| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Editorials & Other Articles |

|

| Demeter

|

Fri May-29-09 07:40 PM Original message |

| Weekend Economists' Battlestar Galactica Weekend May 29-31, 2009 |

|

Edited on Fri May-29-09 07:52 PM by Demeter

Folks, we here in the Democratic-Socialist-Populist wing of the United States of America constitute the moral equivalent of the remnants of the human race gathered into Battlestar Galactica. Our enemy, the slaves turned aggressors, the equivalent of the Cylons, are the multinational corporations, especially the financials, originally created by us but now totally out of our control. We are in the stages of battling to the death or to truce with the corporations, trying to save our families and the American dream. Let us learn the lessons about dealing with single-minded collectives: Never Give Them a Chance, a Break, or a Fair Deal. For certain, don't give them perpetual life and citizenship! Or bailouts of taxpayer money.

Battlestar Galactica has a cast of iconic characters. We have Congress. (Good God, Sir, was that fair? John Adams beseeched). We have the courts, riddled with 30 years of activist judges, Republican fascist appointments. We have Obama, who is far too wishy-washy to be a leader in the classical mold. Whether Obama is the leader we need, or the punishment we deserve, has yet to be discovered. ("President Laura Roslin: Billy Keikeya: That's smart. President Laura Roslin: No, it's not smart. It's politics. ") But in the meanwhile, there's the economy. Have at it! Post what you have, annotate according to our theme, add snark and wit if possible, and enjoy learning more about this mad, mad, mad, mad, world. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 07:42 PM Response to Original message |

| 1. No Announcements of Bank Seizures as of 8:40 PM Eastern Daylight Time |

|

See Friday's SMW for a searing indictment of Citibank, which OUGHT to be seized and liquidated, and yet still walks the earth.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 07:57 PM Response to Original message |

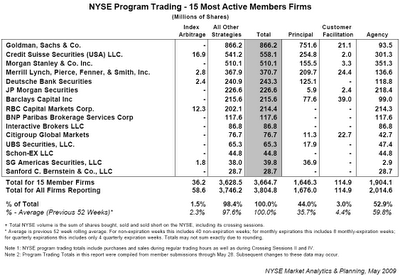

| 2. Bank of America lead director resigns; Departure may put more pressure on CEO Kenneth Lewis |

|

http://www.marketwatch.com/story/bank-of-americas-top-board-member-resigns?siteid=yahoomy

Temple Sloan, after serving 13 years on the board, stepped down on Tuesday, Bank of America said in a statement released after the markets closed. He was most recently lead director and served as the chairman of the board's executive and compensation committees. Sloan also had been a member of the corporate-governance committee. At the bank's annual meeting in late April, roughly a third of shareholders voted against the re-election of Sloan and Lewis to the board. "The core message that shareholders delivered was the need for leadership change at Bank of America," said Bill Patterson, executive director at CtW Investment Group. Sloan's resignation "is a sign that the board is responding." The next step for the board is to find a new chief to replace Lewis, Patterson added. CtW Investment Group, which helps union pension funds be more active investors, has been critical of Lewis for some time. Before the annual meeting, the group called for the bank's shareholders to vote against Lewis, Sloan and governance-committee chairman Thomas Ryan. "The board has made its position on Mr. Lewis clear," Scott Silvestri, a Bank of America spokesman, said Friday. He declined to comment further. After the annual meeting last month, Bank of America said Walter Massey was elected chairman, replacing Lewis, who held the chairman and chief executive roles up to that point. The lender also noted that the board "unanimously expressed its support for Lewis to continue" as chief executive. U.S. regulators have pressured Massey to recruit new board members, and directors other than Sloan already have volunteered to resign, The Wall Street Journal reported late Friday, citing an unidentified person familiar with the situation. More board departures may be announced soon, the paper said. CtW sent a letter to Massey on Friday asking the new chairman to "expeditiously replace Ken Lewis as CEO and reconstitute the board." ......... Bank of America has been forced to take more than $40 billion in government support as the mortgage meltdown and the ensuing credit crisis have pummeled the company. In the wake of stress tests of the nation's largest lenders earlier this month, the Obama administration ordered Bank of America to raise more than $30 billion in new equity capital. The company is on its way to completing the task, but some shareholders have been upset with the resulting dilution of their stakes. Lewis has come under particular fire for Bank of America's acquisition of Merrill Lynch. New York Attorney General Andrew Cuomo recently alleged that, under government pressure, Bank of America didn't disclose Merrill's growing fourth-quarter losses before shareholders voted on the transaction. See full story at link At Bank of America's annual meeting in late April, Lewis defended the decision to go through with the Merrill deal, and said there was "no duty for Bank of America to disclose its negotiations with the government" about the transaction. See full story at link Despite that, 50.34% of shares held were voted to strip Lewis of his chairman's role, in an unusual display of dissatisfaction for investors at a major U.S. company. All 18 directors were re-elected, although 32.67% of shares voted against Lewis and 37.4% voted against Sloan. These tallies included controversial broker votes. See related story. Federal regulators reportedly have been pressuring Bank of America to restructure its board to include more experienced executives. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 07:58 PM Response to Reply #2 |

| 3. Doctor Gaius Baltar: All right, that's it! No more Mr. Nice Gaius! |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 08:06 PM Response to Original message |

| 4. Northern Rock risk revealed in 2004 |

|

http://www.ft.com/cms/s/0/4cc9637a-4c8a-11de-a6c5-00144feabdc0.html

By Norma Cohen and Chris Giles Banking regulators identified Northern Rock as the weak link in Britains banking system during secret war games held as long ago as 2004, the Financial Times has learned. The risk simulation planning, conducted by the Financial Services Authority, the Bank of England and the Treasury, made clear the systemic risks posed by Northern Rocks business model, and its domino effect on HBOS, then the UKs largest mortgage lender. The revelation is at odds with the notion that no one could have foreseen the September 2007 collapse of Northern Rock or the subsequent rescue of HBOS, which was sold to Lloyds Bank. The FT has found the troubled lender and HBOS were at the centre of a 2004 war game that regulators held to test how banks would cope with sudden turmoil in mortgage markets and the withdrawal of the money from foreign banks on which Northern Rocks business model relied. Regulators chose that scenario because they were worried about the growing dependency of banks such as Northern Rock and HBOS on such funds rather than on stable retail deposits. Even though the exercise revealed the banks vulnerability, the regulators concluded they could not force the lenders to change their practices, according to several people familiar with the matter. It was felt that it was too hard to say Northern Rocks business model was excessively risky, and in any case banks following that strategy were profitable and growing, though the Bank did warn of the growth in wholesale deposits repeatedly in its financial stability reports. However, as wholesale lending markets dried up in mid-2007, the war games findings proved eerily prescient. Both banks sustained irreparable damage beginning in 2007 as wholesale lending markets seized up and mortgage-backed securities became unsaleable. Regulators on Friday confirmed that Northern Rock and HBOS were central to the war game. But spokespeople for the FSA and the Bank of England said the exercise was focused on uncovering weak regulatory practices rather than predicting individual bank failure. Mervyn King, Bank governor, alluded to the war games in a 2005 interview with the FT, saying the Bank had looked at a situation in which there could be a problem in a particular institution which isnt terribly big, which may for completely unpredictable reasons turn out to pose a liquidity problem to a very big institution. But until now no one has known the name of any banks used in the exercise. The Financial Times sought details in early April under the Freedom of Information Act from the Bank and the Treasury, but those requests have so far been unsuccessful. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 08:08 PM Response to Reply #4 |

