General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forumsnotadmblnd

(23,720 posts)Kinda makes one wonder why anyone would want to be rich, doesn't it?

democratisphere

(17,235 posts)as they did previously.

madokie

(51,076 posts)somewhere in the 80% range would be about right in my way of thinking. Hell even when they were paying 90% they still had more money than they could spend.

No one should be allowed to hoard money like so many of the rich do especially when they get those riches off the backs of the average Jane and Joe.

Major Nikon

(36,827 posts)At one time the top marginal rate was 90%, but this means they only paid 90% on income that exceeded the bracket, and this was after deductions that heavily favored the rich.

Between 1969-1972, Nixon paid only 7% of his income in taxes despite making over $1 million.

All taxes should be progressive, but in reality none are, including federal income tax if you consider investment income is taxed at the middle class rate. The top marginal rate should be between 95-99% including (and especially) investment income. AMT should also halt all deductions above a certain threshold.

hfojvt

(37,573 posts)although for myself, I would allow the real estate deduction. The White House was his principle residence, but it was also a temporary one.

And looking at THAT loophole today, his gain on that sale would not be taxable (or at least $250,000 of it would not be, his $142,000 gain in 1969 is equivalent to $900,000 today) even IF he did NOT buy another residence.

I remember from my senior year of high school in 1980 that the top rate did not kick in until $300,000 income, which would be $848,000 today. And today our top rate kicks in at a much lower income.

The really amazing thing to me is seeing the Wall Street Journal of 1973 NOT being part of the Right Wing Noise Machine.

Imagine today's WSJ writing an editorial like this

"With the Watergate story unfolding, American confidence in government again was shaken. A Wall Street Journal editorial on November 13 spoke to the heart of the issue:

It does seem unseemly that the President of the United States should almost completely escape taxation. Since he is in some way supposed to set a national example, a case can be made that he ought to bend over backward to make sure his taxes are not too low.

The editorial then called for a strengthening of the minimum tax to close loopholes. The editorial concluded with:

There is a great deal to be said for it [the minimum tax] on the basis of simple equity. Considering what the average citizen pays, a President earning $200,000 should pay more than a few hundred dollars in tax. And so should anyone else earning $200,000."

It's like I am looking at the good old days, and the United States had a "free press" instead of an M$M catapaulting propaganda for the rich.

How much we have lost...

JHB

(37,160 posts)...pay attention to the income levels tax brackets used to affect:

Adjusting for inflation, before the Kennedy-era tax cuts typically over (sometimes well over) half the brackets affected incomes over $250,000, with about 40% affecting incomes above $500,000. Inflation eroded those levels (the brackets were not indexed for inflation) until the late 70s, when the top bracket dipped those into the single digits. Reagan's tax cuts cut even those further, eliminating brackets starting at over 500K entirely. And at the end of his term, the top bracket kicked in at roughly the median income, not anything that could be considered high (BushI went back on his "read my lips" line because these were unsustainably low).

It seems, to paraphrase Leona Helmsley, that income tax progressivity is for little people.

In case you're wondering why I picked 1942 as a start date, it's purely for readability, thanks to my graphics skills or lack thereof. I need to figure out how to pull off skipping some intervals, because some of those inflation-adjusted brackets reach higher. Much higher:

okaawhatever

(9,462 posts)that followed the only other period of equal economic inequality. During that time, not only did the wealth consolidate, there was a big lack of funding for the government.

