Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 29 January 2016

[font size=3]STOCK MARKET WATCH, Friday, 29 January 2016[font color=black][/font]

SMW for 28 January 2016

AT THE CLOSING BELL ON 28 January 2016

[center][font color=green]

Dow Jones 16,069.64 +125.18 (0.79%)

S&P 500 1,893.36 +10.41 (0.55%)

Nasdaq 4,506.68 +38.51 (0.86%)

[font color=green]10 Year 1.98% -0.02 (-1.00%)

[font color=red]30 Year 2.79% +0.01 (0.36%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

ErisDiscordia

(443 posts)Few public intellectuals have a better grasp of the inherent injustices of our current economic order than the Noble Prize-winning economist Paul Krugman. But when it comes to weighing the political reality of our current predicament Krugman’s analysis, as put forth in a recent column, shows an astonishing lack of vision.

In an article titled, “How Change Happens,” Krugman gives us political advice that one would not expect from the leading left-liberal voice on the New York Times’ op-ed page. Krugman argues that we must dispense with the “persistent delusion that a hidden majority of American voters either supports or can be persuaded to support radical policies, if only the right person were to make the case with sufficient fervor.”

“On the left” Krugman continues, “there is always a contingent of idealistic voters eager to believe that a sufficiently high-minded leader can conjure up the better angels of America’s nature and persuade the broad public to support a radical overhaul of our institutions.”

Here Krugman grossly underestimates the power of a committed citizenry to make social change and fails to see that the United States is a different country today than when calls for a more “centrist” politics made any sense...

ErisDiscordia

(443 posts)http://www.nakedcapitalism.com/2016/01/krugmans-cowardly-attack-on-david-dayen-over-krugmans-misrepresentation-of-sanders-financial-reforms.html

Paul Krugman’s recent posts have been most peculiar. Several have looked uncomfortably like special pleading for political figures he likes, notably Hillary Clinton. He has, in my judgement, stooped rather far down in attacking people well below him in the public relations food chain, violating one of the unwritten rules of discourse: if you are going to kick someone, you kick up or at least sideways.

Perhaps the most egregious and clearest cut case is his refusal to address the substance of a completely legitimate, well-documented article by David Dayen outing Krugman, and to a lesser degree, his fellow traveler Mike Konczal, in abjectly misrepresenting Sanders’ financial reform proposals and attacking that straw man. Dayen pointed out that the proposal that both criticized, Sanders’ plan to break up big banks, was Elizabeth Warren’s so-called 21st Century Glass Steagall bill. That also meant they misrepresented Sanders as not addressing shadow banking and undermined Warren’s reform program. Similarly, as Dayen stressed, both tried to depict Sanders as a naive hair-on-fire idealist for wanting to break up the banks when both the FCIC and foreign bank regulators back the idea.

Now there are elements of Sanders’ reform plan not to like. For instance, while reinstituting a usury ceiling is a stellar idea, the specific way Sanders has formulated it needs rethinking. Similarly, he wants to stop paying interest on bank reserves and instead impose charges on them, which is misguided. The interest payments on reserves are an artifact of QE, since it has resulted in excess reserves piling up in the banking system, and the payment of interest rates becomes necessary to allow the Fed to maintain an interest rate floor. But rather than do their own homework, which would have included reading the Warren bill, these self-styled wonks simply amplified Clinton’s anti-Sanders talking points with a bit of extra hand-waving.

What so irritated Krugman, and led him to issue not one but two posts going after Dayen on a bizarre no-name, no-link basis? It’s doubtful that it was Dayen describing at length how Krugman’s attacks on Warren’s bill (had he even understood that that was what he was attacking) were at odds with his past position, or that Mike Konczal’s recent skepticism of Glass Steagall-type reforms, was a flip-flop from a long document he co-wrote in 2010. This is what appears to have set Krugman on tilt:

The radicals in this debate, in other words, are those protecting the deregulatory status quo….

But denying this consensus, and delegitimizing structural reform as silly and shortsighted, only does the work of banks and their lobbyists, who want to preserve the current system and cut off any avenues for a more far-reaching redesign.

Why in the world are people who call themselves liberals helping them do it? Those wondering why Warren hasn’t endorsed Hillary Clinton yet should consider whether it’s because Clinton and her minions are delivering a mortal wound to the cause of Warren’s life.

more

ErisDiscordia

(443 posts)Cash won't be around in a decade, the chief executive of one of Europe's biggest banks predicted on Wednesday.

