Demeter

Demeter's Journalwords to live by: Aries!

You've been too agreeable lately -- and you run the risk of being branded a pushover! Today, it's time to stand up for what you think is right. Don't back off from being the lone voice of dissent in the room. If something isn't right to you, then it isn't right! You deserve the chance to say your piece and have your thoughts be given just as much respect as everyone else's. No one is taking the spotlight away from you -- you've been giving it away. Take some of it back today.

How Wall Street Won the Election Long Before the First Vote Was Cast By Nomi Prins

THEY BOUGHT IT, OF COURSE!

http://truth-out.org/news/item/12358-how-wall-street-won-the-election-long-before-the-first-vote-was-cast

Before the campaign contributors lavished billions of dollars on their favorite candidate; and long after they toast their winner or drink to forget their loser, Wall Street was already primed to continue its reign over the economy. For, after three debates (well, four), when it comes to banking, finance, and the ongoing subsidization of Wall Street, both presidential candidates and their parties’ attitudes toward the banking sector is similar – i.e. it must be preserved – as is – at all costs, rhetoric to the contrary, aside.

Obama hasn’t brought ‘sweeping reform’ upon the Establishment Banks, nor does Romney need to exude deregulatory babble, because nothing structurally substantive has been done to harness the biggest banks of the financial sector, enabled, as they are, by entities from the SEC to the Fed to the Treasury Department to the White House.

In addition, though much is made of each candidates' tax plans, and the related math that doesn’t add up (for both presidential candidates), the bottom line is, Obama hasn’t explained exactly WHY there’s $5 trillion more in debt during his presidency, nor has Romney explained HOW to get a $5 trillion savings.

For the record, both missed, or don’t get, that nearly 32% of that Treasury debt is reserved (in excess) at the Fed, floating the banking system that supposedly doesn’t need help. The ‘worst economic period since the Great Depression’ barely produced a short-fall of an approximate average of $200 billion in personal and corporate tax revenues per year, according to federal data.)

...We have no leader that will take on Jamie Dimon, Chairman of the country’s largest bank, JPM Chase, who can devote 15% of the capital of JPM Chase, which remains backstopped by customer deposit insurance, to bet on the direction of potential corporate defaults, and slide by two Congressional investigations like walks in the park....

NOMI NAMES NAMES, PRINTS NUMBERS AND KICKS BUTT

The Dark Age Of Money by James C. Kennedy

http://www.zerohedge.com/news/2012-10-25/guest-post-dark-age-moneyIf you often wonder why ‘free market capitalism’ feels like it is failing despite universal assurances from economists and political pundits that it is working as intended, your intuition is correct. Free market capitalism has become a thing of the past. In truth free market capitalism has been replaced by something that is truly anti-free market and anti-capitalistic...Beginning sometime around 1970, the U.S. and most of the ‘free world’ have diverged from traditional “free market capitalism” to something different. Today the U.S. and much of the world’s economies are operating under what I call Monetary Fascism: a system where financial interests control the State for the advancement of the financial class. This is markedly different from traditional Fascism: a system where State and industry work together for the advancement of the State.

Monetary Fascism was created and propagated through the Chicago School of Economics. Milton Friedman’s collective works constitute the foundation of Monetary Fascism. Knowing that the term ’Fascism’ was universally unpopular; Friedman and the Chicago School of Economics masquerade these works as ‘Capitalism’ and ’Free Market’ economics. The foundation of Friedman’s corrupting principle is that the investor (money to be more precise) has no duty, obligation or covenant to anyone or anything. Friedman’s ‘Market’ is not subject to ‘any’ human standard of morality, political limitations or national interests. Money is free to act without bounds or conventions. Nothing is prohibited as long as the market can provide a “clearing price”.

The fundamental difference between Adam Smith’s free market capitalism and Friedman’s ‘free market capitalism’ is that Friedman’s is a hyper extractive model, the kind that creates and maintains Third-World-Countries and Banana-Republics, without geo-political borders If you say that this is nothing new, you miss the point. Friedman does not differentiate between some third world country and his own. The ultimate difference is that Friedman has created a model that sanctions and promotes the exploitation of his own country, in fact every country, for the benefit of the investor, money the uber-wealthy. He dressed up this noxious ideology as ‘free market capitalism’ and then convinced most of the world to embrace it as their economic salvation. As improbable as it sounds, this ideology has the near-universal support of most economists, the media, universities, the Federal Reserve, the U.S. Treasury, nearly every member of The U.S. Congress and most everyone you know. Today Friedman’s ideology is accepted, to some degree, by nearly every country in the world. But ultimately this exploitive model is not sustainable at any level, or for anyone or any nation.