Igel

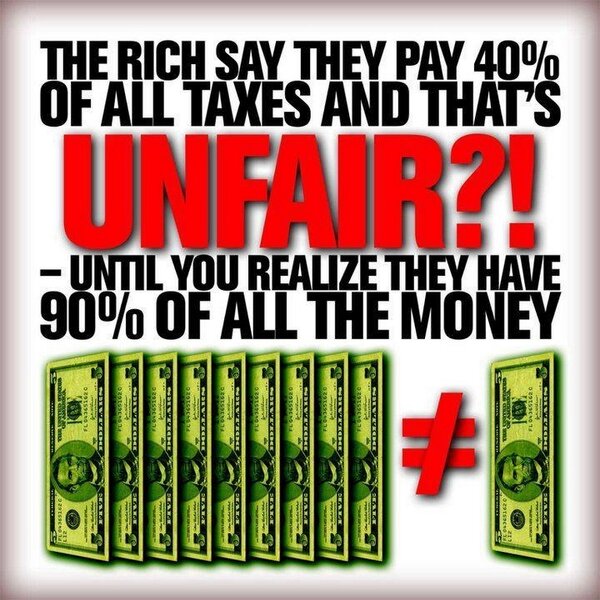

(35,309 posts)Then again, the OP also botches it: the rich pay 40% of income taxes but have most of the wealth.

The problem is that the percentage of income taxes they pay is about the same as their percentage of all income. That they have wealth sitting around is irrelevant to the first claim--my parents paid low income tax on their reitirement income even though they had a $200k house, two cars, a couple of IRAs and a couple hundred thousand in the bank (after cashing out all the savings bonds my mother had).

There are counter-arguments to be made--that the income taxes don't include payroll taxes, that 10% of $10k in income is different in effect on a family's living standard from the effect of 10% taxes on $100k or $1 million.

Then again, the idea that wealth is something that should be taxable all by itself is also a bit odd--my neighbors didn't lose anything when their houses went from $140 to $90k in worth any more than they gained when their houses went from $120 to $140k in 1996 or from $90k to $110k in 2013. Unless they were busy selling them at the time--then they had a loss (or gain). They've gained wealth and lost it (only to gain it back) and it has, properly, no tax implication. It would suck for a family making $50k a year to suddenly have to pay income taxes on an extra $20k one year, then two years later lose $50k in wealth with little effect on their income taxes, and 3-4 years after that pay taxes on another $20k as their houses regained value.

LiberalFighter

(50,928 posts)LiberalFighter

(50,928 posts)NYC_SKP

(68,644 posts)You have to note the name of the image file and where you saved it, ie desktop or documents, etc.

![]()

Adrahil

(13,340 posts)MissMillie

(38,557 posts)payroll taxes.

When payroll taxes are figured into the mix, the lower income earners pay more of a share of their income than the filthy rich.

SoapBox

(18,791 posts)Just a small print detail that the rich don't want to talk about.

subterranean

(3,427 posts)all of which are regressive.

Sgent

(5,857 posts)if anything I would think they would be flat taxes (same percentage based on worth), or possibly a little progressive with homestead exemptions taken into account.

subterranean

(3,427 posts)but as a percentage of income, they tend to be slightly higher for middle- and lower-income households compared to the very wealthy. So in that sense they can be considered regressive. Homestead exemptions do offset that effect in some states.

that makes sense.

I was thinking of it as an asset tax not an income tax.

Two other points:

1) In some states the homestead exemption can be significant. For instance in Louisiana you have 75,000 exemption and freezes on those 65+. Given an average home price of probably 150,000-200,000 that's huge.

2) Renters do get hit hard on their implicit property taxes paid as they do not get a homestead exemption.

Octafish

(55,745 posts)Pruneface led the charge to drop corporate profits tax from 50-percent to 28-percent. Many Democrats and almost all the pukes have tripped over themselves to keep it that way.

Then, there's their "work" in service of those who own stocks and other financial instruments. The capital gains tax once stood at 50-percent. That's at 15-percent.

And the rich complain their life is tough. How many of them commit suicide from having too much money?

antigop

(12,778 posts)Octafish

(55,745 posts)People have become too numb to notice and too dumb to notice.

antigop

(12,778 posts)Enthusiast

(50,983 posts)Proud Liberal Dem

(24,412 posts)And that's not even taking into account all of the ways they dodge taxes and "shelter" their income.

B Calm

(28,762 posts)valerief

(53,235 posts)freshwest

(53,661 posts)Is it cash flow?

Is it investment or property that generated that cash flow?

Is it the ability to live independently of the rest of society - literally?

Or is a ratio of their cash flow, non-fungible assets, percentage of control over corporations, amount of land owned by mortgage or outright, or is it something else?

Many people with land, businesses or stocks don't have much cash flow. And that's how taxes are calculated to be paid.

