General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe ROBS Act

Truth in advertising, courtesy of Mr. Jim Hightower, Democrat of Texas:

The ROBS Act

Wednesday, 04 April 2012 13:13

By Jim Hightower, Truthout | Op-Ed

EXCERPT...

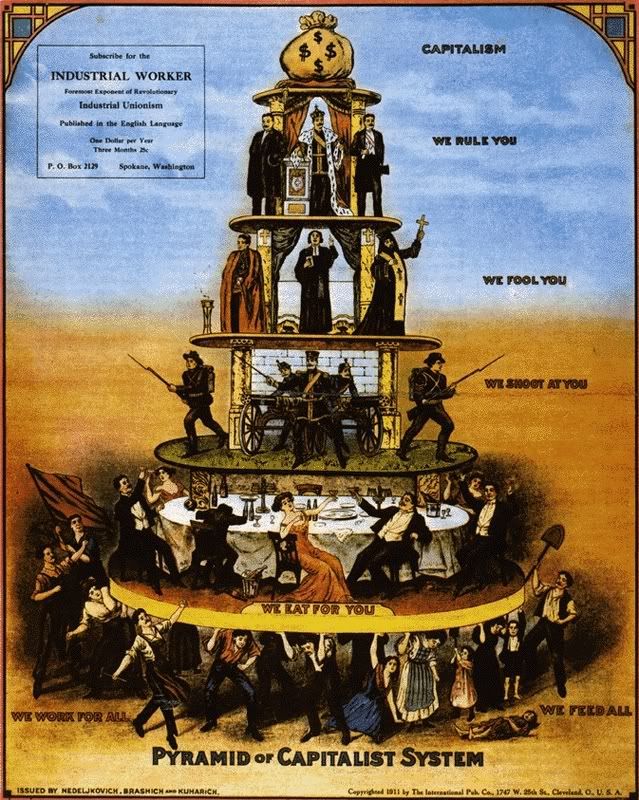

Clucking with sympathy, Congress' tea party Republicans have rushed to the side of these poor, rich financiers, pledging to unshackle them from "burdensome" regulations. Serving Wall Street is not all that popular these days with voters, however, so the Repubs and their Democratic allies have committed their own fraud in order to pass this bill, deceptively titled it the "JOBS Act" (even though it doesn't actually create any jobs).

Then they pushed it in the name of small businesses (even though they quietly defined "small" as a billion dollars a year in sales). In fact, the accent on the JOBS acronym should be on "B.S." Will it surprise you to learn that the word "jobs" isn't even included in the title? Instead, JOBS stands for "Jump-start Our Business Start-ups."

Alarmingly, the so-called "onerous" regulations that Congress eliminated primarily are the extremely useful financial disclosure rules passed a decade ago to prevent another Enron scandal.

The GOP House even tried to free financial hucksters from having to tell potential investors the names of the executives running the company and — get this — from providing such essential investor information as a description of what the company does and accurate accounting of its financial condition!

CONTINUED...

http://truth-out.org/opinion/item/8312-the-robs-act

Anyone remember the Savings and Loan bailouts?

It was the largest financial fraud in history, until the Great Wall Street Bailout of '08?

How about the next one? Anyone give a damn?

sabrina 1

(62,325 posts)From your last link:

Paulson, according to a celebratory 2006 BusinessWeek article entitled “Mr. Risk Goes to Washington,” was “one of the key architects of a more daring Wall Street, where securities firms are taking greater and greater chances in their pursuit of profits.” Under Paulson’s watch, that meant “taking on more debt: $100 billion in long-term debt in 2005, compared with about $20 billion in 1999. It means placing big bets on all sorts of exotic derivatives and other securities.”

In almost all of the documentaries of the Global Meltdown, it was made clear that he played a major role, and his desperation to get the bailout seems more to cover his gambling debts, than anything that was meant to 'save' the country from a collapse he contributed to.

Octafish

(55,745 posts)Seeing how Congress and the Executive are so shy about such things, it's nice to see someone with the guts to name names and state what's what (and I don't like Mayor Bloomberg's politics):

How Paulson Gave Hedge Funds Advance Word of Fannie Mae Rescue

By Richard Teitelbaum - Nov 29, 2011 12:46 PM ET

Bloomberg Markets Magazine

EXCERPT...

A Different Message

At the Eton Park meeting, he sent a different message, according to a fund manager who attended. Over sandwiches and pasta salad, he delivered that information to a group of men capable of profiting from any disclosure.

