Demeter

Demeter's JournalGail Tverberg: Debt - Eight Reasons This Time is Different

http://www.planbeconomics.com/2014/07/gail-tverberg-debt-eight-reasons-this.htmlIn today’s world, we have a huge amount of debt outstanding. Academic researchers Carmen Reinhart and Kenneth Rogoff have become famous for their book This Time is Different: Eight Centuries of Financial Folly and their earlier paper This Time is Different: A Panoramic View of Eight Centuries of Financial Crises. Their point, of course, is that the same thing happens over and over again. We can learn from past crises to solve our current problems. Part of their story is of course correct. Governments have gotten themselves into problems with debt, time after time. This is happening again now. In fact, the same two authors recently prepared a working paper for the International Monetary Fund called Financial and Sovereign Debt Crises: Some Lessons Learned and Some Lessons Forgotten, talking about ideas such as governments inflating their way out of debt problems and pushing problems off to insurance companies and pension funds, through regulations requiring investment in certain securities.

Many seem to believe that if we worked our way out of debt problems in the past, we can do the same thing again. The same assets may have new owners, but everything will work together in the long run. Businesses will continue operating, and people will continue to have jobs. We may have to adjust monetary policy, or perhaps regulation of financial institutions, but that is about all...I think this is where the story goes wrong. The situation we have now is very different, and far worse, than what happened in the past. We live in a much more tightly networked economy. This time, our problems are tied to the need for cheap, high quality energy products. The comfort we get from everything eventually working out in the past is false comfort. If we look closely at the past, we see that in some cases the outcomes are not benign. There are situations where much of the population in an area died off. This die-off did not occur directly because of debt defaults. Instead, the same issues that gave rise to debt defaults, primarily diminishing returns with respect to food and other types of production, also led to die off. We are not necessarily exempt from these same kinds of problems in the future.

Why the Current Interest in Debt Levels and Interest Rates

The reason I bring up these issues is because the problem of too much world debt is now coming to the forefront. The Bank for International Settlements, which is the central bank for central banks, issued a report a week ago in which they said world debt levels are too high, and that continuing the current low interest rate policy has too many bad effects. Something needs to be done to normalize monetary policy....Janet Yellen, Federal Reserve Chair, and Christine Lagarde, managing director or the International Monetary Fund, have also been making statements about the issue of how to fix our current economic problems (News Report; Video). There is the additional rather bizarre point that back in January, Lagarde used numerology to suggest that a major change in policy might be announced in 2014 (on July 20?), with the hope that the past “seven miserable years” can be followed by “seven strong years.” The IMF has talked in the past about using its special drawing rights (SDRs) as a sort of international currency. In this role, the SDRs could act as the world’s reserve currency, be used for issuing bonds, and be used for setting the prices of commodities such as gold and oil. Perhaps a variation on SDRs is what Lagarde has in mind...So with this background, let’s get back to the main point of the post. How is this debt crisis, and the likely outcome, different from previous crises?

1. We live in a globalized economy. Any slip-up of a major economy would very much affect all of the other major economies. Banks hold bonds of governments other than their own. If a major government fails to make good on its promises, it can affect other governments as well. Smaller countries, like Greece or Cyprus, can be bailed out or their problems worked around. But if the United States, or even Japan, should run into major difficulties, it would affect the world as a whole. See my post, Twelve Reasons Why Globalization is a Huge Problem.

2. Our problem now is not simply governmental debt; it is debt of many different types, affecting individuals and businesses of all kinds, as well as governments. In the studies of historical debt by Reinhart and Rogoff, the focus is on governmental debt. Now there is much more debt, some through banks, some through bonds, and some through less traditional sources. There are also derivatives that are in some ways like debt. In particular, if there are sharp moves in interest rates, it is possible that some issuers of derivatives will find themselves in financial difficulty. There are also promises that are in many ways like debt, but that technically aren’t guaranteed, because legislatures can change the promised benefits whenever they choose. Examples of these are our current Social Security program and Medicare benefits. Citizens depend on these programs, even if there is no promise that they will continue to exist in their current form. With all of these kinds of debt and quasi-debt, we have a much more complex situation than in the past.

3. Our economy is a self-organized system that has properties of its own, quite apart from the properties of the individual consumers, businesses, governments, and resources that make up the system. Circumstances now are such that the world economy could fail, even though this could not happen in the past...I recently wrote about the nature of a networked economy, in my post Why Standard Economic Models Don’t Work–Our Economy is a Network. In that post, I represented our networked economy as being somewhat like this dome that can be built with wooden sticks.

?w=640

?w=640

Figure 1. Dome constructed using Leonardo Sticks

Years ago, when a civilization collapsed, the network of connections was not as dense as it is today. Most food was not dependent on long supply chains, and quite a bit of manufacturing was done locally. If one economy collapsed, even a fairly large one like the Weimar Republic of Germany, the rest of the world was not terribly dependent on it. Figuratively, the “hole” in the dome could mend, and over time, the economy could strengthen and go on as before. We cannot count on this situation today, however.

4. Fossil fuels (coal, oil and natural gas) available today are what enable tighter connections than in the past, and also add vulnerabilities. Early economies relied mainly on the sun’s energy to grow food, gravity to help with irrigation, human energy and animal energy for transport and food growing, wind energy to power ships and wooden windmills, and water energy to operate water wheels. Wood was used for many purposes, including heating homes, cooking, and making charcoal to provide the heat needed to smelt metals and make glass. In the past two hundred years we have added fossil fuels to our list of fuels. This has allowed us to make metals in quantity, as well as concrete and glass in quantity, enabling the development of much technology. The use of coal enabled the building of hydroelectric dams as well as electrical transmission lines, thus enabling widespread use of electricity. Fossil fuels enabled other modern fuels as well, including nuclear energy, and the manufacture of what we today call “renewable energy,” including today’s wind turbines and solar PV.

Of the fossil fuels, oil has been especially important. Oil is particularly good as a transport fuel, because it is easily transported and very energy dense. With the use of oil, transport by smaller vehicles such as cars, trucks and airplanes became possible, and transport by ship and by rail was improved. Such changes allowed international businesses to grow and international trade to flourish. Economies were able to grow much more rapidly than in the pre-fossil fuel era. Governments became richer and began offering education to all, paved roads, and benefits such as unemployment insurance, health care programs, and pensions for the elderly. Thus, fossil fuels enable a very different lifestyle, and very different governments and government programs than existed prior to fossil fuels. If something were to happen to all fossil fuels, or even just oil, most businesses would have to cease operation. Governments could not collect enough taxes to continue functioning. Very few farmers would be able to produce food and transport it to market, because oil is used to transport seeds to farmers, to operate machinery, to operate irrigation equipment, to transport soil amendments, and to create herbicides and pesticides. This situation now is very different from the past, when most food was produced using human and animal labor, and transport was often by a cart pulled by an animal. Before fossil fuels, even if governments collapsed and most people died off, the remaining people could continue growing food, gathering water, and going about their own lives. If we were to lose oil, or oil plus electricity (because oil is required to maintain electric transmission and because businesses tend to close when they are missing either oil or electricity), we would have a much harder time. Most of our jobs would disappear. Banks wouldn’t be able to operate. Our water and sewer systems would stop working. We would find it necessary to “start over,” in a very different way.

