General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsEconomists Say We Should Tax The Rich At 90 Percent

America has been doing income taxes wrong for more than 50 years.All Americans, including the rich, would be better off if top tax rates went back to Eisenhower-era levels when the top federal income tax rate was 91 percent, according to a new working paper by Fabian Kindermann from the University of Bonn and Dirk Krueger from the University of Pennsylvania.

The top tax rate that makes all citizens, including the highest 1 percent of earners, the best off is “somewhere between 85 and 90 percent,” Krueger told The Huffington Post. Currently, the top rate of 39.6 percent is paid on income above $406,750 for individuals and $457,600 for couples.

Fewer than 1 percent of Americans, or about 1.3 million people, reach that top bracket.

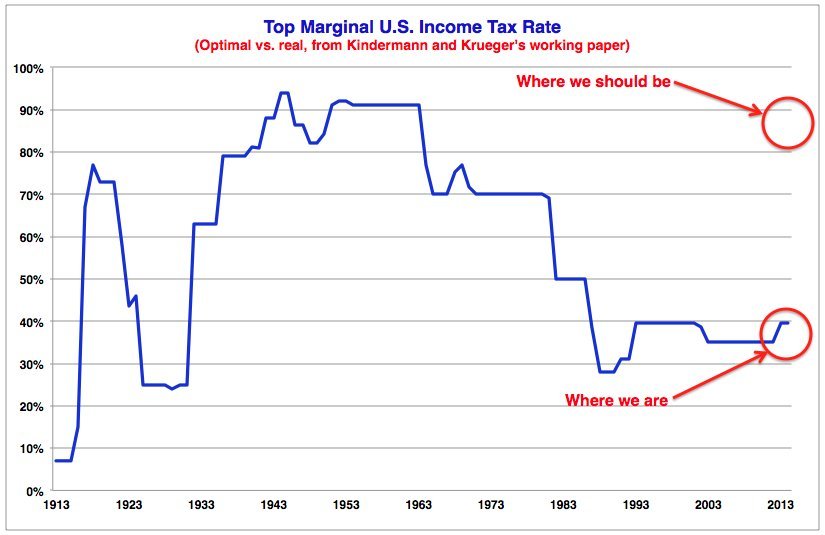

Here is the conclusion from the report, charted:

.....Kindermann and Krueger say that a top marginal tax rate in the range of 90 percent would decrease both income and wealth inequality, bring in more money for the government and increase everyone’s well-being -- even those subject to the new, much higher income tax rate.

MUCH MORE:

http://www.huffingtonpost.com/2014/10/22/economists-tax-rich_n_6024430.html

GummyBearz

(2,931 posts)But we'll lose our walmart jobs!!!

DetlefK

(16,423 posts)You know why the US-economy boomed in the 1950s? Because they had no competition in exports because Europe's industry was destroyed.

I doubt, it had much to do with the top-bracket tax-rate.

SheilaT

(23,156 posts)We had such high employment and growth in wages in no small part because it was hardly worthwhile for the owners of businesses or manufacturing plants to pay themselves obscenely, as they couldn't take home very much of it. So they gave decent wage increases to the rank and file.

It didn't hurt that we had strong unions then also.

The2ndWheel

(7,947 posts)Part of the equation was the higher taxes, but part of it was also that there was no international competition. Also part of the reason why union membership peaked back then. There was nowhere for the jobs to go.

loudsue

(14,087 posts)you heard all the time...daily in the 1950's. And it bolstered Japan's economy and innovativeness. Honda scooters were everywhere, and then toyota ...just a peek at what made Japan wealthy beyond their wildest dreams....for many years.

The Wizard

(12,545 posts)were reduced to rubble, and their manufacturing capabilities, especially automobiles, didn't realize its potential until the mid 70s. The US auto industry fell victim to old technology and accountants making engineering decisions based on the bottom line (See Michael Moore's "Roger and Me"![]() .

.

the United States rebuilt Germany's and Japan's manufacturing under the Marshall Plan so as to avert a continuation of the World Wars that started in 1914. The Versailles Treaty that ended hostilities in 1919, also bankrupted Germany and laid the groundwork for the Third Reich.

With new steel mills and modern facilities Germany and Japan surpassed the US in manufacturing. The oil embargo of 73-74 caused people to demand more efficient cars, and the US auto industry wasn't in tune with the market demands.

The tax structure also encouraged big business to reinvest its profits in R&D and expansion, thus creating new jobs.

Ronald Reagan's ill advised economic strategy gave the wealthy their tax breaks on the front end and encouraged big business to hide money in off shore tax havens and money laundries. Without a tax structure to encourage expansion, but rather designed to send jobs to cheap labor third world sweat shops America's manufacturing base slowly drifted off shore along with the commensurate well paying jobs and in the process taking money out of circulation.

W. Bush's tax cuts put Reagan's policies on steroids and the economy tanked in 08, just a few months before the Bush economic team expected.

Even with the cratered economy coming under W. Bush, the corporate media did its best to blame Obama.

Have to stop now for more coffee.

That coupled with the emergence of "maximizing shareholder value" as a managing philosophy in the late 1970's...

calimary

(81,238 posts)Glad you're here! The quarterly-earnings mentality is also something that has to be adjusted. Big business never seems to think past the next quarterly earnings statements. I sure see that in my old industry, broadcasting. They're riding on the myopia train - doing only quick-fixes and foolish cuts hoping they can just make it through the next book, and show better ratings and better quarterly earnings. NOTHING for the longterm. They don't give anybody long enough to establish. (Of course, I'm hoping that ethic does NOT change when it comes to NBC, "Meet the Press," and chuck todd - they can hose him anytime they like, and they shouldn't wait OR "give him time to get established" as far as I'm concerned!)

cherokeeprogressive

(24,853 posts)SheilaT

(23,156 posts)was probably less than you think. When soldiers went off to war, women and African American men filled their shoes in the larger workforce. When they came back home, those same women and African Americans were simply laid off in large numbers.

According to Wikipedia, there were 291,557 combat deaths in WWII, and 113,842 other deaths during that war. Keep in mind those deaths were spread out over four years. Even with those deaths, even though the overall birth rate was well down because so many potential fathers were away, the population of the country grew every single year of the war.

Another thing to keep in mind is that during WWII we went to a full war economy. Almost no regular consumer items were being produced, or what was produced went straight to the military. No cars. Tanks and airplanes instead. No nylon stockings. Parachutes instead. No or very few houses. Barracks for soldiers instead. And so on. So when the war ended, there was a huge pent-up demand for everything. and because so little could be bought during the war, and because people were strongly encouraged to buy government bonds instead, there was also a huge stockpile of money now available to spend on goods.

