Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 8 January 2016

[font size=3]STOCK MARKET WATCH, Friday, 8 January 2016[font color=black][/font]

SMW for 7 January 2016

AT THE CLOSING BELL ON 7 January 2016

[center][font color=red]

Dow Jones 16,514.10 -392.41 (-2.32%)

S&P 500 1,943.09 -47.17 (-2.37%)

Nasdaq 4,689.43 -146.34 (-3.03%)

[font color=green]10 Year 2.14% -0.02 (-0.93%)

30 Year 2.93% -0.01 (-0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Warpy

(111,237 posts)Hold tight to the reins, fellow cowpokes, gonna be a wild ride at the rodeo tomorrow. China has suspended it circuit breaker for tomorrow, so if their market goes into full panic selling, it's going to be a wild day here, also. Our circuit breaker is still in place, so the carnage will be limited, but Wall Street is going to be very, very unhappy.

China will most likely have a rally late in trading, the bargain hunters who still have cash materialize after any big slide. Then again, their markets are so new that they're unpredictable and this might not happen, so the wild ride will extend through next week.

I see oil is having a big slide of its own. It goes down much more, they'll have to pay us to fill up our cars.

Yeah, I know, but if you're going to dream, dream big.

Proserpina

(2,352 posts)The China Securities Regulatory Commission has suspended a circuit breaker that halted stock trading twice this week. The CSRC says the circuit breaker was doing more harm than good. The regulator has not said when, if ever, the circuit breaker will return.

http://qz.com/588386/chinas-new-stock-market-circuit-breaker-is-broken-and-it-is-panicking-investors/

China’s new circuit breaker shut down its volatile stock markets on Jan. 7—the second time in one week. Though the two-part mechanism—introduced on Jan. 4 and put to immediate use—was meant to tame drastic fluctuations, critics say it made investors panic instead.

At 10:30pm local time (9:30 pm ET) on Jan. 7, the China Securities Regulatory Commission announced on Weibo that it was suspending the circuit breaker rule.

The rule halted trading for 15 minutes after a 5% drop in the CSI 300 index (a benchmark of the largest 300 stocks listed in Shanghai and Shenzhen) and then halted them for the rest of the day after a 7% retreat. In both instances this week, a first pause was quickly followed by trading being shut down. (Jan. 7 was China’s shortest trading day ever.)

A similar circuit breaker exists in the US, but with much wider gaps: It temporarily halts trading after a 7% drop in the Standard & Poor’s 500 Index, then again at 13%—but suspends trading for the day only if losses reach 20%.

In China’s volatile market, where a 5% drop or jump isn’t uncommon in a normal trading day, all that a 5% pause period does when the market falls is “create a time when everyone can get their sell orders in,” Christopher Balding, an economics professor at Peking University HSBC Business School, told Quartz.

And then, when the market drops by 7% and is shut for the day, investors “wake up the next morning and think ‘I have got to take my money out,'” Balding said. “It ramps up the panic mentality.” Most market experts agree circuit breakers should just be used in “extraordinary circumstances.”

The 5% and 7% stops have “a ‘magnet effect’ as prices gravitate towards the breaker, and prompt a stampede that drains market liquidity,” wrote Hao Hong, chief China strategist at Bocom International Holdings in a report cited by Bloomberg.

And there are early signs Thursday that China’s down markets could spark investors around the world to sell: Britain’s FTSE 100 index was down as much as 3% in early trading, and Germany’s DAX Index had dropped 3.5%.

The circuit breaker is just the latest example of Beijing’s heavy-handed attempts to control the stock markets, efforts that cost the government and state-owned enterprises over $1 trillion last year. Chinese regulators don’t seem to understand “what markets are, how they work or how they are going to react,” Balding said.

Oh, let's be honest about it...the wrong people were losing money. When they figure out how to game it so that the little guy is always taking it in the neck, then they will have "controlled the stock markets".

Proserpina

(2,352 posts)China's foreign exchange reserves fell by $107.92 billion in December, the biggest monthly drop on record, data from the People's Bank of China released Thursday showed.

For the whole year of 2015, China's foreign exchange reserves were down by $512.66 billion, also the largest recorded annual decline.

The PBOC has been using its huge foreign exchange reserves for intervention in the foreign exchange market to defend the yuan's value since the effective devaluation on Aug 11 last year.

The forex reserves fell heavily, down by $93.9 billion in August, following by another $43.3 billion drop in September. There was a modest increase of $11.4 billion in October and a hefty decline of $87.2 billion in November.

There has been concerns that the PBOC's intervention in the interbank forex market could soon deplete the country's huge foreign exchange reserves, which stood at $3.33 trillion through the end of December...

Proserpina

(2,352 posts)China’s great success as a significantly controlled economy is foundering for similar reasons to that of the last great Asian success story, Japan, which also had a model of central guidance and in many ways, even less economic integration that China has shown in recent years (Japan’s domestic market was famously impenetrable to foreigners even after the West demanded the dismantling of import barriers; Japanese consumers simply did not want and 30 years later are still suspicious of foreign goods).

Japan had financial liberalization forced on it by the US in the 1980s, which wanted the world made safe for America’s investment banks. Japanese banking was deregulated rapidly, and Japanese banks, lacking the skill to manage complex new risks, blew themselves up in remarkably short order (admittedly aided and abetted by the Bank of Japan, which thought that stoking asset appreciation would create a wealth effect that would increase domestic consumption).

The Chinese variant of this story is that China’s evolution from an economy with restrictions on capital flows and a controlled currency to one that is more open is deemed to be both internationally and in China a sign that China is “maturing”. But we’ve been skeptical of the conventional wisdom that leaving economies open to the free movement of capital is all that it is cracked up to be. This view was confirmed by an important 2011m paper, Global imbalances and the financial crisis: Link or no link?, by Claudio Borio and Piti Disyatat of the Bank of International Settlements, which ascertained that America’s capital flows were a stunning 61 times greater than trade flows, and argued that a major driver of the crisis was excessive financial elasticity. Similarly, in their study of 800 years of financial crises, Carmen Reinhart and Kenneth Rogoff found that higher levels of international capital flows were strongly correlated with more frequent and severe financial crises.

They just figured that out? more at link

Proserpina

(2,352 posts)Why Oil Keeps Falling off the Chart

After having been through the greatest two-year loss on record, the price of oil plunged 9.6% on Wednesday and in evening trading. As I’m writing this, WTI hit $32.62 a barrel, a new low since the desperate depth of the Financial Crisis, when it very briefly kissed $30.28 a barrel on December 23, 2008, before bouncing off sharply...This time, it’s serious. Brent, the global benchmark, has crashed to $32.75, an 11-year low. This isn’t a quick scare that happens during a Financial Crisis. It’s the result of a persistently growing glut.

