Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 13 January 2016

[font size=3]STOCK MARKET WATCH, Wednesday, 13 January 2016[font color=black][/font]

SMW for 12 January 2016

AT THE CLOSING BELL ON 12 January 2016

[center][font color=green]

Dow Jones 16,516.22 +117.65 (0.72%)

S&P 500 1,938.68 +15.01 (0.78%)

Nasdaq 4,685.92 +47.93 (1.03%)

[font color=green]10 Year 2.10% -0.08 (-3.67%)

30 Year 2.88% -0.09 (-3.03%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

17 replies, 1878 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (11)

ReplyReply to this post

17 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

STOCK MARKET WATCH -- Wednesday, 13 January 2016 (Original Post)

Tansy_Gold

Jan 2016

OP

Robert Reich: Why Sanders' Plan to Bust Up the Big Banks Is So Much Better than Clinton's

Proserpina

Jan 2016

#4

Proserpina

(2,352 posts)1. Mathew D. Rose: Now It Is Polandís Turn

http://www.nakedcapitalism.com/2016/01/mathew-d-rose-now-it-is-polands-turn.html

Yves here. Germany is very upset that Poland has voted in a populist, Euroskeptic, anti-austerity government. Germany is also critical of the fact that the new government increased its control over public media. This is the pot calling the kettle black, since as Rose documents in detail, a great deal of reporting on state-controlled media amount to official propaganda.

By Mathew D. Rose, a freelance journalist in Berlin

Oh well, here we go again. Now it’s the Poles who are being recalcitrant and rebelling against Germany’s dictate. And once again it’s the bloody minded voters who are to blame. Poles recently elected the Law and Justice party, providing it with an impressive mandate, being the first party in the post-Communist era to obtain an absolute majority, while routing the neo-liberal, quisling party Civic Platform.

The victorious Law and Justice party is conservative, Catholic, nationalistic, and Eurosceptic. Even worse in the eyes of Germany, the party espouses a Keynesian economic programme, including additional taxation of banks. Law and Justice’s unprecedented electoral support was a reaction to the corruption that is a hallmark of Civic Platform and the general perception that during eight years of Civic Platform government Poland’s economic growth, much in the tradition of the EU, has mainly benefitted a small elite.

Not only has the new government rapidly enacted legislation to increase government control over the constitutional court and the civil service, but it has passed a new media law giving control of Polish public radio and TV to a national media council close to the government, as well as permitting the treasury minister to hire and fire broadcasting chiefs – a role currently in the hands of a media supervisory committee, which was dominated by Civic Platform.

Public media broadcasters are a valuable democratic resource and any infringements upon their autonomy are an egregious blow for citizens, wishing to obtain information free of particular interests. Unfortunately public media is constantly a victim of intervention by the political powers that be. Even the BBC, one of the jewels of British culture, is currently facing a dramatic attack by the Tory government in connection with license fees and its upcoming charter renewal.

The most vociferous critics of the new Polish media laws are the Germans. This is rather odd because German public media broadcasters are completely in the hands of the political parties, better said, of Chancellor Merkels Christian Union and the waning Social Democrats...

Yves here. Germany is very upset that Poland has voted in a populist, Euroskeptic, anti-austerity government. Germany is also critical of the fact that the new government increased its control over public media. This is the pot calling the kettle black, since as Rose documents in detail, a great deal of reporting on state-controlled media amount to official propaganda.

By Mathew D. Rose, a freelance journalist in Berlin

Oh well, here we go again. Now it’s the Poles who are being recalcitrant and rebelling against Germany’s dictate. And once again it’s the bloody minded voters who are to blame. Poles recently elected the Law and Justice party, providing it with an impressive mandate, being the first party in the post-Communist era to obtain an absolute majority, while routing the neo-liberal, quisling party Civic Platform.

The victorious Law and Justice party is conservative, Catholic, nationalistic, and Eurosceptic. Even worse in the eyes of Germany, the party espouses a Keynesian economic programme, including additional taxation of banks. Law and Justice’s unprecedented electoral support was a reaction to the corruption that is a hallmark of Civic Platform and the general perception that during eight years of Civic Platform government Poland’s economic growth, much in the tradition of the EU, has mainly benefitted a small elite.

Not only has the new government rapidly enacted legislation to increase government control over the constitutional court and the civil service, but it has passed a new media law giving control of Polish public radio and TV to a national media council close to the government, as well as permitting the treasury minister to hire and fire broadcasting chiefs – a role currently in the hands of a media supervisory committee, which was dominated by Civic Platform.

Public media broadcasters are a valuable democratic resource and any infringements upon their autonomy are an egregious blow for citizens, wishing to obtain information free of particular interests. Unfortunately public media is constantly a victim of intervention by the political powers that be. Even the BBC, one of the jewels of British culture, is currently facing a dramatic attack by the Tory government in connection with license fees and its upcoming charter renewal.

The most vociferous critics of the new Polish media laws are the Germans. This is rather odd because German public media broadcasters are completely in the hands of the political parties, better said, of Chancellor Merkels Christian Union and the waning Social Democrats...

Proserpina

(2,352 posts)2. How the Labor Cost Competitiveness Myth is Making the Eurozone Crisis Worse

http://ineteconomics.org/ideas-papers/blog/german-wage-moderation-and-the-eurozone-crisis-a-critical-analysis

By Servaas Storm, Senior Lecturer in Economics, Delft University of Technology and co-author, with C.W. M. Naastepad, of Macroeconomics Beyond the NAIRU (Cambridge, MA: Harvard University Press), which won the Myrdal Prize of the European Association for Evolutionary Political Economy.

It is high time to look more closely at the labor cost competitiveness myth.

Progress in economics “is slow partly from mere intellectual inertia,” wrote Joan Robinson (1962, p. 79) long ago, because “in a subject where there is no agreed procedure for knocking out errors, doctrines have a long life.” As a recent illustration of such inertia, it took more than five years since Eurozone crisis started full-force (in May 2010) to come to a more or less reasonable “consensus diagnosis” as proposed by a group of economists associated with CEPR (in “Rebooting the Eurozone,” published in Vox on 20 November 2015).1

Even though this diagnosis marked a substantial advance, it invited strong critiques by Peter Bofinger (2015), one of the five members of Germany’s Sachverständigenrat, and from Oxford University’s Simon Wren-Lewis (2015).2 Both critics argue that the “consensus diagnosis” inappropriately focuses just on the deficit-crisis countries of Southern Europe, while neglecting the role of Germany, and of German wage moderation in particular, in bringing about the intra-Eurozone current account imbalances which are arguably at the heart of the Eurozone problématique.

The sad truth, however, is that Bofinger and Wren-Lewis are right for the wrong reason—hence their interventions are less than helpful, because rather than knocking out the remaining errors in the “consensus diagnosis”, they help perpetuate a mistaken doctrine: that relative unit-labor-costs matter are the prime determinant of a country’s international competitiveness, current account balance, and foreign indebtedness. The issue is serious: keeping alive the dangerous myth that labor costs drive “competitiveness” feeds the irrepressible urge of the orthodox mainstream to try to bring about economic recovery by reducing Eurozone unit labor costs (Gabrisch and Staehr 2014; Janssen 2015; Storm and Naastepad 2012, 2015b, 2015c). This intrinsically beggar-thy-neighbour strategy has already become codified into official Eurozone policy: in the Euro Plus Pact (adopted by the European Council in March 2011) and recently by the Informal European Council (February 2015), which both combine it with a prescription for fiscal austerity based on a tight cyclically-adjusted public budget constraint.3 It is therefore high time to look more closely at the labor cost competitiveness myth.

