| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Topic Forums » September 11 |

|

| seemslikeadream

|

Tue Jul-29-08 08:23 PM Original message |

| 9/11 Truth: The Warnings |

|

Edited on Tue Jul-29-08 08:28 PM by seemslikeadream

http://www.youtube.com/watch?v=WLt1kBjKjAo

UBS = ENRON = BCCI  Just a castaway, an island lost at sea, oh Another lonely day, with no one here but me, oh More loneliness than any man could bear Rescue me before I fall into despair, oh I'll send an S.O.S. to the world I'll send an S.O.S. to the world I hope that someone gets my I hope that someone gets my I hope that someone gets my Message in a bottle, Message in a bottle, A year has passed since I wrote my note But I should have known this right from the start Only hope can keep me together Love can mend your life but Love can break your heart I'll send an S.O.S. to the world I'll send an S.O.S. to the world I hope that someone gets my I hope that someone gets my I hope that someone gets my Message in a bottle, Message in a bottle, Message in a bottle, Message in a bottle, Walked out this morning, don't believe what I saw Hundred billion bottles washed up on the shore Seems I'm not alone in being alone Hundred billion castaways, looking for a home I'll send an S.O.S. to the world I'll send an S.O.S. to the world I hope that someone gets my I hope that someone gets my I hope that someone gets my Message in a bottle, Message in a bottle, Message in a bottle, Message in a bottle, Sending out at an S.O.S. Sending out at an S.O.S. Sending out at an S.O.S. Sending out at an S.O.S. Sending out at an S.O.S. Sending out at an S.O.S...  http://tinyurl.com/5sqnl3 UBS Is Enron Posted by McCamy Taylor on Fri Jul-25-08 05:57 PM Learn the name UBS . This company does not just act like Enron. It really is Enron. For one thing, as I will show, UBS Warburg bought the main money making operation of Enron, the Energy Trading Unit that Ken Lay used to price gouge California. And it bought Enron's senator, Phil "Nation of Whiners" Gramm the on again off again on again John McCain financial adviser----though he was an ex-senator by the time UBS acquired him. About the only difference is this round of scandals involves the banking/mortgage industry rather than energy price fixing. All the other ingredients are here. Investors have been defrauded. Insiders have dumped their own securities as prices have fallen. And Republican lawmakers in the administration are engaged in a cover up. Today, UBS is back in the headlines, because NY state has filed a $37 billion lawsuit on behalf of defrauded investors. This, despite the Bush administrations vendetta against Eliot Spitzer which was probably designed to discourage states from seeking to punish bank fraud where the feds refused to do so. I. With So Many Enrons Just Waiting to Happen, Former Senator Phil Gramm Would Not Be Out of Work Long In 2002, just months after leaving the U.S. Senate in disgrace over the roles which he and his wife played in helping Enron construct its house of cards ( for details and links see my recent journal McCain Economic Adviser Phil "Nation of Whiners" Gramm and Wife Wendy Brought Us Enron http://tinyurl.com/66nt64 Phil Gramm was hired by USB Warburg. http://tinyurl.com/668yc9 October 7, 2002 II. UBS Is Enron This employment opportunity did not come out of nowhere. USB Warburg had already bought Enron's Energy Trading Unit in early 2002, making USB the new Enron---literally---since energy trading was Enron's main source of income. http://tinyurl.com/6loxym The Enron Corporation announced yesterday that UBS Warburg had won the bidding for its energy-trading business, which was the crown jewel of Enron and was responsible for about 90 percent of its revenue. The New York Times makes it sound like happy days are here again, but read this blog entry from a different source. http://tinyurl.com/6krr5l While former US Senator Phil Gramm's wife, Wendy Gramm was a member of Enron's audit committee, and also serving on the company's of the Board of Directors, UBS was a consultant for the State of California in 2002 to help fix the State's energy crisis. And here is the link about the broker that UBS fired in August 2001 at the urging of Enron, because he advised employees of Enron who owned stock in their company to sell when shares were at $36. You read that correctly. UBS helped Enron to trick Enron employees into holding onto worthless shares in the company, in order to inflate the company's value, even as Enron executives and friends within the Bush administration were dumping their stock. Enron (news/quote) executives pressed UBS PaineWebber to take action against a broker who advised some Enron employees to sell their shares in August and was fired by the brokerage firm within hours of the complaint, according to e-mail messages released today by Congressional investigators. http://tinyurl.com/6gl7g8 And here is an excellent document that has much, much more on the many ties between UBS-PaineWebber and Enron, including the many Enron assets and executives which EBS obtained, the investigations of UBS related to the Enron scandal and its eventual settlement with the government. http://tinyurl.com/5bvgoj UBS Warburg purchased Enrons energy trading unit in January of 2002, after the company filed for bankruptcy. The operations were renamed UBS Warburg Energy. In addition to obtaining the business, UBS Warburg acquired two Enron skyscrapers and took aboard 650 former Enron employees, including executives John Lavorato and Louise Kitchen, who had taken the companys largest bonuses after the bankruptcy ($5 million and $2 million), and Greg Whalley, Enrons former president. For all practical purposes, UBS was and is Enron. Here is the settlement. On December 20, 2002 the SEC released information on the $1.4 billion settlement that had been reached between numerous regulating agencies (Securities Exchange Comission , New York Attorney General, National Association of Securities Dealers , North American Securities Administrators Association , and New York Stock Exchange ), and ten prominent investment banking firms that had been under investigation. The settlement was finalized on April 28, 2003.The terms of the settlement focused on each firms need to: Somehow, I do not think that this hand slap taught UBS anything except that corporate fraud can be very, very