Science

Related: About this forumGambling on Innovation

The paper to which I'll point, because it's, um, "different" is this one: Gambling on Innovation (Darrell Velegol Industrial & Engineering Chemistry Research 2021 60 (20), 7689-7699)

I love Hillary Clinton. I think she would have been an outstanding President of the United States, and the majority of Americans agreed with me that she should have had to opportunity to have served her country in this capacity. Of course I enthusiastically voted for her to become President and was astounded when she did not accede to the office that the clear majority of Americans chose her to assume. A residual clause in the US Constitution connected to human slavery, the Electoral College, prevented this, of course. It is entirely possible that this clause will have led to the complete destruction of that more than two century old system of government. Instead an racist corrupt ignoramus was seated in the office, doing great damage to our country, as this awful excuse for a human being is an "anti-Midas," inasmuch as everything he touches turns to shit. The race related clauses of the Constitution may yet succeed at killing it.

Nevertheless, no matter how much I liked her, even as early as 2008, during her first Presidential primary run against Barack Obama, I was very annoyed even back then when she made a statement, if I recall correctly that the solution to climate change was to "fund more research into 'renewable energy.'"

In the week beginning June 1, 2008, the concentration of the dangerous fossil fuel waste carbon dioxide in the planetary atmosphere, as measured at the Mauna Loa Observatory was 388.59 ppm.

Of course we have bet the planetary atmosphere on "more research into renewable energy." You cannot open very many scientific journals concerned with energy and the environment, particularly with respect to climate change, without coming across scores of articles detailing funded research into so called "renewable energy."

Here from the Mauna Loa Observatory is the data for the last 5 days for concentrations of the dangerous fossil fuel waste carbon dioxide in the planetary atmosphere:

June 01: 417.04 ppm

May 31: 419.90 ppm

May 30: 419.97 ppm

May 29: Unavailable

May 28: 420.65 ppm

Last Updated: June 2, 2021

Recent Daily Average Mauna Loa CO2 (Accessed 6/2/21 9:11 pm EDT)

The average of these numbers works out to 419.39 ppm, which is almost 31 ppm higher than it was around the time, June of 2008, I somewhat recall Ms. Rodham Clinton suggested we could save the world with "more research" into so called "renewable energy."

We didn't save the world, not that this has stopped "more research" into so called "renewable energy."

...well funded ]research...

...massively funded research.

For most of my adult life, the advocates of so called "renewable energy" have expressed little or no concern for eliminating dangerous fossil fuels, although dunderheads sometimes comment weakly and insipidly that this statement represents a (gasp) "straw man." They are against fossil fuels, they claim, although they express nowhere near as much angst here or elsewhere in connection with the seven million air pollution deaths that take each year as they do when, say, a tunnel collapses at a nuclear weapons plant.

We have bet the planetary atmosphere on the proposition that nuclear energy is "too dangerous," even though the worst possible case - which can be engineered away just as we engineer away the causes of aircraft crashes which have killed way more people than nuclear energy has - was established when an RBMK type nuclear reactor exploded in what is now Ukraine in 1986. It burned for weeks, and much of the inventory of its volatile fission products was released into the atmosphere, with results nowhere near as dire as the roughly 240 million people who have died from air pollution since 1986.

Air pollution isn't "too dangerous" in this calculation. Climate change isn't "too dangerous" in this calculation. Only nuclear energy is "too dangerous."

It would be better if we thought more about our betting, which is what this interesting paper is all about. From the introduction:

The allocation of innovation resources is an essential decision for chemical research to reach fruition and is part of the process design for innovation processes. A common approach is to base the allocation on the estimated net present value (NPV) and/or internal rate of return (IRR) or similar commonly used measures for the projects. One estimates the investment required over time and the revenue expected over time, discounts these back to the present-day value (e.g., with the cost of equity, CoE, as the discount rate), and takes the difference. If NPV greater than 0 with IRR greater than CoE, the project is a “yes” and otherwise a “no”. However, this approach suffers from three important challenges. (1) Not every innovation project results in a success, perhaps failing at the R&D level, the commercial level, the regulatory level, or others. Not all companies estimate a “probability of success” for their payoffs, which can be disastrous. It is like playing blackjack without knowing the odds. As this article shows, it is essential to have an estimate of the probability of success. For early-stage innovation, oftentimes p less than 50%. (2) The NPV–IRR style approach still does not indicate what fraction of our initial innovation bankroll we should invest in each project. In the extreme, should we simply pick out one, two, or three highest NPV projects and put all our investment there? Or as many as we can afford until we have spent out? Or some other strategy? (3) As we will see in this article, the NPV or IRR types of “arithmetic average” approaches inevitably lead to “going bust” over time. Your company might still limp along, like an engineer who loses every weekend at the casino but remains solvent due to a steady income, but the innovation gambles that you are making are losing money, or they are at the least inferior to what they could be.

