kentuck

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:05 AM

Original message |

| Would you support raising the retirement age for Social Security? |

|

I heard it mentioned on C-SPAN this morning, as a way to save the program.

That may be fine for some people that are able and wish to work until they are 70 or older. However, there are many people that are not able to work. And even if able to work, how are they supposed to find work in this economy? Employers do not want to hire people over 55, let alone over 65.

This will be my line in the sand for the Democratic Party. If they raise the age limit, rather than the income limit, they have lost me. I cannot support such an idea.

|

unpossibles

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:07 AM

Response to Original message |

| 1. I think it could be an option. |

|

Not sure if I'd want it to be mandatory because different people age differently and some would need to retire at that age, but our lifespans and lifestyles are different than generations past too.

|

fasttense

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:32 AM

Response to Reply #1 |

| 30. Where have you been? The age limit is already at 70?????? |

kestrel91316

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:04 AM

Response to Reply #30 |

| 56. Wrong. People CAN start collecting it at 65, or they can wait until as late as 70 |

|

to start - it's individual choice.

Perhaps changing it so you can't start collecting until 66 would help. But only if they enact a ban on forced retirement at 65 (except where safety issues are in play).

|

TreasonousBastard

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:19 AM

Response to Reply #56 |

| 63. Still wrong-- you can start collecting at 62 like I did. 70 is just for the upper... |

|

limit on benefits. Sometime in your 50s, you start getting statements from SS telling you what your benefits will be.

I took a hit of around a 150 bucks a month to start collecting at 62 instead of 65, but since I'm damn near flat broke without it, even with two P/T jobs, it wasn't much of a hit.

If, for some reason, I want to collect the full benefit at 65, or even more at 70, I would have to pay back everything they paid me up to then before I could collect the higher amount. Can't imagine many scenarios where that would happen.

|

sandnsea

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:37 AM

Response to Reply #63 |

| 75. Well the hit is a lot bigger than that now |

|

You only get about half what you would if you waited until 70. The ones who need to retire, the laborers, are the ones who can't, and they're also most likely to die in their early 70s.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:28 PM

Response to Reply #75 |

dflprincess

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:00 PM

Response to Reply #75 |

| 188. I got my annual statement from Social Security today. |

|

Based on my current income, I would collect $690 more a month if I retire at 70 instead of 66. That's a big incentive to keep working - assuming, of course, I manage to stay employed at the same income until then.

|

SoCalDem

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 06:20 PM

Response to Reply #188 |

| 211. If you are married, you might be better off collecting at age 62 |

|

since your husband's would become yours if he dies before you do.. the amount you would collect in the interim (62-70 for you) would probably outweigh the difference in yours.. If he were to pass in that time-frame, yours would just be forfeited completely..(assuming that his would be more)

|

high density

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 06:56 PM

Response to Reply #75 |

| 214. You have to live for quite a while to make up the difference |

|

I think people should start collecting as soon as they can.

|

CTyankee

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 01:41 PM

Response to Reply #63 |

| 128. I couldn't start collecting at 65; I had to wait until 65 and 4 months. So the age |

|

you can collect full benefits has inched up incrementally. My husband, a full year younger than me had to wait a bit longer than the 4 months. My guess is that they will keep on incrementally increasing the age...a month or two here and there could make a difference in the aggregate...

The thing is that you have to have SOME sort of a plan if you want to retire. I had desperately wanted to retire at 62 but decided to stuff my 401k with every penny I could each pay period, put off spending that wasn't absolutely necessary, pay down any debt I had and take no vacations. I had 3 more years of absolute misery in my job but got through it...it was no easy lift, that...

|

luckyleftyme2

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 11:59 PM

Response to Reply #63 |

|

you are correct you can start collecting at age 62 and some of the younger ones will have to wait until they are 70 for full benefits!

you can apply for medicare at 65!

|

Hannah Bell

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Wed Mar-31-10 05:36 PM

Original message |

|

Edited on Wed Mar-31-10 05:39 PM by Hannah Bell

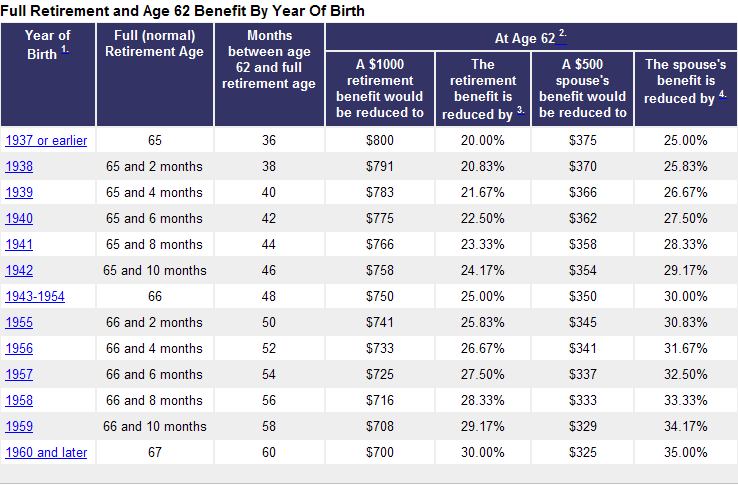

Here's how it works. If your full retirement age is 67, the reduction for starting your benefits at 62 is about 30 percent; age 63 is about 25 percent; age 64 is about 20 percent; age 65 is about 13 and 1/3 percent; and age 66 is about 6 and 2/3 percent. http://www.ssa.gov/pubs/retirechart.htmhttp://www.ssa.gov/retirement/1938.htmlhttp://www.ssa.gov/retire2/agereduction.htm |

fasttense

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 12:19 PM

Response to Reply #56 |

| 199. Wrong - you lose anywhere from 20% to 55% if you don't wait until 70. n/t |

|

Edited on Tue Mar-30-10 12:21 PM by fasttense

|

high density

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 06:58 PM

Response to Reply #199 |

| 215. You lose a lot more if you defer to 70 and happen to die in your 60s. NM |

activa8tr

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Wed Mar-31-10 05:32 PM

Response to Reply #215 |

| 229. Exactly! I know people seldom think about it as more than a |

|

monthly amount, but if they were to think of what they would collect between 62 and 70, and then how healthy they will be at 70 instead of say 65, to go on trips, spend time away, do everything they want to do...

