mind-controlling scheme...

MORE

Demeter

(85,373 posts)Inspired by the disclosures of NSA whistleblower Edward Snowden, a campaign for a new global treaty against government mass surveillance was launched today in New York City. Entitled the “The International Treaty on the Right to Privacy, Protection Against Improper Surveillance and Protection of Whistleblowers,” or, colloquially, the “Snowden Treaty,” an executive summary of the forthcoming treaty calls on signatories “to enact concrete changes to outlaw mass surveillance,” increase efforts to provide “oversight of state surveillance,” and “develop international protections for whistleblowers.”

At the event launching the treaty, Snowden spoke via a video link to say that the treaty was “the beginning of work that will continue for many years,” aimed at building popular pressure to convince governments to recognize privacy as a fundamental human right, and to provide internationally-guaranteed protections to whistleblowers who come forward to expose government corruption. Snowden also cited the threat of pervasive surveillance in the United States, stating that “the same tactics that the NSA and the CIA collaborated on in places like Yemen are migrating home to be used in the United States against common criminals and people who pose no threat to national security.”

The treaty is the brainchild of David Miranda, who was detained by British authorities at Heathrow airport in 2013, an experience that he described as galvanizing him towards greater political activism on this issue. Miranda is the partner of Glenn Greenwald, a founding editor of The Intercept who received NSA documents from Snowden. Authorities at Heathrow seized files and storage devices that Miranda was transporting for Greenwald. (The Press Freedom Litigation Fund of First Look Media, the publisher of the Intercept, is supporting Miranda’s lawsuit challenging his detention.)

Along with the activist organization Avaaz, Miranda began working on the treaty project last year. “We sat down with legal, privacy and technology experts from around the world and are working to create a document that will demand the right to privacy for people around the world,” Miranda said. Citing ongoing efforts by private corporations to protect themselves from spying and espionage, Miranda added that “we see changes happening, corporations are taking steps to protect themselves, and we need to take steps to protect ourselves too.”

The full text of the treaty has yet to be released, but it is envisioned as being the first international treaty that recognizes privacy as an inalienable human right, and creates legally-mandated international protections for individuals who are facing legal persecution for exposing corruption in their home countries. Its proponents hope to build momentum and convince both governments and multi-national organizations to adopt its tenets. Since the Snowden revelations there has been increasing public recognition of the threat to global privacy, with the United Nations announcing the appointment of its first Special Rapporteur on this issue in March, followed by calls for the creation of a new Geneva Convention on internet privacy.

Greenwald also spoke at the event, saying, “This campaign offers the opportunity to put pressure on governments to adopt a treaty that pushes back against mass surveillance, and also makes clear that individuals who expose corruption should not be subject to the retribution of political leaders.” Adding that many governments that make a show of supporting the dissidents of other countries tend to persecute their own whistleblowers, Greenwald added, “We need a lot of public pressure to say that mass surveillance should end, and that people who expose corruption should be entitled to international protections.”

Demeter

(85,373 posts)The Mayor of Lewiston, Maine, has figured out the answer to society’s ills, and it comes in the form of public shaming. Upset by the fact that Maine’s government maintains a website that lists the amount of money received by pensioners in the state, and angered by the existence of welfare recipients, or the “victimized, protected class,” Lewiston Mayor Robert Macdonald devised a plan. The Tea Party-backed conservative, who is currently seeking re-election to a third term in his town of 36,000, announced a bill to create a website would list the names and addresses of welfare recipients publicly online.

Macdonald wrote in the Twin City Times:

“We will be submitting a bill to the next legislative session asking that a website be created containing the names, addresses, length of time on assistance and the benefits being collected by every individual on the dole. After all, the public has a right to know how its money is being spent.”

In a comment to the Bangor Daily News, Macdonald said that the listings were not meant to embarrass people, adding that welfare recipients already “flaunt it in public.” Macdonald also said he would push for a bill that would bar the state from paying benefits to families for additional children born after a recipient has been receiving welfare payments and cap welfare payments after a certain time period. Of Maine’s $2.7 billion budget, $100 million goes to state welfare benefits, Maine Democrats have already pointed out. And despite Macdonald’s most fervent hopes, they also note that such a law would be illegal, anyways.

It’s not the first time he’s faced backlash — in 2012, residents called for his resignation after his xenophobic remarks advising Somali immigrants to “accept our culture and you leave your culture at the door.” But the Lewiston mayoral election is coming up in November, and a young progressive challenger has already broken the state record for mayoral campaign fundraising. If Lewiston’s lucky, Macdonald will never even get a chance to see his bill fail.

Demeter

(85,373 posts)Trading in the $12.7 trillion U.S. Treasuries market, once the domain of Wall Street’s biggest banks, is increasingly dominated by firms most people have never heard of. Determining which ones is largely guesswork, however, which is peculiar in this market, which is the deepest, most liquid in the world and sets the benchmark rates for everything from mortgages to corporate debt. The unwelcome secrecy is also a little strange considering how much more transparent the world’s largest banks have become.