| 5. Lt. Kara 'Starbuck' Thrace: [reacts to a joke] That was weak! So very, very weak! |

|

Samuel T. Anders: |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 08:22 PM Response to Original message |

| 6. What One Stimulus Buck Could Do |

|

http://www.motherjones.com/politics/2009/05/what-one-stimulus-buck-could-do

Okay, quick: Which portion of the US economy consumes the most energy? Nope. Its not transportation. Not manufacturing either. The correct answer is the building sector, which guzzles about three-quarters of the nation's electricity and half of our overall energyand is responsible for almost half of America's carbon emissions. Round two: Which sector, besides banking, has been hardest hit by the recession? You can see where this is going. Construction unemployment stands at 20 percent, more than twice the national rate. For the six months that ended in April, the building industry has shed jobs at a rate of about 120,000 per monthmore than 1.2 million jobs have been lost since December 2007. Private construction, which normally accounts for about 9 percent of America's GDP, is on its knees. For near-broke local governments, this means a shrinking tax base, new foreclosures, and more citizens and companies in need of handouts. But what if there were a way to simultaneously revive this flagging industry, slash energy use, and reduce carbon emissions using federal stimulus cash? And what if the strategy generated all sorts of jobs and filled government coffers and kept people in their homeseven people who have nothing whatsoever to do with the construction? |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 07:44 PM Response to Reply #6 |

| 82. So many construction jobs lost. What will the illegal immigrants do with all that spare time? |

|

Or is it just the citizens who are laid off? Illegals being cheaper, maybe builders will keep them working.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun May-31-09 08:13 PM Response to Reply #82 |

| 86. A Lot Are Going Home |

|

and remittances are way down.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Fri May-29-09 08:26 PM Response to Original message |

| 7. Putting a Headache to bed |

|

Sleep well, all! See you in the morning!

|

| Printer Friendly | Permalink | | Top |

| AnnieBW

|

Fri May-29-09 08:34 PM Response to Original message |

| 8. John Cavil = Dick Cheney |

|

I think that Kindasleezy would be D'Anna Biers.

And of course, the sleeper Cylons would be: Sol Tigh - Arlen Specter Galen Tyrol - Ben Nelson Helen Tigh - Dianne Feinstein Sam Anders and Tori Foster, I dunno. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 07:26 AM Response to Reply #8 |

| 14. How About Reid and Pelosi, that Great Comedy Team? |

| Printer Friendly | Permalink | | Top |

| MattSh

|

Sat May-30-09 01:14 AM Response to Original message |

| 9. A View from Kiev. |

|

A couple of months ago, I wrote a few things about how things look here from Kiev, and hoped to post on a semi-regular basis. Since then, just like in the states, everybody seemed to take an overdose of happy pills, and bad news virtually disappeared. But a few dark clouds are beginning to sneak back into the picture. Whether this is a few passing clouds, or a class 5 hurricane with an accompanying tsunami, well, who knows right now?

I have been known to say that one of the reasons I find Ukraine fascinating is that I can see the future of the USA here. Not that I want the future of the USA to look like this. But I see nobody in a position of power doing much of anything to stop it; indeed, I see little indication that anyone in DC is even aware that there is a problem. Demographic trends: Marriages still down The London-based Economist magazine took a look at demographic trends in Ukraine and found: The 40 percent drop in the number of marriages between 1990 and 2004 underlines the link between the decline in living standards in the post-independence period and the decisions to marry later and to have smaller families. Although the number of marriages has subsequently picked up, in 2007 it was still down by 14 percent compared with the 1990 level. The death rate increased from 12 per 1,000 inhabitants in 1990 to just under 15 per 1,000 in 2001. This reflects the deterioration of the healthcare system since independence, as well as lifestyle factors, such as rising alcohol abuse. This has had an especially strong impact on male life expectancy since independence. Economist predicts slow growth ahead in Ukraine Also, the Economist magazine's May 27 economic forecast for Ukraine wasnt particularly upbeat. Under a best-case scenario, the London-based magazine forecast average growth in gross domestic product of only 2.4 percent annually until 2030. The prediction is based on optimistic assumptions on labor productivity and the growth in capital stock, and presuppose that sound policies will bring further economic liberalization, disinflation and only limited fiscal deficits. The risk is that policymaking will be worse than expected, given the continued strength of vested interests, resulting in even more modest growth rates. The Economist also wrote: Not only has the population declined by around five million Egypt takes notice of fewer Ukrainian visitors Partly because of a sharp drop in Ukrainian vacationers this year, Egypts tourism industry is suffering. Citing Egypts tourism minister, Zoheir Garrana, Reuters news agency on May 26 reported that arrivals from Ukraine decreased by more than 57 percent in the first four months of the year, compared to the same period a year ago. Arrivals from Poland and Russia also declined by about 23 percent during the same period, the news agency reported. Overall, the report says that Egyptian revenues from tourism fell 13.2 percent year-on-year, to $3.6 billion, in the four-month period, with arrivals overall down by 10.3 percent. Ukraine remains tough place to do business Although many areas of the business environment have enjoyed significant liberalisation in the past few years, Ukraine will remain a difficult place to conduct business, writes the Economist in a May 27 report. Companies are exposed to pervasive corruption, and an unwieldy and unreformed bureaucracy. The enforcement of property rights is still weak, the tax system remains complex and contradictory, and corporate governance is poor. State involvement in running the economy is excessive, and the liberalisation of key sectors--in particular, energy and utilities--has been delayed. (Hmmm, some of that sounds like the USA these days). Oh, what else? Well, it seems that beginning June 1st, some housing and utility fees will double or triple. It will be interesting to see how people react to this. Two years ago, when some fees were raised, many people just stopped paying their bills. Within a few weeks, all rate increases were rolled back, and those who skipped a month only had to pay the lower rate. Those rate increases occurred during winter, so turning off services was out of the question. These rate increases are much larger, and occurring in summer, so maybe this time they hope to wait it out and make the increases stick. This time too, those in new projects and determined to be better off will pay the higher increases. This must be IMF demands being put in place, because no one in the government here would vote higher rates on the rich or moderately well-to-do unless their backs were against the wall. So, will this be a long hot summer upcoming, or will the world continue to sleepwalk toward a fate no one wants to contemplate? Only time will tell, I guess... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 07:31 AM Response to Reply #9 |

| 15. Thank You Matt |

|

I was going to visit the Old Country with my Babcia in 1986, but that summer Chernobyl went up, so going to any part of Europe seemed like a really bad idea for someone who hadn't reproduced yet. Sigh.

At this rate, I'll be lucky to ever visit Canada, and it's only an hour away, but I refuse to buy a passport for such a pedestrian reason. |

| Printer Friendly | Permalink | | Top |

| DemReadingDU

|

Sun May-31-09 05:36 AM Response to Reply #9 |

| 45. Thanks for a view from another part of the world, n/t |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 07:57 PM Response to Reply #9 |

| 84. Spacebo. Sometimes we Americans forget the Earth has other countries. |

|

It's nice to hear what's going on elsewhere. Why, I hear sometimes foreigners actually have good ideas. Universal health care, universal college education, gasoline taxes that encourage fuel efficient cars, corporate executives committing hara kiri when they run a company into dishonorable bankruptcy, etc.

