Two-thirds of U.S. corporations did not pay federal income tax. GAO Report

Source: HuffPo

A new government report shows just how easy corporate America has it.

Every year from 2006 to 2012, some two-thirds of U.S. corporations did not pay federal income tax, according to a Government Accountability Office study released on Wednesday. In 2012 alone, 42.5 percent of businesses that the GAO defines as large did not pay federal taxes, including 19.5 percent of big corporations that posted a profit.

Read more: http://www.huffingtonpost.com/entry/gao-study-profitable-corporations-no-federal-taxes_us_570e6c62e4b0ffa5937dbadb

Bastards.

saturnsring

(1,832 posts)PSPS

(13,601 posts)daleanime

(17,796 posts)this![]()

Baobab

(4,667 posts)Corporate income taxes in the United States as a share of the economy are significantly less than the average among developed nations, according to an analysis of the most recent data from the Organization for Economic Cooperation and Development (OECD). Data from the Treasury Department show that U.S. corporate taxes as a percentage of GDP are 2.3 percent, which is 15 percent less than the 2.7 percent weighted average among the other 32 OECD countries for which data are available.

Justice

(7,188 posts)GOP repeatedly says US has 'highest tax rate' for corporations.

Rate is meaningless - it's what you actually pay that matters. That is the point of the original post.

Your point is also good.

Kingofalldems

(38,458 posts)Enthusiast

(50,983 posts)rhett o rick

(55,981 posts)thereismore

(13,326 posts)Baobab

(4,667 posts)actually, single payer would cost around what we are spending now. (2/3 of every health care dollar is paid by the government now in 2016! Shhh!)

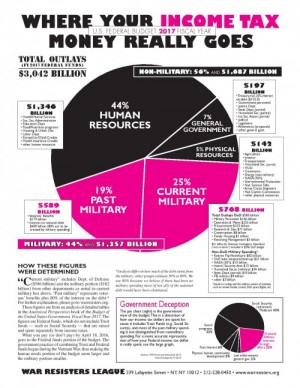

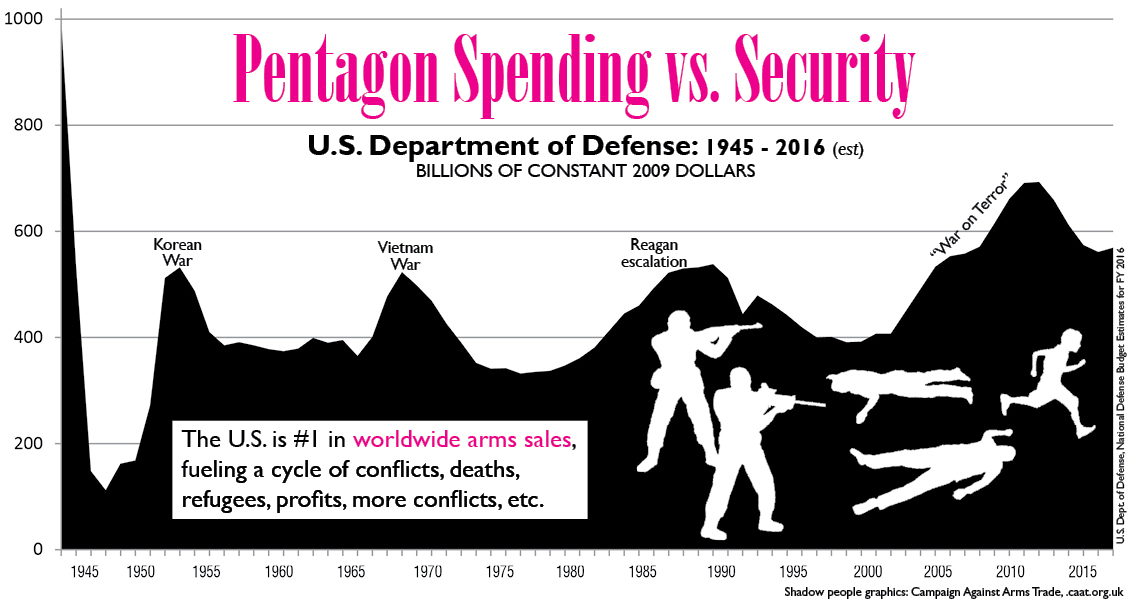

So we could have all those things with very little or no tax increases right now if we just eliminated the limit on income figured into social security and spent less on military and wars.

especially spent less on military

Sources:

David U. Himmelstein, MD, and Steffie Woolhandler, MD, MPH

http://ajph.aphapublications.org/doi/full/10.2105/AJPH.2015.302997

Objectives. We estimated taxpayers’ current and projected share of US health expenditures, including government payments for public employees’ health benefits as well as tax subsidies to private health spending.

