Democratic Primaries

Related: About this forumMedicare for All Would Give Workers 'Biggest Take-Home Pay Raise in a Generation'

Last edited Mon Nov 4, 2019, 02:26 PM - Edit history (1)

Once again economists have pointed out that single payer health care is more economical than our current system.

https://www.commondreams.org/news/2019/10/25/two-leading-economists-say-medicare-all-would-give-workers-biggest-take-home-pay

"Insurance premiums are the most regressive possible type of tax: a poll tax. The secretary pays the same amount as the executive," Saez and Zucman wrote. "Proposals such as Medicare for All would replace the current privatized poll tax by taxes based on ability to pay. Some believe that it would result in a big tax increase for America's middle class."

But the Medicare for All legislation authored by Sen. Bernie Sanders (I-Vt.) and backed by Sen. Elizabeth Warren (D-Mass.) "would, in fact, lead to large income gains for the vast majority of workers" by eliminating private health insurance premiums, Saez and Zucman said."

"Take again the case of a secretary earning $50,000 in wage and currently contributing $15,000 through her employer to an insurance company. With universal health insurance, her wage would rise to $65,000—her full labor compensation. With an income tax of 6%—which, if applied to a base large enough, would be enough to fund universal health insurance—she would have to pay about $4,000 more in tax. But the net gain would be enormous: $11,000. Instead of taking home $50,000, the secretary would take home $61,000."

:large

:large

Robert Pollin, an economist at the University of Massachusetts Amherst and author of a 2018 study that found Medicare for All could save the U.S. $5.1 trillion over 10 years, told the Post that two-thirds of the single-payer program can be funded by redirecting existing government healthcare spending from Medicare, Medicaid, and the Department of Veterans Affairs.

Pollin emphasized to the Post that the basics of funding Medicare for All "are very simple."

"It drives me nuts when people say this is so complicated. It's not," Pollin said.

primary today, I would vote for: Undecided

SterlingPound

(428 posts)primary today, I would vote for: Undecided

calimary

(81,220 posts)primary today, I would vote for: Joe Biden

Will help so many.

primary today, I would vote for: Undecided

Cartaphelius

(868 posts)a benefit reserved primarily those who usually

pay little to nothing to start, would even be better!

primary today, I would vote for: Undecided

InAbLuEsTaTe

(24,122 posts)

Bernie/Elizabeth or Elizabeth/Bernie 2020!!

Either way, they're stronger together!!

Welcome to the revolution!!!

primary today, I would vote for: Undecided

TexasTowelie

(112,128 posts)If they can't start the argument without telling a lie, then the rest of the argument isn't worth reading.

primary today, I would vote for: Joe Biden

mjvpi

(1,388 posts)Respectfully, Pease read the entire post. Americans already spend 19.8% of GDP on health care. What we, as a country need to do, is to look at how we are spending that money. Health insurance is a valuable part of many American’s compensation package. Employers don’t provide it out of the goodness of their hearts. Wages are lower because "benefits " are provided. People are paying for their own health insurance, their employer just collects it and pays it for you, and gets to use it as a tax deduction even though you couldn’t deduct it if you were paid the money and bought the insurance on your own.

primary today, I would vote for: Undecided

brooklynite

(94,503 posts)Good to know.

primary today, I would vote for: Joe Biden

zeusdogmom

(990 posts)Nary a company I have ever worked for would voluntarily give their employees the difference. And forcing them to do so? Good luck with that.

It is good we are talking about how to pay for medical care for all. So many different ideas - all with some pretty major hurdles/flaws - but lets keep talking with open minds. Eventually we will get there but it is not a "my way or else" proposition.

primary today, I would vote for: Undecided

Buzz cook

(2,471 posts)Many people point to the failure of the US auto industry in 2008 as an example of how health insurance costs can be an insurmountable burden for US industry.

While other industrialized countries industries had set back due to the world wide recession none need the billions of dollars in bail out that US industry did.

Our current system is unsustainable. It has a deleterious effect on industry as well as workers.

primary today, I would vote for: Undecided

JudyM

(29,233 posts)hit hard and often unpredictably by shouldering their portion of employees’ insurance, and they’d prefer to go with Medicare for all. Too tired to look for it now ![]()

primary today, I would vote for: Undecided

emmaverybo

(8,144 posts)neither do their employers for a single policy. That is more than 1,000 per month. In any case, how will employers be forced to pay the cost out to employees?

