General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDOW rises 535 points today

Since only bad news seems to get a thread around here, was a great day for investors. Job growth is breaking records, DOW up over 12% this year. We're in the middle of a year of close to 7% GDP growth, highest in decades. Those are the realities, Biden started in a huge hole, the recovery has been faster than anyone could have imagined.

Reminder, Donald Trump was a total and complete economic disaster. He had the worst jobs record since Herbert Hoover and left the worst year for GDP since 1947.

Response to Johnny2X2X (Original post)

Chin music This message was self-deleted by its author.

Johnny2X2X

(19,252 posts)2021 will be either the 2nd or the first highest GDP growth since 1960 and there's people on TV acting like we're in a recession. 7% growth is insane! Only been done 1 time since 1955.

If Trump or any republican were President, they'd literally be holding ticker tape parades for themselves for these growth numbers.

Response to Johnny2X2X (Reply #5)

Chin music This message was self-deleted by its author.

nolabear

(42,001 posts)It’s funny how many people can’t tell the difference between bullshit and reality. I constantly hear (not here) how Joe’s hiding, not accomplishing anything, failing. What he’s doing is working and getting results as best he can without having to constantly blow his own horn or blame others. All too many people out there in red world don’t look any further than the loud and griftery for their “facts.”

Patton French

(790 posts)Glad the “experts” were wrong.

doc03

(35,425 posts)couldn't care less about the DOW.

Johnny2X2X

(19,252 posts)What about wages? Wages are rising at their highest rates in generations.

Response to Johnny2X2X (Reply #6)

Chin music This message was self-deleted by its author.

jimfields33

(16,066 posts)I’m sorry but inflation is going rapidly. Go to the store and prices are insane. It needs to stop.

Johnny2X2X

(19,252 posts)You've got Covid related interruptions to the supply chain, so companies are charging more for the good they have, or they are buying more than they need of supplies and absorbing the cost to store the, so they cost more. Biden is doing a great job of getting the disaster of an economy he inherited back up and running., the inflation has nothing to do with the job he's doing an d he's working to minimize it.

Response to Johnny2X2X (Reply #11)

Chin music This message was self-deleted by its author.

misanthrope

(7,435 posts)I think the fantasy is to return to the gasoline station lines of the Carter era.

Metaphorical

(1,604 posts)Electric vehicle prices are still too high, but they nonetheless represent a ceiling for the energy sector - when energy costs get high enough (especially oil and gasoline), then the demand for electric cars also rises, putting more EVs on the road and retiring ICE engines. So the oil sector in particular has to be very careful about how high they actually go before they risk accelerating the EV adoption rate.

misanthrope

(7,435 posts)then I don't see how that doesn't affect EVs as well.

Metaphorical

(1,604 posts)I think consumer electronics and automotive platforms will both be more expensive for a while, though there are indications that chip availability is beginning to ease. A lot of auto manufacturers cut their orders for chips at the beginning of the pandemic fearing that automobile sales would collapse. They did for a bit, but recovered fairly quickly, but by then most of the chips had been sold for other uses. Couple that with a fire at a chip fab in Japan and this caused a chip crunch early this year. However, the fab is back online and chip production is increasing again. It's also highlighted the need for more American chip production, not just design, something that was part of one of Biden's earlier initiatives.

Metaphorical

(1,604 posts)Actually the reason that gasoline isn't counted in inflation figures has more to do with the fact that it usually IS counted as part of the overall delivery cost within the supply chain as part of production, so counting it again would give it an outsized contribution. However, also keep in mind that fuel prices are not that much dramatically higher than they were in 2019, pre-pandemic, and seem to be stabilizing around $75 a barrel.

Agreed also on your analysis - I expect prices to start coming back down towards Spring 2022, though it'll likely be through the increased use of discounts rather than sticker adjustment. I'm also seeing COLA pressures beginning to make companies finally start raising wages.

doc03

(35,425 posts)up but prices are going up on everything. We will get around a 6% COLA and Medicare and supplemental insurance will take a chunk of it. Most private pension plans get no increases. I may get 2% at the very most. And I will have to pay more tax on my SS benifits.

Response to doc03 (Reply #10)

Chin music This message was self-deleted by its author.

Johnny2X2X

(19,252 posts)Sounds like you're coming out ahead.

doc03

(35,425 posts)go up. I will get no increase in pension income so I will gain maybe 2% at best. If inflation is only 4.9% how is it

we get a COLA of 6% when they say that the COLA does not represent the actual cost of living of a senior?

karynnj

(59,508 posts)If wages rise because of inflation AND you own a house with a fixed mortgage, you might over all come out ahead. If interest rates rise AND you are a retiree on SS with some assets in bonds, you might benefit.

Who is definitely hurt? Someone on a fixed income renting a home with increased costs for everything.

NutmegYankee

(16,204 posts)The wages rise, but the mortgage stays the same.

karynnj

(59,508 posts)ALL the gain in the value of the house goes to the owner's equity no matter how much mortgage principal remains. Even as their mortgage cost remains the same, their assets increase.

PoindexterOglethorpe

(25,925 posts)People here like to act as if any drop in the Dow is imminent sign of a huge collapse. Or they call the stock market a Ponzi scheme, showing they really have no clue how it actually works.