Because so few houses were built during the war, and because of population growth, it was commonly assumed that the housing shortage that existed immediately after the war would persist for a decade or more. Instead, lots of construction companies came into existence to build the needed houses.

It also helps to remember that we'd had a decade long Depression leading into the war, when people simply didn't have the money to buy things they wanted or needed. Then, during the war, they made money which they were forced to save, and spent that money in the immediate aftermath.

I have no idea what we were selling abroad in those years, but I suspect it wasn't very much. Not compared to what was being sold and purchased here at home.

happyslug

(14,779 posts)People tend to forget that the US was a Net Oil EXPORTER till 1969, thus a lot of oil was shipped from the US to Europe during WWII and in the Post WWII era. The #2 exporter was the USSR (who would remain #2 till the 1980s when it fell to #3, then recently popped back up to #1. Since the 1960s the top three oil producers has been the US, USSR (and later Russia) and Saudi Arabia. Till the early 1980s the US was still #1, then Saudi Arabia passed the US production level. Russia's oil production fell in the 1990s but never fell out of the top three producers. Russia was #1 in 2013 but expected a drop in production with Saudi Arabia returning to the #1 spot.

We did other exports, Food, vehicles, electronics etc. The Marshall Plan was more a way to return the resulting Trade Surplus back to Europe, for we were slowly draining any remaining wealth from Europe in the Post WWII years (This slow drain of wealth was seen as strengthening the Communists in Western Europe so the Marshall Plan was invented to undo the harm being caused by the excess trade surplus in favor of the US).

SheilaT

(23,156 posts)that we stopped taxing obscene levels of income at high levels, that our economy began declining. I do know that no one thing will be responsible, but there's a very interesting correlation.

It may also be connected to recovery of the rest of the world from WWII. I've seen it said that Germany and Japan were lucky in that their industrial infrastructure was totally destroyed in the war, so they rebuilt from scratch, and in a few years had modern factories that were well ahead of what we had in the U.S., none of which had been bombed.

The essential point that we are in a true global economy may be the most important one.

happyslug

(14,779 posts)Prior to the 1980s, people would speculate, but on whether something would make money in five to ten years, NOT as today, on whether the stock value will go up to down today or in the next few days.

Now, you always had speculators in the stock market, but the 90% tax rate kept most of the big money out of such activities. Thus people on the 50% tax rate would play in the market, but no one at the 90% tax rate for you had better investment opportunities in some long range investment.

Post reduction of the high tax on short term gains, you had the Savings and Loan Crisis of the 1980s. In that crisis you saw where making a quick killing in short term investments was done while leaving long term investments die:

http://en.wikipedia.org/wiki/Savings_and_loan_crisis

Such short term speculators invested heavily into the Micro Computer market in the early 1990s and the net since 2000. In some ways these investments made sense, but in many ways the profit was in the first few years, then the speculators pulled out and the companies went under.

Romeny made his money buying companies then using the Companies assets to give himself and other investors huge return on investment, then left the company go under for lack of capital. Other investors have adopted such policies, all do to the fact the top income tax rate in NOT 90% subject to the 50% disregard if held for more then four years. The Stock Market is booming do to these low tax rate, as the rest of the Country goes under.

The best way to control Speculation is to tax such gain by the 90% rate of the 1950s, or at least the 70% rate of the 1960s and 1970s.

3rdwaydem

(277 posts)JDPriestly

(57,936 posts)The story you don't hear about the gilded age was the recurring recessions. Right before the crash of 1929, the marginal tax rate on the rich was about as low as it was right before the crash of 2008.

To have a functioning, growing economy that enables people to solve problems and adopt new technologies, you need a fair amount of equality. This does not mean that everyone earns or has the same amount of money. Far from it. It merely means that the very top of the income of the richest should be taxed to pay for infrastructure, education and support for those who earn little. The middle class does well when there is more balance. And in the end, the economy is healthier, more balanced, and innovators are well rewarded. It's good for everyone.

We need a higher tax rate for the top margin of income. The economists have crunched the numbers. This is not just an empty theory.

Jim Beard

(2,535 posts)storm and then become even richer.

The 90% tax rate force the tax payer to re invest be it apartment buildings or anything the government saw that the country needed. The best tax breaks were for what we needed. If they did not want to invest in the US, they had to pay. Its a good system because as today, the rich just set on thier money without any incentive to invest.

laundry_queen

(8,646 posts)hifiguy

(33,688 posts)JDPriestly

(57,936 posts)MannyGoldstein

(34,589 posts)Still much lower than you might think.

BobbyBoring

(1,965 posts)We used to make fun of people that had things that were made in Japan. Now days, about everything is made overseas.

pampango

(24,692 posts)In Canada it's 51%, Germany 75%, France 47%, Norway 49%, Sweden 64%, etc.

http://data.worldbank.org/indicator/TG.VAL.TOTL.GD.ZS

malthaussen

(17,194 posts)It was a seller's market for labor in the 50's and much of the 60's, especially so since the labor pool was artificially limited and businesses were expanding (in part due to the lack of competition you cite). This, plus the fear of the Red Menace, made it imperative for the bosses to appease the workers. But they didn't forget.

-- Mal

Bandit

(21,475 posts)The rich got richer and everybody else did okay. Now the Rich get much richer and everyone else gets much poorer..We could learn something from history I think.. ![]()

7962

(11,841 posts)No one paid the top rate back then either. ANd no one would pay it now. They'd just hide cash and/or avoid paying.

We just topped 3 trillion in revenue and its still not enough.

happyslug

(14,779 posts)It is easy to hide a few thousand here and they, but when you are talking of MILLIONS, it is just hard to hide. My favorite story was the tips paid to high end operators of high end Card games in Las Vegas. All the IRS did was have an agent stand around while the game was going on, and watch the tips being given and then presented that evidence to the Tax payer when he claimed the tips were much less.

Another way was how the IRS got Al Capone, what he PURCHASED clearly was more then he had reported as income and thus he had failed to report his income and was sent to jail for that crime (and forced to pay a fine equal to what taxes he should have paid, the cost of the prosecution AND an additional amount as an actual fine. Collection was done by grabbing his assets, thus Al Capone's Armor Car became US property and was used by FDR when it went to Congress on December 8 1941 to ask for a Declaration of War on Japan, the US had no other armor car for his protection).

Sorry, huge houses, latest car, expensive vacations are all indications of wealth and if no enough wealth is reported to cover such expenses the IRS will pounce (THere is also an IRS policy was rewarding people who turn in non payers of Income tax, it brings in sufficient income for the treasury).

Remember the old maxim, That percentage of Income People spend on necessities tends to fall as income increases, the percentage spend on housing tends to stay about the same, while the percentage spent on luxuries increase as income goes up. Thus looking at the luxuries is how these people are caught. Housing is another indication, not as strong as luxuries but still a good indication of Income. THe IRS uses both to determine if someone is cheating (The FBI uses both to see who may be taking money from foreign nations to spy on the US).