Since the oil price plunge began in July 2014, every rally, every “opportunity of a lifetime” to buy oil “for cents on the dollar” has turned out to be a falling knife. This is what the three trading-day, 15% crash of WTI looks like:

The contagion of the oil price plunge has been drifting into other sectors of the US economy, housing and office space in Houston, the state budget in Alaska, jobs, manufacturing…. Investments have gone up in smoke. Loans have gone bad. Defaults, restructurings, and bankruptcies are now a routine occurrence. Banks are looking over their shoulder. PE firms are licking their wounds from their mega-bets on fracking made in prior years, and they’re licking their new wounds from having tried to catch many falling knives. This isn’t going to be an easy bust to get through. It’s a US problem. And it’s a global problem...In the US, crude oil production started declining on a monthly basis in mid-2015, according to EIA estimates. But despite those monthly declines, production averaged 9.3 million barrels per day in 2015, the highest rate since 1972, and a 7% increase over 2014. On Wednesday, the EIA reported that US crude oil stocks dropped 5.1 million barrels during the week to 482.3 million barrels. Drawdowns at this time of the year are common. So it left stock levels a monstrous 100 million barrels above the already high stock levels at the same time last year.

The chart shows the hair-raising stock levels. I added the two red lines to juxtapose the already high stocks at this time last year (above the 5-year range, gray area) with the current level:

Note how declines are common this time of the year, but how last year at this time inventories began to skyrocket. It is unlikely that inventories will skyrocket to the same extent this year. If they do, it’s going to get ugly beyond comprehension. It’s more likely that inventories will rise at a pace closer to normal seasonal increases. Even those increases will inflate inventories – if there’s even enough storage capacity available – to dizzying heights by the time driving season begins. However, the spooky thing in Wednesday’s report was the buildup of 10.6 million barrels in gasoline stocks, the largest weekly buildup since 1993. Without it, there wouldn’t have been a crude oil drawdown!

more

Proserpina

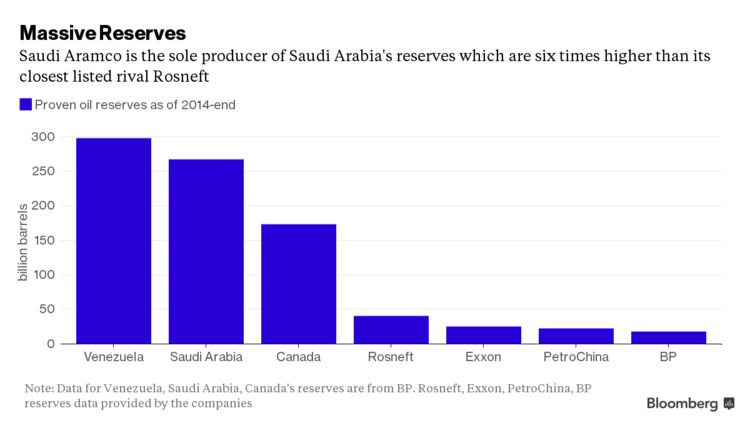

(2,352 posts)The world biggest crude exporter is considering selling a stake in its state-owned company, which controls more than a tenth of the global oil market. A potential initial public offering is under review for Saudi Arabian Oil Co., also known as Aramco, Mohammed bin Salman, the kingdom’s deputy crown prince, said in an interview with The Economist. A decision will probably be taken in the next few months, he said, without giving further details.

“Personally I’m enthusiastic about this step,” Salman said. “I believe it is in the interest of the Saudi market, and it is in the interest of Aramco” by helping to promote transparency and counter corruption, he said.

Aramco could rival Apple Inc. as the world’s biggest listed company. It is solely responsible for tapping the world’s second-largest crude reserves, with production double that of its nearest rival. The company is one of the key players in balancing the oil market and its investment decisions have the potential to move crude prices and affect economies around the world.

more

Proserpina

(2,352 posts)Default Rate Highest since 2009, US Distress Ratio Soars.

Standard & Poor’s slashed the credit ratings of 112 corporations around the globe to default (D) or selective default (SD) in 2015, according to S&P Capital IQ Global Credit. The highest number of global defaults since nightmare-year 2009, when a previously unthinkable 268 companies defaulted, and not far behind the second highest default tally of 125, in 2008.

The oil & gas sector led with 29 defaulters (26% of the total). Metals, mining, and steel followed with 17 defaulters (15% of the total). The consumer products sector and the bank sectors tied for the third place, each with 13 defaulters (12% of the total). So where are the defaulters? In Russia and Brazil? The economies of both countries have been ravaged by deep recessions and other problems. They rank high on the list but the country with most of the defaulters is… the US. In total, 66 defaulters were US issuers, up 100% from 33 in 2014, and the highest since 2009. US defaulters accounted for 59% of the global total. Some of this dominant share of defaulters can be attributed to the size of the US economy and the enormous size of its credit market. But the US is also the epicenter of oil & gas defaults, with contagion now spreading to other sectors.

An indication of what’s coming in 2016 is the Standard & Poor’s Distress Ratio. It’s the proportion of junk-rated bonds with yields that exceed Treasury yields by at least 10 percentage points (option-adjusted spread). And this Distress Ratio soared in December to 24.5%, up from around 5% in 2014. There are now 437 bond issues tangled up in the ratio:

Of those 437 bond issues in the Distress Ratio, 127 have been issued by oil & gas companies. The metals, mining, and steel sector has 71 bond issues in the ratio. The remaining 239 issues are spread over other sectors. And a number of these distressed issuers will default down the line. So defaults in the US are likely to get even uglier in 2016. Emerging Markets were in second place with 25 defaulters, up from 15 in 2014 and the highest since 2009, according to S&P Capital IQ Global Credit, “owing largely to a credit spillover effect of the increasingly unfavorable geopolitical climate in Brazil and Russia.” Brazil sported eight defaulters, and Russia seven, thus occupying the second and third country-rank behind the US. In Europe, where QE and negative yields are raging, S&P downgraded 16 issuers to default, up 167% from 2014, despite the current monetary policies that should make defaults virtually impossible. The remaining 5 defaulters were spread over other developed nations (Australia, Canada, Japan, and New Zealand):

There are different reasons companies can be downgraded to D or SD. Of the 112 defaulters, 36 (or 32% of the total) undertook “distressed debt exchanges,” a favorite extortion method in the US oil & gas sector, whereby the company tells investors to swap existing bonds for new bonds with a huge haircut, or risk an even worse fate in bankruptcy court. This tool is becoming increasingly popular: in 2015, 32% of defaults were distressed debt exchanges, up from 23% in 2014. Another 32 defaulters failed to make interest or principal payments, while 22 filed for bankruptcy. Among the remaining defaulters, 11 were the result of regulatory interventions. Standard & Poor’s global “weakest links” – companies on the lower end of the junk-bond spectrum most in danger of defaulting – reached 195 in December, the highest since March 2010 (when there were 203), representing $234 billion in rated debt, with oil & gas in first place and financial institutions (!) in second place:

more

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2016-01-07/wall-street-promotion-logjam-endures-with-fleming-latest-to-exit?cmpid=yhoo.headline&ref=yfp