A person is not expected to seel off thsir home, business, cattle or whatever else is a long-term, low-yield investment every year to pay the tax man.

Taxes from earned income come out front and are inescapable, putting the worker, even if that person is a highly paid professional, at a strong disadvantage with the businessman or investor. Because they do not have that money to invest or pay off debt during the year, while will increase their debt level and deny them the chance to invest or make other changes to better themselves, with the greater harm to the lower paid workers.

With all of their dollars on the table for inspection and payment up front, instead of being allowed to generate jobs for others or opportunity for the worker, they lose the value of their work and increase their debt.

Whereas others have their money in their hands all year and it is seen as future wealth by a gamble on stocks, business or property taxes and to be more valuable to the country as a whole, and more prestigious. In a fashion a contract worker has more flexibility to manage their 'wealth' that is really just cash flow.

The system favors certain kinds of wealth and either cluelessly or by design, goes hard against the worker or those with less money. The liberal system was meant to mitigate that without attacking the root, trying to bring out about suffiicient wealth distribution to let workers overcome the challenge of being in the system by virtue of paying their retirement and tax burden upfront to benefit all of their class.

The problem we are confronted with by my thinking, is that those who were advantaged, no longer see themselves as part of the whole and some who were nevee advantaged now want out of the system and that hss caused a collapse of revenue to support the whole.

We need a basic standard for all, and then tax reform that takes into account all the advantages that the wealthy do recieve from the system, which they currently deny their need for thus their excuse not to pay taxes. I don't know if there is any truth in that, at least is has not been so in may life, and I believe they have gamed the system to 'socialize their losses and maximize their profits' under their arrogant notion that they really created the system and it's time they pulled out their profits. No, they should not be able to do that.

I'm sure someone else has a much explanation for what I've tried to say, about how the wealth goes up in a way that voters can understand. The older expressions aren't working.

people making over $200,00 at the 80% rate...AFTER disallowing All deductions...and counting everything they get as income.

Glassunion

(10,201 posts)I'm not rich, but far from poor. I have no problem paying my taxes. This year, all state, federal and local taxes combined I'm paying about 41%. Why can't they?

Triana

(22,666 posts)I wish they all had as much common sense as you.

SoCalDem

(103,856 posts)75 at the very least.. ALL of it..even the "carried interest" & investments..

and their money should be taxed when "passed down" too..

gollygee

(22,336 posts)I was thinking, "Yeah, and how much of the money do they have?"

LOL

davidthegnome

(2,983 posts)It's time to get out the torches and pitch forks...

Dyedinthewoolliberal

(15,574 posts)said Leona Helmsley.![]()

![]()

Jack Rabbit

(45,984 posts)Last edited Fri Jan 24, 2014, 02:12 PM - Edit history (1)

And even that's giving them a break.

Of course, 67% leaves room to raise it to 90% if they continue to prove as worthless at job creation and paying living wages as they've been for the last 30 years.

Spitfire of ATJ

(32,723 posts)If you total all that you have with the house and everything in it and your vehicles and life insurance and your business (if you have one) then you are worth a million so the Dems are gonna raise your taxes.

This leads some farmer to believe he's part of the 1% along with the Dupont Family.

The FOX "News" audience keeps hearing that business is going broke under Obama. Tell one of them Wall Street is breaking records and they refuse to believe it. They can not visualize someone making the same amount in five minutes as they make in a year.

Another talking point from the Right is to say, "Obama GOT his tax increase and it did NOTHING." which also flies in the face of facts. The Bush Tax Cuts on the top were allowed to go back to Clinton Era levels and despite the predictions that the economy would collapse overnight it turned out a 3% change wasn't even felt by the wealthy and it made a huge dent in the deficit.

obxhead

(8,434 posts)but that's all I have.

No house

No savings

No life ins

and I couldn't even fill my car with belongings that have any monetary value, let alone a house.

For sale: 2004 Honda Element. First million takes it, I'll even change the oil and fill the tank upon transfer of title.

Spitfire of ATJ

(32,723 posts)They want to return to the days when only wealthy land owners could vote.

obxhead

(8,434 posts)They want to return to a past that will lead to a future where they are filthy rich.

