2016 Postmortem

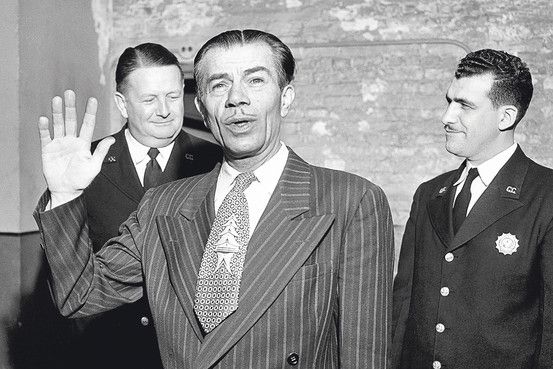

Related: About this forumThese two work in ''Wealth Management'' at UBS

I think they really love their jobs. Perhaps they just love their boss, Phil Gramm, former US Senator from Texas.

Before their days at UBS, they all ran together in Washington. Back then, ol' Phil Gramm shepherded financial deregulation of the banks through Congress and President Bill Clinton signed into law the Gramm-Leach-Bliley Act that repealed the pesky New Deal protections that kept Wall Street from using the taxpayers as unwilling co-signers at the big Wall Street casino. President Bush helped out Big Time, too, making sure the Banksters got away scot-free in 2008. I wonder who else they'll welcome to the Wealth Management department, come 2017?

Raster

(20,998 posts)The one that won't be in that little club spends his time elsewhere... teaching Sunday School, building homes for the homeless, monitoring elections worldwide to ensure democracy.

Octafish

(55,745 posts)From 2008 when the trail was fresh...

Know your BFEE: Phil Gramm, the Meyer Lansky of the War Party, Set-Up the Biggest Bank Heist Ever.

The Sting

In the best rip-off, the mark never knows that he or she was set up for fleecing.

In the case of the great financial meltdown of 2008, the victim is the U.S. taxpayer.

Going by the lack of analysis in Corporate McPravda, We the People are in for a royal fleecing.

Don’t just take my word about the current situation between giant criminality and the politically connected.

[font color="green"][font size="5"]You see, there is evidence of conspiracy. An honest FBI agent warned us in 2004 about the coming financial meltdown and the powers-that-be stiffed him, too.[/font size][/font color]

The story’s below. And it’s not fiction. It is true to life.

The Set-Up

You don’t have to be a fan of Paul Newman or Robert Redford to smell a BFEE rat. The oily critter’s name is Gramm. Phil Gramm. He helped Ronald Reagan push through his trickle-down fiscal policy and later helped de-regulate the nation's once-healthy Saving & Loan industry. We all know how well that worked out: Know your BFEE: They Looted Your Nation’s S&Ls for Power and Profit.

In 1999, then-super conservative Texas U.S. Senator Gramm helped pass the Gramm-Leach-Bliley Financial Services Modernization Act. This law allowed banks to act like investment houses. Using federally-guaranteed savings accounts, banks now could make risky commercial and real-estate loans.

The law should’ve been called the Gramm-Lansky Act. To those who gave a damn, it was obviously a potential disaster. During the bill’s debate, the specter of a “taxpayer bail-out” was raised by Sen. Byron Dorgan of North Dakota, warning about what had happened to the deregulated S&Ls.

Gramm wasn’t alone on the deregulation bandwagon. The law passed, IIRC, like 89-9. More than a few of my own Democratic faves went along with this deregulation, “get-government-off-the-back-of-business” law.

Today we have their love child, MOAB—for the Mother Of All Bailouts.

The Mark

In a sting, someone has to supply the money to be ripped off. Crooks call that person the mark or target or mope. In the present case, that’s the U.S. taxpayer.

Today’s financial crisis seems like a re-run of what happened to the Savings & Loans industry in the late 1980s. Well it is a lot like what happened to the S&Ls. Then, as now, it’s the U.S. taxpayer who gets to pick up the tab for someone else’s party.

Don’t worry, U.S. taxpayer. You’re getting something (among several things) for your $700 billion. You’re getting all the bad mortgage-based paper on almost all of Wall Street. I’d rather have penny stocks, because if there ever was something of negative value it’s the complicated notes and derivatives based on this mortgage debt.

When it comes to Bush economic policy, left holding the bag are We the People, er, Mopes. Don’t worry, it can’t get worse. As St. Ronnie would say, “Well. Yes.” You see, what the bag U.S. taxpayers hold is less than empty. It’s filled with bad debt.

The Mastermind

Chief economist amongst these merry band of thieves and traitors was one Phil Gramm (once a conservative Democrat and then an ultraconservative Republican-Taxus). An economist by training and reputation, Gramm was one of the guiding lights of Reaganomics, the cut taxes, domestic spending, and regulations while raising defense-spending to new heights. In sum, it was a fiscal policy to enrich friends – especially the kind connected to the BFEE.

Foreclosure Phil

Years before Phil Gramm was a McCain campaign adviser and a lobbyist for a Swiss bank at the center of the housing credit crisis, he pulled a sly maneuver in the Senate that helped create today's subprime meltdown.

David Corn

MotherJones.com

May 28, 2008

Who's to blame for the biggest financial catastrophe of our time? There are plenty of culprits, but one candidate for lead perp is former Sen. Phil Gramm. Eight years ago, as part of a decades-long anti-regulatory crusade, Gramm pulled a sly legislative maneuver that greased the way to the multibillion-dollar subprime meltdown. Yet has Gramm been banished from the corridors of power? Reviled as the villain who bankrupted Middle America? Hardly. Now a well-paid executive at a Swiss bank, Gramm cochairs Sen. John McCain's presidential campaign and advises the Republican candidate on economic matters. He's been mentioned as a possible Treasury secretary should McCain win. That's right: A guy who helped screw up the global financial system could end up in charge of US economic policy. Talk about a market failure.

