Economy

Related: About this forumI am so confused, I get the market and the economy are different

but why has the market not nose dived yet? I don't want it to, I am invested in it to a large extent. I have set my mind that I can expect a huge drop and have to do the mantra that you don't loose till you cash out. But again, if the market is so smart why has it not reacted? If the consumer has no money, they don't purchase, if they don't purchase than business can't prosper? Again I get they are different, but are they not co-dependent? I learned that the economy fuels the market, and I see no fuel in the pipe line.

cilla4progress

(24,701 posts)is that it is being propped up by Russian oligarchs to aid in drumpf's re-election.

Plausible?

Hoyt

(54,770 posts)OneBro

(1,159 posts)While no one was looking, $6 Trillion went from the US to them as the Federal Reserve quietly and repeatedly bailed out investors who kept coming back for more once they saw that it was a never-ending gobstopper.

https://wallstreetonparade.com/2020/01/federal-reserve-admits-it-pumped-more-than-6-trillion-to-wall-street-in-recent-six-week-period/

Abnredleg

(669 posts)S&P is weighted towards large tech companies and Amazon, who aren’t hurt as much by the pandemic shut down. Companies with a large online presence can hold their own in such a situation. The service industry has been hammered, with millions of workers laid off, but most of the businesses are not publicly owned (large franchises excepted) and thus their losses are not reflected in the market.

As you point out, “The market is not the economy”

PoindexterOglethorpe

(25,808 posts)Also, the companies that simply declare bankruptcy but stay in business will come out of this quite nicely. They'll be able to shed debt and keep on doing whatever it is they always did. So when you read that Company X is declaring bankruptcy, it may not mean that it's shutting down.

Here's something else to keep in mind: Two years out of every three the market goes up. And most gains and losses occur in a very short time span, which is why timing the market is a fool's game. In fact, I have in front of me a chart from an annuity company that says in the past 94 years, 69 of them had a positive return in the market, and 25 of them had a negative return. The Great Depression did start with four years in a row of negative returns. Then in 1933 the market went up 54%.

I wish I could find this chart on line so I could share it, because it really is quite fascinating.

The most essential thing is to understand that the economy and the market are two very, very different things. And that in the long run staying invested is a very good idea. It may be that taking some profits out now would make sense for an individual. But selling everything, as some have advocated, because the market is going to crash, crash, CRASH any day now, shows a lack of understanding about how the market works.

RazzleCat

(732 posts)is invested in stocks that have always paid in dividends, including downturns, recessions, and depressions. But still waiting on that drop.

PoindexterOglethorpe

(25,808 posts)iemitsu

(3,888 posts)They have not been hurt by anything and in many cases have been handed our tax money to make their lives even easier.

Midnight Writer

(21,672 posts)iemitsu

(3,888 posts)PoindexterOglethorpe

(25,808 posts)the market, buying and selling, hoping to time things correctly, then yeah. That way is a rich person's game. But if you're in it for the long haul, as people should be, staying in and not panicking at every downturn, then over time you make money. Sometimes a lot of money.

It's better to invest in a diversified group of funds. You can either do a lot of research yourself, or find a good investment advisor. I have the remarkable good fortune to have the latter, and even in the sharp downturn earlier this year, my portfolio went down, but considerably less than the market as a whole.

One strategy that some people swear by is to purchase stocks with a strong history of good dividends. You can either re-invest those dividends, or use them as income. The only caution here is that if every bit of your money is in such stocks, and you need every penny of those dividends to live on, you're in deep trouble if the dividends are cut. Hopefully you can avoid that precarious situation.

![]()

Laelth

(32,017 posts)They have to put it somewhere. The markets look like the best bet to them right now, even if the fundamentals are weak. What else are they going to do with their cash? They can’t eat it, so they invest it. The people may be poor, but our capitalists are not. They have nothing better to do with their cash than to buy stocks.

-Laelth

progree

(10,883 posts)Last edited Tue Aug 11, 2020, 07:59 AM - Edit history (4)

