Environment & Energy

Related: About this forumHigh as a Kite on Carbon Dioxide: Fracking Delirium in the American 1%

http://www.juancole.com/2014/04/fracking-delirium-american.htmlHigh as a Kite on Carbon Dioxide: Fracking Delirium in the American 1%

By Juan Cole | Apr. 2, 2014

(By Michael Klare)

Of all the preposterous, irresponsible headlines that have appeared on the front page of the New York Times in recent years, few have exceeded the inanity of this one from early March: “U.S. Hopes Boom in Natural Gas Can Curb Putin.” The article by normally reliable reporters Coral Davenport and Steven Erlanger suggested that, by sending our surplus natural gas to Europe and Ukraine in the form of liquefied natural gas (LNG), the United States could help reduce the region’s heavy reliance on Russian gas and thereby stiffen its resistance to Vladimir Putin’s aggressive behavior.

Forget that the United States currently lacks a capacity to export LNG to Europe, and will not be able to do so on a significant scale until the 2020s. Forget that Ukraine lacks any LNG receiving facilities and is unlikely to acquire any, as its only coastline is on the Black Sea, in areas dominated by Russian speakers with loyalties to Moscow. Forget as well that any future U.S. exports will be funneled into the international marketplace, and so will favor sales to Asia where gas prices are 50% higher than in Europe. Just focus on the article’s central reportorial flaw: it fails to identify a single reason why future American LNG exports (which could wind up anywhere) would have any influence whatsoever on the Russian president’s behavior.

The only way to understand the strangeness of this is to assume that the editors of the Times, like senior politicians in both parties, have become so intoxicated by the idea of an American surge in oil and gas production that they have lost their senses.

As domestic output of oil and gas has increased in recent years — largely through the use of fracking to exploit hitherto impenetrable shale deposits — many policymakers have concluded that the United States is better positioned to throw its weight around in the world. “Increasing U.S. energy supplies,” said then-presidential security adviser Tom Donilon in April 2013, “affords us a stronger hand in pursuing and implementing our international security goals.” Leaders in Congress on both sides of the aisle have voiced similar views.

Champion Jack

(5,378 posts)Just collateral damage.

Do they need to go to court to get an injunction of some type ? What will it take to keep the gas fumes on the well pad ? What do you suggest ? Who is the responsible agency ?

Does anyone know IF ANYONE HAS AUTHORITY OVER THIS SITUATION ?

These people need help. They should not be forced to live away from their homes because of gas activity. This is SIX days now. The state is allowing this activity to occur and to continue. Does our state bear any responsibility for these citizens who, thru no fault of their own are put in harm’s way by the actions of nearby industrial, unregulated activity?

Are their lives and health to be sacrificed so that some gas company can profit from more natural gas. Who permitted this well to be put here to start with ? Who has been responsible for inspecting and enforcement here, if anyone ?

http://www.frackcheckwv.net

hunter

(38,304 posts)The money spent won't be paid back.

There will be hell to pay when the bubble breaks and natural gas prices spike.

People in at the beginning will make a lot of money. But that's all that matters in the U.S.A., right? That the wealthy get wealthier and fuck all the rest.

happyslug

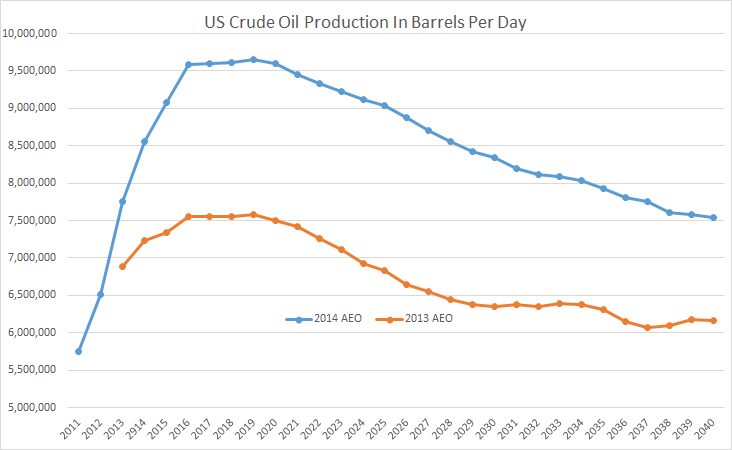

(14,779 posts)The people making the predictions are being attack as over simplifying oil production, but that is the only way they predictions can be attacked for they agree production will increase over the next two to four years, but at about that time period is when production from new wells will fail to match the drop in production of older wells.

