General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsProgressives please...stop giving these soundbites

Learn a lesson from the repukes. Have you ever heard them announce " we need to make the rich richer" hell no!

Yikes, if this keeps up, we will lose to a maniac.

https://news.yahoo.com/rep-ilhan-omar-supports-taxing-wealthiest-americans-90-135004259.html

shanny

(6,709 posts)Laura PourMeADrink

(42,770 posts)shanny

(6,709 posts)Under Eisenhower--back when we paid for our wars--the top marginal rate was just over 90%.

I don't remember it tanking the economy or consigning rich people to poverty. Fun fact: it (the progressive tax schedule) built the middle class that politicians supposedly care so much about.

Laura PourMeADrink

(42,770 posts)Like that and getting a headline on Yahoo with millions of followers thinking we all back a 90% tax rate is a good thing? If we want to win that is.

The right is very hard at work, it's orchestrated, I've heard the same message for days now. We are too leftist. We want 70 and now 90% tax rates. And we know how that turned out for Hillary.

Just please wait until we get the WH.

shanny

(6,709 posts)of anger at and resentment of the rich in this country. It is boiling over and rump, bless his heart, is stoking the fire.

tblue37

(65,340 posts)does not apply to all of the person's income, not even if they are super rich.

And almost nobody is bothering to explain.

MisterProton

(56 posts)

See this article from Slate.

https://slate.com/business/2017/08/the-history-of-tax-rates-for-the-rich.html

shanny

(6,709 posts)marginal rates are not the same as average tax rates.

brush

(53,776 posts)especially low-info voters, it's probably not a good idea to be throwing around calls for 70 or 90 percent marginal tax rates.

It makes it too easy for repugs to characterize all Dems as extreme left wing crazies.

Wounded Bear

(58,649 posts)The trick is in what deductions are allowed that reduce net income to escape the higher brackets.

Back in the day, personal and corporate deductions were more limited and targeted toward re-investments that fed back into the economy. Unfortunately, those deductions multiplied and spread out into areas that only protected the income without incentivizing re-investmenst that spurred economic growth.

Now, the wealthy are hoarding wealth. An economy needs wealth moving around to be healthy. When large portions of the 'money supply' calcifies into a few accounts at the top, the economy dies.

MichMary

(1,714 posts)they didn't tank the economy was because no one paid them. It was a well-known fact that the wealthy could shield so much of their income that the richest did not pay 90%. I remember my mother complaining that the middle class paid all the taxes.

shanny

(6,709 posts)MichMary

(1,714 posts)the success of the 50s tax plan, why not be realistic about it?

I heard the other day that in the 50s there were only 8 people who paid the top marginal rate. EIGHT. In other words, that 91% top marginal rate didn't exactly net a lot of tax dollars for the US government.

Overall, the highest income earners paid in about 42% of their income. As of 2014, the highest earners paid a little over 36%. (That's according to the article I posted below.)

The problem is that if you were to impose a 90% (or even 70%) marginal tax rate without allowing the tax shelters that were available in the 50s, the money would be moved to somewhere else.

NurseJackie

(42,862 posts)... so the way the vote now is to protect the "wealth" that they imagine they'll one day have.

treestar

(82,383 posts)Right now, they are working "hard" and it is going to lead to their having big capital to invest (though they live paycheck to paycheck). The existing rich are going to one day discover their brilliance and hire them or put them in charge, though!

Wounded Bear

(58,649 posts)Basically, it said that most Americans won't acknowledge that they are poor, but think of themselves as temporarily distressed millionaires.

![]()

brooklynite

(94,535 posts)USALiberal

(10,877 posts)shanny

(6,709 posts)article I posted showed 76% of Americans favor higher taxes on the rich (53% strongly agree, 23% somewhat). Does that sound like a losing issue? Does it make you uncomfortable for some reason?

Isn't the point to inspire voters, enlarge our coalition and improve people's lives? The tax-the-rich-less mantra of the past 40 years has not done any of those things and has, in fact, destroyed the middle class and crushed the poor. Enough.

brooklynite

(94,535 posts)...that implies that "the not-rich people" are voting with us.

shanny

(6,709 posts)It doesn't take 99% to outvote 1%. It doesn't even take 76%.

Bettie

(16,104 posts)what exactly? That we're just like Republicans in our desire to ensure that the wealthy never have to pay their share?

treestar

(82,383 posts)Bettie

(16,104 posts)I am tired of people who demand that we don't say what is right because it might scare the really rich people or the Trumpkins. Those people will never vote for us in any case.

Laura PourMeADrink

(42,770 posts)I am referring to isolated numbers that they are just waiting in lurch to use against us. People will remember a number and never the context..nor will they research.

shanny

(6,709 posts)they should be paying all the tax. ![]() Works for me.

Works for me.

Bettie

(16,104 posts)Ever.

shanny

(6,709 posts)welp, the two of us are saying it, and so are some of our congresscritters. It's a start.

![]()

Bettie

(16,104 posts)over nothing.