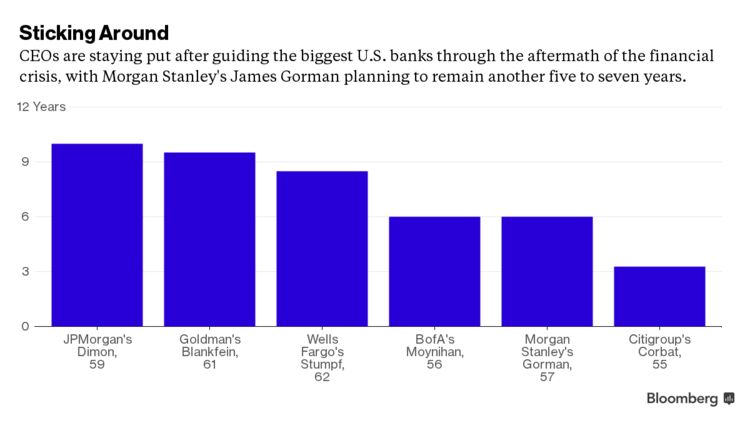

Morgan Stanley is demonstrating how rising to the top of a big U.S. bank is getting even harder, as chief executive officers stay on after guiding their firms through the aftermath of the financial crisis. Greg Fleming, one of Morgan Stanley’s most senior leaders, announced Wednesday he’s stepping down. That came after CEO James Gorman indicated he plans to stay on at least five more years and installed an older deputy in the firm’s No. 2 position, according to people with knowledge of the matter.

The situation is likely to feed the growing unease on Wall Street described by recruiters in recent months: Managers see a logjam ahead of them, blocking promotions they think they deserve. And it reaches to the top. CEOs at five of the six biggest U.S. banks already have held their posts at least six years and haven’t publicly signaled any intent to leave soon.

“These guys are very control-oriented and they want to work as long as they can,” Michael Karp, head of recruitment firm Options Group Inc., said after the changes at Morgan Stanley became public. “Stability is great, but the younger generation is blocked from moving up and running these institutions. It’s a huge hindrance.”

Gorman, 57, recently told lieutenants about his decision to stay for five to seven more years, which was longer than what he had previously indicated, according to a person familiar with the situation. That and his decision to promote Colm Kelleher, 58, to president prompted Fleming to decide it wasn’t worth sticking around, the people said. He could’ve remained in his current role atop Morgan Stanley’s brokerage with Kelleher as his superior, the people said.

When a CEO decides to keep going, would-be successors may leave to run their own companies. JPMorgan Chase & Co. CEO Jamie Dimon, who’s repeatedly said he wants to stay another five years, has overseen a stream of departures of potential successors. They include former co-Chief Operating Officer Frank Bisignano, who left in 2013 to run First Data Corp., and Mike Cavanagh, who stepped down in 2014 to join Carlyle Group LP before becoming finance chief at Comcast Corp...The situation in the U.S. contrasts with Europe, where the region’s biggest banks have undergone an unprecedented wave of management changes. Firms including Deutsche Bank AG, Credit Suisse Group AG and Standard Chartered Plc installed new leaders at the top last year. Barclays Plc picked Jes Staley, who had spent more than three decades at JPMorgan and had once been viewed there as a potential future CEO.

Such changes may spell opportunity for more U.S. executives willing to move...

more

Proserpina

(2,352 posts)Companies in the Standard & Poor’s 500 Index really love their shareholders. Maybe too much.

They’re poised to spend $914 billion on share buybacks and dividends this year, or about 95 percent of earnings, data compiled by Bloomberg and S&P Dow Jones Indices show. Money returned to stock owners exceeded profits in the first quarter and may again in the third. The proportion of cash flow used for repurchases has almost doubled over the last decade while it’s slipped for capital investments, according to Jonathan Glionna, head of U.S. equity strategy research at Barclays Plc.

Buybacks have helped fuel one of the strongest rallies of the past 50 years as stocks with the most repurchases gained more than 300 percent since March 2009. Now, with returns slowing, investors say executives risk snuffing out the bull market unless they start plowing money into their businesses.

“You can only go so far with financial engineering before you actually have to have a business with real growth,” Chris Bouffard, chief investment officer who oversees $9 billion at Mutual Fund Store in Overland Park, Kansas, said by phone on Oct. 2. “Companies have done about all that they can in terms of maximizing the ability to do those buybacks.”

S&P 500 constituents will probably say earnings rose 4.9 percent in the third quarter when they begin reporting results this week, according to more than 10,000 analyst estimates compiled by Bloomberg. Alcoa Inc., Yum! Brands Inc. and Monsanto Co. are among nine companies scheduled to announce financial details.

more

Proserpina

(2,352 posts)Iceland will need a broad package of measures, including potentially a financial transaction tax, to ensure stability as it prepares to unwind the last of its capital controls, according to the head of parliament’s economic affairs committee.

"There’s probably no single solution that resolves everything," Frosti Sigurjonsson, chairman of the committee, said in a telephone interview. "A Tobin tax could be one of many measures, but I think it’s better to have more than less alternatives."

Policy makers at the central bank are working on a plan to prevent so-called carry trading from once again imperiling financial stability. As Iceland moves closer to doing away with krona restrictions, in place since its banks collapsed in 2008, investors are showing renewed interest in one of the world’s smallest currencies to profit from the country’s higher interest rates.

In response to accelerating inflation, the central bank has raised rates three times since June to 5.75 percent, driving foreign demand for its debt. With other benchmarks rates across the world near zero, or even below, foreign investors now control more than 24 percent of Iceland’s government debt market.

Central Bank Governor Mar Gudmundsson said in an interview in November that monetary policy was being challenged by the renewed carry trade and that it was looking at measures to reduce investors interest in short-term krona positions, including a tax or minimum reserve requirements with very low or no interest.

more

Proserpina

(2,352 posts)In short: the market is getting worried that Riyadh is about to careen into crisis. In the face of slumping crude, the Saudis are staring down double digit budget deficits and the prospect of having to once again tap debt markets in order to offset the SAMA burn and keep the kingdom from having to implement further subsidy cuts.

The open hostilities with Iran all but guarantee the war in Yemen will escalate (just today for instance, Tehran accused the Saudis of bombing the Iranian embassy in Sana’a) and that entails a further drain on the kingdom’s finances as the monarchy will be forced to fund a prolonged and intractable struggle with the Houthis.

Additionally, the more tension there is between Riyadh and Tehran, the more fractious OPEC will become and with Iranian supply set to rise in the new year as international sanctions are lifted, this may well be one Mid-East conflict that drives oil prices lower rather than higher - especially if the SAR peg falls.