Oh, and now M4All will bring on a significant tax increase?

This is all very complicated.

primary today, I would vote for: Joe Biden

Abnredleg

(669 posts)But we have amazingly good insurance. Nothing out of my paycheck and total out of pocket of $250. We do this through a combination of a high-deductible insurance policy and self insurance.

Given this, I would think $15,000 would be at the high end of what employers pay.

primary today, I would vote for: Undecided

emmaverybo

(8,144 posts)around sixty, for 100 percent coverage, no deductible, very low prescription costs. In retirement, I pay no premium for a Medicare with supplemental and my benefits cover my Medicare fee. So I get why some many millions might want to keep their employer-provided or retirement benefits provided.

We have to have coverage for people between employment. I thought Obamacare ran lower than that for one policy.

In any case, Medicare4All can not be rolled out for some time, so your having to pay such a high cost persists, no?

primary today, I would vote for: Joe Biden

Abnredleg

(669 posts)Our broker said she’s never seen a plan that that offers as much as ours does.

primary today, I would vote for: Undecided

Fiendish Thingy

(15,585 posts)And the demographics of the employees.

Smaller companies have a higher risk pool and get charged higher premiums.

Big companies have a more diverse risk pool, as well as greater profit generating, and get lower premiums through volume discounts.

I worked for a county govt., and our union had 15,000 members, so could negotiate a Cadillac/Platinum plan with no deductible, low copay, $35 premium/mo for a family of 4.

My brother works for a small copy machine repair company, maybe 100-200 employees. He pays over a thousand a month in premiums, plus high deductible and high copays.

My son and his fiancée are covered through her Nike corporate policy- no premiums, moderate deductible, low copay.

M4A eliminates all of that - no one will be dependent upon winning the employer lottery for the type of coverage they get.

The question I haven't heard asked of those who oppose M4A is "how do you justify your position to the millions who will still be without adequate healthcare, or will have such poor benefits that they risk bankruptcy, or have to choose between buying groceries and going to the doctor?"

primary today, I would vote for: Undecided

emmaverybo

(8,144 posts)everyone is altruistic. And there are other options for getting affordable healthcare for all than M4All that give those less altruistic choice. We are talking many millions here, state and fed workers across a number of professions and many union workers. Also, retirees whose plans carried over in benefits.

primary today, I would vote for: Joe Biden

wasupaloopa

(4,516 posts)Payment based on your ability to pay!

EASY!

No new contortions to go through. Add it onto the ACA.

If we win big in 2020 it could become law in a year's time.

primary today, I would vote for: Undecided

Fiendish Thingy

(15,585 posts)primary today, I would vote for: Undecided

wasupaloopa

(4,516 posts)primary today, I would vote for: Undecided

mjvpi

(1,388 posts)I can’t imagine that it would be an onerous burden, given that companies treat benefits as pay in terms of their taxes. I’m sure that they put a value on them and keep careful records of them.

primary today, I would vote for: Undecided

Sienna86

(2,149 posts)It’s time.

primary today, I would vote for: Undecided

InAbLuEsTaTe

(24,122 posts)Thankfully, Bernie and ELIZABETH get it... one of whom will be rewarded with the Democratic nomination for President!!

Bernie/Elizabeth or Elizabeth/Bernie 2020!!

Either way, they're stronger together!!

Welcome to the revolution!!!

primary today, I would vote for: Undecided

turbinetree

(24,695 posts)and now we see what Warren and Sanders are / have talking about.........................here is a oldie but goodie..................

primary today, I would vote for: Undecided

YOHABLO

(7,358 posts)primary today, I would vote for: Undecided

InAbLuEsTaTe

(24,122 posts)

Bernie/Elizabeth or Elizabeth/Bernie 2020!!

Either way, they're stronger together!!

Welcome to the revolution!!!

primary today, I would vote for: Undecided

dsc

(52,155 posts)which in many cases won't happen. My employer spends about 5500 per employee (only employee is covered we pay full freight to add spouses and children). I won't see a penny of that 5500 if MFA passes. Not one penny. People insuring children and spouses, of course, will but single people like me not a cent.

primary today, I would vote for: Joe Biden

Autumn

(45,057 posts)an example pays $15,000 for her share, out of her check. With MFA she is no longer paying that $15,000. Instead, she will pay an increased tax of $4.000. Also, your employer can offer MFA as part of your compensation package, at a much cheaper cost to them.

primary today, I would vote for: Undecided

dsc

(52,155 posts)her employer spends that. As to me I pay $50 a month for 10 months or $500 a year. I make 61,000 a year from that job and about 5k from other things. Call it $65,000 4% of that is $2600. Now, to be fair in years I have medical expenses that take out my entire deductible I would likely be better off but in other years I would be worse off. That said, I don't have an actual problem with that but we should be honest.

