General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsI don't think there is anything wrong with the tax rate

Really. I mean we could move it a point or two higher sure, but that is not the problem. The problem is the "rich" don't pay taxes the way the rest of us do. They have all sorts of ways to lower the burden they should shoulder.

I think it is even easier than raising the tax rate, remove the tax deductions for the wealthy.

Flat rates, progressive. 5-10-15-20-25-30-35-40%

Certain deductions are allowed in each bracket and once you get to the top bracket there are no longer any deductions, period. You pay 40%. Done. No one making under double the poverty rate should pay any taxes, they would fall in the 5-10% bracket but would have enough deductions to make their taxes 0, deductions should include rent, daycare, utilities, and food. Once you move past that bracket into the 15% then the deductions for food should go away and so on and so forth up the progressive chain until all deductions are removed.

MannyGoldstein

(34,589 posts)And the average earner, IIRC, paid 13%.

Nye Bevan

(25,406 posts)Top Federal rate = 39.6%, plus state tax of 8.8%, plus city tax of 3.6%.

MannyGoldstein

(34,589 posts)Thanks to capital gains nonsense.

Nye Bevan

(25,406 posts)Anyone earning a salary as opposed to investment income will be paying the top 39.6% Federal rate (as well as the top local tax rates).

Chan790

(20,176 posts)I could get behind that.

Xyzse

(8,217 posts)Capital Gains is taxed low to encourage investment.

However, they really need to raise that much higher when it hits a certain mark.

What that mark is though is debatable.

hfojvt

(37,573 posts)on their income above a certain amount - not on ALL their income.

And most people do not make salaries that high. The income of the highest earners is typically capital gains and dividends. See Romney for an example.

In my view, the 90% top tax rate was a large disincentive to steal more money. Once it got taken away, CEO salaries sky-rocketed. Not because CEOs were suddenly doing more or better work, but because they now had more incentive to demand and take more of the pie.

Lurker Deluxe

(1,036 posts)hfojvt

(37,573 posts)As I remember it only 40% of long term capital gains were taxed.

Also used to have sort of a neat little deduction. The first $100 of interest and dividend income were not taxed at all.

Lurker Deluxe

(1,036 posts)The problem is the people making insane amounts of money are not paying anywhere near that. They use the capitol gains system to game the tax code and pay closer to 15% than 40%.

I suggest treating all income the same.

Nye Bevan

(25,406 posts)taxing capital gains and dividends the same as income, and simultaneously eliminating the corporate tax. The rationale for taxing dividends at a lower rate is that corporate tax has already been paid on that income, but without corporate tax a lower rate would not be necessary.

Also, corporate tax is too easily gamed by corporations playing games with allocating profits internationally. Companies spend millions in legal fees to game the system, and when they do still owe corporate tax it is passed on to the consumers who buy their products. Without a corporate tax, the billions that corporations are keeping abroad could be brought back to the US, tax-free, but as soon as any of it is actually paid to anyone (i.e. shareholders) it would be taxed at the new, higher dividend rate.

pampango

(24,692 posts)(at a 40% to 50% rate in the upper brackets, I would suggest) is an interesting idea.

To the small extent that dividends and capital gains go to middle class people, their benefit would not be effected. To the extent that corporations get to keep more of their profits, they can pay more to top executives (40%-50% tax rate), increase dividends (40%-50% tax rate for the rich, less for the middle class), pay more to their regular employees to increase their loyalty and productivity in the long run (unlikely but possible) or reinvest in the business which should boost employment.

While it is an interesting idea the key (and hard part) would be passing and maintaining a 40%-50% tax rate on all forms of income in the upper tax brackets.

Bunnahabhain

(857 posts)However I would place Pigovian taxes on any activity leading to negative externalities. Also I would back a VAT. I know Americans tend to not like VATS but if you want Euro-style democratic socialism you need to have Euro-style taxes too.

Nye Bevan

(25,406 posts)Probably will never happen, though.

Bunnahabhain

(857 posts)Of course corporations do not want them and I find that the average Joe does not want to hear talk about "negative externalities" and such so it's just hard to get any traction.

MH1

(17,600 posts)Alternative Minimum Tax, right?

The one problem with AMT (assuming I understand it correctly) is that it was not indexed to inflation. Thus it started affecting people of lower and lower incomes until it hit the middle class, then became a yearly negotiating point in Congress. (The opportunity to use it for a negotiating point is probably why it is impossible to simply fix it once.)

Lurker Deluxe

(1,036 posts)It is all crazy. It needs to be made simpe.

The problem is people game the system, if it was simler it would be harder to do.