"“Cash I think in ten years time probably won’t (exist). There is no need for it, it is terribly inefficient and expensive,” John Cryan, chief executive of Deutsche Bank, said during a discussion on financial technology, known as "fintech".

Other predictions made during the panel discussion at the World Economic Forum in Davos included James Gorman, chief executive of Morgan Stanley, who warned against "hysteria" surrounding fintech...Dan Schulman, CEO of Paypal, flagged cybercrime as the biggest threat to the financial industry.

"The big next stress is that the financial system is going to be hacked for one or two days”.

Punx

(446 posts)A "Wet Dream" for a long time. And remember the big banks make a % on each retail transaction.

Also, get a bit “Uppity” and they can track everything you do and shut off all your money with a couple of keystrokes.

I’m not sure a lot of people will go for that here in the US, right or left. At some point I expect the government to come up with some BS reason to outlaw cash; which would kill the medical & recreational marijuana business here in Oregon and Washington.

Of course the way things are going, none of us are going to have any $ to spend anyway.

ErisDiscordia

(443 posts)The $15 trillion rout in global equity markets since May is reawakening the lure of gold for investors seeking safety.

Hedge funds and other large speculators more than doubled their net-long position in bullion last week, just three weeks after they were the most-bearish ever. Investor holdings of gold through exchange-traded products are expanding at the fastest pace in a year, and the value of the ETPs has jumped by $3 billion in 2016.

Bullion has seen a revival of its appeal as a haven after being mainly ignored last year in the face of the Paris terror attacks in November and the Greek bailout negotiations in July. This time around, concerns about global markets will support the metal, Citigroup Inc. analysts led by Ed Morse said last week as they raised their 2016 price forecast.

“People have become complacent about risks, whether it’s macroeconomic and geopolitical,” said George Milling-Stanley, the Boston-based head of gold investments at State Street Global Advisors, which oversees $2.4 trillion. “What’s out of fashion may be coming back. That atmosphere of people feeling completely calm and untroubled, I think, is starting to go away. Gold is a very good risk-off trade, and I think people are starting to look very, very carefully at the risky positions that they have on a number of other markets.”

more

ErisDiscordia

(443 posts)There’s been endless speculation in recent weeks about whether the U.S., and the whole world for that matter, are about to sink into recession.

Underpinning much of the angst is an unprecedented $29 trillion corporate bond binge that has left many companies more indebted than ever.

Whether this debt overhang proves to be a catalyst for recession or not, one thing is clear in talking to credit-market observers: It’s a problem that won’t go away any time soon.

Strains are emerging in just about every corner of the global credit market. Credit-rating downgrades account for the biggest chunk of ratings actions since 2009; corporate leverage is at a 12-year high; and perhaps most worrisome, growing numbers of companies -- one third globally -- are failing to generate high enough returns on investments to cover their cost of funding. Pooled together into a single snapshot, the data points show how the seven-year-old global growth model based on cheap credit from central banks is running out of steam.

“We’ve never been in a cycle quite like this,” said Bonnie Baha, a money manager at DoubleLine Capital in Los Angeles, which oversees more than $80 billion. “It’s setting up for an unhappy turn.”

more

ErisDiscordia

(443 posts)The world’s biggest oil companies are asking tanker operators to slow down delivery of crude amid an ever-expanding supply glut on land, Europe’s largest owner of supertankers said.

Tankers hauling 2 million-barrel cargoes are delivering them at speeds of about 13 knots, compared with a maximum of 15, Paddy Rodgers, chief executive officer of Antwerp, Belgium-based Euronav NV, said in an interview in London on Thursday. The slower speeds might result in a voyage that would normally take 40 days instead lasting 48. Shore-based supplies are getting so big that it’s probable the need for storage at sea may soon grow, he said.

The market is contending with a glut of oil that’s not going away because OPEC is insisting it didn’t create the excess and won’t tackle it alone. Countries within the Organisation for Economic Cooperation and Development have a near-record of almost 3 billion barrels of oil stockpiled, the International Energy Agency estimates.

“I’ve not seen a supply-side market like it in terms of the production of oil,” said Rodgers, a lawyer who joined Euronav two decades ago and is based in London, after an earlier interview with Bloomberg Television. His company’s VLCCs earned $55,000 a day last year, double what they made in 2014, thanks in part to fuel prices that plunged along with crude, he said.

more

ErisDiscordia

(443 posts)Glencore Plc is said to be storing oil on ships off the coast of Singapore and Malaysia as a market structure known as contango allows traders to benefit from holding on to supplies for sale later.