5. Because of the big role of debt today, economic growth is essential to keeping the current economic system operating. It is much easier to pay back debt with interest when an economy is growing than when it is shrinking, because when an economy is shrinking, people are losing their jobs. Even if only, say, 10% lose their jobs, this loss of jobs creates many loan defaults. Banks are likely to find themselves in a precarious position and are likely to cut back on lending to others, making the situation worse. If the economy starts shrinking, businesses will also have difficulty. They have fixed costs, including rent, management salaries, and their own debt repayments. These costs tend to stay the same, even if total revenue shrinks because of an economic slowdown. Because of these problems, businesses are also likely to find it increasingly difficult to pay back their own debt in a recession. They are likely to find it necessary to lay off workers, making the recession worse.

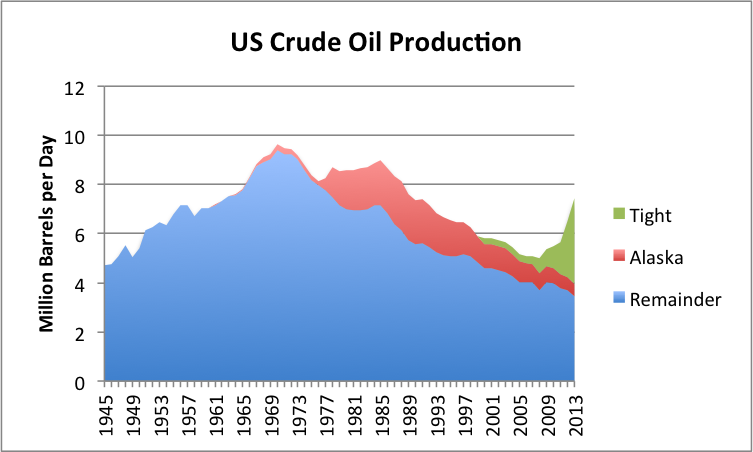

If economic growth is very low, this lack of growth can to some extent be covered up with very low interest rates. But such very low interest rates tend to be a problem as well, because they encourage asset bubbles of many sorts, such as the current run-up in stock market prices. It is not always clear which bubbles are being run up by low interest rates, either. For example, it is quite possible that the recent run-up in US oil extraction (see Figure 4, below) is being enabled by ultra-low interest rates debt (since this is a cash-flow negative business) and by investors who a desperate for an investment that might yield a slightly higher yield than current low bond yields...Actually, the current need for growth to prevent defaults is not all that different from the situation in the past 800 years. In Reinhardt and Rogoff’s academic paper mentioned above, the authors remark, “It is notable that the non-defaulters, by and large, are all hugely successful growth stories.” Reinhardt and Rogoff didn’t seem to understand why this occurred, however.

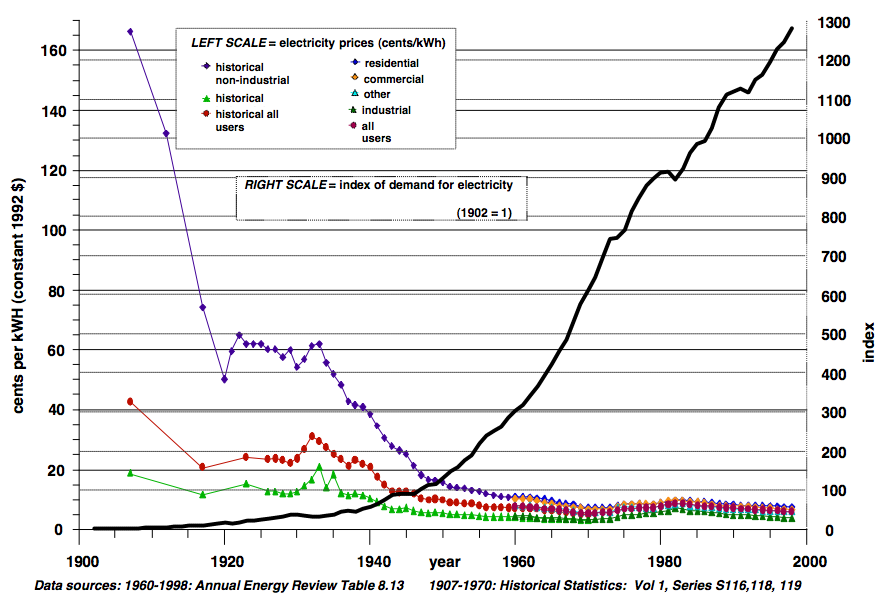

6. The underlying reason regarding why we are headed toward debt problems is different from in the past. We now are dependent both on oil products and electricity, two very concentrated carriers of energy, instead of the more diffuse energy types used in the past. Our problem is that these energy carriers are becoming high-cost to produce. It is these high costs (a reflection of diminishing returns) that lead to economic contraction. This time, in order to continue economic growth, we need a growing supply of very high-quality energy products, namely oil products and non-intermittent electricity, to support the economy that we have built. These products need to be low-priced, if customers are to afford them. Thus, it should not be surprising that economic growth in the past seems to have been driven by a combination of (1) falling prices of electricity as we learned to more efficiently produce it, and (2) continued low prices for oil.

?w=640&h=442

?w=640&h=442

Figure 2. Electricity prices and electrical demand, USA 1900 – 1998 from Accounting for Growth, the Role of Physical Work by Robert Ayres and Benjamin Warr, Structural Change and Economic Dynamics, February, 2004).

According to Ayres and Warr (Figure 2), power stations in 1900 converted only 4% of the potential energy in coal to electricity, but by 2000, the conversion efficiency was raised to 35%. This improvement in efficiency allowed the continuing decrease in electricity prices. With lower prices, more individuals and businesses were able to afford electricity, and more technology using electricity became feasible. Cheap electricity allowed goods to be produced at prices that workers could afford, and the system tended to grow. For oil, the price of oil remained relatively flat in inflation-adjusted terms for a very long time, even as engineers developed ever-more-efficient devices to use that oil.