"Take again the case of a secretary earning $50,000 in wage and currently contributing $15,000 through her employer to an insurance company. With universal health insurance, her wage would rise to $65,000—her full labor compensation. With an income tax of 6%—which, if applied to a base large enough, would be enough to fund universal health insurance—she would have to pay about $4,000 more in tax. But the net gain would be enormous: $11,000. Instead of taking home $50,000, the secretary would take home $61,000."

If she were paying the 15k her current take home would be 35k not 50k.

primary today, I would vote for: Joe Biden

Autumn

(45,057 posts)company provides. Before I retired I paid $500 a month for my share of my company-provided health insurance. That covered only me. My husband's share of his insurance through the state cost him $245 after the kids turned 18 and were off his insurance.

As an aside before I qualified for Medicare I had Humana through the exchange. Out of state, out of network had a kidney stone too large to pass. 2 years later I'm on the hook and still paying off the $19,000 hospital bill. They were kind enough to give me Medicare rates, even though I wasn't on Medicare since Humana wouldn't pay for it.

primary today, I would vote for: Undecided

I teach math for a living so I know how to add numbers.

"Take again the case of a secretary earning $50,000 in wage and currently contributing $15,000 through her employer to an insurance company. With universal health insurance, her wage would rise to $65,000—her full labor compensation. With an income tax of 6%—which, if applied to a base large enough, would be enough to fund universal health insurance—she would have to pay about $4,000 more in tax. But the net gain would be enormous: $11,000. Instead of taking home $50,000, the secretary would take home $61,000."

Her salary is 50k, 50k + 15K = 65K Clearly she is currently taking home 50k. Under your numbers she would be taking home 35k. This is directly from the OP. The OP and the article envisions that the employer would be paying its share to her.

primary today, I would vote for: Joe Biden

Autumn

(45,057 posts)a share of my insurance I'm considering that is her share of provided health insurance that the company withholds from her paycheck and the company pays a share. If you are not having to pay a share of your insurance every month that is more money in your pocket. My share for my $500 a month was for an HMO with high deductibles.

primary today, I would vote for: Undecided

dsc

(52,155 posts)but clearly they are counting what the employer pays as money that would be going to her. Otherwise the numbers don't work. The one and only way they can be getting to 65k is to be adding it to 50k. And the only way that works is if her employer is paying it.

primary today, I would vote for: Joe Biden

Autumn

(45,057 posts)for her share that would bring her takehome pay up to 61 thousand since she no longer has to pay that that share and she would see a tax increase on her wage of $4000 for MFA resulting in a savings of $11,00. The article should have made the distinction between what she pays and what her employer pays. A $15,000 share of your employee provided insurance is not unreasonable if you insure a family. I paid my share of $6,000 a year for myself.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)It's the employers contribution to the insurance company as a benefit to the lady employee.

This article envisions that under M4A that the employees base pay of $50k would be increased to $65k when the employer stopped paying the premium(benefit) and gave it to the employee.

That's not going to happen.

primary today, I would vote for: Undecided

Autumn

(45,057 posts)from my employer was deducted from my check $250 bi-weekly and the company paid their share. It doesn't say anywhere in the article that her insurance cost the company $15,000 and the company paid the whole amount. I personally have never worked for a company that picked up the complete tab for my insurance.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)And I paid almost $11k/yr per employee....which is exactly what this article is saying..(its a commondreams c&p btw)..but it refers to a Guardian article by Saez and Zucman....says..." The rest of the population must obtain coverage by a private company, which they typically get via their employers. Insurance, in that case, is funded by non-tax payments: health insurance premiums.

