Sadly, the healthcare debate is mostly portrayed as a debate between personalities and parties: Republicans (who generally ARE against any reform), blue dogs (who often DO get a lot of money from the healthcare industry) and more progressive Democrats. The media tends to focus on the personalities, which suggests that are no legitimate policy issues, but there are. I still think a lot of the debate is attributable to political posturing, but here are three ideas being discussed, which do represent legitimate policy choices that must be made.

1.

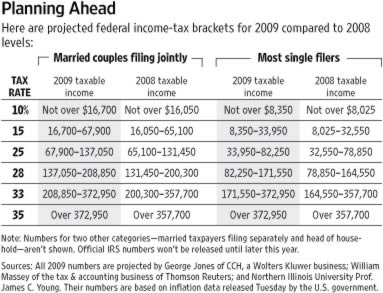

Capping the maximum tax rate for the tax exemption of healthcare benefits - This is actually a version of President Obama's proposal to cap the maximum tax rate for charitable deductions. His reasoning is that this deduction or exemption disproportionately benefits the very wealthy who have a 35% marginal tax rate while a lower paid individual in the 28% tax bracket actually enjoys less of a benefit. Put another way, if you are a single filer earning over $370,000, you receive a $1.00 in healthcare benefits for the equivalent of $0.65 in after tax dollars. In contast, a single filer earning about $50,000 gets $1.00 in healthcare benefits for the equivalent of $0.75 in after tax dollars. So, using the current tax brackets:

<

>

If you cap the tax rate benefit at 28%, then this means that upper income tax payers only receive the same tax benefit as the middle class. To me, this does not sound like a bad idea to increase revenue, in that it merely place upper income tax payers on the same footing as middle class tax payers. Also, when and if President Obama allows the Bush tax cuts for the rich to expire, then this should prevent the rich from getting a real windfall. Can you imagine getting a dollar in healthcare for $0.60 while most folks have to pay $0.75? Yup, that's right, under our current healthcare system, healthcare is incredibly regressive with the rich getting a tax free windfall.

2.

Placing an upper limit on the tax exemption of healthcare plans so that dollars above a certain level are no longer exempt - The key here is the level of the ceiling, but if it is placed at a level like $10,000, then it could work. First, in 2007, the average premium for family coverage was $12,106, which is up 6.1 percent from 2006. However, the actual cost of healthcare premiums varies depending on the plan with some plans being substantially more than $12,000 annual.

<

>

If a public plan is included AND a certain minimum level of benefits is mandated, then a cap on the value of a plan that is exempt may make sense. so long as that cap is set at such a level that most plans remain exempt in their entirety. For example, place a tax exemption cap of $20,000 for a family of four such that any dollar above $20,000 is not tax exempt. This will make cheaper, more efficient plans more attractive. Indeed, many cafeteria plans sort of work like this with the employer offering to pay a certain portion with the remainder being paid by the employee, which is why the blue collar workers in many companies choose the HMO while the upper income types choose the PPO.

3.

Creating an independent board to set Medicare rates - The AMA opposes this, but the bluedogs support this. Of course, this issue is often politicized as doctors threaten to start rejecting medicare patients unless they receive an increase reimbursement in medicare insurance rates that exceeds inflation. Such a board in theory would reduce costs, but the CBO only reports $2 billion in savings over 10 years, which seems small given the extent to which the AMA opposes this measure, so either the CBO or the AMA is mistaken.

Anyhow, I apologize if I am mistating these issues, but I just thought it would be nice to actually discuss the actual substance of the debate, rather than the personalities. At this point, to make ends meet, we will either need to cap or contain costs, which will piss some folks off, or increase revenues (taxes), which will piss other people off. Covering the uninsured will, of course, cost substantial money, but it is sad how little weight is given to the moral and policy value of covering the uninsured.

Finally, it would be nice if there was more substance actually discussed. The media complains about the lack of specifics, but then they ignore the actual proposals being debated, and instead focus on the politics and breathlessly report alleged "setbacks" in reform without disclosing the basis of the alleged disagreement. So, here is my poor attempt to discuss some of these issues.