General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsWhat do you consider a "fair share" that the top 1% should pay in income tax?

I tried to do a search on it, but got wild numbers from 90% all the way to 0% (with everything paid by sales tax). Any good websites that give a proper breakdown of the numbers with what would be an appropriate rate, what types of income the taxes would be assessed on, and how much revenue would be generated?

Amishman

(5,557 posts)So the top of the top tax bracket cannot play games to shirk their tax obligation, but at the same time the base tax rate for them is the same as for everyone else who breaks into the top tier of the current structure

LakeArenal

(28,820 posts)iemanja

(53,035 posts)Dave says

(4,618 posts)Maybe as high as 60% effective for FIT, state, and local income plus a 1% per year wealth tax.

Ka-Dinh Oy

(11,686 posts)I'm thinking back taxes. ![]()

tenderfoot

(8,437 posts)eom

ProfessorGAC

(65,076 posts)The tax exemption avenues, averaging, & loopholes resulted in so much being eliminated from AGI that nobody paid 91%.

That could be done without even having to hire an accountant. With one, the very high earners paid more like 42%.

The 91% tax rate was an "on paper" myth.

I would say a 45-48% effective rate would be appropriate, using a maximum level for any & all tax reduction avenues.

In addition, I'd tax any qualified dividend income above $500k, be taxed as regular income. So, instead of 22%, they'd pay 45-48% on that, too.

Today, the effective tax rate on 1% earners is under 20%.

That, IMO, is far too low.

Dave says

(4,618 posts)I agree with all your points except the “hardly” one.

While 10,000 can be thought of as “hardly”, it is (to me) about economic justice.

https://taxfoundation.org/taxes-on-the-rich-1950s-not-high/

I am of course talking about marginal rates, “tax brackets”. Adjusted for inflation, income above $4 million is taxed at that level. We have far more people making over $4 million today than $200,000 (in 1950 dollars) then. There are far more dollars exposed now to the top bracket. Taxing them with a 90% bracket will proportionally bring in more dollars than it did in 1950.

Overall (including federal, state, and local income taxes) the top 1% pay about 6% less in taxes than they did between 1950 to 1959. For me, for economic justice, that 6% belongs in the coffers of tax collectors.

As for the idea that it is easy for the rich to avoid taxes, it isn’t easy. That’s why they pay so much to tax lawyers and accountants to help them. I’m ok with that effort. The lawyers and accountants likely end up spending more of their income on goods and services than the rich who already have everything. Value is created every time dollars change hands. Push that income down the income ladder and more wealth (for all) is created. It’s about velocity of cash flow. When stuffed in the pockets of the wealthy, that velocity slows down.

But getting back to your other good points, I’d throw a progressive wealth tax into the mix.

ProfessorGAC

(65,076 posts)I'd still call that nothing, though.

There were a heck of a lot more than 10,000 households earning at that marginal rate.

Our philosophical difference is that I see no value in symbolically high marginal rates, that only affect 5-10% of said earners.

I'd rather the marginal rates be set as a revenue target & then make moves in the law to assure that 100% in that bracket pay it, absent criminality on their part.

Other than that, we seem to be on the same page.

LonePirate

(13,426 posts)Dave says

(4,618 posts)Just like it was in the Eisenhower years.

ProfessorGAC

(65,076 posts)The 90% rate is effectively a myth.

Nanjeanne

(4,961 posts)acceptable to me to have wealthy people pay significant percentage on the income over 1-2 million. In 1970 the tax rate over $100,000 was 70%. In 2021 that would be approximately $713,000. I wouldn’t go that far but I’d be happy to see a tax of 50% on the portion of income over a million or two.

We message taxes so strangely. So many people believe if you say 50% on income over a million that it’s 50% on the whole income. But we have tax brackets and everyone pays the same % in the brackets. So someone making $1,200,000.00 would pay 50% on the $200,000 not the whole enchilada. And that’s after the deductions, etc. It’s crazy to me that the effective tax rate of billionaires is about 8%. But talking about taxes has become so difficult. It’s misunderstood and badly messaged.