This week, Risk.net published a list it obtained ranking the top interdealer traders of Treasuries. It showed three Chicago-based firms, Jump Trading, Citadel Securities and Teza Technologies, accounting for 51 percent of the volume executed by the top 10 firms on BrokerTec, a popular electronic debt-trading platform. Icap Plc, which owns the BrokerTec system, disputed the numbers but declined to disclose alternative ones. Regardless of the precise distribution of trading, the shift is clear. Many of the dealers listed are high-frequency traders or firms that rely on computer algorithms to arbitrage small differences in Treasury prices. That isn’t necessarily bad. In many cases, these traders are filling a void left by Wall Street banks, which have shrunk their U.S. government bond trading desks in the face of new regulations and less-predictable profits. But it’s difficult to evaluate the actions of firms that operate largely in the shadows, hard to observe by competitors and regulators. And it increases the risk that a market-rattling hazard could erupt from seemingly nowhere.

This may help explain why regulators spent months examining what happened last Oct. 15, when yields on 10-year Treasuries plunged suddenly and somewhat randomly, roiling related markets and causing some dealers to stop trading entirely before yields quickly rebounded. There wasn’t a clear catalyst for the turmoil, which raised questions about the market’s stability. Regulators came up with the rather inconclusive conclusion that changes in market structure could lead to “rare but severe bouts of volatility.” The influence of high-frequency traders in the Treasury market is clearly growing. That is alarming to some, perhaps needlessly. The automation could potentially provide a key service to markets that are being abandoned by bigger dealers...

OR, ALTERNATIVELY, IT COULD CRASH THE GLOBAL ECONOMY SO HARD THAT THE DOLLAR NEVER HAS VALUE AGAIN. YOUR CHOICE

Demeter

(85,373 posts)Demeter

(85,373 posts)If Warren Buffett hadn't already donated $23.7 billion worth of Berkshire Hathaway stock to the Bill & Melinda Gates Foundation, he'd be the ninth richest person in American history.

Warren Buffett is rich, but he's far from the richest person in history. As you can see in the chart above, his $61.2 billion net worth ranks him behind all 10 of the greatest American fortunes, accumulated by the likes of John D. Rockefeller, Cornelius Vanderbilt, and John Jacob Astor.

Buffett's wealth comes primarily from his interest in Berkshire Hathaway (NYSE:BRK-A) (NYSE:BRK-B), a sprawling conglomerate with a current market value of $319 billion. The 85-year-old Oracle of Omaha has been a director and the controlling shareholder of Omaha-based business since 1965 and its chairman and chief executive officer since 1970.

Berkshire Hathaway's latest proxy statement shows that Buffett controls 33.9% of the voting interest in the company and 19.6% of its economic interest. This is despite the fact that he's already transferred 185 million class B shares to the Bill & Melinda Gates Foundation, as a part of Buffett and Gates' Giving Pledge, a commitment by the world's wealthiest individuals and families to dedicate the majority of their wealth to philanthropy.

MORE GLOATING AT LINK

I DON'T THINK THEY TAKE INFLATION INTO ACCOUNT....ALL THOSE EARLY FORTUNES WERE IN GOLD

Demeter

(85,373 posts)I BET THOSE NUMBERS WERE COOKED TO A FARE-THEE-WELL. LET'S SEE HOW FAR THEY DROP NEXT QUARTER.

http://www.reuters.com/article/2015/09/25/us-usa-economy-idUSKCN0RP1AR20150925?feedType=RSS&feedName=businessNews

The U.S. economy expanded more than previously estimated in the second quarter on stronger consumer spending and construction, backing the case for an interest rate rise before the end of the year despite data sounding a note of caution for September.

The Commerce Department said on Friday gross domestic product rose at a 3.9 percent annual pace in the April-June quarter, up from the 3.7 percent pace reported last month.

The data supports the case that the U.S. economy may be gaining enough strength to withstand an increase in benchmark interest rates from record low levels despite growing concerns about the global economy.

Still, many economists are expecting a cooler pace of growth in the third quarter, a view bolstered by separate data showing slower growth in services and a drop in consumer sentiment in September....

THOSE NUMBERS ARE THE RESULT OF INEVITABLE REPLACEMENT OF WORN-OUT ITEMS, NOT EXPANSION

Demeter

(85,373 posts)Nobody really likes government shutdowns, including me. But sometimes you have to make a point. Send a message. Show voters what you really believe. Take a stand.

With John Boehner set to resign at the end of October, many believe the outgoing speaker can team up with House Democrats to avoid a government shutdown on October 1. Ace Washington watcher Dan Clifton of Wall Street firm Strategis reports, "The risk of a government shutdown next week has been eliminated." And he expects Congress to pass a short-term continuing resolution that will fund government appropriations through December 11. That would be a clean bill that does not defund Planned Parenthood. More Democrats than Republicans would support it. And Senate majority leader Mitch McConnell stands ready to pass a similar clean resolution. But will this non-disruptive approach really work?