Progress: What the Consensus Diagnosis Gets Right

But first let me clarify that the consensus diagnosis is right in pointing out that the Eurozone crisis is not a sovereign debt crisis in its origin. Instead, it correctly holds that (i) the Eurozone crisis originated in a (banking) crisis of cross-border capital flows gone wild that led to massive intra-Eurozone (current account) imbalances; and (ii) that the crisis has been amplified by institutional flaws in the design of the Eurozone. The consensus authors rightly point to the vicious “doom loop” in which crisis-struck Eurozone governments, lacking access to a lender of last resort, were left to borrow only from their national banking systems—systems which had become increasingly insolvent and in turn had to be bailed out by the same governments. The diagnosis that the Eurozone crisis is a crisis of deregulated (too-big-to-fail) banking is consistent with earlier analyses by Lane (2012), Lane and Pels (2012), Gabrisch and Staehr (2014), Storm and Naastepad (2015c, 2015d), O’Connell (2015) and others.

It is a far cry from the orthodox diagnosis propounded by mainstream economists such Sinn (2014) and by the European Commission, which absolve TBTF banks from any responsibility for the crisis and instead blames the “victims,” arguing that profligate Southern European countries, by allowing nominal wage growth to persistently exceed labor productivity growth, let their relative unit labor costs increase and their cost competitiveness deteriorate. In this narrative, rising unit labor costs are due to fiscal profligacy and “rigid” “over-regulated” labor markets, powerful unions, and strong employment protection. Rising relative unit labor costs supposedly killed Southern Europe’s export growth, raised current account deficits, created unsustainable external debts and reduced fiscal policy space, and hence, when the crisis broke, these countries lacked the resilience to absorb the shock. It follows in this story that the only escape from recession is for the Southern European countries rebuild their cost competitiveness—cutting wage costs (because Eurozone members cannot devalue their currency) by as much as 30% (as proposed by Sinn 2014), which requires in turn that their labor markets be thoroughly deregulated.

The Flip Side: The “Unit-Labor Cost Competitiveness Matters” Myth

Bofinger is right: when it comes to individual countries, the “consensus diagnosis” one-sidedly focuses on the crisis-struck deficit countries of Southern Europe, while the role of the Eurozone surplus countries, and Germany in particular, in bringing about the imbalances is left unmentioned. This omission is even worse, because the “consensus diagnosis” promulgates the “official” party line by claiming (in a throw-away sentence) that “the rigidity of factor and product markets [in Southern Europe] made the process of restoring competitiveness slow and painful in terms of lost output.” The consensus diagnosis thus accepts the official remedy of internal devaluations and labor market deregulation imposed on the crisis-struck countries by the European Commission, the ECB and the IMF.

Bofinger and Wren-Lewis wish to set part of the record straight by highlighting Germany’s responsibility for bringing about the Eurozone crisis. They argue that Germany’s long-term policy of wage moderation (based on a deliberate voluntary tri-partite agreement between German employers, trade unions and government) undercut its Eurozone neighbours and thereby raised Germany’s labor-cost competitiveness, helping to cause the Eurozone crisis by contributing to the build-up of Eurozone (current account) imbalances. Southern Europe’s cost competitiveness problem, in other words, was created in Berlin. The result, as Bofinger (2015) argues, is that German domestic and import demand slowed down, while its increasingly more cost-competitive exports experienced fast growth; as a result, the profit share in German GDP increased simultaneously with a growing current account surplus.

Confusing “simultaneity” with “causality,” Bofinger then suggests that the higher corporate profits were used to finance the (net) outflow of German savings to the rest of world, as indicated by its current account surplus.4 German wage moderation in this story is (mostly) to blame for the weakening of Southern Europe’s cost competitiveness as well as the large capital flow from Germany to the increasingly indebted and vulnerable Eurozone periphery. Wren-Lewis calls this the “untold story of the Eurozone crisis,” which is rather remarkable, because many authors made exactly the same point earlier including Lapavitsas et al. (2011), Stockhammer (2011), Bibow (2012), Flassbeck and Lapavitsas (2013) (for a lengthy list of references see Storm and Naastepad 2015a, 2015b, 2015c). These accounts show that wage moderation is a very powerful narrative (especially in Europe’s North), probably because it resonates with Calvinism and fits seamlessly with Weber’s Protestant Ethic, centring around the notion of “delayed gratification”: first the pain of tightening your belts to improve labor-cost competitiveness in order to obtain the gain of higher export growth, higher incomes and more jobs at a later stage. But, as Tolstoy (1882) wrote in A Confession, “wrong does not cease to be wrong, because the majority share in it.”

Knocking Out Errors

Bofinger’s narrative is worrisome in two major ways. First, by exclusively focusing on the real economy (wages, corporate profits, cost competitiveness and trade), the financial sector disappears from the scene—even though Bofinger seems to agree that the Eurozone crisis is in essence a financial crisis—and it becomes almost natural to only look for solutions in the real economy. In this way, the culprits (i.e., TBTF banks) are let off the hook—which means the real origins of the imbalances and crisis are left undebated. Secondly, of course it is true that Germany and German wage moderation bear part of the responsibility for bringing about the Eurozone crisis. Bofinger and Wren-Lewis have the best intentions while making this point (alas, the road to hell is paved with good intentions ….), but their single-minded emphasis on the importance of relative unit labor cost competitiveness is misguided for at least the following three reasons.

Firstly, exports and imports are—by definition (as explained in Storm and Naastepad 2015a, 2015c)—much less responsive to changes in (relative) unit labor costs than to changes in (relative) prices for several reasons. Unit labor costs make up less than 25% of the gross output price, while a second reason is that firms in general do not pass on all (but mostly only half of) unit labor cost increases onto market prices. What it means is that (when using realistic unit-labor cost elasticities) observed changes in Germany’s relative unit labor cost statistically “explain” only a minuscule fraction of its export growth and current account surplus (Wyplosz 2013; Gabrisch and Staehr 2014). For instance, IMF economists Danninger and Joutz (2007, p. 15) find that relative cost improvements accounted for less than 2% of German export growth during 1993-2005. Germany’s superior export performance can instead be completely explained by the “income effect” (Storm and Naastepad 2015a): German firms supply mostly complex, high-tech, and high-priced goods to fast-growing markets as well as to faster-growing countries such as China, Russia and Saudi Arabia (Gabrisch and Staehr 2014; Diaz Sanchez and Varoudakis 2013; Storm and Naastepad 2015a; Schröder 2015). Germany excels in non-price (technology-based) competitiveness and does not engage (much) in price competition.