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Sat May-30-09 05:37 AM Response to Original message |

| 10. Kick |

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Sat May-30-09 07:00 AM Response to Original message |

| 11. The sharks are in the water.....and you taste good. |

|

http://market-ticker.denninger.net/authors/2-Karl-Denninger

What Was THAT? (Friday Market Close) Friday's close was "interesting", to put it mildly. Here's a chart of Friday's price action in the /ES, the S&P 500 "Electronic" Futures:  Notice the huge volume spike (the blue underlay) on the chart at the close. There were 146,083 contracts traded in that one-minute period between 14:59 and 15:00 (Central); the next minute, when the real dislocation hit, traded 91,774 - after the cash market bell had rung. The closing bell is usually busy. But this sort of volume is absolutely unheard of. To put it in perspective yesterday the same time recorded 26,540 contracts, and 36,642 the minute after. Volume was light all day, as is somewhat common in the summer on a Friday. The close started its usual increase, and was up to 23,000 contracts at 14:57 with two minutes remaining. Then all hell broke loose. "Paper", or institutional representation, was stalking the close; the pit audio feed so stated. Directly in front of the bell 1,000 contracts were bought - as near as I could tell at the market. Those are "Big" contracts, each being 5 of the /ES minis; this was, in effect, a 5,000 contract /ES market order. The reaction was instantaneous. The offer side of the market collapsed and the /ES rocketed higher. In the pit, trades went off as high as 925, but on the E-Mini trades were recorded as high as 927.75. As quickly as it got there, it collapsed back to 922 - a nearly six-handle (3/4 of one percent) straight-up and down spike. Now here's the problem: For me to believe this was "organic", that is, this was an un-forced order, I have to believe that someone wanted to go home net long the equivalent of 5,000 /ES contracts into the weekend at a severely disadvantaged price. The market had been calm all day; if you wanted to buy 1,000 spoos (equivalent to 5,000 E-Minis) there was plenty of opportunity to do so all day long. This sort of market order was guaranteed to dislocate the market - so the buyer had to simply not give a damn what sort of price they got. How bad of a fill was this? (snip)more |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 07:35 AM Response to Reply #11 |

| 17. Impossible Things Are Happening Every Day |

|

Unfortunately, it's Cinderella and her fellow poverty-stricken peasants who are getting the shaft.

|

| Printer Friendly | Permalink | | Top |

| Hawkowl

|

Sat May-30-09 06:09 PM Response to Reply #11 |

| 37. Prelude to a crash |

|

Edited on Sat May-30-09 06:10 PM by Hawkowl

I thought that the "big crash" was going to wait until September/October, (as it historically does), but the way the data is manifesting itself, I'm thinking 2-3 weeks now.

The potential for the mother of all financial disasters with a collapsing dollar, rising interest rates, staggering unemployment, yet another commodity bubble, and no wiggle room with neither monetary nor fiscal policy. This is really beginning to make my head spin. Frack. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:50 PM Response to Reply #37 |

| 40. It Will Take More Than a Couple of Weeks, IMO |

|

the bailout/stimulus money is still sloshing around a bit. GM will take a while to bring the entire world to its knees...

|

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Sat May-30-09 07:19 AM Response to Original message |

| 12. What is not happening on Wall Street: mega companies ask for reduced rents |

|

Rite Aid and CRE

Earlier today Bloomberg reported: Starbucks Pushing Landlords for 25% Cut in Cafe Rents Starbucks Corp. ... is pushing some U.S. landlords for as much as a 25 percent reduction in lease rates, taking advantage of a declining real estate market to save on rent. Now I've heard through a reliable source (unconfirmed) that Rite Aid is also asking for rent reductions. Rite Aid apparently held a conference call with 60 Rite Aid landlords and asked for a 25% rent reduction - or they would close the stores. more about commercial real estate under stress at link... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 07:36 AM Response to Reply #12 |

| 18. and So they Should! |

|

I've found the arrogance of commercial real estate (and the cost of newspaper advertising) to be two of the reasons why entrepreneurs can't.

|

| Printer Friendly | Permalink | | Top |

| Dr.Phool

|

Sat May-30-09 07:26 AM Response to Original message |

| 13. Arnolds advice to grads. "Work like hell and marry a Kennedy". |

|

When Arnold Schwarzenegger appeared on The Tonight Show on Tuesday, he joked with Jay Leno about advice he had given in a recent address to students at the University of Southern California. I told them to work like hell and marry a Kennedy, he said, to laughter and applause.

The studio audience loved Mr Schwarzenegger, who is married to Maria Shriver, John F. Kennedys niece. Making his 25th appearance on the show, he was in his element sparring with Mr Leno, who poked fun at the California governors Austrian accent. But he has had little to laugh about away from the television studio. In the past two weeks the former movie star has had to deal with the biggest crisis of his short political career after voters in a special election spurned revenue-raising measures he hoped would avert financial disaster. Hailed as the states saviour when he replaced Gray Davis, who was ousted in 2003, Mr Schwarzeneggers poll ratings have reached their lowest ever. Amid a 29 per cent fall in tax revenues since last September, the state faces a budget deficit this year of $24bn (£15bn, 17bn) and the Republican governor is threatening to take a Conan the Barbarian-style sword to spending on health, education and other vital public services. The people have spoken, he says in a Financial Times interview. We have to live within our means. http://www.ft.com/cms/s/0/b7139fa2-4c76-11de-a6c5-00144feabdc0.html?nclick_check=1 ----------------------------- You'd think they'd quit electing these dickwad Republican actors out there. In the mean time, anybody know any Kennedy's I can hook up with? She doesn't even have to be hot. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Sat May-30-09 07:32 AM Response to Original message |

| 16. Review of Karl Polanyis, "The Great Transformation" (1944) |

|

Karl Polanyis, The Great Transformation is a truly original and important work published in 1944. Polanyi doesnt fit well in our standard left/right economic dichotomy and for the refined economic tastes of the past several decades, he includes far too much history and politics. Most contemporary economists would no doubt shake their heads and say, How can a book about economics be taken seriously, when it doesnt have one equation? That would be a great mistake. Mr. Polanyis insights deserve great attention.

Polanyi wrote The Great Transformation during World War II. With depression and war, the previous two decades had been a cataclysmic time for the planet. His central thesis was, The origins of the cataclysm lay in the utopian endeavor of economic liberalism to set up a self-regulating market system. The book decisively pooh-poohs many of the myths of our ruling economic doctrine. Most importantly, he eviscerates the idea of laissez-faire and uniquely documents Europes century and half revolution to a market society. Time after time, Polanyi shows the very visible hand of the government interfering in all aspects of society in order to insure market dominance. ..... Polanyi is not anti-market. He believes they are indeed beneficial, but they are not self-regulating, and more importantly the ethos of the market should not be the ruling or even dominant ethic of society. The idea of self-regulating markets is utopian, and like all utopias extremely brutal if tried to be realized. http://www.nakedcapitalism.com/2009/05/guest-post-review-of-karl-polanyis-the-great-transformation.html Yet here is another book to add to my list. I am currently reading "A History of American Law" by Lawrence Friedman. Somewhere down the list is a thorough re-reading of Keynes' "General Theory of Employment, Interest and Money" (1936) and then there's Mr. Polyani's book. It seems that it would make a great companion to Keynes' landmark tome. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 07:40 AM Response to Reply #16 |

| 19. When You Think About It, Medieval Markets Always Had a Regulator |

|

whether it was the Crown, the Church, or the local merchants, somebody made rules and enforced them, and this was accepted practice for people who had had enough of pirates, highwaymen, and the like. It was the mark of civilization, and encouraged trade. Would you leave home with valuable cargo, not knowing if you were going to profit, unless there were safe roads and rules of the marketplace?