Nancy Pelosi wants to reauthorize the Export-Import bank. House Republicans do not. So far, the House has not come up with a plan to finance the Highway Trust Fund. And then there's the issue of defunding Planned Parenthood. Is defunding really dead? A shutdown next week is still possible. Most of the Beltway media will blame Republicans. Democrats will blame Republicans. And GOP pundits will blame Republicans. Political death, they will say. Really?

Former National Review reporter Andrew Stiles wrote a most interesting government-shutdown piece almost two years ago when Senator Ted Cruz and other Republicans filibustered to stop full funding of Obamacare. Stiles pointed out that the Cruz shutdown was the 18th shutdown since 1976. And he argued that Democrat Tip O'Neill presided over two-thirds of them. In the late 1970s shutdowns occurred when the Democrats controlled both houses of Congress and the White House. The disagreement was over abortion policy. That caused three shutdowns. Stiles noted that, during the Reagan-O'Neill era, most of the shutdowns were budget focused. Reagan wanted less spending; the Democrats wanted more. They also bickered over funding for missile programs. The Reagan-O'Neill-era shutdowns were short, and in most of them Reagan prevailed. Meanwhile, the Reagan recovery flourished, the Republicans held the Senate (until 1986), and the Gipper was re-elected in a landslide in 1984. Going back to the Obamacare-related shutdown of 2013, a bit more than a year later, the Republicans swept the Senate and gained an even larger majority in the House.

I am not arguing for a constant series of budget shutdowns. And I will always oppose any expiration of the U.S. Treasury debt ceiling. That would be a harmful global economic event. No good. But it is worth remembering that there are no catastrophic political or economic consequences attached to these shutdowns.

OH, REALLY? A BIT MORE AT LINK, BUT IT'S ALL DANGEROUS THINKING

Weirdly, The Democrats' Family Leave Plan Is Better Than Marco Rubio's

http://www.forbes.com/sites/timworstall/2015/09/26/weirdly-the-democrats-family-leave-plan-is-better-than-marco-rubios/

YEAH, WHO WOULD HAVE THOUGHT IT?

I’m not exactly known as a fair minded and non-partisan commentator. I tend to look at anyone even slightly left of the John Birch Society as somewhat suspect, wondering as to their sanity, connection with reality, perhaps even their parentage and whether we can get them classified as a felon for their beliefs. But in breach of this howlingly lopsided ideological commitment I do have to say that the Democrats’ basic plan for a paid family leave plan is better than Marco Rubio’s. And given that no other Republican has even offered the traces of one as yet that’s the only one on offer from the rightwards tendency at present. The point being that the Democrats have understood that you cannot try to get business, or employers, to pay for family leave. To do so would make women of child bearing age virtually unemployable. It has to be a tax financed benefit, not an employer financed one.

This is entirely different from whether there should be a paid family leave plan or not. The US works pretty well without one and other countries work pretty well with one: I don’t see the presence or absence as being all that important either way. Largely, I think, because the societies themselves have adapted to whether there is one or not. My point here though is that if there is going to be a mandate for paid family (or, let’s be honest about this, maternity leave, for that’s what is really at issue) leave then it’s going to have to be financed through the tax system, almost certainly through FICA.

Here’s a brief description of Rubio’s plan:

Rubio’s proposal consists of a 25 percent non-refundable tax credit for employers who offer their employees between four and 12 weeks of paid family leave to new parents, those caring for sick family members, and the families of members of the military. Pay would be capped at $4,000 per employee per year, but it would apply to “all employee arrangements,” his plan says, including those working part time.

Offering a tax credit to employers is obviously an assumption that it will be the employer funding the leave itself. The credit paying part of that cost, sure, but not all of it. What this would really be, in practice, is a subsidy to those employers of the professional classes who already offer paid family leave. Not really the step change in the society that some are looking for. But if anyone wants to create a general right to, or even practice of, paid family leave than it just has to be tax funded:

That’s why Democratic candidates have endorsed a paid family leave mandate for the entire country. Hillary Clinton, Bernie Sanders, and Martin O’Malley all support 12 weeks of paid leave, paid for through an insurance-like system that collects payroll tax contributions from employees. Those plans mirror one proposed by Democrats in Congress, which would require a 0.2 percent contribution from employees and not require employers to pay employees on leave themselves.

That’s roughly (of course, details matter but roughly) the way that it has to be done. For example, in my native Britain, the employer subtracts from wages the national insurance payments due (just as in the US the employer subtracts FICA) and then sends it off to the government. But if there’s someone getting statutory maternity leave then the employer pays that sum to the employee at home with the little one, then subtracts that amount paid (actually, only 90% of it) from that national insurance collected before sending it off. In this manner it’s the general taxpayer, by not receiving the NI payments but people still clocking up the future benefits, that really carries the cost of the paid family leave...