Thus someone may avoid taxes for a few years, but if he or she does it to long OR for to much he or she will be audited and the taxes collected. The rewards for turning someone it also helps the IRS. Both provides the IRS enough evidence to do its job, force people to pay their taxes.

7962

(11,841 posts)You cant hide ALL of it anymore of course. But you can make 10 million a yr and pay tax on 2 million and your standard of living isnt going to raise any eyebrows. You really think the IRS is going to station agents at every casino table? And what about the cash workers? We have a lot of people paying little tax because they work for cash. We depend on their honesty in reporting. AC repair, plumbers, mechanics, accountants, photographers, etc. The list is long. All well paying professions. Not part of the richest of course, but there are LOTS in this category and they pay on what they report.

We're just not going to get enough money to run the government just by focusing on the top 1%. There arent enough of them.

The wonderful days of the 50s the federal budget was about 20% of GDP. Today its over 35%. THATS the number you need to focus on, not tax rates.

happyslug

(14,779 posts)The real cheaters are those making more then $100,000 a year, given median income is less then $50,000 a year who cares of they cheat?

Median Income is that point where 1/2 of the population is earning less than that amount and 1/2 is earning more (but also excludes people making more than $1 million a year so not to strew the number to high).

When I was going to School, I had a teacher who had been an IRS agent and he told our class that the Government NET income for collections of people below Median income was in the negative. i.e. it costs the Government more money to collect from those people below Median Income then the Government gets in Revenue. I.e. if the Government would say NO income Tax on amounts below $50,000 you would save the government money.

Side note: With Modern Computers this may no longer be true, do to reduction in the need to type in what had been written on 1040EZs and 1040As, but if the Government is getting any NET revenue from this group I would be surprised.

Thus the revenue from Income Taxes is from people making more than $50,000 a year, Most of that revenue is from people making more then $100,000 a year. At that rate it is easy to look at such people's life styles and income and its pays to do so .

Now, you may asked why do we tax people who earn less then Median income? That goes back to the 1920s when the Income Tax was first used in peacetime. The GOP was in Control of Congress and they hated the Income Tax, but dare NOT repeal it let it become an election year issue. Thus the present graduated tax system was adopted, so that the lower classes of society would be forced to pay Income taxes thus building up a larger population that oppose the Income Tax (the GOP also kept the concept that all payment had to be at once, i..e March 15th, no withholding and no prepayment so to make any payment of the tax appear to be as harsh as possible).

When the Democrats took power in 1932, rather then fight the GOP on WHO is to pay the Income Tax, they just raise the rates. During WWII, income tax withholding was introduced to reduced the hardship of having to pay on March 15th (The date the tax report was due was also changed to April 15th). After WWII the high rates were continued till the 1960s when the top rate was reduced to 70% and then 35% in the 1980s (the 42% by the late 1980s then cut again in the 1990s).

As to GDP being 35% today, you better tell the Government, they are saying it is only 19% in 2007. In 1950 is was 16%., 1960 AND 1970, 22%. 19% in 1990, 18.5% in 1995. 20% in 1980

http://www.infoplease.com/ipa/A0104575.html

I do NOT know where you are getting 35%, but since the 1950s Government expenditures in terms of percentage of GDP has been around 20%.

7962

(11,841 posts)More than one source. Now it may vary slightly depending on what does and doesnt get counted.

http://www.usgovernmentspending.com/us_20th_century_chart.html

http://www.forbes.com/sites/joshbarro/2012/04/16/lessons-from-the-decades-long-upward-march-of-government-spending/

You mention median income. I dont have a problem exempting those below median income from much of a tax. But a lot of people above median also pay little or no income tax. You ask, why care? Because there are a LOT more of those earners than the top earners. And we all need to pull the govt wagon to some extent. Why not tax income levels based on their share of total earnings in the country?

I pay people cash all the time. Some of them I know better than others. And I know most of that cash goes into their pocket and not on their 1040.

happyslug

(14,779 posts)The Cite everyone is using for data is as follows:

http://www.bea.gov/national/index.htm#gdp

GNP on the above government web site does go back to 1929, here are some examples of those numbers:

2007 14,477.6 billion OR 14,873.7 Billion in constant 2008 Dollars

2013 16,768,10 Billion OR 15,710.30 Billion in 2008 dollars

But then I noticed, the data for Government Expenditures is only from 1999

2007 4,845.40 Billion

2013 5,766.5 Billion

Thus comparison since 1930 is impossible based on the CITE both groups cite as the basis of their own calculations (That does not mean that the Government Web Cite did NOT contain such information in the past, but it just does NOT contain such information at the present time).

As to the 2000 Government expenditures, your cite cite nothing, my cite says $1721.6 billion.

What is posted on the government cite right now is a GNP for 2000 being 10,284.8. That same site say government expenditures for 2000 was $3202.5 for 31% Government expenditures that year. If you remove the $1070.1 Social Spending, i.e. Social Security, you come to 21%.

Thus the difference is simple, do you count PAYMENTS OF SOCIAL SECURITY a Government expense? My cite says no, your cite says yes (While avoiding saying they want to cut Social Security), But is the payment of Social Security anything more than payment on an investment? i.e. NOT government spending in the classic sense of the concept, but that people INVEST in Social Security for their old age and the subsequent payment is just the return on their investment.

All other parts of Government Spending has stayed at 20%, it is SOCIAL SECURITY SPENDING that has gone up, do to an aging population. Remember these same people have been paying the highest Social Security tax ever since 1982. This is the expected "Bump" in the Social Security system everyone has been preparing for since 1982. The US Government has kept this excess social security income in a special fund, so that if Congress ever decides NOT to pay Social Security Benefits, Congress would have to declare those US Bonds have no value. The Effect of this on other US Bonds is unknown, but it is known most investor will sell what they consider a worthless bond, and thus the US ruling the US bonds held by the Social Security Administration worthless would put those other bonds value into question and with that question goes the ability to borrow money.

Thus the difference is Social Security. Government Spending, excluding Social Security, has stayed at a constant 20% since the 1930s. The 15 percentage points increase is all Social Security outlays.

7962

(11,841 posts)But in a way, I dont. SS doesnt run the govt, income tax does. Although theres even disagreement on that too.

HenryWallace

(332 posts)If you where to simply reinstate the 91% tax bracket (using inflation adjusted numbers):

Dividends, Rents, Royalties & Interest would be taxed at 91% if a taxpayer's Adjusted Gross Income exceeds 2.45 (+ or -) Million per year.

Earned income (Wages & Self-Employment earnings) would be subject to a lesser 70% rate.

Capital Gains would be taxed at a flat 25%.