The ultimate difference between Friedman’s ideology and Smith is simply this: Smith was in fact a Mercantilist. True, he opposed the custom of hoarding gold and other Mercantilist practices, but ultimately he was a Mercantilist. Smith promoted “free trade” with the goal of improving the English merchant’s advantage, and thus the State’s. Nothing expresses this more clearly that the title of his book An Inquiry into the Nature and Causes of the Wealth of Nations. Mercantilism is based on the relative wealth of one Nation State over the other, not the plunder of the State and its peoples for the benefit of the individual. Smith believed in the power of the State and recognized that it was only by the power of the State that free enterprise could succeed and thrive. In a world without the State, he sided with Lock, “life was brutish and short”. Consequently one had obligations to the State and the people who make up the state: the working man. According to Smith every butcher, baker, craftsman and merchant would seek out his own self-interest and that economic advantage would ultimately benefit his fellow Englishman and the Crown. Smith’s arguments against some precepts of Mercantilism were intended to give the English tradesman a greater advantage, nothing more. The intended effect was to enrich one’s State above all others as an alternative to the primitive act of war, the traditional means to National enrichment. Smith viewed things as a zero sum game. And as England was the undisputed master of global exploitation at this time, exploitation of other Nations was fair game...Free market capitalism, as conceived by Smith, was Nationalistic in nature and as the Nation State became wealthier, so did its people and industry. This relationship required shared obligations and shared rewards between the State and its people.

Traditional Fascism, as conceived by Mussolini or Hitler, had an aggressive Nationalistic disposition where the State promoted Industry above all others in order to strengthen the State relative to its perceived rivals. Hitler and Mussolini believed that as the State lifted industry, industry lifted the people – dignity and pride in one’s nation were foundational principles...Monetary Fascism, as conceived by Friedman, uses the powers of the state to put the interest of money and the financial class above and beyond all other forms of industry (and other stake holders) and the state itself. In democracies and first world nations this is achieved through lobbying, campaign donations, financial incentives, revolving door regulators and through other means. As such, the state is co-opted into altering regulations / legislation, diverting investigations / prosecutions or creating tax loopholes for the benefit of the financial class/ industry. Ultimately these actions undermine state's sovereignty...For the rest of the world state interests and sovereignty are undermined through the IMF, The World Bank and other global monetary agencies. Monetary Fascism has a strong preference for political rather than capital investments. These investments are designed to sustain and support the preferences and activities of the financial class as it manipulates and create ever larger out-sized rent opportunities or constructs risk-diverting transactions that aggregate a ‘risk-arbitrage premium’ to one side of a transaction and transfers all future losses to the other...

AND THE REST IS HISTORY...MUCH MORE DETAIL AND DESPAIR AT LINK

I'LL LEAVE YOU WITH HIS CONCLUSIONS:

...consider what Friedman’s ‘free market’ banking system has done to Iceland, Ireland, Spain, Greece, Estonia, etc. How many western nations has Islam overthrown? Not one, and by comparison that should scare you...The predictable long term outcome is a steep decline into a very dark Monetary Feudalism. When asked in an interview what humanities’ future looked like, Eric Blair, better known as George Orwell, said “Imagine a boot smashing a human face forever.”

Welcome to the Dark Age of Money.

The progressive case against Obama By Matt Stoller

http://www.salon.com/2012/10/27/the_progressive_case_against_obama/?source=newsletterBottom line: The president is complicit in creating an increasingly unequal -- and unjust -- society...this piece is an attempt at laying out the progressive case for why one should not vote for Barack Obama for reelection, even if you are in a swing state.