Gambling on living until one is 99 or 84 or even 80 is not really worth the years of wear and tear of a job after 65 or so.

Days and time are more important to most people than MAYBE getting a few extra dollars in a monthly check later on down the road.

|

Obamanaut

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:26 AM

Response to Reply #30 |

| 66. It is possible to begin Soc Sec at a reduced rate at age 62. Full |

|

retirement is around 65, depending on year of birth. I started at 62, and will receive a reduced amount until I die or Soc Sec goes under, simply because I started early. It's about a $300/month (roughly) difference.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:30 PM

Response to Reply #66 |

| 112. 'Full' retirement for those born the year I was is 66 and 2 months and it goes up from there |

|

Edited on Mon Mar-29-10 12:31 PM by laughingliberal

My statements now show a reduced benefit for 66 and 2 months (and a seriously reduced benefit at 62) and the full benefit at 70. I was born in 1955. Congratulations in making it out in time.

|

Obamanaut

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:48 PM

Response to Reply #112 |

| 146. My full retirement was closer to 65, born in 1942, but I don't recall |

|

the exact number. I'm glad I started at 62.

Miz O also started at 62. Her disability claim after a motorscooter accident was denied, and it was easier and quicker just to start early SS than to fight it. This was in 2006, and she's still going to various treatments, has some memory issues, and we were told we should expect to see sympoms similar to the after-effects of a stroke.

I'm retired military, and we had Tricare insurance. If not for that, we would have lost everything to medical bills. Thus, I'm in favor of expanding many of these programs - SHIP (or SCHIP), medicare, Tricare w/ all it's branches, VA = into some sort of single payer. The personnel are there, the offices are there, an estimated 100 million people currently use those various programs, why not add a few more staff members and accomodate the remaining citizens.

|

luckyleftyme2

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 11:55 PM

Response to Reply #30 |

| 220. and do you know who made it that- 70 to be max age for ss retirees |

|

how short some right wingers memory really is!

if you told them we sold the shore frontage in Arizona they would believe it!

|

SharonAnn

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:12 PM

Response to Reply #1 |

| 138. No, we've already done that. And the GOP just stole the surplus to give tax cuts to their friends. |

|

No, no, no.

The issue is, how do we get the funding we need to keep Social SEcurity operating the way it is and the way it was promised to be?

The answer is to raise the FICA limits on earning AND to classify all income as subject to earnings taxes.

The way it is, someone who doesn't work but lives on inherited wealth never pays into Social Security. Never!

Think about it.

|

merh

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:21 PM

Response to Reply #138 |

| 169. I like your suggestion. |

|

Now, how do we get the borrowers to put the money back that they took out of the fund?

And can we remove the funds from the general funds, maybe the SS fund untouchable?

|

Statistical

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:31 AM

Response to Reply #169 |

| 195. Why would you make the trust fund untouchable. |

|

SS trust fund will be repaid with interest. That will begin in 2013.

Due to the demographics it was necessary to save up enough to get over the "baby boomer hump".

As a result SS paid General fund for 20 years. Now the reverse will happen and General fund will repay SS for 20 years.

|

G_j

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:08 AM

Response to Original message |

| 2. that would be utter cruelty |

|

so I guess it is possible.

:mad:

|

Liberal In Texas

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:09 AM

Response to Original message |

| 3. I'd rather see the cap raised or eliminated. |

|

Why should those who may not be able to work past 65 have to suffer when there is a way to fix it by raising the cap?

|

woodsprite

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:25 AM

Response to Reply #3 |

kestrel91316

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:05 AM

Response to Reply #3 |

| 58. Raising the cap is an excellent idea. That probably means our Dems will |

|

fail to do it out of fear of their wealthy masters.

|

awoke_in_2003

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:39 PM

Response to Reply #3 |

Fire1

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:10 AM

Response to Original message |

| 4. No, I can't support that either. Mine is already at 67 for full |

|

Edited on Mon Mar-29-10 09:11 AM by Fire1

SS benefits.

|

ThomWV

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:11 AM

Response to Original message |

| 5. I believe it already is rising. Isn't the age going up year by year? |

|

Edited on Mon Mar-29-10 09:12 AM by ThomWV

By a couple of months each year?

|

KatieW

(101 posts)

Send PM |

Profile |

Ignore

(101 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:13 AM

Response to Original message |

| 6. No, I'd rather they raise the cut off limit for when Social Security taxes are withheld. |

calico1

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:14 AM

Response to Reply #6 |

| 8. That would be a better idea. Or have no cut off. n/t |

calico1

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:13 AM

Response to Original message |

|

At the rate they are going we will all be dead before we can start collecting.

|

Bluzmann57

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:14 AM

Response to Original message |

| 9. NO!!!!!!!!!!!!!!!!!!!!!!!!! |

|

I am middle aged and have no intention of working the rest of my life. I have paid into this system since I was 16 and at the risk of sounding selfish, I want my share and I want it sooner rather than later.

|

AngryAmish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:33 AM

Response to Reply #9 |

| 31. You realize you get all you paid in in 4 to 4.5 years, right? |

|

If life expectancy at 67 is 10 years, then you have over five years of freeloading there.

|

yodoobo

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:43 AM

Response to Reply #31 |

|

Guess you never heard of compound interest.

|

AngryAmish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:49 AM

Response to Reply #39 |

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:53 AM

Response to Reply #44 |

| 47. I'd rather do the math on how much has been 'borrowed' to cover the tax cuts for the rich all these |

|

years since Ronnie raised the payroll tax to cover cutting the income tax on the wealthy. How many years did they freeload off the taxes of the workers?