This structure of taxation was never about "median" earners. It's about long-term wealth distribution.

noiretextatique

(27,275 posts)the ones who rely on mortgage and real estate tax deductions. reagan gutted the other deductions that helped the middle class.

7962

(11,841 posts)noiretextatique

(27,275 posts)getting rid of business deductions will be a lot tougher. actually...it will never happen. too many captains of industry and government rely on those deductions to avoid paying taxes. and since they make the laws...

that's how reagan was able to fuck over the middle class.

happyslug

(14,779 posts)And US rates did NOT fall from the 1950s's high of 91% till the Late 1960s when do to laws pushed by JFK, but passed under LBJ the top rate was reduced to 70%.

Now, LBJ did increase taxes in his last year in office to finance the Vietnam war, but Nixon REFUSED to renew those taxes so their expired and we ran a deficient till the late Clinton Years.

The problems with the 1970s is directly tied in with the refusal to pay for the Vietnam war AND that the US was no longer a net exporter of oil.

For the US the top three imports, are oil, machines, Electronic equiipment and vehicles, http://www.worldsrichestcountries.com/top_us_imports.html.

US exports are Machines, Electronic Equipment and oil.

http://www.worldsrichestcountries.com/top_us_exports.html Yes the US does a lot of buiness in oil for we have the refinery capacity to process oil.

For Germany the main exports are Machines, Vehicles and Electronic Equipment

http://www.worldsrichestcountries.com/top-germany-exports.html

Imports for Germany are the same as the US, Oil, machines and Electronic,

http://www.worldsrichestcountries.com/top-germany-exports.html

When Reagan was elected, the economic problems caused by the refusal to pay for the Vietnam war had ended (or may be better referred to as merged) with the growing deficient as a result of the refusal of anyone to pay the deficient. Reagan solution was to reduce the top tax rate to 35% and when that failed to raise it without saying he did so (and Reagan also increased Social Security Taxes and then used that money to reduce the deficient that started with the war in Vietnam). Under Reagan the US went from a net Creditor country to a net debtor country, a position the US had NOT been in since WWI (One of the reasons the US went to War in 1917 was to protect England and France, for they own our banks a lot of money). This not only reflected GOVERNMENT Debt by PRIVATE Debt and in many ways the later is the more serious problem, for unlike Government, which can always increase taxes to pay off a debt, people generally can NOT allocate more money to pay off a debt.

If you take out Oil, Drugs and Weapons from international trade, most trade dies with it. Yes people buy Japanese Cars and Electronics, but those tend to be one times purchases, you buy your food daily AND you use electricity daily (Both of which are US produced). Oil is a big question, but think about it, when you drive your car (excluding electric and hybrids) during the life time of that car, do you spend more on the car or Fuel? The US is still the #3 oil producer in the world, thus most of the gasoline was pumped in the US and then refined in the US.

My point is most things we use that are imported tend to one time purchases not daily or even monthly purchases. The later items, items that we tend to spend more money on, tend to be US made or for labor used in the US. The Internet main centers are in the US (Which is why Putin wants to isolate the Internet from Russia).

Back to the 1950s, Honda had been founded after WWII (Honda is one of the few Japanese Companies that is NOT tied in with one of the Large Corporation that ran Japan prior to WWII). Honda became a large Motorcycle producer in Japan by the 1950s was ready to start to export to the US. Honda noticed the huge sales of Harley Davidson so decided the US would be a good market for its largest cycles. In the late 1950s Honda shipped to the US its largest cycles along with salesmen to talk about them. The Salesmen all rode smaller Honda, 750 cc and smaller and were sent to the US to talk up the largest Honda Motorcycles. The problem was everyone wanted to talk about the smaller bikes the Salesmen were riding NOT the larger bikes they were trying to sell. Honda realized there was a demand for 750 cc and smaller motorcycles in the US and decided to try to take over that market, thus in 1960 Honda started to export these smaller bikes, and sales boomed. It was a niche the US Motor Cycle industry had dismissed since the closing of Indian motorcycles in the early 1950s. On the other hand, while these cycles were produced in Japan, sales AND service of them was in the US. Thus most of the value produced by these imports, tended to be US in puts (Labor in repairs and Gasoline used).

Volkswagen found that to be true, thus once sales reached a certain level, VW (like Honda and other "foreign" vehicle makers) opened plants in the US for such vehicles are costly to produce AND then ship. Below a certain number, it is cheaper to ship, but above a certain number it is better to ship parts and set up final assembly in the country the vehicle will be sold in (Ford found this out prior to WWI, thus Ford is actually larger overseas then in the US).

Yes, I am Bring up a lot of things that seem not associated with each other, but it is to bring up a point, the US was NOT isolated from Imports in the 1950s, it imported items in the 1950s (The Marshall Plan was more to increase Exports from Europe to get them on their feet, for the US was running to high a trade surplus with Europe in the post war era for Europe EVER to pay off, thus the US was looking at a Collapse of Europe unless the US returned the money earned from the exports to Europe). Thus Europe was back on its feet by the late 1940s and starting to exports items to the US (including high end cameras and other "Electronics" high end binoculars and similar items). Japan in the 1950s was noted for exporting the same Junk we are getting from China today.

Thus the US had exports and imports in the 1950s, but the #1 item traded is the same as the #1 item traded today, oil. As long as the trade in oil is the #1 trade item, imports are NOT the Treat it could be to a 90% tax rate. The 70% tax rate was NOT a problem in the 1970s but the 35% top tax rate under Reagan ended up being a problem that even Reagan wanted to end.

One angle where the 90% tax rate will do a lot of good is speculators. Right now profits from such speculation goes into the pocket of the speculators. When the tax rate was 90%, most profits from Speculation went to the Federal Treasury. When FDR supported the High 90% tax rate, it was to drive these speculators out of the market for they were the cause of the Stock Market boom of the 1920s AND its collapse in 1928-1932 (Which lead to the closing of every bank in the US EXCEPT for the Bank tied in with the US Post Office (The US Post Office Bank was closed in 1969 by congress as no longer needed for the bank regulations of the 1930s had ended any need for a Government owned bank i.e the bank lobbied congress to cut out a competitor). FDR wanted such high tax rate on short term gains on the grounds that such gains did NOTHING for the Economy as a whole.

Please note the 90% top tax rate was subject to a 50% disregard if the profit was the product of a five year investment. i.e. if you bought stock and sold it within a year at 100% profit, 90% of that profit went to the Government. On the other hand if you held it for Five Years, 50% of the gain would be viewed as NON taxable, thus you paid 90% tax on 50% of the 100% gain, i.e. a 45% effective tax rate. Thus long term investment was encouraged, while short term speculation was discouraged.