MORE THAN DANGEROUS TO OTHERS, ALSO DANGEROUS TO THEMSELVES

MattSh

(3,714 posts)and pandering to get votes. Hopefully at least the Democrats plan is a real one, 'cause I don't believe that Rubio's is.

Demeter

(85,373 posts)...one of the most crucial needs facing the world: a lack of access to surgery. The aim of universal access to “health care and social protection, where physical, mental and social well-being are assured,” will come to nothing without it. Most of the world lacks access to safe, affordable and timely surgical care.

Every year over 80 million people worldwide face financial catastrophe if they get surgery. And while the individual cost of getting surgery is great, the societal cost of inaction is staggering. If nothing is done to increase surgical access, developing nations are projected to lose $12.3 trillion from their gross domestic products between now and 2030.

Currently, infectious disease interventions are the main focus of global health policies, because many countries lack the personnel and infrastructure to carry out surgical interventions successfully.

Despite the fact that nearly one-third of human disease is amenable to surgery, it remains overlooked in much of the world.... Improve a surgical system, and you improve the very things that are necessary for the delivery of health care in general. Doing so is less costly than it might initially seem. The cost of scaling up a surgical system in resource-poor countries — about $300 billion over 18 years — represents only about 5 percent of the total combined expenses that governments in low- and lower-middle-income countries spend on health annually, and pales in comparison with the $12.3 trillion cost of inaction. And spending that money now will not only lower the current surgical disease burden and allow patients to return to economic productivity, but it will also make the health system itself more resilient when shocks like Ebola hit. Moreover, reliable surgical infrastructure strengthens entire health systems. It is not enough to prevent maternal deaths during childbirth if a health care system cannot care for the children after birth. It is not enough to treat tuberculosis successfully if the patient then dies from a perforated appendix. Surgical scale-up is not and has never been envisioned to exclude other global health priorities — surgery is necessary to meet all global health priorities. It is this inherent synergy that makes surgical delivery a cost-effective intervention.

MORE

Demeter

(85,373 posts)Enjoy it, folks! There won't be many like it.

MattSh

(3,714 posts)Last Saturday, we hit 34C. That's mid 90ish. And I figured, that's over. So yesterday, we hit 30C. That's high 80ish. So it wasn't quite over yet. And the forecast for next week is mid 50's to mid 60's. So yeah, it's fading quickly. Thing is. We've had more 30ish (C) days this month than we had in July, if I remember correctly.

Demeter

(85,373 posts)the Kid and I went to see Hotel Transylvania 2, because the reviews were so bad...and we loved it, as usual. Why non-parents review kids' movies, expecting them to be edgy if not totally gross and violent, baffles me.

And then lunch and a nap. I am so weak from 5 weeks of this disease....at least now I can state for a fact that recovery is underway. That's good, because I'm not ready for hospice.

MattSh

(3,714 posts)Looks like it won't happen this year. Looks like my wife, her cousin, and her aunt again.

The original plan was the first weekend of September, with me going. But the notice was so late that I wouldn't have been able to obtain a visa unless everything went near perfect. Yeah, like that's going to happen. But they should thank me. It rained that whole weekend. Just when I think it's off for good, the plan has been resurrected. But that $160 visa plus other things I really need to do, plus the distractions of it all seems a bit much, especially for what will likely be a 2 day trip.

Why so much for a visa? It's a concept call reciprocity. That's what the USA charges for visas, so that's what Russia charges US citizens. Many countries do this. The difference is a US citizen is much more likely to get a visa to Russia than a Russian citizen is to get a visa to the USA. Probably by a 10 to 1 factor. And you pay whether you get that visa or not.

But my wife really needs to go, to stock up on some medicines. Something she needs currently costs $72 a dose here in Kiev. When it's available. The lowest price we could find in Ukraine was $55, in Kharkiv, about 300 miles east. And not too far from the war zone. In Moscow, it's readily available, and < $15 a dose. Yeah, I'd say that's a no brainer there. But here's the math...

This med, two years ago in Kiev. ~225 hriven or $27 a dose.

This med, now, in Kiev. ~1500 hriven or $72 a dose.

Last year it was 50% less in Moscow. Now it's more than 75% less.

6.6 times high in hriven, 2.6 times higher in USD. I'm not surprised that this "revolution" results in this. I expected it, though many many or now only waking up to the reality that their revolution is not going to ever live up to its promises.

Demeter

(85,373 posts)The latest I read was that the US revolution wasn't, really. The power structure didn't change, they just cast off the colonial power of Britain. And anyone who didn't like that could lump it, or leave for Canada.

Can't really call the Ukrainian kerfuffle a revolution, either, since it was instigated abroad. More like an infiltration and regime change.