Gramm's long been a handmaiden to Big Finance. In the 1990s, as chairman of the Senate banking committee, he routinely turned down Securities and Exchange Commission chairman Arthur Levitt's requests for more money to police Wall Street; during this period, the sec's workload shot up 80 percent, but its staff grew only 20 percent. Gramm also opposed an sec rule that would have prohibited accounting firms from getting too close to the companies they audited—at one point, according to Levitt's memoir, he warned the sec chairman that if the commission adopted the rule, its funding would be cut. And in 1999, Gramm pushed through a historic banking deregulation bill that decimated Depression-era firewalls between commercial banks, investment banks, insurance companies, and securities firms—setting off a wave of merger mania.

But Gramm's most cunning coup on behalf of his friends in the financial services industry—friends who gave him millions over his 24-year congressional career—came on December 15, 2000. It was an especially tense time in Washington. Only two days earlier, the Supreme Court had issued its decision on Bush v. Gore. President Bill Clinton and the Republican-controlled Congress were locked in a budget showdown. It was the perfect moment for a wily senator to game the system. As Congress and the White House were hurriedly hammering out a $384-billion omnibus spending bill, Gramm slipped in a 262-page measure called the Commodity Futures Modernization Act. Written with the help of financial industry lobbyists and cosponsored by Senator Richard Lugar (R-Ind.), the chairman of the agriculture committee, the measure had been considered dead—even by Gramm. Few lawmakers had either the opportunity or inclination to read the version of the bill Gramm inserted. "Nobody in either chamber had any knowledge of what was going on or what was in it," says a congressional aide familiar with the bill's history.

It's not exactly like Gramm hid his handiwork—far from it. The balding and bespectacled Texan strode onto the Senate floor to hail the act's inclusion into the must-pass budget package. But only an expert, or a lobbyist, could have followed what Gramm was saying. The act, he declared, would ensure that neither the sec nor the Commodity Futures Trading Commission (cftc) got into the business of regulating newfangled financial products called swaps—and would thus "protect financial institutions from overregulation" and "position our financial services industries to be world leaders into the new century."

Subprime 1-2-3

Don't understand credit default swaps? Don't worry—neither does Congress. Herewith, a step-by-step outline of the subprime risk betting game. —Casey Miner

CONTINUED…

http://www.motherjones.com/news/feature/2008/07/foreclo...

A fine mind for modern Bushonomics. Kill the middle class. Then, rob from the poor to give to the rich.

The Mentor

Anyone who’s ever heard him talk knows that Gramm must’ve learned all this stuff from somebody. He could never think it all up on his own. He had to have help. That’s where Meyer Lansky, the man who brought modern finance to the Mafia, comes in.

Money Laundering

Answers.com

EXCERPT...

History

Modern development

The act of "money laundering" was not invented during the Prohibition era in the United States, but many techniques were developed and refined then. Many methods were devised to disguise the origins of money generated by the sale of then-illegal alcoholic beverages. Following Al Capone's 1931 conviction for tax evasion, mobster Meyer Lansky transferred funds from Florida "carpet joints" (small casinos) to accounts overseas. After the 1934 Swiss Banking Act, which created the principle of bank secrecy, Meyer Lansky bought a Swiss bank to which he would transfer his illegal funds through a complex system of shell companies, holding companies, and offshore accounts.(1)

The term "money laundering" does not derive, as is often said, from Al Capone having used laundromats to hide ill-gotten gains. It was Meyer Lansky who perfected money laundering's older brother, "capital flight," transferring his funds to Switzerland and other offshore places. The first reference to the term "money laundering" itself actually appears during the Watergate scandal. US President Richard Nixon's "Committee to Re-elect the President" moved illegal campaign contributions to Mexico, then brought the money back through a company in Miami. It was Britain's Guardian newspaper that coined the term, referring to the process as "laundering."

Process

Money laundering is often described as occurring in three stages: placement, layering, and integration.(3)

Placement: refers to the initial point of entry for funds derived from criminal activities.

Layering: refers to the creation of complex networks of transactions which attempt to obscure the link between the initial entry point, and the end of the laundering cycle.

Integration: refers to the return of funds to the legitimate economy for later extraction.

However, The Anti Money Laundering Network recommends the terms

Hide: to reflect the fact that cash is often introduced to the economy via commercial concerns which may knowingly or not knowingly be part of the laundering scheme, and it is these which ultimately prove to be the interface between the criminal and the financial sector

Move: clearly explains that the money launderer uses transfers, sales and purchase of assets, and changes the shape and size of the lump of money so as to obfuscate the trail between money and crime or money and criminal.

Invest: the criminal spends the money: he/she may invest it in assets, or in his/her lifestyle.

CONTINUED...

http://www.answers.com/topic/money-laundering

The great journalist Lucy Komisar has shone a big light on the subject:

Offshore Banking

The U.S.A.’s Secret Threat

Lucy Komisar

The Blacklisted Journalist

June 1, 2003

EXCERPT…

In 1932, mobster Meyer Lansky took money from New Orleans slot machines and shifted it to accounts overseas. The Swiss secrecy law two years later assured him of G-man-proof banking. Later, he bought a Swiss bank and for years deposited his Havana casino take in Miami accounts, then wired the funds to Switzerland via a network of shell and holding companies and offshore accounts, some of them in banks whose officials knew very well they were working for criminals. By the 1950s, Lansky was using the system for cash from the heroin trade.

Today, offshore is where most of the world's drug money is laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20 percent. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption.

Lansky laundered money so he could pay taxes and legitimate his spoils. About half the users of offshore have opposite goals. As hotel owner and tax cheat Leona Helmsley said---according to her former housekeeper during Helmsley's trial for tax evasion---"Only the little people pay taxes." Rich individuals and corporations avoid taxes through complex, accountant-aided schemes that routinely use offshore accounts and companies to hide income and manufacture deductions.

The impact is massive. The IRS estimates that taxpayers fail to pay in excess of $100 billion in taxes annually due on income from legal sources. The General Accounting Office says that American wage-earners report 97 percent of their wages, while self-employed persons report just 11 percent of theirs. Each year between 1989 and 1995, a majority of corporations, both foreign- and U.S.-controlled, paid no U.S. income tax. European governments are fighting the same problem. The situation is even worse in developing countries.