There are many good arguments against Obama, even if the Republicans cannot seem to muster any. The civil liberties/antiwar case was made eloquently a few weeks ago by libertarian Conor Friedersdorf, who wrote a well-cited blog post on why he could not, in good conscience, vote for Obama. While his arguments have tremendous merit, there is an equally powerful case against Obama on the grounds of economic and social equity. That case needs to be made...So why oppose Obama? Simply, it is the shape of the society Obama is crafting that I oppose, and I intend to hold him responsible, such as I can, for his actions in creating it. Many Democrats are disappointed in Obama. Some feel he’s a good president with a bad Congress. Some feel he’s a good man, trying to do the right thing, but not bold enough. Others think it’s just the system, that anyone would do what he did. I will get to each of these sentiments, and pragmatic questions around the election, but I think it’s important to be grounded in policy outcomes. Not, what did Obama try to do, in his heart of hearts? But what kind of America has he actually delivered? And the chart below answers the question. This chart reflects the progressive case against Obama.

The above is a chart of corporate profits against the main store of savings for most Americans who have savings — home equity. Notice that after the crisis, after the Obama inflection point, corporate profits recovered dramatically and surpassed previous highs, whereas home equity levels have remained static. That $5-7 trillion of lost savings did not come back, whereas financial assets and corporate profits did. Also notice that this is unprecedented in postwar history. Home equity levels and corporate profits have simply never diverged in this way; what was good for GM had always, until recently, been good, if not for America, for the balance sheet of homeowners. Obama’s policies severed this link, completely. This split represents more than money. It represents a new kind of politics, one where Obama, and yes, he did this, officially enshrined rights for the elite in our constitutional order and removed rights from everyone else (see “The Housing Crash and the End of American Citizenship” in the Fordham Urban Law Journal for a more complete discussion of the problem). The bailouts and the associated Federal Reserve actions were not primarily shifts of funds to bankers; they were a guarantee that property rights for a certain class of creditors were immune from challenge or market forces. The foreclosure crisis, with its rampant criminality, predatory lending, and document forgeries, represents the flip side. Property rights for debtors simply increasingly exist solely at the pleasure of the powerful. The lack of prosecution of Wall Street executives, the ability of banks to borrow at 0 percent from the Federal Reserve while most of us face credit card rates of 15-30 percent, and the bailouts are all part of the re-creation of the American system of law around Obama’s oligarchy.

The policy continuity with Bush is a stark contrast to what Obama offered as a candidate. Look at the broken promises from the 2008 Democratic platform: a higher minimum wage, a ban on the replacement of striking workers, seven days of paid sick leave, a more diverse media ownership structure, renegotiation of NAFTA, letting bankruptcy judges write down mortgage debt, a ban on illegal wiretaps, an end to national security letters, stopping the war on whistle-blowers, passing the Employee Free Choice Act, restoring habeas corpus, and labor protections in the FAA bill. Each of these pledges would have tilted bargaining leverage to debtors, to labor, or to political dissidents. So Obama promised them to distinguish himself from Bush, and then went back on his word because these promises didn’t fit with the larger policy arc of shifting American society toward his vision. For sure, Obama believes he is doing the right thing, that his policies are what’s best for society. He is a conservative technocrat, running a policy architecture to ensure that conservative technocrats like him run the complex machinery of the state and reap private rewards from doing so. Radical political and economic inequality is the result. None of these policy shifts, with the exception of TARP, is that important in and of themselves, but together they add up to declining living standards.

While life has never been fair, the chart above shows that, since World War II, this level of official legal, political and economic inequity for the broad mass of the public is new (though obviously for subgroups, like African-Americans, it was not new). It is as if America’s traditional racial segregationist tendencies have been reorganized, and the tools and tactics of that system have been repurposed for a multicultural elite colonizing a multicultural population. The data bears this out: Under Bush, economic inequality was bad, as 65 cents of every dollar of income growth went to the top 1 percent. Under Obama, however, that number is 93 cents out of every dollar. That’s right, under Barack Obama there is more economic inequality than under George W. Bush. And if you look at the chart above, most of this shift happened in 2009-2010, when Democrats controlled Congress. This was not, in other words, the doing of the mean Republican Congress. And it’s not strictly a result of the financial crisis; after all, corporate profits did crash, like housing values did, but they also recovered, while housing values have not.

