General Discussion

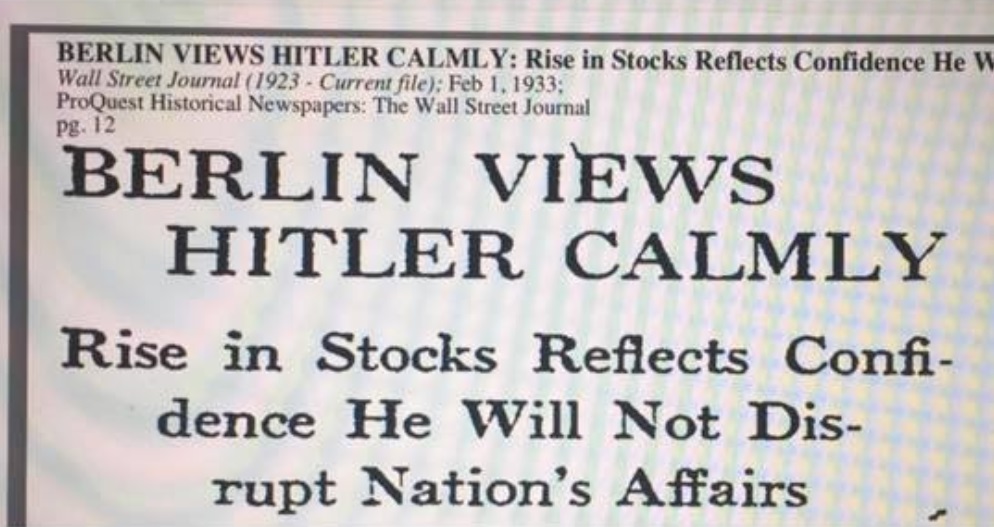

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEverything Is Awful. So Why Is the Stock Market Booming?

What on earth is the stock market doing?

Death and despair are all around. The number of people filing for unemployment benefits each of the last two weeks was about 10 times the previous record — and is probably being artificially held back by overloaded government systems. Vast swaths of American business are shuttered indefinitely. The economic quarter now underway will most likely feature Great Depression-caliber shrinkage in economic activity.

Yet at Thursday’s close, the S&P 500 was up 25 percent from its recent low on March 23. It is down only about 14 percent this year — and is up from its levels of just 11 months ago. There are answers as to why (more on that below). But that doesn’t take away the extremity of the juxtaposition between an economy in free fall and a stock market that is, in the scheme of things, doing just fine.

Two powerful forces are pushing in opposite directions. Commerce is being disrupted to a degree that seemed impossible just weeks ago. But simultaneously, stock investors are betting that powerful interventions out of Washington — including an additional $2.3 trillion in lending programs from the Federal Reserve announced on Thursday — will be enough to enable major companies to emerge with little damage to their long-term profitability.

It’s a battle between collapsing economic activity and, to use a silly meme from finance Twitter, the federal government’s money printer going “brrr.” In the stock market, at least, the revving of the money printer is winning.

https://www.nytimes.com/2020/04/10/upshot/virus-stock-market-booming.html

ck4829

(35,076 posts)They're not tied to reality.

Wellstone ruled

(34,661 posts)You are so right on. Hand full of high flying Tech Stocks as well as a couple Mega Bank stocks are juicing these averages.. When one stock,Bershire Class A trades at 290k plus a share,and they move a few thousand in a session,the math becomes nuts. Or a Tesla Stock which is carrying a price 3-5 times it's actual Worth and moves a million shares in a session,the math goes nuts. Same for Amazon,another bloated example. Brokers and Sales Agents get paid on percentage of increase and value of the S&P as well as the Nasy.

mr_lebowski

(33,643 posts)uponit7771

(90,339 posts)gibraltar72

(7,504 posts)degage

(103 posts)The market is pretty much an entirely made up thing. It has no basis in reality or actual, tangible value of things. It's based on feelings and opinions. Not anything real.

ProfessorGAC

(65,042 posts)...contradict the conclusions of the analysts and those quoted.

An 8.5% drop in earnings is not a reason to pump up prices. It's a reason to wait for official postings and buy low.

Besides, the drop is a guess.

They don't really have enough info to accurately predict that.

Yavin4

(35,438 posts)People forget that the collapse really got started with the fall of Bear Stearns in March 2008. The DOW was around 13,000 or so. It fell a little bit during that summer and then the decline accelerated with the collpase of Lehman in the Fall of 2008.

The markets didn't bottom out until March 2009 at 6600 or so. It took a full calendar year after the start of the collapse to bottom out.

My guess is that:

1. It takes a while for the economic data to measure the full impact of a Black Swan event like this. We simply do not know enough information at the time the event is happening.

2. We also don't know the full impact of secondary negative events. During the collapse it was the collapse of the credit markets.

In sum, we're at the very early stages of this. The data is still to preliminary. We don't know the full secondary impacts as of yet.

sarcasmo

(23,968 posts)Initech

(100,075 posts)Takket

(21,568 posts)Trailrider1951

(3,414 posts)Bail-outs all around! Unless you're one of the workers, that is. Here's some crumbs for you, peon!

LaurenOlimina

(1,165 posts)They got permission to buy ETFs and are buying broadly.

https://www.cnbc.com/2020/04/09/fed-fires-an-even-bigger-bazooka-expands-its-shopping-list-to-include-junk-bonds.html

This started just ahead of the rally a couple weeks back. I'm assuming they are banking HUGE purchases.