And I'm glad some of those congresscritters are saying it.

muriel_volestrangler

(101,312 posts)so, yes, I have heard them announce "we need to make the rich richer". That is their mantra - that "job creators" need more "incentives" to make profits, by lowering their taxes.

They were overjoyed when they passed a tax bill to make the rich richer at the end of 2017. Remember?

pecosbob

(7,538 posts)because no one ever wants to say anything that might upset the other side. I say f*ck the other side. You let them frame the debate and we will always come up with the sh*tty end of the stick.

shanny

(6,709 posts)Laura PourMeADrink

(42,770 posts)Out # like 70% or 90% tax rate which is out of the realm of ever flying and mass media and repukes take the numbers completely out of context and get distributed to millions. Not silence, just some freaking common sense and awareness.

Bettie

(16,104 posts)oddly enough at some of the most prosperous times in our nation's history!

Laura PourMeADrink

(42,770 posts)ck4829

(35,072 posts)She's a smarty pants for creating this wonderful compromise. 70% or 90%, your move, plutocrats.

JHB

(37,160 posts)When they talk about high marginal rates like some loopy, untried, pie-in-the-sky notion, when they ask what successful country ever did things like that, we're not supposed to say "US"?

They will always attack us and twist our words. But part of the problem is that we've spent a generation never talking about this stuff because of fear of the "tax and spend liberal" accusation.

In the 107 years of the income tax, 20 of them had top marginal rates of 90% or more.

50 of them had top marginal raters of 70% or more (includes those mentioned above). Nearly half.

62 of them had top marginal raters of 50% or more (includes those mentioned above). Well over half, including most of the Reagan years.

People don't know that because no one talks about it. But if we do talk about it, if we remember history, it's "giving these soundbites"?

WeekiWater

(3,259 posts)I do understand you point that it sounds a bit unpalatable for those who are rich or do not understand the tax system(a majority of people who aren't rich). That said, many things that have historically been unpopular have gained majority support because of the efforts to keep talking about them. A conversation cannot become mainstream if the conversation doesn't exist.

KPN

(15,645 posts)MichMary

(1,714 posts)in this article.

https://taxfoundation.org/taxes-rich-1950-not-high/

Taxes on the Rich Were Not That Much Higher in the 1950s

August 4, 2017

Scott Greenberg

Twitter Logo

There is a common misconception that high-income Americans are not paying much in taxes compared to what they used to. Proponents of this view often point to the 1950s, when the top federal income tax rate was 91 percent for most of the decade.[1] However, despite these high marginal rates, the top 1 percent of taxpayers in the 1950s only paid about 42 percent of their income in taxes. As a result, the tax burden on high-income households today is only slightly lower than what these households faced in the 1950s.

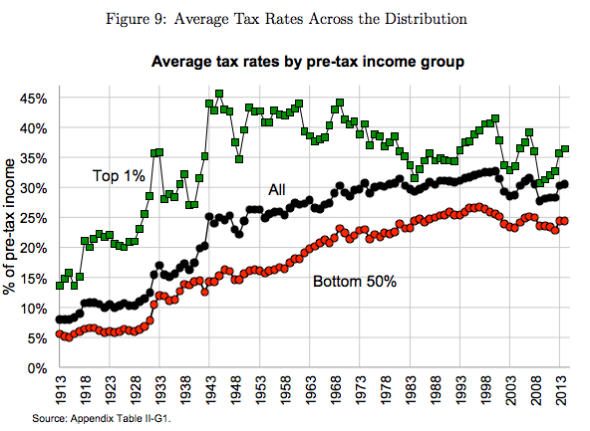

The graph below shows the average tax rate that the top 1 percent of Americans have faced over the last century. The data comes from a recent paper by Thomas Piketty, Emmanuel Saez, and Gabriel Zucman that attempts to account for all federal, state, and local taxes paid by different groups of Americans over the last 100 years.[2]

RandySF

(58,802 posts)If so, who cares?

Laura PourMeADrink

(42,770 posts)US Yahoo mail users who might have seen Yahoo headline implying we want a 90% tax rate on rich. Drudge has it as headline now. He got 140 million hits for 6 mos in 2017.

If someone had said our tax system is unfair and we

need to raise the tax rates for the wealthy it wouldn't even be a headline.

KPN

(15,645 posts)the "trickle-down" economic proposition onto the national stage.

Nothing wrong with these "soundbites" in my opinion. I've been wanting to hear them stated by our elected Dems since the 1980's. About frigging time.

Laura PourMeADrink

(42,770 posts)On wealthy? Sounds like political suicide to me.

KPN

(15,645 posts)put this into perspective. Our economy fared best under Eisenhower, Kennedy and Johnson -- when the upper tax brackets were highest. How the hell else are we going to ever do that unless these we via young new faces put the message out clearly and understandably -- as they are now? Let's not be scared of our own shadow.

KayF

(1,345 posts)they say things like inequality is good, and that talking about equality is class warfare. The tea party types, for example.

But then the party leadership shows a more palatable face.

So if you want to emulate the GOP, Omar would talk like this and Nancy would talk like a centrist.

MineralMan

(146,288 posts)way on this. Although she's the representative from a neighboring district, I applaud her candor.