?w=640&h=385

?w=640&h=385

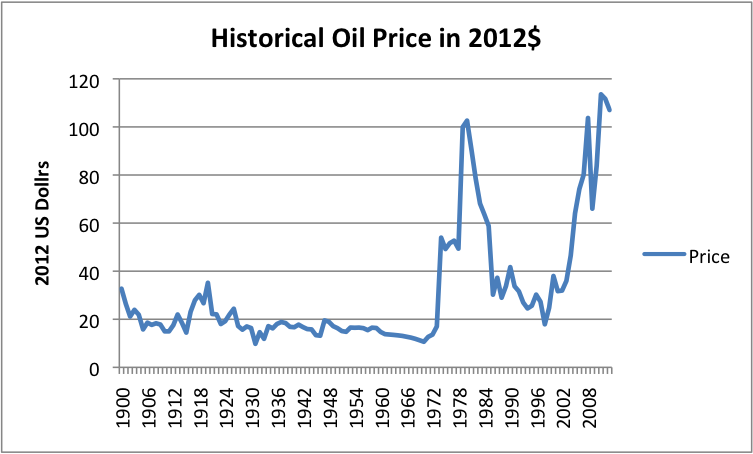

Figure 3. Historical oil prices in 2012 dollars, based on BP Statistical Review of World Energy 2013 data. (2013 included as well, from EIA data.)

We ran into our initial problems extracting oil cheaply in the early 1970s, after US oil production started to decline (Figure 4).

?w=640&h=384

?w=640&h=384

Figure 4. US crude oil production split between tight oil (from shale formations), Alaska, and all other, based on EIA data. Shale is from AEO 2014 Early Release Overview.

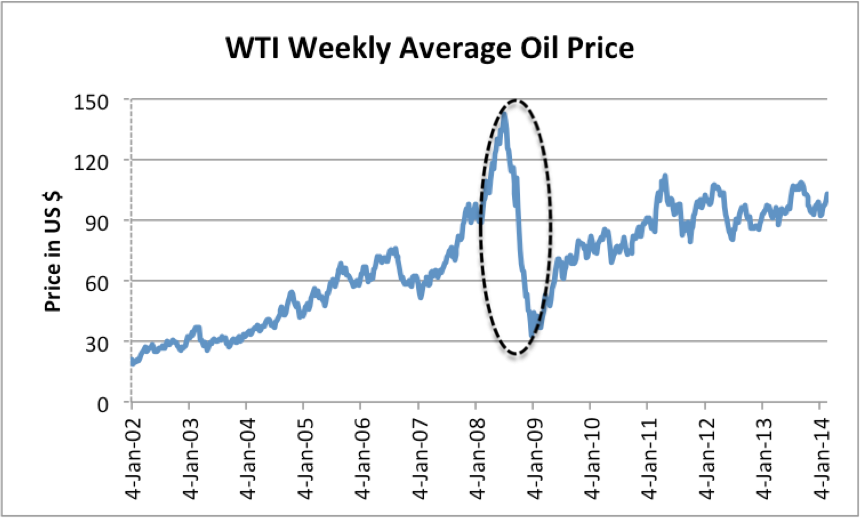

Back in the 1970s, we were able to work around the price spike by bringing oil production online in several additional places, including the Alaska, the North Sea, and Mexico. Unfortunately, those areas are now declining as well. Thus, we are increasingly forced to extract oil from areas that are high priced either (a) because of high extraction costs (such as the tight oil now being extracted in the United States) or (b) because of high indirect costs (such as the need for desalination plants and food subsidies in the Middle East). These can only be funded if oil prices are high, allowing governments to collect high levels of taxes...There is considerable evidence that high oil prices are associated with recession. The Great Recession of 2007-2009 was associated with a huge spike in oil prices. I have written about the way high oil prices contribute to recession in a peer-reviewed article published in the journal Energy called Oil Supply Limits and the Continuing Financial Crisis. James Hamilton has shown that has shown that 10 out of 11 US recessions since World War II were associated with oil price spikes. Hamilton also showed that the effects of the oil price spike were sufficient to cause the recession of that began in late 2007. Now the cost of oil production is high, and electricity prices have stopped falling. We read U. S. electricity prices may be going up for good, from the L. A. Times. It should be no surprise that economic growth is now a problem.

7. In historical periods, defaults were mostly associated with the transfer of ownership of various productive assets (such as land and factories) from one owner to another. Now, we are vulnerable to changes that could ultimately cut off oil and electricity, and thus bring the system down–not just transfer ownership. The kinds of things that could bring the system down are diverse. They include:

?w=640&h=385

?w=640&h=385

Figure 5. Oil price based on EIA data with oval pointing out the drop in oil prices, with a drop in credit outstanding.

8. The world is now filled with a large number of people in powerful positions who mistakenly think they know answers to questions, when they really do not. The problem is that researchers tend operate in subject-matter “silos.” They build models based on their narrow understanding of a problem. These models may temporarily work, but as we reach limits in a finite world, these models produce misleading results. The users of these models do not understand the problem and make decisions based on badly flawed models. Economists do not understand energy issues. They seem to think that their models, which ignore energy issues, are fine. All they need to do is fine-tune regulation, or tweak interest rates, and everything will be fine. Unfortunately, these economic models no longer work, as I explained in a recent post, Why Standard Economic Models Don’t Work–Our Economy is a Network...In fact, the issue is more basic than just bad models that economists are using. The whole “peer-reviewed paper” system, with its pressure to write more peer-reviewed papers, each resting on prior peer-reviewed papers, is flawed. Models are built and used endlessly, in part because that is the way things have been done in the past. Once an approach is used frequently, everyone assumes it is correct. Models can and do have short term-predictive power, but that fact does not mean that the approach works for the long term.

The problem we are running into is the fact the world is finite. Growth can’t continue indefinitely. The way that the physical world enforces the end to growth is not obvious, until we start hitting the limits. The limits are cost of production limits for oil and for our supply of stable grid electricity. (I have talked about selling prices, but selling prices are not really the limits, in themselves. It is the fact that with higher costs of production, either selling prices must go up, or profits and the ability to invest in new production must go down–that is the problem. Right now, the rising cost of production of oil is being hidden in prices that are too low for oil producers. So many assume we don’t have a problem. The issue of adequate government funding is also mixed into the price/cost of production issue.) Models that are no longer correct fill every area of study, from actuarial models, to financial planning models, to economic models, to models forecasting future oil and gas production, to climate change models. Some models are deceptively simple–the idea that the number of years of future production of oil (or gas or coal) can be estimated by (Amount of Resources / Current Annual Production) is a simple model. Unfortunately, this model doesn’t work, because we can never get enough investment capital to extract all of the fossil fuel that seems to be available–the price can never go high enough, and stay high enough. High prices simply bring on recession. See my post, IEA Investment Report – What is Right; What is Wrong.

In fact, it is pretty hard to find any model that continues to work, as we reach limits in a finite world. This is not intuitively obvious. If a model worked before, why wouldn’t it work now? Researchers and well-meaning leaders follow models that sort of worked in the past, but don’t really model the current situation. Thus, we have well-meaning leaders, doing their best to make things better, inadvertently making things worse. In a finite world, everything is “connected” to everything else, so things that look beneficial from one perspective can have a bad outcome viewed another way. For example, a reduction in carbon dioxide emissions from closing coal plants risks major electrical outages is New England and seems likely to raise electricity prices. Such changes push the economy toward recession, and perhaps ultimately toward collapse...Governments are one area squeezed by higher oil and electricity costs. As governments cut back, whether these cut backs are in education, unemployment benefits, military spending, or healthcare spending, there are indirect effects on the economy as a whole. The problem is that government spending creates jobs. As government spending is cut, it pushes the economy toward contraction–even if part of today’s spending is clearly wasteful. It creates a conundrum–fixing one problem makes another problem worse.

