Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

marmar

marmar's Journal

marmar's Journal

June 24, 2013

HONG KONG (MarketWatch) — As investors digest the sharp spike in China’s interbank rates last week, the action of the central bank is now in the spotlight.

Was this a considered policy to purge speculative excess from the financial system, or is the People’s Bank of China seeking to disguise a bigger problem?

On the face of it, slamming the brakes on credit appears a questionable policy when economic growth is already slowing and inflation is seemingly stable. What’s more, would the central bank really engineer a cash-crunch that sent overnight interbank rates to 13% and effectively froze the interbank market?

At the very least, this appears a reckless way to instill market discipline: It risks one default or rumor triggering unintended, wider systematic problems. ........................(more)

The complete piece is at: http://www.marketwatch.com/story/chinas-alarming-credit-crunch-2013-06-23?dist=lcountdown

China’s alarming credit crunch

HONG KONG (MarketWatch) — As investors digest the sharp spike in China’s interbank rates last week, the action of the central bank is now in the spotlight.

Was this a considered policy to purge speculative excess from the financial system, or is the People’s Bank of China seeking to disguise a bigger problem?

On the face of it, slamming the brakes on credit appears a questionable policy when economic growth is already slowing and inflation is seemingly stable. What’s more, would the central bank really engineer a cash-crunch that sent overnight interbank rates to 13% and effectively froze the interbank market?

At the very least, this appears a reckless way to instill market discipline: It risks one default or rumor triggering unintended, wider systematic problems. ........................(more)

The complete piece is at: http://www.marketwatch.com/story/chinas-alarming-credit-crunch-2013-06-23?dist=lcountdown

June 24, 2013

Organizing for Action, the nonprofit advocacy group committed to boosting President Barack Obama's agenda, has reportedly cut its fundraising goal for 2013.

On Sunday, The Washington Post reported that OFA "has halved a $50 million fundraising goal for its first year after slower-than-expected fundraising, according to people familiar with the group's plans. The decision came after the group reversed course and said it would not accept corporate funds."

OFA did not return a request for comment from The Huffington Post. ..........................(more)

The complete piece is at: http://www.huffingtonpost.com/2013/06/24/ofa-fundraising-goal_n_3489982.html?ncid=txtlnkushpmg00000037

OFA Cuts Fundraising Goal In Half: Report

Organizing for Action, the nonprofit advocacy group committed to boosting President Barack Obama's agenda, has reportedly cut its fundraising goal for 2013.

On Sunday, The Washington Post reported that OFA "has halved a $50 million fundraising goal for its first year after slower-than-expected fundraising, according to people familiar with the group's plans. The decision came after the group reversed course and said it would not accept corporate funds."

OFA did not return a request for comment from The Huffington Post. ..........................(more)

The complete piece is at: http://www.huffingtonpost.com/2013/06/24/ofa-fundraising-goal_n_3489982.html?ncid=txtlnkushpmg00000037