Although they are not officially called taxes, insurance premiums PAID BY EMPLOYERS are just like taxes – but taxes paid to private insurers instead of paid to the government."

primary today, I would vote for: Undecided

Autumn

(45,057 posts)based on the knowledge of how my employer-provided insurance was deducted from my check.I contributed, through my employer, $500 out of my check per month which came to $6.000 a year out of my checks and it covered only myself. ![]()

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)Warren says employer contributions will go to the govt as a funding source. for M4A when private insurances is killed

"Where the $20.5 trillion comes from

"Employers are one of the main sources of revenue in this proposal. Warren says she would raise nearly $9 trillion here, a figure that comes from the roughly $9 trillion private employers are projected to spend over the next decade on health insurance. The idea here is that instead of contributing to employees' health insurance, employers would pay virtually all of that money to the government."

https://www.npr.org/2019/11/01/775339519/heres-how-warren-finds-20-5-trillion-to-pay-for-medicare-for-all

primary today, I would vote for: Undecided

Autumn

(45,057 posts)I chose not to have insurance for the first two years I worked there because I was covered under my husbands. MFA will be allowed to be offered by employers to their employees at considerable savings to the company.

primary today, I would vote for: Undecided

wasupaloopa

(4,516 posts)they don't since it is a government plan and then you say they save money!

That is the most convoluted type of thinking there is!

primary today, I would vote for: Undecided

Autumn

(45,057 posts)Bernie said that his MFA can be offered by employers to their employees at savings to them. Liz is talking about taxing the companies to pay for M4A. It's not double talk it's discussing the current two plans for MFA. Nothing is set in stone, we know that from the ACA. It will be hashed out when it's time to start implementing it.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)$5-6-8k....depending on the plan.

I picked up all but $1200 of my peoples coverage...$12k+/yr

Absolutely not are the companies saving...Sen Warren said so...

I linked the article...their taxes are going up and the insurance payments they pay as part of a benefit package will go to the Govt...not the employee.

primary today, I would vote for: Undecided

dsc

(52,155 posts)She has a 50k salary (not after having 15k withheld but a 50k salary and insurance provided by her employer at a cost of 15K). That is the only way she would have 65k if she got the 15k the employer is spending were given to her.

primary today, I would vote for: Joe Biden

mjvpi

(1,388 posts)Why couldn’t we, as a country, require companies to pay their employees exactly the amounts that they deduct on their taxes as expenses related to employment. They pay x amount per employee to an insurance company. The new law is they now have to pay that same x to the employee.

Different, not complicated. The same goes different places on payday.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)and pay that amount to the Govt...instead of the employees benefit package

"Employers are one of the main sources of revenue in this proposal. Warren says she would raise nearly $9 trillion here, a figure that comes from the roughly $9 trillion private employers are projected to spend over the next decade on health insurance. The idea here is that instead of contributing to employees' health insurance, employers would pay virtually all of that money to the government."

https://www.npr.org/2019/11/01/775339519/heres-how-warren-finds-20-5-trillion-to-pay-for-medicare-for-all

primary today, I would vote for: Undecided

wasupaloopa

(4,516 posts)primary today, I would vote for: Undecided

Autumn

(45,057 posts)primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)primary today, I would vote for: Undecided

Autumn

(45,057 posts)package to attract and keep good employees. Talk health insurance off the table and they will have to use something else. More money, childcare, family leave and other things families need.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)Also your idea that the woman was paying $15k out of her check....she wasn't.

Once private plan HI is killed.....they still have to pay the govt for M4A....per Warrens plan. Now you want them to come up with more on top of that Govt. payment......NOT going to happen.

primary today, I would vote for: Undecided

Autumn

(45,057 posts)you are talking about. ![]() I stated that I myself contributed $500 a month, $6,000 a year through my employer to an insurance company and my employer contributed their share. Had I not had to purchase health insurance I would have had $6,000 more per year in disposable income from my paychecks.

I stated that I myself contributed $500 a month, $6,000 a year through my employer to an insurance company and my employer contributed their share. Had I not had to purchase health insurance I would have had $6,000 more per year in disposable income from my paychecks.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)They will now have to give it to the Govt to pay for M4A..

primary today, I would vote for: Undecided

forthemiddle

(1,379 posts)Higher than minimum wage.

How would they ever mandate what a company pays their employees?

primary today, I would vote for: Undecided

Buzz cook

(2,471 posts)Whether its in cash or services. Trying to treat health insurance as a separate and independent thing from her salary is just clouding the issue.

primary today, I would vote for: Undecided

dsc

(52,155 posts)my whole point is that many, if not most, employers are not going to pay that money to employees if MFA passes tomorrow. Mine would never do so.

primary today, I would vote for: Joe Biden

Buzz cook

(2,471 posts)What is the point of compensation? Isn't it so business can attract and keep employees?