Demeter

(85,373 posts)Yes, the Wall Street stock market casino will lose $10 trillion when we get a new president ... yes, it’s “only a matter of time before the next recession strikes,” warns the Economist ... yes, investor Mark Cook warns of a 4,000-point correction ... yes, Jeremy Grantham’s on record predicting a 50% crash by election time, negative returns through the next president’s first term ... and now our Kirk Spano’s new headline screams “the bear market has begun.” Yes, it is happening.

Get it? 95 million investors are at risk. Investors are now virtually 100% certain of new $10 trillion stock-market losses, like 2007-2009. Like the $8 trillion lost in the aftermath of the irrational exuberance insanity into the dot-com recession 2000-2003. Yes, welcome to the slow rollout of the third major recession of the 21st century. Yes, stocks will lose trillions again.

Why trillions in guaranteed losses? More specifically, why will most investors lose so much this cycle? First, cycles statistics prove we get one every eight years. Yes, we are warned. We know it’s coming. And still investors lose trillions.Why? From a behavioral-economics perspective the answer is quite simple: Most investors will tell you they’re rational, convinced they make sound investment decisions.

In fact, no more than one in five are “rational investors,” 80% of investors are irrational, but most don’t even know it ... or if they do, won’t admit it. And lose again.Yes, behavioral-economics studies tell us that only about 20% of all investors act rationally about the future. That’s a max of maybe 20 million rational investors in America. The rest, the other 75 million, 80% of America’s 95 million Main Street investors: They’re in denial, clueless, irrational losers.

10-question quiz: Why you best start preparing for a crash ... today

1. You’re totally confident that you can profit more before the crash?

2. Do you believe you’re an above-average investor?

3. You believe you can beat the market by timing and active trading?

4. You love the adrenaline rush from making investment decisions?

5. You rebalance your portfolio more than once a quarter?

6. You believe cheap online trading accounts actually increase returns?

7. You chase good deals, buy when they’re hot, sell when they cool?

8. You believe active traders are making the big bucks?

9. You believe investors acting collectively create rational markets?

10. You’re saving too little, your portfolio is less than $100,000?

details at link

Demeter

(85,373 posts)

Bearishness has reached an extreme not seen at least since the top of the Internet bubble in early 2000.

Yet this is a bullish omen, according to the inverse logic of contrarian analysis: Extreme levels of bearishness indicate that there is a very robust “wall of worry” for the market to climb...

Demeter

(85,373 posts)When it comes to overbooked flights, no one is safe.

Economist Nouriel Roubini tweeted on Thursday that his Nobel Prize-winning colleague, economist Robert Shiller, was bumped off a United Airlines UAL, -1.62% flight after he and his wife, Virginia, had already taken their seats on the airplane. Shiller, who teaches at Yale University, Roubini tweeted, was a victim of over-booking.

It’s a risk every traveler takes when flying, and not everyone believes a Nobel Prize winner should be given preferential treatment over another passenger. “Is there a rule which says Nobel winners should get preferential treatment?” one person tweeted.

But Shiller, who was traveling with wife Virginia, did not expect special treatment because he won a Nobel Prize. “Bob would never think because he’s a Nobel Prize winner that he deserves anything better than anyone else,” his wife Virginia, who was also on the flight, told MarketWatch. The Shillers were among those told to leave the plane because, she says, she bought their tickets on a travel website. “Apparently, our fare was the lowest,” she says. “I will never do that again.”

So what happened? “They said if nobody was volunteering, they’re going to have to pick someone,” she adds. “They said, ‘You’re going to have to get off the flight. It was just extraordinarily difficult and inconvenient. What if your daughter was pregnant or you were going to a funeral? They ended up paying us $2,700, which did not cover the alternative arrangements we had to make. Never in my wildest dreams did I think they would walk up to us. They did not listen to any of our explanations.”

It would have made more sense for United Airlines staff to offer a larger incentive for passengers (who did not have to be at their destination that evening) to agree to take a later flight, she adds. “It was totally irrational. They probably could have gotten a volunteer to take $2,700. They have these formulas. It’s like something they do in socialist countries.”

Demeter

(85,373 posts)The shock resignation of U.S. House Speaker John Boehner on Friday reduces the chances of a government shutdown next week, potentially removing one source of investor anxiety as Wall Street gears up for a week heavy with economic data and commentary by Federal Reserve policymakers.

Boehner said Friday he will step down from the speakership and leave the House at the end of October. This was seen as a sign that Boehner would advance a bill to fund the government without any complicating factors that would result in a White House veto.

"This significantly reduces the probability of a government shutdown next week," Goldman Sachs economists said in a note to clients on Friday.

While Boehner's resignation makes a government shutdown due to a lack of funding on Oct. 1 less likely, other fiscal challenges remain. A long-term federal budget deal and a debt ceiling increase must still be passed by Congress. Disputes over these issues between the two parties and among Republicans will not be resolved by Boehner's departure.