Not without an army, or in greatest secrecy. |

| Printer Friendly | Permalink | | Top |

| ozymandius

|

Sat May-30-09 08:04 AM Response to Reply #19 |

| 20. Government, Law and the Economy |

|

From the book "A History of American Law":

The settlements depended on roads, ferries, bridges and gristmills for transport, communication and basic food supply. These enterprises were therefore the public's concern, though private enterprise built them and ran them.Our ideas of quality control (for the public benefit) and regulation of markets and incomes were derived from localized planning around the provision of essential public services as defined by colonial America and as an extension of laws of crown and empire. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:12 AM Response to Original message |

| 21. The "CarTalk" SubThread |

|

We should get Tom and Ray to host! News from Detroit (depressing, as it has been since 1967):

GM and Magna reach deal on Opel http://www.ft.com/cms/s/0/6efc6ae6-4c5d-11de-a6c5-00144feabdc0.html The European arm of General Motors will be shielded from the expected insolvency of the US group after an 11th hour deal reached on Saturday morning that will see Magna International, the Canadian parts supplier, take over the business with financial backing from the German government. After a day of drama following Fiats withdrawal from talks with Berlin, GM and the US treasury to acquire the operations, which include the Opel and Vauxhall brands, exhausted negotiators announced the breakthrough at shortly after 2 am, after six hours of talks at the office of chancellor Angela Merkel. Under the signed memorandum of understanding between GM and Magna, shares in GME will be transferred to a trust to protect it from a GM insolvency, expected on to be announced on Monday. GME will also receive 1.5bn in credit guarantees from the German government to keep it afloat while GM and Magna negotiate a final deal...(lots of detail)...Magnas move marks a setback for Sergio Marchionne, Fiats chief executive, who this month launched a plan to combine Opel/Vauxhall with Fiat and Chrysler, thus forging the worlds second-largest carmaker... ......................... Meanwhile, a local Swedish court on Friday granted GMs other lossmaking unit Saab a further extension to its protection from creditors, giving it more time to restructure. The Swedish carmaker, which first sought protection from creditors in February, was granted an extension until August 20 allowing it to line up a new owner and restructure its business. ............................... ● A US bankruptcy judge is expected to rule Monday on the sale of a slimmed down Chrysler to a group including Italys Fiat after three days of questioning and legal arguments this week, reports Nicole Bullock from New York. Chryslers dealers and a group of secured lenders oppose the transaction. The sale is the centerpiece of the fast-track bankruptcy of Chrysler which many believe is the model for its larger rival GM. Chrysler filed on April 30. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:13 AM Response to Reply #21 |

| 22. Tales from a Bankrupt Economy by Bill Bonner |

|

"You're just graduating from college, right? "You wanna make some real money? "Then, rush to Detroit. Set up a law firm specializing in bankruptcy." More advice to college graduates follows...(below)... Two auto-parts suppliers have already filed under Chapter 11. GM is expected to do so momentarily. Too bad about GM. It was set up in 1916. If it had been able to hold together for another 7 years, it would have gone 100 years without having to declare bankruptcy. All people die. All companies die, too. That's why 'buy and hold' is wishful thinking. Buy and hold long enough and you are sure to go broke. And die. Eventually the undertakers and bankruptcy lawyers get you. And today...business is good in Detroit. What cleared the way for the GM bankruptcy was a deal with the bondholders...in which they take equity in exchange for their debt and agree not to contest the bankruptcy filing. Still, the deal - and other deals relating to it...including the presence of one very big and very odd shareholder, the government of the United States of America - is so complicated, it's bound to give bankruptcy lawyers plenty of work for many years.... dailyreckoning.com |

| Printer Friendly | Permalink | | Top |

| KoKo

|

Sat May-30-09 08:21 PM Response to Reply #21 |

| 38. I'm still wondering what to think about Jeff Macke...and his demise... |

|

don't know if you got into how the "Car People Rant" took him down. But...he's one of those Libertarians...and frankly...I've found them to be very duplicitous... Just saying...if you've followed Macke's demise over his comments about the "Car People."

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:48 PM Response to Reply #38 |

| 39. Haven't Encountered Him--Have You a Link? |

| Printer Friendly | Permalink | | Top |

| KoKo

|

Sat May-30-09 10:04 PM Response to Reply #39 |

| 42. He's one of the CNBC "Fast Money" trader crowd...it's not worth your time |

|

for me to dig up the link when you are busy with other things. I thought you might know about him...and he's not important enough to bother with unless one is into "CNBC" stuff.

Thanks for all you do Demeter! |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 10:20 PM Response to Reply #42 |

| 43. Ah! I Am Without Cable |

|

Not that I ever watched TV for the past decade or more anyway...other than the Weather Channel or an occasional "Whose Line Is It Anyway."

|

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 08:35 PM Response to Reply #43 |

| 88. Ah, so we should be quoting from the 1970s Battlestar Galactica. |

|

Edited on Sun May-31-09 08:39 PM by tclambert

"How could I've been so completely wrong? I led the entire human race to ruin!" - Last words of President Adar aboard the Battlestar Atlantia, moments before its destruction.

Or was that President Bush? Lucifer: Anything is possible, but the odds are astronomically against it. Are you old enough to remember Lucifer (Jonathan Harris, aka, Dr. Smith from "Lost in Space")? Boomer: Just keep it up, old buddy, you're going to get us into real trouble. Starbuck: Ten thousand light years from nowhere, our planet shot to pieces, people starving, and *I'm* gonna get us in trouble? Imperious Leader: Welcome, Baltar. I have grave news. A handful of Colonials prevail, but we will soon find them. Baltar: What of our bargain? My colony was to be spared! Imperious Leader: I now alter the bargain. Baltar: How can you change one side of a bargain? Imperious Leader: When one side is a credit card company. Okay, I altered the last quote to have some Weekend Economist relevance. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun May-31-09 10:53 PM Response to Reply #88 |

| 92. Thank you for the Valiant Efforts |

|

I remember Dr. Smith...

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun May-31-09 11:32 AM Response to Reply #21 |

| 54. Sweating the Future of Cars in the US |

|

http://www.nakedcapitalism.com/2009/05/sweating-the-future-of-cars-in-the-us.html

The New York Times discusses whether Americans will return to buying cars at the pre-bust level when conditions return to some level of normalcy. Of course, the subtext is that the US economy will get back on track later this year, when many those who anticipate growth starting 3Q/4Q, when pressed, say the recovery will be so lackluster as to be a borderline recession. The article does point to demographics, that the baby boomers are moving into retirement, and retirees are not big on buying cars. But it still misses or glosses over a couple of key points. One is that every country experiencing a major financial crisis suffered a permanent decline in its standard of living. It isnt unreasonable to think that car purchases will take dent longer term. In fact, a very good slide show by David Rosenberg, until recently, chief economist for North America for Merrill Lynch, had a chart that showed the ratio of adults to cars over a long period of time (sadly, I cannot locate said chart, but I would presume it excluded the prison population). It showed a near continuous decline to its recent level of 1.2 adults for every car. The implication is that not even that long ago, Americans lived with fewer cars, and conceivably could again. I have also been told, but do not have any stats to prove it, that car ownership has fallen sharply among the young in Japan, in part because many are freeters with little job security. The flip side is that if these conservative forecasts do not come to pass, the industry would have gotten so lean that it would be coining money if Americans start buying cars in force again.... |

| Printer Friendly | Permalink | | Top |

| amandabeech

|

Sun May-31-09 03:45 PM Response to Reply #54 |

| 62. In my lifetime (almost 54 yrs.) I noticed a real increase in two and three family cars |

|

when women went into the workplace in larger and larger numbers from the '70s to early '80s.