On Thursday, in the wake of a veritable meltdown in markets across the globe, riyal forwards hit their highest level in almost two decades as oil plummeted. As Bloomberg notes, “twelve-month forward contracts for the riyal climbed 260 points to 950 as of 3:49 p.m. in Riyadh, set for the steepest close since December 1996 [reflecting] growing speculation the world’s biggest oil exporter may allow its currency to slide against the dollar for the first time since 1986.”

Meanwhile, Saudi CDS spreads are now wider than those of Portugal.

So just to drive the point home, Saudi Arabia, which entered 2015 with virtually no debt and an FX reserve war chest that amounted to around three quarters of a trillion dollars, is now viewed as less creditworthy than a country where a coalition of socialists, left-wingers, and communists just overthrew the government.

Proserpina

(2,352 posts)Simultaneous slowdown in Brics economies would jeopardise chances of pick-up in global growth this year, report says...The risk of the global economy being battered by a “perfect storm” in 2016 has been highlighted by the World Bank in a flagship report that warns that a synchronised slowdown in the biggest emerging markets could be intensified by a fresh bout of financial turmoil.

The Bank said the possibility that Brazil, Russia, India, China and South Africa – the so-called Brics economies – could all face problems simultaneously would put in jeopardy the chances of a pick-up in growth in the coming year. It added that the impact would be heightened by severe financial market stress of the sort triggered in 2013 by the announcement by the Federal Reserve that it was considering reducing the stimulus it was then providing to the US economy.

Launching its annual Global Economic Prospects, the Bank said activity in 2015 had failed to live up to its expectations – the fifth year in a row that growth has undershot the forecasts made by the Washington-based institution, which lends to the world’s poorest countries. The Bank said growth had slowed to 2.4% in 2015, from 2.6% in 2014, but added that a stronger performance in developed countries should lead to 2.9% growth this year.

“Downside risks dominate and have become increasingly centred on emerging and developing countries,” it said.

well, then, the Eurozone is going to have to give up its austerity fetish, won't it? And so will Congress, since there won't be any more money to steal from the BRICS...

Proserpina

(2,352 posts)Federal Reserve policymakers appear to have succeeded in their push last month to convince investors the central bank will hold on to its $4.5-trillion portfolio at least until next year, a Fed survey showed on Thursday. Recent interviews with officials showed they were counting on the Fed's massive bond holdings to blunt some of the impact of interest-rate hikes this year. But they were also concerned that markets did not fully appreciate that the central bank was willing to hang on to the bonds for longer than thought only three or six months ago.

They said that apparent perception gap could explain in part why they are expecting a brisker series of rate hikes in 2016 than investors do. It was also a reason why, as it raised rates last month for the first time in nearly a decade, the U.S. central bank used new language saying it will keep its portfolio at its record size until rate hikes are "well under way." The nudge, designed to push back expectations when the Fed would start shrinking its giant portfolio, seems to have worked.

The New York Fed's survey published on Thursday showed that before last month's rate hike most Wall Street dealers had expected the balance sheet to start shrinking around December. But canvassed again on Dec. 18 most forecast the Fed would keep its $2.5 trillion Treasuries portfolio intact until March of next year, and its nearly $2 trillion mortgage-backed securities until January of 2017.

San Francisco Fed President John Williams told Reuters that by holding long-term borrowing costs down, the Fed's giant portfolio should give it some more headroom to raise rates without accidentally triggering an economic slowdown. Williams said that tightening at a brisker pace allows more leeway to cut rates should the recovery go sour, rather than relying on the "cumbersome" tool of quantitative easing if rates were still near zero.

"If we get that negative shock, we get a little bit of a cushion ... and of course we can adjust (rates) as needed," he said in an interview on Dec. 18.

The Fed is currently reinvesting proceeds from maturing assets, under a long-held plan. Doing so for even a few months longer than markets expect could depress longer-term borrowing costs and offset the planned tightening in short-term rates. This faith in the ongoing stimulative effect of the giant portfolio, built up from $900 billion to boost the U.S. recovery from recession, could be tested if world financial markets continue to tumble as China's economy slows.

so, that's the plan...jerk it up until we scream, then sell off the bonds...what a country!

Proserpina

(2,352 posts)Embattled Brazilian President Dilma Rousseff admitted Thursday that her government's "biggest mistake" was underestimating the magnitude of the economic crisis the recession-hit South American country has faced in recent years. In a meeting with a small group of journalists, Rousseff cited economic uncertainty in China and severe drought in Brazil in explaining the slowdown in her own country, the world's seventh largest economy.

"The biggest mistake was failing to see that the crisis was so big in 2014, failing to gauge the magnitude of the economic slowdown due to internal and external problems," she said, as quoted by the Estado de Sao Paulo newspaper.

Rousseff, whose approval rating has slipped to single digits as she faces calls for impeachment over a public financing scandal, said her top priority this year would be to rein in inflation and bring Brazil back to a budget surplus. Inflation in 2015 is thought to have risen above 10 percent, although official figures are not due out until Friday. Rousseff wants to bring that figure back down to 6.5 percent. The political chaos swirling around Rousseff has added to Brazil's economic woes, with GDP down 4.5 percent in the third quarter year-over-year, and the national currency, the real, down one-third against the dollar in 2015.

Rousseff also said that in 2016, Brazil should debate reforms to its pensions systems, with life expectancy on the rise. "We cannot have the average retirement age be 55 years old," she said.

The leftist president said she believed the opposition would back some of her initiatives that are in the nation's best interests.

Proserpina

(2,352 posts)U.S. conglomerate General Electric Co said it signed $157 billion in transactions in 2015 as part of its efforts to divest most of its finance business, GE Capital.

The company also said it has closed transactions of $104 billion, more than half of the target set while announcing its plans to reduce the financing business to less than 10 percent of its total earnings.

An active sales process is ongoing for the remaining international businesses while the company continues to close the previous deals, GE Capital Chief Executive Keith Sherin said.

GE Capital accounted for 42 percent of the company's profit in 2014.

Proserpina

(2,352 posts)Euro zone money markets priced in on Thursday around a 50 percent chance that the European Central Bank lowers its deposit rate deeper into negative territory at its March meeting.

Forward EONIA rates dated for the ECB's meeting on March 10 are trading at -0.30 percent, around 5 basis points below the overnight rate of -0.25 percent. Analysts said this indicated around half of a further 10 basis point cut is priced.

"Markets are reconsidering the ECB's stance and further rate cuts are entering expectations again," said Commerzbank strategist Benjamin Schroeder, expecting the ECB to cut its depo rate to -0.40 percent in March from its current -0.30 percent.

So the bail-ins will continue...austerity forever!

Proserpina

(2,352 posts)http://www.marketwatch.com/story/obamas-last-big-wish-another-supreme-court-appointment-2016-01-08?siteid=YAHOOB

In his gun safety event Tuesday, I was struck by something President Obama said. “I’m not on the ballot again,” he uttered. “I’m not looking to score some points.”