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:57 AM

Response to Reply #47 |

fascisthunter

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:39 PM

Response to Reply #47 |

sad sally

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:50 PM

Response to Reply #47 |

| 180. Why is that fact conveniently forgotten? Imagine how solvent the USA |

|

would be if voodoo economics hadn't happened back then. We could afford health care for all, education for all, trips to the moon, state of the art transportation, clean energy, up to date infrastructure, healthy children, well taken care of old people, well taken care of veterans, assistance to needy Countries and their people, maybe more...

|

MajorChode

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:27 AM

Response to Reply #44 |

| 67. I've done the math an it's not that simple |

|

The more FICA you pay, the larger your annuity check becomes, however the formula is not linear. The more you make, the less you receive as a function of what you paid. So if you take the example of someone who made say $20K for 40 quarters, and then started drawing their SS annuity, it wouldn't take long for them to recoup what they paid. However, if you consider someone who worked for over 40 years and paid the SS maximum for say 30 of those years, they would probably not live long enough to even get out what they paid, much less see any of those freeloading years.

|

Hannah Bell

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:14 PM

Response to Reply #44 |

| 139. let's see *you* do the math. |

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:51 AM

Response to Reply #31 |

| 46. Those who went to work in the 80's have paid a higher payroll tax all these years |

|

It created a surplus over what was required to pay current benefits and the excess has been used to fund the tax cuts for the rich as the income taxes no longer covered all the spending. Now, after paying in to cover these tax cuts for the rich all these years, they don't want to pay back what they 'borrowed' from us.

It's a BS bait and switch. We were given no choice in paying the tax all these years but now our future benefits are being seen as optional.

Lifting the cap on the FICA tax is one way to get back the money we 'loaned' the wealthy all these years so their income taxes stayed low.

|

Lerkfish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:06 AM

Response to Reply #31 |

| 60. freeloading? Ive been paying into it since 1970-- |

|

fuck your "freeloading" attitude. Its MY MONEY.

|

AngryAmish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:34 AM

Response to Reply #60 |

| 72. I've been paying into it for over 25 years myself |

|

If I get 3x what I paid into it (allowing for interest and inflation) then I am a ...wait for it...freeloader. I do not expect my fellow citizens to pay for my things that I did not earn.

|

Lerkfish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:36 AM

Response to Reply #72 |

| 74. even though I've been paying for everyone that came before me? |

|

yup, my money went to fund my grandfather, everyone's grandparents, and then my parents.

sorry, but you have a messed up attitude about this.

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:40 AM

Response to Reply #60 |

| 78. I've paid into it since 1961, and during that time the damn politicians have stolen |

|

funds from the SS fund to cover their recklessness in trying to manage this country. Why politicians are allowed to siphon funds from SS is beyond me. Yet another nefarious "out of sight, out of mind" criminal activity IMO.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:37 AM

Response to Reply #31 |

| 76. That figure never seems to take into account those who pay in all their lives and die before they |

|

can collect benefits. In addition to all the other reasons the figure is not true across the board, it always ignores this.

|

Individualist

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:53 AM

Response to Reply #76 |

|

Some people prefer to ignore that fact.

|

Raineyb

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:15 AM

Response to Reply #31 |

| 93. My mother died at 42. So can my sister and I have the money she paid into it since it |

|

could have been part of her estate instead of going to some freeloader?

Yeah that's what I thought.

Perhaps you would like to rephrase.

|

Big Blue Marble

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 01:21 PM

Response to Reply #31 |

| 126. Your assumption fails to include the time-value of money. |

|

When people start receiving their SS at 66 or 67 the government has had use of some of that money for over 40-45 years. If the government

was paying compounding interest on your money as any other investment would, the amount you receive back would reflect that significantly

increased value.

Your pejorative term "freeloading" is inflammatory and ageist. It reflects a extremely simplistic and dangerous view of how the SS program works

to support our elders.

|

Hekate

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:07 PM

Response to Reply #31 |

| 137. Great RW talking-point, AA. You might want to rethink that. |

|

The intergenerational resentment that is being stoked here at DU is as good a RW talking-point as any I've ever seen.

It's just a joy getting to be over 55 in this country, or even over 50. You lose your job, forget finding anything even close to what you had. I know engineers who never worked in their field again. But somehow they're supposed to make do (at what? Wall-Mart greeter?) without income or health-care for the next 10 - 15 years. Riiiiight.

If you stay in your job past 60, you're stealing a career from younger workers, who have soooo much wisdom and experience under their belts.

Is everything in this country a zero-sum game?

Our SS deposits were supposed to be invested wisely, earning interest, and instead they've been used as a Congressional piggy-bank. Don't blame me for that.

Hekate

|

Statistical

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:33 AM

Response to Reply #31 |

| 196. You are insane or failed math. Every heard of capital costs = interest? |

|

Try doing more realistic math that involves a lifetime of payroll deductions combined with lifetime of compounded interest.

Then compounded interest during repayment period.

|

Greyhound

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Wed Mar-31-10 01:18 AM

Response to Reply #31 |

| 223. Has the corporate bullhorn ever bleated anything that you didn't buy and spread around? |

|

Speaking of doing the math, why don't you?

|

ljm2002

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:14 AM

Response to Original message |

| 10. No, we should raise the income cap... |

|

...we don't have to remove the cap altogether, just raise it up by another $50K or so IMO.