Around the conference room table were a dozen or so hedge- fund managers and other Wall Street executives -- at least five of them alumni of Goldman Sachs Group Inc. (GS), of which Paulson was chief executive officer and chairman from 1999 to 2006. In addition to Eton Park founder Eric Mindich, they included such boldface names as Lone Pine Capital LLC founder Stephen Mandel, Dinakar Singh of TPG-Axon Capital Management LP and Daniel Och of Och-Ziff Capital Management Group LLC.

After a perfunctory discussion of the market turmoil, the fund manager says, the discussion turned to Fannie Mae and Freddie Mac. Paulson said he had erred by not punishing Bear Stearns shareholders more severely. The secretary, then 62, went on to describe a possible scenario for placing Fannie and Freddie into “conservatorship” -- a government seizure designed to allow the firms to continue operations despite heavy losses in the mortgage markets.

Stock Wipeout

Paulson explained that under this scenario, the common stock of the two government-sponsored enterprises, or GSEs, would be effectively wiped out. So too would the various classes of preferred stock, he said.

The fund manager says he was shocked that Paulson would furnish such specific information -- to his mind, leaving little doubt that the Treasury Department would carry out the plan. The managers attending the meeting were thus given a choice opportunity to trade on that information.

CONTINUED...

http://www.bloomberg.com/news/2011-11-29/how-henry-paulson-gave-hedge-funds-advance-word-of-2008-fannie-mae-rescue.html

Crooked as the day is long, that lot.

Thank you, sabrina 1, for giving a damn.

sabrina 1

(62,325 posts)But we have whistle-blowers to prosecute, and I guess that leaves little time to go after the Economic and War criminals.

I wonder how this period will be viewed in history? So few on the right side, at least very few in elected office.

Thanks for all your great OPs on DU. You are one of the reasons why people are still here ![]()

Oilwellian

(12,647 posts)Octafish

(55,745 posts)Matt Taibbi puts it into words better than most:

Why Obama's JOBS Act Couldn't Suck Worse

Matt Taibbi

Taibblog

EXCERPT...

The law also rolls back rules designed to prevent bank analysts from talking up a stock just to win business, a practice that was so pervasive in the tech-boom years as to be almost industry standard.

Even worse, the JOBS Act, incredibly, will allow executives to give "pre-prospectus" presentations to investors using PowerPoint and other tools in which they will not be held liable for misrepresentations. These firms will still be obligated to submit prospectuses before their IPOs, and they'll still be held liable for what's in those. But it'll be up to the investor to check and make sure that the prospectus matches the "pre-presentation."

The JOBS Act also loosens a whole range of other reporting requirements, and opens up stock investment not just to "accredited investors" but to the general public (giving official sanction to the internet-based fundraising activity known as "crowdfunding"

But the big one, to me, is the bit about exempting firms from real independent accounting for five years. This has to be one of the more incredible provisions in the history of federal regulation.

CONTINUED...

http://www.rollingstone.com/politics/blogs/taibblog/why-obamas-jobs-act-couldnt-suck-worse-20120409

Remember when we were told the Bush tax cuts were temporary. It's like that.

progressoid

(50,008 posts)

Octafish

(55,745 posts)Here's that guy's work in a previous incarnation:

What David Stockman said about Trickle Down.

Same as it ever was. Same as it ever was. Thanks, progressoid, for giving a damn!

nashville_brook

(20,958 posts)in "backrooms" where these deals are made.

this is wht the superpower of invisibility would be way cooler than flying.

Octafish

(55,745 posts)To keep such things secret...and to find out such secrets.

Know your BFEE: Spawn of Wall Street and the Third Reich

Regarding superpowers and democracy. Oh yeah. Invisibility would go a long way to restoring it. Didn't it used to be called "Transparency"?

whatchamacallit

(15,558 posts)But I won't because it's the kind of shout-out that'll get me banned.

Octafish

(55,745 posts)...when, as a candidate, he left the campaign trail to fly back to Washington to vote for Bush's bank bailout. I thought, "Gee. Maybe there's more to the situation than what it seems."

No, Len Hart, the Existentialist Cowboy reminds us, it's the same old same old:

"A man who does not know the truth is just an idiot. But a man who knows the truth and calls it a lie is a crook!" -- Bertolt Brecht

The thing is, there was a lot more to the story at the time.