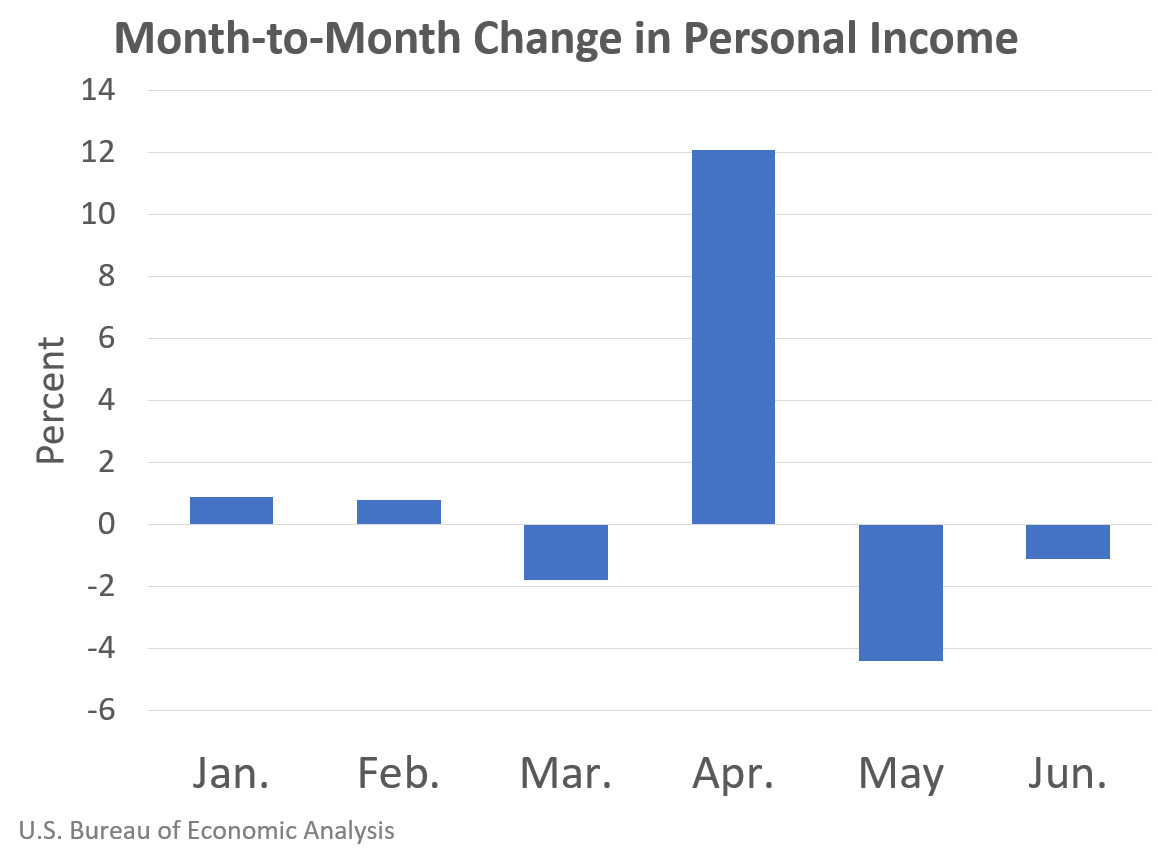

Personal Income increased by 7.3% in Q2, while personal income without government support decreased by 6.1% (graph), 8/6/20

https://finance.yahoo.com/news/stimulus-checks-coronavirus-personal-finance-expert-advice-201536967.html

The Bureau of Economic Analysis produces the Personal Income figures

https://www.bea.gov/data/income-saving/personal-income

Table 2: Personal Income, Q2 2019: 18,480.9 B$, Q2 2020: 20,340.4 B$ -- +1,859.5 B$ (+10.06%)

Graph from Yahoo Finance link (note the sharp increase of 2020 Q2 over 2020 Q1 compared to the previous quarter to quarter increases):

Overall, Q2 2020 was higher by 1,859.5 B$ (10.1%) than Q2 2019 per Table 2 at the bea.gov link above. Hmm, 10.1% is much more than inflation + population growth, so that's a very substantial real per-capita increase.

Graph of the month by month changes from the BEA link above:

That said, the big Q2 jump came in April, followed by month-over-month declines in May and June.

And then there's July and we're a third of the way into August -- Caligula's executive orders and memos look like shams. The $300 from the feds if matched by $100 from the states, else who knows. And the fed money is taken from FEMA, like that money isn't needed, uh huh. And then that's enough to cover what, 5 weeks IIRC? And more people are going to be exhausting their regular state unemployment benefit time limits.

We won't know the July numbers until August 28.

doc03

(35,282 posts)pay next to nothing on interest. There is also a rally

in gold, silver and other precious metals.

progree

(10,883 posts)where it was in 1966.

It took it 25 years to get back to where it was in 1929.

The Nikkei is still down about 40% from where it was at the end of 1989, 30 1/2 years ago, but some day, some day, it will be back to where it was.

(Some people say that, well, Japan is different, it's far away, they are different and all that. Well, consider that, at least post-WWII, they've never elected an evil madman and self-proclaimed debt king)

I have a longer version of this at https://www.democraticunderground.com/11212311

it's just a matter of living long enough and not needing to withdraw your money in the meantime. : sarcasm :

I've long posted here many many times about the superior record of equities (including recently in this subthread about the supposed "safety" of gold ), and for buy-and-hold, buy-and-hold.

But I've always kept in mind that it's not a sure bet either (i.e. that recovery times after a crash will be only a few years).

PoindexterOglethorpe

(25,808 posts)It's also hugely important to remember that the 30 stocks in the Dow are not the entire market.

progree

(10,883 posts)Last edited Tue Aug 11, 2020, 12:44 AM - Edit history (1)

funds (and/or ETFs), only a portion of which might be a total U.S. stock market index fund and/or an S&P 500 index fund (which is close to a total U.S. stock market fund in composition and performance).