The issue surfaces in the press when an accounting scam is so outrageous that it strains credulity. Take the case of Stanley Works, which announced a "move" of its headquarters-on paper-from New Britain, Connecticut, to Bermuda and of its imaginary management to Barbados. Though its building and staff would actually stay put, manufacturing hammers and wrenches, Stanley Works would no longer pay taxes on profits from international trade. The Securities and Exchange Commission, run by Harvey Pitt---an attorney who for more than twenty years represented the top accounting and Wall Street firms he was regulating---accepted the pretense as legal.

"The whole business is a sham," fumed New York District Attorney Robert Morgenthau, who more than any other U.S. law enforcer has attacked the offshore system. "The headquarters will be in a country where that company is not permitted to do business. They're saying a company is managed in Barbados when there's one meeting there a year. In the prospectus, they say legally controlled and managed in Barbados. If they took out the word legally, it would be a fraud. But Barbadian law says it's legal, so it's legal." The conceit apparently also persuaded the Securities and Exchange Commission.

CONTINUED…

http://www.bigmagic.com/pages/blackj/column92e.html

Socialize the risk for Wall Street. Privatize the loss to Uncle Sam’s nieces and nephews. Congratulations, Dear Reader! Now you know as much as Phil Gramm.

The Diversion

Still, a global financial meltdown sounds like something bad. Making things worse, we’re hearing that Uncle Sam is broke! Flat busted. Tapped out.

That’s odd, though. We the People see the Treasury being emptied with tax breaks for the wealthy and checks to the companies they own that make money off of war. Want to know how to make a buck these days? Invest in the likes of Halliburton and Northrup Grumman. Anything in the warmongering business connected to Bush and his cronies will weather the downturn or depression.

The Wall Street Journal -- a paper owned and operated by Fox News’ head, Rupert Murdoch – was very quick to promote the crisis, as DUer JustPlainKathy observed. The paper was even faster to pounce on a solution: What’s needed is a safety net for banks. And quick as a wink, they found the answer!

Only the U.S. taxpayer has the wherewithal to prevent the collapse of the global financial system -- a global economic meltdown that would freeze up credit and investment and expansion and prosperity and a return to the Great Depression. Who can be against that?

Oh. Kay. Sounds about right – Rupert the Alien agreeing with what Leona Helmsley said: “Only the little people pay taxes.”

Gramm and McCain also are in favor of privatization. How nice is that?

The Getaway

George Walker Bush and his right-wing pals feel they can get away with this, their latest rip-off the American taxpayers. Who can blame them? When compared to their clear record of incompetence, lies, fraud, theft, mass-murder, warmongering and treason, what’s a few trillion dollar rip-off?

Still, it's weird how they act.

They must really think they’ll be welcomed with open arms in Paraguay and Dubai and Switzerland.

Going by the welcome the world gave the Shah of Iran, they’re in for a big surprise.

The FBI Guy

Don’t say we weren’t warned. An intrepid FBI agent with something sorely lacking in the rest of the Bush administration, integrity, blew the whistle on the bank thing…

FBI saw threat of mortgage crisis

A top official warned of widening loan fraud in 2004, but the agency focused its resources elsewhere.

By Richard B. Schmitt

Los Angeles Times Staff Writer

August 25, 2008

WASHINGTON — Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Today, the damage from the global mortgage meltdown has more than matched that of the savings-and-loan bailouts of the 1980s and early 1990s. By some estimates, it has made that costly debacle look like chump change. But it's also clear that the FBI failed to avert a problem it had accurately forecast.

Banks and brokerages have written down more than $300 billion of mortgage-backed securities and other risky investments in the last year or so as homeowner defaults leaped and weakness in the real estate market spread.

SNIP…

Most observers have declared the mess a gross failure of regulation. To be sure, in the run-up to the crisis, market-oriented federal regulators bragged about their hands-off treatment of banks and other savings institutions and their executives. But it wasn't just regulators who were looking the other way. The FBI and its parent agency, the Justice Department, are supposed to act as the cops on the beat for potentially illegal activities by bankers and others. But they were focused on national security and other priorities, and paid scant attention to white-collar crimes that may have contributed to the lending and securities debacle.

Now that the problems are out in the open, the government's response strikes some veteran regulators as too little, too late.

Swecker, who retired from the FBI in 2006, declined to comment for this article.

But sources familiar with the FBI budget process, who were not authorized to speak publicly about the growing fraud problem, say that he and other FBI criminal investigators sought additional assistance to take on the mortgage scoundrels.

They ended up with fewer resources, rather than more.

CONTINUED…

http://www.latimes.com/business/la-fi-mortgagefraud25-2008aug25,0,6946937.story

We were warned and nothing happened.

Repeat: And nothing happened.

They must think We the People are really stupid. Are we supposed to believe that all that $700 billion in bad debt just happened? Where did all that money go? Who got all the money?

Meyer Lansky moved the Mafia’s money from the Cuban casinos to Switzerland. He did so by buying a bank in Miami. Phil Gramm seems to have done the same thing as vice-chairman of UBS, except the amounts are in the billions.

Who cares? He’s almost gone? Nope. That money still exists somewhere. I have a pretty good idea of where it might be. And George Bush and his cronies are poised to get away with a whole lot of loot.

Who Should Pay for the Bailout

If you are fortunate enough to be one, good luck American taxpayer! You’re in for a royal fleecing. Once the interest is figured into the bailout, we’re looking at a couple of trill.

[font color="purple"]The people who should pay for the bailout aren’t the American people. That distinction should go to the crooks who stole it -- friends of Gramm like John McCain and George Bush and the rest of the Raygunomix crowd of snake-oil salesmen. For them, the Bush administration -- and a good chunk of time since Ronald Reagan -- has not been a disaster. It’s been a cash cow.[/font color]

The above was posted on DU on Sept. 21, 2008. (Check out the responses, lots of info from DUers.) What's changed since then? Nothing near what I'd hoped for, certainly: http://www.democraticunderground.com/discuss/duboard.php?az=view_all&address=389x4055207

amborin

(16,631 posts)Fawke Em

(11,366 posts)Your entire post was highly informative and interesting, but I wanted to admit to you that I smiled when I saw that Uncle Sam bank.

![]()

grasswire

(50,130 posts)Wouldn't it be cool if he would campaign with Bernie?