"The next relevant question for financial markets will be how this affects the debt limit and other pending issues. There is a clear possibility that the vote next week, which was initially expected to deal just with the extension of spending authority, could instead also address other issues like an extension of the Export-Import Bank and, possibly, even an extension of the debt limit," Goldman Sachs' note said.

Removing one area of uncertainty could help calm a U.S. stockmarket in the midst of a correction in the past month as investors grapple with weakening earnings, China's economic woes and uncertainty surrounding U.S. monetary policy....

I DON'T BELIEVE A WORD OF IT. I'D LOVE TO BE PROVEN WRONG, BUT EVEN IF THE GOP IS CONSUMED BY A POWER STRUGGLE, THEY WILL STILL REFUSE TO DO THE JOB TO WHICH THEY WERE ELECTED. AND BOEHNER WILL STILL BE THERE, UP TO THE LAST MINUTE...

Demeter

(85,373 posts)We call it vision when it works. But what possessed the leadership of Volkswagen to systematically falsify emissions reports? What drives a magnate with unruly hair (so much so that it has its own meme) to toss his pompadour in the ring and make a loud bid for the presidency? Why would the CEO of a BigPharma company think a five thousand percent price hike on a medication was justifiable? Is it really the same impulse that prompts a smiling, trailer-dwelling CEO to transform his online retail site into a model of the workplace 3.0? I’m of course referring to Hsieh’s holacracy in the place of hierarchy strategem: Think Different circa pretty much now. What drove Hsieh, as the press gushed (drinking the punch), was a fear of being bored. To me his biggest legacy is not everyone getting to feel the veneer of equal, but that a mindset does indeed drive leadership. But also: the perception of what is good leadership and bad leadership is inevitably measured by results. If the results are devastating, that same sense of derring-do becomes a characteristic of the damned. Volkswagen’s CEO is out and there are more than 600,000 employees whose level of engagement has just plunged to zero.

What drives leadership is neuroscience; wiring. That’s what drives leaders to be an inspiration to the rest of us or an utter head shaker, or both. It’s their own psychology that brings down a company (and loses it $7.3 billion and a widening, enormous share of the global market) or changes the political game, to the benefit of a nation or not. But there are still two key traits of leadership that will make a workplace instead of breaking it, and we still need to hew to them:

- Transparency. Amongthe forces that cause insomnia on leaders is rigidity. There are leaders who are, simply, too proud to be responsive or adaptive. They refuse to change for the sake of the workplace or the mission; hewing to a dysunfctional model because it is the status quo but also their very survival is entrenched in it. Our brains have built in ways of fighting change, one reason “think different” still seems so radical a concept. But this kind of gravity is the enemy of transparency, without which disasters happen: as well as being unable to adapt to change, they are unable tor respond to problems in an innovative way. It’s not innovative to lie. It’s not visionary to be obnoxious, unless it part of a very long, very annoying corporate con.

- Emotional intelligence. Buzzword it may be, but another key marker of dysfunctional leadership is crowded out vision entirely. There are leaders too busy to win: those too trapped in the forest to see the trees; overwhelmed, constantly connected, unable to turn off and therefore preventing themselves from being able to work at peak performance or productivity — or inspire the engagement and confidence of their workforce. The whole “I live in a trailer, and it’s really cool” ethos that Hsieh transmitted had an underlying message: being too busy to live is being too busy to lead.

I’ve seen organizations dovetail their internal culture and functionality beautifully only to have a leader quash the effort: there are countless surveys advocating the adoption of tech, for instance, and lamenting the gap between recommendation and implementation. We also know leaders with such a precise and confidence instinct for the next zeitgeist that they simply leapfrog over recalcitrant boards or management strata — and that can work as well.

Now, though, perhaps more than any time before, there are global consequences to faulty leadership — just as profound, if not more, as to good leadership. And if we’re touting talent; the human factor; as the new currency in the world of work, let’s take a page form our own playbook. Opaque leadership is a paradox and a contradiction: Volkswagen’s leader made a travesty of the value of transparency, and probably ruined a legacy brand. So if the new world of work is still based on the same classic, sacred geometry: leaders, and followers, perhaps its time to delve into leadership analytics as well as talent analytics, and make sure we’re all aligned. We can’t change our brains, but we can certainly manage the consequences better.

IMO, THE THING THAT MAKES A LEADER IS FOLLOWERS...WHAT MAKES A GOOD LEADER IS GOOD FOLLOWERS!

AND WHEN THE FOLLOWERS ARE STINKY ROTTEN BAD, IT'S TIME TO HEAD FOR THE HILLS!

AND WHEN THERE ARE NO FOLLOWERS? THEN THE WOULD-BE LEADER IS AHEAD OF HIS/HER TIME...THE CRISIS HASN'T LANDED, YET.