Since so much of the U.S. is without decent public transportation and workplaces became increasingly spread out, working women could not often car pool, and second car became much more important. I saw it happen in my own family when my Mom went back to teaching when I was in grade school. A large percentage of women work in our society, and we still have inadequate public transit and spread out workplaces. I don't necessarily see the density of autos and light trucks going down too much, but I do see the age of the vehicles increasing and eventually the size decreasing. That is until our public transit system improves or there are so few jobs that pay enough to justify a car (and maybe child care) that only one person from a couple will be able to work regularly. |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 08:54 PM Response to Reply #54 |

| 89. Not sure how it relates, but on the TeeVee they said the scrap rate for cars now exceeds the puchase |

|

rate, by about 3 million. America now destroys more cars than we manufacture. But I won't believe we really want fewer cars until I hear that bicycle sales have gone way up. And will somebody tell Ed Begley, Jr. to shut the frack up?

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun May-31-09 10:56 PM Response to Reply #89 |

| 93. A Lot of Front Yards Must Be Getting Cleaned Up |

|

and many cities have done something about abandoned cars these days...

If people will snatch grave markers for the metal, think of the possibilities of doing well by doing good and picking up after junk cars! |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:17 AM Response to Original message |

| 23. And oil is signaling a global rebound, isn't it? |

|

"I don't think so," says MoneyWeek's editor in Paris. "There is no increase in oil consumption. Instead, consumption is still going down. What we're seeing is speculation. The central banks are adding to the funds available for speculation. So far, that money isn't reaching the consumer economy...it's mostly in the natural resources market betting on inflation." But you have to give the feds credit. Raw materials...gold...oil...emerging markets - all have seen big increases. Major stock markets too are showing big gains. But the feds' plan is not to reflate the asset bubble, but to reflate the economy. For that, they need rising consumer prices. Consumers need to borrow...and spend. They'll do so, say economists, when prices rise and their dollars lose value. So far, milk and potatoes aren't cooperating. The price of milk fell so low that farmers slaughtered their herds. As for potatoes...we don't know. In Europe, inflation has disappeared. This is the first time the euro zone has ever had flat and falling prices. In America, too, consumer price inflation is ebbing away. In other words, the feds may be winning a battle but losing the war! As usual, there's a lot of smoke and fog on this battlefield. Consumer confidence is rising...but so is unemployment. The New York Times says US joblessness may soon pass Europe's habitually-high rates. The Chinese are still buying America's debt - but only the short-term stuff. America's biggest industrial company goes broke...the government takes a key role in key industries...but investors buy more stocks! If you look through your binoculars you will have a hard time figuring out who's really winning. In the confusion of the battlefield, even a hardened veteran often fails to tell which way the fight is going. In fact, you might see rising stock prices and get the wrong idea...like watching the Yankees get chased back to Washington after the first battle of Bull Run; you might have thought that that was all there was to it. The war was over and the South had won.... http://dailyreckoning.com/tales-from-a-bankrupt-economy/ |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:31 AM Response to Original message |

| 24. Old But Good Joke |

|

"A man and his wife were preparing their wills... The woman asks her husband if he would get married again, if she died first. "'No, I wouldn't want to marry again,' he said. "'Well, why not?' she answered. 'Don't you like being married?' "'Well...yes...' "'Then why wouldn't you want to get remarried?' "'Well...okay...maybe I would get remarried.' "'But where would you live...would you bring your new wife to our house?' "'I guess so...it's a nice house...I wouldn't want to move.' "'You mean...you'd let her drive my car and sleep in my bed?' "'I don't know...I hadn't thought about it...but, yes...I guess so...why not?' "'And I suppose you'd even let her use my golf clubs?' "'Oh no, I wouldn't do that. She's left handed.'" |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:36 AM Response to Original message |

| 25. The Only Two Reasons to Own Gold by The Mogambo Guru |

|

http://dailyreckoning.com/the-only-two-reasons-to-own-gold/

Tampa Bay, Florida I always get a real kick out of hearing that "the consumer is 70 percent of the economy," mostly because it gives me a chance to heap ridicule and scorn on whoever said it, and I say that the consumer is 100 percent of the economy! One CAN say that, with or without the heaping of ridicule and/or scorn, but at least with an arrogant and smug authority that comes from 100 percent certitude, that "The Mogambo is 100 percent certain that the consumer is 100 Freaking Percent (100FP) of the economy!" I make this Bold Mogambo Assertion (BMA) for two reasons. First, I hope that by debunking this silly "the consumer is 70 percent of the economy" crapola, I will win a Nobel Prize or some other award that has a cash-award component of the prize winnings, perhaps one that has a LARGE cash-award component. My argument is that the ultimate consumer pays the price for everything by buying and consuming, for instance, a frozen pizza or delicious candy bars, and maybe something nice to drink, knowing that a slice of the purchase price is used to pay back creditors and producers for the use of capital, labor and land invested in producing these - and more! - delicious 'ready-to-eat' snacks and treats of high caloric content, of which the sugary, chocolaty and salty varieties I find particularly good. Yum! ...there are only two good reasons to own gold; to preserve wealth when prices are stable, and to make a lot of fiat wealth when your government acts so stupid as to create...excess money and credit... And speaking of spending, I was surprised to see that the current- account balance of the USA has collapsed to $673.3 billion in the last 12 months, down from its high of over $800 billion, and the trade balance has fallen to $730.4 billion in the last year, which is down about 20 percent from its high of a couple of years ago, too. And while the 12.8 percent fall in industrial production in the last year seems like bad news for us Americans, it is worse by whole orders of magnitude other places. Japan has industrial production down 34.2 percent over the last 12 months, and in the euro area it is down by 20.2 percent. Just when I thought I would go berserk at such horrific economic news, I see John Stepek at Money Morning newsletter had a subhead that caught my eye, which was "Three sound reasons to own gold." I admit that I did not read the article, but as far as I know, there are only two good reasons to own gold; to preserve wealth when prices are stable, and to make a lot of fiat wealth when your government acts so stupid as to create, or allow to be created, excess money and credit that eventually destroys the currency, especially when undertaken so as to enlarge the size of government, like now, which makes the problem of inflation worse because those more government weenies have a bigger incentive to save their own phony-baloney jobs, but can only make things worse. Like, I said, I did not read the article because I am lazy, but the advice to buy gold is the lesson of the last 4,500 years of governments acting irresponsibly when given control of a fiat currency with which they could create as much money as they wished; inflation in prices inevitably caused chaos, misery, starvation and revolution.... |

| Printer Friendly | Permalink | | Top |

| tomreedtoon

|

Sat May-30-09 08:38 AM Response to Original message |

| 26. Well, the new "Galactica" sucked. |

|

The original was a parable of the Exodus. The new version was full of compromise, mendacity, and hidden betrayal. How cute was it that some of the main characters turned out to be the same robots that were killing the human race. It suggests the betrayal of Democratic Congresscritters whose votes betrayed the promises that got them elected.

