So much for the self proclaimed fiscal conservative's trickle-down bullshit.

Money well spentJosh Bivens

April 7, 2011

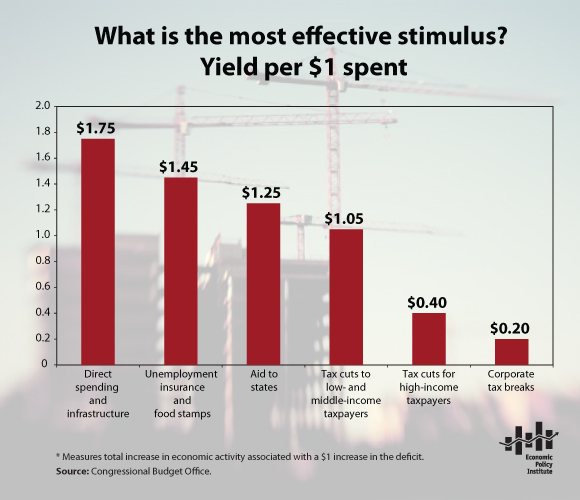

Many Republican federal budget proposals assert that tax breaks for the wealthy and for large corporations, combined with reduced safety net spending, will grow the economy. The Figure, from a new EPI briefing paper, Abandoning What Works, shows the folly in that logic. Using analysis from the Congressional Budget Office, the figure shows the stimulus, or yield, of $1 spent in different ways. It shows that direct federal spending and infrastructure, and spending on safety net programs such as unemployment insurance and food stamps, are highly effective, returning well over $1 in economic activity for each dollar spent. In contrast, tax cuts for high-income taxpayers yield just 40 cents on the dollar, and corporate tax breaks return just 20 cents on the dollar.

Money invested in infrastructure, unemployment insurance, or aid to state governments is quickly re-spent in local economies, spurring a cycle of increased economic activity. Dollars saved by tax cuts, especially for wealthy individuals and corporations, are much more likely to be socked away. Because the U.S. economy is currently underperforming due to decreased demand for goods and services, tax cuts for the already privileged are far less effective than spending as economic stimulus.

SOURCE:

http://www.epi.org/economic_snapshots/entry/money_well_spent/---