Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 22 January 2016

[font size=3]STOCK MARKET WATCH, Friday, 22 January 2016[font color=black][/font]

SMW for 21 January 2016

AT THE CLOSING BELL ON 21 January 2016

[center][font color=green]

Dow Jones 15,882.68 +115.94 (0.74%)

S&P 500 1,868.99 +9.66 (0.52%)

Nasdaq 4,472.06 +0.37 (0.01%)

[font color=green]10 Year 1.98% -0.01 (-0.50%)

30 Year 2.75% -0.01 (-0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)We might see freezing on Sunday. And no snow--oh, it pretends to snow, but there's nothing to show for the effort. Except a lot of car crashes from a thin glaze of ice left behind.

The Great Lakes have only 14% ice cover...so there will be lots of evaporation, lowering the water levels. There's snow accumulating in Canada, maybe some of that will fill in the gap.

Christmas flew by, but winter is dragging.

Ghost Dog

(16,881 posts)sorry, warm. you & mom. ![]()

Here's a singer-songwriter I'm working with:

Proserpina

(2,352 posts)Soothes the savage breast, and all that.

Ghost Dog

(16,881 posts)profound reflection.

Here's John Martyn with Danny Thompson - Solid Air:

A pleasure, working with artists...

Proserpina

(2,352 posts)Senators Elizabeth Warren (D-Mass.), Patty Murray (D-Wash.), Tammy Baldwin (D-Wisc.), Chuck Schumer (D-N.Y.) and others announced a package of legislation they say will make higher education more affordable for future college students and help borrowers currently struggling with debt better manage their burden.

The package, dubbed the RED Act, a reference to a campaign that activists and members of Congress launched on social media during the State of the Union speech last week to help students and borrowers who are “#InTheRed,” hashtag includes three proposals that various Senate Democrats have championed in recent years.

The first proposal is a federal-state partnership that would waive resident tuition for two years of community college. Under the bill, for every $1 a state puts in to make community college free, the federal government would provide $3. The package also includes a proposal that would index the Pell grant — the money the government provides to low-income students to attend college — to inflation and provide mandatory funding for the program. The third component of the bill would allow current student loan borrowers to refinance their loans at lower interest rates.

not enough by any measure

Proserpina

(2,352 posts)http://www.marketwatch.com/story/the-best-jobs-of-2016-all-have-something-in-common-2016-01-21

Each year, the job-search company Glassdoor compiles a list of the 25 best jobs. At the top of the list this year are data scientist, tax manager, solutions architect and engagement manager -- and they all boast salaries of more than $100,000.

The emphasis on salary “shouldn’t be a surprise,” said Scott Dobroski, a community expert at Glassdoor. “Salary is tied into all of our livelihoods.”

In fact, salary and compensation is the single most sought-after quality of a new job based on Glassdoor research; 68% of job seekers consider it.

But as Nobel-prize winning Princeton economist Angus Deaton and psychologist Daniel Kahneman famously found, workers’ day-to-day happiness rises until they reach a $75,000 salary, at which point their happiness plateaus.

there are no words

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2016-01-18/wef-boss-schwab-warns-commodities-rout-could-spur-more-migration

As the crash in commodities prices spreads economic woe across the developing world, Europe could face a wave of migration that will eclipse today’s refugee crisis, says Klaus Schwab, executive chairman of the World Economic Forum.

“Look how many countries in Africa, for example, depend on the income from oil exports,” Schwab said in an interview ahead of the WEF’s 46th annual meeting, in the Swiss resort of Davos. “Now imagine 1 billion inhabitants, imagine they all move north.”

Whereas much of the discussion about commodities has focused on the economic and market impact, Schwab said he’s concerned that it will also spur “a substantial social breakdown.”

That fits into what Schwab, the founder of the WEF, calls the time of “unexpected consequences” we now live in. In the modern era, it’s harder for policy makers to know the impact of their actions, which has led to “erosion of trust in decision makers.”