And that's why we need to draw this to the attention of all Democrats and DUers -- and to the attention of all Americans who give a damn. We the People -- the 99-percent plus the 1-percent -- are running out of time. Every day wasted, makes it that much more difficult to fix our nation's problems, most of which can be fixed through progressive taxation and economic justice, once main planks of the Democratic platform.

Uncle Joe

(58,483 posts)Thanks for the thread, Octafish.

Octafish

(55,745 posts)It's hard to make this stuff up.

In Wake of Groupon Issues, Critics Wary of JOBS Act

By MICHAEL RAPOPORT

Wall Street Journal

A little-noticed provision in the new JOBS Act would allow companies to iron out disagreements with regulators behind closed doors before they go public—a provision that might have prevented investors from finding out about Groupon Inc.'s GRPN -2.05% early accounting questions until after they had been resolved.

The provision, part of the bill passed by Congress and expected to be signed by President Barack Obama this week, would enable companies to submit confidential drafts of their initial-public-offering documents to the Securities and Exchange Commission before they file publicly.

Critics say that measure would allow a company like Groupon, which had well-publicized disagreements with the SEC over its accounting last year, to resolve such issues under the radar, without investors learning of them until later although still before any IPO.

SNIP...

"I find it amazing that Congress would allow any firm to work behind closed doors on any accounting or auditing issue," said J. Edward Ketz, an associate professor of accounting at Penn State University. "We learned a long time ago that sunshine is the best antiseptic."

CONTINUED...

http://online.wsj.com/article/SB10001424052702304023504577317932455874856.html

PS: You are most welcome, Uncle Joe. I very much appreciate that you give a damn about justice.

sabrina 1

(62,325 posts)Critics say that measure would allow a company like Groupon, which had well-publicized disagreements with the SEC over its accounting last year, to resolve such issues under the radar, without investors learning of them until later although still before any IPO.

The reason it's 'hard to make this stuff up' is because most people are not corrupt or, there would be consequences for the average person if they even tried. But for those who are corrupt, it's apparently easy to keep on doing what they were doing before, because there are never any consequences for them.

whatchamacallit

(15,558 posts)Octafish

(55,745 posts)This wasn't on tee vee. Yet, it's important to know. Wall Street didn't get everything its owners wanted.

That Peculiar Odor...

A Jobs Bill for Wall Street

by ROBERT HUNZIKER

CounterPunch MARCH 29, 2012

EXCERPT...

Imagine the facial expressions of Jeffrey Skilling, former CEO of Enron, who is serving a 24-year sentence in federal prison for a $60 billion fraud, and Bernard Ebbers, former CEO WorldCom, who checked into federal prison in 2006, serving a 25-year sentence for an $11 billion accounting fraud. They’re probably smiling ear-to-ear for the first time since behind bars, knowing Congress has opened the doors for them, assuming they get out early on good behavior. The capital markets need some rambunctious CEOs for job creation, and now it will be much easier to pocket funds from less-sophisticated investors. Wow! This will be a bonanza for guys who have fuzzy reputations.

Well, on the other hand, maybe Jeffrey and Bernie should consider stepping into the hedge fund business because the new JOBS Act opens the spigots up for creative upstart hedgies and the established hedgies raising new capital. Under existing law, private hedge funds are only allowed to market to a small defined group of sophisticated investors with whom they have a pre-existing relationship. However, under the new bill, hedge funds will be able to sponsor sporting events and/or begin advertising their funds in print, promoting their wherewithal to the general public at large. Thus, overturning a ban of marketing to the general public that dates back to the Securities Act of 1933.

The JOBS Act definitely makes it easier for hedge funds to raise capital from the more naïve general public, but one has to wonder if the new legislation will actually help create a lot of jobs, other than openings for Jeffrey and Bernie, and how about Madoff too, if, and when, they change colors from bright orange to subdued dark blue.

SNIP...

And, more authoritatively yet, according to Rep Spencer Bachus (R.Ala.), who famously, or rather infamously, purchased ‘puts’ on the market expecting it to crash, after secretly meeting with Treasury Secretary Paulson in 2008, in support of the bill, “You take the risk out, you take out the reward.” If you have any doubts about the sanctity of this new bill, this is extremely comforting, coming from a professional investor who is also a member of Congress.

CONTINUED...

http://www.counterpunch.org/2012/03/29/a-job-bill-for-wall-street/

Thanks, whatchamacallit. Very much appreciate that you give a damn.