Conclusion

We live in perilous times. We have leaders who think they know the answers but, in fact, they do not. The debt problems we face now are not just overspending problems; they are signs that we are reaching limits of a finite world. World leaders do not seem to understand this connection. It is not even clear that they understand the connection of debt problems to the need for cheap-to-produce, high-quality energy products. World leaders are nevertheless convinced that they know the answers, based on complex, but very flawed, models. Unfortunately, actions taken based on these models have a good chance of making the situation worse rather than better. For example, trying to tie a world economy closer together, when it is already heading toward collapse, seems like a recipe for disaster.

I find Christine Lagarde’s use of numerology in her January 14, 2014 speech at the National Press Club Luncheon disturbing. Is she trying to signal some “in crowd” to make different decisions, in advance of a big IMF announcement? Or is numerology being used for prediction? Such an approach to forecasting would seem to be even worse than using models based on silos of limited understanding.

All But 4 High-Profile Domestic Terror Plots In Last Decade Were Crafted From The Ground Up By FBI

https://www.techdirt.com/articles/20140722/14463127971/report-all-four-high-profile-domestic-terrorism-plots-last-decade-were-crafted-ground-up-fbi.shtmlHuman Rights Watch has just published a report containing the facts needed to back up everyone's suspicions that the FBI counterterrorism efforts are almost solely composed of breaking up "plots" of its own design. And the bigger and more high-profile the "bust" was, the better the chance that FBI agents laid the foundation, constructed the walls… basically did everything but allow the devised plot to reach its designed conclusion.

Of those four exceptions, two (Boston Bombing/LAX shooting) were successfully pulled off. Feeling safer with the g-men's increased focus on preventing terrorist attacks? Within the report is even more damning information that shows the FBI preyed on weak individuals in order to rack up "wins" in the War on Terror.

Those that weren't weak enough were broken.

Ali was given a life sentence and is currently serving it at a Supermax prison.

As much as the DHS and FBI have stated concerns about "radicalization" and domestic terrorism, those captured in FBI sting operations were strongly pushed in that direction by informants and undercover agents. The FBI created threats where none existed.

MORE DISGUSTING, OFFICIAL CRIMINALITY AT LINK

Who Bled Detroit Dry? By Peter Rugh

http://www.vice.com/read/who-bled-detroit-dry

“You can call the police, but I'm not moving,” she told the two men with the Detroit Water Collections Project. The men were employees of Homrich Wrecking, a private corporation that was handed a $5.6 million contract by Detroit's water department to shut off the taps of thousands of Detroit residents, some of whom are as little as two months behind on their bills.

Balking at Valerie's presence, the men with Homrich Wrecking simply moved on. Valerie followed their truck as it lurched down her street, shutting off water to approximately 25 homes on her block. Since then, Valerie has turned her front lawn into an emergency center, like the kind that pop up after hurricanes. She is working with local NGOs to distribute water and keeps a cauldron of stew or vegetable chili brewing at all times. “My neighbors can't cook, can't bathe. They have nothing to drink,” she said. “My neighborhood is now a disaster area.”

Awash with empty homes, skyscrapers, and factories and saddled with nearly 15 percent unemployment, Detroit has been economically water-boarded and bled dry. Most of the city's inhabitants have fled the city in the last several decades, or else they are holding on for dear life. At the same time, the wealthy business elites have remained are buying up land for pennies a pop, creating a powerful wave of gentrification that looms over the city—that is, if it can survive its latest crisis.

Tens of thousands of people who live beside a river and the largest freshwater source in the world, the Great Lakes, can't even drink from their own faucets. As of July 1, 141,137, or 48 percent, of Detroit's residential water accounts were at least 60 days overdue—the cutoff threshold set by the Water and Sewage Department. Fifty-four percent of the city's commercial accounts and 47 percent of its industrial accounts were two or more months delinquent as well. Nearly half of Motor City is under threat of losing its water, the price of which has risen 110 percent over the last decade.

On Monday the water department announced that it was suspending the shutoffs for 15 days to allow Detroit's residents time to scrounge up cash, but damage has already been inflicted on thousands of households and the threat of losing water continues for some 300,000 citizens including children, the elderly, and the ill. America's registered nurses declared Detroit a “public health emergency zone,” in a statement distributed to the press last week through their 180,000 member union, National Nurses United. The United Nation's High Commission on Human Rights condemned the shutoffs in June and said it would reach out to the Obama Administration to prevent further violations to people's right to water. Locally, mutual recriminations have been flying all over the place. The Water and Sewage Department has claimed some residents could pony up if they really wanted to but were simply mooching off the city. This was a view shared by the surly cabdriver who gave me a lift into town from the airport. The city is “going to shit” he said before making the sinking sound of a bomb landing with his lips. The citizens of Detroit are, by and large, slovenly idiots—the kind of people who keep going back to the convenient store for cans of beer instead of buying the whole six-pack, he explained. The cabby had lived in the city for 35 years after immigrating from Iraq, but, he told me, these days “Detroit is worse than Baghdad.”

And certain statistics back him up. Baghdad actually has both a lower unemployment rate and a lower murder rate than Detroit.

We drove past the field where the old Tigers' stadium once stood and where rows of shabby bars that had counted on customers the team brought their way remained. I stationed myself at Corktown Inn, the kind of place most people rent by the hour. A vending machine by the front desk dispensed underwear for two dollars. There was a realtor’s sign on the front lawn, but there couldn't have been many eager buyers. It looked as if the Rapture had taken place outside, an impression eerily reinforced by a billboard on the corner of Trumbull and Michigan, put up by evangelists, that asked, “What is after death?”

While Detroit has been dying of neglect and malfeasance for decades, now it is dying of thirst.

The water shutoffs began when Detroit's unelected emergency manager, Kevyn Orr, who was appointed by Governor Rick Snyder in 2012, filed the city for Chapter Nine bankruptcy last year, in an effort to rid it of approximately $18 billion in municipal debt....A large chunk of the city's obligations are the result of borrowing, dating back to 2005, conducted by the city's former mayor, Kwame Kilpatrick, who was convicted on federal corruption charges last year. To cover budget shortfalls, Kwame issued $3.7 billion worth of bonds in complicated interest-rate swap deals with the likes of UBS, Chase, and Bank of America. When the the stock market tanked in 2008, it sent interest rates skyrocketing. Liabilities on the loans later jumped to $15 billion, more than four times the amount originally borrowed. To pay its way out of one bond deal, the Department of Water and Sewage borrowed $300 million in 2012.