I remember in 2008 Biden saying paying taxes is patriotic and being lambasted for it. He was right and if we actually paid taxes for thing people needed and wanted like education, infrastructure, healthcare, etc we would be doing the most patriotic thing we could be doing.

newdayneeded

(1,955 posts)15% to 20% with zero loopholes. trump took away itemizing my property tax and mortgage interest. but he did raise the standard deduction.

Funny thing that; it makes some people think twice about buying a home now, "might as well rent since you don't get any breaks from itemizing"

Have you noticed all the apartment buildings being built? those aren't middle class people building them. So this again was a policy that helped the rich. now even more people pay landlords for housing.

EarnestPutz

(2,120 posts).....questions that received the most consistent response, across all groups, men and women, black and white, young and old, North or South, wealthy or poor, educated or not, etc. etc. etc., was what do you think would be a fair tax for everyone to pay. Almost everyone said fifteen percent.

hunter

(38,317 posts)In return I expect for everyone free medical care, a strong social safety net, lifetime free education, a comfortable retirement, and strong labor and environmental protections.

Is that too much to ask?

Skittles

(153,169 posts)yup

newdayneeded

(1,955 posts)If could get every penny of the trillions of dollars back on our shores and tax at 10%, that probably cut our deficit by a major amount, or provide all the spending for needed causes.

mvd

(65,174 posts)75% rate for over $1 billion.

Make sure corporations can’t avoid paying taxes.

marie999

(3,334 posts)mvd

(65,174 posts)Much of the problem stems from corporations reinvesting profits. Tax credits and reductions also play a role.

Bluethroughu

(5,172 posts)IbogaProject

(2,816 posts)Or higher. One thing set whatever maximum to include state taxes so you effectively can't dodge taxes by moving to Florida or Texas and all. I feel there should only be national taxes on income and all excess property. Our party has to improve the bottom 70 or even 80% all tax hikes on the top. That is the economically productive segment. Give them more spending will go up.

Johnny2X2X

(19,066 posts)Capital gains, other benefits of corporate life. Tax it all progressively. Create several new tax brackets. Say 50% at $1M, 60% at $2M.

Everyone’s first $50K of income is tax free. You don’t start paying taxes until you’ve got the basics in life.