June 24, 2013

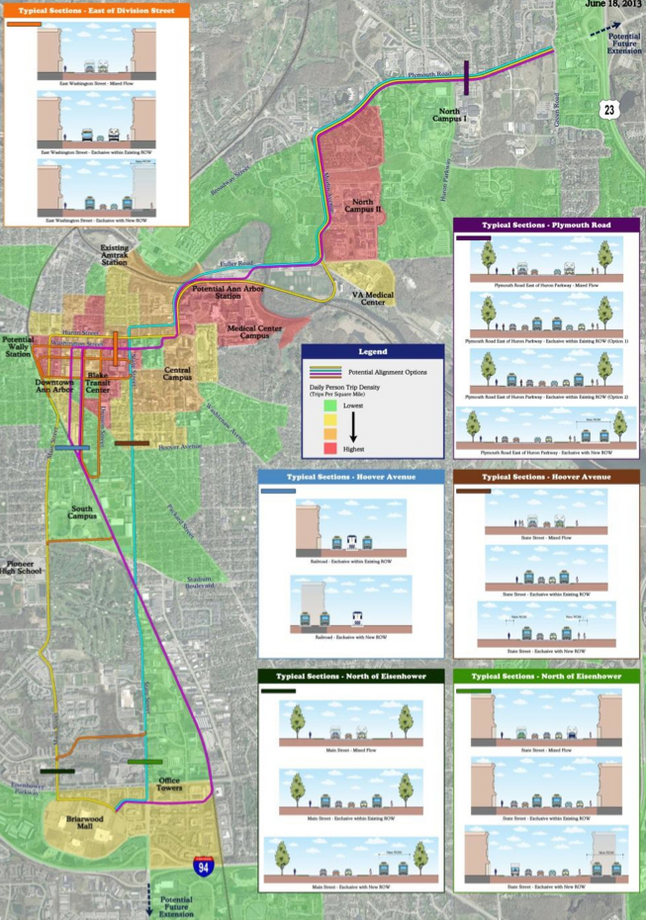

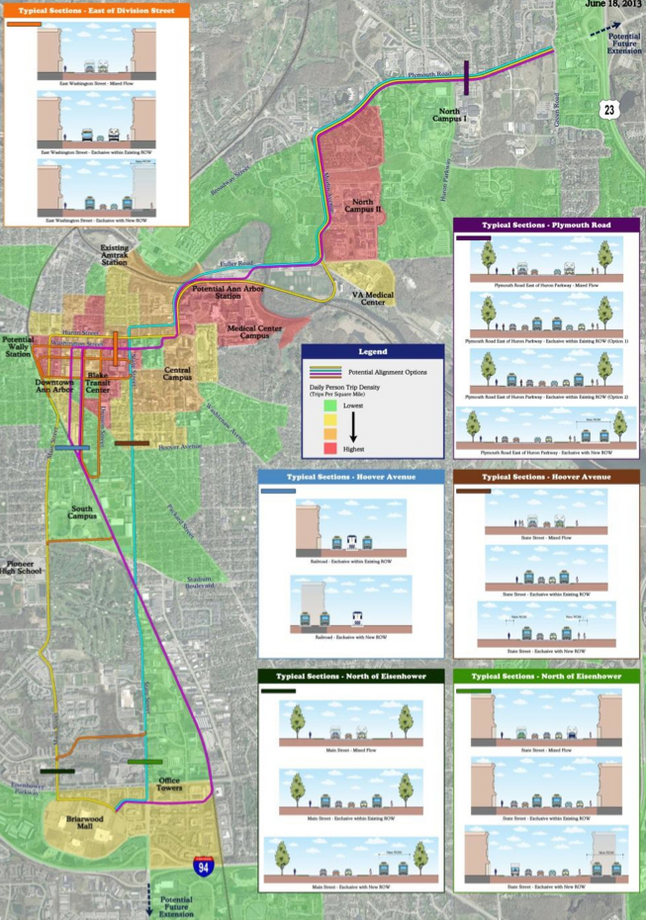

Ann Arbor's vision for high-capacity transit taking shape with possible Connector routes mapped

By Ryan J. Stanton Political Reporter

Posted on Sun, Jun 23, 2013 : 5:59 a.m.

The vision for a high-capacity transit system in Ann Arbor — either light rail, streetcar or bus rapid transit — is taking shape with preliminary route alternatives now mapped.

Officials behind the Ann Arbor Connector project have released documents showing a series of possible options for connecting some of the city's major activity centers.

Each scenario proposes connecting the University of Michigan's North and Central campuses, while also linking to the university medical center, downtown and Briarwood Mall.

Four partners are involved in the ongoing Connector study: the city of Ann Arbor, Downtown Development Authority, Ann Arbor Transportation Authority and U-M. .....................(more)

The complete piece is at: http://www.annarbor.com/news/connector-vision-for-high-capacity-transit-in-ann-arbor-taking-shape-with-possible-routes-mapped/

Ann Arbor's vision for high-capacity transit taking shape with possible Connector routes mapped

Ann Arbor's vision for high-capacity transit taking shape with possible Connector routes mapped

By Ryan J. Stanton Political Reporter

Posted on Sun, Jun 23, 2013 : 5:59 a.m.

The vision for a high-capacity transit system in Ann Arbor — either light rail, streetcar or bus rapid transit — is taking shape with preliminary route alternatives now mapped.

Officials behind the Ann Arbor Connector project have released documents showing a series of possible options for connecting some of the city's major activity centers.

Each scenario proposes connecting the University of Michigan's North and Central campuses, while also linking to the university medical center, downtown and Briarwood Mall.