“It all ties in together,” said Vanessa Fluker, a short, matter-of-fact housing attorney who, in her 60s, could still pass for a lightweight boxer. Walking past the Chase building with me downtown, she noted that the same banks who suckered the city into interest-rate swap deals created a housing crisis through subprime loans. These were bundled and sold to investors with bullshit triple-A ratings. When homeowners couldn't make mortgage payments and were shown the curb, it sent global markets plummeting and interest rates on the city's swaps through the roof.

Automation and globalization had already been gradually shrinking the workforce of the big auto giants and the population of Detroit, which reached a height of 1.85 million people in 1950 but has now dwindled to approximately 700,000. The 2008 financial crisis, however, proved to be a knockout blow to Motor City's staple employers. Chrysler and General Motors (currently immersed in litigation surrounding faulty ignition switches that led to at least 16 deaths) filed for bankruptcy, and a fresh round of layoffs ensued. The federal government bailed out the automakers and the big banks, but Detroit and its “economically abused” citizens, as Vanessa describes them, have gotten no relief.

In April, Bank of America and UBS agreed to accept a flat $85 million from the city to cover further debt obligations tied to the swaps, a deal the judge overseeing Detroit's bankruptcy signed off on. But in order to cover the budget shortfalls caused by its dealings with Wall Street, the Water and Sewage Department is still twisting the arms of residents and businesses already feeling the pinch of the Great Recession.

“I will tell you the same thing a hundred thousand people in Detroit will tell you,” Valerie Blakely told me. “My husband lost his job at Lapeer Metal Stamping in 2008, and he's been fixing cars here and there just to get by ever since.” On top of everything else, Detroit is coming off a brutal polar-vortex winter where, Valerie said, “our utility bills literally quadrupled.” At this point she estimates she owes the city about a grand in back payments. She is not alone.

“Right now we've got about $89 million out there in delinquencies,” Greg Eno, a spokesperson for the water department told me when I reached him by phone. “That's why we've decided to ramp up our efforts.” Last August, 2,752 accounts were shut off; 3,487 in September. By June of this year the number of shutoffs had escalated to 7,210. “It's working,” said Greg. “We're getting people's attention. We've collected almost $2 million since February.”

Some might question why a city that can barely keep water in its pipes and its lights on would help a land baron like Christopher Ilitch build a new arena when he already has a perfectly good one. Others are hoping to ride his coattails.

Weekend Economists Commemorate the Dark Knight July 25-27, 2014

It was a time of uncertainty and peril, great crimes and general chaos....

Ironically, the characters have been re-envisioned over time as diametrically opposed. Superman – the “Blue Boy Scout” – surveys Metropolis, a city that is as much the pinnacle of civilization as he is the pinnacle of heroism. Batman – the “Dark Knight Detective” – prowls Gotham, a slum so corrupt that it warrants having a shadowy vigilante protecting it. They’re kinda different...

While both heroes have strict codes against killing, that wasn’t always the case. Before the Comics Code Authority in the 50′s forced comic book companies to adhere to strict censorship, it wasn’t uncommon for either Superman or Batman to cause the death of a criminal through accident or intention. In Batman’s first appearance, he casually chucks a criminal off a roof! Post-Comics Code Authority, both heroes have curbed their violence, but Batman often still has murderous impulses.

In “The Dark Knight Returns”, Batman rigs some thugs’ bomb to blow up before they can use it, resulting in their deaths. He muses that “two men die, leaving the world no poorer”. Compare that to the anguish Superman has over killing Zod, someone much more threatening than two mooks. As the paragon of heroism, it wouldn’t be crazy to think Superman might find Batman’s laxness towards violence objectionable and confront him over it. That’s not even mentioning some of Bats’ other questionable methods such as using children as partners, terrifying citizens, and using nigh-lethal weaponry.

...If a random mugger shot a ten year old’s parents in front of him, that kid would probably grow up with trust issues. Likewise, Batman is often shown to distrustful of people’s intentions, even other superheroes...

http://whatculture.com/film/batman-vs-superman-10-potential-reasons-theyre-going-to-fight-one-another.php

In large part, the character and history of Batman is defined by the medium: comic books.

Since the later 20th century, comic books have gained note as collectable items. Comic shops cater to fans, and particularly valuable issues have fetched in excess of a million dollars. Systems of grading comic books have emerged, and plastic bags and backing boards are available to maintain the comic books' condition....

Aficionados know the period from the late 1930s through roughly the end of the 1940s as the Golden Age of comic books. It featured extremely large print-runs, with Action Comics and Captain Marvel selling over half a million copies a month each; comics provided very popular cheap entertainment during World War II especially among soldiers, but with erratic quality in stories, art, and printing. Unusually, the comics industry provided jobs to an ethnic cross-section of Americans (particularly Jews), albeit often at low wages and in sweatshop working-conditions.[citation needed] In the early 1940s over 90 percent of girls and boys from seven to seventeen read comic books.

Following the end of World War II, the popularity of superheroes greatly diminished, while the comic book industry itself expanded. A few standard characters like Superman, Batman and Wonder Woman continued to sell, but superheroes as a genre became relegated to the status of a subgenre of adventure comics, a genre which itself was not amongst the popular genres at the time. Between 1950 and 1952 all attempts at publishing new superhero comic books were in vain.

Dell's comic books accounted for a third of all North American sales in the early 1950s. Its 90 titles averaged a circulation of 800,000 copies each issue, with Walt Disney's Comics and Stories peaking with a circulation of three million in 1953. Eleven of the top 25 best-selling comic books at the time were Dell titles. Out of forty publishers active in 1954, Dell, Atlas (Marvel), DC and Archie were the major players sales-wise. By this time, former big-time players Fawcett and Fiction house had ceased publishing.

Circulation peaked out in 1952, when 3161 issues of various comics were published with total circulation at about one billion. After 1952, the number of individual releases dropped every year for the rest of the decade, with the biggest losses coming in 1955–56. These rapid losses followed the introduction of laws that curbed the sales of comic books that were seen as being harmful to children, as well as a crackdown on press wholesalers by the U.S. Senate, which freed retailers from tie-ins. While there was only a 9% drop in the number of releases between 1952 and 1953, circulation plummeted by an estimated 30–40%. The cause of the decrease is not entirely certain. Television had come to provide competition with comic books, or the rise of conservative values that came with the election of Dwight Eisenhower. The Comics Code Authority, a self-censoring body founded to curb juvenile delinquency believed to be influenced by crime and horror comics, has been targeted as the culprit, though sales had begun to drop the year before it was founded. The major publishers were largely unaffected by the drop, but smaller publishers like EC (the prime target of the CCA) were wiped out. By the 1960s, output stabilized at about 1500 releases per year.

The dominant comic book genres of the post-CCA 1950s were funny animals, humor, romance, television properties and Westerns. Detective, fantasy, teen and war comics were also popular, while adventure, science fiction, superheroes and comic strip reprints were in decline, with Famous Funnies seeing its last issue in 1955.

https://en.wikipedia.org/wiki/American_comic_book

Batman and other comic books were basic cheap, fantasy entertainment for the young and not terribly sophisticated. I remember scrounging for 6 pop bottles (2 cents deposit) to buy the latest 12 cent issue...

