General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe Untouchables: How the Obama administration protected Wall Street from prosecutions

http://www.guardian.co.uk/commentisfree/2013/jan/23/untouchables-wall-street-prosecutions-obamaGlenn Greenwald comments on last night's Frontline and more...

What Obama justice officials did instead is exactly what they did in the face of high-level Bush era crimes of torture and warrantless eavesdropping: namely, acted to protect the most powerful factions in the society in the face of overwhelming evidence of serious criminality. Indeed, financial elites were not only vested with impunity for their fraud, but thrived as a result of it, even as ordinary Americans continue to suffer the effects of that crisis.

Worst of all, Obama justice officials both shielded and feted these Wall Street oligarchs (who, just by the way, overwhelmingly supported Obama's 2008 presidential campaign) as they simultaneously prosecuted and imprisoned powerless Americans for far more trivial transgressions. As Harvard law professor Larry Lessig put it two weeks ago when expressing anger over the DOJ's persecution of Aaron Swartz: "we live in a world where the architects of the financial crisis regularly dine at the White House." (Indeed, as "The Untouchables" put it: while no senior Wall Street executives have been prosecuted, "many small mortgage brokers, loan appraisers and even home buyers" have been).

SidDithers

(44,228 posts)Sid

Angry Dragon

(36,693 posts)Whovian

(2,866 posts)GeorgeGist

(25,321 posts)Luminous Animal

(27,310 posts)Are banks too big to jail?

Before you say that Breuer is just being a kind, compassionate guy, remember that the foundational notion of equal justice under the law is not supposed to be kindness or compassion. It is supposed to be blindness — specifically, blindness to a person’s stature and station, regardless of whether that person is a single human or a corporation. Even though that principle has never been applied perfectly (to say the least), the government is supposed to at minimum rhetorically honor its ethos.

Yet, here you have the Obama administration via its chief prosecutor setting the precedent for exactly the opposite: namely, a government that brags that when it comes to Wall Street, justice is not — and should not — be blind. Instead, as Breuer demands, prosecutors should be “kept up at night” worrying primarily about how an enforcement action will affect bankers who break laws and harm millions of Americans.

ProSense

(116,464 posts)"the lack of even a single arrest or prosecution of any senior Wall Street banker for the systemic fraud that precipitated the 2008 financial crisis"

There have been prosecutions.

Former BofA Exec Indicted For Fraud

http://www.democraticunderground.com/1002990749

Former Chief Investment Officer of Stanford Financial Group Pleads Guilty to Obstruction of Justice

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-785.html

Former Corporate Chairman of Consulting Firm and Board Director Rajat Gupta Found Guilty of Insider Trading in Manhattan Federal Court

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120615.html

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

CEO and Head Trader of Bankrupt Sentinel Management Indicted in Chicago in Alleged $500 Million Fraud Scheme Prior to Firm’s 2007 Collapse

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-120601.html

Yahoo! Executive and California Hedge Fund Portfolio Manager Plead Guilty in New York for Insider Trading

http://www.stopfraud.gov/iso/opa/stopfraud/NYS-120521.html

Three Former Financial Services Executives Convicted for Roles in Conspiracies Involving Investment Contracts for the Proceeds of Municipal Bonds

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-at-620.html

Former Chairman of Taylor, Bean & Whitaker Sentenced to 30 Years in Prison and Ordered to Forfeit $38.5 Million

http://www.stopfraud.gov/news/news-06302011-2.html

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Former Chief Financial Officer of Taylor, Bean & Whitaker Pleads Guilty to Fraud Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/2012/12-crm-342.html

Seattle Investment Fund Founder Sentenced to 18 Years in Prison for Ponzi Scheme and Bankruptcy Fraud

http://www.stopfraud.gov/iso/opa/stopfraud/WAW-120210.html

Former Hedge Fund Managing Director Sentenced to 20 Years for Defrauding 900 Investors in $294 Million Scheme

http://www.stopfraud.gov/iso/opa/stopfraud/ILN-111117.html

You can go here and find convictions related to the current crisis: http://www.stopfraud.gov/news-index.html