I'm retired, living on a fixed income (SS, investments, two annuities, and a very small pension) and I actually have more income than I ever have had in my life. Not by a lot, but by enough to be nice. Plus, one of my annuities just increased its payout by a few dollars a month. A lot of people trash annuities and I just don't understand. So far, the value of them has risen since I started taking money out, and there will probably be a pretty hefty residual amount left over when I'm no longer collecting.

traitorsgalore

(1,396 posts)And for telling everyone else how stupid we are for not understanding.

PoindexterOglethorpe

(25,925 posts)income who had nonetheless saves some pretty decent sum of money. Don't recall the amount and it's not important now. But what has stayed with me all these years is that he said something like, "Someone out there is living on two thousand dollars a year less than you are."

I have always lived well below my means, which is sometimes a foreign concept to people.

I am this well off precisely because I saved steadily, lived below my means, and still do.

I do understand people being very close to the edge, because I've been relatively poor at various times in my life. But then I read about someone who made six figures and has zero savings. Really?

WarGamer

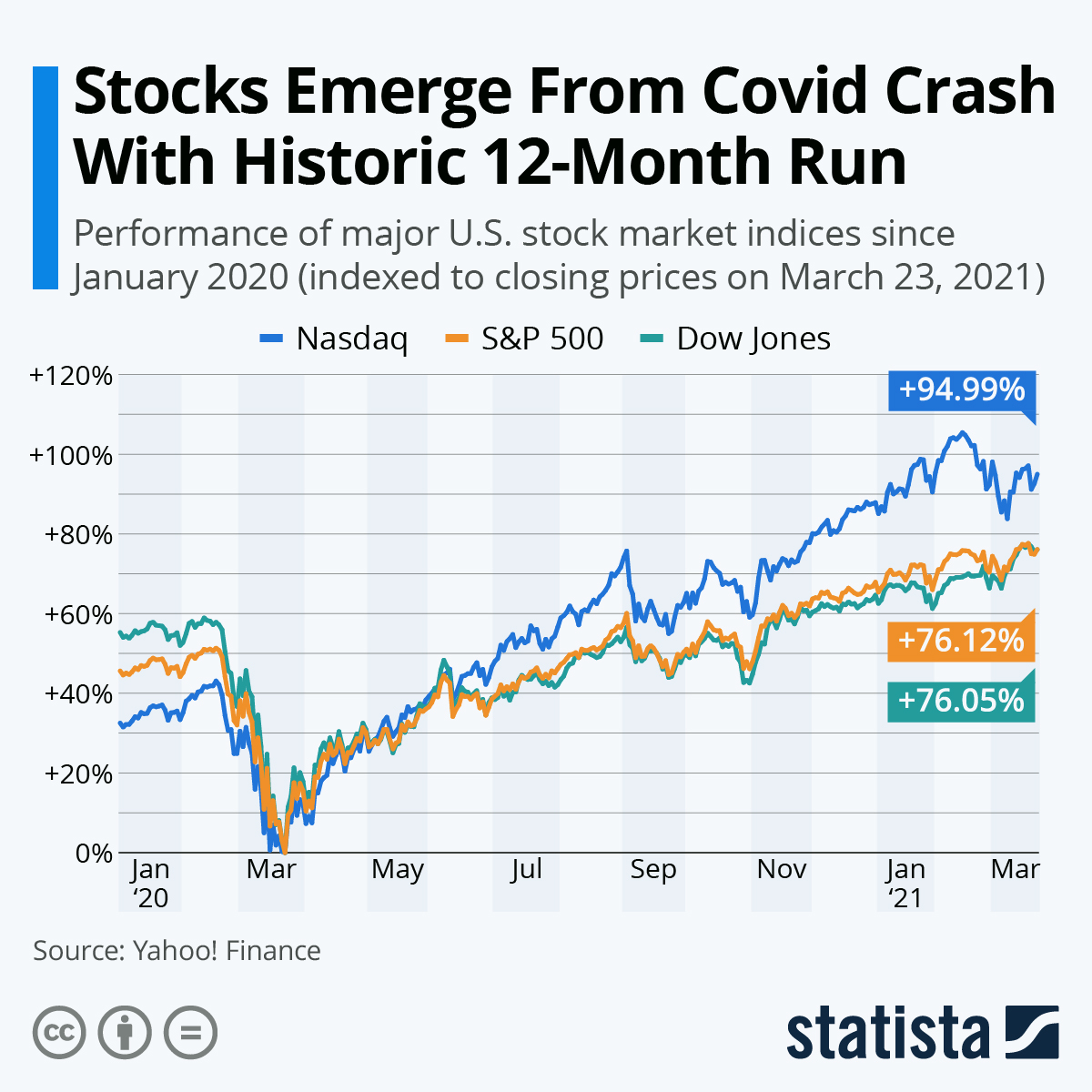

(12,491 posts)It's been going UP UP UP ever since although it peaked in August 2021.

brooklynite

(94,888 posts)…that only benefited the wealthy.

(And of course, Union pension funds)

traitorsgalore

(1,396 posts)So the president must also control Bitcoin, precious metals, bonds, currencies and every algorithm used to speculatively trade all of them!

Wow, what a smart guy! LOL!

Johnny2X2X

(19,252 posts)But this thread was in response to the multiple threads we get when the DOW falls a few hundred points.

The markets are up 15% this year. The economy is growing at 6-7%, UE is already back down to 4.8%. This economy is strong and Biden deserves credit for it.

malaise

(269,250 posts)them up! ![]()

Patton French

(790 posts)401k happiness.