LastDemocratInSC

(3,647 posts)meadowlander

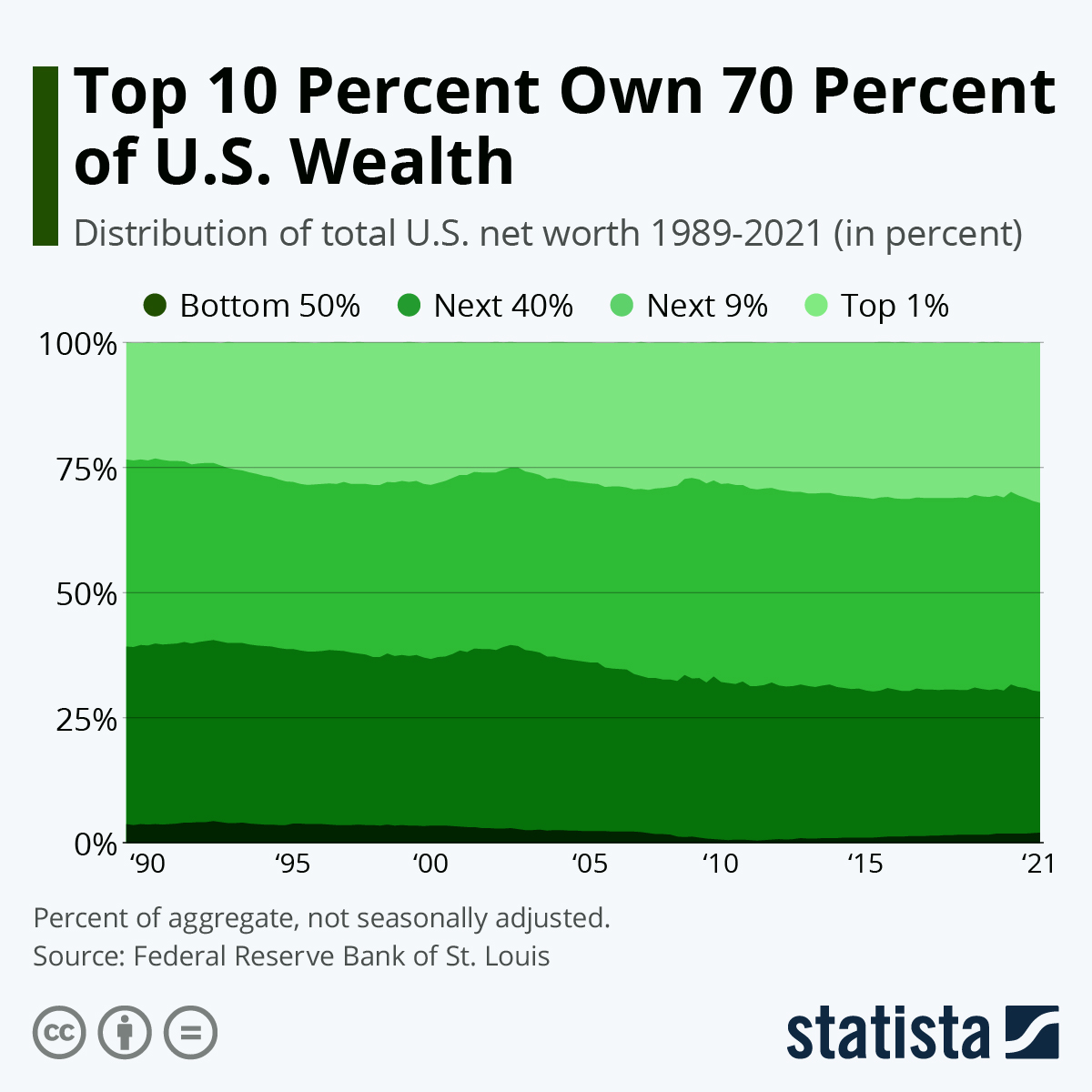

(4,399 posts)

1. Work out a budget for the country.

2. The top 1% of earners pay for 30% of it.

3. The top 2-10% of earners pay for 40% of it.

4. The top 11-50% of earners pay for 25% of it.

5. The bottom 50% of earners pay for 5% of it.

A company is an earner. Corporations are people too, my friend.

IbogaProject

(2,816 posts)Yes this basic framework looks good. But we need to increase spending that gets into a majority of households. The reason to tax progressively is the wealthy spend their money slowly and often not locally. Progressive tax rates isn't to redistribute as an equalization but to put money where it will be spent faster and more efficiently. We have to be clear in how we market this.

NowISeetheLight

(3,943 posts)I'd would eliminate deductions for everything but charitable contributions. I'd eliminate the "stepped-up" basis for inheriting stocks and property which allows someone to avoid paying taxes on all the years of gains if they die. I'd increase the capital gains rate for those making over $1m a year to the rate their income tax is (no more 20%).

Tax rates for the top 1% have fallen dramatically since WWII while the rate for everyone else have remained fairly constant.

https://www.taxpolicycenter.org/taxvox/effective-income-tax-rates-have-fallen-top-one-percent-world-war-ii-0

The Center for American Progress said the average income tax rate for the top 400 from the Forbes list was 8.2% from 2010-2018.

https://www.americanprogress.org/article/forbes-400-pay-lower-tax-rates-many-ordinary-americans/

When I look at my last eight years of Turbo Tax filings my average rate was around 16% after deductions.

Hekate

(90,714 posts)Buzz cook

(2,472 posts)They seem to be more descriptive now rather than prescriptive. But still worth the time.

There are lots of articles that indicate higher tax rates will help the economy. The Clinton tax policy sure seemed to prove that.

sanatanadharma

(3,707 posts)The tax rate is fair when the rich find themselves needing to budget and cut back due to their tax costs for maintaining a society from which they greatly benefit.

Hav

(5,969 posts)30, 40 or 90% are meaningless without an objective behind it. It totally misses the point for why funds are needed and seems to focus on sticking it to certain people you dislike.

The major consideration should be a society with the best possible outcome for the large majority or possibly all without communities or the country going bankrupt. Choose a rate that helps fund the social programs and infrastructure for that.

The appropriate rate will probably change over time. There's no point in lowering taxes when you see that your city has no money to maintain the streets, bridges or healthcare facilities and there's no need for raising taxes or keeping a high rate when you have surplus after surplus with no programs to spend it on.