Politicalboi

(15,189 posts)And one of them interferes with voting so his S/O can get more votes. I can't believe I once liked this asshole. ![]()

Octafish

(55,745 posts)Certainly isn't doing anything good for the country.

Perhaps it requires another language to describe what is visible only to a certain class.

haikugal

(6,476 posts)Octafish

(55,745 posts)It's almost an ENIGMA, what the rich and powerful say. It's to hide what they do.

Case in point: One Neil Mallon Pierce Bush, son of then-president George Herbert Walker Bush and caught with his hand in a billion-dollar S&L cookie jar called Silverado Savings & Loan. Here's what Poppy did for his Number 3 Son:

How the Elite Talk in Code

EXCERPT...

A perfect example of code talk comes from a true master insider, George H.W. Bush, when his son, Neil, was caught red handed in the middle of the S&L crisis as a director of Sliverado Bank.

Did Bush lay out his cards and call in his operatives and say pull some strings, get my son out of this investigation (Remember Bush was president at the time.) No. Bush is too smooth. In his published collection of letters, All The Best, George Bush, he shows us how the heat is delicately taken off Neil. On page 449, there is this letter to Thomas Ludlow Ashley.

Ashley is a Yale University grad, and member of the secret society Skull and Bones along with Bush. Here's the letter:

The Honorable Thomas Ludlow Ashley

Association of Bank Holding Companies

Washington, D.C. 20005

Dear Lud,

Thank you for your good memo December 8th.

I would appreciate any help you can give Neil. He tells me he never had any insider dealings. He got off the Board early--long before I was elected President. The Denver paper apparently ran a very nice editorial about him on that. He is an outside director, and thus I guess has liability, but I can't believe his name would appear in the paper if it was Jones not Bush. In any event, I know that the guy is totally honest. I saw him in Denver and I think he is worried about the publicity and the "shame". I tell him not to worry about that but any advice you can give as this matter unfolds would be greatly appreciated by me. If it turns out there has been some marginal call, or he has done something wrong, needless to say there will be no intervention from his dad. But, I'm quite confident this is not true...

Warm regards,

George

Notice how smooth. No talk about getting Ashley anything for taking care of the matter. The nice touch about if Neil "has done something wrong", but the clear finish, he didn't.

CONTINUED...

http://www.economicpolicyjournal.com/2009/07/how-elite-talk-in-code.html

When it comes to money and power, it really is a small world. We'd hear it more often, if only we were privy to the conversation.

When it comes to democracy, justice and freedom, We the People should be in on the discussion. And we should be fully informed. That leads the nation to make sound decisions.

haikugal

(6,476 posts)They move in elite groups and socialize the losses but never the profits. Smooth. They teach their children all this from the time they are very young. Privileged criminals.

Thank you!

reformist2

(9,841 posts)Hydra

(14,459 posts)And yes, I think greed is considered a cardinal virtue in Bushco?

Octafish

(55,745 posts)

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

The fact the nation's "news media" isn't really following this story should also be of great concern -- for the 99-percent.

Roland99

(53,342 posts)Octafish

(55,745 posts)"You're On Your Own."

McCain’s Gramm Problem

by Jared Bernstein

Think Progress, JUL 12, 2008

John McCain spent the day doing something you’d rather not do when you’re running for president in the midst of an economic downturn: trying hard to distance himself from his top economic advisor, former Texas Senator Phil Gramm.

McCain had no choice. In one of a series of deeply dissonant gaffes from the McCain squad this week, Gramm argued that the only recession out there was in people’s heads (“this is a mental recession”) and that everyone should just stop whining. We’ve lost jobs for six months in a row (down over 400,000), paychecks are getting whacked by rising unemployment and soaring gas prices, the federal government is contemplating a takeover of Fannie and Freddie, as financial markets carve out new lows everyday, and this guy — not just any guy, but the top economist for the Republican candidate for president — tells us it’s all in our heads.

The thing is, I find all of this quite reassuring. I know Phil Gramm is a huge economic danger zone, so when he reveals his true colors to the point where McCain has to disavow him, it’s a good day. What scares me is when he’s quiet. It’s in the dead of night, under the cover of deregulatory darkness, where Gramm has successfully struck his most damaging blows.

Driven by that lethal combination of ideological market fundamentalism, or, if you prefer, YOYO economics (“you’re on your own), and the desire to help rich friends in the banking industry, Gramm crafted legislation that helped get us where we are today. Most notably, in 1999, he sponsored the Gramm-Leach-Bliley Act, which essentially took down the regulatory walls between commercial and non-commercial lenders (the latter being investment banks like Bear Stearns or mortgage brokers like Countrywide, to pull a few names out of the air).

Before that, most lending was from commercial banks, subject to Federal Reserve oversight and a variety of common sense rules regarding capital reserve ratios and underwriting standards. Now, most lending is from non-commercial entities, which would not necessarily be a problem if they were subject to similar oversight.

CONTINUED...

http://thinkprogress.org/wonkroom/2008/07/12/bernstein-... /

Our guest blogger is Jared Bernstein, the Director of the Living Standards program at the Economic Policy Institute and author of the book "Crunch: Why Do I Feel So Squeezed?" -- Think Progress

Austerity for Good Times: Advice that makes the rich richer and the middle class into the poor.

JackRiddler

(24,979 posts)as though this would win votes for HRC.

Bad, bad man.

Octafish

(55,745 posts)...and came to the conclusion that some things are more important than maintaining party loyalty to the brand and standard bearers, that is: Integrity.

I couldn't live with myself if I didn't stand up now.

More Old Buy Partisan News that Never Really Was ''Absorbed'' by the Public:

Remember how fast Bushler distanced himself from Kenny Boy? That was when all that HARKEN SEC brouhaha was bubbling up, again. Then, just before sentencing, Kenny left this mortal toil? Too sad.

Federal Reserve Directors' Banks and Businesses Took $4 Trillion in Bailouts -- Sanders FED Audit

http://www.democraticunderground.com/1002807254

PS: Here's the Buy-partisan ENRON angle:

Lieberman in ENRON Land

PS: I know it's old news to you, JackRiddler. Must think of future generations...