There was a downside, someone whose salary reached the lower levels of the 90% top rate (Some Actors and Actresses were at this rate). To avoid such high rates actors and Actresses started to demand part of the profit from any movie they were in, thus took it as a long term investment not as salary. Authors of books often tried to make the book something of a long term investment not sales from the first years of sales (If done right, by delaying payment over many years, could be viewed as a long term investment). Income tax averaging also could be used to offset the problems caused by such high rates (Income can be averaged back 3 years and forward five years, to spread out a one time huge increase in income).

Notice there are downside to the 90% top tax rate, but most are know from the last time we had a 0-0% top tax rate and are still on the books.

Just come comments on why a high TOP TAX rate would be good for the country.

daleanime

(17,796 posts)Kelvin Mace

(17,469 posts)For gains realized in 30 days of less the tax rate would be 90%

> 30 days <= 1 year = 75%

> 1 year <= 5 years = 60%

> 5 years <= 10 years = 40%

> 10 years <= 20 years = 20%

> 20 years <= 30 years = 10%

> 30 years = 5%

This would stop day trading, encourage long term investment in pension plans for retirement and decrease market volatility.

ileus

(15,396 posts)JDPriestly

(57,936 posts)It would stop some of what I suspect is market manipulation by the big, very wealthy investors.

It would make the stock market, as you say, an investment institution and discourage gamblers. I have seen people who knew nothing about economics or money or stocks or much of anything lose a lot of money because they did not understand the risks they were running in our volatile stock market.

Of course, the hedge fund managers would hate it because they make their money through the market manipulation. They have the money to risk.

Kelvin Mace

(17,469 posts)but it would be an easier tax to defend as opposed to treating gains and dividends as regular income subject to the normal tax rates. It promotes RESPONSIBLE investment strategies and makes a LOT of money available for long term growth.

hifiguy

(33,688 posts)As for rates I think a continued gradation of indexed rates up from the $250,000 cutoff is only basic fairness. And there should be a 90% marginal rate kicking in somewhere around the $25-50 million level.

ETA - The reichwingers always talk about the "dignity of work" but tax monies earned by work far more highly than they do monies earned by money. More hypocritical horseshit. Quintessential Republicanism.

Kelvin Mace

(17,469 posts)is to stop money sloshing around chasing more money. If a billionaire wants to drop $250 million into the stock market and leave it for 30 years, I really have no problem with him paying only 5% in tax. But day trading should be discouraged regardless of the amount invested, since it leads to a host of abuses, bad practices and market volatility.

The same would be true of dividend re-investment. Keep re-investing the dividends, and you pay the lowest rates on the income when you retire and start drawing the dividends as income. The rate is based on the age of the investment, so that would stop people having a token amount, then investing a massive amount and trying to game the system. If you had $1,000,000 for 30 years, then invested $9,000,000 last month, then dividends on the original 30 year old investment would be taxed at 5%, whereas the $9,000,000 investment's dividends would be taxed at 90%.

Orsino

(37,428 posts)...so they could cry poverty when it comes to the social safety net and infrastructure. It's not the tax rate that would fix things; it's how much better off everyone else would be with a big budget.

JEB

(4,748 posts)in building value by hiring people doing good work. Now the wealthy simply collect their dividends and let the money pile up at a lower rate than if they actually did something with the money. The deck is stacked against most of us.

JHB

(37,160 posts)It's not just the rates, but how they are distributed. The ~90% marginal rates used to kick in at incomes that would be nearly 3.5 million in today's dollars. All progressivity on very high incomes was eliminated under Reagan and has never been restored.

Number of brackets (total, and number that kick in at levels above $250K and $500K after adjusting for inflation to 2013 dollars)

Expressing those as percentages:

JDPriestly

(57,936 posts)SunSeeker

(51,550 posts)Hortensis

(58,785 posts)Spider Jerusalem

(21,786 posts)Last edited Wed Oct 22, 2014, 02:55 PM - Edit history (1)

because at the end of WWII it was the only major industrial power that hadn't been bombed to devastation or economically crippled by the war (Europe took over a decade to recover), and because immediately postwar the US produced half the world's oil (equivalent to all of OPEC plus Russia, today, to put that into perspective). High income taxes had very little to do with that; it would have happened anyway (although some of those taxes did pay for things like the Interstate Highway System and hydropower projects in the Southwest, at least).

salib

(2,116 posts)Next, I will probably see how WWII brought us out of the Great Depression. Wasn't the New Deal at all, huh?

War does not help an economy. War is a sink hole with no real return. Ask Eisenhauer. Build a school and you have dividends far beyond the expense. Build a bomb, drop it, and that's it. It is a huge drain.

Now, I like how this has morphed into:

- "because at the end of WWII it was the only major industrial power that hadn't been bombed to devastation or economically crippled by the war (Europe took over a decade to recover)"

-"because immediately postwar the US produced half the world's oil (equivalent to all of OPEC plus Russia, today, to put that into perspective)".

Neither would do anything specifically for the middle-class (let alone working class and poor) relative to the rich. Yet, we saw HUGE improvements in living standards, percentage of total wealth and income, education, etc. with the high marginal tax rates. The idea that the rich boomed because of WWII and it trickled down to the rest of us is both unimportant here and unimportant to the people of this country (except the few very rich).

The point is that with these higher marginal income tax rates (90%+) we see an economy that can grow rapidly when given special privileges (like the two you point out), can grow steadily and not tank overall (New Deal reforms), and even more importantly includes and especially uplifts the vast majority of the people (again, high marginal tax rates and the New Deal). And again, for final emphasis, it did not tank the economy, the economy did very well, thank you very much.

Spider Jerusalem

(21,786 posts)all the growth at the end of WWII came about because the USA was exporting the products of its industry to the world (which led to full employment) and because the USA had the energy to support that growth (see: half the world's oil). The postwar boom is generally considered to be about 1945-1970; 1970, coincidentally, is the year that US oil production peaked (and the USA ceased being able to supply its oil demand from domestic production, leading to widening balance of trade issues from petroleum imports and inflation).

The tax rates had a lot less to do with rising prosperity than full employment, the gains of the labour movement, and the GI Bill.

salib

(2,116 posts)So, when you say "all the growth at the end of WWII came about because the USA was exporting the products of its industry to the world", what about all the growth IN DEMAND in the U.S. Remember, we were the "not bombed out" country. How were we supposed to grow when our growth depended upon selling to those where are devastated? That is a very simplistic assumption.

Of course, our trade with other countries improved after WWII. It had to. War depresses everything, so of course.

Also, if you do include all the U.S. growth in demand in your "all the growth at the end of WWII", then one is simply say "all the growth at the end of WWII came about because of all the growth after WWII". It is meaningless.

Again, to paraphrase Clinton, it's not the growth, stupid. (not you, me).