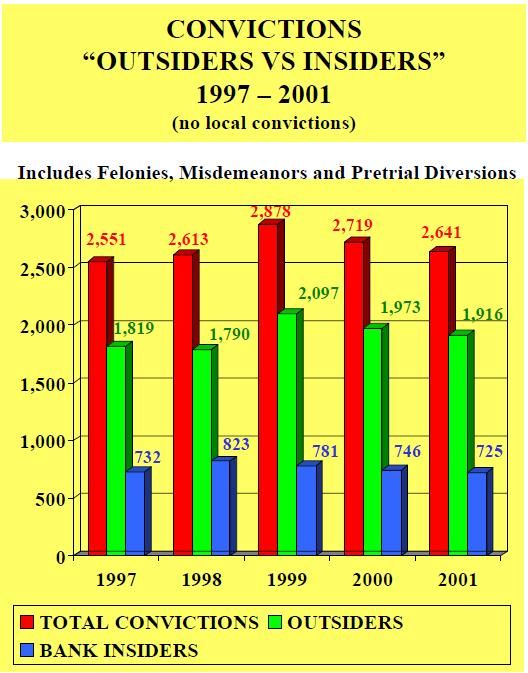

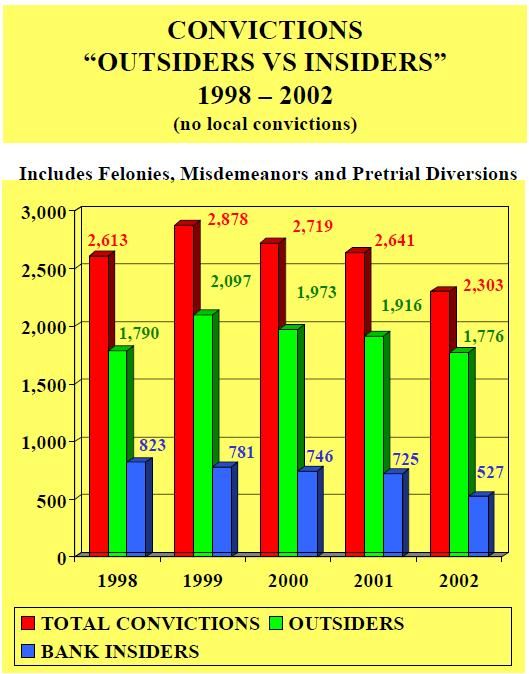

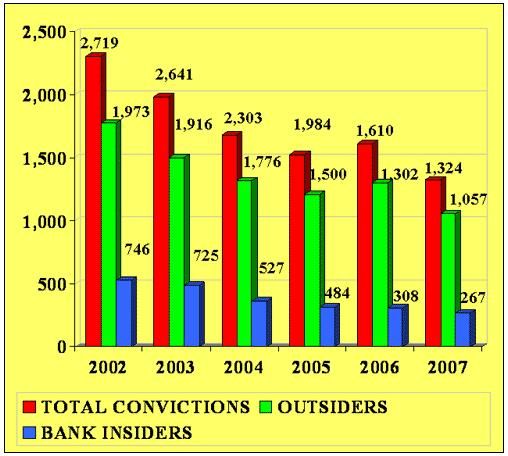

I've researched the data, including the following chart that's past around to erroneously conclude that there have been fewer convictions. It shows prosecutions, not convictions. It's also not conclusive because it doesn't state what specifically it includes and appears to be related to bank fraud. Here's the reference:

This category can refer to crimes committed both within and against banks. Defendants include bank executives who mislead regulators, mortgage brokers who falsify loan documents, and consumers who write bad checks. (Here are some recent cases of bank fraud prosecutions.)

Goldman Sachs is not a bank. Still, even if it is mostly bank fraud, it does offer more evidence of Bush's "abysmal" record, as prosecutions dropped significantly during his Presidency. The drop off is likely due to fewer financial convictions, resulting from the repeal of Glass-Steagall.

The following is from the Financial Institution Fraud and Failure Reports for each fiscal year.

http://www.fbi.gov/stats-services/publications/fiff_00-01

http://www.fbi.gov/stats-services/publications/fiff-2002

(b): Types of Subjects Convicted in FIF Cases During FY 2007*

SUBJECT TYPE NUMBER OF SUBJECTS

Legal Alien 8

Illegal Alien 20

All Other Subjects 1,038

Bank Officer 88

Bank Employee 179

International or National Union Officer 1

President 1

Business Manager 2

Office Manager 2

Financial Secretary 1

Federal Employee - GS 12 & Below 1

State - All Others 1

Local Law Enforcement Officer 1

City Councilman 1

Possible Terrorist Member or Sympathizer 1

Company or Corporation 7

Local - All Others 2

Total 1,354

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

http://www.fbi.gov/stats-services/publications/fiff_06-07/fiff_06-07

Given the charts directly above and the break out for 2007, it appears that most of the convictions were not bank executives. In fact, the majority were bank "outsiders," likely meaning more bad-check writers and document falsifiers.

Also, bank fraud is separate from corporate fraud, mortgage fraud, and securities and commodities fraud.

The following is from the Financial Crimes Report to the Public for each fiscal year:

(Note: The 2005 report does not break out securities and commodities fraud. The 2010-2011 report is the only one that breaks out financial institution fraud. All reports show corporate fraud and mortgage fraud.)

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#CORPORATE

http://www.fbi.gov/stats-services/publications/fcs_report2005/fcs_2005#MORTGAGE

_________

http://www.fbi.gov/stats-services/publications/fcs_report2006

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Securities

http://www.fbi.gov/stats-services/publications/fcs_report2006/financial-crimes-report-to-the-public-fiscal-year-2006#Mortgage

___________

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#securities

http://www.fbi.gov/stats-services/publications/fcs_report2007/fcr_2007#mortgage

______________

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#corporate

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#securities

http://www.fbi.gov/stats-services/publications/fcs_report2008/financial-crimes-report-to-the-public#mortgage

____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2009/financial-crimes-report-2009#mortgage

_____________

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Corporate

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Securities

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Financial-ins

http://www.fbi.gov/stats-services/publications/financial-crimes-report-2010-2011/financial-crimes-report-2010-2011#Mortgage

Pending cases are important because they can still result in convictions.