Making people work longer is counterproductive, since there is a dearth of jobs too! Not to mention that people deserve to have retirement before they are too old and feeble to really enjoy it.

|

frazzled

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:14 AM

Response to Original message |

| 11. No, just raise the freaking cap on income subject to SS tax |

|

It's easy, it's progressive, it will work. End of story.

|

blindpig

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:16 AM

Response to Original message |

| 12. This will be the final blow |

|

It's coming.

Again, a Democratic administration will do what the Republicans dare not.

All in the service of the ruling class.

k&r

|

LibDemAlways

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:17 AM

Response to Original message |

|

My 59 year old husband was recently laid off and is looking for work. He's not alone. Companies have caught on to the idea that if they let older workers go before retirement age they save money. Meantime the worker is up shit creek without a paddle.

|

newspeak

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:55 AM

Response to Reply #13 |

|

It's getting harder for people in their fifties and sixties to even find employment. Also, I worked for SSA years ago--I had claims where the worker died leaving no wife or children--they had worked for years and all they received was the lump sum death payment. Many act like we all survive to our sixties and seventies. SSA is an assurance for those who do survive and it was put into place for a very damn good reason.

|

LibDemAlways

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:53 PM

Response to Reply #104 |

| 120. My husband attended a job fair last week for a big corporation with a |

|

new government contract. He's well qualified for the work. There were other men and women there his age and older. He said that all the older people were basically getting the brush off while the recruiters were buzzing like flies on honey around the younger applicants. He finally cornered one recruiter who wouldn't even look him in the eye and then admitted they want to hire 200 new college grads this year and have their older workers train them. Good luck with that. In a year they'll be hiring more experienced people as contractors to fix all the screw ups. Penny wise. Pound foolish.

Not suggesting that younger workers don't need jobs, but in this economy it's cruel to let people near but not quite at retirement age go to fend for themselves. Horrific on the ego as well.

|

raccoon

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:18 AM

Response to Original message |

| 14. No effing way--mine is already 66. nt |

Echo In Light

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:18 AM

Response to Original message |

Skink

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:18 AM

Response to Original message |

| 16. Obama said what most people here are saying when I saw him. |

|

Edited on Mon Mar-29-10 09:19 AM by Skink

raise the cap. Let's let him do tht now while we have the momentum.

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:19 AM

Response to Original message |

| 17. The fallacy in this line of thinking is believing there are unlimited jobs available for |

|

people over 65. I have friends in their 50's, multiple degrees and skills, unable to find employment. One friend just started working at McDonald's making hamburgers. He said he felt fortunate. He has a EE degree + MBA and an incredible work history. I have a number of friends like this discriminated on because of age. People not in ones shoes always seem to have solutions for the others...

|

LibertyLover

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:21 AM

Response to Original message |

| 18. I would have no problem with it |

|

Edited on Mon Mar-29-10 09:22 AM by LibertyLover

but my employer mandates that everyone retire at age 62. Our employees association is trying to get that raised to at least 65, but I understand that they have been trying to get it raised for 20 or more years and it never happens. Some of the bosses get extended past 62, but for the most part, it's 62 and out. I will have a pension from them at 62 (and it's an old-fashioned, honest-to-Goddess pension, thank the Gods) which will help, but with a child who will just be going into junior high I'll need to continue to work. However, as the OP pointed out, employers don't want to hire anyone old.

|

activa8tr

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Wed Mar-31-10 05:36 PM

Response to Reply #18 |

| 232. I didn't think an employer could "mandate" based upon age. |

|

I thought that went out 15 or so years ago under Clinton.

What you probably mean is that your employer gears your retirement pension to maximize at 62, and have no added incentive to stay longer .

That might still be legal, I'm not sure.

If you retire, you don't have to start collecting from Social Security if you don't want to, of course you know that.

|

jgraz

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:25 AM

Response to Original message |

| 20. Or... we could just stop stealing from the trust fund to finance wars and tax cuts. |

|

That would also "save" the program.

|

chill_wind

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:30 AM

Response to Reply #20 |

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:31 AM

Response to Reply #20 |

| 29. EXACTLY TRUE!!! The politicians have stolen from the SS fund for a long time. It has |

|

been no less than outright criminal theft and negligence IMO in CF America.

|

newportdadde

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:40 AM

Response to Reply #20 |

fascisthunter

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:41 PM

Response to Reply #20 |

| 119. we spend more on death and destruction than on bettering life itself |

|

that tells me everything right there.

|

JVS

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:27 AM

Response to Reply #20 |

| 193. That hardly sounds fair! |

wordpix

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:40 AM

Response to Reply #20 |

Deep13

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:27 AM

Response to Original message |

|

First of all a lawyer or a professor might be able to work into her 80s, but that might be difficult for an iron worker. Second, people already don't get enough free time.

|

fasttense

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:28 AM

Response to Original message |

| 22. Thanks to Raygun and Greenspan the age limit has already been raised to 70. |

|

The earliest I can retire is at 62 BUT I take a cut in my benefits of 43%. If I retire at age 66.5, I take a cut of 22%. I DO NOT GET MY FULL BENEFITS UNLESS I WAIT UNTIL I REACH 70 YEARS OLD.

I've been paying in for 38 years now and I'll probably only live to 75. So, I pay in for 52 years and get back full benefits for only 5 years.

Where have you been these last 30 years the age limit has already been raised.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:25 PM

Response to Reply #22 |

| 108. I'm not sure how people missed that. I noticed it on my estimated benefit statements a while back |

|

The amount it once said I could collect at 66 and 2 months is now lower and the full amount is not until 70. What do they want? Raise it to 80?

|

closeupready

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:28 AM

Response to Original message |

|

Just raise or eliminate the cap as necessary.

|

Hepburn

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:28 AM

Response to Original message |

JustABozoOnThisBus

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:29 AM

Response to Original message |

| 25. I'd trade that for a cessation of H-1B visas |

|

Edited on Mon Mar-29-10 09:31 AM by JustABozoOnThisBus

If we're going to raise the age AND give jobs away, then no, I don't support it.