Painful Progress in Detroit

BS+MS+PHD (PILED HIGHER AND DEEPER)

http://www.nytimes.com/2014/07/23/opinion/painful-progress-in-detroit.html?_r=1

If the measure of a good compromise is that everyone is left unhappy, the Detroit bankruptcy plan certainly qualifies.

Detroit’s municipal retirees have approved a restructuring blueprint that will cut their promised pension payouts significantly as part of a larger effort to reduce the city’s $18 billion debt. Other creditors rejected the blueprint, including hedge funds and bond insurers that hold or back billions of dollars in municipal debt. One of their complaints is that the blueprint unfairly discriminates against them in favor of pensioners. Another complaint, advanced by a group of bondholders who would receive 100 percent of their principal under the plan, is that their losses are too great compared with what they would have made under the bonds’ original terms.

The next step is for Judge Steven Rhodes of federal bankruptcy court to hold a trial, scheduled to begin on Aug. 14, at which the City of Detroit will have to make the case for the blueprint, while objectors argue against it. If the judge finds the plan legal, equitable, fair and feasible, he would confirm it, in effect, forcing the blueprint’s terms on the “no” voters. Whatever the result, there will be no victories. Pensioners voted yes not because they were getting a sweet deal, but because they faced even deeper cuts — potentially as high as 27 percent of monthly benefits for some retirees — if they voted no. To avert such a crippling blow, the State of Michigan, nonprofit foundations and donors to the Detroit Institute of the Arts pledged $816 million to reduce the planned pension cutback and to protect the city’s art collection from being sold to pay off bondholders — but only if the pensioners approved the blueprint and if the judge confirms the plan. Nonuniformed city retirees now face cuts to their monthly pension payments of 4.5 percent, the elimination of annual cost-of-living adjustments and, for some, claw backs of annuity payments deemed excessive. Police and fire retirees, who are not covered by Social Security, face deep cuts to annual cost-of-living adjustments.

The no votes, in contrast, basically reflect the hopes of bondholders for a better deal, which they have the right to fight for. Some of their grievances involve complex legal issues that clearly need to be resolved in court. But there is no doubt that municipal pensioners who voted yes on the blueprint are a more vulnerable constituency than the financial institutions that voted no. The pensioners also have negotiated in good faith on a plan that is now Detroit’s best hope for making a fresh start. By comparison, most of the other creditors are professional investors who knew or should have known the risks of lending money to Detroit yet now find themselves calling for deeper pension cuts or auctioning off masterpieces in order to minimize their losses. Their no votes on the blueprint — and their probable appeal if Judge Rhodes confirms the blueprint — will only further delay Detroit’s restructuring and deepen its misery.

For now, the painful bankruptcy process is moving forward as it should. The outcome is uncertain, but one thing is sure: The people of Detroit have suffered enough.

THIS FROM THE CITY THAT GOT BAILED OUT BY GERALD FORD....

Hedge funds escaped billions in taxes

http://www.usatoday.com/story/money/business/2014/07/21/hedge-funds-options-trades-tax-avoidance/12947225/Two large banks used a complex financial scheme to help 13 hedge funds avoid paying billions of dollars in taxes and evade federal borrowing limits on brokerage accounts over a 15-year period, according to the findings of a Senate subcommittee investigation. Deutsche Bank and Barclays Bank sold "basket options" to the hedge funds that allowed the funds to report trading profits as long-term capital gains for tax purposes, even though 97% of the assets were held for less than six months, the Senate Permanent Subcommittee on Investigations said. Also, the trades were made in the banks' accounts so that the hedge funds would not be subject to leverage limits that prevent banks from lending more than $2 for every dollar put up by the hedge funds, according to its report. The funds, however, controlled all assets, executed all the trades and reaped the profits, the subcommittee said.

From 1998 to 2013, its report said, the banks sold 199 basket options to hedge funds to conduct more than $100 billion in trades. One fund, Renaissance Technologies, earned about $34 billion in profits and avoided paying $6.8 billion in taxes through the financial legerdemain, the report said. The subcommittee's findings focused on two hedge funds — Renaissance and George Weiss Associates — because it said they were involved in the single-largest volumes of trades.

"Ordinary Americans have shouldered the tax burden these hedge funds shrugged off," said Sen. Carl Levin, D-Mich, chairman of the subcommittee. "The same ordinary Americans would pay another price if the reckless borrowing outside of federal safeguards would blow up."

Deutsche Bank said in a statement: "The options offered by Deutsche Bank which were discussed in the Committee's report were at all times fully compliant with applicable laws, regulations and guidance. Moreover, they were a niche offering to a small number of clients over a discrete period of time which we completely ceased offering in 2010. We fully cooperated with the Committee throughout its investigation."

Barclays said in a statement that it "has been fully compliant with the law, has cooperated with the committee and looks forward to continuing that cooperation at the hearing. "

In a statement, Renaissance spokesman Jonathan Gasthalter said: "We believe that the tax treatment for the option transactions being reviewed by the (subcommittee) is appropriate under current law. These options provide Renaissance with substantial business benefits regardless of their duration. The IRS already has been reviewing these option transactions for over six years, and Renaissance has cooperated fully with both reviews."

George Weiss Associates said it terminated its basket options in May 2010 "because of increasing market volatility." It added, "basket options are lawful financial instruments often used to obtain leverage."

The basket options will be the subject of a subcommittee hearing Tuesday morning.

According to the subcommittee's findings, Deutsche Bank began selling the basket options in 1998 and Barclays started offering them in 2002. By exercising the option, a hedge fund would either make or lose money based on the results of millions of trades over many months. Since they often waited more than a year to exercise the option, the hedge funds treated the profits as long-term gains. The subcommittee, however, says the option was simply an artifice and the funds made an average 26 million to 36 million trades during the year, holding many positions for only seconds. As a result, the trades should have been part of a normal brokerage account, and the funds should have been paying an ordinary income tax rate for short-term gains, which is as high as 39% instead of a 15% or 20% rate for long-term capital gains.

In 2010, the Internal Revenue Service issued a memorandum that said basket options with constantly changing assets were not true options and investors must recognize the gains or losses when they occurred rather than when an option was exercised. At that time, Barclays continued offering new options for two years, the Senate report said. Deutsche Bank stopped offering new options but continued to administer existing ones. In 2012, the IRS notified Renaissance that it would not allow basket option profits from trades lasting less than 12 months to be treated as long-term capital gains and sought additional taxes from the company, the report said. Renaissance submitted a letter opposing the finding and the matter is now awaiting an appeal.