Four partners are involved in the ongoing Connector study: the city of Ann Arbor, Downtown Development Authority, Ann Arbor Transportation Authority and U-M. .....................(more)

The complete piece is at: http://www.annarbor.com/news/connector-vision-for-high-capacity-transit-in-ann-arbor-taking-shape-with-possible-routes-mapped/

June 24, 2013

LONDON (MarketWatch) -- Technical problems forced a Boeing 787 Dreamliner flown by United Airlines to make an emergency landing on Sunday. "United flight 94 from Houston to Denver returned to Houston Sunday due to a brake indicator issue," the airline said in a statement quoted in media reports. "Following standard operating procedures, as a precautionary measure, the flight landed in emergency status." It's the second unscheduled landing for an United Airlines Dreamliner in a week, after a flight from Denver to Tokyo had to land in Seattle due to an oil filter problem. Earlier in June, a glitch in the anti-icing system forced a Japan Airlines Dreamliner to turn back to Tokyo. The entire 787 fleet was grounded in January for four months by regulators investigating battery problems after a fire on a Dreamliner.

http://www.marketwatch.com/story/boeing-787-dreamliner-makes-emergency-landing-2013-06-24?link=MW_popular

Boeing 787 Dreamliner makes emergency landing

LONDON (MarketWatch) -- Technical problems forced a Boeing 787 Dreamliner flown by United Airlines to make an emergency landing on Sunday. "United flight 94 from Houston to Denver returned to Houston Sunday due to a brake indicator issue," the airline said in a statement quoted in media reports. "Following standard operating procedures, as a precautionary measure, the flight landed in emergency status." It's the second unscheduled landing for an United Airlines Dreamliner in a week, after a flight from Denver to Tokyo had to land in Seattle due to an oil filter problem. Earlier in June, a glitch in the anti-icing system forced a Japan Airlines Dreamliner to turn back to Tokyo. The entire 787 fleet was grounded in January for four months by regulators investigating battery problems after a fire on a Dreamliner.

http://www.marketwatch.com/story/boeing-787-dreamliner-makes-emergency-landing-2013-06-24?link=MW_popular

June 24, 2013

from Naked Capitalism:

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

If anyone doubted that Ben Benanke’s “we’re convinced the economy is getting better, so take your lumps” press conference after the FOMC statement last week was awfully reminiscent of 1937, the newly-released Bank of International Settlements annual report is tantamount to a kick to the groin. And to change metaphors, if the Fed’s sudden hawkish posture is playing Russian roulette with the real economy, the BIS just voted loudly for putting a couple more bullets in the cylinder.

Investors took the news badly, with 10 year Treasury yields rising from 2.18% before the FOMC statement to 2.53% at the end of Friday. And the selloff continues, with the 10-year yield as up to 2.62% as of this writing.

Some commentators thought the Fed talk was misread, pointing to the various thresholds and triggers the central bank set for for commencing its QE exit and they actually weren’t so terrible. Others refused to believe Bernanke was serious, with Marc Faber saying that bonds, stocks, and equities were “very oversold” and arguing, “We are going to go with the Fed to QE99.”

Unfortunately, the worry warts are looking to have the more accurate reading. Tim Duy zeroed in on a key bit of information, namely, St. Louis Fed James Bullard’s speech on Friday, on his dissent from the FOMC’s vote (Bullard thinks low and falling inflation means the economy is weaker than his colleagues believe). This was Duy’s takeaway:

The complete piece is at: http://www.nakedcapitalism.com/2013/06/the-bis-has-lost-its-mind-advocates-kicking-citizens-and-the-bond-markets-even-harder.html

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

from Naked Capitalism:

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

If anyone doubted that Ben Benanke’s “we’re convinced the economy is getting better, so take your lumps” press conference after the FOMC statement last week was awfully reminiscent of 1937, the newly-released Bank of International Settlements annual report is tantamount to a kick to the groin. And to change metaphors, if the Fed’s sudden hawkish posture is playing Russian roulette with the real economy, the BIS just voted loudly for putting a couple more bullets in the cylinder.

Investors took the news badly, with 10 year Treasury yields rising from 2.18% before the FOMC statement to 2.53% at the end of Friday. And the selloff continues, with the 10-year yield as up to 2.62% as of this writing.

Some commentators thought the Fed talk was misread, pointing to the various thresholds and triggers the central bank set for for commencing its QE exit and they actually weren’t so terrible. Others refused to believe Bernanke was serious, with Marc Faber saying that bonds, stocks, and equities were “very oversold” and arguing, “We are going to go with the Fed to QE99.”