This is the shape of the system Obama has designed. It is intentional, it is the modern American order, and it has a certain equilibrium, the kind we identify in Middle Eastern resource extraction based economies. We are even seeing, as I showed in an earlier post, a transition of the American economic order toward a petro-state. By some accounts, America will be the largest producer of hydrocarbons in the world, bigger than Saudi Arabia. This is just not an America that any of us should want to live in. It is a country whose economic basis is oligarchy, whose political system is authoritarianism, and whose political culture is murderous toward the rest of the world and suicidal in our aggressive lack of attention to climate change...MUCH MORE WORTHYOF YOUR READING....We need to build a different model of politics, one in which people who want a different society are willing to actually bargain and back up their threats, rather than just aesthetically argue for shifts around the margin. The good news is that the changes we need to make are entirely doable. It will cost about $100 trillion over 20 years to move our world to an entirely sustainable energy system, and the net worth of the global top 1 percent is $103 trillion. We can do this. And the moments to let us make the changes we need are coming. There is endless good we can do, if enough of us are willing to show the courage that exists within every human being instead of the malevolence and desire for conformity that also exists within every heart.

Systems that can’t go on, don’t. The political elites, as much as they kick the can down the road, know this. The question we need to ask ourselves is, do we?

15 Things Neither Romney Nor Obama Is Brave Enough to Stand For By Bill Quigley

http://www.alternet.org/civil-liberties/15-things-neither-romney-nor-obama-brave-enough-stand?akid=9596.227380.Kblf2r&rd=1&src=newsletter734154&t=61. Neither candidate is interested in stopping the use of the death penalty for federal or state crimes.

2. Neither candidate is interested in eliminating or reducing the 5,113 US nuclear warheads.

3. Neither candidate is campaigning to close Guantanamo prison.

4. Neither candidate has called for arresting and prosecuting high ranking people on Wall Street for the subprime mortgage catastrophe.

5. Neither candidate is interested in holding anyone in the Bush administration accountable for the torture committed by US personnel against prisoners in Guantanamo or in Iraq or Afghanistan.

6. Neither candidate is interested in stopping the use of drones to assassinate people in Afghanistan, Pakistan, Yemen or Somalia.

7. Neither candidate is against warrantless surveillance, indefinite detention, or racial profiling in fighting “terrorism.'

8. Neither candidate is interested in fighting for a living wage. In fact neither are really committed beyond lip service to raising the minimum wage of $7.25 an hour – which, if it kept pace with inflation since the 1960s should be about $10 an hour.

9. Neither candidate was interested in arresting Osama bin Laden and having him tried in court.

10. Neither candidate will declare they refuse to bomb Iran.

11. Neither candidate is refusing to take huge campaign contributions from people and organizations.

12. Neither candidate proposes any significant specific steps to reverse global warming.

13. Neither candidate is talking about the over 2 million people in jails and prisons in the US.

14. Neither candidate proposes to create public jobs so everyone who wants to work can.

15. Neither candidate opposes the nuclear power industry. In fact both support expansion....

*********************************************************

Bill Quigley is a human rights lawyer and professor at Loyola University New Orleans College of Law. He is also a member of the legal collective of School of Americas Watch.

Weekend Economists Batten Down the Hatches October 26-28, 2012

This clipping from "Bell, Book and Candle", my favorite Hallowe'en movie, is a riff on "Stormy Weather", a standard mood piece:

Either way, we are facing rough weather.

First there's the big scary Frankenstorm that is the biggest buzz in meteorological circles:

"Frankenstorm" — a potentially devastating and highly unusual mix of tropical and winter weather approaching the mid-to-upper Eastern Seaboard — is being called simply Hurricane Sandy by The Weather Channel, along with the National Weather Service, the National Hurricane Center and other forecasters.... http://www.chicagotribune.com/news/ct-talk-frankenstorm-sandy-athena-1027-20121026,0,6607579.story

http://finance.yahoo.com/news/people-starting-freak-hurricane-sandy-144250090.html

...Writing today in the WSJ, resident weather expert Eric Holthaus is pointing toward a worrying scenario for the North-East: The hurricane could blend with a snowstorm to create havoc before Halloween, becoming a "snor’eastercane." Holthaus believes the odds of the storm hitting NYC are 2 in 3.