By conducting trades in the banks' accounts, the banks were able to provide the hedge funds as much as $20 in loans for each dollar put up by the funds, according to the report. While the hedge funds controlled all of the trades, the banks contend they were simply acting as investment advisers, the subcommittee said. The subcommittee said the banks also profited from the scheme, with Deutsche Bank earning $570 million in financing, trading and other fees and Barclays taking in $655 million. The subcommittee says the IRS should audit hedge funds that used basket options from Deutsche Bank or Barclays and collect unpaid taxes. Regulators also should step up their scrutiny of these transactions. The Treasury Department and the IRS also should simplify the rules so that regulators don't have to notify potentially thousands of a hedge fund's partners to conduct an audit, the subcommittee said.

Meet Executive Order 12333: The Reagan rule that lets the NSA spy on Americans By John Napier

http://www.washingtonpost.com/opinions/meet-executive-order-12333-the-reagan-rule-that-lets-the-nsa-spy-on-americans/2014/07/18/93d2ac22-0b93-11e4-b8e5-d0de80767fc2_story.htmlJohn Napier Tye served as section chief for Internet freedom in the State Department’s Bureau of Democracy, Human Rights and Labor from January 2011 to April 2014. He is now a legal director of Avaaz, a global advocacy organization.

In March I received a call from the White House counsel’s office regarding a speech I had prepared for my boss at the State Department. The speech was about the impact that the disclosure of National Security Agency surveillance practices would have on U.S. Internet freedom policies. The draft stated that “if U.S. citizens disagree with congressional and executive branch determinations about the proper scope of signals intelligence activities, they have the opportunity to change the policy through our democratic process.” But the White House counsel’s office told me that no, that wasn’t true. I was instructed to amend the line, making a general reference to “our laws and policies,” rather than our intelligence practices. I did. Even after all the reforms President Obama has announced, some intelligence practices remain so secret, even from members of Congress, that there is no opportunity for our democracy to change them.

Public debate about the bulk collection of U.S. citizens’ data by the NSA has focused largely on Section 215 of the Patriot Act, through which the government obtains court orders to compel American telecommunications companies to turn over phone data. But Section 215 is a small part of the picture and does not include the universe of collection and storage of communications by U.S. persons authorized under Executive Order 12333. From 2011 until April of this year, I worked on global Internet freedom policy as a civil servant at the State Department. In that capacity, I was cleared to receive top-secret and “sensitive compartmented” information. Based in part on classified facts that I am prohibited by law from publishing, I believe that Americans should be even more concerned about the collection and storage of their communications under Executive Order 12333 than under Section 215.

Bulk data collection that occurs inside the United States contains built-in protections for U.S. persons, defined as U.S. citizens, permanent residents and companies. Such collection must be authorized by statute and is subject to oversight from Congress and the Foreign Intelligence Surveillance Court. The statutes set a high bar for collecting the content of communications by U.S. persons. For example, Section 215 permits the bulk collection only of U.S. telephone metadata — lists of incoming and outgoing phone numbers — but not audio of the calls. Executive Order 12333 contains no such protections for U.S. persons if the collection occurs outside U.S. borders. Issued by President Ronald Reagan in 1981 to authorize foreign intelligence investigations, 12333 is not a statute and has never been subject to meaningful oversight from Congress or any court. Sen. Dianne Feinstein (D-Calif.), chairman of the Senate Select Committee on Intelligence, has said that the committee has not been able to “sufficiently” oversee activities conducted under 12333. Unlike Section 215, the executive order authorizes collection of the content of communications, not just metadata, even for U.S. persons. Such persons cannot be individually targeted under 12333 without a court order. However, if the contents of a U.S. person’s communications are “incidentally” collected (an NSA term of art) in the course of a lawful overseas foreign intelligence investigation, then Section 2.3(c) of the executive order explicitly authorizes their retention. It does not require that the affected U.S. persons be suspected of wrongdoing and places no limits on the volume of communications by U.S. persons that may be collected and retained.

“Incidental” collection may sound insignificant, but it is a legal loophole that can be stretched very wide. Remember that the NSA is building a data center in Utah five times the size of the U.S. Capitol building, with its own power plant that will reportedly burn $40 million a year in electricity. “Incidental collection” might need its own power plant...Before I left the State Department, I filed a complaint with the department’s inspector general, arguing that the current system of collection and storage of communications by U.S. persons under Executive Order 12333 violates the Fourth Amendment, which prohibits unreasonable searches and seizures. I have also brought my complaint to the House and Senate intelligence committees and to the inspector general of the NSA....I am not the first person with knowledge of classified activities to publicly voice concerns about the collection and retention of communications by U.S. persons under 12333. The president’s own Review Group on Intelligence and Communication Technologies, in Recommendation 12 of its public report, addressed the matter. But the review group coded its references in a way that masked the true nature of the problem....When I started at the State Department, I took an oath to protect the Constitution of the United States. I don’t believe that there is any valid interpretation of the Fourth Amendment that could permit the government to collect and store a large portion of U.S. citizens’ online communications, without any court or congressional oversight, and without any suspicion of wrongdoing. Such a legal regime risks abuse in the long run, regardless of whether one trusts the individuals in office at a particular moment.

I am coming forward because I think Americans deserve an honest answer to the simple question: What kind of data is the NSA collecting on millions, or hundreds of millions, of Americans?

MUCH MORE AT LINK

Most of the World Doesn’t Like Our Unaccountable Flying Death Robots By: Jon Walker

WELL, I NEVER! (LIKED THEM MYSELF)

http://fdlaction.firedoglake.com/2014/07/14/most-of-the-world-doesnt-like-our-unaccountable-flying-death-robots/

Amazingly, American flying robots that can rain death down on almost anywhere on Earth, with very little accountability, are not popular among the people forced to live on Earth. From Pew Research:

Widespread Opposition to Drones

Nothing wins hearts and minds like flying death machines.

How to clean up a broken CFL bulb

http://www.cnet.com/how-to/how-to-clean-up-a-broken-cfl-bulb/?ftag=CAD9f89b0cIf a fluorescent light comes crashing down onto your kitchen floor, releasing the mercury trapped within, you don't need to panic. Just follow these steps to safely get things cleaned up...First things first, you don't need to panic. While mercury is nothing to play around with, the amount contained inside a standard CFL is only about 1 percent of the amount that you'll find inside an old-fashioned mercury thermometer. Still, to be safe, you'll want to be sure that you clean the mess up correctly -- here's how to do just that, per EPA standards.

Step one: Air out the area

As soon as that bulb breaks, you'll want to let the room air out for about 15 minutes. Get everyone out (especially pets, who might be inclined to investigate the mess), then open the windows and shut the doors. You'll also want to be sure and turn off your central air -- the last thing you want is to circulate that mercury throughout your home.

Step two: Find a sealable container

While you're avoiding the area in question, go ahead and take a moment to find something capable of containing that broken bulb. A glass jar with a metal lid is ideal, but if you don't have one handy, a plastic food container or even a sealable plastic bag will do the trick.

Step three: Pick up the pieces

You'll be tempted to sweep everything up with a broom -- but don't. Anything that rifles through the broken bits of your bulb is going to risk mercury contamination. You'll also want to be sure not to use your vacuum, as doing so will risk kicking mercury back up into the air.

