Demeter

Demeter's JournalGoldman Sachs' Global Coup D'etat

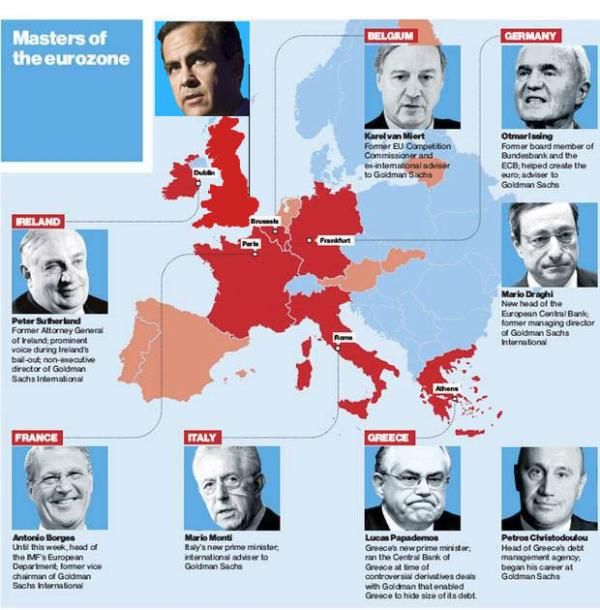

http://truth-out.org/opinion/item/12996-goldman-sachs-global-coup-de-tatWhen the people of Greece saw their democratically elected Prime Minister George Papandreou forced out of office in November of 2011 and replaced by an unelected Conservative technocrat, Lucas Papademos, most were unaware of the bigger picture of what was happening all around them.

Similarly, most of us in the United States were equally as ignorant when, in 2008, despite the switchboards at the US Capitol collapsing under the volume of phone calls from constituents urging a “no” vote, our elected representatives voted “yes” at the behest of Bush's Treasury Secretary Henry Paulsen and jammed through the biggest bailout of Wall Street in our nation’s history.

But now, as the Bank of England, a key player in the ongoing Eurozone crisis, announces that former investment banker Mark Carney will be its new chief, we can’t afford to ignore what’s happening around the world.

Steadily – and stealthily – Goldman Sachs is carrying out a global coup d’etat.

MORE AT LINK

THIS IS AN ELOQUENT CALL TO ARMS!

"Now is the winter of our discontent" Weekend Economists: November 30-Dec 2, 2012

Richard III Quote (Act I, Scene I). Wm. Shakespeare The Life and Death of King Richard III (c. 1591)

I was listening to the BBC when this report came out: Archaeologists think they have found the skeleton of the 15th century monarch Richard III...

I was greatly surprised. I didn't know they had lost him in the first place...England being the cradle of history that it is, I thought they kept track of things like that. Especially monarchs. Even the "bad" ones. Here are reports on the subject:

http://www.bbc.co.uk/news/uk-england-leicestershire-19575558

...Archaeologists began a dig searching for his last resting place on 25 August under a car park in Leicester. The excavation has uncovered the remains of a church which is thought to be where he was buried...

It is described as a "powerful and historic story" with "shades of Dan Brown". Clues at the dig for Richard III, archaeologists suggest, point to a skeleton's discovery being one of the most remarkable find ever made in England. Ahead of DNA confirmation, those who were there have reflected on what could be their own place in history.

Archaeologist Mathew Morris, described how they made the first discovery in one end of a 30m-long trench.

"We found one of his legs, sticking out into the trench from the side," he said. "You expect to find bits of bone in a churchyard because things get mixed up, so you then look for something connected to the leg and once you have that you know you have a burial. We weren't entirely sure we were in the church at that point, we could have been in the graveyard outside the church, so we actually waited for a few days to be sure of where it was before we to looked at it."

Work continued though, when the skeleton's location within the building was confirmed.

Mr Morris said: "It was a very simple grave, we don't think there was a coffin he was just wrapped in a shroud but he was laid carefully in the grave, it was done with respect. We cleaned all the other parts first but - because it is one of the fiddliest parts - we left the spine to last moment. So it was right after we had the rest of him uncovered, and [the spine] was really obviously curved and we looked at each other and said 'Wow, this is a really good candidate'. And when we lifted the spine, we found an arrowhead!"

