General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWe are nowhere near a recession.

https://fred.stlouisfed.org/series/GDPNOW2.2% quarterly growth is right in line with the last 10 years. Just a continuation of the good economy created by President Obama.

The Dow is stable.

Economy is stil creating hundreds of thousands of new jobs each month.

Dotard won't let a trade war with China happen. He just wants to build supense so he can pretend to have a big 2020 victory when him and Xi sign a deal that they probably have in mind now.

It's all smoke and mirrors. He wants us to focus on this strength of his and not his manifest unfitness and criminality.

Kurt V.

(5,624 posts)MarvinGardens

(779 posts)And I sure wouldn't bet against one, either. I'm no expert in these things, but I think it's really difficult even for the experts to predict. This guy might argue with you.

https://www.hussmanfunds.com/comment/mc190805/

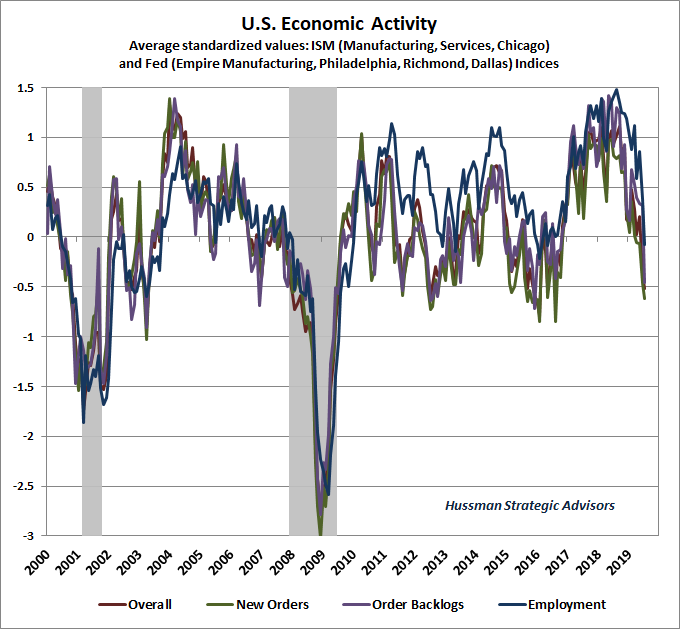

You’ll notice that new orders (green) have experienced the strongest plunge in recent data, with the employment line (blue) slightly lagging that decline. That’s how the sequence of economic data typically evolves. New orders and backlogs, though volatile, generally lead. Production measures, not surprisingly, tend to coincide with broad movements in economic output. Finally, employment measures lag, sometimes considerably, because decisions surrounding job creation and layoffs tend to be careful and time-consuming.

The collapse we’ve observed in leading economic measures over the past 10 months is now consistent with monthly job creation falling nearly -350,000 jobs short of its 10-month average of 186,000, implying potential losses of as much as -164,000 jobs per month in upcoming reports. You’ll notice in the chart below that recent non-farm payroll data has clearly bucked these progressively deteriorating expectations. The last time we saw this sort of deviation was in October 2000, a month before the U.S. economy rolled into recession. Again, employment data lags, and month-to-month data can be noisy.

Doodley

(9,088 posts)US exports to China are down 31% Foreign investment in US is also down by a similar percentage. Farmers are going bust. Steel is suffering.

Meanwhile, borrowing is soaring to pay for the tax cuts. It is ONLY because of the growing deficit that the economy is growing at all.

Global demand is slowing, as leading economies slow or teeter around zero growth/recession. We are very near recession.

Red Mountain

(1,732 posts)If you can.

We're overdue for a correction. We'll see what that amounts to.

John Fante

(3,479 posts)He really is this stupid.

Doodley

(9,088 posts)credit for having the intelligence to have any type of strategy.

Solomon

(12,310 posts)Doodley

(9,088 posts)brush

(53,776 posts)by 500,000 so who is lying?

Blue_true

(31,261 posts)Smells like recessionary stuff to me.

In order to end the trade dispute with China, Trump has to admit defeat, I don't see him doing that. He will instead focus instead of blaming something or someone else, the Fed, NATO, the EU, immigrants, former President Obama, for a downturn that Trump caused. The man seems to have never accepted the blame for anything.

Celerity

(43,336 posts)

Economic data looks nothing like that of a recession, according to Credit Suisse.

The firm created a “recession dashboard” in which the firm tracked the state of seven main economic indicators at the start of each recession dating back to 1973. In past recessions, most of the indicators were “recessionary” or “neutral,” while the current state of the economy is telling a different story.

“Key signals such as labor and credit trends remain quite healthy,” said Credit Suisse’s chief U.S. equity strategist, Jonathan Golub, in a note to clients Tuesday.

Last week, the U.S. bond yield curve inverted, a phenomenon that historically presages a recession. That was the only one of the seven major indicators Credit Suisse tracks to signal a downturn. In past recessions, indicators like inflation trends, job creation, credit performance, ISM manufacturing, earnings quality and the housing market were all showing weakness.

The labor market is strong with the total labor force hitting a record high of 163.4 million, according to the Labor Department’s July jobs report. And credit conditions have not deteriorated to recession levels.

snip

Blue_true

(31,261 posts)Voices that said the economy was facing big headwinds were voices in the wilderness.

There is far too much uncertainty now. What happens with Brexit and the outcomes, will China choose to stay with new grain supply countries instead of returning to the US market, consumer and corporate debt at record levels, increasingly expensive natural disasters. There are items in that list where if a single one has a hiccup, we are in a deep recession that will cause other economic pins to fall. I have no faith in Trump to correct the economy once it clearly starts heading south, he is way too erratic and has suckass advisors advising him.

Doodley

(9,088 posts)obstacles that did not apply before other recessions, namely Donald Trump, his trade war, his protectionism, his insults to the people of the world (he has effectively shut the door to massive inward investment), his instability, his lack of any coherent strategy, his tax cuts that have led to a return of trillion dollar deficits. He has damaged economies around the world. The level of damage to the US economy is uncertain, but a dashboard of past recessions ignores all of this.

Celerity

(43,336 posts)IF one is coming may it soon hit, and NOT hit within months of our new POTUS being sworn in.

![]()

OkSustainAg

(203 posts)Coming this December. So many stocks with high p/e ratios not enough earnings just asking for a big sell off. I think that is what Buffet waiting for. Then swoop in. When smoke clears.

A HERETIC I AM

(24,367 posts)

Yup. Because the greatest indicator of a robust economy is one in which a significant market indicator has been basically stagnant for the last 5 quarters.

"Dotard won't let a trade war with China happen."

Too late.

ck4829

(35,069 posts)Oregon1947

(43 posts)hope our candidate can do better.