eridani

eridani's JournalCost Still a Barrier Between Americans and Medical Care

One in three Americans say they have put off getting medical treatment that they or their family members need because of cost. Although this percentage is in line with the roughly 30% figures seen in recent years, it is among the highest readings in the 14-year history of Gallup asking the question.

Last year, many hoped that the opening of the government healthcare exchanges and the resulting increase in the number of Americans with health insurance would enable more people to seek medical treatment. But, despite a drop in the uninsured rate, a slightly higher percentage of Americans than in previous years report having put off medical treatment, suggesting that the Affordable Care Act has not immediately affected this measure.

The percentage of Americans with private health insurance who report putting off medical treatment because of cost has increased from 25% in 2013 to 34% in 2014.

This year, 22% of Americans say they have put off medical treatment for a "very" or "somewhat serious" condition.

One of the goals of opening the government exchanges was to enable more Americans to get health insurance to help cover the costs of needed medical treatments. While many Americans have gained insurance, there has been no downturn in the percentage who say they have had to put off needed medical treatment because of cost

http://www.nytimes.com/2014/12/02/upshot/underinsurance-remains-big-problem-under-obama-health-law.html

The A.C.A. has not done as much as many had hoped it would to reduce underinsurance. In fact, it may be helping to spread it. And proposed modifications to the law, like those that would introduce a new tier of “copper” plans in addition to bronze, silver, gold and platinum, might make underinsurance worse.

The point of having insurance is to be able to get care when you need it, without too large a financial burden. Underinsured Americans are not receiving this benefit, though. They can’t get the care they need. Twenty-seven percent of adults with a deductible large enough to render them underinsured didn’t see the doctor when they were sick; 23 percent didn’t get a preventive care test; 29 percent skipped a test, treatment or follow-up appointment; and 22 percent didn’t see a specialist to whom they were referred. Forty percent of them had at least one of these cost-related access problems.

These are people who had private health insurance for the full year. They are not the uninsured.

In the quest for universal coverage, it’s important that we not lose sight of “coverage” in order to achieve “universal.” The point of improving access is, after all, to make sure that people can get, and afford, care when they need it.

Comment by Don McCanne of PNHP: Health care reform should have eliminated underinsurance, not create more of it. The private insurance industry will not fix this problem but only compound it as it strives to keep its premiums competitive.

We need to replace the private insurers with our own single payer program. For some, Medicare is also underinsurance. We need to fix that and then provide it to everyone.

(Posted as a comment on the NYT website as a response to Aaron Carroll’s article.)

Hospital's lack of contract renewal with insurers unknowingly puts patients out of network

http://www.georgiahealthnews.com/2014/11/grady-blue-cross-impasse-contract-expires/

Contract standoffs between hospital systems and health insurers typically have a way of being resolved — often right before a deadline.

But high-stakes negotiations between Grady Health System and Georgia’s biggest insurer failed to produce a new contract before the midnight deadline Sunday.

That means Grady Memorial Hospital is now “out of network” for Blue Cross and Blue Shield of Georgia members. Patients with Blue Cross insurance will face higher out-of-pocket costs at the Atlanta hospital and its clinics.

Lindsay Caulfield, senior vice president of public affairs at Grady, said in a statement Monday that Blue Cross “pays our health system up to 70 percent less than it pays other Georgia hospitals. By paying us unfairly low rates, Blue Cross Blue Shield has long put Grady at a disadvantage and threatens our long-term sustainability.”

Grady proposed several compromise plans, Caulfield said, “but Blue Cross continually refused to move in their position in any meaningful way.”

The lack of an agreement will affect Blue Cross in trauma services, where Grady has a strong profile, Smith said. But he added that he believes the two sides will eventually reach a new deal. “It’s going to be very difficult for any hospital not to have the largest payer in the state,’’ he said.

Comment by Don McCanne of PNHP: We’ve heard similar stories many times before. The largest insurer in Georgia, WellPoint’s Blue Cross and Blue Shield of Georgia, has been unable or unwilling to negotiate a contract renewal with Grady Memorial Hospital, the home of one of the most prominent trauma centers in the nation.

Although Grady will continue to provide emergency services, it is the patients who will be exposed to excessive costs, only because we have a system in which we insist that private, for-profit, autonomous corporations be allowed to take charge of our health care dollars.

The solution is obvious - fire WellPoint and the other private insurers and replace them with our own single payer national health program - an improved Medicare that covers everyone.