Dr Jo Appleby, University of Leicester osteoarchaeologist, said they were still sceptical even as the excavation was being carried out.

"We thought it was pretty unlikely to be Richard III," she said. "So it was quite a shock when it began to show the characteristics it did. We found the damage to the head and that set a few alarm bells ringing - but of course we live in a world where you just don't find dead kings! I told myself it was just coincidence, it was some other guy, lots of medieval people were involved in battles. Pieces of medieval masonry recovered from the site Fragments of masonry showed the dig was on the site of a high status building...But when we got to the spine and we saw that kink in it, it was incredible. If you had a tick list of what you wanted to find, this was it."

The bones also provide powerful evidence of a violent death.

"We haven't looked at all of the skull yet but we have two wounds so far," said Dr Appleby. "Basically, a slice has been taken off the back of the head and there is also wound to the top of the head, very small on the outside but causing a lot of damage inside, caused by something more pointy."

Mr Morris said the team's achievement was not clear at first.

"We didn't get off-site until seven in the evening, with the sun going down and we were under such pressure to do it properly that we didn't think about it much," he said. "But driving home that evening it began to sink in what we might have done. It was a surreal evening...As an archaeologist people always ask what the best thing you have ever found is. I used to have to think about that, not any more."

http://www.bbc.co.uk/news/uk-england-20116118

The government has confirmed a skeleton that could be that of Richard III will be interred in Leicester if it is confirmed as the 15th Century king...Leicester, Nottinghamshire and York MPs discussed a permanent grave on Friday. In a written answer, justice minister Helen Grant said the skeleton would be interred at Leicester Cathedral if tests proved it was Richard III. In response to a question posed by Dan Jarvis, Labour MP for Barnsley, Ms Grant wrote:

"My Department issued a licence to exhume human remains which could be those of Richard III...Remains have now been exhumed and archaeologists are currently carrying out tests to determine the identity of the remains. Should they be found to be those of Richard III, the current plan is for them to be reinterred in Leicester Cathedral."

DNA results on the bones are being compared to that of living descendants of Richard's eldest sister, Anne of York.

Richard died at the hands of forces of Henry Tudor near Market Bosworth, Leicestershire. His grave, in the church of Greyfriars in Leicester, was lost during centuries of redevelopment.

http://www.bbc.co.uk/news/uk-england-leicestershire-20391935

Archaeologists who discovered a skeleton thought to be Richard III have said it could be January before tests confirm whether it is the former king...

Prof Lynn Foxhall, from the University of Leicester, said the team has got to be sure of its facts before it confirmed whether it was the monarch. The results of DNA tests on the bones had been expected in mid-December.Prof Foxhall said:

"We always said once we got the DNA going it would take a minimum of 12 weeks, I think that is still the case. There are quite a lot of different experts involved, mostly around the University of Leicester, but outside experts as well, and there's loads of things to check up."

She said each bone can take eight hours to scan in order to give a detailed X-ray. "It's not like CSI [Crime Scene Investigation], it just takes a long time," she said. "But the evidence is looking really good."

MORE DETAILS AS THEY UNFOLD...

Why Even a Deal on the Budget Is Bad for the American Economy

http://www.alternet.org/economy/why-even-deal-budget-bad-american-economy?page=0%2C1&akid=9721.227380.wjdf8I&rd=1&src=newsletter750513&t=18&paging=offOutcomes range from slowdown to outright recession. And it's all totally unnecessary...Looking at the latest US data, business sentiment and capital spending have been eroding, and given the lagged impact of capital expenditure, that trend looks set to continue for the next few months. Against that, a number of consumer sentiment indicators remain upbeat and housing looks like it is in a firmly established uptrend, after a 5 year bear market. In fact, the existing home inventory to sales ratio is as low as it ever gets, and that is with still very depressed sales. If sales pick up further, given low inventories and with new housing starts still below the replacement rate, home prices could lurch forward.

