Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Economy

Related: About this forumLeft-wing austerity during international crises--it's the financial markets, stupid!

Surprisingly, left governments adopted more conservative fiscal policies than right governments in recent economic crises. These appear to have dire electoral consequences.https://socialeurope.eu/left-wing-austerity-during-international-crises-its-the-financial-markets-stupid

Left and right governments used to pursue distinct macroeconomic policies, with left governments associated with fiscal profligacy (and redistributive policies). Over the past few decades, however, left and right have converged, with no notable differences in their fiscal policies. Even in times of crisis, when we might expect divergence, left and right fiscal policies appear indistinguishable. For instance, in reaction to the global financial crisis of 2007-08, both left and right governments endorsed austerity policies. While the news is already bad for the core constituencies of left parties, the reality is even worse. My recent study scrutinises this convergence. It focuses on the role of government partisanship in fiscal-policy responses to international economic crises in advanced democracies. I find that, over the course of the business cycle in the two last crises, left governments pursued more restrictive fiscal policies than their right-wing counterparts. This amounts to no less than a reversal of traditional partisan effects.

Financial-market constraints

The switch in partisan effects is caused by constraints imposed by financial markets. My analysis shows that market actors were concerned about deficits in 1990-94 and about deficits and spending in 2008-13. Specifically, statistical analysis suggests that (indebted) left governments were less likely to engage in fiscal stimulus than right governments during the protracted early-1990s recession. During the subsequent crisis, bond-market investors compelled indebted left governments, by comparison with their right-wing counterparts, to stimulate less forcefully by way of spending increases in 2008-09 and consolidate more forcefully by way of cuts during 2011-12. Meanwhile, investors more strongly constrained left governments to consolidate by reining in spending than did right governments in the (fragile) recovery of 2010.

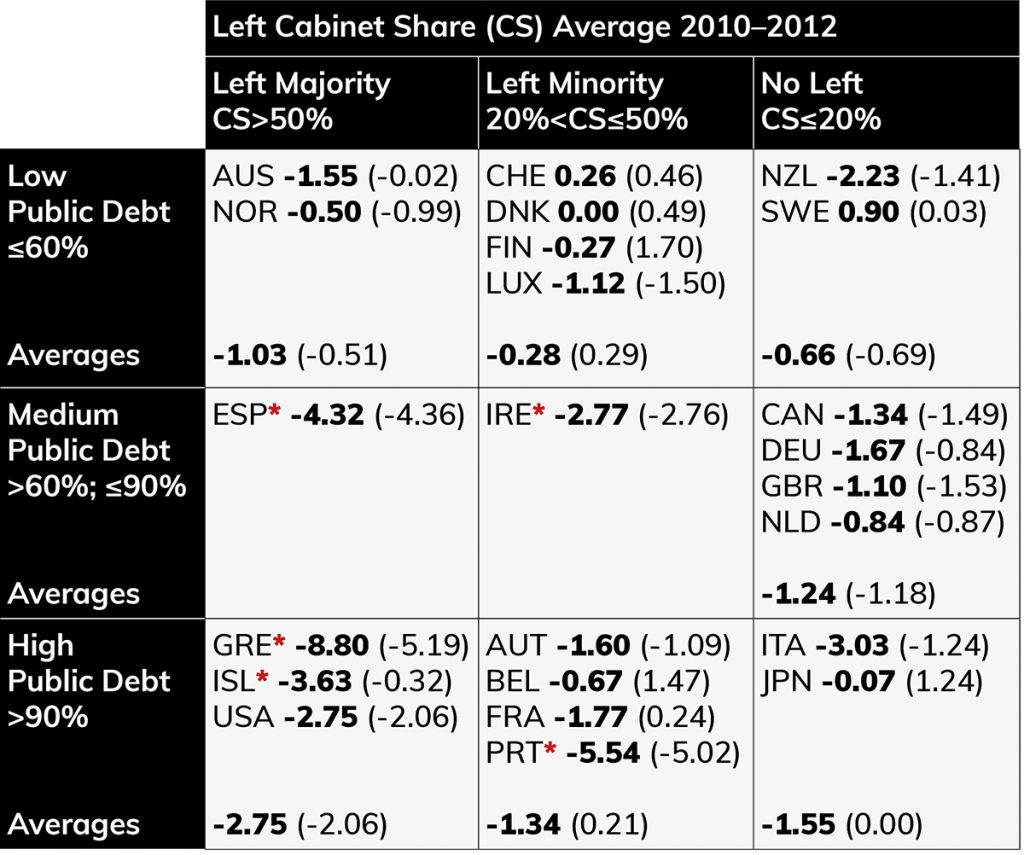

Fiscal policy outputs under different constellations of partisanship and debt in 2011-12

Size of fiscal stimulus (as % GDP) in bold; positive numbers indicate movement towards deficits. Size of spending increases (as % GDP) in parenthesis. US Democrats coded as left parties. Public debt measured in 2010. Averages (per quadrant) exclude Greece, Iceland, Ireland, Portugal and Spain under IMF/EU bailout (*).

Government reactions in the early 1990s and late 2000s / early 2010s set them apart from responses to earlier crises. If anything, fiscal-policy responses in the early 1980s were reminiscent of traditional partisan patterns. Left governments stimulated more during downturns, although the models are statistically insignificant. They also consolidated less during the early recovery of 1984, irrespective of a country’s exposure to financial markets. Low levels of indebtedness and limited capital-market openness in the early 1980s explain the absence of reversed partisan effects. Financial-market constraints are stronger for left than right governments at high debt level. This is because left governments have lower credibility as sovereign debtors. Bond-market actors are concerned about debt financing, defaults or incentives to inflate away public debt. In the view of market participants, these are the trademark of left governments. To maintain access to borrowing at similar rates to right governments during debt crises, left governments are compelled to impose more austerity. It’s the price left-wing governments must pay for the ‘credibility gap’.

Fiscal policy central

Fiscal policy is not only crucial for economic stability; it also reflects a government’s objectives, as enshrined in the national budget. With the advent of democratic capitalism, the economic dimension has been the main axis along which the political space is structured. It has defined distinguished party positions, with left parties more in favour of state intervention. The core constituencies of left parties are more supportive of government redistribution. Conversely, individuals believe that left parties champion such policies more than right parties. The legitimacy of the party system and the democratic order itself still hinge on traditional partisan effects. The ideological mix with political partisanship during hard times is certainly confusing to ordinary citizens.

Voting with their feet......

snip

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

0 replies, 801 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (1)

ReplyReply to this post