profitable. III. UBS Warburg Clients Should Have Paid Attention to What Happened to Enron Investors Today, New York state Attorney General Andrew Cuomo announced a massive lawsuit against the Swiss giant on behalf of 50,000 investors whom he claims have been swindled out of $20 billion. http://tinyurl.com/5wgtny The suit alleges that UBS defrauded more than 50,000 customers out of more than $20 billion by knowingly misrepresenting the investments, which are known as auction-rate securities, while several senior bank executives were selling off more than $21 million of their personal holdings in these bonds. Apparently the executives at UBS left an email trail a mile wide, when they began to dump their ARSs, while failing to notify their investors that their own ARSs were going down the toilet. Now, where did that happen before? Ah, that's right! At Enron! For people like me whose academic specialty is not business, here is a wiki link about Auction Rate Securities. Basically, these were an investment option for the rich and for corporations (minimum buy in $25,000) that promised greater return on investment) which were sold to investors as being risk free because the bank promised that it would step in to guarantee a certain minimum price at auction if no one else wanted to bid on these pieces of paper. Well, surprise, surprise, in February of this year, USB, Citigroup, Morgan Stanley and Merrill Lynch decided that they would not hold up their part of the bargain, no one bid on the ARSs, 80% of them had no bidders, the market failed, values of the ARSs fell----and USB still will not buy up its ARS at the new lower prices, leaving its very rich and powerful investors steaming mad. No wonder so many state attorney generals are taking action where the federal government refuses to do anything. http://en.wikipedia.org/wiki/Auction_rate_security As if this is not bad enough, the executives of the company have been caught in an insider trading scandal. No, not a Martha Stewart pretend insider trading scandal. This is the real thing. From the WaPo link above. In one instance, the suit says, UBS's chief risk officer sent an e-mail to the firm's chief executive, who copied another executive, outlining "potential trouble" with the securities, dangers posed by the company's growing inventory of them and the potential damage to the firm's reputation if it didn't fulfill its obligations to investors. The suit does not name the executives. We all want to know if Phil Gramm's name is in that lawsuit. And also, did his wife have any of those ARSs and did she sell any of them? And what about the McCains? IV. How Much of the Blame Rests on Gramms Shoulders and How Much Will Stick to Him and McCain? Even before this lawsuit, people were putting two and two together and coming up with Enron Redux. Here are some of the reviews of UBSs spectacular fall from grace. This article from June claims that Phil Gramms job was to lobby Congress to keep UBS afloat----which was what Ken Lay paid him to do for Enron when he was a Senator. And it is a PR nightmare for Gramm and McCain because it ties the UBS scandal to Enron and to the GOP presidential candidate and his financial adviser. http://tinyurl.com/6qla29 After showing initially profitable results, the banking world has since reminded some of why we had particular banking laws in place since the Great Depression. Gramm ignored history and thought he knew better. As the credit crisis grew Gramm, a Washington insider, was tasked with lobbying Congress to ease the pain of the problem he helped create. In July, the story was still gaining momentum. When investors have lost billions, they tend to make their voices heard. http://www.newsweek.com/id/145011/page/2 Critics have charged that Gramm's action as a senator helped lay the groundwork for some of the problems in the housing and oil markets. But it's hard to pin any of the UBS debacles on the former Texas senator. At UBS, Gramm held the post of vice chairman, a position Michelle Leder dubbed in Slate "the greatest job in business" for its combination of high status and low work rate. Gramm was a lobbyist and adviser, not an operating executive. And he had nothing to do with the forces that impelled banks and banking executives into foolish behavior in recent years; cheap money, greed and a bubble mentality are far bigger than Gramm. But UBS's continuing travails should lead us to wonder how effective Gramm is as an elder statesman. As an adviser, an economist, an expert in the ways of Washington and in the American financial system, part of Gramm's job surely was to advise the bank how to stay out of investment and regulatory trouble. Oops! And then there is this piece which basically lays out the charges for a criminal indictment of UBS---and its agent Phil Gramm http://tinyurl.com/6cvyea Gramm's UBS is a leader on three important fronts in the effort to destroy the U.S. economy: the $1.3 trillion subprime mortgage catastrophe, the $330 billion Auction Rate Securities (ARS) freeze, and a tax evasion scheme of unknown magnitude. V. I Meant It When I Wrote That UBS Is Enron (Minus Ken Lay) UBS enabled Enron to pass itself off as a solvent company to investors for several months after it was clear that it was on the verge of bankruptcy. This cost many their life's savings. UBS paid nothing for its crimes. UBS them absorbed Enron---and its senator, Phil Gramm---and began to exploit the Enron loophole that had allowed Enron to make so much paper profit. This produced the exact same results---eventual financial loss for the company and customers, executives who avoided loss through insider trading and misrepresentation to their clients. All of this was made possible by Phil Gramm, who successfully lobbied to get even more privileges for business to allow them to steal even more from investors---even though everyone knew his history and the history of his company when it came to investor fraud. UBS is Enron. Phil Gramm is a serial enabler of corporate fraud on a massive scale who can not be allowed to direct economic policy in this country. Because if he could get Congress to do what it did for UBS when he was a private lobbyist, imagine what he could accomplish if he had a job in someone's cabinet, making administrative decisions. UBS stands for "Union Bank of Switzerland." leveymg (1000+ posts) Sat Jul-26-08 12:18 AM |