That said, the markets have been fairly upbeat given the rising perception of a deal to avert the US falling off the ‘fiscal cliff’. But even a deal that drains, say, 1-1.5% of GDP will have negative consequences for the US economy. Bear in mind that the U.S. still has a very high ratio of private debt to GDP. Therefore any such fiscal restriction as contemplated by the two parties may result in a significantly lower economic growth rate than the average 3% rate of the last five quarters (which is what the revised economic data of the past few quarters will eventually show).

Of course, if there is no compromise, the impact could be calamitous. The IMF projects as much as a 4% decline in GDP if there is a full fiscal cliff. In 1936-37 there was a fiscal cliff of almost 6% of GDP. It was followed by a 36% non annualized decline in industrial production in a mere eight months in late 1937/early 1938. More recently, all of the European countries fiscal restriction has had a more negative impact on GDP than had initially been forecast.

So the range of likely outcomes ranges from slowdown to outright recession and the silly thing is that it is all so unnecessary. Social Security, Medicare and Medicaid impose no real burdens, even with a rising proportion of ageing baby boomers. In fact, one could plausibly make the case that an aging society could help to generate favorable conditions for achieving sustained high employment with high productivity growth. As the number of aged rises relative to the number of potential workers, what is required is to put unemployed labor to work to produce output needed by seniors. Providing social security benefits to retirees will generate the necessary effective demand to direct labor to producing this output. Just as rapid growth of effective demand during the Clinton boom allowed sustained growth of the employment rate, even as productivity growth rose nearer to United States long-term historical averages, tomorrow’s retirees can provide the necessary demand to allow the United States to operate near to full employment with rising labor productivity—a “virtuous combination” of the high productivity growth model followed by Europe and Japan from 1970–95 and the high employment model followed by the United States during the 1960s, as well as during the Clinton boom. Here’s what most members of Congress (and, indeed, the media and the public) fail to appreciate: Policy formation must distinguish between financial provisioning and real provisioning for the future; only the latter can prepare society as a whole for coming challenges. While individuals can, and should, save financial assets for their individual retirements, society cannot prepare for waves of future retirees by accumulating financial trust funds. Rather, society prepares for aging by investing to increase future real productivity. Unfortunately, no such discussions are taking place, which is likely to lead to a bad to horrific policy outcome.

MORE

Marshall Auerback is a market analyst and commentator.

Michael Hudson on How Finance Capital Leads to Debt Servitude

http://www.nakedcapitalism.com/2012/09/michael-hudson-on-how-finance-capital-leads-to-debt-servitude.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29Q: How has the financial system evolved into the form of economic servitude that you call “debt peonage” in your book, implying a negation of democracy as well as free-market capitalism as classically understood?

A: The original hope of banking and finance capitalism in the 19th century was that banks would make productive loans to finance industry. The aim was for banks to do something new, that no economy had done in the past: make loans not merely to ship and market goods once they were produced, but to finance new capital investment by manufacturers and producers, as well as by the public sector to build infrastructure. The idea was for these investments to create profits out of which to pay the interest and the principal back to the lenders.

This was defined as productive lending. Nothing like it occurred in antiquity or in the post-feudal period. Investment always had been self-financed out of savings. Banks only entered the picture when it came to shipping and trading what had been produced.

As matters have turned out, banking has allied itself with real estate, mineral extraction, oil, gas and monopolies instead of with industry. So instead of getting a share of the profits, it has focused on lending against economic rent. This technical term is defined as unearned income. It is obtained by charging prices in excess of cost value. Economic rent has no counterpart in the cost of putting means of production in place. And land has no cost; it is provided by nature. The only “cost” is the price of buying the right to charge rent on it. This economic rent is created by special legal privilege or ownership rights to install tollbooths on roads, education systems and other basic needs. Owners aim to charge as they can, without regard for how this affects overall growth and balance.

Banks have the privilege of creating credit and charging for access to it. Most bank credit is extended to buy property or rent-seeking privileges already in place. Banks rarely are set up to evaluate new capital investment. Their time frame is notoriously short-term. It takes time to develop production facilities, mount a sales campaign and develop markets for new goods. It is easier simply to buy a privilege to extract charges without producing anything at all. This is what property rights are, along with special privileges such as charging interest without making a tangible investment. So banks back the kind of economy that makes money without new capital investment. The easiest way to do this is to make loans for real estate at increasingly debt-leveraged, bank-inflated prices. They call this a post-industrial “service” economy. It is simply a rentier tollbooth economy.