H2O Man

(73,536 posts)Thank you!

Octafish

(55,745 posts)

http://observer.com/2016/03/bill-and-chain-the-clinton-presidency-could-hold-back-hillary/

ETA what I just learned: Disclosure: Donald Trump is the father-in-law of Jared Kushner, the publisher of Observer Media.

Which is sad.

And you are most welcome, H2O Man.

floriduck

(2,262 posts)Octafish

(55,745 posts)It makes for a Big Circus.

Take the overthrow of Democracy in Chile for Wall Street: Who knew they'd be thinking about doing this to the schmucks at home?

President Clinton and the Chilean Model.

By José Piñera

Midnight at the House of Good and Evil

"It is 12:30 at night, and Bill Clinton asks me and Dottie: 'What do you know about the Chilean social-security system?'” recounted Richard Lamm, the three-term former governor of Colorado. It was March 1995, and Lamm and his wife were staying that weekend in the Lincoln Bedroom of the White House.

I read about this surprising midnight conversation in an article by Jonathan Alter (Newsweek, May 13, 1996), as I was waiting at Dulles International Airport for a flight to Europe. The article also said that early the next morning, before he left to go jogging, President Bill Clinton arranged for a special report about the Chilean reform produced by his staff to be slipped under Lamm's door.

That news piqued my interest, so as soon as I came back to the United States, I went to visit Richard Lamm. I wanted to know the exact circumstances in which the president of the world’s superpower engages a fellow former governor in a Saturday night exchange about the system I had implemented 15 years earlier.

Lamn and I shared a coffee on the terrace of his house in Denver. He not only was the most genial host to this curious Chilean, but he also proved to be deeply motivated by the issues surrounding aging and the future of America. So we had an engaging conversation. At the conclusion, I ventured to ask him for a copy of the report that Clinton had given him. He agreed to give it to me on the condition that I do not make it public while Clinton was president. He also gave me a copy of the handwritten note on White House stationery, dated 3-21-95, which accompanied the report slipped under his door. It read:

Dick,

Sorry I missed you this morning.

It was great to have you and Dottie here.

Here's the stuff on Chile I mentioned.

Best,

Bill.

Three months before that Clinton-Lamm conversation about the Chilean system, I had a long lunch in Santiago with journalist Joe Klein of Newsweek magazine. A few weeks afterwards, he wrote a compelling article entitled,[font color="green"] "If Chile can do it...couldn´t North America privatize its social-security system?" [/font color]He concluded by stating that "the Chilean system is perhaps the first significant social-policy idea to emanate from the Southern Hemisphere." (Newsweek, December 12, 1994).

I have reasons to think that probably this piece got Clinton’s attention and, given his passion for policy issues, he became a quasi expert on Chile’s Social Security reform. Clinton was familiar with Klein, as the journalist covered the 1992 presidential race and went on anonymously to write the bestseller Primary Colors, a thinly-veiled account of Clinton’s campaign.

“The mother of all reforms”

While studying for a Masters and a Ph.D. in economics at Harvard University, I became enamored with America’s unique experiment in liberty and limited government. In 1835 Alexis de Tocqueville wrote the first volume of Democracy in America hoping that many of the salutary aspects of American society might be exported to his native France. I dreamed with exporting them to my native Chile.

So, upon finishing my Ph.D. in 1974 and while fully enjoying my position as a Teaching Fellow at Harvard University and a professor at Boston University, I took on the most difficult decision in my life: to go back to help my country rebuild its destroyed economy and democracy along the lines of the principles and institutions created in America by the Founding Fathers. Soon after I became Secretary of Labor and Social Security, and in 1980 I was able to create a fully funded system of personal retirement accounts. Historian Niall Ferguson has stated that this reform was “the most profound challenge to the welfare state in a generation. Thatcher and Reagan came later. The backlash against welfare started in Chile.”

But while de Tocqueville’s 1835 treatment contained largely effusive praise of American government, the second volume of Democracy in America, published five years later, strikes a more cautionary tone. He warned that “the American Republic will endure, until politicians realize they can bribe the people with their own money.” In fact at some point during the 20th century, the culture of self reliance and individual responsibility that had made America a great and free nation was diluted by the creation of [font color="green"] “an Entitlement State,”[/font color] reminiscent of the increasingly failed European welfare state. What America needed was a return to basics, to the founding tenets of limited government and personal responsibility.

[font color="green"]In a way, the principles America helped export so successfully to Chile through a group of free market economists needed to be reaffirmed through an emblematic reform. I felt that the Chilean solution to the impending Social Security crisis could be applied in the USA.[/font color]

CONTINUED...

http://www.josepinera.org/articles/articles_clinton_chilean_model.htm

These economic policies have served to make the rich into the superrich. The process also transformed the middle class into the new poor, which is nice if the Leader Dog also wants to lord over the canine masses.

Karmadillo

(9,253 posts)Octafish

(55,745 posts)...from the great DUer Wilms, regarding the unindicted Richard Bruce Cheney:

Ford White House Altered Rockefeller Commission Report; Cheney Spearheaded Editing of Report

Washington, DC, February 29, 2016 – The Gerald Ford White House significantly altered the final report of the supposedly independent 1975 Rockefeller Commission investigating CIA domestic activities, over the objections of senior Commission staff, according to internal White House and Commission documents posted today by the National Security Archive at The George Washington University (www.nsarchive.org). The changes included removal of an entire 86-page section on CIA assassination plots and numerous edits to the report by then-deputy White House Chief of Staff Richard Cheney.

Today’s posting includes the entire suppressed section on assassination attempts, Cheney’s handwritten marginal notes, staff memos warning of the fallout of deleting the controversial section, and White House strategies for presenting the edited report to the public. The documents show that the leadership of the presidentially-appointed commission deliberately curtailed the investigation and ceded its independence to White House political operatives.

This evidence has been lying ignored in government vaults for decades. Much of the work of securing release of the records was done by the John F. Kennedy Assassinations Records Board in the 1990s, and the documents were located at the National Archives and Records Administration at College Park, Maryland; or at the Gerald R. Ford Library in Ann Arbor, Michigan. Additional mandatory declassification review requests filed by Archive fellow John Prados returned identical versions of documents, indicating the CIA is not willing to permit the public to see any more of the assassinations story than we show here. The documents in this set have yet to be incorporated into standard accounts of the events of this period.