| Printer Friendly | Permalink | | Top |

| wildbilln864

|

Sun Aug-03-08 11:51 AM Response to Original message |

| 1. kick. nt |

| Printer Friendly | Permalink | | Top |

| Bassman66

|

Sun Aug-03-08 02:51 PM Response to Original message |

| 2. Warburg |

|

"Learn the name UBS . This company does not just act like Enron. It really is Enron. For one thing, as I will show, UBS Warburg bought the main money making operation of Enron, the Energy Trading Unit that Ken Lay used to price gouge California."

Is there a connection with THE Warburg of Jekyll Island fame. Same names keep cropping up behind the scenes. |

| Printer Friendly | Permalink | | Top |

| davidwparker

|

Sun Aug-03-08 06:43 PM Response to Original message |

| 3. seemslikeadream, I'll see your Police and raise you an AC/DC. |

|

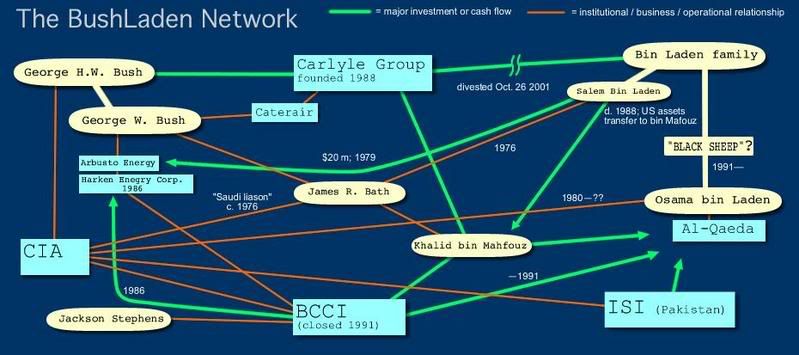

With the web-like structure of your diagram and the evil that is the * Crime Family, this could be their theme song.