Methods. We tabulated official Centers for Medicare and Medicaid Services figures on direct government spending for health programs and public employees’ health benefits for 2013, and projected figures through 2024. We calculated the value of tax subsidies for private spending from official federal budget documents and figures for state and local tax collections.

Results. Tax-funded health expenditures totaled $1.877 trillion in 2013 and are projected to increase to $3.642 trillion in 2024. Government’s share of overall health spending was 64.3% of national health expenditures in 2013 and will rise to 67.1% in 2024. Government health expenditures in the United States account for a larger share of gross domestic product (11.2% in 2013) than do total health expenditures in any other nation.

Conclusions. Contrary to public perceptions and official Centers for Medicare and Medicaid Services estimates, government funds most health care in the United States. Appreciation of government’s predominant role in health funding might encourage more appropriate and equitable targeting of health expenditures.

Enthusiast

(50,983 posts)Kip Humphrey

(4,753 posts)Gregorian

(23,867 posts)aggiesal

(8,917 posts)Gooooooglllle it

Gregorian

(23,867 posts)But it was only after sitting here a while before it donned on me. Haha.

aggiesal

(8,917 posts)Robin Hood spelled backwards.

And yes there is such a principle.

Dooh Nibor is the stealing from the poor to give to the rich.

Robin Hood in reverse. Hence Dooh Nibor.

AxionExcel

(755 posts)

Duppers

(28,125 posts)ish of the hammer

(444 posts)and an investment of 153 million dollars to keep from paying taxes is WELL worth the potential payback of Billions.

kadaholo

(304 posts)'There is something profoundly wrong in America when one out of five profitable corporations pay nothing in federal income taxes,' Sanders said in a statement."

THANKS (AGAIN!) BERNIE! A CANDIDATE WHO TRULY CARES!

Scuba

(53,475 posts)Curtis

(348 posts)<crickets>

.

.

.

.

.

.

.

</crickets>

Pretty much the same thing she always does to us. Bet she had a lot of advice for Goldman Sachs though ![]()

bullsnarfle

(254 posts)The major news media.

rhett o rick

(55,981 posts)appear to sometimes pay as much taxes as what should possibly be paid, as least part of the time. I will work very, very hard to explain to the corporations how important it is to give the appearance of supporting the economy. And if they continue the appearance of not always paying the total of what might be expected, I will shake my finger and tell them in no uncertain terms to "cut it out".

In private she says, "As President I guarantee that I will never support anything that might impinge on your profits. Make checks payable to Clinton Cash and have them bring my car around."

Optimism

(142 posts)Meanwhile the Clinton Welfare Bill kicks thousands off of food stamps.

Bernie MUST win New York !! The FBI MUST release their findings SOON !!

rhett o rick

(55,981 posts)It's all about greed. The Clinton Family Wealth is currently at about $150,000,000 and climbing. We need an electric indicator that shows the Clinton Family Wealth as it grows and grows. And to think, they really haven't tapped into the huge wealth in their Foundation. I think they are saving it as a retirement plan.

TryLogic

(1,723 posts)A tax on energy used to obtain raw materials, energy to manufacture, and energy to transport regardless where in the world an item is constructed.

allan01

(1,950 posts)these ones use our radio waves , roadways , public water , and so fourthe . deny them these basic services .

MrMickeysMom

(20,453 posts)Some animals are more equal than others? Not on MY planet.

Enthusiast

(50,983 posts)Because congress is bought off.

highprincipleswork

(3,111 posts)articles show clearly spell out what the GAO says is true.

