| Latest | Greatest | Lobby | Journals | Search | Options | Help | Login |

|

|

|

This topic is archived. |

| Home » Discuss » Archives » General Discussion (1/22-2007 thru 12/14/2010) |

|

| tex-wyo-dem

|

Wed Dec-09-09 01:41 PM Original message |

| The Money Party |

|

Edited on Wed Dec-09-09 01:41 PM by tex-wyo-dem

If you've never read this excellent series, you need to; if it's been a while since you've read it, read it again. Explains why, even with Democratic majorities, the people rarely get what they want.

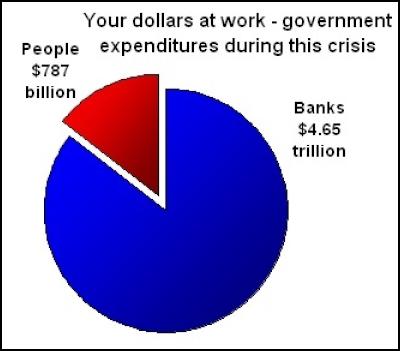

The Money Party (Part 1): The Essence of our Political Troubles Sunday, 30 September 2007, 8:50 pm Opinion: Michael Collins The Money Party is a small group of enterprises and individuals who have most of the money in this country. They use that money to make more money. Controlling who gets elected to public office is the key to more money for them and less for us. As 2008 approaches, The Money Party is working hard to maintain its perfect record. It is not about Republicans versus Democrats. Right now, the Republicans do a better job taking money than the Democrats. But The Money Party is an equal opportunity employer. They have no permanent friends or enemies, just permanent interests. Democrats are as welcome as Republicans to this party. Its all good when youre on the take and the take is legal. This is not a conspiracy theory. There are no secret societies or sinister operators. This party is up front and in your face. Just follow the money. One percent of Americans hold 33% of the nations wealth. The top 10% hold 72% of the total wealth. The bottom 40% of Americans control only 0.3% (three tenths of one percent). And that was before pay day loans. The story is as old as civilization but the stakes have never been higher than they are right now. <continued: http://www.scoop.co.nz/stories/HL0709/S00549.htm> The Money Party (Part 2): Why We Get Such Lousy Leaders and How to Get Rid of Them Monday, 8 October 2007, 10:19 pm Opinion: Michael Collins  Hey, hold on there! Who says we have lousy leaders? Just about everybody. Between 40% and 60% of voting age citizens stay away form the polls in just about every election. In 2004, there were 221 million voting age citizens and 44 % of them, 98 million people, chose not to vote. Of the 226 million potential voters in 2006, a whopping 62%, 141 million people, stayed home. When you ask why they chose not to vote, the common answer is it makes no difference, theyre all a bunch of crooks. If no difference were a candidate, he or she would win every election. Why dont we hear more about this huge voting block, no difference? Because an open discussion of the year in and year out refusal of half of those 18 and older to participate throws cold water on the legitimacy of every president and elected representative that we have. No matter who they are, the elected consistently lack the endorsement of around half the population that stayed home plus somewhat less than half of those who voted since those voters chose another candidate. The right to govern is consistently granted by around 25% of the voting age citizens in presidential elections and 20% or less in off year elections. <continued: http://www.scoop.co.nz/stories/HL0710/S00107.htm> The Money Party (Part 3): Big Lies that You Must Believe Monday, 19 November 2007, 2:44 pm Opinion: Michael Collins  Because if you don't, the whole scam may fall apart. Previously in The Money Party series, we discussed the fact that there is only one political party in the United States, The Money Party. It has two wings, Republican and Democratic. That party represents excessive concentrations of wealth in the hands of corporations, other organizations, and individuals. They put up the money and get what they pay for every time. They make sure that the election system is rigged to rely on money like a junkie relies on heroin. The system takes care of them. They don't have to obey the same rules that we do. Why? Because they're above the law. The Money Party owns the mainstream media entirely. NBC is really General Electric, ABC is Disney, CBS was Viacom but now it's just the name for a mega-corporation, and Fox is News Corp., the Rupert Murdoch financial empire. That's why it's called the corporate media. They're publicity shops, "corporate communications divisions," owned and controlled by Money Party members. <continued: http://www.scoop.co.nz/stories/HL0711/S00308.htm> The Money Party (4): Money Party to Citizens: Drop Dead! Friday, 1 February 2008, 10:37 am Opinion: Michael Collins  Now they've done it. The Money Party road show just hit a speed bump at 90 mph and that speed bump was us. There are no more "booms" to hype. No more schemes to hook investors into the stock market. The high tech boom is dead and biotech turned into road kill thanks to a president who talks to God and believes that evolution is just "a theory." All they had left was the housing bubble. Ram home prices up by flooding the market with buyers. Get them in that home anyway you can. The finance guys will figure it out. We saw "interest only" mortgages to sell people more home than they could afford. And the highly "recommended" adjustable rate mortgages that mature in record time plus other schemes were there to qualify those who should have bought less for more than they'd ever hoped. What a great deal that was. The economy is now tanking. Only 18% of middle class families have three months worth of accumulated income, the amount needed to have a chance of surviving a financial crisis. As foreclosures go through the roof, the know-it-alls in The Money Party public relations shop (the mainstream media) trot out their paid liars to blame the people. <continued: http://www.scoop.co.nz/stories/HL0802/S00005.htm> The