A Minimum-Wage Worker Can't Afford A 2-Bedroom Apartment Anywhere in the US

Last edited Thu Jun 14, 2018, 12:07 AM - Edit history (1)

Source: Washington Post

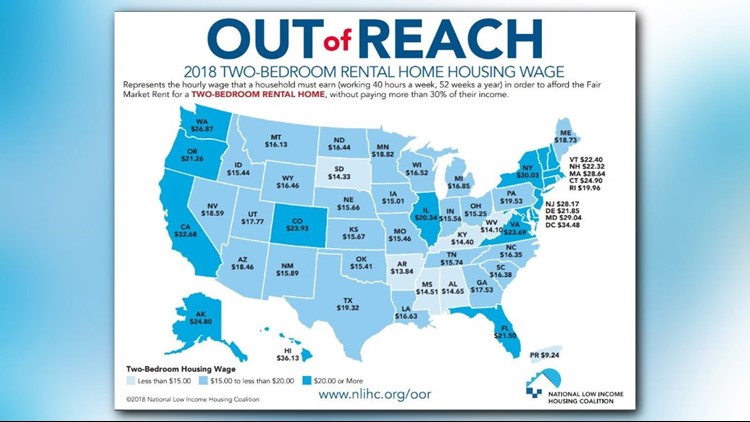

The economy's booming. Some states have raised minimum wages. But even with recent wage growth for the lowest-paid workers, there is still nowhere in the country where someone working a full-time minimum wage job could afford to rent a modest two-bedroom apartment, according to an annual report released Wednesday by the National Low Income Housing Coalition.

Not even in Arkansas, the state with the cheapest housing in the country. One would need to earn $13.84 an hour -- about $29,000 a year -- to afford a two-bedroom apartment there. The minimum wage in Arkansas is $8.50 an hour. Even the $15 living wage championed by Democrats would not make a dent in the vast majority of states.

In Hawaii, the state with the most expensive housing, one would have to make $36.13 -- about $75,000 a year -- to afford a decent two-bedroom apartment. The minimum wage in Hawaii rose to $10.10 an hour this year. It gets worse in many metropolitan areas. San Francisco, Marin and San Mateo counties top the list of most expensive jurisdictions, where one would need to make $60.02 an hour to afford a modest two-bedroom apartment.

"The housing crisis is growing, especially for the lowest-income workers," said Diane Yentel, president of the National Low Income Housing Coalition. "The rents are far out of reach from what the average renter is earning. "Here is how much you would need to afford rent in your state: (See Map Graphic)..

Read more: https://www.msn.com/en-us/news/us/a-minimum-wage-worker-can%e2%80%99t-afford-a-2-bedroom-apartment-anywhere-in-the-us/ar-AAyAJxs

>"The low-wage workforce is projected to grow over the next decade, particularly in service-sector jobs such as personal-care aides and food-preparation workers."

>"Housing and Urban Development Secretary Ben Carson recently proposed tripling rent for the poorest households and making it easier for housing authorities to impose work requirements on those receiving rent subsidies."

*National Low Income Housing Coalition, Report "Out of Reach 2018"

http://nlihc.org/oor

guillaumeb

(42,641 posts)All part of the constant class warfare that the 1% is winning.

OhNo-Really

(3,985 posts)in a metro city.

We were so underpaid!

Gymbo

(133 posts)In Trump's America ... and title

Hortensis

(58,785 posts)and worse. The title at least implies that min wage full-time workers could afford a one-bedroom apartment, and for most of them that simply is not true, although many may manage to pay the rent for a while. But almost all are one ordinary misfortune or run of ordinary problems away from living in their cars -- those who have one.

Blame the national shift to conservatism beginning around 1978-80 and still continuing. In the liberal era before, our nation as a whole felt that full-time work should pay a living wage.

I graduated from college in 1980 and immediately got a fulltime, minimum wage job. The job market was crap and I needed health insurance. Two room apartment? Don't think so. One room apartment? Nope! Lived at home. My friend had a somewhat better than minimum wage job with a major company and had a roommate. She couldn't even afford a winter coat. Needed a new car because her beater died? Moved back home. 1980 sucked. Trump is NOT the cause of all problems.

appalachiablue

(41,146 posts)Reagan's "Govt. is the problem, not the solution" on inauguration day began the big conservative 'Counter Revolution'/push to eradicate gains of the New Deal, the Great Society and more. Cut taxes on the wealthy, dismantle govt., the safety net, liberalism, worker rights and protections, security that came with the American Dream, deregulate business, block AIDS research, and more.

Reagan also began the demise of affordable college, and the break down of the mental health system beginning in Ca. which has since deteriorated to an appalling living nightmare for the ill and general public. In 1980 we had almost eliminated poverty in the US, and the homelessness problem was minor compared to the last 20+ years.