This is nonsense, of course. All presidents want to run up the score, particularly in their final year when days are few and the sense of urgency great. January 20, 2017 is just around the corner, and Obama intends to keep plugging away on his legacy until the very end.

There’s big stuff, of course: he and Ben Bernanke staved off another Great Depression. Like it or not, he got his way on some of his biggest goals: Obamacare, a nuclear deal with Iran, a global climate pact. It’s all one big outrage to Republicans, but because they’ve spent as much time fighting with each other as they have with him, he’s been able to keep scoring touchdowns.

But perhaps the biggest thing of all, something that few “Obama legacy” stories have mentioned thus far is this: he has appointed two Supreme Court Justices, Sonia Sotomayor, and Elena Kagan. Putting these judicial allies—who reflect his cultural and legal philosophy—on the high court means that Obama’s influence will be felt for years, perhaps decades, to come. Sotomayor, a Hispanic, has been a Justice since 2009, but is still just 61. Kagan, who joined in 2010, is 55. In Supreme Court terms they are spring chickens: Four justices are 77 or older and the median age is 67.

The business implications of this cannot be overstated. In the last year alone, the court has ruled on cases with wide-ranging impacts on companies and investors: same-sex marriage, health care subsidies (an Obamacare win), what power the Environmental Protection Agency has over industry (too much, the court ruled), employment discrimination and pregnancy discrimination, among others. Decisions in all but one of these cases (the EPA case) pleased the White House, and in all of them, the votes of Sotomayor and Kagan helped win the day.

Obama would love to put at least one more justice on the court. He would leave office a year from now knowing that a full-third of it was his doing...

As if Congress would let him! No way, Jose!

With a Rethug controlled congress.

The most likely candidate to retire would be RGB; and there is NO WAY IN HELL that the Senate would confirm anyone any way near as good as she is.

Now if Thomas or Scalia could be impeached, odds are we could get a better replacement. Of course that isn't going to happen either.

Proserpina

(2,352 posts)U.S. stock futures pointed to a higher open, putting the market on track to erase part of the week’s losses. A rally by Chinese stocks appeared to cheer investors, as they also brace for a key U.S. jobs report that’s due before the open.

S&P 500 futures rose 25.10 points, or 0.8%, to 1,948

Dow Jones Industrial Average gained 123 points, or 0.8%, to 16,542.

Nasdaq 100 futures added 39.25 points, or 9%, to 4,328.50.

Proserpina

(2,352 posts)Pension coverage in the private sector has shifted from defined benefit plans where professionals make investment decisions to 401(k) plans where participants are responsible for their own investment strategy. The supposition is that individuals are not very good at investing their own money and face high fees. The question is whether this supposition is borne out by the facts. That is, are returns on defined contribution plans markedly lower than those on traditional defined benefit plans?

A new study compares the returns from private sector defined benefit and defined contribution plans over the period 1990-2012. It uses data from the Department of Labor (DOL)’s Form 5500. It also compares returns on IRAs, based on data from the Investment Company Institute, to those on employer sponsored plans from 2000-2012.

Whether looking at reported data or estimating equations that control for asset allocation and size, the bottom line is that, during 1990-2012, defined benefit plans outperformed defined contribution plans by about 0.7 percentage point. The results are not very sensitive to the exclusion or inclusion of small plans and whether or not the plans are weighted by their asset holdings (see Table 1).

Table 1. Geometric Rate of Return, 1990-2012

Plan Defined benefit Defined contribution Difference All plans

Unweighted 6.6% 5.9% 0.7%

Weighted 7.9% 7.0% 0.9%

Plans > $100 million

Unweighted 7.8% 7.3% 0.5%

Weighted 8.2% 7.3% 0.8%

Source: Calculations based on U.S. Department of Labor (Form 5500)

Some researchers have suggested that the differential between defined benefit and defined contribution plan returns has declined over time, but the data show that the differential is generally larger after 2002.

Investment fees, which typically account for 80-90 percent of total expenses, are the most likely explanation. The reason for the higher fees is that defined contribution plans invest through mutual funds, while defined benefit plans do not. When weighted by assets invested, fees for equity funds, bond funds, and hybrid funds, while declining over time, accounted for – on average – about 0.80 percent of assets under management between 2000 and 2014 and were probably substantially higher before that time. Of course, defined benefit plans also have some investment fees, but these are small compared to those associated with defined contribution plans.

The comparison of IRA returns with those for defined benefit and defined contribution plans is particularly alarming. While individuals holding IRAs do not have to fill out a Form 5500, the Investment Company Institute provides data on beginning-year assets, year-end assets, contributions, rollovers, and withdrawals for IRAs that make it possible to calculate the aggregate average return for the period 2000-2012. Over that period, the results show that IRAs produced substantially lower returns than defined contribution or defined benefit plans (see Figure 1).

?uuid=ae71dc0a-b589-11e5-84a2-0015c588e0f6

?uuid=ae71dc0a-b589-11e5-84a2-0015c588e0f6

Foregoing returns over long time periods means that assets at retirement will be sharply reduced. Saving is too hard to have fees eat up such a large portion of investment earnings.

Mission accomplished! Workers stiffed!

antigop

(12,778 posts)Proserpina

(2,352 posts)One of the reasons that no one went to jail for the elite control fraud that caused the financial crisis is because of the pervasiveness of the criminality. You couldn’t send one guy to jail without having that guy very publicly rat out everyone else. To get to a high level on Wall Street you had to be dirty, like in a corrupt police department. No one trusts the one guy who won’t take bribes. Which brings us to Maurice “Hank” Greenberg, the former AIG CEO who is now, for lack of a better word, ratting everyone else out.

AIG, of course, is the massive insurance company which was bailed out by the government, with the Fed taking an 80% ownership stake in 2008. The AIG bailout was a strange deal, and it was renegotiated many times over the years. In a normal clean financial company resolution, AIG shareholders would have gotten wiped out. In the bailouts for Goldman, Morgan Stanley, and most of the big banks, shareholders got to keep their shares. AIG shareholders, by contrast, got to keep a little bit of what they had, a sort of split the baby in half deal. Hank Greenberg, as a shareholder, is extremely angry that he was treated this way. He thinks that he was not given equal treatment to Goldman shareholders, and in that he’s right. Most of us think that he should have been wiped out, and Goldman’s shareholders should have been wiped out too, so there’s little sympathy for this very rich man. But it’s utterly true, and everyone (even the most bank-friendly journalist Andrew Ross Sorkin) is acknowledging that it is true, that the government treated AIG shareholders differently. Greenberg is alleging, with good reason, that the motive here was quite sordid.

