General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBecause apparently it needs to be said.

Social Security is OUR money. It exists because WORKERS PAY INTO IT. Recon lawmakers are desperately trying to steal our money. It is NOT a drain on the economy. Bush ripped off billions from the trust fund to pay for his illegal wars and tax cuts for the wealthy.

Social Security is NOT AN ENTITLEMENT. It is the money we worked our entire lives for.

HUAJIAO

(2,730 posts)Silent Type

(12,412 posts)the OP has a point.

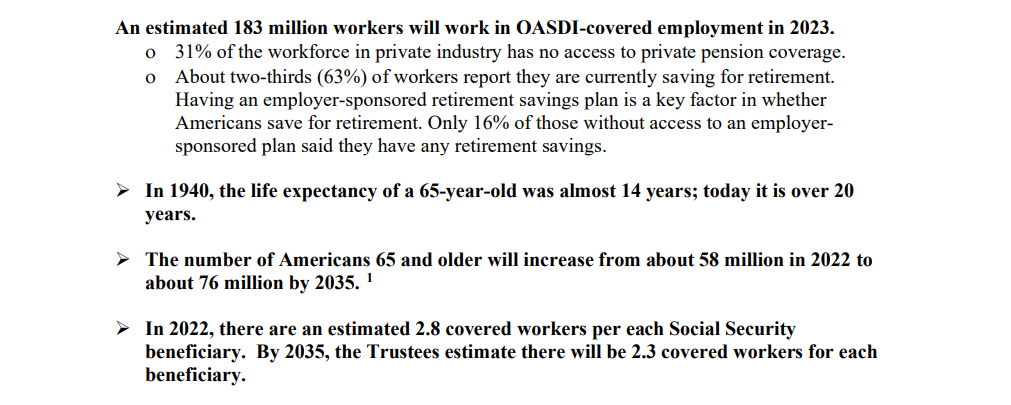

In any event, we need to stop kicking the SS can down the road. Otherwise, we are headed for an automatic 23% cut in benefits around 2033 (according to the SS Trust Fund Report). If GOPers are in control when Congress finally realizes something needs to be done, it'll be off the backs of current/future retirees.

We are not going to get removal of the Wage Cap, no matter how loudly it's touted, but it can certainly be restructured.

onecaliberal

(36,594 posts)above the workers. We are the one who make EVERYTHING go.

Bettie

(19,305 posts)because we tend to spend most of what we bring in...that creates economic activity.

The rich own the businesses, but we are the customers, the consumers...without us, there would be no business.

Meanwhile, Republicans are trying to placate the human dragons who put the money into their vast hordes, removing it from the economy, ensuring it doesn't generate economic activity.

William Seger

(12,225 posts)... not because they have money they don't know what to do with.

orthoclad

(4,728 posts)Amazon and walmart did not create jobs. They REPLACED jobs. They replaced small biz that grew out of the community with massive alienating underpaid warehouses.

jaxexpat

(7,794 posts)They've always seen themselves and the power of their wealth as more important than sustenance for the masses. They're so wrong. It is always massed humanity that propels the grand movements of history. Efforts to maintain the petty fortunes of the few are never more than footnotes. They're always doomed to fate and rust. Refusal to embrace that reality, to find purpose in simply living, is why they are always the minority. GOTV and prosperity is always possible. ![]()

Silent Type

(12,412 posts)housecat

(3,138 posts)how they're told on rightwing medial.

onecaliberal

(36,594 posts)we can do it

(12,988 posts)Last edited Thu Jun 15, 2023, 11:58 AM - Edit history (1)

Silent Type

(12,412 posts)William Seger

(12,225 posts)Unlike, say, food stamps, you aren't elegible for SS unless you or your spouse paid into it - - it's insurance.

we can do it

(12,988 posts)William Seger

(12,225 posts)William Seger

(12,225 posts)... that you're only "entitled" to it because you or your spouse or supporting parent paid for it. Calling it an entitlement makes it sound like a grant, like food stamps, which is why some Rs think it's just a policy decision to cut benefits. Cutting SS would be renigging on a contract.

we can do it

(12,988 posts)we can do it

(12,988 posts)allegorical oracle

(6,206 posts)workers paid Soc. Sec/Medicare tax on every cent they earned. I had my own small business and paid both the employer's and employee's share on every penny that came through the door. Filed at the lowest income bracket (15%) so paid total taxes of almost 38% when income+ FICA taxes were totaled up. More than Jeff Bezos.