It is the overall society. It is equality, education, true freedom (think "The Four Freedoms"![]() economically for the otherwise "underprivileged" (you know, the poor), sharing of the wealth (because that is a good thing, right?), real opportunity and real opportunity to fail without destruction.

economically for the otherwise "underprivileged" (you know, the poor), sharing of the wealth (because that is a good thing, right?), real opportunity and real opportunity to fail without destruction.

Face it, it was the New Deal and progressive tax and social policies that created the greatest period of American prosperity.

Spider Jerusalem

(21,786 posts)and because American industry was producing goods for sale to American workers, yes, but those rising standards of living still would have been relatively impossible had the USA not had half the world's oil and had the war not provided impetus to industry. And no, it was minimum wage and maximum hours laws. You can't really divorce postwar US prosperity from the unique conditions the US enjoyed at the time--the USA accounted for 60% of world industrial output and GDP, in 1950, which represents a temporary imbalance in the world economy thanks to the fact that Europe and Japan were still rebuilding.

salib

(2,116 posts)You are still talking growth. That is not the issue. The only way that relates is the point that high tax rates did not stifle growth.

What the New Deal and Progressive Taxation did was ensure that any growth went to ALL the people. That is the point of all this and the underlying point of these economists.

For anyone reading this, do not get fooled by the growth/employment/trickle-down/war arguments here.

RedCloud

(9,230 posts)Industries that were tooled for the war effort made cars that lasted for generations, not years. Goods had higher quality. People did not see their life savings being vacuumed away by sneaky snake politicians and the greedy corporate masters,

7962

(11,841 posts)Erich Bloodaxe BSN

(14,733 posts)So even if very few STILL paid those rates if they were reinstituted, we'd still be doing better. And if we could actually clean up the corruption that allows them to do endruns around paying, we'd be even better off yet. Win win, really. The only way we lose is by not raising those top marginal rates.

7962

(11,841 posts)Thats what really matters. Thats a HUGE difference in the 50s and now. You're not going to get enough money out of the top earners anyway. There arent enough of them. And if you dont think they'd find a way out of 90% or anything near that, I have a beach home to sell you. Most of Congress fits the description of "rich" and most wont vote themselves an increase either; D or R.

stillwaiting

(3,795 posts)Because they don't pay our current tax rates either do they?

Many of the wealthy pay very, very little on a % basis under today's tax structure.

Wouldn't it be just a tad bit more difficult for them if they had to start their deductions game using 90% of their income over a certain threshold.

Whenever I see the argument that you put forward I just don't understand it. Of course they didn't pay those rates then. But, they don't pay our much lower rates now.

By substantially raising them to previous levels they WILL be paying more. Much more.

A strongly progressive system of taxation is sorely needed in our country to begin to provide some much needed economic fairness in this country. The billionaire's club has clearly shown by this point that they have no interest in being fair to most others in this country. Our financial elite seem to be much more greedy and selfish, and they are actively working to dismantle the pathetic social safety net we have in this country. I think it's about time to fight back a little.

LanternWaste

(37,748 posts)"High income taxes had very little to do with that..."

What's the objective source for this allegation?

Spider Jerusalem

(21,786 posts)Correlation is not causation, after all.

Meanwhile it's indisputable that the US was in a much better economic position than the UK or France or Germany or Japan in the immediate postwar era. (In 1950, for reference, 60 percent of the total world industrial output came from the USA and US GDP represented 61 percent of the world total.)

7962

(11,841 posts)OrwellwasRight

(5,170 posts)Seriously? Taxes are the price we pay to live in a civilized society. They are investments in our future. The US used to have the best infrastructure in the world. Now we can't even catch up to "third world" (:sarcasm![]() economies like China, Singapore, and South Korea in terms of infrastructure. We don't even have a single mile of high speed rail. And we'll never get one with anti-tax folks running the country.

economies like China, Singapore, and South Korea in terms of infrastructure. We don't even have a single mile of high speed rail. And we'll never get one with anti-tax folks running the country.

Spider Jerusalem

(21,786 posts)but it's a mistake to ascribe the USA's post-WWII economic boom to taxation.

Blanks

(4,835 posts)Adrahil

(13,340 posts)corresponds almost precisely with the drop in the top marginal rate from 70%.

salib

(2,116 posts)While Kennedy thought it could be done if loopholes were removed, either the loopholes returned and/or 76 percent was not enough.

clarice

(5,504 posts)This is precisely what is needed to ensure that we have a fair society.

So they can (to paraphase from the movie "Contact"![]() give back to those who have given, no from whom they have taken, so much.

give back to those who have given, no from whom they have taken, so much.

Enthusiast

(50,983 posts)When we had those kinds of tax rates the nation could do great things. Now, not so much.

Nye Bevan

(25,406 posts)and would not consider relocating to Bermuda, the Caymans, or any other tax haven.

Spider Jerusalem

(21,786 posts)since most of their income is taxed as capital gains and not as regular income. (What do you think bonuses for bankers and bond traders and stockbrokers are about? Those aren't actually "bonuses", they're a dodge to get around income tax by providing compensation in a form that's subject to the lower capital gains rate.)

stillwaiting

(3,795 posts)That could be done on a similar progressive scale as well.

NO ONE should be collecting as much wealth and income as currently happens in this country.

Economic fairness is a value.

salib

(2,116 posts)Just as we cannot have an economy where banks are too big to fail (or jail for that matter), we cannot have an economy where a few oligarchs are just too big that they hold the country hostage.

Besides, their investments are all over the world, and will still be all over the world where ever they live, including the U.S., either way.

JDPriestly

(57,936 posts)taxes to keep up the roads and schools that make their property worth so much. Just get them out of the country. Let them go. We don't need them. They aren't contributing anything. It's not as if they actually work. We can do well without them. In fact we would be better off without them. I have lived in other countries. The taxes you pay are higher, and the government comes and investigates to see whether maybe you aren't declaring all your income. If you had ever lived in any other first-world country, you would understand why the rich don't move. Do you seriously think they want to live in Bermuda and Caymans year-round?

Just in terms of medical care, they want to live here so they can have their first-class nose jobs, lip pick-ups, chin-ups, etc. Plastic surgery is so much safer and so much better in the US.

closeupready

(29,503 posts)the US and also by preying upon the middle and lower classes. In their absence, our natural resources can be exploited more fairly as a means of strengthening the socioeonomic well-being of the 99% of Americans who are NOT billionaires.

roamer65

(36,745 posts)hunter

(38,311 posts)stillwaiting

(3,795 posts)We can rebuild without them with a strongly progressive tax structure.

How much of the yearly income that they hoard and shelter from taxation and circulation in our economy actually helps us much anyways?

