Via

EPI:

<...>

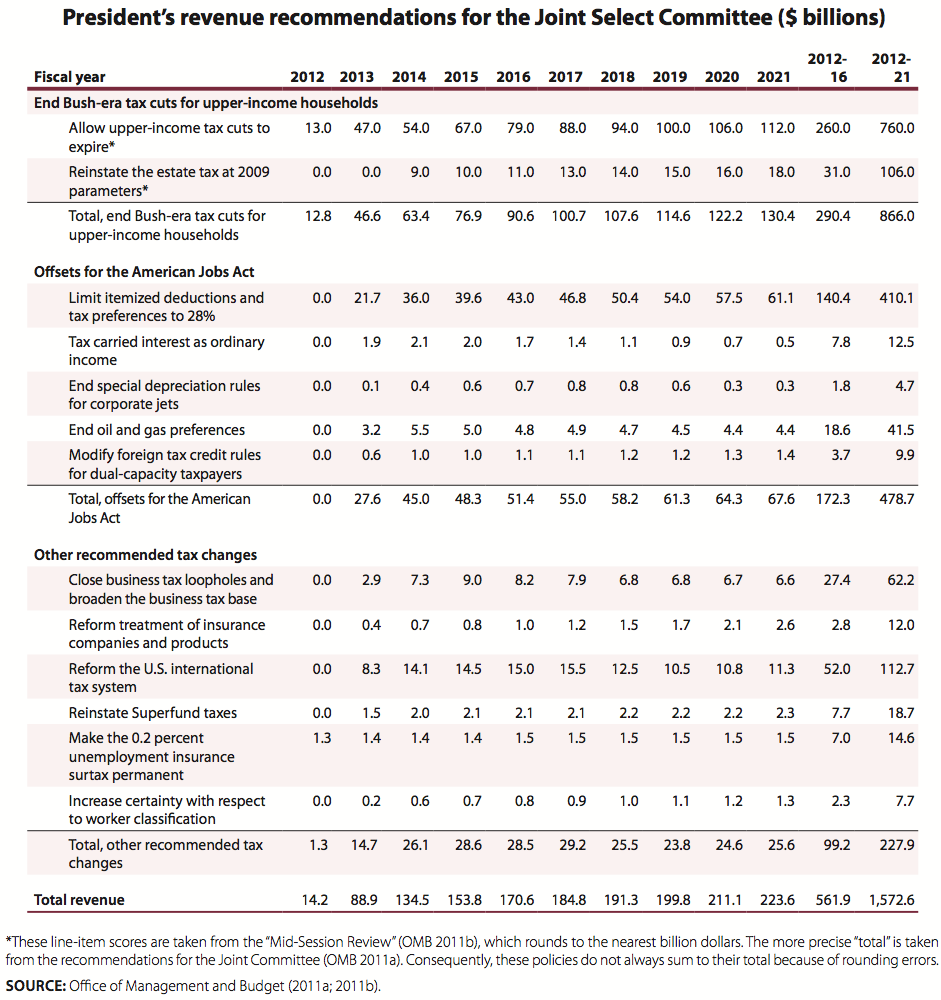

The presidents recommendations for the Joint Select CommitteeThe president offered a comprehensive backup plan to raise $1.6 trillion should Congress fail to raise $1.5 trillion through comprehensive tax reform. Roughly half of this revenue ($760 billion) would come from allowing the Bush-era tax cuts to expire for households earning more than $250,000. The estate tax would also be reinstated at 2009 exemptions and rate.5 The proposed offsets for the American Jobs Act make up another $479 billion, including $410 billion from capping the value of tax expenditures for upper-income households, nearly $13 billion from eliminating the carried-interest loophole, and over $41 billion from eliminating tax carve-outs for the oil and gas industries. Closing other business loopholes (such as those related to inventory accounting), reforming the international tax system, and reinstating Superfund taxes for toxic waste cleanup account for most of the remaining $228 billion of revenue (see Table 1).

<...>

Distributional impact of the presidents recommendationsBased on distributional analysis by the Tax Policy Center, the presidents recommendations for the Joint Select Committee would raise revenues from high-income individuals while reducing or leaving unchanged taxes for the vast majority of taxpayers. Relative to current tax policy, over 95 percent of all the tax increases would be borne by the highest-income 5 percent of householdsthose with incomes above $227,000 (TPC 2011d).22 Millionaires would bear over two-thirds of the tax changes; their effective tax rates would rise 5.5 percentage points to 38.4 percent (TPC 2011e).23 At the same, the tax provisions of the American Jobs Act would, on average, slightly lower taxes for the bottom 60 percent of earnersthose with income below $65,000 (TPC 2011d). Relative to current law (i.e., all the Bush-era tax cuts expire on schedule), however, households earning less than $1 million would, on average, receive a tax cut. Households with over $1 million in income would see an average tax increase of $29,000, raising their effective tax rate by 0.9 percentage points relative to current law (TPC 2011f). In light of the transfer of wealth to upper-income households through the tax policies of the last decade, this modest increase seems appropriate. In 2010, households with over $1 million in income received on average $168,000 from the 2001-08 tax cuts (TPC 2008a), lowering their average tax rate by 5.1 percentage points, all of which was deficit financed.

<...>

That's what sane reform looks like!