840high

(17,196 posts)Lars39

(26,109 posts)Thespian2

(2,741 posts)jwirr

(39,215 posts)Matthew28

(1,798 posts)And make them pay their taxes!!!! Then we can fund infrastructure, science, r&d and education right. Greedy bastards.

Fritz Walter

(4,291 posts)...and how is that fair?"

Or so goes the standard Chamber of Commerce response, and that's usually sufficient for their legislative lap dogs to fall in line.

I call 'Bullshit' on that argument. Setting aside for the moment their lack of empirical evidence to support that view, "fairness" has never been a determining factor in board rooms across this country. It's all about the bottom line and the ROI for investors, including and especially board members and officers of said corporations.

And that tone-deafness is what drives the grassroots movement behind Bernie Sanders' campaign -- we're "so sick and tired of the lies...!"

And before the Hillarites take umbrage at this comment, I would politely but firmly ask to see the script/transcript of what she said to Goldman Sachs corporatistas and her 'white noise' donors in Colorado.

Prove me wrong.

Phlem

(6,323 posts)That'll fix everything!

![]()

Enthusiast

(50,983 posts)I am so sick of this shit.

OnlinePoker

(5,722 posts)I would think the GAO would have access to tax records for all of the past tax seasons as well. I know you have to have an end date, but we're almost through another year.

rurallib

(62,423 posts)or a large gummint contract?

RecoveringJournalist

(148 posts)It's time! Violent or nonviolent...IT'S TIME!!

Octafish

(55,745 posts)Like Leona Queen of Mean Helmsley said.

appalachiablue

(41,145 posts)FailureToCommunicate

(14,014 posts)our taxes. ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

KentuckyWoman

(6,685 posts)Oh wait, in many cases we are..............

http://www.goodjobsfirst.org/sites/default/files/docs/pdf/UncleSamsFavoriteCorporations.pdf

moondust

(19,993 posts)zalinda

(5,621 posts)the mom and pop corporations who employ a huge number of people make up for what the big guys don't pay. I don't understand why people in business don't understand this.

Z

valerief

(53,235 posts)mnhtnbb

(31,392 posts)I couldn't believe the difference between last year and this year. Both my husband and I

collect SS. Last year about 1/3 of our SS payments were taxed: this year 2/3 were taxed.

And of course, no COL increase this year.

Deuce

(959 posts)Peace Patriot

(24,010 posts)...("Organized money hates me--and I welcome their hatred!"![]() , a Harry Truman (he'd strangle these jokers with his own hands for being traitors to the USA).

, a Harry Truman (he'd strangle these jokers with his own hands for being traitors to the USA).

We need someone to KICK BUTT in the nation's board rooms--wherever their headquarters may be located these days. We need a transglobal butt kicker. We need a tough kid from Brooklyn who will chain himself to a black woman on the streets of Chicago and thinks nothing of getting roughed up and arrested by Chicago cops.

We need...we need...oh, yeah, oh hey! Miracles DO happen! We are a blessed country, indeed, for the leaders who have arisen when we needed them.

We need BERNIE SANDERS! And here he is, running for president! Our trust-busting Teddy Roosevelt. Our hated-by-organized money FDR. Our Taft-Hartley-hating tough little guy from Missouri. All wrapped up in one.

GO BERNIE!

Enthusiast

(50,983 posts)The giant drug companies. The giant oil companies. Etc.

Gene Debs

(582 posts)which made their effective tax rate not only zero, but in the negative column.

jtuck004

(15,882 posts)summerschild

(725 posts)No wonder we can't afford to repair any infrastructure!

hopemountain

(3,919 posts)this nation to stand up and have their votes counted and their voices heeded.

tclambert

(11,087 posts)If a CEO willingly had his corporation pay more taxes than they had to, or lobbied for higher taxes for corporations, Wall Street and his companies investors would oust him and probably sue him. Yes, Ayn Randers, the profit motive does sometimes incentivize evil behavior. There are good reasons for greed to be one of the seven deadly sins.

eShirl

(18,494 posts)thereismore

(13,326 posts)the paying ones just stupid? Not clever enough? Too lazy? They might be in for a huge refund if they cared!

This is

Ferd Berfel

(3,687 posts)Have to ask yourself which candidate will even TRY to fix this.............

NCjack

(10,279 posts)reward for the information.