Luminous Animal

(27,310 posts)For now, I will believe the investigators at Frontline and also Bill Moyers who did an excellent show on this subject, as well.

Link to the Frontline piece: http://www.pbs.org/wgbh/pages/frontline/untouchables/

Link to Moyers: http://www.pbs.org/moyers/journal/04032009/transcript1.html

ProSense

(116,464 posts)Hey, I want more bankers to go to jail too, but it's patently false to say that there was not "even a single arrest or prosecution of any senior Wall Street banker" prosecuted.

Luminous Animal

(27,310 posts)people who CAUSED the meltdown. Sure, there have been prosecutions for other matters but not the very thing that has caused so many people so much pain...

FRONTLINE: These sources said that at the weekly indictment approval meetings that there was no case ever mentioned that was even close to indicting Wall Street for financial crimes.

LANNY: If you look at what we and the U.S. attorney community did, I think you have to take a step back. Over the last couple of years, we have convicted Raj Rajaratnam, one of the largest hedge fund leaders. Now, you’ll say that’s an insider trading case, but it’s clearly going after Wall Street.

FRONTLINE: But it has nothing to do with the financial crisis, the meltdown, the packaging of bad mortgages that led to the collapse that led to the recession.

.....

FRONTLINE: But no Wall Street executives?

LANNY: No Wall Street executives, if that’s how you want to define it. But Raj Rajaratnam, he’s in jail.

FRONTLINE: Insider trading case.

http://www.pbs.org/wgbh/pages/frontline/business-economy-financial-crisis/untouchables/lanny-breuer-financial-fraud-has-not-gone-unpunished/

ProSense

(116,464 posts)LANNY: No Wall Street executives, if that’s how you want to define it. But Raj Rajaratnam, he’s in jail.

FRONTLINE: Insider trading case.

More from the link:

<...>

Well, he’s a Wall Street executive. And so the reality? Well, I know that that’s not what you’re here to talk about. But the reality is, if a Wall Street executive was involved in a transaction, and on the other side of that transaction was another Wall Street executive, and they both had sophisticated lawyers and they both had sophisticated disclosure documents, as much as the conduct is reprehensible — and let me be clear here. I am personally offended by much of what I have seen. I think there was a level of greed, a level of excessive risk taking in this situation that I find abominable and I find very upsetting. But that is not what makes a criminal case.

What makes a criminal case is that I can prove beyond a reasonable doubt every element of a crime. And if you can show that you disclosed in some document that your lawyers created that the risks that were created that you felt were disclosed in some form, then I cannot prevail in a criminal case. And I have a constitutional obligation not to bring the case.

Hedge Fund Founder Raj Rajaratnam Sentenced in Manhattan Federal Court to 11 Years in Prison for Insider Trading Crimes

http://www.stopfraud.gov/news/news-10132011.html

More convictions: http://www.democraticunderground.com/?com=view_post&forum=1002&pid=2246770

Luminous Animal

(27,310 posts)Sekhmets Daughter

(7,515 posts)We have this funny system in the US, you can't retroactively prosecute crimes.

naaman fletcher

(7,362 posts)Fraud, which is lying for money, is and was illegal.

Yavin4

(35,438 posts)Under what laws should people have been prosecuted?

DeSwiss

(27,137 posts)Luminous Animal

(27,310 posts) :large

:largereteachinwi

(579 posts)who point out the lack of justice done in the wake of 2008. Many smaller fraudsters went to jail, but Charles Ferguson and William Black have been saying this for years.

http://www.sfgate.com/business/bottomline/article/Why-those-from-Inside-Job-aren-t-inside-a-prison-2473583.php

woo me with science

(32,139 posts)jwirr

(39,215 posts)fail and that if they did fail then the rest of the world would go with them straight into a world wide depression. I hope that is not true but it is a reasonable explanation.

Luminous Animal

(27,310 posts)It's a bullshit excuse.

magical thyme

(14,881 posts)The US government could, as needed, take over "too big to fail" financial institutions, install new management, break them up, clean them up, and sell them back into the private market. ![]()

Luminous Animal

(27,310 posts)WillyT

(72,631 posts)WillyT

(72,631 posts)woo me with science

(32,139 posts)Politicub

(12,165 posts)I just don't know what we can do about it.

xxxsdesdexxx

(213 posts)When the top 10 banks control nearly 80% of all banking assets we have a problem. By the way, the top 10 banks are .02% of the banks.

smokey nj

(43,853 posts)smokey nj

(43,853 posts)Here's the link to the show.

http://majority.fm/

woo me with science

(32,139 posts)xchrom

(108,903 posts)Fire Walk With Me

(38,893 posts)woo me with science

(32,139 posts)Yavin4

(35,438 posts)The Gramm–Leach–Bliley Act legalized what the banks did:

http://en.wikipedia.org/wiki/Gramm%E2%80%93Leach%E2%80%93Bliley_Act

datasuspect

(26,591 posts)better food than we'll ever eat.

they're all on the same team

you just don't do that to people you play golf with.

after all, your kids might need a coveted internship or job one day.