Silent Type

(12,412 posts)They’ll make a small increase in Cap, but that’s just kicking the can down the road.

DENVERPOPS

(13,003 posts)SSI is only paid on what is called "Earned Income", and the wealthy and uber rich only earn "Capital Gains".

Since their profits are mostly/all because of "Capital Gains" they pay nothing or next to nothing into SSI.

And the Republicans have been able to lower the tax on Capital Gains steadily to the present 15?% rate.

Warren Buffet wasn't joking when he, as a Multi-Billionaire, stated that he paid a lesser %age tax than his housekeeper..........

15% less was because he doesn't pay a penny into SSI, the rest was his extremely low rate of Capital Gains which is his entire source of income...........

Silent Type

(12,412 posts)DENVERPOPS

(13,003 posts)I haven't seen U.S. Democrat House Members or Senators standing in line to change the laws when they have had the opportunity.

Reviewing the wealth of them, might provide clues!

All of the huge Trump/Republican tax cuts to the wealthy, weren't reserved just for Republicans only.......

And did anyone ever get nailed for the massive amount of Republicans doing incredible amounts of "Insider Training" the same afternoon as a private meeting when they found out that the Covid was a REAL threat? They all ran to their phones, and realigned their investments that afternoon, and notifying all their wealthy Donors and friends.

The Grand Champion of Insider Trading that afternoon was some U.S. Republican Female Senator? That the SEC first reported having traded 20 Million in stock out of companies that were sure to crash, and putting the money in companies that were certain to increase profitability during a Pandemic. She never got nailed, or any of the rest who were doing it that afternoon after the meeting. Of course, her husband was President of the New York Stock Exchange, I'm sure that helped..........

Like George Carlin said: "It's a club, and you ain't in it"

BTW: the Federal minimum wage is still at 7.50 and has been for years and years and years. There are some States and Cities that have a minimum wage much higher, but there are a whole big bunch of states, (esp Republican ones), that have used the Federal Minimum Wage as THEIR State's Minimum Wage...............

Rebl2

(17,427 posts)wackadoo wabbit

(1,287 posts)We need to reclaim the word "entitlement." Don't let the right redefine that word.

Rebl2

(17,427 posts)people hear the word entitled or entitlement and they think grifter. Like tfg guy thinks he is entitled to keep those boxes he stole and kept at his Florida club.

You are right that it is an entitlement because we worked for that money and it was promised to us when we retired at 65 years of age. I wish there was a different word we could use regarding the SS we were promised.

HUAJIAO

(2,730 posts)and so it has obtained an incorrect meaning..

johnnyfins

(3,460 posts)Unfortunately, Rush Limbaugh singlehandedly turned "Entitlement" into a RW dirty word and equated it to welfare. That's what happens when the Fairness Doctrine is destroyed.

dchill

(42,660 posts)Ferrets are Cool

(22,539 posts)I PAID for the "entitlement" of receiving SS.

KPN

(17,146 posts)their entitlement to subsidies for the corporations that support them and that they invest in; their entitlement to lower tax rates for the wealthy which to a large extent includes themselves; their entitlement to pass along the wealth they've hoarded throughout their lifetimes untaxed to their kids and across generations; their entitlement to being the ruling class; etc., etc.

bullimiami

(14,073 posts)The SS assets (trust fund) has about 4 TRILLION and increasing.

SS can only distribute what it brings in.

It CANNOT BORROW from other revenue.

The Govt is often borrowing against the SS surplus to fund things.