And just like our economy, the Galacticans ended up in poverty and sorrow, without their technology and without everything they had learned, little more than a bunch of shivering, cold, naked primitives trying to scratch out a bare survival living out of the dirt. And darkness, and decay, and the Republican Death held illimitable dominion over all. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:50 AM Response to Reply #26 |

| 28. Life Sucks, and Then You Die |

|

I think that's the Optimists' Creed.

|

| Printer Friendly | Permalink | | Top |

| tomreedtoon

|

Sat May-30-09 09:43 AM Response to Reply #28 |

| 32. I prefer Steve Chandler's take on the poster... |

|

It's far more optimistic and cheery.

Consider it a public service. And it will be used more and more in America. (100 Japanese a week killed themselves in April because of the economy. It's the newest thing from Japan!) |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 09:03 PM Response to Reply #26 |

| 90. But in the new version they showed a planet getting nuked! |

|

Tell me you didn't think that was cool. C'mon, doesn't everyone secretly want to nuke a planet and kill billions? Or is that just me?

Did I mention I root FOR the Cylons, and the Terminators, and Colossus and all the other killer machines? Humans are way over-rated. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sun May-31-09 10:57 PM Response to Reply #90 |

| 94. I Confess, When I Heard of Cheney's Hit Squad, The Plot Bunny Awoke |

|

Love to see him hoist on his own petard.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:48 AM Response to Original message |

| 27. Goldman Sachs Principal Transactions Update: Collapse In Agency Program Trading Volume |

|

Edited on Sat May-30-09 08:49 AM by Demeter

http://www.nakedcapitalism.com/2009/05/guest-post-goldman-sachs-principal.html

In the week ended May 22, NYSE program trading dropped to a statistically significant low of 2.9 billion shares, down from 3.3 billion the week before, and from a 3.8 billion prior 52 week average. As for specific actors, no surprise, Goldman leading the governments SLP team with a 7:1 ratio of principal to facilitation/agency.  As for todays market close, with a literally parabolic jump in the last minute of trading, if anyone still thinks this market trades based on anything resembling normal behavior (unless someone had a very Jerome Kerviel-esque fat delta hedging finger or one/two moderate/large quants who had a huge index hedge imploded), I have some BBB+ rated CMBS to sell to you at par. One culprit could be hiding in the huge drop of agency trading, which this week dropped to a several month low of 1.875 billion shares. http://www.nakedcapitalism.com/wp-content/oldimages/nakedcapitalism/3/_FM71j6-VkNE/SiBAFFmQ38I/AAAAAAAAC7Y/O04ryCQdtbY/s400/agency+5.29.09.jpg So as essentially no institutional or retail clients are trading any more, it is just a few desperate computers trying to front run each other. And, of course, for the biggest beneficiary of this PT principal bonanza, look no further than the chart below. http://www.nakedcapitalism.com/wp-content/oldimages/nakedcapitalism/1/_FM71j6-VkNE/SiBA1pO4IpI/AAAAAAAAC7g/UWjyQ409tBg/s400/principal+5.29.09.jpg Going back to todays ridiculous close, the chart below shows it all: the complete tape painting volume spike at the very end of the day speaks for itself. And as computers now simply issue forced stock recall orders to each other, painting the tape wet with manipulative intent and volume spikes into the last 20 minutes of trading every day, their human creators are left on the sidelines, trying to outshout each other as to the reason for why the market keeps rising while the economy keeps tumbling. http://www.nakedcapitalism.com/wp-content/oldimages/nakedcapitalism/3/_FM71j6-VkNE/SiBBUA4c-uI/AAAAAAAAC7o/95yqvJZE3GQ/s400/SPY+Vol+5.29.09.jpg Is there ever going to be any transparency in this market again? |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:53 AM Response to Original message |

| 29. How economists can misunderstand the crisis By Niall Ferguson |

|

http://www.ft.com/cms/s/0/a635d12c-4c7c-11de-a6c5-00144feabdc0.html

On Wednesday last week, yields on 10-year US Treasuries generally seen as the benchmark for long-term interest rates rose above 3.73 per cent. Once upon a time that would have been considered rather low. But the financial crisis has changed all that: at the end of last year, the yield on the 10-year fell to 2.06 per cent. In other words, long-term rates have risen by 167 basis points in the space of five months. In relative terms, that represents an 81 per cent jump. Most commentators were unnerved by this development, coinciding as it did with warnings about the fiscal health of the US. For me, however, it was good news. For it settled a rather public argument between me and the Princeton economist Paul Krugman. It is a brave or foolhardy man who picks a fight with Mr Krugman, the most recent recipient of the Nobel Prize for Economics. Yet a cat may look at a king, and sometimes a historian can challenge an economist. A month ago Mr Krugman and I sat on a panel convened in New York to discuss the financial crisis. I made the point that the running of massive fiscal deficits in excess of 12 per cent of gross domestic product this year, and the issuance therefore of vast quantities of freshly-minted bonds was likely to push long-term interest rates up, at a time when the Federal Reserve aims at keeping them down. I predicted a painful tug-of-war between our monetary policy and our fiscal policy, as the markets realise just what a vast quantity of bonds are going to have to be absorbed by the financial system this year. De haut en bas came the patronising response: I belonged to a Dark Age of economics. It was really sad that my knowledge of the dismal science had not even got up to 1937 (the year after Keyness General Theory was published), much less its zenith in 2005 (the year Mr Krugmans macro-economics textbook appeared). Did I not grasp that the key to the crisis was a vast excess of desired savings over willing investment? We have a global savings glut, explained Mr Krugman, which is why there is, in fact, no upward pressure on interest rates. Now, I do not need lessons about the General Theory . But I think perhaps Mr Krugman would benefit from a refresher course about that works historical context. Having reissued his book The Return of Depression Economics, he clearly has an interest in representing the current crisis as a repeat of the 1930s. But it is not. US real GDP is forecast by the International Monetary Fund to fall by 2.8 per cent this year and to stagnate next year. This is a far cry from the early 1930s, when real output collapsed by 30 per cent. So far this is a big recession, comparable in scale with 1973-1975. Nor has globalisation collapsed the way it did in the 1930s. Credit for averting a second Great Depression should principally go to Fed chairman Ben Bernanke, whose knowledge of the early 1930s banking crisis is second to none, and whose double dose of near-zero short-term rates and quantitative easing a doubling of the Feds balance sheet since September has averted a pandemic of bank failures. No doubt, too, the $787bn stimulus package is also boosting US GDP this quarter. But the stimulus package only accounts for a part of the massive deficit the US federal government is projected to run this year. Borrowing is forecast to be $1,8400bn equivalent to around half of all federal outlays and 13 per cent of GDP. A deficit this size has not been seen in the US since the second world war. A further $10,000bn will need to be borrowed in the decade ahead, according to the Congressional Budget Office. Even if the White Houses over-optimistic growth forecasts are correct, that will still take the gross federal debt above 100 per cent of GDP by 2017. And this ignores the vast off-balance-sheet liabilities of the Medicare and Social Security systems. It is hardly surprising, then, that the bond market is quailing. For only on Planet Econ-101 (the standard macroeconomics course drummed into every US undergraduate) could such a tidal wave of debt issuance exert no upward pressure on interest rates. Of course, Mr Krugman knew what I meant. The only thing that might drive up interest rates, he acknowledged during our debate, is that people may grow dubious about the financial solvency of governments. Might? May? The fact is that people not least the Chinese government are already distinctly dubious. They understand that US fiscal policy implies big purchases of government bonds by the Fed this year, since neither foreign nor private domestic purchases will suffice to fund the deficit. This policy is known as printing money and it is what many governments tried in the 1970s, with inflationary consequences you do not need to be a historian to recall. No doubt there are powerful deflationary headwinds blowing in the other direction today. There is surplus capacity in world manufacturing. But the price of key commodities has surged since February. Monetary expansion in the US, where M2 is growing at an annual rate of 9 per cent, well above its post-1960 average, seems likely to lead to inflation if not this year, then next. In the words of the Chinese central banks latest quarterly report: A policy mistake ... may bring inflation risks to the whole world. The policy mistake has already been made to adopt the fiscal policy of a world war to fight a recession. In the absence of credible commitments to end the chronic US structural deficit, there will be further upward pressure on interest rates, despite the glut of global savings. It was Keynes who noted that even the most practical man of affairs is usually in the thrall of the ideas of some long-dead economist. Today the long-dead economist is Keynes, and it is professors of economics, not practical men, who are in thrall to his ideas. The writer is Laurence A. Tisch professor of history at Harvard University and author of The Ascent of Money (Penguin) :popcorn: |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:54 AM Response to Reply #29 |