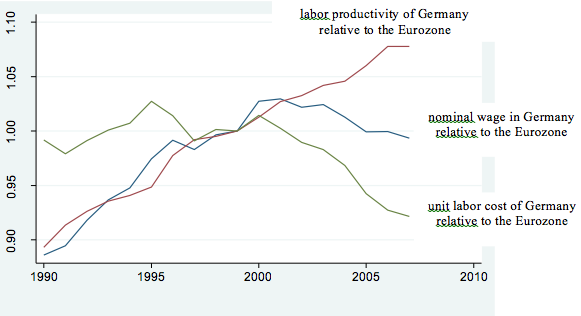

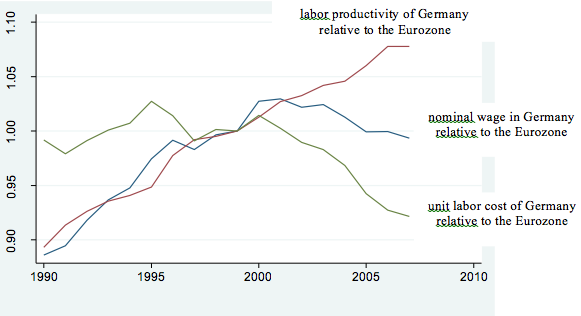

Secondly, as shown in Figure 1, there is no clear sign of a nominal wage squeeze on German workers if we compare Germany to the Eurozone as a whole (but excluding Germany). German nominal wages increased relative to the Eurozone in the 1990s and the German relative nominal wage stayed more or less flat during the period 1999-2007 (there was a negligible decline of 0.7 percentage points over these eight years). It is nevertheless true that Germany’s unit labor cost declined relative to those of the rest of the Eurozone (as Figure 1 illustrates), but this was not a result of wage restraint: It was completely due to Germany’s outstanding productivity performance: during 1999-2007 average German labor productivity (per hour worked) increased by almost 8 percentage points compared to the rest of the Eurozone, which accounts fully for the decline in Germany’s relative unit labor costs by 7.8 percentage points over the same period. It was German engineering ingenuity, not nominal wage restraint or the Hartz “reforms”, which reduced its unit labor costs. Any talk of Germany deliberately undercutting its Eurozone neighbors is therefore beside the point.

Thirdly, the increase in current account deficits in Southern Europe resulted from an increase in the trend growth of their imports, while the trend growth of their exports stayed unchanged (notwithstanding the sustained rise in their unit labor costs). There is convincing statistical evidence for the European Union (Diaz Sanchez and Varoudakis 2014; Storm and Naastepad 2015c) showing that initial increases in current account deficits were followed only later in time by increases in relative unit labor costs—which, if true, means that the current account deteriorations were not caused by higher (relative) unit labor costs. The only rational explanation for the observed time-sequence is that Southern Europe first experienced a debt-led growth boom, which then led to higher imports and higher capital inflows leading only after a lag of many quarters to lower unemployment and higher wage growth in excess of labor productivity growth (see Storm and Naastepad 2015c). This explanation is consistent with the first two statements of “consensus diagnosis” outlined above

.

Nominal hourly wages, hourly labor productivity and unit labor cost:

Germany vis-à-vis the rest of the Eurozone (1990-2007; 1999 = 1.00)

German-Wage-Moderation-and-the-Eurozone-Crisis

Authors’ calculations from EU-KLEMS Database. See Storm and Naastepad (2015a). Relative unit labor cost is defined as the ratio of the relative nominal wage and relative labor productivity.

The Unmentioned Issues

The real problem of the Eurozone is, accordingly is not that unit labor costs have not converged but that the common currency and monetary unification have not led to a convergence of member countries’ production, employment, and trade structures, but rather to a centrifugal process of structural divergence in production. In a nutshell, since the mid-1990s, Germany has become stronger and more productive in high-value-added, higher-tech manufacturing (in conjunction with outsourcing to Eastern European countries), while Southern European countries became more strongly locked into lower-tech, lower value-added and, often, non-tradable activities (Storm and Naastepad 2015c). This has reinforced the core-periphery relationship between Germany and the Southern-European countries—meaning that Southern European growth spills over into German growth (via trade and finance) but not vice versa (Janger et al. 2012; Simonazzi, Ginzburg & Nocella 2013; Botta 2014; O’Connell 2015). This centrifugal process has been fueled and strengthened not just by the surge in cross-border capital flows following the introduction of the euro, but also by the common currency itself (as argued by Wierts, van Kerkhoff and de Haan 2014) as well as by the centralized and uniform interest rate policy of the ECB which up to 2008 was perhaps appropriate for stagnant and low-inflation Germany, but was undeniably out-of-sync with inflation levels in Southern Europe (Storm and Naastepad 2015c). Cheap credit in the South created unsustainable asset bubbles and facilitated untenable debt accumulation which fed into higher growth, lower unemployment and higher wages—but all concentrated in the non-dynamic and often non-tradable sectors of their economies.

In this analysis, the role of German wage moderation is very different from conventional wisdom. It mattered a lot, not through its supposed impact on cost competitiveness, but via its negative impacts on demand or, more specifically, (wage-led) German growth and inflation, which in turn prompted the ECB to lower the interest rate excessively for the Eurozone as a whole (as is illustrated in Storm and Naastepad 2015c, by Figure 1). The real issues facing the Eurozone have nothing to do with wages, cost competitiveness or trade imbalances. They are instead how to bring about a structural convergence between member countries of a common currency area (so far lacking any meaningful supranational fiscal policy mechanisms) in terms of productive structures, productivity levels, and ultimately incomes and long-term living conditions—which certainly will not be achieved by cutting wages and deregulating labor markets? What is the appropriate interest rate for the structurally divergent “core” and “periphery” in a one-size-fits-all monetary union? And how can banks, the financial sector and capital flows be made to contribute to a process of convergence (rather than divergence)?

These are hard nuts to crack —but let us hope that it will not take another five full years to finally ditch the dangerous myth that unit labor cost competitiveness is the prime problem and come up with a more rational Eurozone macro policy than the self-destructive policies of internal devaluation” and “structural reforms” pursued so far.

1. http://www.voxeu.org/article/ez-crisis-consensus-narrative

2. http://www.socialeurope.eu/2015/12/german-wage-moderation-and-the-eurozone-crisis/ and http://www.socialeurope.eu/2015/12/was-german-wage-undercutting-deliberate/

3. See Costantini (2015) for a hard-hitting exegesis of cyclically-adjusted budgetary policy, which traces its evolution from an essentially Keynesian concept in the 1940s, ’50s and ’60s, to a dogmatic New-Classical and (within the Eurozone) an Ordo-Liberal concept today.

4. The simultaneous increases in corporate savings and net capital outflows from Germany are not directly linked. Net capital outflows are the result of gross cross-border capital flows, which in turn are determined (even “pushed”) by events in the countries (such as Germany) where the large financial institutions channeling the lending are based (O’Connell 2015). This means gross capital flows are not necessarily (or at all) related to the financing of trade. For example, Germany was Ireland’s biggest net creditor by far, but only a minor Irish trading partner. O’Connell (2015) convincingly argues that the Eurozone crisis is a creditors’ crisis.

By Servaas Storm, Senior Lecturer in Economics, Delft University of Technology and co-author, with C.W. M. Naastepad, of Macroeconomics Beyond the NAIRU (Cambridge, MA: Harvard University Press), which won the Myrdal Prize of the European Association for Evolutionary Political Economy.

It is high time to look more closely at the labor cost competitiveness myth.

Progress in economics “is slow partly from mere intellectual inertia,” wrote Joan Robinson (1962, p. 79) long ago, because “in a subject where there is no agreed procedure for knocking out errors, doctrines have a long life.” As a recent illustration of such inertia, it took more than five years since Eurozone crisis started full-force (in May 2010) to come to a more or less reasonable “consensus diagnosis” as proposed by a group of economists associated with CEPR (in “Rebooting the Eurozone,” published in Vox on 20 November 2015).1

Even though this diagnosis marked a substantial advance, it invited strong critiques by Peter Bofinger (2015), one of the five members of Germany’s Sachverständigenrat, and from Oxford University’s Simon Wren-Lewis (2015).2 Both critics argue that the “consensus diagnosis” inappropriately focuses just on the deficit-crisis countries of Southern Europe, while neglecting the role of Germany, and of German wage moderation in particular, in bringing about the intra-Eurozone current account imbalances which are arguably at the heart of the Eurozone problématique.