http://peakoilbarrel.com/will-us-light-tight-oil-save-world/

Remember for Shale Oil to be profitable, the price of oil MUST exceed $80 a barrel:

http://www.resilience.org/stories/2013-10-30/the-peak-oil-crisis-the-shale-oil-bubble

There is 42 gallon in a Barrel of oil, thus $1.94 a gallon is the lowest the price of Gasoline can get, and that is NOT including the cost of refining or shipping the oil (nor taxes on Gasoline). While the Federal tax on Gasoline is 18.4 Cents a gallon, the average tax (including the Federal Tax) is 49.5 Cents a gallon.

http://en.wikipedia.org/wiki/Fuel_taxes_in_the_United_States

Today, the "average" Crude Gasoline costs about $2.55 a gallon, and sells for $3.90 a gallon", That is a difference, of $1.35 a gallon, of which only 49.5 Cents represents taxes:

http://energyalmanac.ca.gov/gasoline/margins/

Thus refining and distribution costs runs around 85 cents a gallon (the closer you are to the coast the cheaper the price of gasoline, the exception is the areas around Dakotas, for that is in many way a "Captive" market, limits as to how much oil they can ship out, which in turns leads to lower prices in that area of the Country.

If you add $1.94, the bottom price to Shale Oil to $1.35, the prices comes to $3.29 is the lowest the price of Gasoline can go. Now, the price can go lower in some areas, where the distributions costs are low and where taxes are low, but as a whole you are looking at $3.29 a gallon as the BOTTOM price gasoline can go. Remember if gasoline price drops below $3.29, all of the tight oil formation (the more correct name for Shale Oil) can NOT produce gasoline at a profit. Such wells will either have to shut down (most can not, debts has to be paid, thus if you can not maximize profit, you minimize loss) OR be pumped, but no replacement wells will be pump to replace the oil being pumped for no one will want to invest in a well they will lose money on.

Thus, it is possible for gasoline to drop below $3,00 a gallon, but then only for a three to six month period, as the old wells dry up and no new wells are drilled to replace those old wells.

Furthermore, New Jersey will have cheaper gasoline then Pennsylvania for New Jersey Gasoline taxes are 18 cents cheaper then the "Average", while Pennsylvania is right on that "Average" AND as you get away from the coast, the cost of distribution increases, thus Pennsylvania will have higher gasoline prices not only do to higher gasoline taxes, but also higher cost of getting the fuel to Pennsylvania (Worse, Western Pennsylvania will have a different fuel price, for oil for Western Pennsylvania comes up the Mississippi and Ohio river by barge, for that is more cost efficient then hauling oil over the Appalachians Mountains).

Fracked Oil Wells have a 40% Annual Depletion Rate:

http://www.theoildrum.com/node/9506

http://fuelfix.com/blog/2013/12/16/eia-expect-141-oil-by-2040/?cmpid=eefl

Please note the above site says oil will reach $141 a barrel by 2040 at the latest ($3.36 a gallon of crude oil, $4.71 including all refining, distribution costs AND taxes on Gasoline).

Thus the numbers are frightening, but it is for the "distant" future of 2017-2020 not the present of 2014, thus the attackers are correct, no problem in the "near" future, but then they define near as this year.

Champion Jack

(5,378 posts)Laelth

(32,017 posts)-Laelth

Nihil

(13,508 posts)... down to the last redneck moron in Bumfuck, TX (who believes it).