No, it's stuff like the lead-poisoned water in Flint that causes the erosion of trust.

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2016-01-21/trump-fear-stalks-davos-as-elite-pray-for-spring-reality-check

If Donald Trump as president of the United States is the ghost that’s stalking Davos, many among the global elite hope he’ll be banished by spring. Others see that as wishful thinking.

“I think the nominees will be Donald Trump for the Republicans and Hillary Clinton” for the Democrats, Donald Baer, a former White House adviser under President Bill Clinton, said at a panel co-hosted by Bloomberg and WPP Plc. “The next year will be a very uncertain, chaotic period.”

The prospect of Trump in the White House is ratcheting up anxiety among the 2,500 business and political leaders gathered at the Swiss ski resort for the annual World Economic Forum. With less than two weeks before voting in primaries gets under way and Trump in the Republican Party lead, those who fear a rise in protectionism and economic mismanagement are speaking out against the billionaire property developer.

“Unfortunately I do think that if there were to be a Trump administration the casualty would likely be trade,” said Eric Cantor, a former Republican House Majority Leader and now vice chairman of Moelis & Company. “That’s a very serious prospect for the world.”

then they all ought to support Bernie. Talk about clueless!

Proserpina

(2,352 posts)As chairman of investments at Guggenheim Partners, Scott Minerd thought he had a realistic view on how big an economic challenge climate change poses.

Then, at a Hoover Institution conference almost three years ago, he met former U.S. Secretary of State George Shultz. Minerd recalled him saying:

“Scott, imagine that you woke up tomorrow morning, and the headline on the newspapers was, 'The World Has Discovered a New Ocean.’”

The opening of the Arctic, Shultz told him, may be one of the most important events since the end of the ice age, some 12,000 years ago.

And while Shultz’s spokesman couldn’t confirm the conversation, there’s no doubting the melting of the Arctic ice cap, and the unveiling of resources below, presents mind-boggling opportunities for energy, shipping, fishing, science, and military exploitation. Russia even planted its flag on the sea floor at the North Pole in 2007...

Figures it would be Schultz, and the Hoover Institute

Proserpina

(2,352 posts)The ruble slumped to an all-time low as oil’s retreat choked revenue of the world’s largest energy exporter and restricted Russia’s ability to lift its economy out of a recession.

The currency weakened as much as 4.1 percent to 81.941 against the dollar, surpassing the previous record it touched at the peak of Russia’s financial-market turmoil in December 2014. Unlike then, when the central bank stepped in to shore up the ruble amid a crisis in confidence in the country due to sanctions over Ukraine, now Governor Elvira Nabiullina says the ruble is trading at a fair value and doesn’t need support.

While the ruble has fallen more than any other emerging market in 2016 with a depreciation of almost 10 percent, Brent crude has slumped by a steeper 26 percent. That’s driven Russia’s earnings from each barrel of oil it sells to the lowest since 2010 and forced the government to start considering austerity measures to avoid draining its rainy-day fund used to cover shortfalls in the budget.

"Oil is still a falling knife," said Piotr Matys, a strategist for emerging-market currencies at Rabobank in London, who’s next potential target is for the ruble is about 82.57. “The precipitous depreciation of the Russian ruble may have negative implications for inflation expectations, which would prevent the central bank from resuming its easing cycle."

more

Proserpina

(2,352 posts)The Russian ruble hit a historic low against the US dollar during Wednesday's trading on the Moscow exchange. The currency fell below 80.10 rubles to the dollar, the previous low of 16 December 2014, dubbed Black Tuesday.

The euro also gained on the Russian currency, trading at over 88 rubles, but below Black Tuesday's 100 mark...

The 2014 currency crisis led to a multibillion-dollar bank run in Russia. According to Herman Gref, chairman and CEO of Russia’s Sberbank, depositors panicked which destabilized the financial situation in the bank and the whole country.