Classical economists from the Physiocrats down through the Progressive Era a century ago explained why land rent, subsoil natural resource rent and monopoly rent should have been the source of tax for cities, states and nations. That is the essence of classical economics. But instead of supporting productive industry by extending credit to increase tangible capital investment, the banking system has extended credit mainly (about 80 percent in the United States and most English-speaking countries) to buy real estate and load it down with debt. The result is that rental income is used to pay interest to the banks rather than to pay taxes. This forces governments to tax wages, profits and sales. That increases the cost of living and doing business, on top of the interest charge...MORE--IMPORTANT!

Read more at http://www.nakedcapitalism.com/2012/09/michael-hudson-on-how-finance-capital-leads-to-debt-servitude.html#GWKesZhwLyWVrezf.99

Someone Noticed the IRS isnít Enforcing Tax Laws in the Mortgage-Industrial Complex?

http://www.nakedcapitalism.com/2012/09/mirable-dictu-has-someone-noticed-the-irs-isnt-enforcing-tax-laws-in-the-mortgage-industrial-complex.html#z5yhT3tFJuxommSZ.99Reader Deontos highlighted a post on Reuters by two Brooklyn Law School professors, Bradley Borden and David Reiss, on a subject near and dear to our hearts, the abject failure of the IRS to take interest in widespread, probably pervasive, violations of REMIC, the part of the Federal tax code that governs mortgage securitizations.

The reason this matters is that this situation belies on of the Administration’s pet claims, that its hands were tied as far as addressing the foreclosure mess was concerned because it had no leverage over servicers. As we’ll discuss, in fact the Administration has a nuclear weapon in its hands that it is simply refusing to use.

The reason the Borden and Reiss piece is noteworthy is it’s the first time I’m aware of that experts have chosen to comment at length on the REMIC issue, suggest that there is likely a BIG problem here, and politely point out that the REMICs may have committed fraud, which would allow the statute of limitations to remain open indefinitely, giving the IRS plenty of time to investigate and litigate.

However, I suspect the professors have heard that the IRS is choosing to do nothing, as their quote of Lee Sheppard at the top of their piece suggests:

We suspect they know full well the Wall Street Rule is being applied here...

The Goldman Sachs Project to take over Europe nearly complete

AND WHAT DO THOSE MORONS THINK THEY ARE GOING TO DO WITH IT?

RESURRECT THE ROMAN EMPIRE? FAT CHANCE OF THAT. THERE'S NO GOING BACKWARDS, AND IF THEY HAVE A PLAN FOR GOING FORWARD, THEY HAVEN'T LET A WHISPER OF IT OUT.

http://www.dailykos.com/story/2012/11/26/1164745/-The-Goldman-Sachs-Project-to-take-over-Europe-nearly-complete

Sometimes a person or organization becomes so powerful and Evil that they appear cartoonish. It might seem impossible to find a similar character outside of a James Bond movie or a cartoon about a mouse with an oversized brain. After all, who really wants to take over the world and has a plan to do it, right?

And yet, Goldman Sachs is on the verge of doing what Julius Caesar, Charlemagne, Hitler and Napoleon tried and failed to do.

"He is quite simply the best, most experienced and most qualified person in the world to be the next Governor of the Bank of England," Osborne said.

The announcement sounds unthreatening until you put it into perspective. For example, in July the Independent had a great graphic that displayed the New Reality in Europe:

Well now that graphic needs to be updated to this.

Everywhere that a nation has gotten into economic trouble, Goldman Sachs has moved into a position of power.

Most companies are usually content to pump-and-dump a stock to the public. Goldman Sachs does it with nations. The normal scenario usually involves helping a nation hide a problem and sell its debt until the problem blow up into a bubble that bursts in a spectacular way. Goldman Sachs makes money selling the overpriced debt, and by betting against the nation. Goldman Sachs then puts their "man" into a position of power to direct the bailouts so that Goldman gets all its money back and more, while the nation's economy gets gutted. 3rd world nations have seen this before, but Goldman Sachs have been sparing no one.