The core concept behind this article is a method familiar to the investing and gambling communities, the Kelly criterion (KC). In 1956, shortly after Claude Shannon had published his famous article on information theory,(1) Kelly sought to use the ideas of information theory to improve performance in games of chance. He wanted to find the maximum growth rate in total wealth for a gambler with a private but potentially noisy wire of information. As Kelly stated in his article, “The maximum exponential rate of growth of the gambler’s capital is equal to the rate of transmission of [Shannon] information over the channel.”

In fact, we might see the role of a company’s innovation team (including R&D, as well as commercial leadership, marketing, manufacturing, legal, finance, regulatory, safety, and other functions) as providing information that reduces the risk (i.e., probability of a non-success) of an innovation idea failing somewhere in the process. There are systematic methods for reducing this risk and increasing the speed of innovation.(2,3) In the academic world, one usually publishes an article only with a high probability—perhaps greater than 99% or even 99.9%–—that the work is correct. However, attaining a 1.0 or 0.1% probability of failure (risk) is very expensive in terms of time and money, and in a competitive marketplace, a manager needs to know how to allocate investments in part to avoid being scooped. It is well-known in the investing world that asset allocation is among the most important factors of success, that is, choosing when to pull money from one class of investment and put the money elsewhere including even cash. In this article, I provide a quantitative method for doing this with innovation investments, and as we will see in Section 6, the method can be extended to a broad range of activities.

To introduce the concept, let us explore an example, which will provide some intuition on how to place our bets on innovation projects. Let us say that I enter a coin flipping game at a casino. The casino lets me use a coin from my own pocket, which I believe is unbiased, such that the probability (p) of heads is 0.5 and tails is 0.5. In this game, if heads comes up, my payoff odds are given as 1.5 (i.e., if I bet $1 and win, I increase to have $1 + $1.5 = $2.5; so here I define a payoff ratio b = 1.5), and if tails comes up, I lose my bet (i.e., if I bet $1 and lose, I now have $1 less; I define a loss ratio a = 1). The casino offers me the opportunity to make 1000 flips, and if I start, I must finish all 1000 flips or forfeit any winnings. If I start with $100, how much should I bet each round? The bet is clearly biased in my favor, as the casino knows; however, there must be some reason why they offered the bet. Wanting to maximize my wealth at the end of the 1000 bets, I don’t want to squander my advantage. So should I bet it all? Before I do so, thankfully I recognize that putting “all my eggs in one basket” is probably not wise either. Note that this game is not an ergodic process. Placing 1000 simultaneous bets at one time period is much different from placing 1000 bets consecutively and independently.

We can simulate the result. What happens if I bet 34% each round? Starting with $100, I’ll bet $34 on the first flip. If I win, I now have $100 + $34 × 1.5 = $151. On the second round, I would bet 34% of my new amount, or $51.34. If I continue this pattern for all 1000 flips, then simulations show that my median outcome would be about $18 left after 1000 flips, and I would in fact go bust (“ruin”, where I reach less than $1) about 41% of the time. Aha! That’s why the casino made me this generous offer! And if I were to bet 50% each time, I would go bust greater than 99.9% of the time, and my median final wealth would be $0. That is, by betting 34 or 50%, I’m putting “too many eggs in one basket”, again even though I have the clear advantage in the betting. My arithmetic average outcome will be even higher but only because some rare runs make it so; in fact, my median outcome is awful in these cases. This is the reason why financial investors use a portfolio of (hopefully independent) investments rather than putting the entire investment into equities for instance.

If, by contrast, I were to bet at half of the previous rate, or 17% of my capital each round, my median take home amount after 1000 bets would be about $72 B, and I would go bust ( less than $1) with a probability of less than 0.0065% (i.e., once every 154,000 trips to the casino, or almost never). How could I possibly know to bet “so little” to win so much? This is the problem that Kelly solved in 1956.(4) The Kelly criterion in eq 1 below, derived in Supporting Information Section A, in fact gives fKC = 0.1667. Plugging in p = 0.50 (probability of winning) and q = 1 – p = 0.5 (probability of losing), with b = 1.5 and a = 1 gives f = 0.1667. By maximizing the growth rate of the total wealth, he established what is now known as the KC for the fraction of your wealth (fKC) to gamble in a binary (win–lose) bet

Some additional text:

1. Allocation of bets. What fraction of my initial innovation bankroll (W0) should I bet on each of my potential innovation projects? Which bets should I avoid entirely?