If they leave and we begin to pay our workers more fairly like in other civilized countries, then our tax collections and economy will improve. Economic fairness will help everyone. It's like they are mobsters that hold on to much of the national psyche by threatening to "Go Galt". Well, do it then I say. Just leave.

You seem to just give up and give them all of the power.

I find that outrageous.

hunter

(38,311 posts)I've got no problems with moderate wealth, but the kind of wealth that buys the attentions of our politicians is damaging the nation.

Cleita

(75,480 posts)anyone. Once they reach that, we need to tax them 100% of everything over that.

Shoulders of Giants

(370 posts)Cleita

(75,480 posts)I think a billion a year should give them plenty of incentive. Anything over that is the worst greed ever. I would hope they wouldn't want to earn anything over that. Thats the idea behind this kind of tax.

taught_me_patience

(5,477 posts)Fourth ammendment seizure.

Cleita

(75,480 posts)However, good luck with that. Unless you are a billionaire, I'm curious why you would defend unmitigated greed?

Enthusiast

(50,983 posts)deserve their wealth. Actually create domestic jobs and such.

undergroundpanther

(11,925 posts)hunter

(38,311 posts)The really sad thing is that most of the uber-wealthy would actually be happier if they were only moderately wealthy and taxed in a manner that reflected the great benefits they enjoy in this society.

Having to hire body guards for yourself and your family, living in a security fortress home, etc., has got to be the ultimate suckage.

The uber-wealthy live in cages of their own making. I think most of them know this. The rest are sociopaths.

Here's Alice Walton's mugshot:

Does she look happy?

I've seen Bill Gates, in person, looking stressed out. I wonder, does he ever think, "Gee, I could have been a moderately successful Open Source Software developer, just another mostly anonymous fellow enjoying the street scene in Seattle, San Francisco, wherever, with my family?"

Cleita

(75,480 posts)Very few actually did pay that and they paid on the average of 35% of their income after exploiting all loopholes. Maybe we should just cut out the loopholes and make the highest earners pay a flat rate of 35%. I'm more into taxing assets than income, myself, like a Wall Street transaction tax.

salib

(2,116 posts)Proposed changing them from 91% to the 70-percentage range and closing "loop-holes." It actually ended up enacted as a 71% top marginal rate. And look what happened in the graphs in the post from JHB, the overall amount paid by those with the most went down.

Two things here:

- Sounds like a good idea, but in practice has not accomplished the goal, i.e., Lower tax rate but some tax amount actually collected

- "Loop-holes" are good things many times. Eliminating a loop-hole that encourages one to give to charities in order to reduce a 90+% tax rate is likely very good, or one that encourages investment rather than hoarding (to some extent) for the same reason, although don not get me started on the idea of taxing capital gains at a lower rate. That is way overboard. Nevertheless, it appears that it is quite likely that it is the very fact that there is a "near-100%" tax on what you make after you have made enough (high marginal tax rate) that motivates people to be the good citizens we all hope they want to be and encourages economic actions (and policies) that create a more equal society.

roamer65

(36,745 posts)That would be a good start.

Also make the first 25k tax free. That would put money into the pockets of those most likely to spend it.

closeupready

(29,503 posts)amongst the 1% who belong to the Democratic Party (and some who are Republican) - they KNOW that she will continue to support regressive tax policies that neglect to address the hoarding of wealth and the failure to honor the 1%'s responsibility to create jobs for the middle class.

K&R

Enthusiast

(50,983 posts)malthaussen

(17,194 posts)We don't want them to cry.

The most important consideration in any mulcting scheme, however, is to make sure that the mulct actually works. Passing laws that are not enforced or evaded by clever accountancy tricks will not improve the revenue stream, and we really must improve the revenue stream.

-- Mal

Enthusiast

(50,983 posts)Thank you, patriot kpete.

joeglow3

(6,228 posts)SoapBox

(18,791 posts)Taitertots

(7,745 posts)Correction- they don't listen to economists that arnt being paid to tell them what they want to hear.

undergroundpanther

(11,925 posts)Taxing the rich 90% .The rich should never be so rich they buy the government away from the people,most of which struggle under the rich peoples demands for everything for nothing.

abelenkpe

(9,933 posts)Yes we need to return to these rates, rebuild unions and place countervailing tariffs or tax penalties on corporations that offshore work. Only those comfortably well off refuse to recognize this. Any young or working class individuals who buy the excuses for not doing this are gullible fools.

lovemydog

(11,833 posts)Tierra_y_Libertad

(50,414 posts)indepat

(20,899 posts)Reagan-ese highest marginal rates have, in effect, been designed to promote egregious welfare for the wealthy, such a right-wing-thingy to do, all at the expense of society, i.e., explicitly to the detriment of the general welfare which gives a big middle finger to the Preamble to the Constitution. But that's always been what right wingers do foremost. ![]()

AZ Progressive

(3,411 posts)And it seems like he's succeeded.

A feudalistic nation where most American citizens are serfs under the complete mercy of their lords, their employers, and the environment is such that they are heavily punished for not pleasing their lords if it means they lose their job (and are thus punished through poverty, homelessness, a collapse of life, extreme stress, etc...) because it's not so easy for many nowadays to get another job, especially within a short period of time.

SunSeeker

(51,550 posts)lovemydog

(11,833 posts)roamer65

(36,745 posts)Anyone making 25k or below should pay no income tax. We should only pay tax on income beyond that amount.

happyslug

(14,779 posts)As I stated above, in the 1970s when I took an Accounting Class run by an ex IRS Agent, he told the class the Government net revenue on collecting income tax on people earning less then Median Income as in the Negative. i.e. cost more to collect then the government received. Median Income has stagnated at about 45,000 for the last decade or so, so a no tax on anyone earning less then $50,000 will probably lead to a net increase in revenue for the Government.

Thus a $50,000 cut off makes economic sense.

AZ Progressive

(3,411 posts)if it is social engineering that pushes the rich to be good citizens. When the top tax rate was very high, the rich had more incentive to reinvest money into their businesses (including paying their workers better) than to hoard it and put it into investments. Bring the top tax rate down, and the incentive for the rich is to hoard it and park it into investments. That's why we have been having a bunch of bubbles since Reagan came in, and had from the gilded age till the great depression, because the rich would get so much money that they would put it into whatever is the hottest investment of the time (which was housing just before the recession of 2008), creating all these bubbles that would eventually burst and sink the economy.

Top Tax Rate High: Rich reinvest in businesses and pay workers better, making all Americans richer, pumping money into the economy that leads to more business, more jobs, and a much more healthy society.

Top Tax Rate Low: Rich don't reinvest in businesses, don't pay workers better, and hoard the money (rather than pump it more effectively into the economy) and create economic bubbles that bring the economy down, hurting everyone significantly except the richest of society.

nitpicker

(7,153 posts)Remember the all deductible three-martini lunches?