Money Party (Part 5): "Us versus Them" Wednesday, 26 March 2008, 10:14 am Opinion: Michael Collins We have been warned again and again that seeing the world as an "us versus them" proposition is a fatal error. It's polarizing. It leads to "class warfare." It absolves "us" of the collective responsibility we all have in a democracy. Can't have it, not allowed. Well, here's some news for "them". It is precisely an "us versus them" world. We live in a nation where tremendous wealth calls the shots without respect or regard for the public will, fails miserably again and again, and then hides behind "collective responsibility." We're supposed to believe that somehow "we all allowed this to happen." This point is critical: If "we" all allowed it to happen then "they" aren't responsible, ever. They have the ultimate "Get out of jail free" card. Kill, maim, steal, lie, cheat, etc. etc. and all they have to do is say everyone was in on it; therefore, they are not responsible. Starting a war based on lies that breaks the bank of the federal budget while the richest 1% get tax cuts is just one example of the fraud perpetrated by our "public servants." Did you have anything to do with that? Now the "D" word is being used we're on the verge of a major depression or, at least, a calamitous recession, take your pick. How did this happen? See if you can identify your role. How will they blame us in order to survive and do it all over again? <continued: http://www.scoop.co.nz/stories/HL0803/S00402.htm> The Money Party (Part 6): "A Cascade of Ruin" Monday, 22 September 2008, 11:27 pm Column: Michael Collins  (Wash. DC) Well, they finally did it. The Money Party exposed the nauseating underbelly of first world finance. It's a cross between a Ponzi scheme and a complex math puzzle, all geared to let those in charge rake off as much money as they can, whenever they can, while they leave us out in the cold. Unfortunately, this time their greed and lack of control has the world poised for a systemic economic meltdown. The collapse and subsequent government rescue of home mortgage giants Freddie Mac and Fannie Mae, stock brokerage Merrill Lynch, investment bank Bear Stearns, and, an insurance company, AIG, are designed to show we're moving away from the brink of disaster to a safer place. "The system is working" to manage what Alan Greenspan is calling a once in a century event. One thing the system might do while it's working so hard is explain why we're bailing out a stock brokerage and an insurance company? Isn't this about banks? Don't hold your breath. The corporate elite and political misanthropes who caused this are getting ready to put the final nail in the coffin of the United States economy and the livelihood of the vast majority of citizens. If this happens, they will have achieved their goal: overshadowing nearly all of the domestic resistance to their schemes of perpetual empire and plunder with a financial meltdown that places survival and subsistence as the highest value. <contined: http://www.scoop.co.nz/stories/HL0809/S00274.htm> The Money Party (Part 7): Bailout Blackmail: We Pay for the Money Party Written by Michael Collins Wednesday, 24 September 2008  We're being blackmailed into accepting the responsibility and debt for the worst managed financial institutions in the history of this country. The starting price, our debt, is $700 billion dollars. What's really about to happen is that the failed financial institutions will be rewarded for their bad behavior. As a result, they and others will be encouraged to do it again. It's just a matter of time. We're under the gun and told that we have just days to make a decision to bailout these mismanaged entities. The last thing they want is an open hearing on the problem. Deliberation is deadly for them. We're told that our world will collapse; there will be a systemic breakdown if the president's bailout legislation is not passed. Without it, we'll all be eating stale beans and rice for the rest of our lives. <continued: http://www.apj.us/index.php?option=com_content&task=view&id=1794&Itemid=2> Averting Further Economic Disaster Written by Michael Collins Thursday, 05 February 2009 The human costs of the U. S. financial crisis are coming into clear focus. Family members lose their jobs, then their homes, and the cascade of ruin begins in earnest. Health problems are ignored, anxiety and depression increase, and domestic violence is more common. Many are on the edge, anticipating their worst fears: losing their home or apartment then struggling to find the next meal. The biggest issues right now are about basic needs -- food and shelter. There's a rational, reasonably immediate solution to a good part of the economic disaster. The banks won't like it but you will. But first the sad facts. There were 2.3 million default notices to homeowners in 2008, up 80% over 2007. It will be worse in 2009 with Option ARMs coming due (those favorites of Alan Greenspan). Typically the nation's economic leader, California, saw foreclosures increase by 160% in 2008. As a result three percent of California homes, 240,000 in all, became bank properties. These are the same banks that slithered up to the bar and demanded a double shot of the new elixir for failed financial institutions, federal bailouts. Put it on the tab. <continued: http://www.apj.us/index.php?option=com_content&task=view&id=2199&Itemid=2> Too Little Too Late? The Money Party at Work Written by Michael Collins Thursday, 19 February 2009  President Obama announced a $75 billion assistance package to address home foreclosures yesterday. He also promised a $200 billion infusion into Freddie Mac and Fannie Mae, the nation's underlying lenders. That's exactly $275 billion more dollars than the previous administration committed to