| 30. My Therapeutic Rant on the Current Economic Madness, Posted by Michael Perelman |

|

http://econospeak.blogspot.com/2009/05/my-therapeutic-rant-on-current-economic.html

During the Vietnam War, a U.S. soldier seems to have anticipated the spirit of the current economic policy, explaining: "we had to destroy the village in order to save it." The difference today is that while the government destroys villages of the working classes, it is devoting enormous to improve the castles of the rich. Anyone can see the care and feeding of bankers and financiers, while treating much of the rest of the economy with an iron fist. The problem is compounded because alongside the federal stimulus, funding for state and local government is falling off the cliff, in effect, neutralizing much of the stimulus. This contradiction in economic policy is nothing new. A half century ago, E. Cary Brown showed him austerity in state and local governments undid much of the New Deal. Brown, E. Cary. 1956. "Fiscal Policy in the 'Thirties: A Reappraisal." The American Economic Review, Vol. 46, no. 5 (December): pp. 863-66. Nowhere is that policy divergence clearer than in California. A Republican minority blocks all tax increases. The budget deficit seems to increase by a few billions every few weeks. The answer is to eliminate welfare, slash payment to home healthcare workers, and decimate education. I have been looking at papers by Greg Duncan showing the devastating effect of child poverty on children's productive capacity as they mature. In my forthcoming book, The Invisible Handcuffs, I discuss literature that compares the consequences of child poverty on brain development, an effect that resembles the impact of a stroke. Conservatives worry about future tax costs, but what if the losses in the capacity to pay costs exceeds the presumed future burdens of public debt. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:57 AM Response to Original message |

| 31. Must See: Ralph Nader on Corporate Personhood, etc |

| Printer Friendly | Permalink | | Top |

| tclambert

|

Sun May-31-09 09:14 PM Response to Reply #31 |

| 91. Wait, are you saying that corporations aren't really people? |

|

Surely they are just as human as any other anthropomorhized abstraction. Not that I would want one to marry my sister.

|

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 01:05 PM Response to Original message |

| 33. Rail Traffic Down; Truck Traffic Down; Air Cargo Hoping For A Bottom |

|

http://globaleconomicanalysis.blogspot.com/2009/05/rail-traffic-down-truck-traffic-down.html

Green shoots are not yet showing up in cargo statistics. Let's take a look starting with AAR: Rail freight traffic down from a year ago. Freight traffic on U.S. railroads during the week ended May 23 remained down in comparison with last year, although it did show an increase from the previous week this year, the Association of American Railroads reported today. U.S. railroads originated 259,265 cars during the week, down 21.5 percent from the comparison week in 2008, but up 4.9 percent from the previous week this year. In comparison with last year, loadings were down 16.4 percent in the West and 28.0 percent in the East. All 19 carload commodity groups were down from last year, with declines ranging from 4.8 percent for farm products other than grain to 59.7 percent for metallic ores. Intermodal volume of 188,885 trailers or containers was off 19.1 percent from last year, with container volume down 14.2 percent and trailer traffic off 37.2 percent. Intermodal volume was up 0.2 percent from the previous week this year. For the first 20 weeks of 2009, U.S. railroads reported cumulative volume of 5,295,843 carloads, down 19.3 percent from 2008; 3,720,454 trailers or containers, down 16.8 percent; and total volume of an estimated 562.0 billion ton-miles, down 18.2 percent. Canadian railroads reported volume of 53,316 cars for the week, down 33.5 percent from last year, and 37,052 trailers or containers, down 18.9 percent. For the first 20 weeks of 2009, Canadian railroads reported cumulative volume of 1,193,070 carloads, down 23.4 percent from last year; and 810,785 trailers or containers, down 14.5 percent. Mexican railroads reported originated volume of 13,102 cars, virtually the same as last year, and 5,188 trailers or containers, down 18.8 percent. Cumulative volume on Mexican railroads for the first 20 weeks of 2009 was reported as 219,541 carloads, down 12.3 percent from last year; and 95,217 trailers or containers, down 19.8 percent. Combined North American rail volume for the first 20 weeks of 2009 on 14 reporting U.S., Canadian and Mexican railroads totaled 6,708,454 carloads, down 19.9 percent from last year, and 4,626,456 trailers and containers, down 16.4 percent from last year. Rail Carloading Report The Weekly Railfax Rail Carloading Report has the hollowing charts of interest.  Total Industry Charts, US, Canada, Mexico Additional charts show numbers up from earlier in the year. However the charts also show a seasonal dip at the beginning of the year. Is truck freight bottom close? Fleet Owner is asking Is truck freight bottom close? Freight tonnage fell again in April, according to numbers released by the American Trucking Assns. (ATA), indicating that trucking companies are still facing lean times. The ATA said its seasonally adjusted for-hire truck tonnage index fell 2.2% in April, after plunging 4.5% percent in March. Compared with April 2008, tonnage contracted 13.2%, which was the worst year-over-year decrease of the current cycle and the largest drop in thirteen years, said Bob Costello, ATA chief economist. While most key economic indicators are decreasing at a slower rate, the year-over-year contractions in truck tonnage accelerated because businesses are right-sizing their inventories, which means fewer truck shipments, he explained. The absolute dollar value of inventories has fallen, but sales have decreased as much or more, which means that inventories are still too high for the current level of sales. Until this correction is complete, freight will be tough for motor carriers. Costello added that truck freight has yet to hit bottom and it could be a few more months before this occurs. However, Eric Starks, president of research firm FTR Associates, pointed out that while the freight market might not have bottomed out as of yet, its very close to doing so. We still think well reach that bottom around the middle of summer, he told FleetOwner. The million dollar question from Starks perspective is how long the freight market will stay at the bottom. Even once we reach the bottom, are not out of the woods. We could sit with some very depressed freight levels for some time, he cautioned. Air cargo at a bottom? The International Air Transport Association says air cargo market probably hit bottom. A decline in the air cargo freight market following the international financial crisis seems to have hit bottom, the head of the International Air Transport Association said on Sunday. Air cargo, a key barometer of world trade, has slumped amid the global economic downturn and shortage of financing. Global air freight volumes in January saw a record 23 percent year-on-year dive. "I would say, looking at the numbers, that it has hit bottom," the global association's Director-General Giovanni Bisignani told Reuters. Bisignani said the market had at least been stabilising at levels around 20 percent lower than a year ago. "It's not yet enough to say that the situation is picking up because this is also linked with the level of inventories of the manufacturers. So we have to wait at least another 3 or 4 months in order to see if we start moving." Rebound Questionable Shipping may have bottomed, but as long as the economy is losing 500,000 jobs a month and housing is still in a decline, any rebound will be anemic at best. Mike "Mish" Shedlock http://globaleconomicanalysis.blogspot.com |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 04:40 PM Response to Original message |

