Economy

Related: About this forumStock market futures sky high again today!

S&P Futures

3,372.00

+19.25(+0.57%)

Dow Futures

27,993.00

+314.00(+1.13%)

Nasdaq Futures

11,058.00

-14.00(-0.13%)

Russell 2000 Futures

1,603.50

+19.60(+1.24%)

Price earnings ratio based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio),

is now at 31.08.

Just before 1929 crash the highest it reached was 30.0 I expect a catastrophic market crash coming up, no idea when.

jimfields33

(15,751 posts)Ugh. Trump is setting up Biden for the biggest mess in history. This will make W’s mess for President Obama look like “swatting a fly”.

2naSalit

(86,498 posts)Converting it to stock market gains. It's our $$ floated to prop up the market to keep -45 from having a hissy fit and put our money in the enablers' pockets.

at140

(6,110 posts)

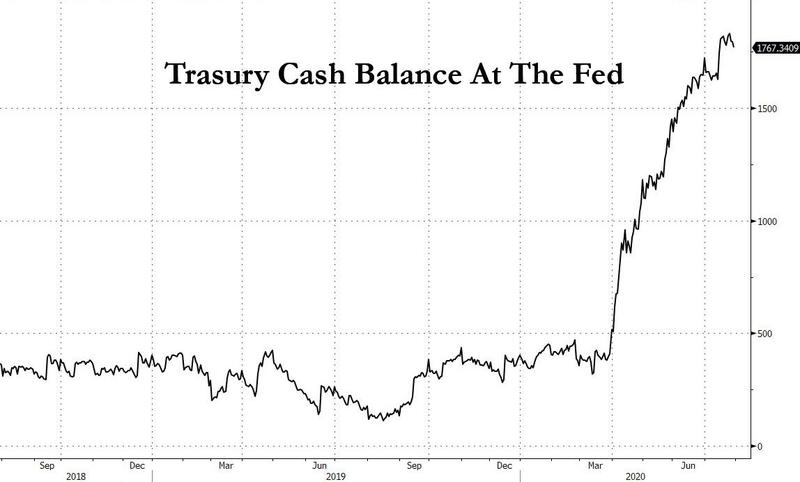

It is not tax payer dollars, because economy is worse than March 2020. It is the printing press operated by FED.

progree

(10,901 posts)far in excess of inflation and population growth. A very substantial real increase.

Details of the graph's and numbers' sources are in post#9 in another Econ Group thread

Result: market back up.

Despite a nose-dive in earnings:

Q1 S&P 500 Earnings per share:

2017 Q1: 27.46,

2018 Q1: 33.02,

2019 Q1: 35.02,

2020 Q1: 11.88 👀 😲

https://ycharts.com/indicators/sp_500_eps

We don't have the full Q2 earnings yet. But likely to be a lot worse, given that Q1 GDP declined by 5%, and Q2 GDP declined by 32.9% (both on an annualized rate basis. The actual GDP drops were Q1: 1.3%, Q2: 9.5%). So it would be pretty much impossible for Q2 earnings to be anything but a lot worse than Q1 earnings.

at140

(6,110 posts)according to your chart. I got stimulus check which I did not need.

Laid off workers received $600/Week additional besides state benefits. Many got more money than their wages.

So of course personal income was inflated. What happens when gov't reduces printing money?

progree

(10,901 posts)from February 19 to March 23 might provide a hint ... ![]()

Claustrum

(4,845 posts)And his only "economy" message is gone. Republicans can't let that happen.

at140

(6,110 posts)Can't lose all those 401-k people.

BillyBobBrilliant

(805 posts)How well the large corporations are capitalizing on our collective misery.

at140

(6,110 posts)Price of stocks / earnings is now higher than at top before 1929 monstrous crash.

progree

(10,901 posts)Hasn't the CAPE been above 1929 levels for a few years now? Anyway, since it's an average of 10 years (40 quarters), it is pretty insensitive to change, such as the one disastrous quarter so far (Q1).

What worries me is earnings now: Q1 2020, which are down 66% from Q1 2019, with Q2 looking like it's going to be way worse (given that the GDP decline in Q2 was much more severe than in Q1), post#6 bottom

at140

(6,110 posts)It was higher only during internet bubble and huge tax cuts to corporations by Trump.

progree

(10,901 posts)least. Won't use that search phrase again (I searched for "CAPE ratio graph" or something like that, DUH) . Thanks for the link ![]() . You're right (ooops I should say "correct" not "right"

. You're right (ooops I should say "correct" not "right" ![]() )

)

Here's monthly plain old P/E that goes from early 1928 to June 2020

https://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

Selecting the 5 year graph:

I'm surprised at the January 2020 peak (wouldn't the P/E be a heck of a lot higher than that in June with earnings so far down, and S&P 500 in June just a little below January's levels?)

In January, the S&P 500 ranged between 3225-3329

In June the S&P 500 ranged between 3002-3232

(based on the daily closing prices)

https://finance.yahoo.com/quote/%5EGSPC/history?p=%5EGSPC

Must be the same "E" in January as in June in this graph?

progree

(10,901 posts)https://finance.yahoo.com/news/stock-market-news-live-august-11-2020-222729869.html

Stocks mostly rose Tuesday, with the S&P 500 closing in on a record level as hopes for a vaccine and further stimulus spurred a global risk rally and a pop in “reopening” stocks. The Nasdaq underperformed again as shares of Big Tech names Facebook (FB), Amazon (AMZN) and Netflix (NFLX) extended Monday’s losses and gave back some of their sharp year-to-date gains.

Russia’s President Vladimir Putin said Tuesday that Russia became the first country globally to give regulatory approval to a Covid-19 vaccine, ...

... "some names in the Nasdaq – in particular, cloud and some other areas like stay-at-home stocks, are pretty egregiously expensive. Some of these names are a 1000x earnings, 50x cash flow.”

[blah blah Trump's stimulus orders blah blah]

During remarks late Monday, Trump added that he was considering a capital gains tax cut.

10:06 AM ET: Dow up 298 (+1.07%), S&P 500 up 6 (+0.17%), Nasdaq down 85 (-0.76%)

at140

(6,110 posts)Could be right after election. Trade safe everybody!