General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMy response to the Chicago Tribune's Endorsement of President Obama

I was pleased to see The Chicago Tribune's endorsement of President Obama -- it made for a nice trio along with that of the NY Times and the Washington Post. But then I actually read it. It was a veritable screed of deficit fear-mongering, with a flat-out lie concerning Social Security. Basically, they were endorsing President Obama, but were critical of both candidates for not addressing the national debt. They called the national debt the greatest existential threat both present and future the country faces. Grateful though I was for their endorsement of the President, I simply couldn't sit on my hands in the face of such and outrageous attempt to foster confusion concerning the national debt, and the (non-)role of Social Security in that debt. Here is my response:

"This nation faces no existential threat greater than the enormous federal indebtedness that imperils today’s America and, far more important, our children’s America. That slow strangulation endangers every household in the land -- when our debt payments skyrocket, our taxes rise to fill the fiscal voids, and entitlement programs go insolvent: Federal trustees now say our Social Security trust fund will run dry in 2033, not 2036 as they predicted just last year. Medicare's hospital fund will pay out its last dollar in 2024, not 2029 as the trustees projected two years ago."

Where to even begin to unpack that paragraph!

1. THE NATIONAL DEBT IS A LONG-TERM PROBLEM, NOT AN IMMEDIATELY PRESSING ONE.

The nation's most pressing crisis is not the national debt, it is JOBS! The debt must be dealt with, certainly, but it is a longer-term issue, and should not be the priority until the jobs crisis has been addressed. Look, if we don't address the jobs crisis, until the economy is generating a sufficient number of well-paying jobs that afford their holders the ability to comfortably buy homes, live a reasonably dignified lifestyle WHILE saving for their kids' college educations and their own retirement, the economy will remain weak for years to come. The nation is not having any difficulty making the payments on its debt. Our level of indebtedness is still less, as a percentage of GDP, than it was during WWII. Isn't it amazing, then, that in the years following WWII, we were able to both pay our debt AND expand Social Security, create Medicare, build an interstate highway system and send astronauts to the moon?

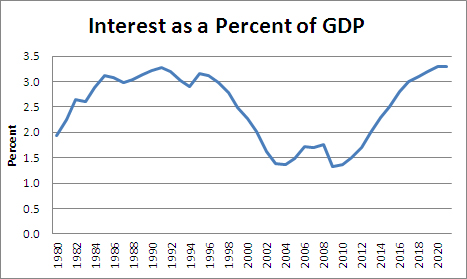

Of course, even in the longer run, the real problem isn't debt payments (since the vast majority of our debt is borrowed against ourselves, not, contrary to popular myth, China), but the interest payments on that debt. But even here, there is little cause for alarm. The Congressional Budget Office published a graph a few months back, showing interest on the national debt as a percentage of GDP, from 1980 projected through 2020:

(See http://www.cepr.net/index.php/blogs/beat-the-press/the-graph-you-really-need-when-watching-the-republican-and-democratic-conventions )

In other words, the chart graphs the interest _burden_ (as opposed to the rate). Currently, interest payments on our national debt total approximately 1.5% of GDP. Those rates are projected to rise sharply until 2020, and then flatten out. What is the projected burden in 2020? A whopping 3.3 or 3.4%: roughly the same level of burden we carried at the end of the Reagan administration, and also during the Clinton administration in the '90s.

2. THE SOCIAL SECURITY TRUSTEES NEVER SAID THE SOCIAL SECURITY TRUST FUND WOULD "RUN DRY" IN 2036 OR 2033.

Here you are doing your readers an enormous disservice by misrepresenting what the Trustees actually said. What the trustees actually said in their 2012 report was that Social Security can meet 100% of its obligations through 2037 (later adjusted to 2033), and for another 37 years after that, it can fund its obligations at a level of 75%. Here is the quote from the Trustees' report:

"Beginning in 2021, cost exceeds total income and combined OASI and DI Trust Fund assets diminish until they become exhausted in 2033. After trust fund exhaustion, continuing income is sufficient to support expenditures at a level of 75 percent of program cost for the rest of 2033, declining to 73 percent for 2086."

(See http://www.ssa.gov/oact/tr/2012/VI_H_glossary.html#1005633 ).

That gap is not the result of profligate spending; it was a long-predicted, but temporary, shortfall resulting from the large number of baby boomers moving into retirement age, and an insufficient number of younger working people to carry the funding burden. That issue can readily be addressed by raising the cap on Social Security withholdings. Apart from the temporary shortfall, Social Security is a self-funding program that has not contributed one dime to the national debt. In fact, the Social Security Trust Fund is the CREDITOR for a very large share of our national debt.

President Bush mired this country in two, off-budget and enormously expensive wars. A certain segment of our economy -- the private defense contracting and related industries (along with those who have invested in those industries) -- has extracted huge profits for over a decade, what with no-bid contracts and other sweetheart deals the GOP showered upon them, all at the expense of the American taxpayer. But that expense wasn't paid for at the time (because the GOP is famously averse to imposing the taxes necessary to pay for their misadventures), and was financed largely by bonds issued by the Social Security Trust Fund to the Department of Defense. Now, these same folks who manipulated public opinion in order to maneuver the country into those two wars (while avoiding budgetary accounting for them), seeks to solve the problem of the debt they were largely responsible for running up on the backs of a very vulnerable segment of our society. It is an attempt at wealth redistribution from the bottom to the top -- Robin Hood in reverse, if you will.

* * *.

It is a truly sorry state of affairs when so august an institution of the Fourth Estate as The Chicago Tribune, a source many will turn to in search of accurate information on the issues that confront us, engages in obfuscation and the spread of misinformation on these two, critically important issues. There are only two plausible explanations for the misinformation contained in this editorial: the economic illiteracy or ignorance of the editors, or the willful misrepresentation of fact in the service of promoting their own self-interest or that of a certain well-connected constituency. If the explanation is ignorance, such ignorance is inexcusable for the editors of a major urban daily. If, on the other hand, it is willful misrepresentation, then it calls into question the integrity of your organization as a journalistic institution.

markpkessinger

(8,883 posts). . . but I think the issues raised in this one are important. So, I'm kickin' it!