The commodities trader has at least 4 very large crude carriers, each of which can hold about 2 million barrels, floating at sea off the nations’ coast in Southeast Asia, people with knowledge of the matter said, asking not to be identified because the information is confidential. When a market is in contango, prices for supplies today are lower than those in future months, allowing traders with access to stored crude to potentially lock in a profit...

While the oil market has been in contango since 2014, the premium fetched by future cargoes increased to the highest since February last month. The price difference between a Brent oil contract for immediate delivery and a year forward was at about minus $7 a barrel on Thursday, twice the level in mid-July.

To benefit from the contango, profits from selling a stored cargo must exceed the cost of chartering ships to hold the supply. Euronav NV, Europe’s largest owner of supertankers, would charge about 75 cents per barrel each month for storing, its chief executive officer said on Thursday. Brent crude for April costs about 80 cents more than for March, data from ICE Futures Europe show. Traders incur additional expenses over and above freight...

more

ErisDiscordia

(443 posts)Saudi Arabia may further ease restrictions on foreign ownership in the economy and overhaul one of the world’s most restrictive visa systems as the kingdom seeks to draw investors to help reduce its reliance on oil exports.

The world’s biggest oil exporter is considering allowing foreigners to own 100 percent of a company in at least four more industries, Mohanud Helal, secretary general of the Economic Cities Authority, said in an interview in Riyadh. Retail and wholesale will be opened fully, from a 75 percent limit now, once rules are approved, Abdullatif Al-0thman, governor of the Saudi Arabian General Investment Authority, said on Monday.

The role of foreign investors in the economy has always been a controversial issue in Saudi Arabia, which follows an austere version of Sunni Islam. Yet as oil prices plummet to around $30 a barrel, authorities are racing to find alternatives to revenue from crude exports to finance a budget deficit about 15 percent of economic output.

Foreign investments in non-oil industries are also crucial to to create jobs for Saudi nationals in the private sector in a country where youth unemployment stands at about 30 percent. Almost 90 percent of private-sector jobs created in five out of the six-nation Gulf Cooperation Countries between 2000 and 2010 went to expatriates, according to the International Monetary Fund. Nationals filled over 70 percent of public-sector jobs...

more

ErisDiscordia

(443 posts)Oil prices were about 3 percent higher on Thursday after the Russian energy minister said Saudi Arabia had proposed that oil-producing countries trim output, which would be the first global deal in over a decade to help clear a glut that has depressed prices for over a year and a half.

Prices pared gains amid growing doubts over the deal to cut production by up to 5 percent after media reports said that delegates from the Organization of the Petroleum Exporting Countries had not yet heard of any plans for talks and that Saudi Arabia had not proposed cuts.

Crude had jumped as much as 8 percent after Russian Energy Minister Alexander Novak revealed the proposed reductions in output, which would amount to about 500,000 barrels a day of cuts by Russia, one of the largest producers outside OPEC...

more

ErisDiscordia

(443 posts)Deutsche Bank AG is scrapping 2015 bonuses for its 10-member management board and some other staff as it cuts performance awards across its workforce after posting its first annual loss in seven years.

“It would be inappropriate vis-a-vis society just to post 5.2 billion of legal provisions in one year and not reflect that in compensation, particularly when the share price has fallen and shareholders have suffered,” co-Chief Executive Officer John Cryan told reporters in Frankfurt on Thursday, referring to the company’s 5.2 billion euros ($5.7 billion) of litigation costs last year.

Cryan is shrinking assets and cutting costs to boost capital levels and profitability to reverse a share slump that has made Deutsche Bank the worst-valued global bank. After announcing a plan to suspend the company’s dividend to shore up its finances in October, the co-CEO has said that employees will have to shoulder some of the cost of the fines resulting from the bank’s past misconduct.