The sad truth, however, is that Bofinger and Wren-Lewis are right for the wrong reason—hence their interventions are less than helpful, because rather than knocking out the remaining errors in the “consensus diagnosis”, they help perpetuate a mistaken doctrine: that relative unit-labor-costs matter are the prime determinant of a country’s international competitiveness, current account balance, and foreign indebtedness. The issue is serious: keeping alive the dangerous myth that labor costs drive “competitiveness” feeds the irrepressible urge of the orthodox mainstream to try to bring about economic recovery by reducing Eurozone unit labor costs (Gabrisch and Staehr 2014; Janssen 2015; Storm and Naastepad 2012, 2015b, 2015c). This intrinsically beggar-thy-neighbour strategy has already become codified into official Eurozone policy: in the Euro Plus Pact (adopted by the European Council in March 2011) and recently by the Informal European Council (February 2015), which both combine it with a prescription for fiscal austerity based on a tight cyclically-adjusted public budget constraint.3 It is therefore high time to look more closely at the labor cost competitiveness myth.

Progress: What the Consensus Diagnosis Gets Right

But first let me clarify that the consensus diagnosis is right in pointing out that the Eurozone crisis is not a sovereign debt crisis in its origin. Instead, it correctly holds that (i) the Eurozone crisis originated in a (banking) crisis of cross-border capital flows gone wild that led to massive intra-Eurozone (current account) imbalances; and (ii) that the crisis has been amplified by institutional flaws in the design of the Eurozone. The consensus authors rightly point to the vicious “doom loop” in which crisis-struck Eurozone governments, lacking access to a lender of last resort, were left to borrow only from their national banking systems—systems which had become increasingly insolvent and in turn had to be bailed out by the same governments. The diagnosis that the Eurozone crisis is a crisis of deregulated (too-big-to-fail) banking is consistent with earlier analyses by Lane (2012), Lane and Pels (2012), Gabrisch and Staehr (2014), Storm and Naastepad (2015c, 2015d), O’Connell (2015) and others.

It is a far cry from the orthodox diagnosis propounded by mainstream economists such Sinn (2014) and by the European Commission, which absolve TBTF banks from any responsibility for the crisis and instead blames the “victims,” arguing that profligate Southern European countries, by allowing nominal wage growth to persistently exceed labor productivity growth, let their relative unit labor costs increase and their cost competitiveness deteriorate. In this narrative, rising unit labor costs are due to fiscal profligacy and “rigid” “over-regulated” labor markets, powerful unions, and strong employment protection. Rising relative unit labor costs supposedly killed Southern Europe’s export growth, raised current account deficits, created unsustainable external debts and reduced fiscal policy space, and hence, when the crisis broke, these countries lacked the resilience to absorb the shock. It follows in this story that the only escape from recession is for the Southern European countries rebuild their cost competitiveness—cutting wage costs (because Eurozone members cannot devalue their currency) by as much as 30% (as proposed by Sinn 2014), which requires in turn that their labor markets be thoroughly deregulated.

The Flip Side: The “Unit-Labor Cost Competitiveness Matters” Myth

Bofinger is right: when it comes to individual countries, the “consensus diagnosis” one-sidedly focuses on the crisis-struck deficit countries of Southern Europe, while the role of the Eurozone surplus countries, and Germany in particular, in bringing about the imbalances is left unmentioned. This omission is even worse, because the “consensus diagnosis” promulgates the “official” party line by claiming (in a throw-away sentence) that “the rigidity of factor and product markets [in Southern Europe] made the process of restoring competitiveness slow and painful in terms of lost output.” The consensus diagnosis thus accepts the official remedy of internal devaluations and labor market deregulation imposed on the crisis-struck countries by the European Commission, the ECB and the IMF.

Bofinger and Wren-Lewis wish to set part of the record straight by highlighting Germany’s responsibility for bringing about the Eurozone crisis. They argue that Germany’s long-term policy of wage moderation (based on a deliberate voluntary tri-partite agreement between German employers, trade unions and government) undercut its Eurozone neighbours and thereby raised Germany’s labor-cost competitiveness, helping to cause the Eurozone crisis by contributing to the build-up of Eurozone (current account) imbalances. Southern Europe’s cost competitiveness problem, in other words, was created in Berlin. The result, as Bofinger (2015) argues, is that German domestic and import demand slowed down, while its increasingly more cost-competitive exports experienced fast growth; as a result, the profit share in German GDP increased simultaneously with a growing current account surplus.

Confusing “simultaneity” with “causality,” Bofinger then suggests that the higher corporate profits were used to finance the (net) outflow of German savings to the rest of world, as indicated by its current account surplus.4 German wage moderation in this story is (mostly) to blame for the weakening of Southern Europe’s cost competitiveness as well as the large capital flow from Germany to the increasingly indebted and vulnerable Eurozone periphery. Wren-Lewis calls this the “untold story of the Eurozone crisis,” which is rather remarkable, because many authors made exactly the same point earlier including Lapavitsas et al. (2011), Stockhammer (2011), Bibow (2012), Flassbeck and Lapavitsas (2013) (for a lengthy list of references see Storm and Naastepad 2015a, 2015b, 2015c). These accounts show that wage moderation is a very powerful narrative (especially in Europe’s North), probably because it resonates with Calvinism and fits seamlessly with Weber’s Protestant Ethic, centring around the notion of “delayed gratification”: first the pain of tightening your belts to improve labor-cost competitiveness in order to obtain the gain of higher export growth, higher incomes and more jobs at a later stage. But, as Tolstoy (1882) wrote in A Confession, “wrong does not cease to be wrong, because the majority share in it.”

Knocking Out Errors

Bofinger’s narrative is worrisome in two major ways. First, by exclusively focusing on the real economy (wages, corporate profits, cost competitiveness and trade), the financial sector disappears from the scene—even though Bofinger seems to agree that the Eurozone crisis is in essence a financial crisis—and it becomes almost natural to only look for solutions in the real economy. In this way, the culprits (i.e., TBTF banks) are let off the hook—which means the real origins of the imbalances and crisis are left undebated. Secondly, of course it is true that Germany and German wage moderation bear part of the responsibility for bringing about the Eurozone crisis. Bofinger and Wren-Lewis have the best intentions while making this point (alas, the road to hell is paved with good intentions ….), but their single-minded emphasis on the importance of relative unit labor cost competitiveness is misguided for at least the following three reasons.

Firstly, exports and imports are—by definition (as explained in Storm and Naastepad 2015a, 2015c)—much less responsive to changes in (relative) unit labor costs than to changes in (relative) prices for several reasons. Unit labor costs make up less than 25% of the gross output price, while a second reason is that firms in general do not pass on all (but mostly only half of) unit labor cost increases onto market prices. What it means is that (when using realistic unit-labor cost elasticities) observed changes in Germany’s relative unit labor cost statistically “explain” only a minuscule fraction of its export growth and current account surplus (Wyplosz 2013; Gabrisch and Staehr 2014). For instance, IMF economists Danninger and Joutz (2007, p. 15) find that relative cost improvements accounted for less than 2% of German export growth during 1993-2005. Germany’s superior export performance can instead be completely explained by the “income effect” (Storm and Naastepad 2015a): German firms supply mostly complex, high-tech, and high-priced goods to fast-growing markets as well as to faster-growing countries such as China, Russia and Saudi Arabia (Gabrisch and Staehr 2014; Diaz Sanchez and Varoudakis 2013; Storm and Naastepad 2015a; Schröder 2015). Germany excels in non-price (technology-based) competitiveness and does not engage (much) in price competition.