GET YOUR FILTHY REPUBLICAN GREEDY EYES OFF OF OUR HARD EARNED MONEY.

grantcart

(53,061 posts)If you are adding more to the trust fund but significantly increasing future obligations because you are significantly increasing future obligations because you are adding a higher percentage of younger workers then that doesn't mean the trust fund is gaining a 'surplus'.

COVID had a temporary positive impact on SS payments (unfortunately). Could amount to $20 billion this year.

SS Trust fund cannot barrow to meet payments. If the Chief Actuarial Officer determines that the are unable to meet future needs then the law requires that payments to beneficiaries are automatically cut.

Currently it looks like that will happen in 2035.

https://www.ssa.gov/policy/docs/ssb/v70n3/v70n3p111.html

The concepts of solvency, sustainability, and budget impact are common in discussions of Social Security, but are not well understood. Currently, the Social Security Board of Trustees projects program cost to rise by 2035 so that taxes will be enough to pay for only 75 percent of scheduled benefits. This increase in cost results from population aging, not because we are living longer, but because birth rates dropped from three to two children per woman. Importantly, this shortfall is basically stable after 2035; adjustments to taxes or benefits that offset the effects of the lower birth rate may restore solvency for the Social Security program on a sustainable basis for the foreseeable future. Finally, as Treasury debt securities (trust fund assets) are redeemed in the future, they will just be replaced with public debt. If trust fund assets are exhausted without reform, benefits will necessarily be lowered with no effect on budget deficits.

The author is the Chief Actuary of the Social Security Administration.

Traildogbob

(12,575 posts)And life long health care passed on to their spouses is ALSO OUR money. Most of them find ways to contribute nothing in taxes that pay for it. THAT is a god damned entitlement.

Lonestarblue

(13,246 posts)the millionaire business owners who are required to pay their share of the tax. Corporations have no loopholes passed by Republicans to avoid or not pay SS and Medicare taxes. That is why Republicans object to it.

William Seger

(12,225 posts)People who want to make it a retirement account are only interested in making Wall Street brokers and fat cats fatter. It would flood markets with boatloads of cash chasing equity that isn't increasing in real value.

WinstonSmith4740

(3,416 posts)He was mercilessly ridiculed for it. He was, of course, right. Republicans have been trying to get their hands on that fund for as long as I can remember. Their attitude seems to be "If we can't raid it for our purposes, we'll destroy it." Kind of like, "If I can't have you, no one can." And we all know how dangerous that attitude is.

Martin Eden

(15,376 posts)Their formula is fairly simple:

Tax cuts for the rich drive up huge budget deficits.

Then they scream we have to cut spending so much on "entitlements" the nation can no longer afford.

It's should be obvious to anyone capable of critical thought this is a brazen scheme to transfer wealth from working Americans into the pockets of millionaires & billionaires who finance the political careers of these Rethuglicans.

![]()

onecaliberal

(36,594 posts)We can't let it continue.

Martin Eden

(15,376 posts)The rich have bern waging and winning class warfare for decades.

Wild blueberry

(8,138 posts)I worked 46 years, earning my benefits.

Think wealthy and big business especially hate it because employers have to pay into it, too.

GreenWave

(12,371 posts)And if you work long enough and your spouse of ten or more years doesn't, your spouse gets roughly a half share at no cost to you.

aggiesal

(10,554 posts)If you don't know how Social Security works, you should look into it.

And yes it is an entitlement. We paid into it, we are entitled to it.

Laura PourMeADrink

(42,770 posts)Bucky

(55,334 posts)It was during the Reagan years that they start using the social security surplus to hide the enormous budget deficits he was running up with his reckless tax cuts.

The tax cuts actually help the economy a tiny bit, but they honestly really should have been structured as tax deductions provided there was effectual measures made by employers to support and maintain the middle class.

Instead the Reagan tax cuts were just throwing spaghetti against the wall with the promise that whatever trickles down to the floor the poor can eat. Clinton balancing the budget in the 90s prove that you can grow the economy without screwing the middle class or future generations. We need to get back to that.

allegorical oracle

(6,206 posts)taxed, it "trickles down" to the workers. Not so much. But my Repug acquaintances still believe it trickles down..."I ain't ever gotten a job from a poor person."