“Unfortunately, we could not avoid the panic. You saw what happened. But I can only say this: first, the attack was coordinated, thousands of text messages were sent in each region, including a large number of mailings done from foreign websites. The target was to destabilize the country's largest bank and financial situation in the country,” he said in May 2015.

more

https://www.rt.com/business/329535-ruble-record-low-dollar/

Proserpina

(2,352 posts)Iceland just sentenced their 26th banker to prison for his part in the 2008 economic collapse. The charges ranged from breach of fiduciary duties to market manipulation to embezzlement...

nice summary of events

Proserpina

(2,352 posts)If you were under the impression that the Federal Reserve was done buying Treasuries, think again.

While the central bank won’t be expanding its balance sheet, about $216 billion of Treasuries in its portfolio mature in 2016, up from negligible amounts the past few years. Last week, New York Fed President William C. Dudley reiterated policy makers’ plan to keep reinvesting the proceeds for the time being, giving bondholders and Wall Street dealers reason to cheer.

The Fed is the biggest holder of the government’s debt. Its $2.5 trillion hoard, amassed in a bid to support the economy after the financial crisis, is more of a focus for some investors than the trajectory of interest rates. From this month through 2019, about $1.1 trillion of Treasuries in the portfolio are set to mature.

For bond bulls, the Fed’s signals that it will roll over the obligations have been another reason to doubt the consensus forecast that yields will rise in 2016. If officials had chosen to stop funneling that money into new debt, the government would likely have to boost borrowing in the market by roughly an equivalent amount this year, potentially pushing up Treasury yields...

higher interest rates for thee and me, but not for the Federal Reserve!