“I feel responsible for basically a 7 billion-euro loss, personally responsible for all of it,” Cryan said of the 6.79 billion euro shortfall for last year, its first since 2008. “A decision was made by the supervisory board not to award bonuses to board members for their role as board members this year.”

more

ErisDiscordia

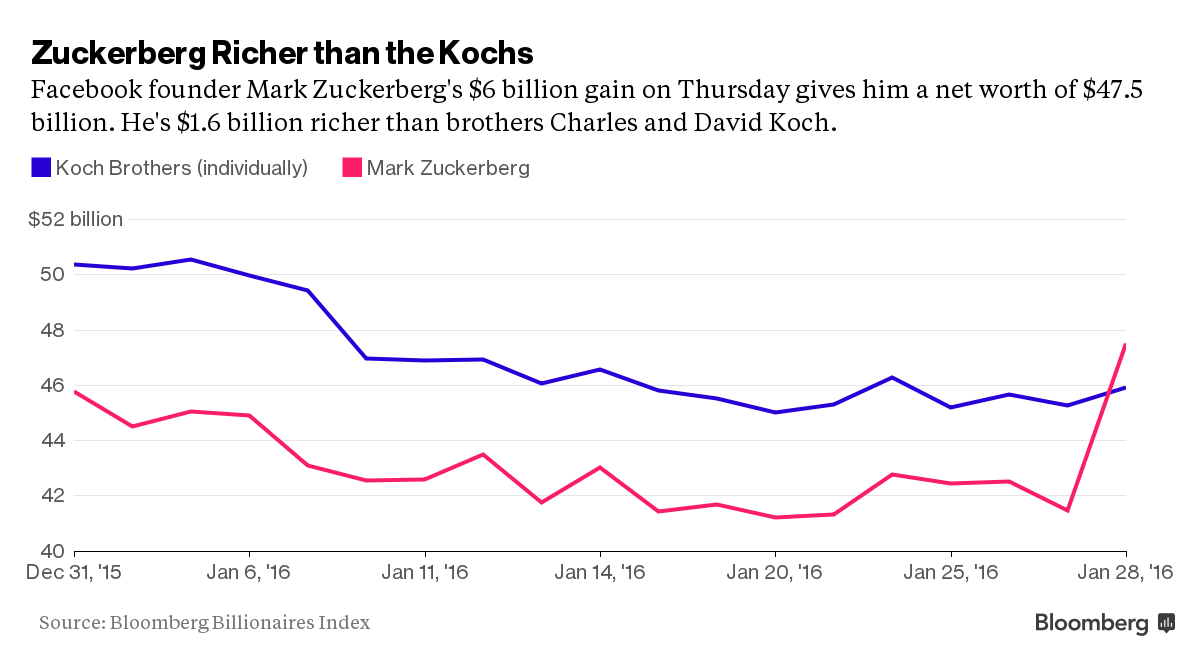

(443 posts)Mark Zuckerberg became the sixth-richest person on Earth today.

The Facebook Inc. founder saw his fortune rise $6 billion in trading Thursday after the world’s biggest social network delivered another quarter of record revenue. That gives the 31-year-old a net worth of $47.5 billion, enough to surpass the $45.9 billion holdings of brothers Charles and David Koch, according to the Bloomberg Billionaires Index.

Facebook reported on Wednesday that fourth-quarter sales were up 52 percent to $5.84 billion and net income had more than doubled to $1.56 billion from a year earlier. More than 1.59 billion users are now logging on every month, according to the company.

Thursday’s surge turned a year-to-date decline of more than $4 billion for Zuckerberg into a $1.7 billion gain for the year and pushed him above the Kochs, whose industrial holdings have been hit by lower oil prices.

more

ErisDiscordia

(443 posts)China is trapped. The more it burns through foreign reserves to defend the currency, the more it tightens domestic credit...Bad debts in the Chinese banking system are four or five times higher than officially admitted and pose a mounting risk to the country's financial stability, the world's leading expert on debt has warned.

Harvard professor Ken Rogoff said China is the last big domino to fall as the global "debt supercycle" unwinds. This is likely to expose the sheer scale of malinvestment that has built up during the country's $26 trillion credit bubble.

Prof Rogoff said the official 1.5pc rate of non-performing loans held by banks is fictitious. "People believe that as much as they believe the GDP data," he told the World Economic Forum in Davos.

The real figure is between 6pc and 8pc. He warned that unexpected problems can come "jumping out of the woodwork" once a debt denouement unfolds in earnest...

more

ErisDiscordia

(443 posts)...One of the companies will house Xerox's hardware operations and the other its services business, the Journal reported on Thursday, citing people familiar with the matter.

Icahn will be given the seats on the board of the company holding Xerox's services business, the Journal reported...

...Icahn disclosed a 7.1 percent stake in the printer and copier maker in November and called its shares "undervalued".

Xerox is expected to announce the split on Friday when it reports quarterly results, the Journal said.