Bucky

(55,334 posts)I can tell you as an economics teacher, there is a dollop of Truth in the big fat Crock-Pot of Lies that makes up supply side economics.

Friedmanesque economics does have a particular macroeconomic impact when applied to money supply and how it affects inflation and sustainable growth rates. But when it comes to aggregate microeconomics, which means day to day living for regular families, it's Keynesian economics, aggregate demand, and its impact on real life opportunities that runs the show.

I say this because there is a high tax point at which the Laffer curve is legitimate, that increasing tax rates will reduce smaller government tax revenues. But it's somewhere around the 40 to 50% effective tax rate (not the nominal rates), which we haven't seen since the Kennedy administration.

Increasing the top marginal rate right now would dramatically lower the deficit and potentially put us on track to balanced budgets again. Sadly, that would also eventually affect the reliable income streams to the institutions lending money to the federal government. The high finance organizations that help Congress get reelected don't necessarily have an interest in seeing balanced budgets.

allegorical oracle

(6,206 posts)of a global pandemic was stirred into the mix.

NowISeetheLight

(4,002 posts)If it really “trickled down” the wealth gap wouldn’t have exploded like it did after the Reagan, Bush, and Trump tax cuts.

live love laugh

(16,207 posts)usonian

(23,651 posts)In the party of racism's thesaurus.

Warpy

(114,406 posts)weren't thinking clearly, those "socially liberal, fiscally conservative" types we were stuck with in the 80s and 90s, picked right up.

Social Security is an INSURANCE PLAN that was set up to decrease poverty among children who had lost parents, among people who became disabled through illness or accident, and people who just had too many birthdays to keep on working. We pay our premiums out of every single paycheck and if any of the above conditions affect us, the insurance pays out.

Rich SOBs have been trying to kill it off since its inception in the 1930s. Some years ago, my right wing dad, then in his mid 80s, told me not to be alarmed at hysteria from Republicans that the system was going broke or it would bankrupt the country, he'd heard the same horseshit from them since the day it was passed.

Republicans are the deadly enemy of all working people. Never forget that.

iluvtennis

(21,470 posts)Prospero1

(83 posts)Social Security is basically a pension fund.(and to some extent an insurance fund) Pension/Insurance funds are supposed to be invested so that the funds grow over time and future obligations can be met. Congress has treated Social Security taxes as if they were regular tax payments and used them up as they come in rather than investing them. This issue even come up in the 2000 election (remember the "lockboxes"![]() . This is the reason for the Social Security funding crisis.

. This is the reason for the Social Security funding crisis.

grantcart

(53,061 posts)Bucky

(55,334 posts)They can say they made a small contribution in lieu of providing a pension directly.

We all have to pay taxes to maintain a civilized society. Preserving the dignity of retirees is one of the most basic civilizing things that define us as a community.

It's only parasites who want to have the benefits of society but not pay their fair share to maintain it

grantcart

(53,061 posts)It is one of many misnomers about SS in this thread but if your are leading with "Because apparently it needs to be said" then the next statement really should be factually correct. The other misnomers are too numerous to engage but I did have to correct the one about SS having a surplus etc, see 37 above for one example.

Bucky

(55,334 posts)Just adding context to the discussion

grantcart

(53,061 posts)pnwmom

(110,197 posts)Part of their compensation are those "contributions."

grantcart

(53,061 posts)The idea that it is paid for 100% by the employees with their money is just more of the mumbo jumbo that is widespread and frequently quoted. Half paid by the employer and half paid by the employee.

Federal Insurance Contribution Act (FICA) taxes support the federal Social Security and Medicare programs. The total due every pay period is 15.3% of an individual's wages – half of which is paid by the employee and the other half by the employer.

