"Tax Increases Reduce GDP - Study by Christina Romer (yes Obama's former advisor)"

You take an academic study that isolates tax increases from other factors to prove what? Romer acknowledges that other factors can lessen the impact to "substantially." These likely include lowering spending on health care, job creation and other investments.

<...>

Romer and Romer also examine the behavior of output following changes in other measures of taxes. Using broader measures of tax changes, such as the change in cyclically adjusted revenues or all legislated tax changes, the estimated output effects are substantially smaller than those obtained using the new measure of exogenous tax changes. This leads the researchers to conclude that failing to account for the reasons for tax changes can lead to substantially biased estimates of the macroeconomic effects of fiscal actions.

When they consider the two types of exogenous tax changes separately, Romer and Romer find suggestive evidence that tax increases to reduce an inherited budget deficit have much smaller output costs than other tax increases. This is consistent with the idea that deficit-driven tax increases may have important expansionary effects through expectations and long-term interest rates, or through confidence.

<...>

Her point isn't in contradiction to Spitzer's

<...>

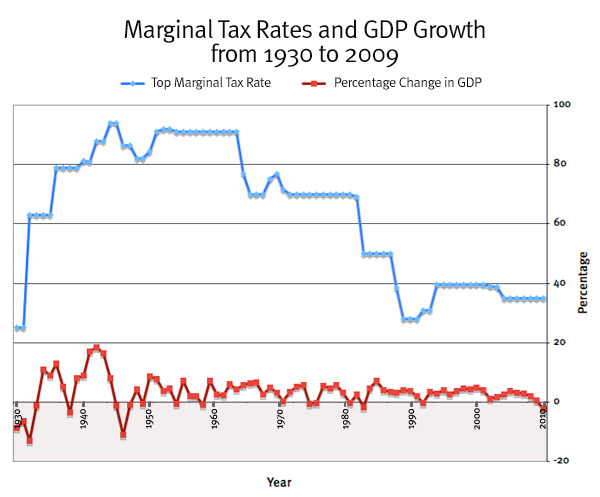

A caveatobvious but criticalis in order. Simultaneity does not equal causation. Annual growth rates are a consequence of many factors, macro and micro, and the isolated impact of marginal tax rates on growth is hard, if not impossible, to discern from these numbers alone.

That said, it's obvious that there is no correlation between higher marginal tax rates and slowing economic activity. During the period 1951-63, when marginal rates were at their peak91 percent or 92 percentthe American economy boomed, growing at an average annual rate of 3.71 percent. The fact that the marginal rates were what would today be viewed as essentially confiscatory did not cause economic cataclysmjust the opposite. And during the past seven years, during which we reduced the top marginal rate to 35 percent, average growth was a more meager 1.71 percent.

More sophisticated efforts to analyze this relationship also produce decidedly murky results. An excellent review of this in the Yale Law Journal, "Why Tax the Rich? Efficiency, Equity, and Progressive Taxation," concludes that there is scant, if any, legitimate academic support for the proposition that moderate, as opposed to dramatic, increases in marginal rates have any impact on the willingness of the wealthy to participate in the economy.

So where does this leave us? Probably with Weisman's conclusionthat the debate between justice and virtue will continue for years to come. But this debate may be little more than a Rorschach testan inkblot into which we read our underlying values about income distribution and social welfare. Those who see taxes as the bane of progress will still claim that higher marginal rates are the enemy of economic growth. Those who favor greater progressivity will say there is no evidence of such a claim. They will concludeand they will be rightthat the wealthier can afford to pay more, with no harm to the nation's economic growth.