ErisDiscordia

(443 posts)Data showing the economy barely grew in the fourth quarter could set the tone for markets Friday.

The risk is that GDP could be even weaker than the 0.8 percent growth expected by economists, and while the data are backward looking, the market is already fearful about the economy slowing.

"It didn't seem that weak through the fourth quarter. Yet everyone's got estimates below 1 percent. When you dig down into the number, it just looks like a lot of fluky things are dragging us down," said Stephen Stanley, chief economist at Amherst Pierpont. "I don't think it's going to be persistent. The broader issue to me is it doesn't seem the economy is as weak as the GDP numbers are going to suggest, and I think we'll see a bounce back."

Yet stocks have latched on to negatives, like the Fed's more cautious comments on the economy Wednesday, and there are expectations the market will stumble if the number contains any nasty surprises....

ErisDiscordia

(443 posts)http://www.marketwatch.com/story/would-you-go-to-these-extremes-with-your-credit-card-2016-01-27

You’ve heard about “extreme couponing,” but how about extreme credit carding?

Take Chinese billionaire art collector Liu Yiqian, who said in November he planned to put the cost of Amedeo Modigliani’s “Nu Couche” — a painting that cost $170.4 million — on his American Express AXP, -3.01% Centurion card.

Or you may have heard of Walter Cavanagh, who is known as “Mr. Plastic Fantastic” and claims to have a nearly perfect credit score, made headlines recently for his Guinness World record of owning 1,497 valid credit cards. He started the collection as a bet in the ‘60s and today says he has $1.7 million in available credit.

While these are not everyday uses of credit cards, some consumers are willing to try some unconventional measures to benefit from credit card rewards and promotions — from credit card “churning” to using one card to pay off another.

more

Roland99

(53,342 posts)If I can snag the APR I want from one of my Credit Unions (2.9% or less on a 1-2 year-old car), I might quite possibly buy one w/a credit card and then pay that off w/the proceeds of the check from the CU.

At least if the dealership is willing to go that route. Otherwise, put as much on there as possible. We've managed to snag a couple roundtrips on Southwest just by virtue of paying for groceries, gas, cell phone, water bill w/the SW card and paying it off each month.

ErisDiscordia

(443 posts)George Soros' investment track record made him the equivalent of a .400 hitter in baseball. Yet, in a decade that has been lousy for all investors, even the "Granddaddy of Hedge Fund Managers" has had it tough.

Soros quietly left the hedge-fund scene in 2011, turning his fund into a family office. But his last few years in the game were hardly like his first. Indeed, 2010 was Soros' worst year since 2002, with his flagship fund up a mere 2.63%. The following year was even worse, with his famed Quantum fund reportedly down 15%.

A quick glance at Warren Buffett's returns shows that the Oracle of Omaha has had a tough stretch as well. Over the past 15 years, Berkshire Hathaway's average annual returns have shrunk to 7.89%. Granted, that's over a span in which the S&P 500 has risen only 4.35% a year.

Nevertheless, these anemic returns are a long way from either Soros' or Buffett's glory days....

snot

(10,520 posts)DemReadingDU

(16,000 posts)or daughter?

ErisDiscordia

(443 posts)Fuddnik

(8,846 posts)Your getting as bad as me.

nitpicker

(7,153 posts)Amazon shares slide on sales miss

9 hours ago

From the section Business

Amazon missed analysts' estimates for the fourth quarter despite posting a 21.8% rise in sales and record profits.

Net sales rose to $35.75bn, which was about $200m short of Wall Street predictions. That was enough to send shares tumbling more than 13% in after-hours trading in New York.

Annual net profit of $596m also missed estimates as operating expenses jumped almost 18%.

(snip)

DemReadingDU

(16,000 posts)1/25/16 Disney IT workers allege conspiracy in layoffs, file lawsuits

Disney IT workers laid off a year ago this month are now accusing the company and the outsourcing firms it hired of engaging in a "conspiracy to displace U.S. workers." The allegations are part of two lawsuits filed in federal court in Florida on Monday.

Between 200 and 300 Disney IT workers were laid off in January 2015. Some of the workers had to train their foreign replacements -- workers on H-1B visas -- as a condition of severance.

The lawsuits represent what may be a new approach in the attack on the use of H-1B workers to replace U.S. workers. They allege violations of the Federal Racketeer Influenced and Corrupt Organizations Act (RICO), claiming that the nature of the employment of the H-1B workers was misrepresented, and that Disney and the contractors knew the ultimate intent was to replace U.S. workers with lower paid H-1B workers.

