General Discussion

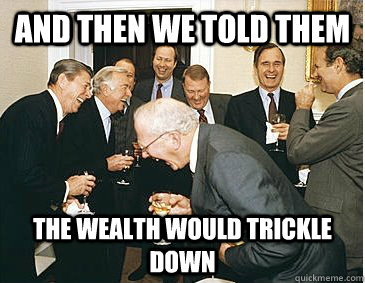

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsDoes the GOP admit that there is no trickle down of trillions

of corporate profits parked overseas to Americans? (they don't want to pay current taxes). Ask them if they'd admit to that as a start to a wider discussion on taxes. It seems obvious.

2naSalit

(86,612 posts)that's why they're trying to shove the TPP and other travesties up our butts, so that we can't make them or even ask. They're laughing about how so many bought that line of rubbish so long ago and that they can still get away with screwing us at every turn.

Journeyman

(15,031 posts)

Recursion

(56,582 posts)or Germany's or...

For that matter, just about the only countries with higher median incomes than the US are tiny outliers like Monaco, UAE, and Luxembourg, along with Scandinavia.

https://en.wikipedia.org/wiki/Median_household_income

Using 2012 purchasing power parity dollars, the US median household income was $44K*. Canada's was $41K. Germany's was $33K. The UK's was $32K. France's was $31K.

Now, the quality of life in a lot of those countries is in many ways better, because they have much stronger social programs. We should too. But our corporations simply are paying us more than their corporations are.

* if that looks low, it's an artifact of purchasing power parity, which adjusts for the cost of living; the nominal value was something like $52K IIRC.

applegrove

(118,657 posts)this past year because the young adults are having trouble in the us. That may change back as canada is greatly affected by the slump in oil price and is teetering a bit right now.

Recursion

(56,582 posts)The middle Canadian makes less than the middle American. Though "middle class" has become such a broad term that I have absolutely no doubt there's a definition of it for which that is true...

TrollBuster9090

(5,954 posts)Canada's middle class has surpassed the United States' middle class. (But as you say, it may not last, given the Canadian economy's dependence on oil.)

http://www.nytimes.com/2014/04/23/upshot/the-american-middle-class-is-no-longer-the-worlds-richest.html?_r=0

TrollBuster9090

(5,954 posts)Since there are five western european countries that have both a higher median household income, and a higher per capita income, while having a higher top income tax rate. As well as a higher capital gains tax, higher corporate taxes, and (as you pointed out) MUCH more extensive social programs.

In fact, Norway not only has a higher median household income and a higher per capita income than the USA, but ever Norwegian now has a ONE MILLION DOLLAR RETIREMENT FUND thanks to their policy on taxation of the oil industry.

Recursion

(56,582 posts)They have a 20+% VAT

Scuba

(53,475 posts)... continues to slide downward as more and more families are doing worse and worse.

Nice try though; I'm sure you fooled a few people who don't understand the difference between mean and median.

Recursion

(56,582 posts)I've told you this several times and you keep bringing this zombie up.

If Bill Gates walks into a bar, the mean income goes up by several million dollars.

The median income doesn't budge.

Why do you persist in getting this wrong?

Scuba

(53,475 posts)Recursion

(56,582 posts)Interesting. Not terribly surprising, though.

Incredibly rich outliers don't pull the median up. Can you at least acknowledge that?

Spitfire of ATJ

(32,723 posts)....that you can find bosses that act like it's ridiculous to expect them to pay their employees enough to earn a living.

The employee pulls into the parking lot with a new car and the employer is resentful that the employee could afford that.

I said it before and I'll say it again, America didn't vote for Reagan to give their boss a raise. They voted for Reagan because he said their boss couldn't AFFORD to give THEM a raise. Those tax cuts for the rich were supposed to go into PAYROLL.

Not the pockets of the already rich.

TrollBuster9090

(5,954 posts)Last time I saw trickle-down economics being boosted was in 2011, I think, when Obama was wanting to let the Bush tax cuts expire, and Boehner and McConnell had just got a new catch phrase from Frank Lunts:

"Don't Tax The Job Creators..."

I think they realize that every primate that doesn't have a prehensile tail knows that the wealth doesn't trickle-down. So, Frank Luntz rebranded it as a job creation measure, rather than a wealth for the middle class measure, and gave them a fresh set of talking points. The talking point given to the leaders was "Don't tax the job creators." And the reciprocal talking point given to the GOP followers was "I've never been given a job by a poor person..."

As for the trillions in profits being held offshore, whenever they're confronted with it they just blather about how it's not the fault of the companies, but the fault of corporate taxes being too high...blah blah blah.... (The only time they DON'T complain about corporate taxes being too high is when they mention General Electric, which donates a lot to the Democrats. Then they whine about GE paying too little. How much did they pay? Well, if you, yourself paid ONE PENNY in taxes, you paid more than GE did.)

Scuba

(53,475 posts)