:hi:

edit to add: Well, all that AND taxing the "value add" due to outsourcing.

|

Locrian

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:30 AM

Response to Original message |

lunatica

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:31 AM

Response to Original message |

| 28. No. But they should be able to keep working to supplement their SS checks |

|

Chances are they would pick lesser paying jobs since in reality they want to retire. That would still leave jobs for the younger people. I'm sure something could be worked out where they can work at least part time so they aren't on a fixed income.

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:34 AM

Response to Reply #28 |

| 32. No offense, but could you please provide a list of these jobs? n/t |

lunatica

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 05:35 PM

Response to Reply #32 |

| 154. I was thinking of the kinds of jobs they're forced to take for cash only |

|

There's plenty of talent among the retired people. Crafts, repair work and general maintenance work, teaching, helping foreigners learn to read. Would you hire someone who's retired to repair odds and ends around your house or paint it? I definitely would. I would also hire them as tutors to help my kids learn to read and write better. The Boomers retiring now are very useful and a resource that's being wasted because of the stupid social security laws.

My point is that if they can supplement their SS checks legally they would retire more readily. Gardening, making toys, mending clothes, or simply creating arts and crafts to sell at flea markets. All the things they do now only without having to hide it for fear of losing their social security.

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 05:47 PM

Response to Reply #154 |

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:56 AM

Response to Reply #28 |

| 49. If a person waits til 65 or whatever their age for the full benefit is they are allowed to work and |

|

make money. Those who take the reduced benefit at 62 are limited in what they can make in a year but not after the full age has been reached.

|

lunatica

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 05:38 PM

Response to Reply #49 |

| 155. If they weren't limited they would be more willing to retire and |

|

Edited on Mon Mar-29-10 05:38 PM by lunatica

let younger people get jobs. Our economy would benefit in both cases. The retiree making spending money and the younger worker getting a job and making spending money. It would be a two-fer.

|

SocialistLez

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:41 PM

Response to Reply #155 |

caty

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:35 AM

Response to Original message |

| 33. There needs to be more |

|

flexibility in this. If SS is running low, eliminate the cap until it is solvent again. When it has an abundance, lower the cap again. Sometimes government finds ways to complicate something that should be so simple.

|

RKP5637

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:41 AM

Response to Reply #33 |

| 37. The politicians over the years outright stole funds from SS to make themselves |

|

look good by budget balancing and eliminating tax increases. Therein is one of the reasons SS is always on the edge... until we have responsible politicians, we will always have difficulties with SS.

|

wordpix

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:42 AM

Response to Reply #37 |

| 198. budget balancing? With a $14 trillion deficit??? |

old mark

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:35 AM

Response to Original message |

| 34. Mine was already 66, but I retired at 59, got SS at 62. I understand people wanting to work longer, |

|

Edited on Mon Mar-29-10 09:37 AM by old mark

but they should understand those of us who have had enough, too.

I have already had at least 2 heart attacks, diabetes, circulatory problems and back problems for years before I retired, and got nothing but grief from my employers for being sick.

I wanted some time to enjoy my life, which I was not doing for all my years working. I had enough to retire early and survive till SS began at 62, and I want the Democrats to defend people's right to choose and to be as free as possible in making life decisions.

I recall one of my sociology profs who worked with dying people told us that no one on their death bed ever said "I wish I had spent more time at work".....

I feel very fortunate to be retired and to still be healthy enough to enjoy it. Tax those rich enough, let those of us who had to work for life at least have a bit of freedom of choice.

mark

|

loudsue

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:36 AM

Response to Original message |

|

To save social security, they need to quit wiping the asses of high salaried workers, and let the withholding be the full 14% no matter what the salary level. (7% is paid by the employer for those who are employed by someone else. The full 14$ is paid by those who are self-employed. )

Right now they cut off taking social security out of your check after somewhere around $80,000 in salary. If they would STOP that cut-off, social security WOULD NOT BE IN ANY TROUBLE!!! PERIOD!!!!

|

yodoobo

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:46 AM

Response to Reply #35 |

|

actually its around a $106k

|

Mariana

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:55 AM

Response to Reply #40 |

Jeff In Milwaukee

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 12:29 PM

Response to Reply #48 |

| 202. And that's just wages.... |

|

If all your income is from interest, dividends, and capital gains, you don't pay any Social Security at all.

Tax EVERYTHING. A dollar is a dollar is a dollar. I suspect you could make Social Security solvent AND reduce payroll taxes for those already paying them.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:58 AM

Response to Reply #35 |

| 52. Actually, the withholding is 15.3% now. My husband is self employed and that's what we pay. nt |

ctaylors6

(362 posts)

Send PM |

Profile |

Ignore

(362 posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 07:25 AM

Response to Reply #52 |

| 192. that 15.3% SE tax includes 12.4% SS and 2.9% medicare |

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:36 AM

Response to Original message |

| 36. I'm already in an age group which must wait until 66 and 2 months to draw my entire benefit |

|

The trick, here, is the benefit is calculated more heavily on the most recent years. With that in mind, those who find themselves spending long periods of time in the later years unemployed or having to take lower paying jobs to stay employed will see their estimated benefits go down. This has been a push by Republicans for years. Remember Paul O'Neill who 'couldn't see why able bodied older Americans couldn't provide for their own needs?" Now, I'm sure the Democrats will be joining in calling for this draconian measure.

|

tonysam

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:49 AM

Original message |

|

Edited on Mon Mar-29-10 11:50 AM by tonysam

Suppose I never find a job again at age 55, and my current "estimated" benefit is a piddling $771 a month at 62, which will be reduced because I have five years into Nevada PERS. What then?