To understand the backstory, let’s take a quick look at AIG’s role in the housing bubble. Broadly speaking, AIG sells insurance, and one of its divisions (AIG Financial Products) sold a very specific type of insurance called a credit default swap. If you were a big bank and you owned a mortgage backed security (stuffed into a collateralized debt obligation, or CDO), you could buy a credit default swap against the possibility that the security would default. Then, because you owned this insurance, whatever that security might contain, be it good loans or the most toxic dreck imaginable, it was as good as gold. Default? No problem, AIG had you covered. The problem was that AIG covered everyone in the market (well not everyone, but a lot of the big players especially Goldman) so while the company had a really big balance sheet, it ended up being liable for sums that were larger than the amount of capital the parent company could access. There were other serious problems at AIG, such as its securities lending operation, but those aren’t as relevant to the story. And yes, technically speaking, a credit default swap wasn’t legally considered a type of insurance, it was considered a ‘derivative’. But that was just a legal fiction so that insurance regulators, who would have forced AIG to hold enough money to back its bets, couldn’t touch the company. A credit default swap is insurance.

So anyway, AIG blew up because it guaranteed an entire collapsing market of mortgage-backed securities. The Federal Reserve came in and pumped money into the company, for fear of the whole system collapsing. So why the lawsuit? Seems open and shut. Beyond that, Greenberg wasn’t even the CEO of AIG at the time of the crisis, he had already been dispatched for accounting shenanigans by then-New York Attorney General Eliot Spitzer in an earlier blood feud. The answer is that Greenberg plays hardball, and he’s still a big shareholder in AIG. Beyond that, he was excluded by the government from negotiations during the restructuring of a company he ran for decades, so he has a personal motive in spending his time and money harassing Geithner, Paulson, Bernanke, and company...Bernanke, Geithner, and Paulson have told their sides of the story, through friendly reporters or through books of their own. But no one has had the chance to cross-examine them, to demand they prove that what they were telling the public was true (my read of Geithner’s book was that his recollection of the bailouts was a long and charming set of lies, but you can draw your own conclusions). But now these men are being put on the stand, and an alternative set of facts is coming to light. We’ve always had alternative theories about what happened during the pressure-filled days of the bailouts, but actual evidence has been based on self-serving portraits from CEOs, regulators, and the reporters who love them. And guesses.

No longer. We have already learned a few interesting facts about AIG (courtesy of Yves Smith). First of all, we learned that AIG didn’t necessarily need to be bailed out by the United States government. There were two and a half offers on the table to recapitalize the insurance company. One came from China, which offered to buy parts of the company. Paulson prevented this from happening. We don’t know why, though it could be due to national security concerns (rumors of AIG being heavily involved with the CIA have always floated around). The second offer came from rich Middle Eastern investors, represented by Senator Hillary Clinton (through her friend Mickey Kantor). This didn’t happen either, and again, we don’t know why. Could be national security. But the third offer suggests otherwise. The New York financial regulator offered to let AIG dip into $20 billion of capital it had in an insurance subsidiary, but Geithner said the company didn’t need it. You heard that right — Geithner turned down an internal recapitalization of AIG. $20 billion wasn’t enough to plug the hole, but it wouldn’t have hurt.

There’s more funky stuff that went on. The board of AIG was never even shown the term sheet for the bailout by the government, and the board only approved it because their lawyer — superlawyer Rodge Cohen —made a dramatic reversal of his legal position. Cohen at first told the board that a bankruptcy was a reasonable option, but a few days later he said that if the board chose bankruptcy rather than the government offer, sight unseen, the board members could be personally liable. At the same time, Cohen was also representing AIG counterparties, and was informally advising the government. Whoa there.

In addition to all this, we’ve learned that the Fed, in doing all of this, was probably breaking the law. First, the New York Fed changed the terms of its offer without authorization from the Board of Governors, which was a no-no. More importantly, the Federal Reserve simply could not do what it was doing, which was to buy shares in AIG and take a controlling interest (even if it stuck the shares in a trust, which was the structure it chose). Here’s Scott Alvarez, the Fed’s attorney, saying that. (see link)

This legal jeopardy also explains a lie that Bernanke told about the commercial paper market (which is the mechanism big companies use to borrow money). The week before the bailouts passed Congress, Bernanke explained to Congress that the commercial paper market was freezing up. If they didn’t approve the Troubled Asset Relief Program (TARP), even companies like General Electric would go down. After Congress approved TARP, Bernanke then created a wholly Federal Reserve-concocted facility to back the commercial paper market, thus showing he could protect that market with or without TARP. Why did Bernanke want TARP so badly? Because the Fed needed Treasury to get the authority to buy shares, so Treasury could take the Fed’s illegally held AIG shares off their hands.

In other words, we learned that AIG was bailed out by the Federal Reserve because Paulson, Bernanke and Geithner wanted it bailed out by the Federal Reserve. They exceeded their legal authority to buy AIG for the government, and then lied about it. The $700 billion Troubled Asset Relief Program then bailed them out of this jam.

But why?

Greenberg alleges that their motive was to steal AIG from its shareholders, and then funnel money through AIG to banks like Goldman. There’s compelling evidence this is true; we also learned that banks, even Bank of America and Goldman, were willing to give up some of the money they were owed by AIG as part of their credit default swap payoffs. They would take less than 100 cents on the dollar for counter-party payouts. But Geithner ensured that these banks would get 100 cents on the dollar, as well as legal indemnity. To put it another way, AIG owed these banks a bunch of money, but if it had to pay the banks, it would go bust. But if it didn’t pay the banks, the banks would lose money. The banks were willing to lose a little bit of money, but Geithner said no no, you don’t have to lose any money in the deal at all. The accusation is that Geithner and co. shot AIG in the head, and then let other banks feast on its rotting carcass (liberally spiced with government money). Paulson has actually confirmed this was the goal. Big bank shareholders got bailed out, while AIG shareholders only got partially bailed out, both of course by the public. It was an utterly selective political judgment to choose one set of actors over another set of actors. What’s really interesting is not just this allegation, but how the New York Fed — run at the time by Tim Geithner — tried to hide it. Here are several examples of New York Fed officials explicitly trying to avoid the Freedom of Information Act, as well as SEC disclosure requirements. (See page 72.)

Eventually Republican Darrell Issa, of all people, got information of who was benefitting from the AIG death rattle (Goldman, Soc Gen, etc), and leaked it. Even so, the ‘AIG as backdoor bailout’ theory was vehemently denied for years, until now. Now it’s being understood, even by people like Hank Paulson, as true. Sorkin, says as much in his piece in Dealbook.

Dean Baker shows the significance of this statement, and notes that the idea of AIG as a backdoor bailout “was not something generally conceded in policy circles.”