Demeter

(85,373 posts)HAS BILL NEVER HEARD THE EXPRESSION "CAVEAT EMPTOR"?

http://www.reuters.com/article/2015/09/25/us-petrobras-billgates-lawsuit-idUSKCN0RP1OY20150925?feedType=RSS&feedName=businessNews

The Bill & Melinda Gates Foundation Trust has sued Brazil's Petrobras to recoup stock losses stemming from a corruption scandal at the state-run oil company. According to a complaint filed late Thursday night in federal court in Manhattan, Petrobras' "pervasive bribery and money laundering scheme" caused the trust and another plaintiff, WGI Emerging Markets Fund LLC, to lose tens of millions of dollars by investing in the company. (Westwood Global Investments LLC, a Boston-based firm, manages investments for the foundation and the WGI fund.) "Indeed, the scandal still seems to escalate by the day - as more guilty pleas, more arrests, and more secret bank accounts are uncovered," the complaint said.

Petrobras, whose formal name is Petroleo Brasileiro SA, is facing a slew of U.S. class-action litigation claiming that years of corruption, including bribery, inflated the value of more than $98 billion of its stock and bonds.

Created in 2000 by Microsoft Corp (MSFT.O) co-founder Bill Gates and his wife Melinda, the Gates Foundation focuses on improving health and education and reducing poverty. Based in Seattle, it is among the world's largest philanthropic organizations, with a $41.3 billion endowment. Berkshire Hathaway Inc Chairman Warren Buffett is a trustee of the foundation. The trust, which manages the endowment assets, is suing on its own, suggesting it believes it might recover more of its losses on Petrobras' American depositary shares that way.

A Brazilian affiliate of Petrobras auditor PricewaterhouseCoopers (PwC) is also a defendant. Petrobras and PwC declined to comment. Lawyers for the trust did not respond to requests for comment. Petrobras' market value has plunged more than 90 percent from nearly $300 billion seven years ago. It took a $17 billion writedown in April for overvalued assets. Prosecutors have said more than $2 billion of bribes were paid over a decade, mainly to Petrobras executives from construction and engineering companies.

Demeter

(85,373 posts)BECAUSE LITTLE MINDS CANNOT CONCEIVE OF SUCH A CATASTROPHE?

http://marketrealist.com/2015/09/expect-muted-returns-us-equities/

...Looking ahead to 2016, the big risk to U.S. stocks remains an emerging market-induced global recession. Emerging markets account for a growing percentage of global growth, and the recent slowdown in the emerging world isn’t limited to China, as data from Bloomberg demonstrate. Economies in Brazil and Russia are contracting, and most large emerging markets, with the possible exception of India, are slowing, according to the data. But while 2016 is likely to be another year of slow global growth, I don’t foresee a global recession. While China remains a genuine threat, the government has additional monetary and fiscal tools to manage its slowdown. As such, I also don’t see a bear market starting during the first half of 2016.

The slowdown in the Chinese economy has had many side-effects. China (FXI) is a major market for commodities, so more evidence of a hard landing in China led to a major slump in commodity prices. Commodity-exporting economies are already reeling due to low commodity prices.

Russia (RSX), a major oil exporter, is in a deep recession, with its GDP (gross domestic product) slumping by 4.6% in the latest quarter. Brazil (EWZ), a major exporter of raw materials, has also entered recession territory, with its GDP falling by 1.9%, unannualized, in 2Q15.

However, not all emerging markets (EEM) are negatively affected by low commodity prices. Emerging Asian economies, including China and India (INDA), are big importers of oil. Lower commodity prices are a plus for these economies.

As we mentioned earlier, the United States is a relatively closed economy that’s less affected by a slowing global economy. It’s more dependent on consumer spending. However, companies with international exposures could be negatively affected by the slowing demand elsewhere...

Demeter

(85,373 posts)An analyst says one-third of the companies could be bankrupt by the end of next year...

UNLESS A SHOOTING WAR BREAKS OUT AND DEMAND SHOOTS PRICES SKY-HIGH, OF COURSE. I'M NOT A BETTING PERSON, BUT GIVEN THE LEVEL OF CUPIDITY/STUPIDITY, I'D SAY THAT WAS VERY LIKELY.

Demeter

(85,373 posts)from his lips to god's ear

Demeter

(85,373 posts)Imagine your doctor put you on a daily dose of oxycontin, phenobarbital and Quaaludes for six years straight. Then he suddenly cancelled your prescription. Do you think your behavior might become a bit erratic? This is what’s going on with the stock market. It’s trying to shake off six years of overmedication brought on by the Fed’s zero rates and liquidity injections. Let me explain: Until recently, stocks had been on a tear that pushed valuations into the stratosphere. Volatility stayed low because Bernanke’s easy money and QE made investors more placid, serene and mellow. They ventured further out on the risk curve and took more chances because they were convinced that the Fed “had their back” and that there was nothing to worry about.