It will never happen, but they will fight (the wrong way) for a dream that will never be.

Spitfire of ATJ

(32,723 posts)Keep in mind that when Dubya became President I had forgotten that I used to yell at my TV.

lumberjack_jeff

(33,224 posts)Vincardog

(20,234 posts)GROSSLY under-taxed.

airplaneman

(1,239 posts)obxhead

(8,434 posts)we can discuss the fairness of taxes.

Until then they can go fuck themselves.

WillyT

(72,631 posts)fleabiscuit

(4,542 posts)Imagine all the sniveling that would take place if all forms of compensation was considered "Income" and taxed as such.

N_E_1 for Tennis

(9,722 posts)This is not all by any means a complete list.

Roads. Maintained by some government.

How do those big trucks get to the store?

Let the little people run into potholes, we need to sell more tires, wheels, etc.

Fire. Let it burn?

Your goods are at stake. Run ya might get burned, sorry I forgot...

In league with the insurance companies.

Rail. Once again, maintained by some government.

Get your goods to the public. Forget the accidents, spills of toxic waste.

You'll pay for it. You the little guy, not me.

Police. To protect your precious stuff. So you can rip us off...oh yea so you can create jobs, sorry.

And don't freaking forget. They keep those nasty protesters away. Don't want anyone to know we don't pay a living wage.

Taxes, we don't need your taxes. We are all supreme, oh yea they got those too!

Any need for the sarcasm card?

Iggo

(47,552 posts)TNNurse

(6,926 posts)bkanderson76

(266 posts)in this country pay more taxes? They still happen to be the richest people in this country.

RVN VET

(492 posts)This, my friends, is why we need pitchforks, torches, and gallows.

No? Gallows are a step too far?

Well, let's think about it: that 90% of the money is not enough for them. They want -- and are getting ready to take -- more. And if we wind up with less than 10% of the money, we won't be able to buy pitchforks or fuel for torches or wood (and rope) for gallows. That may not be a primary reason for their grabbing at some of our 10% -- but they'll nod affirmatively if asked whether they think it's a perfect unintended consequence.

They own 90% and pay 40%. And they want to pay less and less and less. Food Stamps? Let 'em starve. Social Security? Let 'em work 'til they drop dead. Medicare? Let 'em die if they can't afford doctorin'. We (the owners of the U.S.) can't afford all that "Nanny State" garbage. And the so called "poor people" actually have refrigerators (!) so they are not "suffering." (Not enough, anyway. There's room for way more suffering before they shrivel up and die; and when they die, they thus decrease the surplus population.)

Saint Carlin was right on the money: they own us. But what he was too kind to reveal was this other truth: they don't want us around. Once they figure out how to squeeze wealth out of the tired and depleted Earth without our labor, they will wish us away -- saving a few for servants and forcing the rest to wander the few open stretches of land, semi-comatose, like the starving Irish during the Great Starvation which their British Overlords, foreshadowing the duplicity of the GOP's Frank Luntz, called the Great Famine.

ReRe

(10,597 posts)... but one thing's for sure: If their lips are moving, odds are they are speaking a bold-faced lie. You can take that to the bank. Poor whiney-assed babies. And I bet you never heard one of them EVER count their blessings. And you can also bet the only charitable donations they give are to one of those 501c3 or 4s whose money goes straight to the Republicans to elect their man in Congress. And they don't go down to the soup-kitchen to help serve the poor and the homeless. They will regret ever saying those words when the hoards come climbing over the fence and breaking down their doors. They need to be taxed 60-70%, and then they would be crying for the good old days when they only had to pay 40%. ![]()

Todays_Illusion

(1,209 posts)A good start could be, begin increasing that min. wage, twice a year until it is double today's rate.

defacto7

(13,485 posts)75% above 1 million.

50% estate tax at death above $5 million, 90% estate tax at death above $20 million. 99% estate tax above 250 million. That will keep the wealth balanced and working for everyone, not just wealthy families.

under that is negotiable.

jimlup

(7,968 posts)to make up for all of the government infrastructure that benefited them in accumulating their wealth.