I know and remember from being in DC when he was elected, inaugurated and for years afterwards. In the late 70s and early 80s there were few homeless people in downtown DC. That dramatically increased by the later 80s and 90s.

In 1981 when I got out of grad school in DC I had much difficulty finding a job in my field which related to the Smithsonian. And I was worried sick, but lucky that my parents helped with housing temporarily for three of us in DC colleges. Eventually I found a position but didn't know about the early 'Reagan Recession' and govt. cutbacks that were occurring then, until years later.

Hortensis

(58,785 posts)suited to govern modern democratic nations. Actually, I don't believe most are suited to run authoritarian dictatorships and fascist states either without running the ruling class's gravy train into the ground. America's mood has empowered ongoing conservative dominance for the past 40 years now, and we seeing their unfitness in the slow decline of our nation, development and shift of wealth and power to new centimillionaire and billionaire classes, and strong decline in the wellbeing of many millions.

Let's face it. Government of, by and for the people, respect for inherent value and good of most individuals, and equality of all people and inherent rights are liberal concepts. Many moderate conservatives believe in them also.

But they just don't ping with most strong conservatives, who believe equality is a ridiculous and unnatural concept, that people will naturally tend to behave badly if not required to be good, and that it is the people who are unsuited to govern and must be governed.

It's time for this conservative era to end, with another big shift in national mood to liberalism. I suspect we'd be well into it if it weren't for the efforts of ultrawealthy conservatives to keep that from happening.

blue-wave

(4,356 posts)In Illinois, some state legislators and community groups are organizing to pass rent control laws. Rent controls are not allowed under current state law. It is my understanding that JB Pritzker, the Democratic candidate for governor is in favor of allowing local governments to pass rent controls. With the increases in rent we are experiencing nationwide, I would guess this movement will gain steam.

OhNo-Really

(3,985 posts)quartz007

(1,216 posts)So the rents were low, except with the shortage, one needed to pay a huge sum under the table to sign a lease.

BigmanPigman

(51,611 posts)People's incomes have increased from $46,000 to $57,000 between 1976 and the present. Do you think there is a huge problem here? Meanwhile no affordable healthcare or education. Robert Reich said that since 1976 and the price of gas/oil as well as major inflation made more spouses forced to work for the added income. Then people maxed out their credit cards and that was a fiasco, and finally they mortgaged their homes to make ends meet and now there is nothing left for the average family to do and still remain above water.

appalachiablue

(41,146 posts)appalachiablue

(41,146 posts)In the US, the geography of poverty is shifting. According to a May report from the Pew Research Center, since 2000, suburban counties have experienced sharper increases in poverty than urban or rural counties. This is consistent with research across the U.S. over the past decade - as well as my own book, "Places in Need."

The suburbanization of poverty is one of the most important demographic trends of the last 50 years. Poverty rates across the suburban landscape have increased by 50 percent since 1990. The number of suburban residents living in high poverty areas has almost tripled in that time. These new trends are not just occurring in the wake of the Great Recession.

In 1990, there were nearly as many poor people in the suburbs of the largest 100 U.S. metropolitan areas as within the cities of those metros, even though poverty rates historically have been much higher in cities.

Why is poverty rising faster in suburbs than in cities? There are many reasons. Population growth in suburbs plays a part - the US has become a suburban nation. However, that's not the most important factor. My research finds that suburban poverty is growing three times faster than population size in suburban communities across the country. As in cities and rural communities, poverty is rising in suburbs because of the changing nature of the labor market. For those in low-skill jobs, earnings have stayed flat for the last 40 years.

In most suburbs, unemployment rates were twice as high in 2014 as in 1990. Good-paying jobs that don't require advanced training have started to disappear in suburbs, just as they did in central cities more than a quarter century ago. These national employment trends have contributed to rising poverty everywhere, but the impact has been particularly acute in suburbs, where there are a large percentage of workers without advanced education or vocational training. More, http://www.businessinsider.com/poverty-is-rising-faster-in-us-suburbs-than-in-cities-heres-why-2018-6

OhNo-Really

(3,985 posts)50% earned less that $26,500 a year. It hasn't improved much at all.

oberliner

(58,724 posts)Report from the same group in 2015:

That's the depressing takeaway from a new report by the National Low-Income Housing Coalition. The paper includes this map tallying the hours a worker would have to put in at her job each week to rent a one-bedroom apartment without it eating more than 30 percent of her wages.

https://www.vox.com/2015/5/28/8679889/minimum-wage-housing-map

miyazaki

(2,244 posts)Where I hear there are some Puerto Rican girls just dyin' to meet you.

oberliner

(58,724 posts)Which is kind of arbitrary.

A 2-bedroom apartment in a not-so-nice area of NYC is going to cost around $3500 a month, which is $42,000 a year.

