General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsLet banks fail: Icelandís plan looks to be working

Let banks fail: Iceland’s plan looks to be working

Bloomberg News | January 27, 2014

A cyclist passes an Icelandic national flag hanging in a popular shopping

street in Reykjavik, Iceland. Paul Taggart/Bloomberg

While the euro area grapples with record joblessness, led by more than 25 percent in Greece and Spain, only about 4 percent of Iceland’s labor force is without work. Prime Minister Sigmundur D. Gunnlaugsson says even that’s too high.

“Politicians always have something to worry about,” the 38-year-old said in an interview last week. “We’d like to see unemployment going from where it’s now — around 4 percent — to under 2 percent, which may sound strange to most other western countries, but Icelanders aren’t accustomed to unemployment."...

...Of creditor claims against the banks, Gunnlaugsson says “this is not public debt and never will be.” He says his main goal while in office is “to rebuild the Icelandic welfare state.” ...Successive Icelandic governments have forced banks to write off mortgage debts to help households. In February 2010, 16 months after Kaupthing Bank hf, Glitnir Bank hf and Landsbanki Islands hf failed, unemployment peaked at 9.3 percent. The rate was 4.2 percent in December, according to Statistics Iceland. In the euro area, unemployment held at a record 12.1 percent in November, Eurostat estimates....

MORE

http://business.financialpost.com/2014/01/27/let-banks-fail-icelands-plan-looks-to-be-working/

orpupilofnature57

(15,472 posts)A Simple Game

(9,214 posts)svpadgham

(670 posts)These banksters are all about letting the free market work things out until it's their asses on the line.

rurallib

(62,413 posts)very enlightening.

Note also that they are increasing welfare while other Nordic countries are cutting it.

BelgianMadCow

(5,379 posts)the unmentioned revolution. I follow news rather closely yet had very little idea what he was on about.

And that's still the case for many, many people. Thanks for breaking the silence.

mackerel

(4,412 posts)to believe this was the smartest move Iceland has ever made.

AnneD

(15,774 posts)most Governments basically covered the banks debt but did not institute any real reform and the debt has been passed on to the innocent public. Basically, the banks are foisting their debt onto the public and frankly, the public doesn't owe the debt. Let them fail. Haul those responsible into court and let them face jail time. That will give those banks the corporate equivalent of a death sentence.

BelgianMadCow

(5,379 posts)of banks, of "countries" (truth is, "Greece" = german, french and greek banks) and, given LIBOR and similar manipulative schemes (mortgage fraud), it could be applied to a LOT of debt.

Which would free us from debt slavery (as brought upon entire people by the IMF and other troikans), and would constitute a modern day debt jubilee of the kind the Bible calls for every 70 years. Steve Keen, the economist that DOES include banks in his modeling and who predicted the crisis, also advocates for one.

AnneD

(15,774 posts)am in favor of a Jubilee, for much the same reasons.

MisterP

(23,730 posts)AnneD

(15,774 posts)lemon socialism but have heard the quote.

Baclava

(12,047 posts)how many banks do they even have?

a dozen?

BelgianMadCow

(5,379 posts)

There are several reasons why Iceland hasn't been repeated yet. But population size or number of banks aren't among them.

Information, perhaps.

solarhydrocan

(551 posts)Do the properties of banking change with the scale?

I doubt it.

Baclava

(12,047 posts)Iceland had to obtain emergency funding backing from the IMF and many European countries in November 2008 to keep afloat.

I doubt there'd be anyone there to support our economy while we restructure

geek tragedy

(68,868 posts)work here.

Take the fallout from Lehman, multiply it by ten, and that's what would have happened if Citigroup were allowed to simply fail without any kind of orderly process.

Oh, and it would have been bought at a firesale price by JPM and Jamie Dimon.

sabrina 1

(62,325 posts)See the huge bonuses our 'failed' bankers are getting. Rewards for their success.

Iceland clearly didn't get the message, they were supposed to turn into a third world country where workers would work for low wages so Corporations could make more profits among other things, make the people desperate so they'll settle for anything.

But Wikileaks caught them off guard, the Wall St crooks when they leaked the documents on Iceland's Banks and refused to take them when they were threatened.

Whistle Blowers, a necessity to any democracy. Had those documents not been leaked Iceland would be in the same desperate situation as the rest of Europe.

pampango

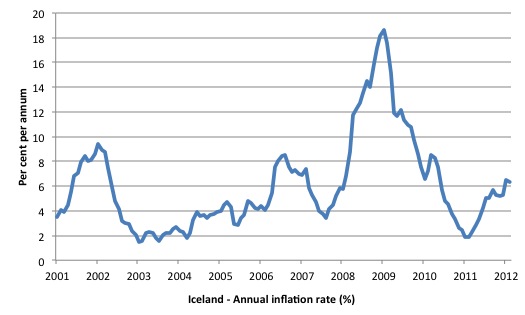

(24,692 posts)"But we can't forget who's paying for all that - it is the citizens in Iceland, because inflation doubled while salaries stayed the same. We don't pay with high unemployment, but with lower salaries," Omarsson added.

"I would not recommend Cyprus to leave the euro now, even you can wonder in hindsight if it was reasonable to join. Rather, get the capital controls lifted so domestic payments can work again properly, sit down and figure out what to do to shift the burden from locals who lost a lot in a very unfair manner to a more equitable solution," Magnusson said.

http://euobserver.com/economic/119718

Iceland becomes first European country to sign free trade agreement with China

Iceland on Monday became the first European nation to strike a free trade deal with China, offering hope for its recession-battered economy while giving Beijing a leg up in its drive for expanded influence in the Arctic.

The China-Iceland free trade pact will lower tariffs on a range of goods and is expected to boost seafood and other exports from the remote Nordic state to the world’s second-largest economy.

http://www.washingtonpost.com/business/iceland-set-to-become-first-european-country-to-sign-free-trade-agreement-with-china/2013/04/15/6282da48-a5b4-11e2-9e1c-bb0fb0c2edd9_story.html

AnneD

(15,774 posts)quantitative easing with high unemployment AND lower salaries. Explain to me again how what the Feds did was better. I think I missed something (actually I don't think I did). And we have inflation to boot.

edited to add...The lesson I learned about Cyprus was not to keep much money in the bank.

pampango

(24,692 posts)Republicans are, of course, the big deficit hawks and push 'austerity' budgets as a way to attack the safety net. The fiscal impact "austerity budgets" is to slow the economy down, increase unemployment and lower wages (all pretty typical republican goals). The Federal Reserve, through quantitative easing, has been increasing the money supply which stimulates the economy (and runs the risk of causing inflation). There has been a 'war' between the contractionary effect of fiscal policy and the stimulative effect of monetary policy.

Paul Krugman consistently posts that worries about inflation, which republicans often cite as a reason for 'austerity' budgets, is misplaced in the US and that we have had little inflation in recent years.

I did not mean that 'what the Feds did was better', just that no solution is painless. Iceland's inflation was over 10% for a while, peaking at around 18%. That does not mean that what our government did was 'better', just that Icelanders paid a price for their solution even if it was a more acceptable price.

Rex

(65,616 posts)Now all we have is a corporate owned government that throws the occasional bone to the working poor.