It was a Goldman Sachs man, Mark Carney, now head of the Bank of England, that helped tank Russia's economy in the 1990's.

The fact that Goldman Sachs has felt it necessary to put one of their own in the Bank of England should raise alarm bells about what the future holds for Britain...

THERE'S MUCH MORE, AND IT'S A DISSECTION OF EVIL.

Meet the TPP: A Worldwide Corporate Power Grab of Enormous Proportions

http://understory.ran.org/2012/09/10/meet-the-tpp-a-worldwide-corporate-power-grab-of-enormous-proportions/As international trade negotiators gathered this week at a posh golf resort in rural Virginia to hammer out details of the proposed Trans Pacific Partnership (TPP), they sought to project an image of inclusion and receptivity to public input. In reality, this high-stakes global corporate pact, now in its 14th round of discussions, is heavily guarded by paramilitary teams with machine guns and helicopters as it is developed behind closed doors under a dangerous and unprecedented veil of secrecy. What the hell is the TPP, you may ask? While it is among the largest and potentially most important ‘free trade’ agreements the world has ever seen, one can hardly be blamed for not being familiar with it yet. The corporate cabal behind it, including names like Cargill, Pfizer, Nike and WalMart, has done an exceptional job of maintaining an almost total lack of transparency as they literally design the future we will all inhabit. While 600 corporate lobbyists have been granted access and input on the draft texts from the beginning, even high-ranking members of Congress have been denied access to the most basic content of what US negotiators are proposing in our names.

Demand transparency now! Write to US trade representative Ron Kirk and lead Cargil trade lobbyist Devry Boughner to demand they make the text public. Thankfully, draft texts of the proposal have appeared on Wikileaks and the website of Citizen’s Trade Campaign. It is difficult to overstate the potential implications on the lives of people around the world if anything like the agreement in these leaked documents were to be implemented with the force of law. The TPP is called a ‘trade agreement,’ but in actuality it is a long-dreamed-of template for implementing a binding system of global corporate governance as bold as anything the world’s wealthiest elite has attempted before. Of the 26 chapters under negotiation, only a few have to do directly with trade. The other chapters enshrine new rights and privileges for major corporations while weakening the power of nation states to oppose them. The TPP essentially proposes to establish a parallel system of justice where companies can sue countries in a tribunal of judges composed of unaccountable international trade lawyers with little to no process for appeal. This wild bastardization of the concept of justice endangers everything from affordable medicines, internet freedoms and intellectual property rights to democratically enacted labor laws and environmental protections. And that’s not to mention the massive outsourcing of middle class jobs from the US to countries like Vietnam and Brunei. This isn’t just a bad trade agreement, it’s a wish list of the 1%—a worldwide corporate power grab of enormous proportions.

This week, in an empty warehouse on the outskirts of downtown Baltimore, a group of activists from around the US gathered to plan a spirited week of resistance to the TPP. Finally, after three years of secret negotiations, the momentum of an opposition movement is building. On Sunday, a diverse and raucous crowd of a couple hundred people descended on this exclusive golf resort to demand their voices be heard, chanting after each speaker: “Flush the TPP!” NAFTA was the last straw that sent the Zapatistas into armed rebellion. The WTO negotiations spawned a robust and global anti-globalization movement the likes of which the world had never seen. Even after 9/11, the FTAA elicited a pushback of people power that even a fully militarized Miami police force could not completely suppress.