Let's have "perpetual training" (( with "all food provided at the off site, just sleep on the floor in your sleeping bag..."![]() )

)

House this year's trainees for cheap!

((sarcasm off))

People wrote tales in the 50s and 60s about people taking fringe benefits from companies versus getting pay raises that could be taxed at 91%.

pansypoo53219

(20,976 posts)indepat

(20,899 posts)the nation's major budget, fiscal, and deficit woes just like a proverbial piss in the ocean would raise sea levels. ![]()

Warren DeMontague

(80,708 posts)But that's not going to happen, either.

B Calm

(28,762 posts)Anybody who doesn't have their head up their ass knows it's the consumer who creates jobs!

True Blue Door

(2,969 posts)pampango

(24,692 posts)Prophet 451

(9,796 posts)I would suggest that inserting a few more tax bands, topping out at, say, 60% and reforming the tax code to encourage expanding and employing more workers would have the same effect.

melm00se

(4,992 posts)and all this back and forth as if any one single policy or action drove the postwar economic boom:

tax rates?

postwar worldwide industrial economy/capacity?

International competition?

Organized labor?

Shift from war economy to a consumer economy?

Oil (and other) exports?

the dearth of "consumer" goods during the war years?

I have a news flash for everyone: it is a combination of all of these as well as other factors.

Among the things not mentioned:

- GI Bill - by delaying the returning GIs re-entry to the labor pool and into higher education, the integration of returning soldiers back into the economy was slowed and the US economy did not experience a recession similar to what was experienced post WWI.

- The Depression: While American industry did not produce consumer products during WWII, that was just another 4 (or so) years on top of the Depression years that had a very low consumer goods demand/market.

- The "war": Someone above poo-poo'd the war as the reason the Great Depression came to an end. War certainly did have a role to play in ending the Great Depression (there were many others and the New Deal also had an impact but the war did it in a lot less time). the American entry into the war did so by getting money moving at a much higher rate than the previous decade had seen. (Static money is, as one of my economics professors pointed out, is just a pile of paper. Once that money begins to move, it gains power). By manufacturing war material that are consumed (that is to say they had to be continuously produced) like: boots, belts, ammunition, rations, tires and, to a lesser extent, airplanes, tanks, trucks etc, this gave a place for what was static money a place to go.

Now couple the war with moving approximately 10% of the American population out of the civilian employment sector to the military, the number of open jobs spiked bringing people back into the labor force with full employment.

- Government (non-tax) fiscal policy: Normally, such a rapid expansion of the labor force (and thus discretionary income) would lead to inflation as prices rose to find a point of homeostasis. Unchecked inflation would have negatively impacted the war effort. The government siphoned some of this income out of the economy (which is not an entirely accurate statement but it will suffice) thru the sale of war bonds. It gave the government the necessary funds to finance the war but it also tamped down inflationary pressures.

As these war bonds matured (or redeemed early), this money was slowly reintroduced back into the consumer economy thus avoiding any significantly negative economic impact.

I can go on and on but these few points illustrate that something as large as the US economy is not impacted by just one factor but a whole series events and actions (both internal and external) that taking the position that *this* (one event) carries (or not) the burden of responsibility is a foolish argument/stance to take.

CJCRANE

(18,184 posts)top marginal tax rate!

![]()

Martin Eden

(12,864 posts)Might that seriously impede their ability to purchase politicians in Washington?

AZ Progressive

(3,411 posts)Rich get all this extra money because the tax rates are low, they put it in investments, INCLUDING buying politicians!

CJCRANE

(18,184 posts)not $1 million.

Martin Eden

(12,864 posts)and make them LITERALLY One Percenters!

whereisjustice

(2,941 posts)is something they claim will trickle down on us as a consequence of giving the rich more economic and legislative power. That's why they support TPP, fracking, NSA, Wall Street, Monsanto, privatization of schools and prisons and hospitals, etc. If it weren't for a few liberals we would be a corporate run fascist state and that seems to be frustrating for many of the 3rd way Democrats. They aren't happy that corporations only control 90%. They want that last 10% of influence taken away from us.

EEO

(1,620 posts)... saw their average wealth and good paying jobs disappear. Surely just a peculiar coincidence.

One_Life_To_Give

(6,036 posts)90% Federal plus another 12% some places state and local. Yeah right nobody paid it then nor will they now. Capital Gains on Stock Options 15%. Hence less than 1% even hit $400K income, save 20% even today. Car and Driver/security guard provided by employer, live in assistant/housekeeper, etc.

Decide how you want the rich to receive income and where to have them invest. Then design your tax policy to make it happen!

Amimnoch

(4,558 posts)Also, will it be applied to the typical 1%er eazy out and apply to Capital Gains tax income as well?

Without it, this will hit the 60-80% margin the hardest (or those who work for salary, not shares), but the top 20%, especially those who have direct control over how their "income" is distributed will just adjust their wage down, their Shares and investments up, and in a couple years be right back at making a fortune, but paying little in taxes.

For example:

http://moneyover55.about.com/od/taxtips/ss/2014-Tax-Rates.htm?utm_term=capital%20gains%20tax%20rate%202014&utm_content=p1-main-4-more&utm_medium=sem&utm_source=msn&utm_campaign=adid-bc35be37-1995-479d-8dc2-3f8cdc0cfc38-0-ab_msb_ocode-28811&ad=semD&an=msn_s&am=broad&q=capital%20gains%20tax%20rate%202014&dqi=capital%2Bgains%2Btax%2Brate%2B2014&o=28811&l=sem&qsrc=999&askid=bc35be37-1995-479d-8dc2-3f8cdc0cfc38-0-ab_msb

Many people are unaware that there is now a 0% tax rate that applies to long term capital gains and qualified dividends for those that fall in the 15% or lower tax bracket. That means for those with taxable income under about $36,900 for singles and $73,800 for marrieds they can use smart tax planning to pay very little tax on their investment gains.

This type of smart planning would involve intentionally harvesting capital gains at the zero percent tax rate. In this way the gains don't build up and you do not have a large embedded tax liability on down the road. There are not very many ways to truly earn tax-free money so I think a strategy that helps you manage capital gains is worth the effort.

So, If I have the ability to manipulate my own pay, and I want to pull $2 million, all I have to do is pay myself $36,000 or $73,800 for 2014, and cash in my long term investments that I made a few years back. All of that money becomes tax free income.

Only way to make that 90% work is to scale up the capital gains, and other 1% loopholes with it. Otherwise, it'll just be another play with the money game for them.

Man from Pickens

(1,713 posts)The rich don't make "income" like we plebes do. They make "capital gains". Richie Rich laughs at your ignorance of just how far ahead of your attempts to moderate the looting he is.