Among the highlights of today’s posting:

* White House officials of the Ford administration attempted to keep a presidential review panel—the Rockefeller Commission—from investigating reports of CIA planning for assassinations abroad.

* Ford administration officials suppressed the Rockefeller Commission’s actual report on CIA assassination plots.

* Richard Cheney, then the deputy assistant to the president, edited the report of the Rockefeller Commission from inside the Ford White House, stripping the report of its independent character.

* The Rockefeller Commission remained silent on this manipulation.

* Rockefeller Commission lawyers and public relations officials warned of the damage that would be done to the credibility of the entire investigation by avoiding the subject of assassinations.

* President Ford passed investigative materials concerning assassinations along to the Church Committee of the United States Senate and then attempted—but failed—to suppress the Church Committee’s report as well.

* The White House markup of the Rockefeller Commission report used the secrecy of the CIA budget as an example of excesses and recommended Congress consider making agency spending public to some degree.

CONTINUED with all manner of scholarly work, ignored by Corporate McPravda and a shockingly large percentage of DU...

http://nsarchive.gwu.edu/NSAEBB/NSAEBB543-Ford-White-House-Altered-Rockefeller-Commission-Report/

Thanks to bananas for posting this.

http://www.democraticunderground.com/1016147583

For some reason, the nation's mass media failed to report that story. I know I didn't hear about it in history class.

closeupready

(29,503 posts)But it matters to me, you, and anyone with a conscience. K&R

Octafish

(55,745 posts)...we'd be in the One Percent, lapping at the Federal, State and Local Troughs -- courtesy of their nice employees in Wall Street-on-the-Potomac, from loyal lobbyists who write the legislation to corrupt judges who think money is speech to pols who know money trumps peace to corrupt corporate owned news networks that for some reason continue to miss the actual news.

Dual Citizenship: Wall Street and Washington

Michael Froman and the revolving door

By Felix Salmon December 11, 2009

Michael Froman is one of those behind-the-scenes technocrats who never quite makes it into full public view. But according to Matt Taibbi, he’s one of the most egregious examples — up there with Bob Rubin, literally — we’ve yet seen of the way the revolving door works between business and government generally, and between Citigroup and Treasury in particular.

I’m not sure how much of this information is new, but a lot of it was new to me, especially the bit about Froman “leading the search for the president’s new economic team” — while he was still pulling down a multi-million-dollar salary at Citigroup, no less. Apologies for quoting at length:

Leading the search for the president’s new economic team was his close friend and Harvard Law classmate Michael Froman, a high-ranking executive at Citigroup. During the campaign, Froman had emerged as one of Obama’s biggest fundraisers, bundling $200,000 in contributions and introducing the candidate to a host of heavy hitters — chief among them his mentor Bob Rubin, the former co-chairman of Goldman Sachs who served as Treasury secretary under Bill Clinton. Froman had served as chief of staff to Rubin at Treasury, and had followed his boss when Rubin left the Clinton administration to serve as a senior counselor to Citigroup (a massive new financial conglomerate created by deregulatory moves pushed through by Rubin himself).

Incredibly, Froman did not resign from the bank when he went to work for Obama: He remained in the employ of Citigroup for two more months, even as he helped appoint the very people who would shape the future of his own firm. And to help him pick Obama’s economic team, Froman brought in none other than Jamie Rubin, a former Clinton diplomat who happens to be Bob Rubin’s son. At the time, Jamie’s dad was still earning roughly $15 million a year working for Citigroup, which was in the midst of a collapse brought on in part because Rubin had pushed the bank to invest heavily in mortgage-backed CDOs and other risky instruments…

On November 23rd, 2008, a deal is announced in which the government will bail out Rubin’s messes at Citigroup with a massive buffet of taxpayer-funded cash and guarantees… No Citi executives are replaced, and few restrictions are placed on their compensation. It’s the sweetheart deal of the century, putting generations of working-stiff taxpayers on the hook to pay off Bob Rubin’s fuck-up-rich tenure at Citi. “If you had any doubts at all about the primacy of Wall Street over Main Street,” former labor secretary Robert Reich declares when the bailout is announced, “your doubts should be laid to rest.”

It is bad enough that one of Bob Rubin’s former protégés from the Clinton years, the New York Fed chief Geithner, is intimately involved in the negotiations, which unsurprisingly leave the Federal Reserve massively exposed to future Citi losses. But the real stunner comes only hours after the bailout deal is struck, when the Obama transition team makes a cheerful announcement: Timothy Geithner is going to be Barack Obama’s Treasury secretary!

Geithner, in other words, is hired to head the U.S. Treasury by an executive from Citigroup — Michael Froman — before the ink is even dry on a massive government giveaway to Citigroup that Geithner himself was instrumental in delivering. In the annals of brazen political swindles, this one has to go in the all-time Fuck-the-Optics Hall of Fame.

Wall Street loved the Citi bailout and the Geithner nomination so much that the Dow immediately posted its biggest two-day jump since 1987, rising 11.8 percent. Citi shares jumped 58 percent in a single day, and JP Morgan Chase, Merrill Lynch and Morgan Stanley soared more than 20 percent, as Wall Street embraced the news that the government’s bailout generosity would not die with George W. Bush and Hank Paulson.

How much influence did Froman have over the appointment of Geithner as Treasury secretary? Geithner, who wanted to become Treasury secretary and who as New York Fed president was a central (if not the central) figure in orchestrating the massive Citigroup bailout just after the election, knew what Froman’s job was in the Obama transition team, and knew that Froman was a senior executive at Citigroup.

CONTINUED...

http://blogs.reuters.com/felix-salmon/2009/12/11/michael-froman-and-the-revolving-door/

If we didn't give a damn, the only voice heard would be the Right's-- the bayonet of the 1-percent of 1-percent.