Lasher

(27,579 posts)Or a flat tax with limited deductions.

PowerToThePeople

(9,610 posts)pnwmom

(108,977 posts)Thirteen percent for everyone.

Funny I never hear anyone on DU talking about that.

mick063

(2,424 posts)When loopholes and exceptions are taken in to account.

Corporations are being subsidized not to pay taxes.

Johnny Ready

(203 posts)Just curious how you feel about a 999 flat tax for everyone?

9% sales tax

9% income tax

9% corporate tax

PowerToThePeople

(9,610 posts)Nye Bevan

(25,406 posts)For the poor, who don't pay income tax but would owe an extra 9% on everything they bought, not so much.

Lurker Deluxe

(1,036 posts)The tax rate we have now is progressive, just like the one I laid out, where the 999 BS proposed by Goldfingers was not progressive at all.

The issue with our progressive system now is that people who make large sums of money pay lawyers to game the system to not pay their fair share of income tax. I submit that the issue we have now is not the problem of rates, it is unfunded liability because of deductions that are placed into the system by the wealthy, for the wealthy.

And capital gains tax rates.

Romulox

(25,960 posts)taxes than do the poor. In addition, most corporations pay no tax at all.

A "progressive" tax code would be a massive change from what we have now.

Lurker Deluxe

(1,036 posts)Our current tax system was designed to be progressive, however years and years of special interests have made the system what it is today.

Again, the issue is unfunded liability, people do not pay what they should because the system has been corrupted by money in government.

Johnny Ready

(203 posts)until we stop the corruption and wasteful spending (wars we don't need, weapons we will never use) the tax rate will never be a factor in true change. Raise the roof, we just jump higher.

You may have a point, S corporations that I am familiar with do have the ability to deduct most of the costs of being in business. My question is without the ability to make these deductions and resulting profit why would anyone invest 100k in opening a new business, which provides jobs and taxable income for every employee? Is the income tax from the employees and the sales tax they pay with the earnings they spend, a fair trade off for the owners deductions? I think so. We need investors who will gamble the 100k, they need incentive. It is much easier to buy 100K in Ford or Apple stock with much less risk.

I agree we could change the rates, but it seems we continue to waste the tax revenue and that is part of the problem.

Tommy_Carcetti

(43,181 posts)

NoOneMan

(4,795 posts)Math and science are irrelevant. All that matters is if you can boil it down in a salespitch. 999. Could anything be simpler? Nooo. Then could anything be more correct?

WillyT

(72,631 posts)

kentuck

(111,089 posts)Unless it is invested in jobs or production. Weath for the sake of wealth should be taxed at much higher rate. It is ass backwards.

Lurker Deluxe

(1,036 posts)So, I bought my first house in 1987. It was a HUD house and was in really bad shape, through years of hard work and some money being thrown into it I sold it in 1995 and made $20K, and you think that should be taxed higher??

I have no problem with it being thrown into my regular earnings and moving into a different bracket but taxing it higher just to make it higher is crazy. So, how do you intend to treat losses?

Wealth is what it is, savings is wealth, as is any stock or any other investment including your homestead ... taxing that higher than regular income would hurt the wrong people.

The problem is deductions, the rich can afford to hire people to lobby for them and then once put into place take advantage of them.

bhikkhu

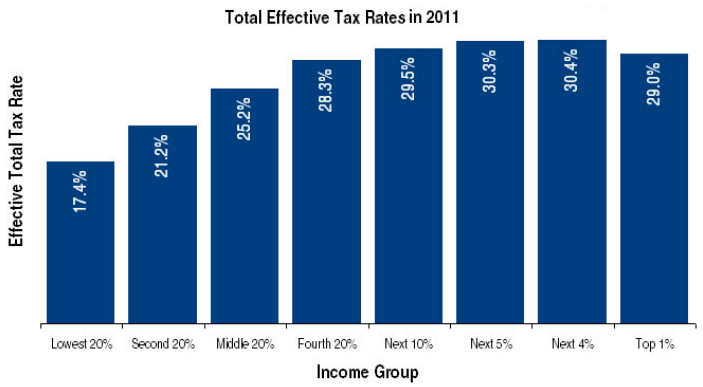

(10,715 posts)Overall, if you look at the total picture, it is fairly balanced:

It would look different, and even more balanced, if you accounted for the majority of rent as paying the majority of property taxes, instead of as a tax paid by the wealthy. But in talking about tax rates, it is important to look at the whole picture - sales tax, property tax, state tax, etc. The poor definitely pay their share, as does everyone.

Of course, a couple of percentage points on the bottom makes a much bigger impact to more people than a couple points on the top.