2. Quantiles of the compound annual growth rate (CAGR). If I have a set of bets, each with a binary success probability (p) of payoff (b) and a probability of loss (q = 1 – p) of amount (a), what is the anticipated median CAGR? Is it greater than the cost of equity (CoE)?

3. ruin rate. How often will I “go bust”? We could choose any fraction to define “ruin”, but here, we will define “ruin” as losing 99% of your initial investment. Your company might still feed a bad innovation process, keeping it afloat, but the portfolio selection might make it a loser.

4. Algorithm and heuristics. Is there a simple and practical algorithm that I can use to allocate my portfolio of bets? Are there guiding heuristics that I can use in the absence of more detailed knowledge?

Despite its advantages, there are two well-recognized shortcomings of betting according to the KC.(7) (1) Finding good bets. This article provides a method for evaluating known opportunities, but it does not provide a route for identifying or generating new opportunities.(3) (2) A relatively high early allocation. While it is true that the KC maximizes your long-term growth rate, the initial allocation is still volatile, and so, many investors or gamblers avoid going bust early by using a “fractional Kelly bet”, often half. I point out that there are critics of the KC for investing, perhaps most notably, the late Nobel laureate Paul Samuelson.(8) His primary critique was that maximizing the growth rate is equivalent to maximizing a logarithmic utility function, but that there are other utility functions. Ziemba wrote a helpful article,(9) not disputing Samuelson as much as showing how his arguments sharpen the theory and its effectiveness...

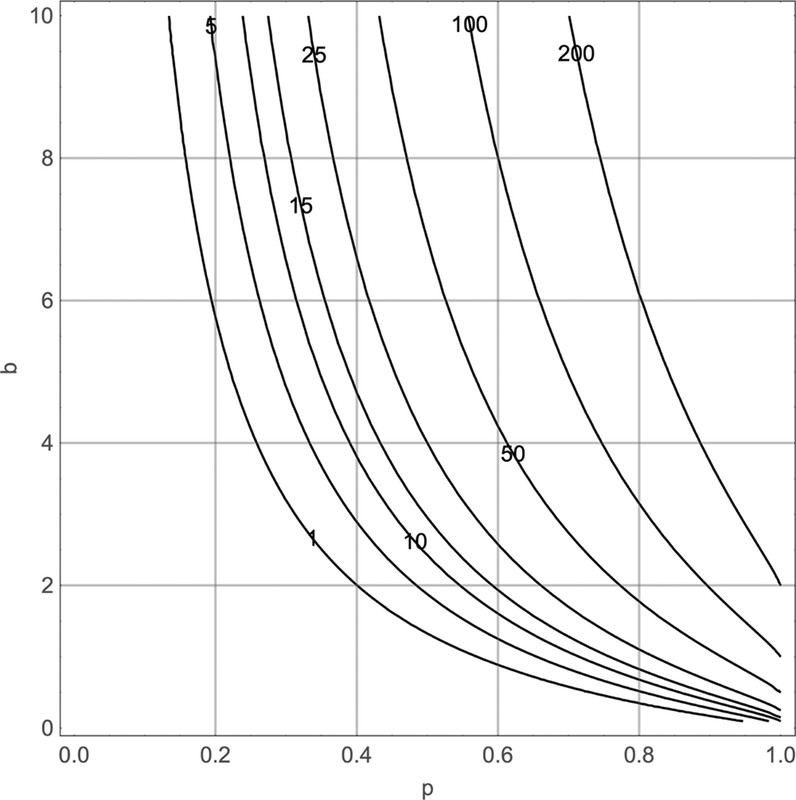

A graphic from the paper:

The caption:

There is some mathematical discussion in the paper about the "ruin rate," the third item in the list above, "going bust."

Here's what I would call "going bust:"

In the year 2000, for the week beginning May 28, 2000, the 12 month running average of comparison with the CO2 concentrations in a particular week with the concentrations for the same week ten years before was 15.08 ppm higher, or 1.51 ppm/year. In 2021, for the week beginning May 23, 2021, that value was 24.43 ppm or 2.44 ppm per year.

We've gone bust.

It was a wild bet. History will not forgive us for making it, nor should it.

It's a fun paper. If you have a chance to access it, I recommend it.

Have a nice day tomorrow.