http://www.azlyrics.com/lyrics/acdc/evilwalks.html">Evil Walks. Black shadow hangin' over your shoulder Black mark up against your name Your green eyes couldn't get any colder There's bad poison runnin' thru your veins Evil walks behind you Evil sleeps beside you Evil talks arouse you Evil walks behind you Black widow weavin' evil notion Dark secret's bein' spun in your web Good men goin' down in your ocean They can't swim cos their tied to your bed Evil walks behind you Evil sleeps beside you Evil talks arouse you Evil walks behind you You're just crying wolf I sometimes wonder where you park your broom Oh black widow C'mon weave your web Down in your ocean You got 'em tied to your bed With your dark dark secret's And your green green eyes You black widow Evil, walks behind you Evil, sleeps beside you Evil, talks arouse you Evil, walks behind you Evil walks behind you Evil sleeps beside you Evil talks arouse you Evil walks behind you Evil sleeps beside you Evil talks arouse you Evil walks behind you Evil walks You're so bad |

| Printer Friendly | Permalink | | Top |

| Bolo Boffin

|

Sun Aug-03-08 08:12 PM Response to Reply #3 |

| 4. I'm in for Monty Python |

|

Down at an English fair,

One evening I was there, When I heard a showman shouting Underneath the flare: Hoi've got a lo-ve-ly bunch o' coconuts. There they are a-standin' in a row. Big ones, small ones, some as big as yer 'ead! Give 'em a twist, a flick o' the wrist, That's what the showman said. Hoi've got a lo-ve-ly bunch o' coconuts. Hevery ball yer throw will make me rich. There stands me wife, the idol of me life, Singin' "roll a-bowl a ball, a penny a pitch! Singin' roll a-bowl a ball, a penny a pitch! Singin' roll a-bowl a ball, a penny a pitch! Roll a-bowl a ball, roll a-bowl a boll, singin' roll a-bowl a ball a penny a pitch! Instumental I've got a lo-ve-ly bunch of coconuts (They're lovely!) There they are a standing in a row. (One, two, three, four) Big ones, small ones, some as big as your head (And bigger) Give 'em a twist, a flick of the wrist, thats what the showman said. Now that hoi've got a lo-ve-ly bunch of coconuts. (La-da-de-da-da) Hevery ball you throw will make me rich. (Have a banana) There stands me wife, the idol of me life, Singin' roll a-bowl a ball, a penny a pitch! All together now! Singin' roll a-bowl a ball, a penny a pitch! (Harmony!) Singin' roll a-bowl a ball, a penny a pitch! Roll a-bowl a ball, roll a-bowl a ball, singin' roll a-bowl a ball, a penny a pitch. Instumental Singin' roll a-bowl a ball, a penny a pitch! |

| Printer Friendly | Permalink | | Top |

| DU

AdBot (1000+ posts) |

Thu Apr 25th 2024, 08:05 PM Response to Original message |

| Advertisements [?] |

| Top |

| Home » Discuss » Topic Forums » September 11 |

|

Powered by DCForum+ Version 1.1 Copyright 1997-2002 DCScripts.com

Software has been extensively modified by the DU administrators

Important Notices: By participating on this discussion board, visitors agree to abide by the rules outlined on our Rules page. Messages posted on the Democratic Underground Discussion Forums are the opinions of the individuals who post them, and do not necessarily represent the opinions of Democratic Underground, LLC.

Home | Discussion Forums | Journals | Store | Donate

About DU | Contact Us | Privacy Policy

Got a message for Democratic Underground? Click here to send us a message.

© 2001 - 2011 Democratic Underground, LLC