AccuWeather Alex Sosnowski also warns an inland storm could result in "coastal flooding, flooding rainfall, high winds, downed trees, power outages, travel mayhem and even Appalachian snow" from Boston to DC (including New York City).

Some even say the financial impact of this "mega-storm" worse than the Perfect Storm, the deadly storm immortalized by a George Clooney movie. The Weather Channel's meteorologist Jim Cantore is completely freaking out about the storm on Twitter.

The unique nature of the storm is its scariest aspect. From the National Weather Service:

THE HIGH DEGREE OF BLOCKING FROM EASTERN NORTH AMERICA ACROSS THE ENTIRE ATLANTIC BASIN IS EXPECTED TO ALLOW THIS UNUSUAL MERGER TO TAKE PLACE, AND ONCE THE COMBINED GYRE MATERIALIZES, IT SHOULD SETTLE BACK TOWARD THE INTERIOR NORTHEAST THROUGH HALLOWEEN, INVITING PERHAPS A GHOULISH NICKNAME FOR THE CYCLONE ALONG THE LINES OF "FRANKENSTORM", AN ALLUSION TO MARY SHELLEY'S GOTHIC CREATURE OF SYNTHESIZED ELEMENTS.

Mayor Bloomberg has warned New Yorkers to be prepared for an evacuation...

Then there's the election...and that's all I'm going to say. Fatigue set in early.

And of course, there's the ongoing economic climate change...

So post any and all these things. Or just post diversions in the art world.

Welcome to the Weekend!

How Castro Held the World Hostage

THIS IS AN AMAZINGLY BIASED SLANT ON HISTORICAL EVENTS--

I'D CALL IT: THE MOUSE THAT ROARED --DEMETER

http://www.nytimes.com/2012/10/26/opinion/how-castro-held-the-world-hostage.html?_r=0

ON Oct. 26-27, 1962, human civilization came close to being destroyed. Schoolchildren were ordered into shelters; supermarket shelves were emptied of soup cans and bottled water. It was the most perilous moment of the Cuban missile crisis, and of the cold war. But the danger of Armageddon did not begin, as legend has it, when the United States learned that Soviet missiles had reached Cuba’s shores earlier that month.

Rather, it was driven by Fidel Castro’s fears and insecurities after the botched Bay of Pigs invasion and by the failures of President John F. Kennedy and Premier Nikita S. Khrushchev to take him seriously. With Soviet missiles stationed on the island and America poised to attack, Cuba 50 years ago was far more dangerous than Iran or North Korea is today. But the 1962 crisis shows that a small, determined revolutionary state, backed into a corner and convinced of its inevitable demise, can bring the world to the brink of catastrophe...

OF COURSE, PICKING ON A TINY, DEFENSELESS ISLAND SIMPLY BECAUSE IT THREW OUT YOUR OCCUPATION IS NOT BRINGING THE WORLD TO THE BRINK OF CATASTROPHE...

I'M NOT SAYING CASTRO IS A SAINT, BUT I AM DISAPPOINTED IN THE USA'S CONTINUAL MISTREATMENT OF OUR NEIGHBOR

The Case Against the Looters of the American Economy, and a Mission for Occupy Wall Street

http://truth-out.org/news/item/12255-the-case-against-the-looters-of-the-american-economy-and-a-mission-for-occupyA little-known lawsuit advancing in federal court has the potential to change the moral and legal balance of power between private equity and the public good. But analysts say it may take the Occupy Movement to bring about needed regulatory reforms...The story begins in 2006 when the Department of Justice (DOJ) let it be known that it was conducting an investigation into possible antitrust violations within the private equity industry. While the DOJ has prosecuted private equity companies before under antitrust laws, these cases tend to apply to instances where a particular buyout deal would result in the monopolistic concentration of ownership within a market. For example, in 2008, federal prosecutors argued that if Bain Capital had been allowed to purchase a controlling stake in the media giant Clear Channel Communications then, "competition in the sale and provision of advertising on radio stations in [certain] markets would be substantially lessened or eliminated." This was pretty standard antitrust litigation for Justice Department lawyers. It did little to slow private equity's debt-financed takeovers and value extraction. Bain ended up buying Clear Channel in a club deal that included Thomas H. Lee Partners later that year. What was different about the DOJ's 2006 investigation into private equity was that federal prosecutors were said to be surveying the fundamental business practices of the entire industry with an eye to how virtually every other leveraged buyout was cheating shareholders, manipulating securities markets and illegally extracting value from public corporations.