So some are going to do better, and some worse.

The conventional wisdom was that the Dow 30, being select "blue chip" stocks, was a less volatile and safer piece of the overall market. Turns out that at least as far as avoiding long recovery times, it wasn't such a safe group of stocks.

Nowadays some think that MOAT stocks and/or value stocks are a safer group of stocks than the overall market. And afficionados of the various segments of the market all have their euphoric narratives.

There are no guarantees of a short recovery time for every equity investment, even highly diversified ones. Especially beginning with runaway P/E ratios.

Q1 S&P 500 Earnings per share:

2017 Q1: 27.46,

2018 Q1: 33.02,

2019 Q1: 35.02,

2020 Q1: 11.88 👀 😲

https://ycharts.com/indicators/sp_500_eps

We don't have the full Q2 earnings yet. But likely to be a lot worse, given that Q1 GDP declined by 5%, and Q2 GDP declined by 32.9% (both on an annualized rate basis. The actual GDP drops were Q1: 1.3%, Q2: 9.5%). So it would be pretty much impossible for Q2 earnings to be anything but a lot worse than Q1 earnings.

It will be interesting to see an excuse for the Japanese stock market.

PoindexterOglethorpe

(25,808 posts)It's very important to understand that the market, especially the Dow, which is all of 30 stocks, is at best peripherally connected to the economy at large. The reason the Dow has not reacted is that it has almost nothing to do with the economy.

Various companies are declaring bankruptcy. That does not mean they are shutting down completely. It means that they are going to be able to restructure their debt, cast off certain financial obligations, and move forward. Trust me, I know about this. I worked for ten years for an airline that went through at least two bankruptcies, and was able to divest itself from its pension obligations. Which means that my pension is less than one third of what it should be. For me, personally, it's not a big deal as I'd never thought I'd get much money from the pension. But for the co-workers who stayed there 30 years or more, who counted on that pension as a significant part of their retirement income, whoops! All of a sudden the largest part of their retirement income became the smallest part. The enraging thing is that they had done everything they were supposed to. And now it was kicked out from under them.

People who piss and moan about the 401k are clueless. At least the 401k isn't subject to things like the company going bankrupt. You actually have control over your investments, and it's crucial you pay attention and maintain that control.

progree

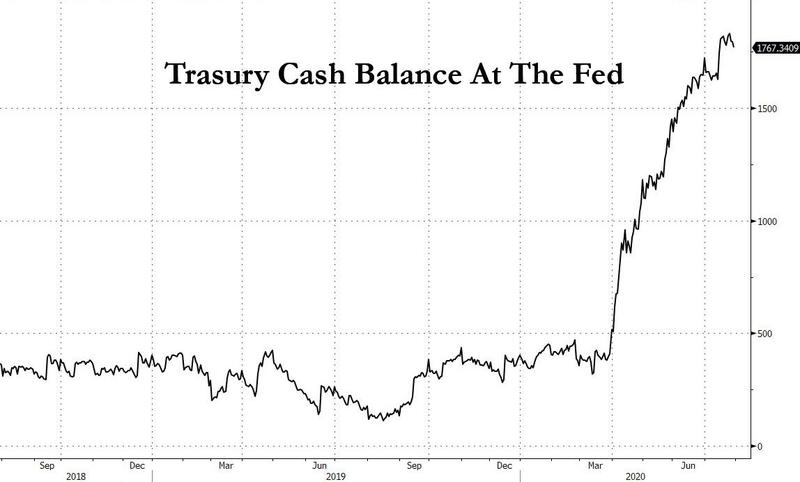

(10,883 posts)But the Fed cut interest rates to zero and began virtually unlimited money creation and lending to corporations. Meanwhile deficit-tripling spending began. Enough to substantially boost personal income in Q2 2020 by 10.1% compared to Q2 2019 - far in excess of inflation and population growth. A very substantial real increase.

Details of the graph's and numbers' sources are in post#9

I borrowed this from at140 ![]() (Trasury?)

(Trasury?)

Result: market back up.

Despite a nose-dive in earnings:

Q1 S&P 500 Earnings per share:

2017 Q1: 27.46,

2018 Q1: 33.02,

2019 Q1: 35.02,

2020 Q1: 11.88 👀 😲

https://ycharts.com/indicators/sp_500_eps

We don't have the full Q2 earnings yet. But likely to be a lot worse, given that Q1 GDP declined by 5%, and Q2 GDP declined by 32.9% (both on an annualized rate basis. The actual GDP drops were Q1: 1.3%, Q2: 9.5%). So it would be pretty much impossible for Q2 earnings to be anything but a lot worse than Q1 earnings.

Ahh, if it were only sustainable. Ahh, if only chapter 3, where all the unsustainable stimulus is eventually and inevitably dialed back, proceeded as nicely as chapter 2 (the great-stimulus phase). Ahh, if only P/E ratios really didn't matter anymore.