Then things began to fall apart. The Fed ended its asset purchase program and started talking about “normalization”, an opaque term the Fed uses to avoid the harsher sounding “rate hikes.” This is what began to rouse investors from their drug-induced trance. The era of cheap money was coming to an end. The punch bowl was being taken away. Then– just as the Fed’s surging liquidity had calmed the markets for six years– the absence of liquidity and high-frequency trading sent stocks gyrating wildly for months on end. The markets became unpredictable, convulsive, topsy-turvy. And while rates remained fixed at zero throughout, the mere anticipation of higher rates was enough to ignite a sustained period of extreme volatility unlike anything traders had ever seen before. By taking its foot off the gas pedal and trying to restore traditional market dynamics, the Fed had slammed the vehicle into reverse unleashing pandemonium across global markets.

Naturally, the pundits tried to blame the mayhem on China or emerging markets or droopy commodities prices or even deflation. But it’s all baloney. The source of the problem is the Fed’s easy money policies, that’s what created the disconnect between valuations and fundamentals, that’s what sent stock prices to the moon, and that’s what inflated this ginormous stock-and-bond bubble that is just now beginning to unwind. China might have been the trigger, but it’s certainly not the cause. Last Thursday, the unthinkable finally happened: The FOMC issued a statement that the interest rates would not be raised after all, but that ultra-accommodative policies would remain in place for the foreseeable future. On similar occasions, the markets have always rallied in gratitude for more-of-the-same easing. But not this time. This time, the Dow Jones surged 100 points before cratering 299 into the next session.

“Ah, the Fed has lost its magic touch”, the analysts opined. The promise of zero rates was no longer enough to push stocks higher. What does this mean? If the Fed does not have supernatural powers, then who will keep the markets from plunging? Who will keep the bubble intact? Who will save us from a painful correction?

Nobody knows. What we do know is that stocks are currently rising on the back of cheap credit that is being diverted into Mergers and Acquisitions (M&A) and stock buybacks. Corporate debt continues to grow even while earnings and revenues shrink. In other words, the Fed’s perverse incentives (zero rates) have seduced corporations into piling on record debt for financial engineering and asset stripping, while investment in building up their companies for future growth (Capex) has fallen to post war lows. That’s the kind of shenanigans that’s driving the markets. Corporations have been riding the crest for the last three years, refinancing more than $1 trillion per year from 2012 to 2015. But tighter credit conditions and mounting debt servicing is expected to curb their appetite for more borrowing dampening the prospects for higher stock prices. The same rule applies to stock buybacks. When equities prices flatten out or drift lower, and debt gets more pricey, share repurchases no longer make sense. So, you can see that –even if rates stay low– tighter credit and extra debt servicing is going to pull the rug out from under the market and put stocks into a deep freeze.

The point is, the Fed knows what’s going on but just looks the other way. They know their easy money isn’t building a strong, sustainable recovery. They know it’s being used to beef up leverage on risky bets so dodgy speculators can make a killing. They know it all, but they don’t give a rip. They just want to keep the game going a little bit longer, that’s all that matters to them. Heck, maybe Yellen has convinced herself that she can pull a rabbit out of her hat at the last minute and save us all from disaster? It’s possible, but I doubt it. I think she knows we’re goners. The economy is soft, the markets are zig-zagging wildly, and the whole bloody contraption looks like its ready to blow. She must know that the game is just about over.

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

Demeter

(85,373 posts)As documented in Douglas Blackmon's book, Slavery By Another Name: The Re-Enslavement of Black Americans from the Civil War to World War II, the institution of slavery in the U.S. South largely ended for as long as 20 years in some places upon completion of the U.S. civil war. And then it was back again, in a slightly different form, widespread, controlling, publicly known and accepted -- right up to World War II. In fact, in other forms, it remains today. But it does not remain today in the overpowering form that prevented a civil rights movement for nearly a century. It exists today in ways that we are free to oppose and resist, and we fail to do so only to our own shame.

During widely publicized trials of slave owners for the crime of slavery in 1903 -- trials that did virtually nothing to end the pervasive practice -- the Montgomery Advertiser editorialized: "Forgiveness is a Christian virtue and forgetfulness is often a relief, but some of us will never forgive nor forget the damnable and brutal excesses that were committed all over the South by negroes and their white allies, many of whom were federal officials, against whose acts our people were practically powerless." This was a publicly acceptable position in Alabama in 1903: slavery should be tolerated because of the evils committed by the North during the war and during the occupation that followed. It's worth considering whether slavery might have ended more quickly had it been ended without a war. To say that is not, of course, to assert that in reality the pre-war United States was radically different than it was, that slave owners were willing to sell out, or that either side was open to a non-violent solution. But most nations that ended slavery did so without a civil war. Some did it in the way that Washington, D.C., did it, through compensated emancipation.