It was rumored to be an investigation of sweeping scope into the industry's cartel-like organization through so-called club deals. The PE industry was worried; elite defense lawyers were mobilized to prepare a defense if necessary. After two years of rumors, but no suit announced, many observers began to conclude that the investigation was coming up short of the overwhelming evidence federal prosecutors often seek. Even so, counsel friendly to private equity advocated cosmetic changes to the industry. "Although it would be difficult for the DOJ to prove anticompetitive behavior, the recent inquiry should serve as a signal to private equity firms, such as KKR, to make changes," opined Jessica Jackson, a legal scholar sympathetic to the industry, in a 2008 Florida Law Review article. To defuse potential DOJ action, Jackson advocated greater transparency, written consortium agreements and lobbying and public relations investments to boost private equity's reputation, concluding that, "whatever the outcome, the DOJ probe might actually spur changes for the better."

Private equity's biggest firms breathed a collective sigh of relief when after several years no government action was filed and the investigation seemed to fizzle out. With the exception of increased public relations expenditures to combat bad press - the PE industry founded the Private Equity Growth Council, an industry lobbying association, in 2007 - mild changes advocated by reform proponents like Jackson were mostly set aside. One can only speculate about why the DOJ investigation evaporated...This wasn't the end of the inquiry, however. As is with many DOJ investigations, aggrieved individuals and plaintiff's lawyers took note that federal prosecutors were retreating, and therefore assembled their own case against the industry. In 2007 several individual investors filed suit against collusive clubs of private equity firms composed of Goldman Sachs Capital Partners, the Carlyle Group, Blackstone, TPG, and Permira Advisers.These firms are alleged to have stolen millions from shareholders in the leveraged buyouts of Freescale, a semiconductor manufacturer, and Kinder Morgan, a pipeline company. In 2008 the Detroit Police and Fire Retirement System filed its own lawsuit against the same firms, and other private equity titans, that together allegedly colluded in deals to privatize Neiman Marcus, Michaels Stores, the hospital corporation HCA, food services company Aramark, software designer SunGard, and PanAmSat, a satellite operator. These cases were quickly consolidated into what has become one of the most important federal antitrust class actions to advance in recent years, Dahl v. Bain Capital Partners.

In 2010 the judge hearing Dahl v. Bain, Edward F. Harrington of the Federal District Court in Massachusetts, allowed for a major expansion of the buyout deals being subjected to investigation and discovery, from 17 to 27. The plaintiffs recently concluded their survey of records of famous buyout deals produced by the industry's biggest players - more than 5 million documents according to a lawyer close to the case. Buyouts subject to investigation include Toys "R" Us, Harrah's Entertainment and the second largest buyout ever - the 2007 purchase of TXU for $44 billion - and even the Clear Channel deal mentioned above. The buyouts in question are nothing less than the crown jewels of private equity's corporate raids during the bull market of the mid-2000s.

Dahl v. Bain targets a dozen private equity groups as conspirators, including the giants of the industry, TPG, Blackstone, KKR, Goldman Sachs PIA, and Carlyle, which are in respective order the top-five largest PE firms, holding $221 billion under combined management....

SO MUCH MORE AT LINK!

How Higher Education in the US Was Destroyed in 5 Basic Steps

http://www.alternet.org/how-higher-education-us-was-destroyed-5-basic-steps?akid=9538.227380.aDAXr1&rd=1&src=newsletter728438&t=10&paging=offHigher education is not what it used to be, and that's no accident...A few years back, Paul E. Lingenfelter began his report on the defunding of public education by saying,

In the last few years, conversations have been growing like gathering storm clouds about the ways in which our universities are failing. There is talk about the poor educational outcomes apparent in our graduates, the out-of-control tuitions and crippling student loan debt. Attention is finally being paid to the enormous salaries for presidents and sports coaches, and the migrant worker status of the low-wage majority faculty. There are movements to control tuition, to forgive student debt, to create more powerful “assessment” tools, to offer “free” university materials online, to combat adjunct faculty exploitation. But each of these movements focuses on a narrow aspect of a much wider problem, and no amount of “fix” for these aspects individually will address the real reason that universities in America are dying.