Maybe You Don't Need Long-Term Care Insurance After All

http://www.bloomberg.com/news/2014-11-12/maybe-you-don-t-need-long-term-care-insurance-after-all.htmlhttp://crr.bc.edu/briefs/long-term-care-how-big-a-risk/

Mediciad.gov - Community-Based Long-Term Services & Supports

http://www.medicaid.gov/affordablecareact/provisions/community-based-long-term-services-and-supports.html

The biggest threat to a retiree's nest egg isn't a stock market crash. It's a long illness requiring round-the-clock care.

The statistics behind that scenario -- $81,000 a year for a nursing home, $184,000 for 24-hour home care -- are what sells long-term care insurance policies. But while past research suggested that many more people needed the coverage than bought it, a new study suggests that most people should just skip it.

The study, by Boston College's Center for Retirement Research, focused on singles, who now make up the majority of Americans. Long-term care insurance makes financial sense only for the richest 20 to 30 percent of unmarried people, it finds. For the rest, it makes more sense to go without. If they need care, spending down their assets and then letting Medicaid pick up the tab is the most practical solution.

Long-term insurance can pay off for wealthier singles, even under the Center’s new math. It takes $260,405 in assets, or about $90,000 in annual income, to put a household in the top 25 percent, the Russell Sage Foundation and the Congressional Research Service estimate. These affluent customers can afford the premiums, and insurance can protect their heirs' inheritance if that's a goal. The same logic works for couples, but only if they're even wealthier. Webb warns that forthcoming research will show long-term care insurance makes even less sense for married couples than it does for singles.

Comment by Don McCanne of PNHP: The Affordable Care Act included Senator Ted Kennedy’s Community Living Assistance Services and Supports Act (CLASS Act) which would have provided long-term care. Unfortunately the specifics of the CLASS Act proved to be unworkable and thus it has been suspended. But according to this new study, unless you are wealthy, you do not need long-term care insurance anyway. Most of us can simply spend down our assets and then Medicaid will take care of us.

Think about how that could apply to the increasing use of patient cost-sharing, especially the ever-higher deductibles. We could eliminate individual health insurance coverage. When individuals are faced with expensive acute or chronic conditions, they could simply spend down their assets and then go on Medicaid to cover their future health care costs.

The obvious flaw in all of this is that it would require near destitution for us to have our heath care expenses covered. Other nations automatically cover these expenses for everyone without forcing them to relinquish their assets. It is a sad commentary that we accept the policy that a person must go broke before we will provide them with long-term care. This should not happen in a caring society.

But what are we doing with moderate-income individuals and families right now? We are requiring cost-sharing, especially deductibles, at a level that wipes out liquid assets for many of them, if they even have such assets. Financial hardship has become an expected consequence for far too many people who have significant medical needs. It is primarily wealthier individuals and families who have the assurance of being able to obtain health care without losing their assets.

Long-term care should be covered by our health care financing system, and significant cost-sharing should be eliminated. A single payer system would ensure that all of us could get the care we need, including long-term care, without adverse financial consequences.

If we really do expect that people should use their personal assets to contribute to the financing of health care, do it through estate taxes, but make the taxes equitable, that is, progressive. Do not take away from our seniors what little they have in the final years of their lives.

And do not charge the estate specifically for the amount of health care that was given. We shouldn’t deprive families of their modest inheritances just because medical bills were high late in life. Estate tax rates should not apply to smaller estates, but then the rates should increase with the size of the estate, unrelated to whatever health care costs the family faced. Yes, the rich would pay more, but that’s the way it should work in a caring society.

My Insurance Company Killed Me, Despite Obamacare

http://www.thedailybeast.com/articles/2014/11/24/how-the-health-care-bureaucracy-killed-me.htmlMalcolm MacDougall, a prominent speechwriter and creative director, was diagnosed with prostate cancer earlier this year. Even after the passage of the Affordable Care Act, his insurance company delayed and denied cancer treatments despite MacDougall paying his premiums. This is his story, in his own words, written five days before he died.

How willing are they to risk their customers’ health and possibly their lives? Well let me tell you my experience with Health Republic and its affiliate MagnaCare.

For five months—ever since I was diagnosed with stage-four metastasized prostate cancer—they refused to pay my medical bills. On Oct. 20, a nurse with Health Republic overruled my oncologist and my primary-care physician and declared that a critical test to determine the progress of my cancer was unnecessary.

It seems she was wrong. As a result, I am writing this from Lenox Hill Hospital, where I am undergoing emergency tests and treatments ordered by three prominent New York doctors who didn’t agree with that health-insurance nurse.

This latest fiasco is not at all surprising. I have been fighting to get Health Republic and MagnaCare to explain why they suddenly and inexplicably refused to pay for my doctors and my treatments even though I followed their rules for members, went to their online list of providers, and actually received two form letters stating the treatments the doctors had ordered were legitimate.

It’s a long story, but if you want to know what it’s like dealing with the health-insurance bureaucracy when it’s a matter of life and death, you might want to stick with me.

Unable to Meet the Deductible or the Doctor

http://www.healthcare-now.org/unable-to-meet-the-deductible-or-the-doctorPatricia Wanderlich got insurance through the Affordable Care Act this year, and with good reason: She suffered a brain hemorrhage in 2011, spending weeks in a hospital intensive care unit, and has a second, smaller aneurysm that needs monitoring.

But her new plan has a $6,000 annual deductible, meaning that Ms. Wanderlich, who works part time at a landscaping company outside Chicago, has to pay for most of her medical services up to that amount. She is skipping this year’s brain scan and hoping for the best.

“To spend thousands of dollars just making sure it hasn’t grown?” said Ms. Wanderlich, 61. “I don’t have that money.”

About 7.3 million Americans are enrolled in private coverage through the Affordable Care Act marketplaces, and more than 80 percent qualified for federal subsidies to help with the cost of their monthly premiums. But many are still on the hook for deductibles that can top $5,000 for individuals and $10,000 for families — the trade-off, insurers say, for keeping premiums for the marketplace plans relatively low. The result is that some people — no firm data exists on how many — say they hesitate to use their new insurance because of the high out-of-pocket costs.

Insurers must cover certain preventive services, like immunizations, cholesterol checks and screening for breast and colon cancer, at no cost to the consumer if the provider is in their network. But for other services and items, like prescription drugs, marketplace customers often have to meet their deductible before insurance starts to help.

While high-deductible plans cover most of the costs of severe illnesses and lengthy hospital stays, protecting against catastrophic debt, those plans may compel people to forgo routine care that could prevent bigger, longer-term health issues, according to experts and research.

Why Americans Are Drowning in Medical Debt

Because for actual sick people, insurance is a totally useless product. Most of the bankrupted Americans had it, to no avail.

http://www.healthcare-now.org/why-americans-are-drowning-in-medical-debt

After his recent herniated-disk surgery, Peter Drier was ready for the $56,000 hospital charge, the $4,300 anesthesiologist bill, and the $133,000 fee for orthopedist. All were either in-network under his insurance or had been previously negotiated. But as Elisabeth Rosenthal recently explained in her great New York Times piece, he wasn’t quite prepared for a $117,000 bill from an “assistant surgeon”—an out-of-network doctor that the hospital tacked on at the last minute.

It’s practices like these that contribute to Americans’ widespread medical-debt woes. Roughly 40 percent of Americans owe collectors money for times they were sick. U.S. adults are likelier than those in other developed countries to struggle to pay their medical bills or to forgo care because of cost.

California patients paid more than $291,000 for the procedure, while those in Arkansas paid just $5,400.

Earlier this year, the financial-advice company NerdWallet found that medical bankruptcy is the number-one cause of personal bankruptcy in the U.S. With a new report out today, the company dug into how, exactly, medical treatment leaves so many Americans broke.

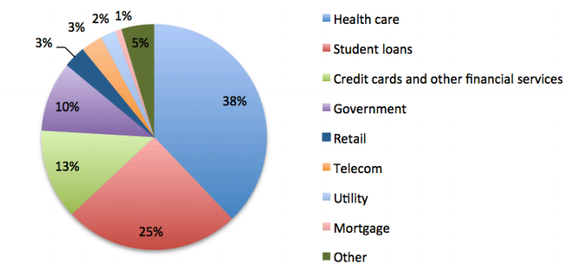

Americans pay three times more for medical debt than they do for bank and credit-card debt combined, the report found. Nearly a fifth of us will hear from medical-debt collectors this year, and they’ll gather $21 billion from us, collectively.

Profile Information

Gender: FemaleHometown: Washington state

Home country: USA

Current location: Directly above the center of the earth

Member since: Sat Aug 16, 2003, 02:52 AM

Number of posts: 51,907