In other words, Greenberg’s case is revealing that the bailouts were done selectively, and there was an attempt to cover up what happened. The Federal Reserve and the Treasury ended up treating Goldman/JP Morgan/Citigroup shareholders and employees exceptionally well, AIG shareholders less well, and the public like irrelevant peasants. Greenberg is right to complain about the unequal treatment. Of course he doesn’t deserve any money himself, because AIG really was insolvent, and he was treated better than he should have been. If the judge could dispense justice, the judge would rule in Greenberg’s favor, and then simply take away the money that big bank shareholders got to keep, claw back bank bonuses, and then also confiscate the rest of Greenberg’s assets held in AIG stock. That would be equal treatment for all citizens. Of course the judge can’t do that. The best he can do is let the trial move forward, and show the public what really happened.

There is an attempt to make this whole episode go away, to say that the government’s decisions at the time, though perhaps illegal and perhaps unfairly favoring a set of actors over another, were necessary. And besides, the bailouts made money. And none of this is news, anyway, so what are you whining about? ...This narrative is fundamentally dishonest. Opponents of the bailouts said a lot of things at the time about the motives of the people in charge. It turns out that bailout opponents were largely correct, and the bailout apologists were lying and/or wrong. Increasingly, the public, judges, and politicians will recognize that the way the corrupt manner in which bailouts were done turned property rights into an explicit reflection of arbitrarily exercised political power.

Once it is broadly recognized that property rights in the post-bailout era truly are such an arbitrary exercise of political power, then a lot of things become possible. I believe in property rights; they are an important part of a just society and a mechanism to protect people from tyrannical public power (as long as they are enforced equally and with an understanding that they must also be balanced against other questions of justice, such as the threat of private monopolies to our freedoms). But because of these bailouts, no one can with a straight face claim we live in a culture that enforces property rights as a mechanism to protect individual liberties. And I’m not sure the bailout proponents are going to like where that leads.

http://www.bloomberg.com/news/articles/2015-06-15/hank-greenberg-s-starr-wins-trial-but-no-damages-in-aig-suit

Hank Greenberg’s other AIG trial: A fight that just won’t end

http://fortune.com/2015/08/27/hank-greenbergs-other-aig-trial-a-fight-that-just-wont-end/

Believe it or not, there is yet another trial starring the former AIG CEO waiting in the wings.

Hank Greenberg isn’t just fighting over money.

This week, Starr International, the company run by former AIG CEO Hank Greenberg, filed its appeal in the bitterly contested and highly publicized case over the government’s financial crisis bailout of AIG. Greenberg says that the judge, who found that the government’s conduct was indeed illegal—one lawyer for the Fed even wrote that the government was on “thin ice”—should also award Starr, which was AIG’s biggest investor, damages; he has argued that the bailout improperly enriched the government by at least $18 billion.

But there is another trial starring Greenberg that is waiting in the wings. It is the remnants of a civil case that Eliot Spitzer, who was then New York’s Attorney General, brought against Greenberg, AIG, and AIG’s former CFO, Howard Smith, in May 2005—a decade ago, two attorney generals ago, and in the pre-financial crisis era. The case has been delayed, and delayed and delayed again, by numerous appeals. In pragmatic terms, what’s left of the original blockbuster seems remarkably petty. None of the punishments, particularly the monetary ones, that the AG is seeking seem momentous in the grand scheme of all things Greenberg.

And yet, of all the legal thrillers starring Hank Greenberg, this case might actually be the one that matters most. The official remedies and the legal wrangling are beside the point. For both sides, it is a highly emotional battle to define the legacy of a financial industry titan.

Reading the original complaint, which accused the defendants of “routinely engag[ing] in misleading accounting and financial reporting,” is like going back in time. “American International Group is the world’s largest commercial insurance company,” it begins. “For 2004, it reported net income of more than $11 billion on revenues of nearly $100 billion. It has approximately 93,000 employees in 130 countries. For 38 years, AIG was run by defendant Maurice R Greenberg, also known as ‘Hank.’”

Even before the complaint was brought, the investigation had forced Greenberg out of the insurance giant. In 2006, AIG agreed to pay $1.6 billion to settle the AG’s, as well as the SEC’s, claims against the company. AIG also restated its financial results going back to 2000, reducing its previously reported profits by almost $4 billion, or about 10% of the total, due to what it called “accounting errors” involving the transactions in the AG’s complaint.

The original complaint detailed nine ways in which AIG’s financial results had been manipulated, and charged Greenberg and Smith with violations of New York’s Martin Act and with common law fraud. But by the end of 2006, Spitzer’s office had filed an amended complaint, dropping five of the transactions as well as the common law fraud charges, leaving just the Martin Act. Unlike common law fraud, the Martin Act, which is meant to cover “all deceitful practices contrary to the plain rules of common honesty,” does not require prosecutors to prove that Greenberg and Smith knowingly intended to commit fraud.

Over time, the government dropped two more transactions from its complaint, leaving just two, neither of which were alleged to have affected AIG’s net income or shareholders’ equity. But they did affect AIG’s reserves, which are viewed by investors as a critical measure of an insurer’s strength.

The bulk of the remaining case against Greenberg and Smith involves a transaction that AIG did with General Re, an insurance company owned by Warren Buffett’s Berkshire Hathaway, in late 2000 and early 2001 that allegedly allowed AIG to increase its reserves by $250 million each quarter. At the time Spitzer brought the charges, there was great concern about the use of so-called “finite reinsurance” transactions to manipulate an insurer’s financial statements. It’s perfectly legitimate for one insurer to reinsure another’s risks, but the deal is illegal if no risk is actually transferred. The language in the original complaint was explosive. “The entire AIG Gen Re transaction was a fraud,” it read. “It was explicitly designed by Greenberg from the beginning to create no risk for either party.”

In early 2008—just before AIG was taken over by the government, something which Greenberg and his supporters say never would have happened if he hadn’t been forced out—four former Gen Re executives and one AIG executive were found guilty in a criminal trial based on the activities alleged in the complaint.

In 2009, Greenberg and other AIG executives agreed to pay $115 million to settle a shareholder lawsuit based in part on the AG’s case; at the same time, Greenberg paid another $15 million to settle with the SEC. (Smith paid $1.5 million.) The SEC’s complaint alleges, among other things, that Greenberg and Smith “knew about the effects that certain improper transactions would have on AIG’s reported financial results.”

Neither man admitted nor denied the SEC’s allegations.

Then, in early 2011, the Second Circuit Court of Appeals overturned the convictions of the Gen Re and AIG executives. The decision itself was based on something of a technicality, but the court also noted “compelling inconsistencies” in the testimony of the government’s star witness, a former Gen Re executive named Richard Napier, that “suggest[ed] that Napier may well have testified falsely.” In a letter sent to current New York Attorney General Eric Schneiderman last fall, Greenberg’s defense counsel, the prominent attorney David Boies, wrote, “Mr. Napier is the sole witness proffered for the assertions that Mr. Greenberg, or indeed anyone at AIG, was advised or understood” that there were questionable aspects of the deal. Nor, Boies noted, did Napier ever actually speak to Greenberg. (The government did not retry the case; in turn, the executives agreed that “aspects” of the deal were “fraudulent.”) The extent to which Napier has been discredited is yet another hotly contested issue, with the AG arguing that other evidence backs him up where it matters most.