PS: Thank you, closeupready. Your understanding, friendship, and kind words mean the world.

closeupready

(29,503 posts)Myrina

(12,296 posts)If you mean, making money off your & your family's last name, and using your connections to other people with boatloads of money that they want to use to influence policy as a means to make yourself richer ... then, yeah ... that's work.

marions ghost

(19,841 posts)Octafish

(55,745 posts)"Work" as in grabbing as much as you can as quick as you can, oh yeah.

By DEALBOOK

The New York Times, NOVEMBER 9, 2009

The chief executive of Goldman Sachs, which has attracted widespread media attention over the size of its staff bonuses, says he believes banks serve a social purpose and are “doing God’s work.”

“We’re very important,” Lloyd C. Blankfein said in an interview with The Times of London. “We help companies to grow by helping them to raise capital. Companies that grow create wealth. This, in turn, allows people to have jobs that create more growth and more wealth. It’s a virtuous cycle.”

The dominant Wall Street bank posted third-quarter earnings of $3 billion and plans to hand out more than $16 billion in year-end bonuses.

“We have a social purpose,” he told the newspaper.

Mr. Blankfein also defended the firm’s compensation, saying that the practices correlated with long-term performance.

CONTINUED...

http://dealbook.nytimes.com/2009/11/09/goldman-chief-says-he-is-just-doing-gods-work/

7wo7rees

(5,128 posts)I think we have an idea who might be joining, will wait and see.......

Octafish

(55,745 posts)"It’s complicated, and we’re going to make sure whatever we do is done in a deliberative fashion." -- George W Bush, Oct. 3, 2008

Washington's Blog provides data n details n links n such heh heh heh:

The Government Lied When It Said It Only Bailed Out Healthy Banks … 12 of the 13 Big Banks Were Going Bust

Posted on January 11, 2013 by WashingtonsBlog

The Government’s Entire Strategy Was to Cover Up the Truth

We noted in 2011 that the Geithner, Bernanke and Paulson lied about the health of the big banks in pitching bailouts to Congress and the American people:

The big banks were all insolvent during the 1980s.

And they all became insolvent again in 2008. See this and this (busted link at WB).

The bailouts were certainly rammed down our throats under false pretenses.

But here’s the more important point. Paulson and Bernanke falsely stated that the big banks receiving Tarp money were healthy, when they were not. They were insolvent.

Tim Geithner falsely stated that the banks passed some time of an objective stress test but they did not. They were insolvent.

CONTINUED...

http://www.washingtonsblog.com/2013/01/12-of-the-13-big-banks-went-bust-and-the-government-lied-when-it-said-it-only-bailed-out-healthy-banks.html

Thank you for reading, 7wo7rees! For some reason, none of this gets mentioned by Rachel Maddow.

7wo7rees

(5,128 posts)We quit MSNBC.

We always read your posts, always!! ![]()

valerief

(53,235 posts)Yes, Gramm deserves as much respect as Tom DeLay or Dick Cheney. Or UBS wealth managers.

Octafish

(55,745 posts)EXCERPT...

William K. Black: There were two really big things, under the Clinton administration. One, they got rid of the law that came out of the real-world disasters of the Great Depression. We learned a lot of things in the Great Depression. And one is we had to separate what's called commercial banking from investment banking. That's the Glass-Steagall law. But we thought we were much smarter, supposedly. So we got rid of that law, and that was bipartisan. And the other thing is we passed a law, because there was a very good regulator, Brooksley Born, that everybody should know about and probably doesn't. She tried to do the right thing to regulate one of these exotic derivatives that you're talking about. We call them C.D.F.S. And Summers, Rubin, and Phil Gramm came together to say not only will we block this particular regulation. We will pass a law that says you can't regulate. And it's this type of derivative that is most involved in the AIG scandal. AIG all by itself, cost the same as the entire Savings and Loan debacle.

Bill Moyers: What did AIG contribute? What did they do wrong?

William K. Black: They made bad loans. Their type of loan was to sell a guarantee, right? And they charged a lot of fees up front. So, they booked a lot of income. Paid enormous bonuses. The bonuses we're thinking about now, they're much smaller than these bonuses that were also the product of accounting fraud. And they got very, very rich. But, of course, then they had guaranteed this toxic waste. These liars' loans. Well, we've just gone through why those toxic waste, those liars' loans, are going to have enormous losses. And so, you have to pay the guarantee on those enormous losses. And you go bankrupt. Except that you don't in the modern world, because you've come to the United States, and the taxpayers play the fool. Under Secretary Geithner and under Secretary Paulson before him... we took $5 billion dollars, for example, in U.S. taxpayer money. And sent it to a huge Swiss Bank called UBS. At the same time that that bank was defrauding the taxpayers of America. And we were bringing a criminal case against them. We eventually get them to pay a $780 million fine, but wait, we gave them $5 billion. So, the taxpayers of America paid the fine of a Swiss Bank. And why are we bailing out somebody who that is defrauding us?

Bill Moyers: And why...

William K. Black: How mad is this?

Bill Moyers: What is your explanation for why the bankers who created this mess are still calling the shots?

William K. Black: Well, that, especially after what's just happened at G.M., that's... it's scandalous.

Bill Moyers: Why are they firing the president of G.M. and not firing the head of all these banks that are involved?

William K. Black: There are two reasons. One, they're much closer to the bankers. These are people from the banking industry. And they have a lot more sympathy. In fact, they're outright hostile to autoworkers, as you can see. They want to bash all of their contracts. But when they get to banking, they say, 'contracts, sacred.' But the other element of your question is we don't want to change the bankers, because if we do, if we put honest people in, who didn't cause the problem, their first job would be to find the scope of the problem. And that would destroy the cover up.

Bill Moyers: The cover up?

William K. Black: Sure. The cover up.

Bill Moyers: That's a serious charge.

William K. Black: Of course.

Bill Moyers: Who's covering up?

William K. Black: Geithner is charging, is covering up. Just like Paulson did before him. Geithner is publicly saying that it's going to take $2 trillion - a trillion is a thousand billion - $2 trillion taxpayer dollars to deal with this problem. But they're allowing all the banks to report that they're not only solvent, but fully capitalized. Both statements can't be true. It can't be that they need $2 trillion, because they have masses losses, and that they're fine.