Unfortunately, the worry warts are looking to have the more accurate reading. Tim Duy zeroed in on a key bit of information, namely, St. Louis Fed James Bullard’s speech on Friday, on his dissent from the FOMC’s vote (Bullard thinks low and falling inflation means the economy is weaker than his colleagues believe). This was Duy’s takeaway:

Why would the Fed lay out a plan to withdraw accommodation – which in and of itself is a withdrawal of accommodation – at a meeting when forecasts were downgraded? Because, as a group, policymakers are no longer comfortable with asset purchases and want to draw the program to a close as soon as possible. And that means downplaying soft data and hanging policy on whatever good data comes in the door. In this case, that means the improvement in the unemployment rate forecast. Just for good measure, let’s add on a new policy trigger, a 7% unemployment rate. In my opinion, it is not a coincidence that they picked a trigger variable where their forecasts have been most accurate or even too pessimistic. They loaded the dice in their favor…......................(more)

I think market participants clearly heard Bernanke. After weeks of being soothed by analysts saying that the data was key, that low inflation would stay the Fed’s hand, Bernanke laid out clear as day a plan for ending quantitative easing by the middle of next year. Market participants then concluded exactly what Bullard concluded: It’s the date, not the data.

The complete piece is at: http://www.nakedcapitalism.com/2013/06/the-bis-has-lost-its-mind-advocates-kicking-citizens-and-the-bond-markets-even-harder.html

June 24, 2013

from Naked Capitalism:

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

If anyone doubted that Ben Benanke’s “we’re convinced the economy is getting better, so take your lumps” press conference after the FOMC statement last week was awfully reminiscent of 1937, the newly-released Bank of International Settlements annual report is tantamount to a kick to the groin. And to change metaphors, if the Fed’s sudden hawkish posture is playing Russian roulette with the real economy, the BIS just voted loudly for putting a couple more bullets in the cylinder.

Investors took the news badly, with 10 year Treasury yields rising from 2.18% before the FOMC statement to 2.53% at the end of Friday. And the selloff continues, with the 10-year yield as up to 2.62% as of this writing.

Some commentators thought the Fed talk was misread, pointing to the various thresholds and triggers the central bank set for for commencing its QE exit and they actually weren’t so terrible. Others refused to believe Bernanke was serious, with Marc Faber saying that bonds, stocks, and equities were “very oversold” and arguing, “We are going to go with the Fed to QE99.”

Unfortunately, the worry warts are looking to have the more accurate reading. Tim Duy zeroed in on a key bit of information, namely, St. Louis Fed James Bullard’s speech on Friday, on his dissent from the FOMC’s vote (Bullard thinks low and falling inflation means the economy is weaker than his colleagues believe). This was Duy’s takeaway:

The complete piece is at: http://www.nakedcapitalism.com/2013/06/the-bis-has-lost-its-mind-advocates-kicking-citizens-and-the-bond-markets-even-harder.html

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

from Naked Capitalism:

The BIS Loses Its Mind, Advocates Kicking Citizens and the Bond Markets Even Harder

If anyone doubted that Ben Benanke’s “we’re convinced the economy is getting better, so take your lumps” press conference after the FOMC statement last week was awfully reminiscent of 1937, the newly-released Bank of International Settlements annual report is tantamount to a kick to the groin. And to change metaphors, if the Fed’s sudden hawkish posture is playing Russian roulette with the real economy, the BIS just voted loudly for putting a couple more bullets in the cylinder.

Investors took the news badly, with 10 year Treasury yields rising from 2.18% before the FOMC statement to 2.53% at the end of Friday. And the selloff continues, with the 10-year yield as up to 2.62% as of this writing.

Some commentators thought the Fed talk was misread, pointing to the various thresholds and triggers the central bank set for for commencing its QE exit and they actually weren’t so terrible. Others refused to believe Bernanke was serious, with Marc Faber saying that bonds, stocks, and equities were “very oversold” and arguing, “We are going to go with the Fed to QE99.”