Secondly, as shown in Figure 1, there is no clear sign of a nominal wage squeeze on German workers if we compare Germany to the Eurozone as a whole (but excluding Germany). German nominal wages increased relative to the Eurozone in the 1990s and the German relative nominal wage stayed more or less flat during the period 1999-2007 (there was a negligible decline of 0.7 percentage points over these eight years). It is nevertheless true that Germany’s unit labor cost declined relative to those of the rest of the Eurozone (as Figure 1 illustrates), but this was not a result of wage restraint: It was completely due to Germany’s outstanding productivity performance: during 1999-2007 average German labor productivity (per hour worked) increased by almost 8 percentage points compared to the rest of the Eurozone, which accounts fully for the decline in Germany’s relative unit labor costs by 7.8 percentage points over the same period. It was German engineering ingenuity, not nominal wage restraint or the Hartz “reforms”, which reduced its unit labor costs. Any talk of Germany deliberately undercutting its Eurozone neighbors is therefore beside the point.

Thirdly, the increase in current account deficits in Southern Europe resulted from an increase in the trend growth of their imports, while the trend growth of their exports stayed unchanged (notwithstanding the sustained rise in their unit labor costs). There is convincing statistical evidence for the European Union (Diaz Sanchez and Varoudakis 2014; Storm and Naastepad 2015c) showing that initial increases in current account deficits were followed only later in time by increases in relative unit labor costs—which, if true, means that the current account deteriorations were not caused by higher (relative) unit labor costs. The only rational explanation for the observed time-sequence is that Southern Europe first experienced a debt-led growth boom, which then led to higher imports and higher capital inflows leading only after a lag of many quarters to lower unemployment and higher wage growth in excess of labor productivity growth (see Storm and Naastepad 2015c). This explanation is consistent with the first two statements of “consensus diagnosis” outlined above

.

Nominal hourly wages, hourly labor productivity and unit labor cost:

Germany vis-à-vis the rest of the Eurozone (1990-2007; 1999 = 1.00)

German-Wage-Moderation-and-the-Eurozone-Crisis

Authors’ calculations from EU-KLEMS Database. See Storm and Naastepad (2015a). Relative unit labor cost is defined as the ratio of the relative nominal wage and relative labor productivity.

The Unmentioned Issues

The real problem of the Eurozone is, accordingly is not that unit labor costs have not converged but that the common currency and monetary unification have not led to a convergence of member countries’ production, employment, and trade structures, but rather to a centrifugal process of structural divergence in production. In a nutshell, since the mid-1990s, Germany has become stronger and more productive in high-value-added, higher-tech manufacturing (in conjunction with outsourcing to Eastern European countries), while Southern European countries became more strongly locked into lower-tech, lower value-added and, often, non-tradable activities (Storm and Naastepad 2015c). This has reinforced the core-periphery relationship between Germany and the Southern-European countries—meaning that Southern European growth spills over into German growth (via trade and finance) but not vice versa (Janger et al. 2012; Simonazzi, Ginzburg & Nocella 2013; Botta 2014; O’Connell 2015). This centrifugal process has been fueled and strengthened not just by the surge in cross-border capital flows following the introduction of the euro, but also by the common currency itself (as argued by Wierts, van Kerkhoff and de Haan 2014) as well as by the centralized and uniform interest rate policy of the ECB which up to 2008 was perhaps appropriate for stagnant and low-inflation Germany, but was undeniably out-of-sync with inflation levels in Southern Europe (Storm and Naastepad 2015c). Cheap credit in the South created unsustainable asset bubbles and facilitated untenable debt accumulation which fed into higher growth, lower unemployment and higher wages—but all concentrated in the non-dynamic and often non-tradable sectors of their economies.

In this analysis, the role of German wage moderation is very different from conventional wisdom. It mattered a lot, not through its supposed impact on cost competitiveness, but via its negative impacts on demand or, more specifically, (wage-led) German growth and inflation, which in turn prompted the ECB to lower the interest rate excessively for the Eurozone as a whole (as is illustrated in Storm and Naastepad 2015c, by Figure 1). The real issues facing the Eurozone have nothing to do with wages, cost competitiveness or trade imbalances. They are instead how to bring about a structural convergence between member countries of a common currency area (so far lacking any meaningful supranational fiscal policy mechanisms) in terms of productive structures, productivity levels, and ultimately incomes and long-term living conditions—which certainly will not be achieved by cutting wages and deregulating labor markets? What is the appropriate interest rate for the structurally divergent “core” and “periphery” in a one-size-fits-all monetary union? And how can banks, the financial sector and capital flows be made to contribute to a process of convergence (rather than divergence)?

These are hard nuts to crack —but let us hope that it will not take another five full years to finally ditch the dangerous myth that unit labor cost competitiveness is the prime problem and come up with a more rational Eurozone macro policy than the self-destructive policies of internal devaluation” and “structural reforms” pursued so far.

1. http://www.voxeu.org/article/ez-crisis-consensus-narrative

2. http://www.socialeurope.eu/2015/12/german-wage-moderation-and-the-eurozone-crisis/ and http://www.socialeurope.eu/2015/12/was-german-wage-undercutting-deliberate/

3. See Costantini (2015) for a hard-hitting exegesis of cyclically-adjusted budgetary policy, which traces its evolution from an essentially Keynesian concept in the 1940s, ’50s and ’60s, to a dogmatic New-Classical and (within the Eurozone) an Ordo-Liberal concept today.

4. The simultaneous increases in corporate savings and net capital outflows from Germany are not directly linked. Net capital outflows are the result of gross cross-border capital flows, which in turn are determined (even “pushed”) by events in the countries (such as Germany) where the large financial institutions channeling the lending are based (O’Connell 2015). This means gross capital flows are not necessarily (or at all) related to the financing of trade. For example, Germany was Ireland’s biggest net creditor by far, but only a minor Irish trading partner. O’Connell (2015) convincingly argues that the Eurozone crisis is a creditors’ crisis.

Proserpina

(2,352 posts)3. ObamaCareís Neoliberal Intellectual Foundations Continue to Crumble

http://www.nakedcapitalism.com/2016/01/obamacares-neoliberal-intellectual-foundations-continue-to-crumble.html

By Lambert Strether of Corrente.

ObamaCare is, of course, a neoliberal “market-based” “solution.” ObamaCare’s intellectual foundations were expressed most clearly in layperson’s language by none other than the greatest orator of our time, Obama, himself (2013):

Let’s leave aside the possibility that private plans are phishing for your business, by exploiting informational asymmetries, rather than “competing” for it. Obama gives an operational definition of a functioning market that assumes two things: (1) That health insurance, as a product, is like flat-screen TVs, and (2) as when buying flat-screen TVs, people will comparison shop for health insurance, and that will drive health insurers to compete to satisfy them. As it turns out, scholars have been studying both assumptions, and both assumptions are false. “The dog won’t eat the dog food,” as marketers say. This will be a short post; we’ve already seen that the first assumption is false — only 20%-ers who have their insurance purchased for them by an institution could be so foolish as to make it — and a new study shows that the second assumption is false, as well.