But near as I can tell, even though the TPP is bigger, bolder and badder than any trade agreement before it, the small group gathered this week on a grassy hillside in rural Virginia is the backbone of resistance to the TPP today. The elements are there: a diverse coalition of wonky NGOs, social justice and trade policy experts, urban anarchists, Occupiers and suburban activists painting banners and scheming pranks—labor leaders, environmental groups and representatives from Mexico, Peru and beyond, but the scale is so far totally out of proportion to the threat we’re facing. But this is beginning to change. Speakers at Sunday’s rally included key labor leaders from the Teamsters, and the Communications Workers of America joined with the leaders of environmental groups from the Sierra Club, Friends of the Earth and Rainforest Action Network. The TPP was conceived under the second Bush administration, but it has been embraced and nurtured into maturity under Obama’s watch. The widespread belief among people here opposing it is that the current Administration is in a race to finish much of the negotiations while they can bank on the fact that labor leaders and environmental and human rights advocates will shy away from challenging a democratic president in an election year. Free trade agreements are particularly unpopular in the key swing states Obama needs to win this election—making right now a crucial moment of opportunity to pull the TPP out of the shadows and leverage our combined political power to kill it before it takes root any deeper.

Stay tuned, one way or another history will be made in the coming months and the outcome will forever influence how our communities and countries relate to each other in an ever-shrinking world.

Flush the TPP! MORE INFORMATION AT

http://www.citizenstrade.org/ctc/wp-content/uploads/2012/09/TPPLeesburgReportersMemo.pdf

You Think You're Getting Social Security But You're Not, Says Multimillionaire Banker

http://www.fair.org/blog/2012/11/20/you-think-youre-getting-social-security-but-youre-not-says-multimillionaire-banker/What should the U.S. do about the so-called "fiscal cliff"? Who better to ask than Goldman Sachs CEO Lloyd Blankfein, "one of the world's most influential bankers"?

That's what CBS Evening News must have been thinking, anyway, when they did a segment last night (11/19/12) all about Blankfein's opinions. CBS's Scott Pelley began: "When we asked Blankfein how to reduce the federal budget deficit, he went straight for the subject that politicians don't want to talk about."

PELLEY: Social Security, Medicare, Medicaid?

BLANKFEIN: Some things.

It's maddening, isn't it, when someone who obviously knows exactly what needs to be done insists on being so coy about it? Luckily, Blankfein did offer some specifics on one of those things that we think we're going to get, and aren't:

Huh. So Blankfein–who was paid $16 million last year, and owns $210 million worth of his company's stock–thinks that people can retire on Social Security after working for 25 years? As Gene Lyons pointed out, that would mean that people are getting their first paychecks when they're 42–or, assuming they're willing to take the severe benefit cuts that come with early retirement, at 37. Or possibly he mistakenly believes Social Security allows you to retire at 41.

He also thinks people typically live to be 92 or 97, depending. In real life, of course, most people start working as early as 16, so they reach retirement age after 51 years of labor, when they have a life expectancy of 17 years–or 14 years if they're an African-American man.

On the basis of this peculiar understanding of U.S. society–which, strangely, doesn't seem to trouble Pelley at all–Blankfein has some news for us:

PELLEY: Because we can't afford them going forward?

BLANKFEIN: Because we can't afford them.

You often hear this "we can't afford them" line, sometimes from people who aren't multimillionaires. For the record, in 1937, when the Social Security Act was passed, the per capita GDP of the U.S. was than $7,971. In 1965, when Medicare was created, it was $18,575. Today it's $42,671. (All figures in 2005 dollars.)

It's hard to figure out how we could afford to take care of our old people in 1937 and 1965, when our country was one–quarter or one–half as wealthy as it is today, but can't afford to do so today. Unless it has something to do with the fact that in 1937 and 1965–people like Lloyd Blankfein didn't make $16 million a year.

VIDEO AT LINK

Getting Economics to Acknowledge Rentier Finance FROM SEPT. 11

http://www.nakedcapitalism.com/2012/09/getting-economics-to-acknowledge-rentier-finance.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29The economics discipline has for the most part managed to ignore the 800 pound gorilla in the room: that of the role that the financial services industry has come to play. Astonishingly, even though the reengineering of the world economy along the lines preferred by mainstream economists resulted in a prosperity-wrecking global financial crisis and a soft coup by financiers, the discipline carries on methodologically as if nothing much had happened. And one of its huge blind spots is its refusal to acknowledge the role of banking and finance in modern commerce. Interest rates are simply an input into the preferred form of macro models, DSGE (dynamic stochastic equilibrium models). Economies are assumed to be self correcting, and to automagically “correct” to full employment. All shocks to the system are exogenous. In other words, boom-bust credit cycles are simply omitted because they are ideologically inconvenient and instability is too hard to model.