| 34. Stupid Burglar Nabbed by Backup Program |

|

http://perens.com/works/articles/Burglar/

The following article was included in the email newsletter distributed to constituents by Berkeley City Council Member Susan Wengraf. It's signed by a Berkeley Police officer - Bruce As you may already know, some auto burglars who prowl Northeast Berkeley are prolific; one auto burglar may burglarize several cars in one night. Apprehending one of these prolific individuals can obviously have an impact in reducing the number of auto burglaries in an area affected by property crime, like Northeast Berkeley. With that in mind, I thought you might be interested in hearing about an arrest our Property Crimes Detective Division made recently. On May 5th, at about 6:00 p.m., one of our fellow community members parked his car near the corner of Hearst Avenue and Euclid Avenue. Unknowingly, he left his laptop bag on the back seat of his car. Sometime before 8:00 p.m., someone smashed the car window and stole the laptop from the rear seat. The victim reported the auto burglary but there were no significant investigative leads in the case. This is where the story gets really interesting. The victim had a back-up program installed on his laptop. The burglar proceeded to take photographs of himself with the computer's built-in camera; those photographs were eventually up-loaded to the internet based storage location. The victim discovered the photographs of the suspect and passed them along to Detective Sergeant Ed Spiller and Detective Earl Emelson. The Detectives recognized the suspect, named Vega, who had just been released from jail at the start of the year. The Detectives closely examined the photographs and noticed that Vega appeared to be sitting in a motel room when he snapped the pictures with the computer's camera. Sgt. Spiller, theorizing that the victim's computer had accessed the internet thorough the motel's wireless internet system, began work to identify the I.P. address utilized by the victim's computer in hopes that it would lead them to the motel where Vega was staying. Not content to wait for the I.P. address information to become available, Sgt. Spiller's Detectives decided to expand their search to Oakland motels. While checking motels on MacArthur Blvd., Det. Emelson spotted Vega getting into a car in a motel parking lot. The Detectives stopped Vega and arrested him for possession of the stolen laptop. During the investigation, the Detectives located additional stolen property (from other auto burglaries) inside Vega's car and in his motel room. Vega's girlfriend, Maria Reynoso of Berkeley, was also arrested during the investigation at the motel. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 04:44 PM Response to Original message |

| 35. A finance view of the political nature of the coming GM bankruptcy |

|

http://www.nakedcapitalism.com/2009/05/guest-post-finance-view-of-political.html

...General Motors is a monster company employing a quarter million people worldwide. It sells $150 billion in cars or at least it used to. It is not just a producer of vehicles. It is also a supplier. It has been through several joint ventures and has owned a number of foreign manufacturers, Isuzu and Opel being but two. In short, the company is a very big player, financially, economically and politically. Yet, somehow you get the impression that many in the financial media think we could just turn the lights out and go home. Witness the video below of CNBC anchors Mark Haines, Erin Burnett and Phil Lebeau and a trio of auto analysts trying to impress upon Haines how important GM is. SEE LINK FOR VIDEO The GM bankruptcy is a very big deal and will have wide-ranging implications. Let me review a few of the issues here starting with the politics. 2010 elections In the U.S., we have just witnessed an historic election that some are comparing to the election of Ronald Reagan in 1980 and Franklin Roosevelt in 1932. Indeed, there has been a sea change in the political climate here in Washington since January, with the Democrats and their agenda taking precedence over the Republicans. But, none of that is going to last if we dont see a recovery that lasts through the mid-term elections in 2010. And that is already very much on the minds of politicians in Washington. Here is the calculus. In 2008, the Democrats benefitted greatly from Barack Obamas election as President, taking large majorities in both houses of Congress. Their mandate was to work with the President to fix Americas economic problem. So, Obamas and Congressional Democrats first priority is to end the recession as quickly as possible. I guarantee you there would be hell to pay if this is not done well before November 2010 when the next general election is held. From Obamas perspective, it is crucial that he fix the banks and fix the auto industry as these were the two economic issues front and centre in the election which he said he could tackle. With the banking industry stabilised, the Obama legacy rides crucially on how the Auto Bailout proceeds. Under no circumstances is the Obama Administration going to allow General Motors to do to the economy in 2009 what Lehman Brothers did to it in 2008. They are going to fix GM no matter what it takes. And if this includes heavy-handed tactics, so be it. So, be very clear that the GM and Chrysler issue is an existential question for this administration. Handle it well and you get the Roosevelt treatment and ensure a good outcome for your party in 2010. Screw things up and the depression bears down on America and youre out of office in due course. The key policy decision is how to ensure a favourable outcome. And when I say favourable, I mean one that ensures as many jobs as possible while minimizing any wider economic fallout. Other issues like treating bondholders well, not committing taxpayer monies to the effort, or keeping government out of the auto industry are going to be much less important. German General Election And if Obama is concerned about his political fortunes because of an election next year, you can bet that Germanys Chancellor Angela Merkel is concerned given her election is later this year. In Germany, cars have a mythical status. The Autobahn was begun in the Depression as a way to jumpstart the German economy. The first such road was completed in 1931 between Bonn and Cologne, a road I drove I have driven at least 2 or 300 times (it is a great road for fast driving, by the way, and was opened by Germanys first Chancellor Adenauer when he was Mayor of Cologne. I believe the Bonn Porsche dealership is literally a few hundred meters from the entrance). Shortly thereafter, also during the Depression, the Germans began the car company Volkswagen (literally the peoples car) as yet another car-oriented way to jumpstart the economy. Today there are hundreds of thousands of jobs in Germany tied to the auto sector, which has huge importance in the Rhineland, Germanys industrial heartland and part of the most populous German state North Rhine-Westphalia, as well as in Lower Saxony, Bavaria, and Baden-Württemberg. In short, destroying auto jobs is a sure-fire way to lose an election. The ruling coalition is keenly aware of this and that is why they too will be very involved in the GM bankruptcy as it affects Germany through GM subsidiary Opel... |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 04:47 PM Response to Original message |

| 36. Thought for Our Times |

|

Edited on Sat May-30-09 04:49 PM by Demeter

The science fiction writer, William Gibson, likes to say: "The future is already here--it is just unevenly distributed."

Likewise, the economic recovery has already started. But its distribution will be highly uneven. In my opinion, the distributional effects of this recovery will ultimately determine its sustainability. If policymakers don't figure out ways to counterbalance these uneven distributional effects, we risk heading into a protracted period of subpar growth. http://www.nakedcapitalism.com/2009/05/guest-post-incredibly-uneven-recovery.html The Incredibly Uneven Recovery? by Leo Kolivakis, publisher of Pension Pulse. |

| Printer Friendly | Permalink | | Top |

| Demeter

|

Sat May-30-09 08:56 PM Response to Original message |

| 41. A Return to a Nasty External Dynamic? |

|

http://economistsview.typepad.com/timduy/2009/05/a-return-to-a-nasty-external-dynamic.html