ObamaCare’s Product Is Not Like a Flat-Screen TV

Here’s the key assumptoin that Obama (and most economists) make about heatlth insurance: That it’s a commodity, like flat screen TVs, or airline tickets, and that therefore, there exists a “a product that suits your budget and is right for you” because markets. Unfortunately, experience backed up by studies has shown that this is not true. From ObamaCare is a Bad Deal (for Many). From Mark Pauly, Adam Leive, Scott Harrington, all of the Wharton School, NBER Working Paper No. 21565 (quoted at NC in October 2015):

So, for approximately half the “formerly uninsured,” ObamaCare is a losing proposition; I don’t know what an analogy for flat-screen TVs is; maybe having to send the manufacturer money every time you turn it on, in addition to the money you paid to buy it? That’s most definitely not a “package that fits your budget and is right for you,” unless you’re a masochist or a phool. Second, the portion of those eligible that does the math probably won’t buy the product if they’re rational actors (and Obamaare needs to double its penetration of the eligible to avoid a death spiral). That again is not like the market for flat-screen TVs; the magic of the ObamaCare marketplace has not operated to produce a product at every price point (or a substitute).[1] Bad marketplace! Bad! Bad!

Health Care “Consumers” Tend not to Comparison Shop

We turn now to a second NBER study that places even more dynamite at ObamaCare’s foundations. From Zarek C. Brot-Goldberg, Amitabh Chandra, Benjamin R. Handel, and Jonathan T. Kolstad, of Berkelely and Harvard, “What Does a Deductible Do? The Impact of Cost-Sharing on Health Care Prices, Quantities, and Spending Dynamics” NBER Working Paper No. 21632 (PDF), the abstract:

So, empirically, these “consumers” just don’t act the way that good neoliberal Obama says they should; they do not comparison shop. That alone is enough to undermine the intellectual basis of ObamaCare. If there’s no comparison shopping going on, there’s no competitive pressure for health insurers to improve their product (assuming good faith, which I don’t).

more

By Lambert Strether of Corrente.

ObamaCare is, of course, a neoliberal “market-based” “solution.” ObamaCare’s intellectual foundations were expressed most clearly in layperson’s language by none other than the greatest orator of our time, Obama, himself (2013):

If you don’t have health insurance, then starting on October 1st, private plans will actually compete for your business, and you’ll be able to comparison-shop online.There will be a marketplace online, just like you’d buy a flat-screen TV or plane tickets or anything else you’re doing online, and you’ll be able to buy an insurance package that fits your budget and is right for you.

Let’s leave aside the possibility that private plans are phishing for your business, by exploiting informational asymmetries, rather than “competing” for it. Obama gives an operational definition of a functioning market that assumes two things: (1) That health insurance, as a product, is like flat-screen TVs, and (2) as when buying flat-screen TVs, people will comparison shop for health insurance, and that will drive health insurers to compete to satisfy them. As it turns out, scholars have been studying both assumptions, and both assumptions are false. “The dog won’t eat the dog food,” as marketers say. This will be a short post; we’ve already seen that the first assumption is false — only 20%-ers who have their insurance purchased for them by an institution could be so foolish as to make it — and a new study shows that the second assumption is false, as well.

ObamaCare’s Product Is Not Like a Flat-Screen TV

Here’s the key assumptoin that Obama (and most economists) make about heatlth insurance: That it’s a commodity, like flat screen TVs, or airline tickets, and that therefore, there exists a “a product that suits your budget and is right for you” because markets. Unfortunately, experience backed up by studies has shown that this is not true. From ObamaCare is a Bad Deal (for Many). From Mark Pauly, Adam Leive, Scott Harrington, all of the Wharton School, NBER Working Paper No. 21565 (quoted at NC in October 2015):

This paper estimates the change in net (of subsidy) financial burden (“the price of responsibility”) and in welfare that would be experienced by a large nationally representative sample of the “non-poor” uninsured if they were to purchase Silver or Bronze plans on the ACA exchanges. The sample is the set of full-year uninsured persons represented in the Current Population Survey for the pre-ACA period with incomes above 138 percent of the federal poverty level. The estimated change in financial burden compares out-of-pocket payments by income stratum in the pre-ACA period with the sum of premiums (net of subsidy) and expected cost sharing (net of subsidy) for benchmark Silver and Bronze plans, under various assumptions about the extent of increased spending associated with obtaining coverage. In addition to changes in the financial burden, our welfare estimates incorporate the value of additional care consumed and the change in risk premiums for changes in exposure to out-of-pocket payments associated with coverage, under various assumptions about risk aversion. We find that the average financial burden will increase for all income levels once insured. Subsidy-eligible persons with incomes below 250 percent of the poverty threshold likely experience welfare improvements that offset the higher financial burden, depending on assumptions about risk aversion and the value of additional consumption of medical care. However, even under the most optimistic assumptions, close to half of the formerly uninsured (especially those with higher incomes) experience both higher financial burden and lower estimated welfare; indicating a positive “price of responsibility” for complying with the individual mandate. The percentage of the sample with estimated welfare increases is close to matching observed take-up rates by the previously uninsured in the exchanges.

So, for approximately half the “formerly uninsured,” ObamaCare is a losing proposition; I don’t know what an analogy for flat-screen TVs is; maybe having to send the manufacturer money every time you turn it on, in addition to the money you paid to buy it? That’s most definitely not a “package that fits your budget and is right for you,” unless you’re a masochist or a phool. Second, the portion of those eligible that does the math probably won’t buy the product if they’re rational actors (and Obamaare needs to double its penetration of the eligible to avoid a death spiral). That again is not like the market for flat-screen TVs; the magic of the ObamaCare marketplace has not operated to produce a product at every price point (or a substitute).[1] Bad marketplace! Bad! Bad!

Health Care “Consumers” Tend not to Comparison Shop

We turn now to a second NBER study that places even more dynamite at ObamaCare’s foundations. From Zarek C. Brot-Goldberg, Amitabh Chandra, Benjamin R. Handel, and Jonathan T. Kolstad, of Berkelely and Harvard, “What Does a Deductible Do? The Impact of Cost-Sharing on Health Care Prices, Quantities, and Spending Dynamics” NBER Working Paper No. 21632 (PDF), the abstract:

Measuring consumer responsiveness to medical care prices is a central issue in health economics and a key ingredient in the optimal design and regulation of health insurance markets. We study consumer responsiveness to medical care prices, leveraging a natural experiment that occurred at a large self-insured firm which required all of its employees to switch from an insurance plan that provided free health care to a non-linear, high deductible plan[2]. The switch caused a spending reduction between 11.79%-13.80% of total firm-wide health spending. We decompose this spending reduction into the components of (i) consumer price shopping (ii) quantity reductions and (iii) quantity substitutions, finding that spending reductions are entirely due to outright reductions in quantity. We find no evidence of consumers learning to price shop after two years in high-deductible coverage. Consumers reduce quantities across the spectrum of health care services, including potentially valuable care (e.g. preventive services) and potentially wasteful care (e.g. imaging services). We then leverage the unique data environment to study how consumers respond to the complex structure of the high-deductible contract. We find that consumers respond heavily to spot prices at the time of care, and reduce their spending by 42% when under the deductible, conditional on their true expected end-of-year shadow price and their prior year end-of-year marginal price. In the first-year post plan change, 90% of all spending reductions occur in months that consumers began under the deductible, with 49% of all reductions coming for the ex ante sickest half of consumers under the deductible, despite the fact that these consumers have quite low shadow prices. There is no evidence of learning to respond to the true shadow price in the second year post-switch.