To explain my perspective here, I need to go back in time. Let’s go back to post-World War II, 1950s when the GI bill, and the affordability – and sometimes free access – to universities created an upsurge of college students across the country. This surge continued through the ’60s, when universities were the very heart of intense public discourse, passionate learning, and vocal citizen involvement in the issues of the times. It was during this time, too, when colleges had a thriving professoriate, and when students were given access to a variety of subject areas, and the possibility of broad learning. The liberal arts stood at the center of a college education, and students were exposed to philosophy, anthropology, literature, history, sociology, world religions, foreign languages and cultures. Of course, something else happened, beginning in the late '50s into the '60s — the uprisings and growing numbers of citizens taking part in popular dissent — against the Vietnam War, against racism, against destruction of the environment in a growing corporatized culture, against misogyny, against homophobia. Where did much of that revolt incubate? Where did large numbers of well-educated, intellectual, and vocal people congregate? On college campuses. Who didn’t like the outcome of the '60s? The corporations, the war-mongers, those in our society who would keep us divided based on our race, our gender, our sexual orientation.

I suspect that, given the opportunity, those groups would have liked nothing more than to shut down the universities. Destroy them outright. But a country claiming to have democratic values can’t just shut down its universities. That would reveal something about that country which would not support the image they are determined to portray – that of a country of freedom, justice, opportunity for all. So, how do you kill the universities of the country without showing your hand? As a child growing up during the Cold War, I was taught that the communist countries in the first half of the 20th century put their scholars, intellectuals and artists into prison camps, called “re-education camps.” What I’ve come to realize as an adult is that American corporatism despises those same individuals as much as we were told communism did. But instead of doing anything so obvious as throwing them into prison, here those same people are thrown into dire poverty. The outcome is the same. Desperate poverty controls and ultimately breaks people as effectively as prison…..and some research says that it works even more powerfully.

MORE

Weekend Economists Reminisce: Black Monday October 19, 1987-2012

It's that time of year, when ghoulies and ghosties and things go bump in the dark, and little children like to terrify each other with scary stories and pranks.

But there are adult horrors associated with October, also. One happened 25 years ago today. Since this was 1987, it was a Monday, Black Monday.

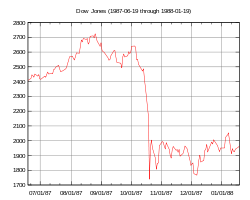

Stock markets around the world crashed, shedding a huge value in a very short time. The crash began in Hong Kong and spread west to Europe, hitting the United States after other markets had already declined by a significant margin. The Dow Jones Industrial Average (DJIA) dropped by 508 points to 1738.74 (22.61%).

By the end of October, stock markets in Hong Kong had fallen 45.5%, Australia 41.8%, Spain 31%, the United Kingdom 26.45%, the United States 22.68%, and Canada 22.5%. New Zealand's market was hit especially hard, falling about 60% from its 1987 peak, and taking several years to recover.

(The terms Black Monday and Black Tuesday are also applied to October 28 and 29, 1929, which occurred after Black Thursday on October 24, which started the Stock Market Crash of 1929. In Australia and New Zealand the 1987 crash is also referred to as Black Tuesday because of the timezone difference.)

The Black Monday decline was the largest one-day percentage decline in the Dow Jones. (Saturday, December 12, 1914, is sometimes erroneously cited as the largest one-day percentage decline of the DJIA. In reality, the ostensible decline of 24.39% was created retroactively by a redefinition of the DJIA in 1916.)

Following the stock market crash, a group of 33 eminent economists from various nations met in Washington, D.C. in December, 1987, and collectively predicted that “the next few years could be the most troubled since the 1930s”. However, the DJIA was positive for the 1987 calendar year. It opened on January 2, 1987 at 1,897 points and closed on December 31, 1987 at 1,939 points. The DJIA did not regain its August 25, 1987 closing high of 2,722 points until almost two years later.

Is it deja vu yet?

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373