The lawsuits cite a form that H-1B employers fill out when placing a visa worker, the Labor Condition Application (LCA). In the LCA, an employer states the job location, salaries paid to the H-1B workers and also attests that U.S. workers will not be "adversely affected."

But former Disney IT workers Dena Moore and Leo Perrero, in their respective lawsuits, allege that they were indeed adversely affected. They had to train their foreign replacements brought in by contractors, and then were terminated.

Both lawsuits name Disney as a defendant; additionally, Moore is suing Cognizant and Perrero is suing HCL.

The LCA requires employers to swear the visa workers "will not adversely affect working conditions" of existing employees, said Sara Blackwell, the Florida attorney who is bringing the case. "Obviously, if you have to train your replacement and then are fired, that is an adverse effect."

Since his layoff, Perrero has been working to raise awareness among lawmakers about the displacement of U.S. workers by foreign temporary labor. "No shortage exists of American STEM (science, technology, engineering, math) workers," said Perrero. "Disney is not the only one to do this and lawmakers need to take action."

Blackwell is representing, as well, some 30 former Disney IT workers who have filed complaints with the U.S. Equal Employment Opportunity Commission (EEOC) over the loss of their jobs. These employees are arguing that they are victims of national origin discrimination. Blackwell said her goal is to "stop the systemic abuse of the immigration system."

more...

http://www.computerworld.com/article/3026332/it-outsourcing/disney-it-workers-allege-conspiracy-in-layoffs-file-lawsuits.html

Roland99

(53,342 posts)Roland99

(53,342 posts)...

There appear to be a number of reasons for the move. The most pressing is the fact that the Bank of Japan continues to struggle to achieve its goal of pushing inflation back up to 2%—considered a healthy level for most economies. The central bank on Friday further pushed out its timetable for achieving that goal to the first half of 2017.

...

Central banks use their deposit to influence how banks handle their reserves. In the case of negative rates, central banks want to dissuade lenders from parking cash with them. The hope is that they will use that money to lend to individuals and businesses, which in turn will spend the money and boost the economy and contribute to inflation.

It is also aiming to force investors to shift money out of bank accounts and into higher-yielding assets.

ErisDiscordia

(443 posts)but you knew that

Roland99

(53,342 posts)Nasdaq 4,557 +51 1.14%

S&P 500 1,915 +21 1.09%

GlobalDow 2,159 +22 1.04%

Oil 34.30 +1.07 3.22%

[font color="red"]Gold 1,112 -4 0.37%[/font]

meanwhile, US 10-year:

U.S. 10yr 1.95 -0.03 1.35% off its daily high (lower rates = higher prices) of 1.913

Been a bit of a disconnected between 10-yr and MBS and the stock indices the last couple of days.

Roland99

(53,342 posts)But now something different is happening. Bonds are holding their ground even as stocks are holding theirs. Not only that, but oil is downright pointing back toward higher ground. Still, bonds aren't having it:

First of all, you might notice that 10yr yields are at 1.947 in this chart--markedly lower than Thursday's close. That's because it was snapped AFTER the most recent salvo was fired in the ever-present global currency war. This time around it was the Bank of Japan with a surprise announcement that it was taking the European plunge and introducing a negative policy rate. Yen/USD did about a month's worth of weakening in a few minutes and Treasury yields moved 3bps lower in fairly short order.

We'll get into more of the nitty gritty details on MBS Live, but in the bigger picture, this is yet another reminder of the wild cards that seem all too prevalent in our deck heading into this year. The Fed is TIGHTENING policy while other central banks are still easing. The dollar is skyrocketing, making for a decent enough consumption outlook, but severely threatening productivity, corporate profits among multinational firms, and commodities prices. All of the above is transpiring at a time when the long term economic cycle in the US is teetering on the edge of entering hospice. Oh, and don't forget to add a preponderance of forecasts calling for higher rates in 2016 (too many traders on one side of the trade is most beneficial for the other side of the trade, eventually).

Roland99

(53,342 posts)Nasdaq 4,614 +107 2.38%

S&P 500 1,940 +47 2.46%

GlobalDow 2,179 +42 1.98%

Gold 1,118 +2 0.17%

Oil 33.59 +0.38

and look at that 10-year disconnect:

U.S. 10yr 1.93 -0.06 2.86%