So, empirically, these “consumers” just don’t act the way that good neoliberal Obama says they should; they do not comparison shop. That alone is enough to undermine the intellectual basis of ObamaCare. If there’s no comparison shopping going on, there’s no competitive pressure for health insurers to improve their product (assuming good faith, which I don’t).

more

Proserpina

(2,352 posts)4. Robert Reich: Why Sanders' Plan to Bust Up the Big Banks Is So Much Better than Clinton's

http://www.alternet.org/news-amp-politics/robert-reich-why-sanders-plan-bust-big-banks-so-much-better-clintons?akid=13874.227380.T_vikp&rd=1&src=newsletter1048826&t=8

...The movie (The Big Short) gets the story essentially right: Traders on the Street pushed highly-risky mortgage loans, bundled them together into investments that hid the risks, got the major credit-rating agencies to give the bundles Triple-A ratings, and then sold them to unwary investors. It was a fraudulent Ponzi scheme that had to end badly – and it did.

Yet since then, Wall Street and its hired guns (including most current Republican candidates for president) have tried to rewrite this history. They want us to believe the banks and investment houses were innocent victims of misguided government policies that gave mortgages to poor people who shouldn’t have got them. That’s pure baloney. The boom in subprime mortgages was concentrated in the private market, not in government. Wall Street itself created the risky mortgage market. It sliced and diced junk mortgages into bundles that hid how bad they were. And it invented the derivatives and CDOs that financed them The fact is, more than 84 percent of the subprime mortgages in 2006 were issued by private institutions, and nearly 83 percent of the subprime loans that went to low- and moderate-income borrowers that year.

Why has Wall Street been pushing its lie, blaming the government for what happened? And why has the Street (along with its right-wing apologists, and its outlets such as Rupert Murdoch’s Wall Street Journal) so viciously attacked the movie “The Big Short?” So we won’t demand tougher laws to prevent another crisis followed by another “too-big-to-fail” bailout...Which brings us back to Bernie and Hillary. Hillary Clinton doesn’t want to break up the big banks or resurrect the Glass-Steagall Act, as Bernie does

Instead, she’d charge the big banks a bit more for carrying lots of debt and to oversee them more carefully. She’d also give bank regulators more power to break up any particular bank that theyconsider too risky. And she wants more oversight of so-called “shadow banks” such as hedge funds and insurance companies like the infamous AIG. In a world where the giant Wall Street banks didn’t have huge political power, these measures might be enough. But, if you hadn’t noticed, Wall Street wields extraordinary power. Which helps explain why no Wall Street executive has been indicted for the fraudulent behavior that led up to the 2008 crash. Or for the criminal price-fixing scheme settled last May. And why even the fines imposed on the banks have been only a fraction of the banks’ gains. And also why Dodd-Frank is being watered down into vapidity. For example, the law requires major banks to prepare “living wills” describing how they’d unwind their operations if they get into serious trouble. But no big bank has come up with one that passes muster. Federal investigators have found them all “unrealistic.”

Most of Hillary’s proposals could already have been put into effect by the Fed and the Securities and Exchange Commission, but they haven’t been – presumably because of the Street’s muscle. As a practical matter, then, her proposals are invitations to more dilution and finagle. The only way to contain the Street’s excesses is by taking on its economic and political power directly – with reforms so big, bold, and public they can’t be watered down. Starting with busting up the biggest banks, as Bernie Sanders proposes.

more

...The movie (The Big Short) gets the story essentially right: Traders on the Street pushed highly-risky mortgage loans, bundled them together into investments that hid the risks, got the major credit-rating agencies to give the bundles Triple-A ratings, and then sold them to unwary investors. It was a fraudulent Ponzi scheme that had to end badly – and it did.

Yet since then, Wall Street and its hired guns (including most current Republican candidates for president) have tried to rewrite this history. They want us to believe the banks and investment houses were innocent victims of misguided government policies that gave mortgages to poor people who shouldn’t have got them. That’s pure baloney. The boom in subprime mortgages was concentrated in the private market, not in government. Wall Street itself created the risky mortgage market. It sliced and diced junk mortgages into bundles that hid how bad they were. And it invented the derivatives and CDOs that financed them The fact is, more than 84 percent of the subprime mortgages in 2006 were issued by private institutions, and nearly 83 percent of the subprime loans that went to low- and moderate-income borrowers that year.

Why has Wall Street been pushing its lie, blaming the government for what happened? And why has the Street (along with its right-wing apologists, and its outlets such as Rupert Murdoch’s Wall Street Journal) so viciously attacked the movie “The Big Short?” So we won’t demand tougher laws to prevent another crisis followed by another “too-big-to-fail” bailout...Which brings us back to Bernie and Hillary. Hillary Clinton doesn’t want to break up the big banks or resurrect the Glass-Steagall Act, as Bernie does

Instead, she’d charge the big banks a bit more for carrying lots of debt and to oversee them more carefully. She’d also give bank regulators more power to break up any particular bank that theyconsider too risky. And she wants more oversight of so-called “shadow banks” such as hedge funds and insurance companies like the infamous AIG. In a world where the giant Wall Street banks didn’t have huge political power, these measures might be enough. But, if you hadn’t noticed, Wall Street wields extraordinary power. Which helps explain why no Wall Street executive has been indicted for the fraudulent behavior that led up to the 2008 crash. Or for the criminal price-fixing scheme settled last May. And why even the fines imposed on the banks have been only a fraction of the banks’ gains. And also why Dodd-Frank is being watered down into vapidity. For example, the law requires major banks to prepare “living wills” describing how they’d unwind their operations if they get into serious trouble. But no big bank has come up with one that passes muster. Federal investigators have found them all “unrealistic.”

Most of Hillary’s proposals could already have been put into effect by the Fed and the Securities and Exchange Commission, but they haven’t been – presumably because of the Street’s muscle. As a practical matter, then, her proposals are invitations to more dilution and finagle. The only way to contain the Street’s excesses is by taking on its economic and political power directly – with reforms so big, bold, and public they can’t be watered down. Starting with busting up the biggest banks, as Bernie Sanders proposes.

more

Proserpina

(2,352 posts)5. Oil Plunges toward $30, Dallas Fed President Sucker-Punches any Leftover Oil Bulls by Wolf Richter

http://wolfstreet.com/2016/01/12/oil-plunges-to-30-handle-dallas-fed-president-sucker-punches-any-surviving-oil-bulls/

“Even lower for even longer”

You’d expect at least some artificial optimism when the president of the Dallas Fed talks about oil. You’d expect some droplets of hope for that crucial industry in Texas. But when Dallas Fed President Robert Kaplan spoke on Monday, there was none, not for 2016, and most likely not for 2017 either, and maybe not even for 2018.

The wide-ranging speech included a blunt section on oil, the dismal future of the price of oil, the global and US causes for its continued collapse, and what it might mean for the Texas oil industry: “more bankruptcies, mergers and restructurings….”

The oil price plunge since mid-2014, with its vicious ups and downs, was bad enough. But since the OPEC meeting in December, he said, “the overall tone in the oil and gas sector has soured, as expectations have decidedly shifted to an ‘even lower for even longer’ price outlook.”

So how low is “even lower?”