What you are saying is that once M4A passes employers would be less likely to want to attract and keep employees. Just so you remember, unemployment is still low. Quality employees are in demand. Workers are more mobile than ever before.

If a worker gets shat upon the will seek employment elsewhere. Supply and demand work with the labor force as well.

Legally we have the ACA.

http://foslaw.com/news-views/affordable-care-act-creates-a-new-protected-class-2/

Recently, a new, less obvious protected class was added by the Affordable Care Act (“ACA”) — health care subsidy recipients. The ACA created a new section of the Fair Labor Standards Act (FLSA) to protect employees from employer retaliation for receiving an ACA subsidy or tax-credit.

M4A is a health care subsidy and that can be strengthened in the new law. Wording that compensation can not be reduced because of the M4A act would be easy to write.

primary today, I would vote for: Undecided

dsc

(52,155 posts)First unemployment has been very low for the past five years. Starting in 2014 it was 5.6% and is now 3.1%. In that time the median income adjusted for inflation went up about 7k out of 54k or a bit above 13%. The vast majority of that occurred from 2014 to 2015. Here you would have an employee who would be no worse off for not having the money (they had health insurance before and would still have it). The employer under Warren would have 98% of that savings taken away. Under Sanders it would be a bit less taken away but the employee would be taxed more. Under if the employer gives the employee anything more than $300 they are worse off. Under Sanders I am less sure of numbers. But in any case, the labor market hasn't reacted all that much to the lower unemployment rate.

primary today, I would vote for: Joe Biden

Buzz cook

(2,471 posts)Has been kept artificially low since Reagan.

In part that explains record corporate profits.

Your 98% figure needs a citation.

The employee gets a net tax cut.

M4A will cost trillions less than our current system.

https://www.commondreams.org/news/2018/11/30/easy-pay-something-costs-less-new-study-shows-medicare-all-would-save-us-51-trillion

I don't have much sympathy for employers.

https://www.motherjones.com/kevin-drum/2017/07/corporations-are-raking-in-record-profits-but-workers-arent-seeing-much-of-it/

https://www.wealthdaily.com/articles/wages-vs-corporate-profits/88939

In a nutshell, wages are falling as corporate profits are rising. This chart shows the disparity as a percentage of total U.S. GDP. Since the mid-'70s, wages as a percentage of GDP have fallen 7%, while corporate profits have risen 7%. That's a pretty compelling relationship.