The best bet is to carefully scoop up the larger bits of glass with a piece of paper or cardboard, something you can easily dispose of along with the broken bulb. Once the big pieces are up, try using a piece of duct tape to easily lift the tinier bits, along with any white powder that you see. You could also use a piece of bread -- just don't eat it afterwards.

Step four: Wipe the floor clean

Once you've gotten the glass up off of the floor, you'll need to wipe things down with a damp paper towel. You'll want to go over the area fairly liberally, making sure not to leave any of that white powder from the bulb behind...Once you're done, add that used paper towel to the container with the paper, the tape, and the broken glass. Go ahead and seal it up, then take it outside. Now would also be a good time to thoroughly wash your hands with soap and water.

Step five: Let the room air out for another few hours

You've gotten the floor spic and span, but there still might be trace amounts of mercury vapor left in the air. If you're able to, leave the windows open and the air conditioning off for another couple of hours. Better safe than sorry, right?

Step six: Dispose of the broken bulb

Depending on your local regulations, you might not be required to take the broken bulb to a recycling center. It's a good idea nonetheless, as you don't want that mercury sent off to a landfill, where it might slowly leech into the ground. The waste management section of your local government's website should have info on which facilities will take hazardous household materials off of your hands.

STEP 7: BUY LED REPLACEMENT BULBS, STAT!--DEMETER

A new American political order? By Burkely Hermann

http://zcomm.org/zblogs/a-new-american-political-order/Recently, pollsters found out, via ‘We Need Smith,’ which is a self-declared “movement of Americans who believe we need new leaders because our country is badly headed in the wrong direction” and not relying on the “usual politics,” what they called the “battlelines of a new political order.” I’m not sure how I feel about this whole ‘We Need Smith’ movement, and as a result I will continue to be critical. This article will not only debut my new chart, the ‘People Policy Counter,’ but it will include charts and data on overarching views of the American public presented by the said pollsters, and other polls. And if you have any suggestions, please share them below.

The People Policy Counter

Basically, the People Policy Counter is a list of 100 issues that a majority of the American people believe, which is then compared to the positions of politicians (hopefully) and political parties. From my tabulations, I found that (numbers ordered by amount of agreement with the American people):

- The Green Party agrees with the American people 79% of the time

- The Justice Party agrees with the American people 61% of the time

- President Obama agrees with the American people 28% of the time

- The Democratic Party agrees with the American people 25% of the time

- The Libertarian Party agrees with the American people 24% of the time

- The Constitution Party agrees with the American people 21% of the time

- The Republican Party agrees with the American people 6% of the time

These results are not trying to advocate for any of the said parties, or President Obama. I tried to take my bias toward certain issues out of the equation, and I mostly just searched on the Gallup website, snatching up poll results as I went. Rather, taken from a number of polls (probably over 50), it is meant to show how in line these political parties are with the opinions of the American people. As it turns out, only the centre-left Justice Party and the Green Party agree with the American public most of the time, more often than most. There were also a number of issues that I did not know the opinions of the said parties, so I did not fill them out, meaning that the percentages came out of the total of 100 issues. Hopefully, I can expand this to other politicians in the future. Here are some interesting positions that NONE of the parties took (to my knowledge) but the American people believe:

- national referendum on key issues if voters request it

- shorten primary season to five months

- have a nationwide primary election, not individual state primaries

- term limits for politicians in US Senate and US House

- Super PACs should be illegal and there would be less corruption in the political system if there were limits on how much could be given to Super PACs

- attack social problems as a way to lower the crime rate

Before I get to the polls conducted by ‘We Need Smith,’ here are some polls which I didn’t use in my People’s Policy Counter but are still interesting, adding questions about a ‘new political order’ emerging in the United States:

http://www.gallup.com/poll/145871/Majority-Wants-Less-Corporate-Influence.aspx

http://www.gallup.com/poll/145871/Majority-Wants-Less-Corporate-Influence.aspx

Results from a recent poll by Rasmussen, which is usually a conservative polling organization:

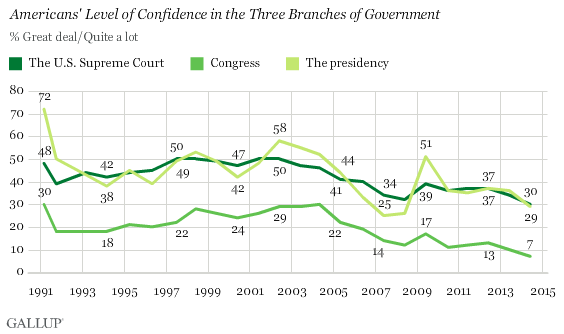

Here’s a graph from Gallup showing Americans are losing confidence in ALL branches of federal government:

Polls by ‘We Need Smith’

Now for some of the polls from ‘We Need Smith’ which I turned into a graphic:

Further analysis

Yet, while these poll results are encouraging, one must remember that it is only applying to American voters. What about the Americans who don’t vote! That’s what makes this polling troubling. Americans in general, one should not forget still view socialism negatively, even though 36% view it positively, including a good amount of liberals, and even some conservatives and moderates. Still, as Gallup notes,

However, what Gallup says about an “unusual and unclear understanding” of socialism is silly as they provide no evidence to back up that claim, and criticizing those who think of the word positively just reinforces their moderate position as a polling organization.

There is more. It is clear that Americans are wary of Big Business and rightly critical of it. After all, US banks and financial institutions are trusted more than two times less than small business, as noted in a Gallup poll. Similarly, Americans do not have a great of confidence in other parts of American society as well: big business, the U.S. Supreme Court, the criminal justice system, the medical system, newspapers, the presidency, the healthcare system, public schools, television news and news on the internet, and Congress. Even organized religion/the church does not have a great deal of confidence from the American people. Sadly, there is low confidence in organized labor while there is high confidence in the military (74% have confidence) and a majority having confidence in the police (53% have confidence).

With the American people having a great deal of confidence in the military and the police, two of the institutions in established society which work to maintain the existing order, makes me question that we are on the “battlelines of a new political order.” Yes, the American people clearly believe in policies which I would say are overwhelmingly social democratic and yes, this is a basis for a transpartisan coalition (a ‘left-right coalition’) against the powers that be. After all, Americans do in some sense or another constitute a “silent radical majority” compared to those currently in power. But, this does not mean that Americans want to overturn the existing system and put in something like, say ‘modified socialism’ as Martin Luther King mentioned once. Rather, the people want reforms that would tweak the existing system. There are definitely some ideas that should be pushed forward, like single-payer healthcare and ending the wars (and general anti-interventionism) that the American people definitely support. However, no one should be fooled into thinking that these polls evidence a new political order, but rather that they show the need for the removing of the shackles of capitalists in order to confront the climate catastrophe and capitalist system itself.

Profile Information

Gender: FemaleHometown: Ann Arbor, Michigan

Home country: USA

Member since: Thu Sep 25, 2003, 02:04 PM

Number of posts: 85,373