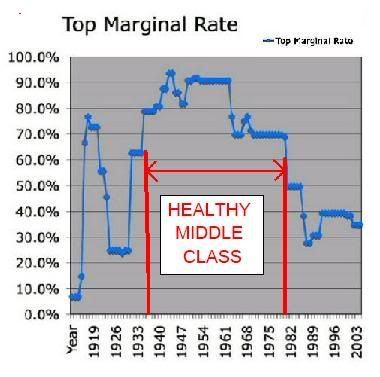

High tax rates on Corporations, Capital gains, Estate and Income tax were not about any Robin Hood scheme. Those tax rates were about assembling a policy structure that encouraged a stable society, where working and middle class families were engaged in the economy, and were better able to take care of their own.

There was no redistribution of wealth from the rich to working and middle class families.

We earned it. We worked for it. And then came the PATCO strike, our right to collective bargaining was under attack, the right for Labor to sit at the table as an equal to Capital. The major part of the Reagan tax changes were not the rich getting huge tax breaks, the biggest change from those days was the corporate tax breaks. The corporate share of the federal revenue pie shrunk.

As corporate tax rates dropped and later, as the global economy spread, tax revenues from US corporations declined. President Obama recently advocated for reducing Corporate taxes. I disagree, the Corporate top rate should be increased and half the revenue gained should go back to corporations who invest in emerging markets and technology, like Solar, wind, renewable storage, and supergrid developments and HVDC.

But I digress.

High mariginal rates reward smarter investment.When the top marginal rate were 90%+ the effective rates were 40-45%, when the top rate was 70% the effective rates were 32-34%. Yes we took huge sums from the uber rich, and gave large portions back to the uber rich. The rich that took their private capital and built factories and business's here in the US got a huge tax break for that smart community oriented investment. We gave huge tax deductions for investing in emerging tech and markets, to incentivize US job creation. To incentivize US innovation.

Todays effective rates are about 31-33% roughly the same they were back in the 1970's. Gone are the deductions and exemptions that spurred US job creation and innovation, rates are at historically low points. All those incentives to create jobs in America are gone. Incentives to innovate, incentives to foster leading edge technological developments.

Do you see a pattern yet? ...Let me continue...

Lets say you are a billionaire....why should you build a factory to make solar panels or wind turbines for a 5 to 10% return, when you can make (20, 25, 30%) far more speculating on commodities?

The picture I'm trying to paint is one of incentives to the flow of capital...

High taxes should not be about punishing the rich. Hi taxes in the past were about creating a stable society, where smarter investments are rewarded. Those exemptions and deductions are a great way to make capital flow where we want it to, instead of willy nilly everywhere, or not at all, like we see now. The right wing likes low taxes with fewer exemptions and deductions to "level the playing field". But what that does is make currency and commodities speculation more profitable than say building factories that produce solar panels and create US jobs......

These high rates also allowed for less of a tax burden on working and middle class families, engaging working and middle class families in the economy, and these families were better able to take care of their own. Nowadays, the tax burden on working and middle class families have taxed them out of the economy.

The level playing field... is really crookedThe right wing "Market ideologists" dont like to pick winners and losers in a market, so the "level playing field" becomes this alter that some grovel before. And how much profit a corporation makes in the next fiscal year becomes more important than long term visionary thinking, like industrial and energy policy looking forward 20 or 30 years. Higher taxes also means less money goes into speculation, so less money goes into speculative bubbles, so recessions arent as broad or deep.

Without incentives for emerging markets like solar and wind, older, mature large markets will dominate, become hard to control, steer, and tend towards senescence and receive legislative favoritism. Emerging markets are overwhelmed. And until the regulatory and tax policies are changed, this will continue.

The path out of the woods.Right now we have 6 tax brackets, there is no way a progressive tax can be truly progressive in its effect with only 6 brackets. One should not describe a geometric curve with 6 straight lines. Adding more brackets for a total of 12 or 15 can better describe that geometric curve.The Peoples Budget adds 5 brackets, with a top rate of 49%, I would go to at least 70% and add exemptions and deductions targeting emerging tech and markets (like solar and wind). Capital gains goes back to 28%. Corporate top rate goes up. Taxing gains from currency, commodities and derivative speculation, deincentivizes those activities, while tax breaks for emerging tech and markets incentivizes capital to flow to US jobs and business activity. This is pretty much what Sidney Hillman called Industrial Policy back in the Depression... the one in the 1930's....

So we've raised taxes, how do we create jobs?A recent NYT article quoted many business people who expressed very little or no interest in a Corporate tax cut, instead opinion overwhelmingly spoke to lack of demand and they would not hire or expand until the had reason to meet increased business. Keynesian Economics is sometimes called demand side economics.

The next generation of Infrastructure: Transportation and Energy.According to the US Dept of Energy there 2 main reasons why

Nearly the same can be said of infrastructure, heavy construction equipment, labor intensive, and domestic resource intensive. Jobs created in these sectors tend to pay well, 40 to 75k, so there is better than average secondary job creation. The US manufacturing sector gets a big boost because of the nature of renewable energy development. Cheap practical renewable energy is good for US businesses trying to hold the line on energy costs.

I estimate during the New Deal we spent about 6-7% of GNP on stimulus. I've been advocating for 10% of GDP on jobs spending. The US spends 2,4% of GDP on infrastructure, the Eurozone spends 5-6%. In a 15 trillion dollar economy we should be spending 5% of GDP, 1.5 trillion on infrastructure. Another 5% should be spent on energy and other vital sectors.

Job creation breakdown by sector

http://www.dailykos.com/story/2011/08/15/1007254/-A-jobs-stim-proposal-that-creates-10-to-14-million-US-jobsImportance of the Supergrid to Renewables

http://www.dailykos.com/story/2011/09/07/1014463/-Do-you-realize-how-important-HVDC-isMore on the Supergrid, HVDC and Solar and Wind Power, looking to 2022.

http://www.dailykos.com/story/2011/08/09/1001465/-Solar,-Wind,-HVDC-and-the-Smartgrid