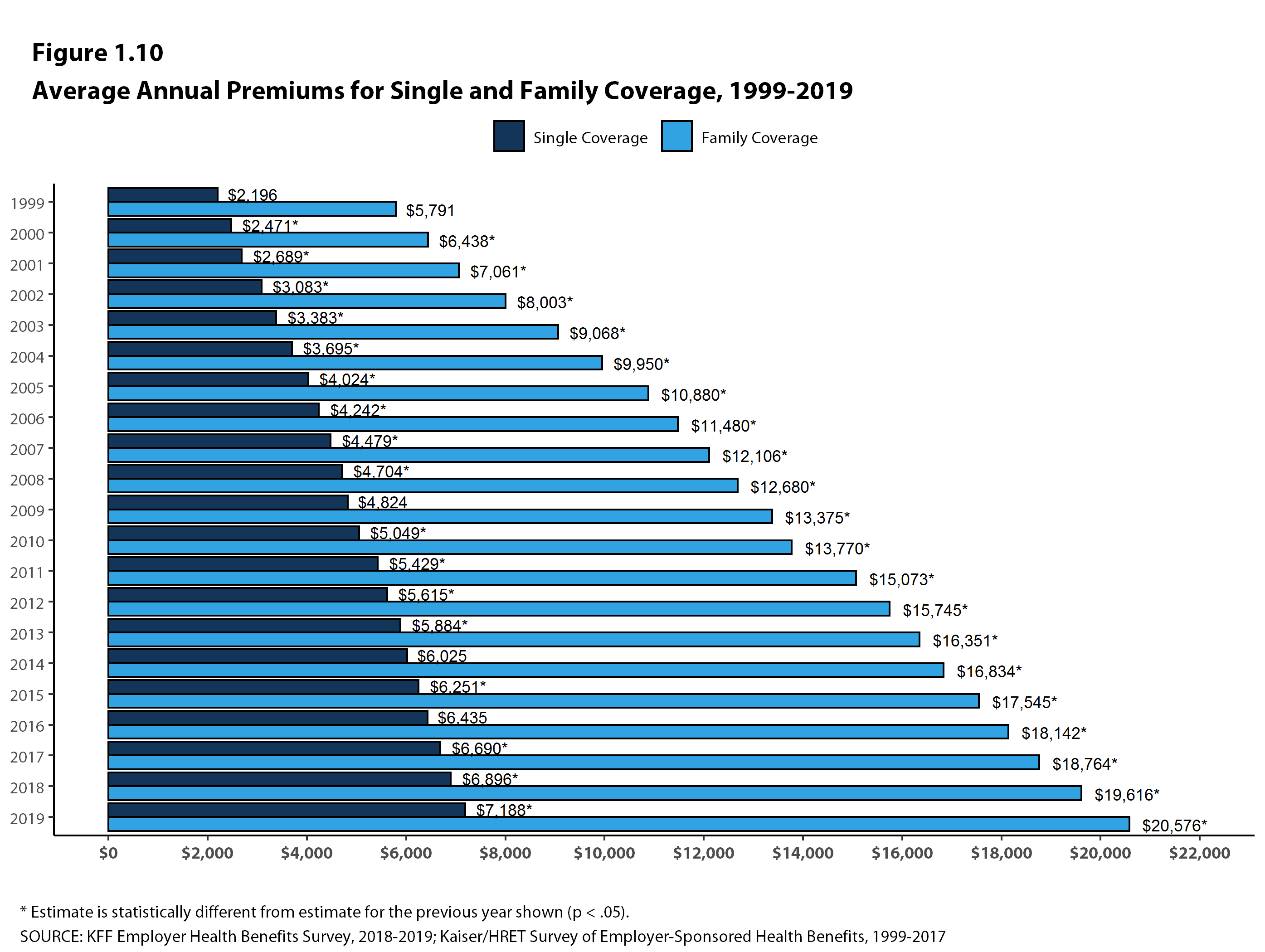

https://www.kff.org/interactive/premiums-and-worker-contributions-among-workers-covered-by-employer-sponsored-coverage-1999-2019/

Health care burden on workers increases every year.

https://www.kff.org/report-section/ehbs-2019-section-1-cost-of-health-insurance/

?w=698

?w=698

Our current system is unsustainable. The cost to workers and companies will drown both in not too many years.

Mayor Pete was for M4A in February. In fact he called single payer the compromise position.

This might upset you. I disagree with the language but the facts are self evident.

&lc=z23ixxyhyu34utgjl04t1aokgl3g2icuoalcyfvhwct2bk0h00410

primary today, I would vote for: Undecided

Hoyt

(54,770 posts)And, Warren's recent cost projection increased from $34 Trillion over 10 years to $52 Trillion.

primary today, I would vote for: Joe Biden

emmaverybo

(8,144 posts)primary today, I would vote for: Joe Biden

mjvpi

(1,388 posts)Why can’t we, as a country, simply require the amount that they pay to health insurance companies per employee, be paid to the employee. Currently, the United States is paying 19.8% of our GDP on healthcare. That is around $3.4 trillion a year. We have millions of people who are in employed and millions more who are under insured.

I believe that our country can do better. Big, systemic changes are needed.

primary today, I would vote for: Undecided

Hoyt

(54,770 posts)toward the funding of MFA.

In fact, that is her biggest funding source, supposedly. More than her wealth tax, etc. So, not sure there will be any money to increase pay based solely on "savings" from health insurance.

primary today, I would vote for: Joe Biden

wasupaloopa

(4,516 posts)primary today, I would vote for: Undecided

Buzz cook

(2,471 posts)Frequently at different rates, but it is taxable.

primary today, I would vote for: Undecided

Snackshack

(2,541 posts)...and more importantly IMO allow people to make choices in employment or take risks they normally would not take in business ventures.

primary today, I would vote for: Undecided

mjvpi

(1,388 posts)But change is frightening.

primary today, I would vote for: Undecided

Autumn

(45,057 posts)other things can take the place of insurance. Higher wages, family leave, childcare costs and other important things.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)Now you want them to come up with more money....they didn't get a big windfall of cash back to their ledger with M4A

primary today, I would vote for: Undecided

Autumn

(45,057 posts)if they choose to at a big savings, if it's cheap enough there is no reason for employers to be involved in people's healthcare. My post was about other things employers can offer when heath insurance is off the bargaining table.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)I linked you the NPR article...no saving for companies.