Unfortunately, the worry warts are looking to have the more accurate reading. Tim Duy zeroed in on a key bit of information, namely, St. Louis Fed James Bullard’s speech on Friday, on his dissent from the FOMC’s vote (Bullard thinks low and falling inflation means the economy is weaker than his colleagues believe). This was Duy’s takeaway:

Why would the Fed lay out a plan to withdraw accommodation – which in and of itself is a withdrawal of accommodation – at a meeting when forecasts were downgraded? Because, as a group, policymakers are no longer comfortable with asset purchases and want to draw the program to a close as soon as possible. And that means downplaying soft data and hanging policy on whatever good data comes in the door. In this case, that means the improvement in the unemployment rate forecast. Just for good measure, let’s add on a new policy trigger, a 7% unemployment rate. In my opinion, it is not a coincidence that they picked a trigger variable where their forecasts have been most accurate or even too pessimistic. They loaded the dice in their favor…......................(more)

I think market participants clearly heard Bernanke. After weeks of being soothed by analysts saying that the data was key, that low inflation would stay the Fed’s hand, Bernanke laid out clear as day a plan for ending quantitative easing by the middle of next year. Market participants then concluded exactly what Bullard concluded: It’s the date, not the data.

The complete piece is at: http://www.nakedcapitalism.com/2013/06/the-bis-has-lost-its-mind-advocates-kicking-citizens-and-the-bond-markets-even-harder.html

June 24, 2013

from Too Much: A Commentary on Excess and Inequality:

A Congress Only CEOs Could Love

June 23, 2013

By Sam Pizzigati

Only 10 percent of Americans now have confidence in Congress, Gallup has just informed us. No other major institution in American life today has this low an approval rating. In fact, adds Gallup, no major American institution has ever had an approval rating this low.

The most amazing aspect of all this? Public confidence in Congress would likely be running even lower if average Americans knew more, day to day, about what Congress is actually doing. The latest case in point: last week’s congressional committee action on H.R. 1135, the “Burdensome Data Collection Relief Act.”

This particular piece of legislation speaks to an ongoing frustration in America’s body politic: the supersized paychecks that go to America’s top corporate executives. Average Americans, in overwhelming numbers, want something done to bring some common-sense back to CEO pay.

But the House Financial Services Committee, this past Wednesday, opted to do the exact reverse. By a 36-21 margin, committee members voted to repeal the only statutory provision now on the books that puts real heat on overpaid CEOs. The full House, observers expect, will shortly endorse this repeal. ....................(more)

See more at: http://toomuchonline.org/once-again-a-congress-only-ceos-could-love/#sthash.XQrQKmsY.dpuf

A Congress Only CEOs Could Love

from Too Much: A Commentary on Excess and Inequality:

A Congress Only CEOs Could Love

June 23, 2013

House Republicans, with help from some Wall Street-friendly Democrats, are rushing to repeal the most promising Dodd-Frank Act check on excessive executive pay. You won’t believe their rationale.

By Sam Pizzigati

Only 10 percent of Americans now have confidence in Congress, Gallup has just informed us. No other major institution in American life today has this low an approval rating. In fact, adds Gallup, no major American institution has ever had an approval rating this low.

The most amazing aspect of all this? Public confidence in Congress would likely be running even lower if average Americans knew more, day to day, about what Congress is actually doing. The latest case in point: last week’s congressional committee action on H.R. 1135, the “Burdensome Data Collection Relief Act.”

This particular piece of legislation speaks to an ongoing frustration in America’s body politic: the supersized paychecks that go to America’s top corporate executives. Average Americans, in overwhelming numbers, want something done to bring some common-sense back to CEO pay.

But the House Financial Services Committee, this past Wednesday, opted to do the exact reverse. By a 36-21 margin, committee members voted to repeal the only statutory provision now on the books that puts real heat on overpaid CEOs. The full House, observers expect, will shortly endorse this repeal. ....................(more)

See more at: http://toomuchonline.org/once-again-a-congress-only-ceos-could-love/#sthash.XQrQKmsY.dpuf

June 24, 2013

from truthdig:

The Eternal Rebel: Ronnie Kasrils

Posted on Jun 23, 2013

By Chris Hedges

NEW YORK—What is it that makes a rebel? Why does one willingly step outside society to destroy a system of power, break the law and risk persecution and even death for an ideal? As the state calcifies into corporate totalitarianism, as prominent rebels such as Julian Assange, Bradley Manning and Edward Snowden are defamed by a bankrupt media and political class and hunted down as criminals, as change through the established mechanisms of reform becomes impossible, as systems of power invert morality to silence and imprison the just, we are going to have to ask hard questions about what we are willing to endure to make a better world. For if we do not rebel, if we do not actively defy corporate power, we will steadily be herded like captive animals into pens where we will be watched, controlled, abused, exploited and finally cast aside when our bodies and our minds are deemed superfluous by the corporate state. It is not enough to interpret the world. We must change it.

