Mortgage Fraud Report - Burn after Modifying: FBI Finds Rampant and Deep Fraud in Real Estate Industry. Guess What State Ranks #1? IOU All-Star California.

It is bad enough that we have legally sanctioned bank robbery being perpetrated by the U.S. Treasury and Federal Reserve punting the U.S. Dollar off the financial edge in Wile E. Coyote fashion. The U.S. Treasury, FDIC, and Federal Reserve are greasing their gears for the obnoxiously named private-public investment program that will start buying legacy assets, what we all know as nuclear waste mortgages. The FBI put out a report highlighting mortgage fraud for 2008 and as you may have guessed it, is rampant with cases of blatant fraud, shows deep corruption, and goes well beyond the few bad apples theory. The FBI found a boatload of scams, gimmicks, and brazen fraud that would make any sensible regulator faint (that is, if anyone was paying attention). We are also seeing a good number of first payment defaults on government backed loans which really should put a break on government backed loans instead of putting our foot on the mortgage gas.

In the publication the FBI found that Suspicious Activity Reports (SAR) for 2008 shot up by 36 percent to 63,713 for the 2008 fiscal year. The report tells us that the actual figure of mortgage fraud is unknown but we all know it is pervasive given that it is latched onto the back of American banking and also has a crew of cronies on Wall Street operating it as if they were maneuvering a remote controlled financial drone. It is fascinating that the FBI also mentioned those pesky legacy assets of Alt-A and Option ARM loans:

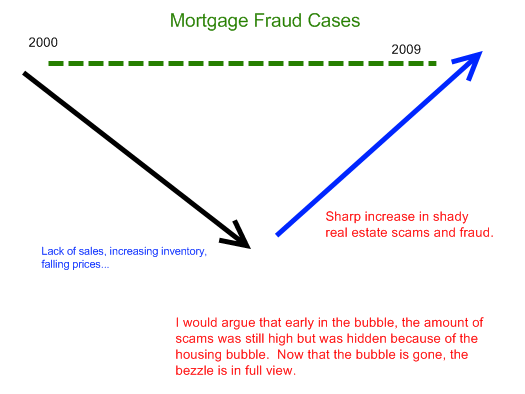

While the amount of mortgage fraud cannot be precisely determined, industry experts agree that there is a direct correlation between fraud and distressed real estate markets. As the housing market continued to decline in response to an increase in housing inventories, lack of sales, and new foreclosures surface, to include a wave of Alt-A and Option ARM loans due to reset beginning in April 2009, real estate values softened, and fraud reporting increased throughout 2008.

Let us map out this relationship:

http://www.doctorhousingbubble.com/mortgage-fraud-report-burn-after-modifying-fbi-finds-rampant-and-deep-fraud-in-real-estate-industry-guess-what-state-ranks-1-iou-all-star-california/

http://www.doctorhousingbubble.com/mortgage-fraud-report-burn-after-modifying-fbi-finds-rampant-and-deep-fraud-in-real-estate-industry-guess-what-state-ranks-1-iou-all-star-california/