Environment & Energy

Related: About this forumIEA says U.S. gas prices of US$5 could spur return to coal

Only regulatory intervention to bar a switch back to coal could prevent greater coal use if gas prices rise to $5 per mmBtu, Birol said.

“If it is left only to economics, around $5 we may see a (coal) comeback, which would definitely be a development which would catch many people by surprise,” Birol said.

U.S. natural gas futures were trading at about $4.20 per mmBtu on Monday.

http://business.financialpost.com/2013/05/27/iea-says-u-s-gas-prices-of-us5-could-spur-return-to-coal/?__lsa=ca39-308c

Buzz Clik

(38,437 posts)FBaggins

(26,721 posts)Perhaps in some marginal way... but I'd say it needs to be higher than that.

The surge of demand toward gas started when gas prices were above $6 and coal prices were generally lower (with a spike well above that).

Moreover, there's a good reason to doubt that it will rise much above that for very long (if at all). People think that the gas producers have been going all out in the last couple years, but one of the reasons that gas prices have risen so quickly (doubled over the last year) is that they've shifted much of their efforts over to shale liquids from the "drier" gases. With prices rising, they'll shift some production back to natural gas - and we've seen how rapidly they can ramp up production there.

happyslug

(14,779 posts)Unlike "conventional" wells, these wells are known for a short production life span. Most gas will be produced in the First 36 months of production, then a rapid decline.

One site says Eight years:

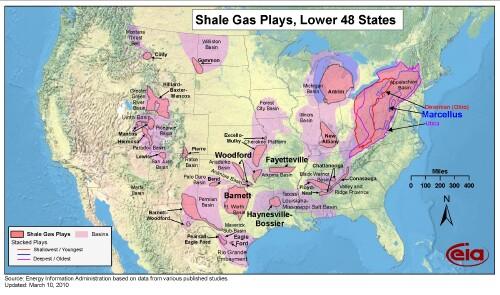

http://www.marcellus-shale.us/Marcellus-production.htm

While the wells may last eight years, 80% of the gas is pumped in the first year:

http://seekingalpha.com/instablog/121744-mark-anthony/723041-implication-of-shale-gas-boom-and-bust-examined

Most fields are almost all gone within 3 years (through they may produce a small amount of gas for 20 years afterward):

http://www.investingdaily.com/16360/the-coming-natural-gas-explosion/

Report calling the Gas boom and bubble:

http://www.desmogblog.com/2013/05/08/interview-energy-investor-bill-powers-discusses-looming-shale-gas-bubble

http://peakoil.com/enviroment/the-fracked-up-usa-shale-gas-bubble

Shale Oil in the US:

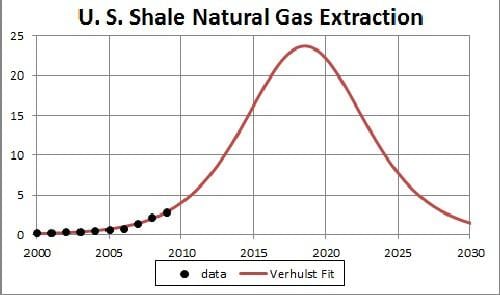

Chart showing what is expected in Gas Production, rapid increase, quick peaking (c2017) then rapid decline: