Demeter

Demeter's JournalThe costs of unemployment – again LEST WE FORGET

http://bilbo.economicoutlook.net/blog/?p=17740One of the extraordinary things that arose in a recent discussion about whether employment guarantees are better than leaving workers unemployed was the assumption that the costs of unemployment are relatively low compared to having workers engaged in activities of varying degrees of productivity. Some of the discussion suggested that there were “microeconomic” costs involved in having to manage employment guarantee programs (bureaucracy, supervision, etc) which would negate the value of any such program. The implicit assumption was that the unemployed will generate zero productivity if they are engaged in employment programs. There has been a long debate in the economics about the relative costs of microeconomic inefficiency compared to macroeconomic inefficiency. The simple fact is that the losses arising from unemployment dwarfed by a considerable margin any microeconomic losses that might arise from inefficient use of resources. ...The daily losses from unemployment. In terms of estimates, not much has changed in the US economy over the last 2 years. The daily losses in income alone are enormous. One of the strong empirical results that emerge from the Great Depression is that the job relief programs that the various governments implemented to try to attenuate the massive rise in unemployment were very beneficial. At that time, it was realised that having workers locked out of the production process because there were not enough private jobs being generated was not only irrational in terms of lost income but also caused society additional problems, such as rising crime rates. Direct job creation was a very effective way of attenuating these costs while the private sector regained its optimism. In fact, it took about 50 years or so for governments to abandon this way of thinking. Now we tolerate high levels of unemployment without a clear understanding of the magnitude of costs that that policy position imposes on specific individuals and society in general.

The single most rational thing a government could do was to ensure that there were enough jobs to match the available labour force....It is well documented that sustained unemployment imposes significant economic, personal and social costs that include:

- loss of current output;

- social exclusion and the loss of freedom;

- skill loss;

- psychological harm, including increased suicide rate (which I will return to later);

- ill health and reduced life expectancy;

- loss of motivation;

- the undermining of human relations and family life;

- racial and gender inequality; and

- loss of social values and responsibility.

We know that the losses encountered during a prolonged recession reverberate into tortured recoveries and that the damage that unemployment causes spans the generations. Even before the crisis hit, these costs in most countries were huge as policy makers began using unemployment as a policy tool rather than a policy target as the obsession with inflation-targetting took hold. Most people do not consider the irretrievable nature of these losses. Every day that unemployment remains above the full employment level (allowing for a small unemployment rate arising from frictions – people moving in-between jobs) the economy is foregoing billions in lost output and national income that is never recovered. The magnitude of these losses and the fact that most commentators and policy makers prefer unemployment to direct job creation, shows the powerful hold that neo-liberal thinking has had on policy makers. How is it rational to tolerate these massive losses which span generations? Neo-liberalism has also changed the way we think about unemployment. In the past we understood clearly that it arose as a result of a shortage of jobs. However, in recent decades, we have been conditioned by a relentless (lying) press and government statements to perceive unemployment as an individual problem. So the unemployed are type-cast as being lazy; having poor work attitudes; refusing to invest in appropriate skills; and subject to disincentives arising from misguided government welfare support, and all the rest of the arguments that mainstream uses to obfuscate the social problem. The focus in the public debate is to “blame the victim” and suggest that most are unemployable and prefer to live on welfare, where that support is available. The overwhelming evidence from the informed research literature is that almost all the unemployed (when surveyed) prefer to work and are willing to take work if offered. The overwhelming evidence from studies in most countries suggests that the unemployed are highly motivated to find work and are victims of a shortage of jobs rather than personal/individual deficiencies. The dominance of the neo-liberal ideology led governments in most countries to have eschew the adoption of policies of direct job creation to reduce the rate of unemployment and to minimise these massive costs. Fiscal policy has became geared to the achievement of budget surpluses as some sort of token of prudent financial management.

NUMBER CRUNCHING ENSUES---SEE LINK

Conclusion

Even under conservative assumptions, the economic and social costs of sustained high unemployment are extremely high. The inability of unemployed individuals and their families to function in the market economy gives rise to many forms of social dysfunction, in addition to output loss. The apparent failure of neo-liberal supply side policies to reduce unemployment prior to the crisis is now highlighted during the crisis. There is now an urgent need to address the large pools of unemployment in world economies. The daily income losses alone are enormous and overwhelm other inefficiencies notwithstanding the productivity heterogeneity that exists across the workforce. There is no financial reason why the government should not deal with this problem directly by introducing a Job Guarantee as a starting point. Then broader investment in public infrastructure could follow according to political preferences. If the Government had the political will, it could readily overcome the problem of persistently high unemployment.

China investors set their sights on Hollywood

A consortium led by Chinese media entrepreneur Bruno Wu is scouring Hollywood for film companies to acquire, in a sign of China’s growing interest in the US entertainment industry

Read more >>

http://link.ft.com/r/XYEWFF/IITIIJ/NRHD3/8ZXLMA/XHMWBL/28/t?a1=2012&a2=1&a3=22

HOW BAD COULD IT GET? (SHAKES HEAD SADLY) THEY COULDN'T DO WORSE THAN WHAT'S COMING OUT OF HOLLYWOOD NOWADAYS.

The Republicans' Dark-Money-Moving Machine

http://motherjones.com/politics/2012/01/republican-governors-association-perry-michiganMichigan's 2010 elections had just concluded, and Rich Robinson, the state's leading campaign finance reform advocate, was conducting his usual postmortem. As he tallied the big money behind the conservative groundswell that swept Republican Rick Snyder into the governor's mansion and placed the state Legislature solidly under GOP control, one particular political action committee caught his eye. Created in December 2009 and shut down shortly after the election, RGA Michigan 2010 had come out of nowhere to spend nearly $8.4 million—54 percent more than any other PAC had poured into any election in Michigan history. Ninety-six percent of the group's donors lived outside the state, and its top three funders included Texas homebuilder Bob Perry, Koch Industries' David Koch, and New York City hedge fund CEO Paul Singer. On the other side of the ledger, RGA Michigan 2010 had given $5.2 million to the Michigan Republican Party—no surprise there—but, mysteriously, it had also funneled $3 million into the campaign coffers of Texas Gov. Rick Perry.

Robinson, the executive director of the Michigan Campaign Finance Network, began to connect the dots. He remembered the phone calls from reporters in Maine and Florida asking if Robinson knew why money from the Michigan Chamber of Commerce had ended up with PACs in their states. The state's Chamber, which usually spent more than $1 million on TV ads during Michigan elections, officially didn't spend a dime on ads in 2010, according to Robinson. But it had given an unprecedented $5.37 million to a national organization that, Robinson now realized, was at the root of the anomalous spending he'd uncovered: the Washington, DC-based Republican Governors Association. During the midterms, while many campaign finance observers were fixated on the proliferation of super-PACs and shadow-spending groups, the RGA spent $132 million—more than the five biggest conservative super-PACs and 501(c) groups combined. It was instrumental in electing a slate of GOP governors—Wisconsin's Scott Walker, Ohio's John Kasich, Georgia's Nathan Deal, and Iowa's Terry Branstad, among others—who hastened to crack down on public-sector unions and roll back environmental regulations. These electoral successes were fueled in part by the creative campaign finance strategy that Robinson began to piece together.

Since 2008, he explains, the RGA has used a network of at least 15 state-level PACs to shuffle campaign cash around the country. Doing so serves a couple of purposes. First, it enables the RGA to scrub the identity of a donor to avoid image issues. For instance, Rick Perry taking $3 million from a Texas oil baron might be controversial, but if that baron gives $3 million to the national RGA, which then diverts the money to RGA Michigan PAC and then to Perry? Harmless. The RGA's cash shuffle also allows it—and its corporate allies—to skirt campaign finance laws. For instance, in Michigan, corporations can't donate directly to candidates or political parties. But the state's Chamber of Commerce donated millions to the national RGA, which then directed some of the money to its PACs in Florida and Maine, where no such corporate-money bans exist. Why would a Michigan group want its money flowing to races in other states? Chamber CEO Rich Studley told Maine Public Radio that its members supported funding "pro-business" candidates outside Michigan.

Robinson has a different theory. During the 2010 election cycle, the Michigan Chamber donated more than $5 million to the RGA. In turn, the RGA's Michigan PAC directed $5.2 million—contributions that largely came from individuals outside the state—to the Michigan Republican Party. Robinson believes that, through this roundabout process, the Chamber's corporate money was swapped out with individual contributions, allowing it to be deployed in Michigan in a more potent form. (The Chamber acknowledges that the RGA called the shots on where its money was spent. Studley says his group's political spending "has been in full compliance with all Michigan and federal laws." The RGA did not respond to a request for comment on this practice.) Robinson and other campaign finance watchdogs liken the RGA's methods to the corporate-contribution laundering scheme that got former GOP congressman Tom DeLay indicted. "The whole thing," Robinson says of the RGA's tactics, "was about wiping the fingerprints off the money."

MORE AT LINK INCLUDING INTERACTIVE GRAPHICS

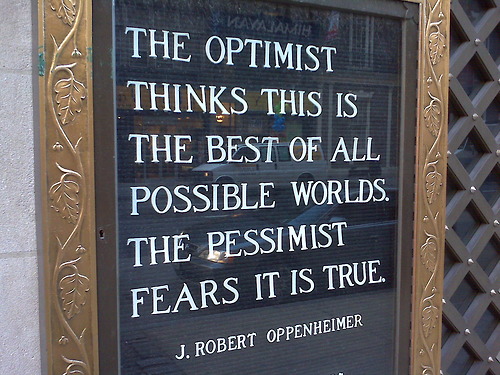

The Weekend Economists' Panglossian Pandemic January 20-22, 2012

Eureka! Yes! I think with this title I can encompass all the suggestions I received in my usual weekly call for inspiration and advice, and bring in some art, as well.

First, some definitions:

Pan·gloss·i·an (adjective) characterized by or given to extreme optimism, especially in the face of unrelieved hardship or adversity.

Origin: 1825–35; after Pangloss, an optimistic character in Voltaire's Candide;

compare Greek panglossía garrulousness, wordiness

http://2.bp.blogspot.com/_fHtiQn5hcbU/Sr68EQcc2VI/AAAAAAAAAMM/tYDkpS4Sgyk/S660/blog+header.png

?w=645

?w=645

pan·dem·ic (n.) A pandemic disease. An epidemic that spreads over a very wide area, such as an entire country or continent.

(adj.)

1. Widespread; general.

2. Medicine: Epidemic over a wide geographic area and affecting a large proportion of the population: pandemic influenza.

From Late Latin pandmus, from Greek pandmos, of all the people : pan-, pan- + dmos, people; see d- in Indo-European roots.

Illustration of the Black Death from the Toggenburg Bible (1411)

Illustration of the Black Death from the Toggenburg Bible (1411)

Put them together, and what have you got? The Global Economy through the rose-colored lenses of far too many 1% Elites:

the Leibnizian mantra of Pangloss, "all is for the best in the best of all possible worlds".

Dear Andrew Sullivan: Why Focus on Obama's Dumbest Critics?

http://www.theatlantic.com/politics/archive/2012/01/dear-andrew-sullivan-why-focus-on-obamas-dumbest-critics/251528/After reading Andrew Sullivan's Newsweek essay about President Obama, his critics, and his re-election bid, I implore him to ponder just one question. How would you have reacted in 2008 if any Republican ran promising to do the following?

I submit that had Palin or Cheney or Rumsfeld or Rice or Jeb Bush or John Bolton or Rudy Giuliani or Mitt Romney proposed doing even half of those things in 2008, you'd have declared them unfit for the presidency and expressed alarm at the prospect of America doubling down on the excesses of the post-September 11 era. You'd have championed an alternative candidate who avowed that America doesn't have to choose between our values and our safety.

Yet President Obama has done all of the aforementioned things.... No, Obama isn't a radical Kenyan anti-colonialist. But he is a lawbreaker and an advocate of radical executive power. What precedent could be more radical than insisting that the executive is empowered to draw up a kill list of American citizens in secret, without telling anyone what names are on it, or the legal justification for it, or even that it exists? What if Newt Gingrich inherits that power?

MERS, the law, and the State By lambert strether.

http://www.nakedcapitalism.com/2012/01/mers-the-law-and-the-state.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29The current version of Harpers — go buy it on the newstand! (OR SUBSCRIBE ONLINE http://www.harpers.org/archive/2012/01 )— has a terrific article by Christopher Ketcham on the MERS mess, which NC has done so much to bring to the attention of the public. I’m going to excerpt and contextualize two portions of the article. First, Ketcham interviews foreclosure activist Vermont Trotter of Coeur D’Arlene, Idaho on the “clouded title” problem. I’m a connoisseur of the worst case scenario, and this is a doozy:

Reston, VA 20190, 1-800-646-6377) was what it could do to homeowners who were current on their mortgage payments: The “good” homeowners who still had a job and weren’t facing foreclosure. If there was no legal record of which bank owned their debt (see below if you haven't been following NC on MERS), and the MERS-mortgaged homeowners had been making payments, then who exactly was the homeowner paying? The checks, clearly, were going out every month, cashed by a bank that claimed to own the note. But without the legal record to certify the owner of the note, it followed that the bank could not legally issue the homeowner a clear title to the home. In effect, a homeowner with MERS on his mortgage could spend thirty years paying a lender that wasn’t the owner of the note. …. “[ Y] ou’d always be looking over your shoulder,” said Trotter. “Some other lender could come and say ‘No, we owned that note. You paid the wrong guy.” “WIth MERS”, he said, “nobody owns anything. You’re only paying rent.”

That’s not a bug. It’s a feature. At least for a rentier, although not necessarily for Trotter.

Second, Ketcham offers a lucid and succinct explanation of how this MERS feature came to be implemented:

After the housing market collapsed, however, MERS found itself under attack in courts across the country. MERS had single-handedly (oh?) unraveled centuries of precedent in property titling and mortgage recordation, and judges in state appellate and Federal bankruptcy courts in more than a dozen jurisdictions — the primary venues where real estate cases are decided — determined that the company did not have the right to foreclose on the mortgages it held. … “There is no evidence of record that establishes that MERS either held the promissory note or was given the authority to assign the note,” the Kansas court held. … “It appears that every MERS mortgage,” a New York State Supreme Court judge recently told me, “is defective, a piece of crap.”

“What’s happened,” said Christopher Peterson, a law professor at the University of Utah who has written extensively about MERS, “is that, almost overnight, we’ve switched from democracy in real-property recording to oligarchy in real-property recording.” The county clerks who established the ownership of land, who oversaw the records, were democratically elected stewards of those records, said Peterson. Now a corporation headquartered outside Washington, DC oversaw the records. “There was no court case behind this, no state from Congress or the state legislatures” , Peterson told me. “It was accomplished in a private corporate decision. The banks just did it.“

Let’s return to that statement: “The banks just did it,” because it raises a number of questions (not necessarily internally consistent). I feel like this post should have been written by a political scientists with training in computer forensics, neither of which I am. And I’d be really happy if the whole post were completely off base, because while I like imagining worst case scenarios, I don’t like it when they actually come to pass. Nevertheless, if the existence and possible retroactive legalization of the MERS system could raise important questions about the nature of law and the State, we’d better start hashing these questions out now. So, far fetching and blue-skying freely:

1. Doesn’t MERS look just like kleptocracy is supposed to look? Leave aside the banks’ outright looting of $200 billion or so in recording fees (so far). Even if those billions would go a long way toward solving the fiscal crisis at the state and local level. Haven’t the banks just appropriated for themselves the very ability to claim the title to hundreds of billions of dollars worth of housing stock? “You own your house if we say you own it..” Well, who owns your house, then?

2. If MERS is what banks can “just do,” is government really the problem?” Aren’t we already living in a libertarian paradise just like the Somalians, except that we’ve got a lot more stuff and a lot more delusion about the warlords who run the country?

3. If MERS controls the chain of title, where and what is the law? Apparently, the supreme law of the land is no longer to be found in in the “the code” — the state and local statutes, rules, regulations, interpretations, and precedents that lawyers and officials and citizens work with. No, so far as I can tell, “the code” is now the computer code of the MERS registration system itself, because the computer code controls the chain of title. But the MERS computer code is proprietary and opaque, so citizens can’t really know what the law is anymore (and possibly not even the MERS programmers themselves, if the system is poorly documented (as it might well be, to provide executives bent on accounting control fraud with plausible deniability)).

4. If MERS is the law, then where is the State? If the supreme law of the land is embodied in software and not controlled by the State as we know it — and empirically it’s not, because with MERS “the banks just did it” — then where is the State to be found? And how does the State gain legitimacy? Does that even matter?

NOTE 1 Questions 3 and 4 are not as far-fetched as they might seem. For example, election results are controlled by proprietary software that’s both proprietary and known to be insecure. And yet election results using these systems are presumed to be legitimate, both by voters and the powers that be. In the FISA debacle, the Fourth Amendment was destroyed by the retroactive legalization of Bush’s program of warrantless surveillance; “the law” was reverse engineered from an already running data mining system.

NOTE 2 If all the title assignments performed under MERS are indeed “crap,” that would give an additional motive — besides pure greed and the lust to inflict pain on the powerless — for the banksters to avoid cram down, HOLC, and any other solution that would involve opening up the MERS can of worms systemically.

Time Is On Our Side: The Survival of Social Security by: Dean Baker

http://www.truth-out.org/time-our-side-survival-social-security/1326733784As we approach budget time we can look forward to another burst of handwringing by the Washington elites, who will once again tell us about the need to cut Social Security and Medicare. News stories and opinion columns will be filled with solemn pronouncements about how these programs must be curtailed before they drive the nation to bankruptcy.

We can look forward to that famously deceptive graph showing how the cost of Social Security, Medicare and Medicaid are projected to soar as a share of the economy over the next two or three decades. Those with good eyes will notice that it is the cost of Medicare and Medicaid that are soaring, not Social Security.

This is primarily due to the projected explosion of private sector health care costs, not the impact of aging on the cost of the programs. That would lead honest people to focus on the need to get U.S. health care costs in line with costs in every other country in the world, but no one ever said that the Washington elites were honest.

But this is old hat. We know that the elites tell stories to advance their agenda. What is worth noting – and celebrating – is that thus far they have failed.

They have been pushing this line for the last twenty years, yet during this period there have been no substantial cuts to either Social Security or Medicare. This is a great victory for the vast majority of the country, the 99 percent, over the One Percent.

This fact is truly an impressive accomplishment. It is not only the Republicans who want to cut these programs; top leaders in the Democratic Party have repeatedly indicated their willingness to cut these programs.

President Clinton was all set to go along with a plan that would have reduced the annual cost of living adjustment for Social Security by as much as 1.1 percentage points. Had he gotten his way back in 1997, many seniors would be getting checks that are more than 10 percent smaller today. This sort of cut could have been devastating for people struggling to survive in the wreckage created by the incredible economic mismanagement of the last 15 years.

More recently, President Obama indicated his willingness to support an increase in the age of eligibility for Medicare and a cut of 0.3 percentage points in the annual cost of living adjustment for Social Security. These cuts would be a great hardship to tens of millions of near retirees who have seen much or all of their wealth destroyed by the collapse of the housing bubble.

In addition to those openly advocating cuts to these programs, Washington is also filled with a large number of “good cops.” These are people who ostensibly support these programs. The good cops tell us that we are better off taking a deal in the long-run, because otherwise the bad guys will come back with even more powerful ammunition and push through larger cuts to Social Security and Medicare.

No one can know the motives among this group of good cops, but the fact is that they have repeatedly been proven wrong. If we had taken their advice back in the 90s, seniors today would already be receiving much lower benefits.

And, there is no reason to think that once cuts were put in place that the elites won’t come back for more. After all, those of us who remember the 2000 presidential race know that any improvement in the budget situation is an argument for more tax cuts. And tax cuts will inevitably mean that we will have more pressure in the future for budget cuts.

The other important part of the argument for delay is the demographic fact that we hear repeated endlessly. The country is aging. The huge baby boom cohort is reaching the eligibility ages for Social Security and Medicare.

This means that the percentage of the electorate directly affected by these programs is rising every year. As hard as it was to make cuts in these 15 years ago, it will be much harder in 2014 or 2016, when the percentage of the adult population eligible for Social Security will be almost 20 percent larger. Better yet, if we can delay to 2020 the Social Security eligible population will be close to 30 percent larger as a share of the adult population.

With older people voting in much higher ratios than young people, there are not likely to be many politicians anxious to support cuts to the programs they depend upon. And, contrary to the stories of the Washington elite, the support of seniors for these programs is not driven by greed. It is driven by the fact that they recognize the importance of these programs in their own lives. They want to ensure that their children and grandchildren will enjoy the same security in their own age.

The moral of this story is that we should celebrate the work of hundreds of thousands of people across the country who have blocked the Washington elite to cut Social Security and Medicare. And remember, the future is on our side.

***************************************************************************************

This work by Truthout is licensed under a Creative Commons Attribution-Noncommercial 3.0 United States License.

******************************************************************************************

DEAN BAKER

Dean Baker is co-director of the Center for Economic and Policy Research in Washington, DC.

He previously worked as a senior economist at the Economic Policy Institute and an assistant professor at Bucknell University. His blog, Beat the Press, features commentary on economic reporting.

He received his Ph.D in economics from the University of Michigan.

When You're 66: A Checklist on Social Security and Medicare

http://registeredrep.com/wealthmanagement/retirementplan/when_youre_66_a_checklist_on_social_security_and_medicare_112/The oldest baby boomers will turn 66 this year. And, with all due apologies to Sir Paul McCartney, it's a much more significant number than 64 for retirement planning. As you advisors know, when you're 66, you can claim full Social Security benefits; 65 is a close runner-up, since it's the year most seniors will file for Medicare.

Social Security and Medicare may be outside the direct purview of most financial advisors. But advisors should understand the ins and outs of filing for both of these critical retirement benefits, and check up to make clients pursue smart strategies and file correctly. Social Security replaces one-third of income for the average retiree, and it's an especially important source of longevity insurance for seniors who reach very advanced ages – especially women. And Medicare is a critical component in meeting the escalating cost of health care in retirement.

With that in mind, here's a checklist of key points to remember when your clients are no longer 64. (And don't forget: You'll be older too -- if only down the long and winding road. Sorry, couldn’t resist the Beatles pun.)

Social Security

Filing age. About half of all Americans file for Social Security at age 62–the first year of eligibility for benefits. But for most, it’s a costly mistake that will mean foregoing thousands of dollars in higher benefits. Although seniors can begin receiving checks at 62, annual benefits will be boosted for every year that they wait, up to age 70.

Many seniors worry about the math of lifetime benefits — that is, they fear they won’t live long enough to make delayed filing “pay off.” But those concerns are off the mark.

Social Security is built around actuarial principles – essentially, the mathematics of risk. And a central actuarial idea behind Social Security is the Normal Retirement Age (NRA), a rule used by the Social Security Administration to ensure the system pays out fairly among all beneficiaries. But the main value of Social Security is replacement of current income, not accumulation of assets. That’s where filing later can help.

Monthly benefits for earlier filers are reduced accordingly to avoid paying then higher lifetime benefits. Under the rules, annual benefits are reduced 8 percent for most of the years you start early, based on an actuarial projection of average longevity. For a 62-year-old filing this year, the net effect will be a permanent reduction of annual benefits of 25 percent.

On the other hand, the SSA will bump up payments by eight percent for every year a senior delays filing beyond the NRA up until age 70, after which credits for waiting no longer are awarded.

Working while receiving benefits. The labor force is getting more gray as Americans work longer. If your client files for Social Security at her NRA, she can earn an unlimited amount of income and receive Social Security benefits. However, earlier filers are hit with a penalty on income over $14,640. (Social Security defines “income” in this context as wages from employment, or net earnings from self-employment). If earnings exceed the limit, $1 will be deducted from benefit payments for every $2 earned over that amount.

However, lifetime benefits wouldn’t be reduced because the withheld benefits are added back into benefits after the senior reaches the NRA.

Spousal benefits: Married couples need to pay attention to the interaction of both spouses’ benefits; certain provisions of the Social Security law can create powerful amplifying effects when the higher-earning spouse waits to file for benefits until the NRA or beyond. The bottom line is that it’s generally beneficial for the higher-earning spouse to delay taking Social Security benefits until the NRA or beyond. More details on the spousal rules can be found here and here.

Medicare

Filing isn't automatic. Although Medicare eligibility begins at age 65, enrollment is only automatic for seniors who already have begun receiving Social Security benefits. In that case, the government mails a Medicare card three months before the date of eligibility. Clients who aren't already receiving Social Security can apply for Medicare through the Social Security Administration, either by visiting a local office or online at the agency's website.

To ensure that your clients’ Medicare Part B coverage start date is not delayed, your clients should apply three months before the month you turn 65, or up to 3 months after.

File on time. It's best for your clients to start thinking about filing for Medicare before retirement, because failing to file within the enrollment window can lead to substantial Part B premium penalties – the monthly Part B premium jumps 10 percent for each full 12-month period that a senior could have had coverage but didn't sign up. A mistake can be costly; a senior who fails to enroll for five years ultimately would face a 50 percent Part B penalty – 10 percent for each year.

“If you’re still working and have healthcare coverage, Medicare’s probably not on your radar. But it’s important to think about it a little bit in advance, especially when you hit 65,” says Adrienne Muralidharan, senior Medicare specialist for Allsup, which offers Medicare plan selection services. “If you don’t enroll in Medicare when you are first eligible, you may face stiff penalties when you do go to enroll – and those penalties will be with you for as long as you rely on Medicare.”

Coordinate with employer-based coverage. For seniors who still are employed at age 65, Medicare is the primary payor under certain circumstances, not in others. At companies with fewer than 20 employees, Medicare is the primary payor; at larger companies, the employer is primary. In the latter situation, a senior can postpone filing for Parts A (hospitalization) or B (outpatient services), although many choose to enroll for Part A anyway since it doesn't require premium payments. Seniors can enroll later without penalty for up to eight months following retirement.

Employed seniors who opt to postpone enrollment should approach this decision with great caution – it should be discussed in person with the Social Security Administration and a workplace plan administrator. And, it's best to notify Medicare at age 65 of a decision not to file in order to ensure that there won't be problems with premium penalties later on. This can be done by checking off a box on the back of a Medicare card that has been sent, by calling the Social Security Administration or through the SSA website.

Traditional Medicare or managed care? Seniors can choose between traditional fee-for-service Medicare or Medicare Advantage, a managed care option that offers all-in-one medical and drug coverage. When a senior joins an Advantage plan, Medicare provides a fixed payment to the plan to cover Part A and Part B; there usually are additional co-payments and deductibles, depending on the plan. Here's a detailed guide to the ins and outs of Advantage plans.

Watch out for premium surcharges. High-income seniors pay surcharges on premiums for Part B and Part D. The surcharges are paid by individuals with $85,000 or more in annual income, and joint filers with income over $170,000, and they scale upwards through four income brackets. The surcharges affect just 5 percent of seniors, since most are retired and don't have that much income. But if you do have clients in these brackets, the payments are substantial.

Consider strategies that might keep the client under the income trigger. One possibility is taking portfolio withdrawals from a Roth IRA, which are not counted in Social Security's definition of taxable income. Or, alternate withdrawals from taxable accounts so that the client doesn't have to pay the surcharge every year.

Mind the gap. Many Medicare beneficiaries opt to purchase an optional Medigap policy, which charges an extra premium but caps out-of-pocket costs. If your clients plan to buy a Medigap policy, it's best to do so during the six-month open-enrollment period, which is open for six months at the time they turn 65 or enroll in Medicare Part B. While no late enrollment penalties are levied, after the open enrollment, seniors may be required to take medical screening tests and can be rejected because of preexisting conditions.

Resources

The non-profit Medicare Rights Center offers an excellent, free online toolkit to assist professionals with Social Security and Medicare enrollment issues.

Allsup offers a free guide to Medicare filing.

The federal government publishes an annual – and very comprehensive – guide to Medicare annually. Click here to download the 2012 edition of Medicare & You.

Medicare produces a guide that explains how Medicare works with other kinds of insurance or coverage and who should pay seniors' bills first.

My online guides to Medicare and Social Security basics are available at RetirementRevised.com

Visit the Medicare website to download a guide to Medigap plans.

*****************************************************************************************

About the Author

Mark Miller is a journalist and author who writes about trends in retirement and aging.

Mark edits and publishes RetirementRevised.com, featured as one of the best retirement planning sites on the web in the May 2010 issue of Money Magazine. He is a columnist for Reuters and also contributes to Morningstar and the AARP Magazine. Mark is the author of The Hard Times Guide to Retirement Security: Practical Strategies for Money, Work and Living (John Wiley & Sons, 2010).

Occupy the Neighborhood: How Counties Can Use Land Banks and Eminent Domain BY ELLEN BROWN

http://www.truth-out.org/occupy-neighborhood/1326472096An electronic database called MERS (Mortgage Electronic Registration Systems) has created defects in the chain of title to over half the homes in America. Counties have been cheated out of millions of dollars in recording fees, and their title records are in hopeless disarray. Meanwhile, foreclosed and abandoned homes are blighting neighborhoods. Straightening out the records and restoring the homes to occupancy is clearly in the public interest, and the burden is on local government to do it. But how? New legal developments are presenting some innovative alternatives.

John O'Brien is register of deeds for Southern Essex County, Massachusetts. He is mad as hell and he isn't going to take it anymore. He calls his land registry a "crime scene." A formal forensic audit of the properties for which he is responsible found that:

- Only 16 percent of the mortgage assignments were valid.

- Twenty-seven percent of the invalid assignments were fraudulent, 35 percent were "robo-signed" and 10 percent violated the Massachusetts Mortgage Fraud Statute.

- The identity of financial institutions that are current owners of the mortgages could be determined for only 287 out of 473 (60 percent).

- There were 683 missing assignments for the 287 traced mortgages, representing approximately $180,000 in lost recording fees per 1,000 mortgages whose current ownership could be traced.

At the root of the problem is that title has been recorded in the name of a private entity called MERS as a mere placeholder for the true owners. The owners are a faceless, changing pool of investors owning indeterminate portions of sliced and diced securitized properties. Their identities have been so well hidden that their claims to title are now in doubt. According to the auditor:

What this means is that ... the institutions - including many pension funds - that purchased these mortgages don't actually own them....

The March of the Attorneys General

John O'Brien was thrilled when Massachusetts Attorney General Martha Coakley went to court in December against MERS and five major banks - Bank of America Corp., JPMorgan Chase, Wells Fargo, Citigroup and GMAC. Coakley says banks have "undermined our public land record system through the use of MERS."

Other attorneys general are also bringing lawsuits. Delaware Attorney General Beau Biden is going after MERS in a suit seeking $10,000 per violation. "Since at least the 1600s," he says, "real property rights have been a cornerstone of our society. MERS has raised serious questions about who owns what in America."

Biden's lawsuit alleges that MERS violated Delaware's Deceptive Trade Practices Act by:

- Hiding the true mortgage owner and removing that information from the public land records.

- Creating a systemically important, yet inherently unreliable, mortgage database that created confusion and inappropriate assignments and foreclosures of mortgages.

- Operating MERS through its members' employees, whom MERS confusingly appoints as its corporate officers so that they may act on MERS' behalf.

- Failing to ensure the proper transfer of mortgage loan documentation to the securitization trusts, which may have resulted in the failure of securitizations to own the loans upon which they claimed to foreclose.

This last allegation - that there are fatal defects in the loan documentation - may be even more conclusive than the MERS defect in establishing a break in the chain of title to securitized properties. Mortgage-backed securities are sold to investors in packages representing interests in trusts called REMICs (Real Estate Mortgage Investment Conduits). REMICs are designed as tax shelters; but to qualify for that status, they must be "static." Mortgages can't be transferred in and out once the closing date has occurred. The REMIC Pooling and Servicing Agreement typically states that any transfer after the closing date is invalid. Yet few, if any, properties in foreclosure seem to have been assigned to these REMICs before the closing date, in blatant disregard of legal requirements. The whole business is quite complicated, but the bottom line is that title has been clouded not only by MERS, but because the trusts purporting to foreclose do not own the properties by the terms of their own documents.

Courts Are Taking Notice

The title issues are so complicated that judges themselves have been slow to catch on, but they are increasingly waking up and taking notice. In some cases, the judge is not even waiting for the borrowers to raise lack of standing as a defense. In two cases decided in New York in December, the banks lost although their motions were either unopposed or the homeowner did not show up, and in one, there was actually a default. No matter, said the court; the bank simply did not have standing to foreclose.

In Citigroup v. Smith, 2011 NY Slip Op 52236 (U) (December 13, 2011), the mortgage document acknowledged that MERS was not the lender, but was "a separate corporation that is acting solely as a nominee for Lender and Lender's successors and assigns." The court held that since MERS was not a party to the underlying note, when it assigned the mortgage to plaintiff Citigroup there was no assignment of the note; and "a transfer of [a] mortgage without the debt is a nullity and no interest is acquired by it."

Failure to comply with the terms of the loan documents can make an even stronger case for dismissal. In Horace v. LaSalle, Circuit Court of Russell County, Alabama, 57-CV-2008-000362.00 (March 30, 2011), the court permanently enjoined the bank (now part of Bank of America) from foreclosing on the plaintiff's home, stating:

Plaintiff's motion for summary judgment is granted to the extent that defendant trust ... is permanently enjoined from foreclosing on the property....

Relief for Counties: Land Banks and Eminent Domain

The legal tide is turning against MERS and the banks, giving rise to some interesting possibilities for relief at the county level. Local governments have the power of eminent domain: they can seize real or personal property if (a) they can show that doing so is in the public interest, and (b) the owner is compensated at fair market value.

The public interest part is easy to show. In a 20-page booklet titled "Revitalizing Foreclosed Properties with Land Banks," the US Department of Housing and Urban Development (HUD) observes:

The volume of foreclosures has become a significant problem, not only to local economies, but also to the aesthetics of neighborhoods and property values therein. At the same time, middle- to low-income families continue to be priced out of the housing market while suitable housing units remain vacant.

The booklet goes on to describe an alternative being pursued by some communities:

To ameliorate the negative effects of foreclosures, some communities are creating public entities - known as land banks - to return these properties to productive reuse while simultaneously addressing the need for affordable housing.

States named as adopting land bank legislation include Michigan, Ohio, Missouri, Georgia, Indiana, Texas, Kentucky and Maryland. HUD notes that the federal government encourages and supports these efforts. But states can still face obstacles to acquiring and restoring the properties, including a lack of funds and difficulties clearing title.

Both of these obstacles might be overcome by focusing on abandoned and foreclosed properties for which the chain of title has been broken, either by MERS or by failure to transfer the promissory note according to the terms of the trust indenture. These homes could be acquired by eminent domain both free of cost and free of adverse claims to title. The county would simply need to give notice in the local newspaper of an intent to exercise its right of eminent domain. The burden of proof would then transfer to the bank or trust claiming title. If the claimant could not prove title, the county would take the property, clear title and either work out a fair settlement with the occupants or restore the home for rent or sale.

Even if the properties were acquired without charge, counties might lack the funds to restore them. Additional funds could be had by establishing a public bank that serves more functions than just those of a land bank. In a series titled "A Solution to the Foreclosure Crisis," Michael Sauvante of the National Commonwealth Group suggests that properties obtained by eminent domain can be used as part of the capital base for a chartered, publicly owned bank, on the model of the state-owned Bank of North Dakota. The county could deposit its revenues into this bank and use its capital and deposits to generate credit, as all chartered banks are empowered to do. This credit could then be used not just to finance property redevelopment, but for other county needs, again on the model of the Bank of North Dakota. For a fuller discussion of publicly owned banks, see http://PublicBankingInstitute.org.

Sauvante adds that the use of eminent domain is often viewed negatively by homeowners. To overcome this prejudice, the county could exercise eminent domain on the mortgage contract rather than on title to the property. (The power of eminent domain applies both to real and to personal property rights.) Title would then remain with the homeowner. The county would just have a secured interest in the property, putting it in the shoes of the bank. It could renegotiate reasonable terms with the homeowner, something banks have been either unwilling or unable to do, since they have to get all the investor-owners to agree, a difficult task; and they have little incentive to negotiate when they can make more money on fees and credit-default-swaps on contracts that go into default.

Settling With the Investors

What about the rights of the investors who bought the securities allegedly backed by the foreclosed homes? The banks selling these collateralized debt obligations represented that they were protected with credit-default-swaps. The investors' remedy is against the counterparties to those bets - or against the banks that sold them a bill of goods.

Foreclosure defense attorney Neil Garfield says the investors are unlikely to recover on abandoned and foreclosed properties in any case. Banks and servicers can earn more when the homes are bulldozed - something that is happening in some counties - than from a sale or workout at a loss. Not only is more earned on credit-default-swaps and fees, but bulldozed homes tell no tales. Garfield maintains that fully a third of the investors' money has gone into middleman profits rather than into real estate purchases and "with a complete loss no one asks for an accounting."

Not only homes and neighborhoods, but 400 years of property law are being destroyed by banker and investor greed. As Barry Ritholtz observes, the ability of a property owner to confidently convey his property is a bedrock of our society. Bailing out reckless financiers and refusing to hold them accountable has led to a fundamental breakdown in the role of government and the court system. This can be righted only by holding the 1 percent to the same set of laws as are applied to the 99 percent. Those laws include that a contract for the sale of real estate must be in writing signed by seller and buyer, that an assignment must bear the signatures required by local law and that forging signatures gives rise to an actionable claim for fraud.

The neoliberal model that says banks can govern themselves has failed. It is up to county government to restore the rule of law and repair the economic distress wrought behind the smokescreen of MERS. New tools at the county's disposal - including eminent domain, land banks and publicly owned banks - can facilitate this local rebirth.

*************************************************************************************

This work by Truthout is licensed under a Creative Commons Attribution-Noncommercial 3.0 United States License.

**************************************************************************************

ELLEN BROWN

Ellen is an attorney and the author of eleven books, including Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free. Her websites are webofdebt.com and ellenbrown.com. She is also chairman of the Public Banking Institute.

Weekend Economists Working for Peanuts Friday the 13th, Jan. 13-16, 2012

It looks so weird, typing 2012. I thought 2011 would never end...or maybe, it never actually started for me. ahem....

WE WILL BE HERE MONDAY, SINCE THE MARKETS ARE CELEBRATING MLK DAY....WHICH EXPLAINS WHY THERE WERE NO BANK FAILURES, TOO.

Could one say that members of the GOP should be working for peanuts? Or is that a vicious stereotype?

It's apparent that there's more than nation-wide approval or public service at work, though, when the GOP goes electioneering. Trouble is, that kind of "eyes on the prize" seems to have crossed the aisle nowadays. So, whom can you trust?

I'm putting my trust in the original Peanuts:

Charles Monroe Schulz (November 26, 1922 – February 12, 2000), nicknamed Sparky, was an American cartoonist, whose comic strip Peanuts proved one of the most popular and influential in the history of the medium and is still widely reprinted on a daily basis.

Born in Minneapolis, Minnesota, Schulz grew up in Saint Paul. He was the only child of Carl Schulz, who was born in Germany, and Dena Halverson, who was Norwegian. His uncle called him "Sparky" after the horse Spark Plug in Billy DeBeck's comic strip, Barney Google.

Schulz loved drawing and sometimes drew his family dog, Spike, who ate unusual things, such as pins and tacks. Schulz drew a picture of Spike and sent it to Ripley's Believe It or Not!; his drawing appeared in Robert Ripley's syndicated panel, captioned, "A hunting dog that eats pins, tacks and razor blades is owned by C. F. Schulz, St. Paul, Minn." and "Drawn by 'Sparky'" (C.F. was his father, Carl Fred Schulz.)

Schulz attended St. Paul's Richard Gordon Elementary School, where he skipped two half-grades. When he was in first grade, his mother helped him get valentines for everybody in his class, so that nobody would be offended by not getting one; but he felt too shy to put them in the box at the front of the classroom, so he took them all home again to his mother.

He became a shy, timid teenager, perhaps as a result of being the youngest in his class at Central High School. One episode in his high school life was the rejection of his drawings by his high school yearbook. Much to its irony, a statue of Snoopy was placed in Central's main office sixty years later.

Military service

In 1943, he was drafted into the United States Army and served as a sergeant with the 20th Armored Division in Europe as a squad leader on a .50 caliber machine gun team. The unit saw combat only at the very end of the war. Schulz stated that he only ever had one opportunity to fire his machine gun, but forgot to load it. Fortunately, he said, the German soldier he ran into willingly surrendered. Years later, he proudly spoke of his wartime service.

After discharge in late 1945, he returned to Minneapolis where he took a job as an art teacher at Art Instruction, Inc. — he had taken correspondence courses before he was drafted. Before having his comics published, Schulz did lettering for a Roman Catholic comic magazine, Timeless Topix, while still teaching at Art Instruction.

Career

Schulz's first regular cartoons, Li'l Folks, were published from 1947 to 1950 by the St. Paul Pioneer Press; he first used the name Charlie Brown for a character there, although he applied the name in four gags to three different boys and one buried in sand. The series also had a dog that looked much like Snoopy. In 1948, Schulz sold a cartoon to The Saturday Evening Post; the first of 17 single-panel cartoons by Schulz that would be published there. In 1948, Schulz tried to have Li'l Folks syndicated through the Newspaper Enterprise Association. Schulz would have been an independent contractor for the syndicate, unheard of in the 1940s, but the deal fell through. Li'l Folks was dropped from the Pioneer Press in January 1950.

Later that year, Schulz approached the United Feature Syndicate with his best strips from Li'l Folks, and Peanuts made its first appearance on October 2, 1950. The strip became one of the most popular comic strips of all time. He also had a short-lived sports-oriented comic strip called It's Only a Game (1957–1959), but he abandoned it due to the demands of the successful Peanuts. From 1956 to 1965 he contributed a single-panel strip ("Young Pillars"![]() featuring teenagers to Youth, a publication associated with the Church of God.

featuring teenagers to Youth, a publication associated with the Church of God.

In 1957 and 1961 he illustrated two volumes of Art Linkletter's Kids Say the Darndest Things, and in 1964 a collection of letters, Dear President Johnson, by Bill Adler.

Schulz receiving his star on the Hollywood Walk of Fame at Knott's Berry Farm in June 1996

Charlie Brown, the principal character for Peanuts, was named after a co-worker at the Art Instruction School; Schulz drew much more inspiration from his own life:

Like Charlie Brown's parents, Schulz's father was a barber and his mother a housewife.

Schulz and Charlie Brown were shy and withdrawn.

Schulz had a dog when he was a boy, although unlike Snoopy the beagle, it was a pointer.

References to Snoopy's brother Spike living outside of Needles, California were likely influenced by the few years (1928–1930) that the Schulz family lived there; they had moved to Needles to join other family members who had relocated from Minnesota to tend to an ill cousin.

Schulz's "Little Red-Haired Girl" was Donna Mae Johnson, an Art Instruction Schools accountant with whom he fell in love. When Schulz proposed to her, she turned him down and married another man.

Linus and Shermy were both named for good friends of his (Linus Maurer and Sherman Plepler, respectively).

Peppermint Patty was inspired by Patricia Swanson, one of his cousins on his mother's side.The name came from the candy "Peppermint Patties."

Influences

The Charles M. Schulz Museum counts Milton Caniff (Terry and the Pirates) and Bill Mauldin as key influences on Schulz's work. In his own strip, Schulz regularly described Snoopy's annual Veterans Day visits with Mauldin, including mention of Mauldin's World War II cartoons.

Critics have also credited George Herriman (Krazy Kat), Roy Crane (Wash Tubbs), Elzie C. Segar (Thimble Theater) and Percy Crosby (Skippy) among Schulz's influences. However,

“It would be impossible to narrow down three or two or even one direct influence on Schulz's personal drawing style. The uniqueness of Peanuts has set it apart for years... That one-of-kind quality permeates every aspect of the strip and very clearly extends to the drawing. It is purely his with no clear forerunners and no subsequent pretenders.

— Good Grief: The Story of Charles M. Schulz, Rheta Grimsley Johnson, p. 68 ”

Sparky in 1956, and sometime thereafter....

http://en.wikipedia.org/wiki/Charles_M._Schulz

When Schulz announced his retirement for health reasons in December 1999, Peanuts was in more than 2,600 newspapers worldwide; he died shortly thereafter, on Saturday, February 12, 2000, just hours before the final Peanuts Sunday strip appeared in newspapers.... http://openlibrary.org/authors/OL4361397A/Charles_M._Schulz

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373