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 01:09 PM

Response to Original message |

| 124. I know. And every year we stay unemployed it goes down a little more |

|

I'm in that boat and so is my husband. The reduction of our income is driving down what little we would have been drawing even further. I see all this as part of a big push to screw the boomers. They used our payroll taxes to fund the tax cuts for the rich all these years and now the plan is to steal it rather than pay it back.

|

AngryAmish

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:41 AM

Response to Original message |

|

If someone retires at 66 today they have a life expectancy of 16.02 years (actually life expectancy has increased in the 5 years since this table was created, but it is close enough for our purposes.

Most people get out in benefits in 4 to 5 years. Then there is ten years or more where younger people have to support you in excess of what you paid in. I think this is unfair.

|

unblock

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:46 AM

Response to Original message |

| 41. given how hard it can be to find a job at 55, the current 70 for full benefits is high enough! |

|

and income test would be much preferred, though in a sense we already have this to the extent that social security distributions are subject to income taxes.

|

w8liftinglady

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:47 AM

Response to Original message |

| 42. I work with a lot of 65+ nurses.I think it depends on the job |

|

I figured the age would increase as the life expectancy does.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:01 AM

Response to Reply #42 |

| 55. The average age of retirement for nurses, however, is 57 |

|

It has been steadily decreasing with the increasing patient loads, forced overtime, exploding documentation demands since the for profits took the industry over. There are still some older nurses around but not nearly the numbers there were when I entered the field in the early 80's.

|

w8liftinglady

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:20 AM

Response to Reply #55 |

| 64. I guess it depends on where you live |

|

Here in the midst of divorce central,most of us are on our own.And,yes-the job hasn't gotten any easier,especially in Texas-a right-to-work state.Most of the older nurses(I am 50) are in more administrative,non-clinical roles.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:31 AM

Response to Reply #64 |

| 71. Yes, those who can make it out of the trenches to administrative positions do last longer |

|

There was a time when that was an option for most nurses as they grew older. With the dearth of younger nurses entering the field these past 20 years, more nurses are having to remain on the front lines. I hit the wall 2 years ago at 53. I've always been in the right to work states and was in Texas for 10 years. The last hospital I worked for was in Texas and I left in 1995 when they had the nurses on the oncology floor taking 10 patients in a shift.

|

yodoobo

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:48 AM

Response to Original message |

| 43. I would support removing the cap, but that would violate Obama's promise |

|

of not raising taxes to folks under $250k

While I don't mind raising taxes of rich bastards making over $100k (let alone $249k), I don't think he should start breaking promises.

|

Ms. Toad

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:14 AM

Response to Reply #43 |

| 61. The cap could be eliminated, |

|

with a credit offset for the taxes collected between the current cap and $250,000.

|

trayfoot

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:50 AM

Original message |

Romulox

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:50 AM

Response to Original message |

| 45. Yes, but only if the change took place immediately. No more kicking the can. nt |

kenfrequed

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:57 AM

Response to Original message |

|

Raise the cap on taxable income so that the Social Security tax is slightly less regressive and they will be able to increase its solvency.

Also it still is not going to go insolvent anytime soon. They merely collected less money than they payed out this year and this could be attributed to unemployment and underemployment more than any other factor which, in my way of thinking, is the product of an economy that is increasingly speculatory. Such an economy does not reward productivity or labor and therefore razors out a fair number of people from participating and therefore contributing to it.

|

lonestarnot

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:58 AM

Response to Original message |

NEOhiodemocrat

(624 posts)

Send PM |

Profile |

Ignore

(624 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:00 AM

Response to Original message |

| 54. NO, raise the cap or remove it |

rocktivity

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:04 AM

Response to Original message |

| 57. Neither has to happen. Just elminate the salary cap |

|

Soc Sec is rendered forever solvent, and everybody pays a lower rate.

:headbang:

rocktivity

|

DURHAM D

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:52 PM

Response to Reply #57 |

| 187. It won't fix anything because the monthly pay out will also have to increase. |

|

It isn't really that high. SS is currently a poor investment plan for higher income workers and a better plan for low - middle income workers.

My sister is one year older than I am. Over the past 48 years I have made more money and contributed more to SS by a large percent then she did. However, the differential in our SS checks is very small. Meanwhile, her deadbeat husband made less than either one of us but his check is bigger because he floated around the the Mediterranean for 18 months in the naval reserves back in the 60s and he gets the good boy military premium. Seem fair?

|

DavidDvorkin

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:06 AM

Response to Original message |

| 59. I'd rather see it lowered |

|

And the benefits increased. Eliminate the cap and make the tax progressive.

|

Warpy

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:17 AM

Response to Original message |

|

While desk jockeys can continue their jobs into their 70s, a lot of the rest of us are not so lucky and have had to do the kind of work that wrecks our bodies.

The way to save SS is to get it out of the general fund, turning it back into a pay as we go insurance program, and raising the cap as needed to keep it funded until we Boomers are all dead.

|

TreasonousBastard

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:22 AM

Response to Original message |

| 65. Tough call-- politically, it seems like it would be poison to put in a means test.. |

|

but that would probably be the better idea.

I suspect they would take the coward's way out and just keep raising the age until the actual payment of benefits is just for a few years-- like it was in the beginning.

|

joe_sixpack

(655 posts)

Send PM |

Profile |

Ignore

(655 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 06:14 PM

Response to Reply #65 |

|

If you have a certain income or asset level at retirement, you should forfeit any benefits. If I'm rich at retirement and have other sources of income, I'll say right now that you can keep my share.

|

madinmaryland

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:28 AM

Response to Original message |

| 68. One of the primary reasons for not hiring older people is health insurance |

|

for older people. If Medicare is allowed to cover younger people (i.e. 55 and above), I have no problem raising the retirement age for SS.

|

CTyankee

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 01:51 PM

Response to Reply #68 |

| 130. I worked part time for a small nonprofit after I retired at 65.4 yrs. |

|

I worked along side a 70 year old, also part time, who had retired from a full time job. The nonprofit could not pay health insurance so hiring us oldsters on Medicare was a good fit! We got interesting jobs in causes and programs we supported and they get our experience and work ethic. It works out well from that perspective...

|

Liberal_Stalwart71

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:28 AM

Response to Original message |

| 69. Yeah, but I would also make Social Security benefits means-tested. |

|

My father who makes well over $250,000 can expect to receive SS benefits that he doesn't need because he can afford to have these nice retirement packages. It's not fair. Even he asserted that it's not fair that he only pays a small percentage of his income for SS benefits. There are seniors who need it much more and are forced to work rather than retire because they cannot afford to live on SS alone.