These are all people who have failed. Paulson failed, Geithner failed. They were all promoted because they failed, not because...

Bill Moyers: What do you mean?

William K. Black: Well, Geithner has, was one of our nation's top regulators, during the entire subprime scandal, that I just described. He took absolutely no effective action. He gave no warning. He did nothing in response to the FBI warning that there was an epidemic of fraud. All this pig in the poke stuff happened under him. So, in his phrase about legacy assets. Well he's a failed legacy regulator.

Bill Moyers: But he denies that he was a regulator. Let me show you some of his testimony before Congress. Take a look at this.

TIMOTHY GEITHNER:I've never been a regulator, for better or worse. And I think you're right to say that we have to be very skeptical that regulation can solve all of these problems. We have parts of our system that are overwhelmed by regulation.

Overwhelmed by regulation! It wasn't the absence of regulation that was the problem, it was despite the presence of regulation you've got huge risks that build up.

William K. Black: Well, he may be right that he never regulated, but his job was to regulate. That was his mission statement.

Bill Moyers: As?

William K. Black: As president of the Federal Reserve Bank of New York, which is responsible for regulating most of the largest bank holding companies in America. And he's completely wrong that we had too much regulation in some of these areas. I mean, he gives no details, obviously. But that's just plain wrong.

CONTINUED...

https://truth-out.org/archive/component/k2/item/83477-william-k-black-sharing-the-blame-for-the-economic-crisis

Like the crowd hired to cheer Trump when he announced he was running for pretzel: Something ain't RIGHT when people all of a sudden appear to deny the obvious.

Octafish

(55,745 posts)

2004: Gramm Told Derivatives Conference You"re Doing "God"s Work."

In a staunch defense a practice that has been criticized by the likes of no less than Warren Buffet as opaque and hard to value --calling them "weapons of mass destruction"—Gramm "told dealers at a derivatives conference in Chicago (in 2004) that they were doing 'God's work" and had no reason to apologize for their industry - which has been faulted for creating opaque and complex financial transactions that helped bring down the likes of Enron." The Financial Times wrote that Gramm said, "derivative dealers have helped make the economy more resilient to recession" by spreading risk. "'When you're defending your interest, you're defending the public interest," he said. "But," the Times noted, "how many noted Gramm's admission earlier on in his speech? 'I find as I get older, I know less."" [11]

CONTINUE...

http://my.democrats.org/page/content/wiki/gramm/

It must be a code for The Aspens, doing God's work.

whatchamacallit

(15,558 posts)Wake up America!

Octafish

(55,745 posts)

Forensic economist and former Fed regulator William K. Black wrote it reminds him of what happened during the Savings and Loans Crisis of the late 80s and early 90s. At the time, that was the greatest heist in history.

KoKo

(84,711 posts)and there are other photos of both Clintons chumming it up at social events and political gatherings. Yet no photos of former President Carter chumming, that I have ever seen.

![]()

Octafish

(55,745 posts)

By Peter Dale Scott

WhoWhatWhy.com on Nov 2, 2014

The Safari Club was an alliance between national intelligence agencies that wished to compensate for the CIA’s retrenchment in the wake of President Carter’s election and Senator Church’s post-Watergate reforms. As former Saudi intelligence chief Prince Turki bin Faisal once told Georgetown University alumni,

In 1976, after the Watergate matters took place here, your intelligence community was literally tied up by Congress. It could not do anything. It could not send spies, it could not write reports, and it could not pay money. In order to compensate for that, a group of countries got together in the hope of fighting Communism and established what was called the Safari Club. The Safari Club included France, Egypt, Saudi Arabia, Morocco, and Iran. (1)

After Carter was elected, the Safari Club allied itself with Richard Helms and Theodore Shackley against the more restrained intelligence policies of Jimmy Carter, according to Joseph Trento. In Trento’s account, the dismissal by William Colby in 1974 of CIA counterintelligence chief James Angleton,

combined with Watergate, is what prompted the Safari Club to start working with (former DCI Richard) Helms (then U.S. Ambassador to Iran) and his most trusted operatives outside of Congressional and even Agency purview. James Angleton said before his death that “Shackley and Helms … began working with outsiders like Adham and Saudi Arabia. The traditional CIA answering to the president was an empty vessel having little more than technical capability.”(2)

Trento adds that “The Safari Club needed a network of banks to finance its intelligence operations. With the official blessing of George Bush as the head of the CIA, Adham transformed . . . the Bank of Credit and Commerce International (BCCI), into a worldwide money-laundering machine.”(3) Trento claims also that the Safari Club then was able to work with some of the controversial CIA operators who had been forced out of the CIA by Turner, and that this was coordinated by Theodore Shackley:

Shackley, who still had ambitions to become DCI, believed that without his many sources and operatives like (Edwin) Wilson, the Safari Club—operating with (former DCI Richard) Helms in charge in Tehran—would be ineffective. . . . Unless Shackley took direct action to complete the privatization of intelligence operations soon, the Safari Club would not have a conduit to (CIA) resources. The solution: create a totally private intelligence network using CIA assets until President Carter could be replaced. (4)

During the 1980 election campaign each party accused the other of plotting an October Surprise to elect their candidate. Subsequently other journalists, notably Robert Parry, accused CIA veterans on the Reagan campaign, along with Shackley, of an arguably treasonable but successful plot with Iranians to delay return of the U.S. hostages until Reagan took office in January 1981. (5)

SNIP...

The oil majors’ manipulation of domestic oil prices, combined with Carter’s failure to bring the hostages home, combined to cause the first defeat for an elected president running for reelection, since that of Herbert Hoover in 1932.

CONTINUED...

http://whowhatwhy.com/2014/11/02/the-deep-state-plots-the-1980-defeat-of-jimmy-carter/

Jimmy tried to do what the others didn't -- end the U.S.A.'s dependency on fossil cough Saudi fuels.

KoKo

(84,711 posts)That photo sure captures The Gap!

Tierra_y_Libertad

(50,414 posts)Octafish

(55,745 posts)

Thanks, mopes!

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

There's always welfare for the wealthy, but justice for pensioners who worked for the City of Detroit? Not so much.