Rebels at the inception of struggle are vilified. They are few in number. They are ostracized by the wider society. They are left to brood in shadows where the organs of state security track and hunt them like prey. These rebels of history must become our tutors. To discuss the nature of rebellion, I recently met with Ronnie Kasrils, who was a leader of the armed wing of the African National Congress when the group was fighting South Africa’s government and who from 2004 to 2008 was minister for intelligence services in the ANC government.

Kasrils, white, middle class and Jewish, turned his back on his race and his class to join the African National Congress as a 22-year-old in 1960. A year later he became a member of the South African Communist Party. He was a founding member, along with Nelson Mandela, of Umkhonto we Sizwe (MK), or Spear of the Nation, the armed wing of the ANC. He served as the commander of the Natal Regional Command and underwent military training in 1964 in Odessa, in the Soviet Union. As a leader in the MK, Kasrils carried out sabotage and bombings of state infrastructure and industrial sites. Although a 1983 MK guerrilla attack left 19 civilians dead and a 1986 raid killed three civilians and injured 73 others, Kasrils points out that overall only a small number of whites died in the struggle while tens of thousands of blacks were slaughtered by the apartheid state.

Kasrils, along with his late wife, Eleanor, lived the shadowy life of an armed revolutionary. In his long liberation campaign he encountered resistance figures ranging from Ernesto “Che” Guevara to Malcolm X. His autobiography, “Armed and Dangerous: My Undercover Struggle Against Apartheid,” is a meditation on the cost and demands of revolutionary discipleship. ....................(more)

The complete piece is at: http://www.truthdig.com/report/item/the_eternal_rebel_ronnie_kasrils_20130623/

Chris Hedges: The Eternal Rebel: Ronnie Kasrils

from truthdig:

The Eternal Rebel: Ronnie Kasrils

Posted on Jun 23, 2013

By Chris Hedges

NEW YORK—What is it that makes a rebel? Why does one willingly step outside society to destroy a system of power, break the law and risk persecution and even death for an ideal? As the state calcifies into corporate totalitarianism, as prominent rebels such as Julian Assange, Bradley Manning and Edward Snowden are defamed by a bankrupt media and political class and hunted down as criminals, as change through the established mechanisms of reform becomes impossible, as systems of power invert morality to silence and imprison the just, we are going to have to ask hard questions about what we are willing to endure to make a better world. For if we do not rebel, if we do not actively defy corporate power, we will steadily be herded like captive animals into pens where we will be watched, controlled, abused, exploited and finally cast aside when our bodies and our minds are deemed superfluous by the corporate state. It is not enough to interpret the world. We must change it.

Rebels at the inception of struggle are vilified. They are few in number. They are ostracized by the wider society. They are left to brood in shadows where the organs of state security track and hunt them like prey. These rebels of history must become our tutors. To discuss the nature of rebellion, I recently met with Ronnie Kasrils, who was a leader of the armed wing of the African National Congress when the group was fighting South Africa’s government and who from 2004 to 2008 was minister for intelligence services in the ANC government.

Kasrils, white, middle class and Jewish, turned his back on his race and his class to join the African National Congress as a 22-year-old in 1960. A year later he became a member of the South African Communist Party. He was a founding member, along with Nelson Mandela, of Umkhonto we Sizwe (MK), or Spear of the Nation, the armed wing of the ANC. He served as the commander of the Natal Regional Command and underwent military training in 1964 in Odessa, in the Soviet Union. As a leader in the MK, Kasrils carried out sabotage and bombings of state infrastructure and industrial sites. Although a 1983 MK guerrilla attack left 19 civilians dead and a 1986 raid killed three civilians and injured 73 others, Kasrils points out that overall only a small number of whites died in the struggle while tens of thousands of blacks were slaughtered by the apartheid state.

Kasrils, along with his late wife, Eleanor, lived the shadowy life of an armed revolutionary. In his long liberation campaign he encountered resistance figures ranging from Ernesto “Che” Guevara to Malcolm X. His autobiography, “Armed and Dangerous: My Undercover Struggle Against Apartheid,” is a meditation on the cost and demands of revolutionary discipleship. ....................(more)

The complete piece is at: http://www.truthdig.com/report/item/the_eternal_rebel_ronnie_kasrils_20130623/

Profile Information

Gender: MaleHometown: Detroit, MI

Member since: Fri Oct 29, 2004, 12:18 AM

Number of posts: 77,067