citizens to help ease their very human crises surrounding foreclosure. Is this enough to stem the tide for those losing their homes? Will those "who have played by the rules," as Obama calls them, be salvaged the indignities and financial oblivion that begin in earnest if they're thrown onto the street? Or will those who broke all the rules profit immeasurably? In order to understand the current situation, it's necessary to take a hard look at some really ugly numbers from 2008 summarizing the "nonprime" home lending situation. (The data in this article is from Federal Reserve Bank of New York Dec. 2008 summary of "nonprime" lending). The nonprime home lending market consists of 2.2 million "Alt-A" home loans to those with good credit who chose "innovative" adjustable rate mortgages plus 2.7 million subprime home loans to those with marginal credit who, often times, used funds to purchase a first home. The total 4.9 million nonprime loans were used to purchase homes that house around 12 to 15 million people. <continued: http://www.apj.us/index.php?option=com_content&task=view&id=2226&Itemid=2> The Money Party: Enough of Everything but Dollars Monday, 02 March 2009, 9:25 am Column: Michael Collins  The government bailout of failed financial institutions locks you into years of debt payments in behalf of the large private banks, debts that you did not create. By all appearances, it also locks the country into years of a weak economy. That means unemployment, underemployment, and more suffering for those willing to work, but left out of the job market. It means lowered opportunities for those who do work and troubles for dependants and indigents. Vital national priorities including affordable health care and the massive effort required to save everyone form calamitous environmental catastrophes are now on hold or under funded. We don't have enough dollars. It was the banks versus the people and we just lost. The theory is that without these payments, the banks will fail and we'll all be in a world of trouble without them. <continued: http://www.scoop.co.nz/stories/HL0903/S00010.htm> Enabling Acts - For An Era Of Greed Tuesday, 14 April 2009, 10:50 pm Opinion: Michael Collins  Our financial system looks ruined beyond repair. The credit default swaps crisis is 40 or so times bigger than the real estate meltdown over subprime derivatives. The top 25 banks in the United States are loaded down with $13 trillion in credit default swaps and the deal is coming unraveled. If we accept the highly dubious assumption that the debt from the financial meltdown needs to be repaid by us, were looking at $43,000 a citizen right now. And we're just starting. It didn't get that way by accident. There was special legislation that enabled the current crisis. This was classic Money Party strategy and tactics. The strategic goal was to turn Wall Street into a big casino for the "in crowd" of major investors, funds, and institutions. No rules and no regulations: "let the market take care of it" was the philosophy. <continued: http://www.scoop.co.nz/stories/HL0904/S00140.htm> Throw the Bums Out All of Them! Senate Tycoons Kill Mortgage Aid for Main Street Written by Michael Collins Friday, 01 May 2009 The United States Senate took a swipe at the spirit of May Day in a spectacular show of callous indifference when it voted down a bill to provide limited assistance to citizens at risk for losing their homes. The final vote was 45 in favor, 51 opposed to Senator Richard Durbin's (D-IL) mortgage assistance bill. The original version of the bill covered some but not all of those requiring assistance. The final version was even more restricted. It applied to only homeowners currently in foreclosure as a result of actions prior to the start of 2009. The denial of assistance to citizens by Senators is ironic given the fact that the origins of the current economic crisis came from Senate legislative actions in 1999 and 2000. While their avarice knows no bounds, their memory suffers. Apparently these multimillionaire aristocrats of the Senate "gentlemen's club" haven't been watching the news. The International Monetary Fund declared that the United States is in a depression almost three months ago. Delinquency and foreclosure rates around the country are rising at spectacular rates. Unemployment has jumped by 3.3 million in the last five months. Economic growth has declined at a rate of 6.3% in the first quarter of 2009. <continued: http://www.apj.us/index.php?option=com_content&task=view&id=2361&Itemid=2> Give It Back Goldman! Thursday, 16 July 2009, 10:55 pm Opinion: Michael Collins  There are a number of stories out there about Goldman Sachs gaining unfair advantage in the financial markets. One concerns a former employee who allegedly swiped a special program to maximize automated stock trades. Questions were raised about the propriety of this since Goldman is hauling in tons of cash on a daily basis while others struggle. A variation of this story involves speculation that Goldman gets insider information through some internet scheme and uses that to maximize their haul. But the biggest outrage is what's happened in public. We Made Goldman Sachs what it is Today If it weren't for our tax dollars and the cash flow that citizens provide for the United States Treasury, Goldman Sachs would have joined Bear Sterns and Lehman Brothers in the graveyard of financial high flyers. But they were saved. Bush Secretary of the Treasury Henry Paulson came to the rescue when he assured that one of Goldman Sachs most important customers, the AIG group, survived a financial mess of its own creation. <continued: http://www.scoop.co.nz/stories/HL0907/S00188.htm> More excellent articles by Michael Collins may be found at http://www.electionfraudnews.com/MichaelCollins.htm |