Various heterodox economists (as well as some empirically oriented economists that come out of the mainstream, most notably Andrew Haldane of the Bank of England and Claudio Borio and Piti Disyatat of the Bank of International Settlements) are making a concerted effort to represent the role of the finance in modern economies. A new paper by Michael Hudson (University of Missouri at Kansas City) and Dirk Bezemer (University of Groningen, Netherlands) makes an important contribution by looking at financial services from a Classical economics perspective. Classical economists took a decidedly dim view of what they saw as unproductive rent-seeking, with “rent” seen as the dead hand of the feudal aristocracy weighing on current production:

Just as landlords were the archetypal rentiers of their agricultural societies, so investors, financiers and bankers are in the largest rentier sector of today’s financialized economies: finance controls the economy’s engine of growth, which is credit in all its forms. Economies obviously need banking services, insurance services, and real estate development and so, of course, not all of finance is “without working, risking, or economizing”. The problem today remains what it was in the 13th century: how to isolate what is socially necessary for ‘retail’ banking – processing payments by checks and credit cards, deciding how to relend savings and new credit under normal (non-speculative) conditions – from extortionate charges such as 29% interest on credit cards, penalty fees and other charges in excess of what is socially necessary cost-value.

Hudson and Bezemer argue that the failure to distinguish between productive activity versus rent seeking distorts and overstates the accounting for national output:

The authors describe how much the financial sector has grown relative to the productive economy. Financial sector total financial assets (as in the asset side of bank balance sheets and off balance sheet vehicles) was one times US GDP in the early 1950s and is roughly 4.5 times GDP now. Financial sector earnings were 10% of total corporate profits in the 1950s and 1950s and rose to 40% in the early 2000s. Yet despite the sorry record, in terms of falling growth rates, stagnant average worker wages, and increasingly frequent and severe financial crises, orthodox economists look favorably upon financial “deepening,” meaning the proliferation of financial products and services (aka “innovation”). To put it more simply, the rentiers have the firm backing of mainstream economists, despite the evidenced of its destructiveness:

Demographically, the effect of debt deflation is emigration and other negative effects. For example, after Latvian property prices soared as Swedish bank branches fueled the real estate bubble, living standards plunged. Families had to take on a lifetime of debt in order to gain the housing that was bequeathed to the country debt-free when the Soviet Union broke up in 1991. When Latvia’s government imposed neoliberal austerity policies in 2009-10, wage levels plunged by 30 percent in the public sector, and private-sector wages followed the decline (Sommers et al 2010). Emigration and capital flight accelerated: the Economist (2010) reported that an estimated 30,000 Latvians were leaving every year, on a 2.2m population. In debt-strapped Iceland, the census reported in 2011 that 8% of the population had emigrated (mainly to Norway).

The irony of Hudson’s and Bezemer’s need to look back to the early days of economics is that a view that was widely shared then was the importance of usury ceilings. Why? If bankers were free to seek out the highest yielding loans, they would. And the people who would pay the most would not be businessmen but rich gamblers. So the fact that unconstrained banking would wind up promoting speculation rather than investment was seen as obvious centuries ago, yet supposedly more sophisticated modern economists seem to prefer to truck with Dr. Pangloss and tell us that the system they’ve helped create is both inevitable and virtuous, when neither is true.

Weekend Economists Back in Business! November 23-25, 2012

Well, in honor of the occasion, the DJIA pole vaulted to 13,000 again. Ben Bernanke had to do something to earn his Xmas (Hanukkah?) bonus...what's a QE for, anyway? Certainly not for the homeless, hungry, sick or unemployed....

So, I guess the theme today is Cynicism. And the subject is turkeys.

Yes, this is where you get to post them:

1. Turkeys of ideas

2. Turkeys of businesses, and/or business people

3. Political turkeys

4. Turkeys you have known, personally (do try to be discreet and not violate privacy, if they are of the human kind)

5. Actual turkeys (for the literalists and those who haven't had enough yet)

6. Anything else that appeals. It's a big tent kind of thread.

&feature=related

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373