I say, means-test SS benefits. I would support that approach more than I would raising the retirement age.

|

tonysam

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:30 PM

Response to Reply #69 |

| 113. Absolutely fucking NOT. That would turn SS into a welfare program. |

|

Edited on Mon Mar-29-10 12:30 PM by tonysam

Absolutely unacceptable. The rich would favor abolishing it altogether.

If you paid into it, god damn it, you have the right to it regardless of how much you make.

|

Liberal_Stalwart71

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:33 PM

Response to Reply #113 |

| 142. You would receive what you paid into. But you would not receive the same level of benefits |

|

that a person who doesn't have as much money, but who paid MORE of their income into it.

SS is a regressive tax. The more you make, the less you pay. The less you make, the more of your earned income you pay.

It's not a welfare program, because if it were, we wouldn't be paying anything. (And frankly, SS did start off as a welfare program under FDR, but doesn't seem that you know much history, so I'll let you slide.)

Bottom line, is that we all will be paying into SS, but because the poor pay more than the wealthier individuals, it is not fair that the level of benefits should be the same.

My father stopped paying as much into SS many decades ago, while those Americans who have to continue to work two jobs, and sometimes more, are still paying into it.

It's just not fair.

This isn't about welfare.

|

joe_sixpack

(655 posts)

Send PM |

Profile |

Ignore

(655 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 06:24 PM

Response to Reply #113 |

| 165. Not a welfare, but an insurance program |

|

Look at it as paying premiums to cover the risk that you might not have other means of support at an elderly age.

|

shanti

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:31 AM

Response to Original message |

|

i plan to take my SS at 62, the earliest age possible. that, added to my pension, will sustain me (and only me, as i'm single). as many others have posted, we've been working since our teens, it's our money!

|

SnoopDog

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:36 AM

Response to Original message |

| 73. No, it should actually be lowered... |

|

This would put more younger people to work...

And raise the cap.

|

Taverner

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:38 AM

Response to Original message |

| 77. It should be an option, but retiring early and going on it should be as well |

|

Change it from 65 to 60-70

|

fasttense

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 12:32 PM

Response to Reply #77 |

| 203. Raygun already changed it to 70 for full benefits. n/t |

Taverner

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Tue Mar-30-10 12:33 PM

Response to Reply #203 |

| 204. Raygun was worse for this country than 9/11, Pearl Harbor and Katrina combined |

Vincardog

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:41 AM

Response to Original message |

| 79. If they want to raise the age they must provide jobs tht pay a living wage, that we can do until we |

|

reach that age. But basically fuck that raise the cap and make the trust fund bastids pay their share instead.

|

M155Y_A1CH

(921 posts)

Send PM |

Profile |

Ignore

(921 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:41 AM

Response to Original message |

| 80. African-American males should'nt have to pay in that case |

|

The CDC states the average life expectancy of this group is 69.5 years.

If the age were raised to 70, more of those who pay in would receive nothing for their payments.

It would certainly increase solvency but is this what we really want.

If the program goes bust the government can just print more money,

like they do for the programs that they want to succeed.

We all do know that the government can't go broke. Not really, because they are the originators of the money.

There is no reserve anymore, to limit the printing presses.

If they loved SS like they love war, there would be no worries about funding.

Caution Advised: Don't go to the CDC site without virus protection. While there checking figures, my Firefox tab and header changed to Chinese letters that persisted even when I closed that tab. I had to reboot my browser and dump cache for it to return to English alphabet. I guess the Chinese have hacked the CDC?

|

barbiegeek

(844 posts)

Send PM |

Profile |

Ignore

(844 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:44 AM

Response to Original message |

| 81. If you earn $1 million in cash a year NO social security |

|

If you earn $1 million dollars in cash a year, why do you need a 500$ SS check?

Or how about since you only pay social security tax on the first $70,000 and the rest of the year is tax free, how about taxing you entire income after $70,000 for social security.

Many rich people--the wealth of our society-- They Quit paying social security in March, because they've already earned $70,000 by March. That's why they don't bitch much about S.S. tax, because it's over for them so quickly.

|

Liberal In Texas

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:50 AM

Response to Reply #81 |

|

Wealthy people should pay more in taxes and SS because they benefit more from a stable society and use more of the infrastructure.

|

barbiegeek

(844 posts)

Send PM |

Profile |

Ignore

(844 posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:38 AM

Response to Reply #83 |

| 97. Can retired Teabaggers send back their SS checks since they hate Govt. in their lives |

Liberal_Stalwart71

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 02:36 PM

Response to Reply #81 |

| 144. Exactly!! They make enough money and have nice 401K retirement packages. |

|

They don't need it. Or, at the very least, the level of benefits should match what they paid into it.

It's a regressive tax that hurts the poor and working classes.

|

MajorChode

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:45 AM

Response to Original message |

| 82. SS does not need saving |

|

Even with the severe recession we experienced, the last SS trustees report only pushed forward the trust fund exhaustion by 2 years. The trustees actuary figures use an extremely conservative estimate for growth. If we get several years of significant growth in the economy (which is very likely), the exhaustion date will push back significantly even using the trustees' overly conservative figures. In all likelihood, the trust fund will never exhaust even if no changes are made to SS. Even if it does exhaust, there will still be money available to pay 3/4ths of all SS benefits. If we do away with the cap at that point, SS will be able to pay 100% of it's obligations with money to spare.