He didn’t say. But here is what is happening right now, just hours after Kaplan got through speaking. On Monday during the day and in late trading, WTI plunged through the $32-level, through the $31-level, and hit $30.53 a barrel, as I’m writing this, down another 7.1%:

This $30.53 a barrel is within a hair of the Financial Crisis closing low on Tuesday, December 23, 2008, of $30.28 a barrel. Oil had plummeted for days as traders had been checking out for the holidays. Practically no one wanted to buy oil. But on Christmas Eve, oil rose to $32.94. It was the first day of a V-shaped recovery. And on Friday, December 26, 2008, oil soared and closed at $37.58 a barrel...

more

“Even lower for even longer”

You’d expect at least some artificial optimism when the president of the Dallas Fed talks about oil. You’d expect some droplets of hope for that crucial industry in Texas. But when Dallas Fed President Robert Kaplan spoke on Monday, there was none, not for 2016, and most likely not for 2017 either, and maybe not even for 2018.

The wide-ranging speech included a blunt section on oil, the dismal future of the price of oil, the global and US causes for its continued collapse, and what it might mean for the Texas oil industry: “more bankruptcies, mergers and restructurings….”

The oil price plunge since mid-2014, with its vicious ups and downs, was bad enough. But since the OPEC meeting in December, he said, “the overall tone in the oil and gas sector has soured, as expectations have decidedly shifted to an ‘even lower for even longer’ price outlook.”

So how low is “even lower?”

He didn’t say. But here is what is happening right now, just hours after Kaplan got through speaking. On Monday during the day and in late trading, WTI plunged through the $32-level, through the $31-level, and hit $30.53 a barrel, as I’m writing this, down another 7.1%:

This $30.53 a barrel is within a hair of the Financial Crisis closing low on Tuesday, December 23, 2008, of $30.28 a barrel. Oil had plummeted for days as traders had been checking out for the holidays. Practically no one wanted to buy oil. But on Christmas Eve, oil rose to $32.94. It was the first day of a V-shaped recovery. And on Friday, December 26, 2008, oil soared and closed at $37.58 a barrel...

more

Proserpina

(2,352 posts)6. Getting To 100% Renewable Energy In the US

https://cleantechnica.com/2016/01/07/getting-100-renewable-energy-us/

Getting to 100% renewable energy in the US by 2050 is a goal that is gaining traction among the US public. Reports from many environmental organizations have been written on how to get to this target, including from Greenpeace and the World Wildlife Foundation. After last year’s COP21 conference, the momentum has gotten stronger in order to keep global temperature within the 1.5°C threshold to avoid dramatic climatic change on the Earth.

Now, another massive report suggests a framework on how the US can get to 100% renewable energy sources by 2050.

A paper titled 100% Clean and Renewable Wind, Water and Sunlight all-sector Roadmaps for the 50 United States suggests this is possible even within 35 years. This analysis shows that getting to 100% renewable energy within the US would consist of:

30.9% onshore wind

19.1% offshore wind

30.7% utility-scale solar photovoltaics (PV)

7.2% rooftop PV

7.3% concentrated solar power (CSP) with storage

1.25% geothermal

0.37% tidal/wave

3.01% hydroelectricity

Under a 100% renewable scenario based on these numbers, millions of jobs would be created. Consider that 3.9 million construction jobs and 2 million operational jobs at renewable energy plants would outpace 3.9 million jobs lost from the traditional energy sectors.

To further enhance these numbers, The Solutions Project website shows what each jurisdiction needs to do to get to 100%. For example, Minnesota could get 60% of its total energy from onshore wind (and note that this is all energy, not just electricity, but relies on electrification of transport). California, on the other hand, can get 26.5% from solar PV plants and 25% from onshore wind.

more

Getting to 100% renewable energy in the US by 2050 is a goal that is gaining traction among the US public. Reports from many environmental organizations have been written on how to get to this target, including from Greenpeace and the World Wildlife Foundation. After last year’s COP21 conference, the momentum has gotten stronger in order to keep global temperature within the 1.5°C threshold to avoid dramatic climatic change on the Earth.

Now, another massive report suggests a framework on how the US can get to 100% renewable energy sources by 2050.

A paper titled 100% Clean and Renewable Wind, Water and Sunlight all-sector Roadmaps for the 50 United States suggests this is possible even within 35 years. This analysis shows that getting to 100% renewable energy within the US would consist of:

30.9% onshore wind

19.1% offshore wind

30.7% utility-scale solar photovoltaics (PV)

7.2% rooftop PV

7.3% concentrated solar power (CSP) with storage

1.25% geothermal

0.37% tidal/wave

3.01% hydroelectricity

Under a 100% renewable scenario based on these numbers, millions of jobs would be created. Consider that 3.9 million construction jobs and 2 million operational jobs at renewable energy plants would outpace 3.9 million jobs lost from the traditional energy sectors.

To further enhance these numbers, The Solutions Project website shows what each jurisdiction needs to do to get to 100%. For example, Minnesota could get 60% of its total energy from onshore wind (and note that this is all energy, not just electricity, but relies on electrification of transport). California, on the other hand, can get 26.5% from solar PV plants and 25% from onshore wind.

more

Proserpina

(2,352 posts)7. RBS is telling traders to 'sell everything'

http://www.independent.co.uk/news/business/news/rbs-is-telling-traders-to-sell-everything-a6807111.html

RBS has advised traders to "sell everything" in an alarming research note that warns of a global deflationary crisis.

That would mean prices start to decline, creating a vicious cycle where people hang onto their money rather than invest it in the economy.

“Sell everything except high quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small,” RBS said in a note to clients...

more

I recall a story of the Great Depression...how Joseph Kennedy was the first to sell everything (perhaps even triggering the stock market crash), and therefore his fortune survived...he had the cash to buy up distressed commercial real estate...and other things...and get even wealthier.

RBS has advised traders to "sell everything" in an alarming research note that warns of a global deflationary crisis.

That would mean prices start to decline, creating a vicious cycle where people hang onto their money rather than invest it in the economy.

“Sell everything except high quality bonds. This is about return of capital, not return on capital. In a crowded hall, exit doors are small,” RBS said in a note to clients...

more

I recall a story of the Great Depression...how Joseph Kennedy was the first to sell everything (perhaps even triggering the stock market crash), and therefore his fortune survived...he had the cash to buy up distressed commercial real estate...and other things...and get even wealthier.

Timing is everything.

The challenge is getting it right. Also not letting greed get in the way and stretching for that last cent before the branch breaks.

The really scary thing to me is that RBS is saying "Deflation" out loud here. Can a panic be far away?

Proserpina

(2,352 posts)8. Anybody going to watch the SOTU Speech Tuesday Night?

I've heard enough bullshit for one day.

Punx

(446 posts)11. I watched the last ~1/2

My reaction, "Meh", but I'm pretty jaded at the moment.

Did he mention TPP? I was assuming he would push it big time tonight.

MattSh

(3,714 posts)12. When the letters SOTU appear in front of me...

I often see STFU. Don't ask me why.

Time to check my eyes. Again.

Proserpina

(2,352 posts)13. It depends on the POTUS, I expect

Hasn't been one worth listening to in my lifetime.

Proserpina

(2,352 posts)14. War Between Saudi Arabia And Iran Could Send Oil Prices To $250

Don't give them any ideas!

http://finance.yahoo.com/news/war-between-saudi-arabia-iran-222438070.html

The rift between Saudi Arabia and Iran has quickly ballooned into the worst conflict in decades between the two countries. The back-and-forth escalation quickly turned the simmering tension into an overt struggle for power in the Middle East. First, the execution of a prominent Shiite cleric prompted protestors to set fire to the Saudi embassy in Tehran. Saudi Arabia cut off diplomatic relations and kicked out Iranian diplomatic personnel. Tehran banned Saudi goods from entering Iran. Worst of all, Iran blames Saudi Arabia for an airstrike that landed near its embassy in Yemen.