General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsSingel Payer a fantasy. Require State tax increases that cant be enforced.#Constitution we love

Ifs a funny world we live in were facts "trump's" rhetoric and purity bills.

http://healthcoverageguide.org/states/summary-of-state-tax-provisions-relating-to-health-insurance/

Personal Income Tax

History shows that it was the states that introduced personal income tax into America. The first modern personal income tax system was originated in 1911 by the State of Wisconsin.

Today, most of the states require their residents to pay a personal income tax. These states generally use one of two methods to determine income tax. These two methods are the graduated income tax and the flat rate income tax, and both methods first require the taxpayer to figure his or her taxable income

Ever since the beginning of our history, the states have maintained the right to impose taxes. The Federal Government has always recognized this right. When our Constitution was adopted, the Federal Government was granted the authority to impose taxes. The states, however, retained the right to impose any type of tax except those taxes that are clearly forbidden by the United States Constitution and their own state constitution.

Today, the states acquire the necessary revenue to maintain their governments through tax collection, fees, and licenses. The Federal Government also grants money to the 50 states. With the revenue that the states receive from the Federal Government, taxes, licenses, and fees, they provide public services to their citizens. Examples of these public services are public schools, police protection, health and welfare benefits, and the operation of the state government.

Among the common types of taxes that many states impose are personal income tax, corporate income tax, sales tax, and real property tax. Throughout the 1930s and 1940s, personal income tax and sales tax were introduced in many states because additional revenue was needed to finance public services.

Real property tax has, however, a long history. In 1646, the Massachusetts Bay Colony began taxing settlers who owned property. After independence, many states started to tax property. As time passed, local communities took over the power to tax property. Today, property tax is usually paid to a local government, a school district, a county government, or a water district, but not to a state.

https://www.treasury.gov/resource-center/faqs/Taxes/Pages/state-local.aspx

Voltaire2

(15,377 posts)There are multiple funding options: employer payroll tax increase, individual income tax increase, raising the income tax rates on higher income individuals, increasing the estate tax on large estates, etc. There is no increase in state taxes, nor can the federal government directly increase state taxes. However, as medicaid would be replaced, most states would see a reduction in their budget for healthcare. Perhaps that is what you meant? That this would (indirectly) lower state taxes?

factfinder_77

(841 posts)The state and local tax deduction, or SALT, has long been a target for tax-policy wonks who see it as an unwise federal subsidy that is mainly claimed by the wealthy. But politics have always intervened: Thanks to the opposition of lawmakers in high-tax states, the deduction has survived every effort to clear out loopholes, including the last federal tax overhaul of similar ambition in 1986.

Now, Republican leaders have made clear the SALT deduction is on the table, and it has shaken up a number of blue-state GOP legislators who are warning that it could derail the ambitious tax plan Trump is now pushing.

https://www.washingtonpost.com/powerpost/to-make-their-tax-plan-work-republicans-eye-a-favorite-blue-state-break/2017/09/16/c726d506-9a26-11e7-b569-3360011663b4_story.html?utm_term=.a73bbd60db53

Voltaire2

(15,377 posts)You seem to be just tossing everything bad republicans might do into your attacks on the MFA.

factfinder_77

(841 posts)Texas has a very low state tax bill, ranking 45th in state taxes per resident. But Texas has a very high local tax bill—16th highest among the 50 states—because the state “pushes down” to local governments a larger share of costs.

https://therivardreport.com/how-texas-spends-its-money-how-texas-gets-its-money-why-it-doesnt-add-up/

Voltaire2

(15,377 posts)Quixote1818

(31,152 posts)brooklynite

(96,882 posts)The Federal Income Tax was introduced in support of the passage of Prohibition, by replacing the excise tax revenue on alcohol.

Prohibition was repealed (in part) when Federal Income Tax revenues dropped during the Depression.

Wellstone ruled

(34,661 posts)the real story,thanks again. Many forget or just never read our Nations funky History about Taxation.

Warren DeMontague

(80,708 posts)Space-time itself will likely rip itself apart in an ever-accelerating expansion due to dark energy.

Truly, there is no point to anything. ![]()

Quixote1818

(31,152 posts)Guess according to the OP we might as well just end it all now!

Warren DeMontague

(80,708 posts)factfinder_77

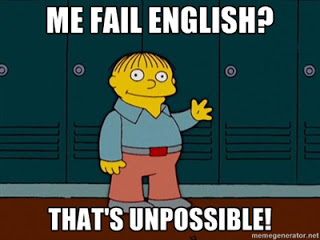

(841 posts)is that diffucult to understand ?

![]()

Quixote1818

(31,152 posts)leftstreet

(39,869 posts)muriel_volestrangler

(105,967 posts)and see if something sticks, rather than actually trying to construct an argument yourself?

What's your point about single payer? If you have one, then state it, don't just post excerpts about state taxes.

factfinder_77

(841 posts)The paper proposes 10 ways to raise funds to pay for the proposed single-payer system, broken into three sections: options to save families and businesses on health care expenses, options to make the wealthy pay their fair share, and options to make Wall Street and large, profitable corporations pay their fair share.

https://thinkprogress.org/sanders-single-payer-announcement-c880718a31dc/

muriel_volestrangler

(105,967 posts)Really, you've not put together anything that could be called an argument. If you have some way of claiming that the current set-up of various state taxes makes single payer a "fantasy", then explain it. Don't just proclaim it in a thread title, with a hashtag as if that means anything.

Were the words "constitution", "we" and "love" literally added at random?

Warren DeMontague

(80,708 posts)It's FREEEEEEEEEEEEE!!!!

![]()

tkmorris

(11,138 posts)

beam me up scottie

(57,349 posts)

R'amen.

demmiblue

(39,558 posts)Trash thread, yet again.

Codeine

(25,586 posts)

Iggo

(49,830 posts)You should tighten that up. ![]()