Proserpina

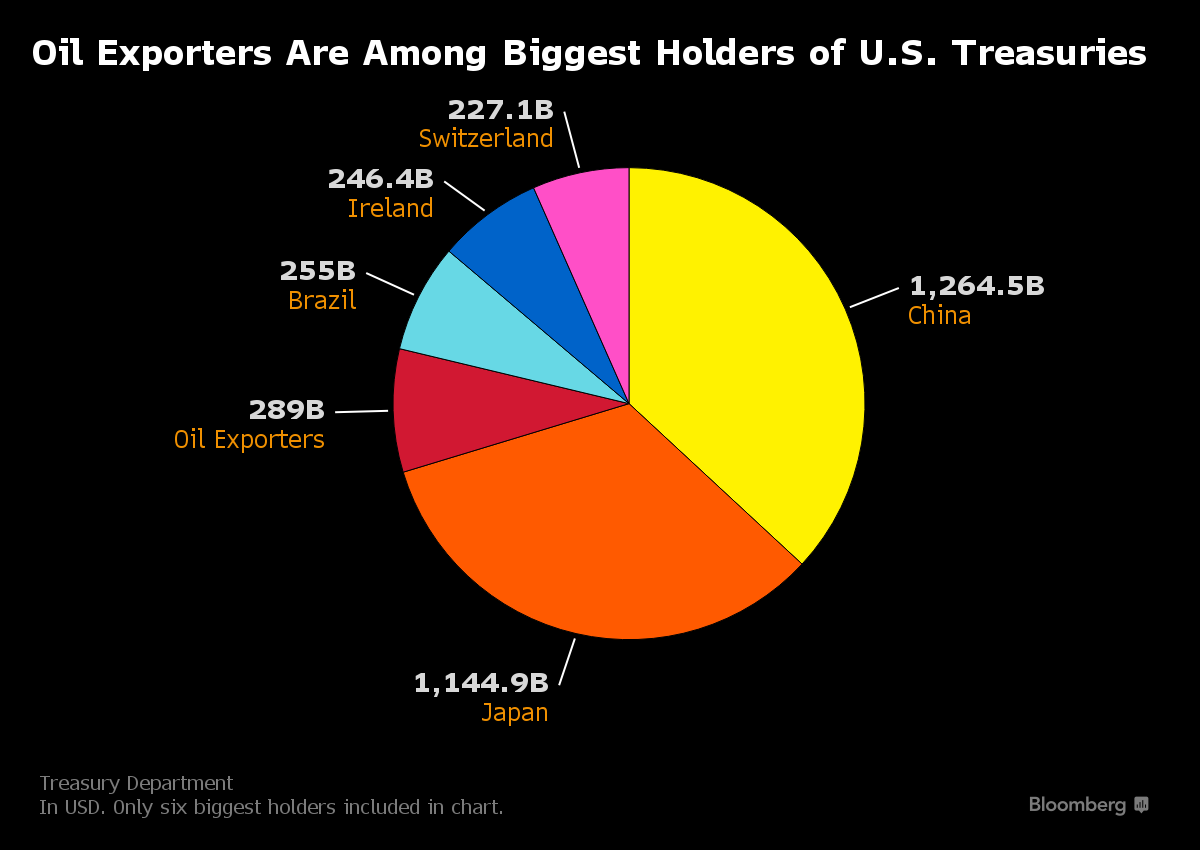

(2,352 posts)It’s a secret of the vast U.S. Treasury market, a holdover from an age of oil shortages and mighty petrodollars: Just how much of America’s debt does Saudi Arabia own?

But now that question -- unanswered since the 1970s, under an unusual blackout by the U.S. Treasury Department -- has come to the fore as Saudi Arabia is pressured by plunging oil prices and costly wars in the Middle East.

In the past year alone, Saudi Arabia burned through about $100 billion of foreign-exchange reserves to plug its biggest budget shortfall in a quarter-century. For the first time, it’s also considering selling a piece of its crown jewel -- state oil company Saudi Aramco. The signs of strain are prompting concern over Saudi Arabia’s outsize position in the world’s largest and most important bond market.

A big risk is that the kingdom is selling some of its Treasury holdings, believed to be among the largest in the world, to raise needed dollars. Or could it be buying, looking for a port in the latest financial storm? As a matter of policy, the Treasury has never disclosed the holdings of Saudi Arabia, long a key ally in the volatile Middle East, and instead groups it with 14 other mostly OPEC nations including Kuwait, the United Arab Emirates and Nigeria. For more than a hundred other countries, from China to the Vatican, the Treasury provides a detailed breakdown of how much U.S. debt each holds.

“It’s mind-boggling they haven’t undone it,” said Edwin Truman, the former Treasury assistant secretary for international affairs during the late 1990s, and now a senior fellow at the Peterson Institute for International Economics in Washington. Because relations were rocky and the U.S. needed their oil, the Treasury “didn’t want to offend OPEC. It’s hard to justify this special treatment for OPEC at this point.”

I suppose avoiding panic isn't a valid excuse, unless you want panic...

Proserpina

(2,352 posts)China’s economic restructuring and deleveraging is going to hurt Asia and Latin America more than it hurts them.

Just ask Vale shareholders. Beyond its $5 billion lawsuit over a mining catastrophe with partner BHP Billiton , Brazil’s iron ore exporter relied on Chinese demand for years. It’s all but evaporated as China desists building ghost towns and airports with no passengers. Vale stock is down 93.3% in the last five years; worse than BHP (-77 %), worse than Rio Tinto (-66.9%) and worse than the MSCI Brazil (-77.37%).

The same story holds for Chilean copper exporters, Argentinian soy and Taiwan tourism. If China goes to hell, it’s taking a bulk of the world with it.

When it comes to markets, no market in the world drives the story like China this year. There is so much anti-China rhetoric in Washington, and perennial voices of hard landing aficionados that it makes one wonder why everyone seems so pleased with themselves when China does poorly? Apple doesn’t want China to do poorly. GM doesn’t. Caterpillar has had to give investors bad news for years because of China. And people on the verge of retirement, having watched their portfolios grow like weeds in a hot summer sun since March 2009, now have China to thank, in part, for recent losses.