Read this about Bernie's deal.....that he has never been able to get passed in all his career.

https://www.vox.com/2019/4/10/18304448/bernie-sanders-medicare-for-all

primary today, I would vote for: Undecided

Autumn

(45,057 posts)until now. Even Obama says that MFA is a good idea. I read Bernie's actual MFA bill.

primary today, I would vote for: Undecided

AncientGeezer

(2,146 posts)And the minute voters know their being forced into this, that private plans are being stripped from them...it's going to be 2010 and '14 all over again.

primary today, I would vote for: Undecided

wasupaloopa

(4,516 posts)Today some people get health care insurance from their employer, many do not. If you opt out of coverage you do not have your portion of the premium deducted from your salary. That results in more net pay but it is not a salary increase. Also your employer does not have the expense of covering you so he/she has more net income by the amount not paid on your behalf.

That is the truth. Anything else made up about it is a lie.

If you have to lie to sell product there is something wrong with it which you try to hide.

primary today, I would vote for: Undecided

andym

(5,443 posts)that is not achieved with programs such as just creating a public option is reversing the increasing cost curve for health care. How? By using the combined power of all US consumers to negotiate with medical providers, drug companies and medical device companies huge savings can be effected.

For example, $1 million drugs will become nonviable, but just because the drug company might get 10x less money in some cases, they will still make a profit. Doctors might earn salaries more in line with Britain and Canada than they do now.

The biggest "pay raise" in history should sell itself to voters-- it is rhetorical--what she really means is that the money individuals are paying toward their care will now go into their pocket, but there will always be conservative skeptics who don't trust government or want change.

primary today, I would vote for: Joe Biden

Aaron Pereira

(383 posts)Last edited Sun Nov 3, 2019, 06:21 PM - Edit history (1)

I'll have more money in my pocket with better coverage. I'll pay a little more in tax but I'll enjoy a substantial net savings when my insurance premiums disappear.

primary today, I would vote for: Undecided

mathematic

(1,439 posts)It invents a fully funded M4A system and then claims that current employer premiums could then be redirected to employees.

THE WARREN PLAN TAXES COMPANIES FOR THESE PREMIUMS.

They can't go to employees because they are going to the federal government. Nobody will see a raise.

primary today, I would vote for: Joe Biden

AncientGeezer

(2,146 posts)"Employers are one of the main sources of revenue in this proposal. Warren says she would raise nearly $9 trillion here, a figure that comes from the roughly $9 trillion private employers are projected to spend over the next decade on health insurance. The idea here is that instead of contributing to employees' health insurance, employers would pay virtually all of that money to the government."

https://www.npr.org/2019/11/01/775339519/heres-how-warren-finds-20-5-trillion-to-pay-for-medicare-for-all

primary today, I would vote for: Undecided

The Mouth

(3,148 posts)Please show any evidence that what employers save will end up in employees' paychecks.

Employers will take what they save, and pay it as bonuses and dividends.

A classic case of the facts being correct but the conclusion drawn from them being completely unsustained.

Employers will be obliged to take very cent they aren't paying for employee health insurance and reward shareholders, minus executive bonuses.

primary today, I would vote for: Undecided

duforsure

(11,885 posts)Are running a negative campaign to scare and lie to the American people.That's why republicans have made it where insurance can make Medicare pay your medical bills first , or basically subsidizing Medicare and still collects there sky high monthly premiums. They are jacking our costs up for health care, along with big pharma whose given millions to trump and the republicans in office. It's a scam, and private insurance and big pharma is why our system is so costly.

primary today, I would vote for: Joe Biden

redstatebluegirl

(12,265 posts)I will turn 65 in a few months. In order to get the same coverage I have with my insurance at my work, it will cost me $700 a month. This is in medicare, part D and supplemental. I have pre-existing conditions, as most people my age do. It is not a panacea, it is not the answer, it may be the answer for some but certainly not all. I think a combination of private insurance, and some kind of public option that is affordable is the way to go.

primary today, I would vote for: Joe Biden

SoCalNative

(4,613 posts)Not always true. My company bases the percentage employees pay on their salaries.

primary today, I would vote for: Joe Biden