That being said, I think we should raise the retirement age. People live much longer than they did in 1935, and more significantly they are able to work longer. Raising the retirement age will still fulfill the original promise of SS. I think we should also eliminate the cap and do away with the FICA exclusion for investment income. Social security is the responsibility of all Americans. Not just the middle and lower wage earners. If we made those changes, we could significantly drop the FICA tax and give all poor and middle wage earners a real tax break for a change.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:58 AM

Response to Reply #82 |

| 85. The retirement age has already been raised for full benefits |

|

And I am absolutely against raising it further especially for those who are now within 10 years of their age to collect full benefits. People may live longer than they did in 1935 but that does not, in and of itself, speak to their ability to do certain types of work for much longer. And with the employment climate demanding higher and higher productivity from workers over the past 30 years, we are seeing the average retirement age of many professions declining. Mine is one of them. With the for profit takeover of the health care industry the demands on nurses increased to levels we never saw before 1980. The average age of retirement for a nurse has now dropped to 57. With higher patient loads and monumental documentation needs, nurse are burning out at a phenomenal rate. Add to that the dearth of younger nurses entering the field the last 20 years and nurses are remaining in direct patient care for much longer when once they would have moved on to administration. And, trust me, you wouldn't want those of us who have been burned to a crisp out there responsible for patient care.

|

MajorChode

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:08 AM

Response to Reply #85 |

| 90. It's not the responsibility of SS to insure an early retirement |

|

Social Security came about because elderly people were quite literally starving and/or eating out of trash cans. Towards this end, SS has been enormously successful. SS is not a retirement plan and never was intended to be a retirement plan. As far as retirement plans go, it's a pretty shitty one even though it's a great social insurance plan.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:24 AM

Response to Reply #90 |

| 95. 66 is not early retirement |

|

Edited on Mon Mar-29-10 11:45 AM by laughingliberal

and that's the age at which I can draw out my benefit (or a very reduced rate at 62). Raising the age will allow us to see many starving and eating out of trash cans, again. In addition to the fact that it's damned hard to get a job if you lose one after 50, there are many who are flat not able to do what they are trained for after 65 or 66. Many who are now within a decade of that age have seen retirement accounts they had decimated by the crash. I actually have started 401k accounts 3 separate times over the years. I was forced to withdraw the first to survive medical problems (I had insurance but was off work 12 weeks and high out of pocket expenses to pay when it was over with).

The 2nd one had to be withdrawn when I lost everything in a flood in 1998 and was forced to relocate. The last was withdrawn 2 years ago when my husband's business crashed with the housing market and I lost my job while he was undergoing cancer treatment and our COBRA premium was $1200 per month along with a mortgage of $1400 and virtually no income. People who have every intention and make every effort to plan for retirement sometimes find they are stuck with SS.

Raising the retirement age now is just another effing bait and switch after stealing our money to cover the tax cuts for the wealthy for 30 years.

edited typo

|

MajorChode

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 09:13 PM

Response to Reply #95 |

| 167. SS was never meant to solve all the problems you mention |

|

If anything, adding additional programs to SS makes it less solvent. And yes, it is problematic when people are forced to rely on SS solely, but other solutions like HCR and others should be sought for those problems.

SS was originally designed to be a pay as you go program. Those who are working pay for the SS annuity of others. The trust fund was Raygun's idea, and a piss poor one, but even with the trust fund, no FICA funds are used to cover tax cuts for anyone.

|

Lydia Leftcoast

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 10:51 AM

Response to Original message |

| 84. That might be fine for people with desk jobs, but |

|

it would be cruel for people whose jobs involve physical labor.

The age has already been raised for people in my generation (boomers). Our parents could retire at 65. We have to wait till 66, and younger people have to wait till 67.

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:00 AM

Response to Reply #84 |

|

I think a lot of people in favor of this either have desk jobs or they are too young to realize that a lot of types of work become much harder as we age.

|

pitohui

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:05 AM

Response to Original message |

| 87. its a done deal under RONALD REAGAN, so GOP did this, not democrats, jesus people are stupid |

|

ronald reagan slammed this thru some decades ago, of course, since it would not come to pass while he was still alive, the stupid people are going to blame it all on obama

seriously, kentuck, before you parrot stupid shit that you half heard on c-span inform yourself a little bit

the younger so-called boomers, people still in our fifties or younger -- we can thank herr reagan for the raised social security age

to try to blame this on DEMOCRATS in any way, shape, or form is bullshit of the highest caliber

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 11:28 AM

Response to Reply #87 |

| 96. I damned well am going to blame it on the Democrats if they go along with it |

|

We all know Ronnie screwed the workers by raising payroll taxes to cover his free ride for the rich freeloaders. If the Democrats go along with a plan to keep us working longer or cutting the benefits now that we approach retirement age, it's on them. They may not have created the problem but it is inherent on them to fix it now. And fixes that further punish workers will be their responsibility if they choose that path.

|

pitohui

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 12:37 PM

Response to Reply #96 |

| 115. can you read? the law was passed in 1986!!!!! christ on a crutch!!! |

|

the stupidity of this entire thread is truly breath taking

|

laughingliberal

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 01:05 PM

Response to Reply #115 |

| 123. I believe what we are hearing now is calls to further raise the age and/or reduce benefits |

|

And we hear Democrats and the people appointed by them condoning it. Yes, there's plenty of stupidity to go around. Can hardly wait for the deficit commission recommendations to come out.

|

Thothmes

(1000+ posts)

Send PM |

Profile |

Ignore

(1000+ posts)

Send PM |

Profile |

Ignore

|

Mon Mar-29-10 07:11 PM

Response to Reply #87 |