| Printer Friendly | Permalink | | Top |

| bain_sidhe

|

Wed Dec-09-09 01:44 PM Response to Original message |

| 1. K & R |

|

and posting so I can find it again, 'cause I have to leave now to spend some of that hard-earned money the Money Party wants to take...

|

| Printer Friendly | Permalink | | Top |

| arcadian

|

Wed Dec-09-09 01:46 PM Response to Original message |

| 2. and you ain't a member. |

| Printer Friendly | Permalink | | Top |

| tex-wyo-dem

|

Wed Dec-09-09 01:54 PM Response to Reply #2 |

| 3. you got that right... |

Interesting going back to these old articles and seeing how little changes. |

| Printer Friendly | Permalink | | Top |

| Blue Owl

|

Wed Dec-09-09 02:30 PM Response to Original message |

| 4. money trumps peace |

|

Money trumps politics, money trumps public healthcare -- my goodness what DOESN'T money trump these days?

|

| Printer Friendly | Permalink | | Top |

| DU

AdBot (1000+ posts) |

Fri Apr 26th 2024, 07:14 AM Response to Original message |

| Advertisements [?] |

| Top |

| Home » Discuss » Archives » General Discussion (1/22-2007 thru 12/14/2010) |

|

Powered by DCForum+ Version 1.1 Copyright 1997-2002 DCScripts.com

Software has been extensively modified by the DU administrators

Important Notices: By participating on this discussion board, visitors agree to abide by the rules outlined on our Rules page. Messages posted on the Democratic Underground Discussion Forums are the opinions of the individuals who post them, and do not necessarily represent the opinions of Democratic Underground, LLC.

Home | Discussion Forums | Journals | Store | Donate

About DU | Contact Us | Privacy Policy

Got a message for Democratic Underground? Click here to send us a message.

© 2001 - 2011 Democratic Underground, LLC