Everyone agrees that Greenberg did call Ronald Ferguson, the CEO of Gen Re, to initiate the transaction in question. But the strong language in the original complaint—that the deal was “explicitly designed by Greenberg from the beginning to create no risk for either party”—turns out to be less than iron clad.

In the criminal case, Greenberg was identified as an “unindicted co conspirator,” but he wasn’t charged. In a hearing, a prosecutor explained to the judge why that was the case. “There wasn’t a single email that we had—that we are able to produce a [sic] trial involving Mr. Greenberg that I … know of standing here … there were no recorded phone calls to Mr. Greenberg … there was no—not even—a substantial witness who spoke about this to Mr. Greenberg.”

Proserpina

(2,352 posts)You and your teeth could be victims of "creative diagnosis."

My household's level of confidence in dentistry is at an all-time low. About six months ago, my dentist informed me that my "bunny teeth" were likely getting in the way of my professional success, a problem he could correct with a (pricey) cosmetic procedure. If I let him fix my teeth, he told me, he was sure I would start "dressing better." A few months later, my husband scheduled a basic cleaning with a new dentist. Once they had him in the chair and looked at his teeth, they informed him that the regular cleaning wouldn't do at all: He would need to reschedule for an $800 deep cleaning. No thanks.

We were convinced we must look like suckers—until I came across an op-ed in ADA News, the official publication of the American Dental Association. The article, by longtime pediatric dentist Jeffrey Camm, described a disturbing trend he called "creative diagnosis"—the peddling of unnecessary treatments. William van Dyk, a Northern California dentist of 41 years, saw Camm's op-ed and wrote in: "I especially love the patients that come in for second opinions after the previous dentist found multiple thousands of dollars in necessary treatment where nothing had been found six months earlier. And, when we look, there is nothing to diagnose."

Poking around, I found plenty of services catering to dentists hoping to increase their incomes. One lecturer at a privately operated seminar called The Profitable Dentist ($389) aimed to help "dentists to reignite their passion for dentistry while increasing their profit and time away from the office." Even the ADA's 2014 annual conference offered tips for maximizing revenue: "Taking time to help our patients want what we know they need," notes one session description, "can drive the economic and reward engine of our practice." Upselling in dentistry isn't a new phenomenon, but it's having a moment. One reason: Dental school tuition—and debt—has doubled since the '90s. According to the American Dental Education Association, students who graduated in 1996 were in the hole $112,000 (in 2013 dollars), on average, while 2013 grads were a whopping $215,000 in debt—28 percent were on the hook for $300,000 or more. By contrast, the average med school grad owed $170,000. ADEA executive director Richard Valachovic explained that one reason dental schools have jacked up tuitions is the rising costs of technology for student labs.

In any case, a generation ago, newly hatched dentists would join established practices as modestly paid associates, with the promise of eventually becoming partners. But these days, with dentists retiring later, there's less turnover in private practice. Instead, more and more young dentists are taking jobs with chains, many of which set revenue quotas for practitioners. This has created some legal backlash: In 2012, for example, 11 patients sued (PDF) a 450-office chain called Aspen Dental, claiming that its model turns dentists into salespeople...Some corporate dentists appear to have crossed the line into fraud. In 2010, Small Smiles, a venture-capital-owned chain with offices in 20 states, was ordered to refund $24 million to the government after an investigation found that its dentists had been performing unnecessary extractions, fillings, and root canals on children covered by Medicaid. A new lawsuit alleges that some toddlers it treated underwent as many as 14 procedures—often under restraint and without anesthesia. (The group was banned from Medicaid this year.) Several other pediatric dentistry chains have been sued over similar allegations.

So what should you watch out for when you go for your next cleaning? First, beware of specials: That laser dentistry and whitening package may be a ploy to get you in the door so the practice can upsell you on more-profitable procedures. Van Dyk also advises caution if your dentist insists on replacing all your old fillings or always recommends crowns instead of fillings. And look out for excessive X-rays: The ADA says healthy patients need a full set (14 to 22) every two years at the most. If your dentist recommends a special "cone-beam" X-ray, get a second opinion, since, along with a 3-D picture of your mouth, it delivers a dose of radiation up to 18 times that of a traditional dental X-ray. While the Food and Drug Administration has approved cone-beam scanners, some radiation experts worry that dentists are using them when a standard X-ray would do just as well. Finally, when it comes to children's dentists, make sure to find a board-certified pediatric specialist, since not all dentists that cater to children have special training.

The practitioners I spoke to were quick to add that even dubious-sounding treatments are in some cases medically necessary. But if your gut says your dentist is going overboard on treatment, get a second opinion. "Will you have to pay a little more for another consult?" Camm asks. "Sure. But it could end up saving you a whole lot more in the long run."

DemReadingDU

(16,000 posts)Karl @tickerguy @8:14AM

Major fiber disruption in the area continues; the ticker will be back when Cox gets their act together

https://twitter.com/tickerguy

Proserpina

(2,352 posts)How can that be possible?

For laugh relief, and something to fix your mind on, join Weekend Economists...very late tonight, if not very early....I have a split personality today, can't make a decision right now.

Be strong, be sane, be careful!

antigop

(12,778 posts)Proserpina

(2,352 posts)Fuddnik

(8,846 posts)I coined a phrase he's going to use in his next one. Clinton Incorporated.

Bill, Hillary, Chelsea, and Wall Street.

Use it early, and use it often.

antigop

(12,778 posts)Proserpina

(2,352 posts)

In the past decade, Venezuela and the nation’s oil company Petroleos de Venezuela SA have sold $65 billion of dollar-denominated bonds without ever seeing a dime.

Sure, they got money, but took in no dollars. To preserve foreign reserves while injecting some much-needed hard currency into the economy, the government, PDVSA and the central bank sold the debt to local investors in return for bolivars. Buyers then sold the notes abroad to obtain U.S. currency, which has become scarce as Venezuela tries to limit capital flight.

$4.5 billion of debt came due October 2014 and with reserves at an 11-year low, Venezuela is realizing the bond sales didn’t actually buy it much time and are instead exacerbating a cash crunch that’s fueling concern the country will default. The nation’s bonds have plummeted 9.5 percent Sept. 2014, the most in emerging markets.

“Bonds were being sold as a foreign-exchange mechanism and then being flogged out at a deep discount, so the government has got a big foreign currency liability and absolutely nothing to show for it,” David Rees, an economist at Capital Economics in London, said by phone...

a look into the past

Fuddnik

(8,846 posts)As of now the Dow is down over 50pts.

Fuddnik

(8,846 posts)Another buying opportunity.

Buy vodka.

![]()

![]()

![]()

I have a feeling that this is going to be an ugly year. 4 hours till ![]()