The U.S. is not immune. In September, the Federal Reserve opted out of a rate hike because of China. The same might hold for 2016, where Fed supposedly planning on raising rates four times...

Proserpina

(2,352 posts)... two women were picked at random on the streets of downtown Toronto. They told the CBC horrendous stories about how difficult their lives are – from being unable to meet the needs of their children, to too much stress at work, not enough money for childcare, and having no time to themselves.

But, if like the two women, you’re under too much pressure in your life and you don’t have any free time, keep in mind it’s happening to just about everyone, and it’s not your fault. It has to do with the way the economic system we live under us putting the squeeze on most of us.

How serious is the problem? A poll conducted for the Heart and Stroke Foundation revealed that half those interviewed were unhealthy because of their lifestyle:

These findings are of interest to the folks at Heart and Stroke because heart disease and stroke kills one in three Canadians and is the leading killer of women.

The two women interviewed by the CBC felt it was their fault that they couldn’t manage their lives better...

Proserpina

(2,352 posts)No -- US growth will slow but remain positive 60%

Yes -- the US will experience a mild recession 15%

No -- the US will experience sustained or improving growth 10%

Not sure 9%

Yes -- the US will experience a harsh recession 6%

source: on line poll by CFA Institute

Proserpina

(2,352 posts)The Agricultural Bank of China Ltd (AgBank) may lose 3.8 billion yuan (US$578 million) from a bills of exchange scam allegedly carried out by two employees, the influential financial publication Caixin reported.

The report, quoting unnamed sources, said the employees had illegally sold the bills of exchange to an unnamed third-party, and then used the proceeds to invest in the stock market, which has slumped since the middle of last year.

The report said the employees, who worked at a Beijing branch, were now under investigation, but did not specify by whom. It said the Ministry of Public Security and the China Banking Regulatory Commission had also reported the case to the cabinet.

Officials at Agbank, China's third largest lender, did not respond to repeated attempts for comment...

Proserpina

(2,352 posts)If you are waiting for Saudi Arabia to save the oil market, don't hold your breath. The country will not cut production and give up its market share in order to prop up prices, the chairman of Saudi Aramco said at the World Economic Forum in Davos.

"We are not going to accept to withdraw our production to make space for others," Khalid al-Falih said at a panel hosted by CNN's emerging markets editor John Defterios.

Saudi Arabia is the world's second biggest oil producer and the top crude exporter.

"This is the position that we've earned...we are not going to leave that position to others," al-Falih said.

He said Saudi Arabia has in the past played the role of a "reserve bank" in the oil market, smoothing short terms shocks. The country has acted during the financial crisis and during civil unrest and wars in oil producing regions that have disrupted supplies. But it will not step in to fix the hugely oversupplied market.

"Saudi Arabia has never advocated that it would take the sole role of balancing market against structural imbalance," he said at the CNN panel.

Related: John Defterios: Saudi Arabia's oil strategy tears OPEC apart

"If there are short term adjustments that need to be made and if other producers are willing to collaborate, Saudi Arabia will also be willing to collaborate," he said.

more

Proserpina

(2,352 posts)

Proserpina

(2,352 posts)with a little economic discussion, if it fits in.

With Davos sucking all the talking heads out of the press, there isn't much economic news available. Even the Davos press is rather close-lipped this time.

But we will make do. Mom still has an untapped trove of emails which she has "gifted" me with. Thanks, mom. You're a peach.

Proserpina

(2,352 posts)on this website: so many trolls and disruptors, rude and lying folk, and the politically corrupt are running neck and neck with the ignorant and proud of it; I don't know why Mom wants to keep this up. I would think once JPR gets rolling, it will outshine and outlast DU. It may be time for a change.

Or breakfast. TGIF!