Pretty straight forward. Employees pay half and employers pay half.

pnwmom

(110,197 posts)just like health insurance is counted in the package, even though that's ALSO mandated by the government.

grantcart

(53,061 posts)You may like the way it sounds that the employee pays all, that it comes out of the employee pocket but it is an employer expense just like rent, electric bill, advertisement and so on. Matching employer contributions to a 401K would be considered part of the employee compensation because the 401k is portable and 100% of the employer/employee contributions stay with the employee.

To ascribe the employer contribution as somehow an employee contribution is just mumbo jumbo.

Bucky

(55,334 posts)... because you paid into it. It wouldn't be hard to fix social security. But we would need both houses of Congress back in sane hands. I'm pretty confident it'll get fixed before 2030, even provided that say legitimate deadline and not just panic mongering

FakeNoose

(40,258 posts)... because that's how they roll. Every American who deposits funds into a personal savings account is entitled to all the money PLUS interest. It's YOUR money, am I right? Nobody questions it, you own the account.

It's the same with our Social Security accounts, as much as the Repukes would like to change our minds. We're entitled to our money and our benefits that we've paid into for 40 (or more) years.

Entitlement isn't a dirty word. Don't let them convince you of that.

![]()

![]()

whathehell

(30,365 posts)They, on the other hand, are very legitimately entitled to big Tax Cuts. ![]()

Celerity

(53,738 posts)Blue Owl

(58,194 posts)onetexan

(13,913 posts)It was money i cohld have invested all my working years till now.

colorado_ufo

(6,200 posts)Al Gore got ridiculed for saying it should be put in a "lock box" - and he was RIGHT! The Democratic Party failed to support him; he should have been our President, without the "hanging chads" crap.

ThoughtCriminal

(14,706 posts)When we see somebody at the grocery store cut in the express line with 30 items (two purchases they explain), we often refer to them as "Self-entitled Jerks".

There is a huge difference between people who insist on "Two Scoops" and funds that we and our employers paid into our retirement.

Republicans want to confuse two very different things, and well they have a base that is not too bright about those kind of distinctions. They want them thinking that SS is going to line breaking "Illegals" and non-white "welfare bums".

pnwmom

(110,197 posts)The Republicans have succeeded in turning the word "entitlement" into some kind of slur. The whole reason it was called an entitlement is to distinguish it from charity.

We don't have to go along with the Rs on that. They want us to forget that we're entitled to it. They want people to think of it as another form of charity to be slashed.

markodochartaigh

(5,060 posts)But I lost a whole lot of respect for them when they made fun of Al Gore for saying that we should put Social Security in a lockbox.

H2O Man

(78,677 posts)wendyb-NC

(4,605 posts)Yes, it absolutely is our money, payed into from our very first jobs, through many years. It is not a slush fund, or a handout.

Tax the wealthy, already.

LetMyPeopleVote

(175,250 posts)The GOP really want to gut and kill social security and medicare

Link to tweet

https://www.rawstory.com/gop-and-social-security/

The proposal outlined by the 175-member Republican Study Committee (RSC), led by Rep. Kevin Hern (R-Okla.), would gradually raise Social Security's full retirement age—the age at which people are eligible for full Social Security benefits—to 69, up from the current level of 67 for those born in 1960 or later.

Nancy Altman, the president of Social Security Works, said the RSC budget would "destroy Social Security as we know it," using a "modest shortfall" that's more than a decade away to justify reducing benefits for millions.

"These changes would transform Social Security from an earned insurance benefit, which replaces wages lost in the event of old age, disability, or death, into a subsistence-level welfare benefit," said Altman, who noted that the RSC "rules out any options for raising revenue, such as requiring billionaires to contribute even a penny more."

Xoan

(25,570 posts)Emile

(40,717 posts)fall for that crazy shit.

Progressive dog

(7,572 posts)The trust fund is invested in special U.S. government bonds. The trust fund will run out of bonds at some point (about 2033) when tax receipts will only be sufficient to pay 77% of benefits. There is a separate fund for disabled workers and one for medicare. The medicare fund will run out of money in 2031 and trust fund income will only pay 89% of benefits.

We need the government to increase the taxes that pay for these funds but Republicans would rather just cut the payments.