By this metric, no one making less than $140,000 a year can afford a 2-bedroom apartment in NYC.

BumRushDaShow

(129,103 posts)NYC is unique where you have rent-controlled apartments. But the metric means that people are often paying upwards of 50+% for rent alone to be there. However what also happens is that you have multiple workers in a household like that.

The "30%" metric is a standard one nationwide and is apparently something lenders now use for underwriting mortgages for example... but I found a good historic explanation of where this figure comes from (per the Census Bureau - PDF file) -

Talk of housing affordability is plentiful, but a precise definition of housing affordability is at best ambiguous. The conventional public policy indicator of housing affordability in the United States is the percent of income spent on housing. Housing expenditures that exceed 30 percent of household income have historically been viewed as an indicator of a housing affordability problem.2 The conventional 30 percent of household income that a household can devote to housing costs before the household is said to be “burdened” evolved from the United States National Housing Act of 1937. The National Housing Act of 1937 created the public housing program, a program that was designed to serve those “families in the lowest income group.” Income limits rather than maximum rents were established for family eligibility to live in public housing; that is, a tenant’s income could not exceed five to six times the rent. By 1940, income limits gave way to the maximum rent standard in which rent could not exceed 20 percent of income - in practice, the same as the predecessor income limit standard. The Housing Act of 1959 maintained maximum rents, but it also gave local public housing authorities more autonomy in establishing them. By 1969, the escalation of rents by public housing authorities struggling to meet spiraling operation and maintenance costs nearly nullified the purpose of the public housing program established in 1937 to serve the nation’s neediest. To reverse this, the Brooke Amendment (1969) to the 1968 Housing and Urban Development Act, established the rent threshold of 25 percent of family income; that is, a family would be required to pay one-quarter of its income in rent. By 1981, this threshold had been raised to 30 percent, which today remains the rent standard for most rental housing programs.

Because the 30 percent rule was deemed a rule of thumb for the amount of income that a family could spend and still have enough left over for other nondiscretionary spending, it made its way to owner-occupied housing too. Prior to the mid 1990s the federal housing enterprises (Fannie Mae and Freddie Mac) would not purchase mortgages unless the principal, interest, tax, and insurance payment (PITI) did not exceed 28 percent of the borrower’s income for a conventional loan and 29 percent for an FHA insured loan. Because lenders were unwilling to hold mortgages in their portfolios, this simple lender ratio of PITI to income was one of many “hurdles” a prospective borrower needed to overcome to qualify for a mortgage. There are other qualifying ratios as well; most of which hover around 30 percent of income. The amount of debt outstanding and the size and frequency of payments on consumer installment loans and credit cards influence the lender’s subjective estimation of prospective homebuyers’ ability to meet the ongoing expenses of homeownership. Through the mid 1990s, under Fannie Mae guidelines for a conventional loan, total allowable consumer debt could not exceed eight percent of borrower’s income for conventional mortgage loans and 12 percent for FHA-insured mortgages. So through the mid 1990s, underwriting standards reflected the lender’s perception of loan risk. That is, a household could afford to spend nearly 30 percent of income for servicing housing debt and another 12 percent to service consumer debt. Above these thresholds, a household could not afford the home and the lender could afford the risk. While there are many underwriting standards, none of them made their ways into the public policy lexicon like the 30 percent of income indicator of housing affordability.

The mid to late 1990s ushered in many less stringent guidelines.3 Many households whose housing costs exceed 30 percent of their incomes are choosing then to devote larger shares of their incomes to larger, more amenity-laden homes. These households often still have enough income left over to meet their non-housing expenses. For them, the 30 percent ratio is not an indicator of a true housing affordability problem but rather a lifestyle choice. But for those households at the bottom rungs of the income ladder, the use of housing costs in excess of 30 percent of their limited incomes as an indicator of a housing affordability problem is as relevant today as it was four decades ago.

1 Callis, Robert and Cavanaugh, Linda, Housing and Vacancy SurveyAnnual Statistics:2007. Available

[Online]: http://www.census.gov/hhes/www/housing/hvs/annual07/ann07ind.html [February 2008].

2 “Housing Affordability: Myth or Reality? “ Wharton Real Estate Center Working Paper, Wharton Real

Estate Center, University of Pennsylvania, 1992

3 “Review of Selected Underwriting Guidelines to Identify Potential Barriers to Hispanic Homeownership”,

U.S. Department of Housing and Urban Development, Office of Policy Development and Research, March

2006

https://www.census.gov/housing/census/publications/who-can-afford.pdf

I grew up where my parents always said to aim for no more than "25%" of income for housing (and usually referenced "net" income vs "gross" ). With the cost of living now, that is difficult.

New York state minimum wage (current because they are gradually moving to $15/hr over time) is $13/hr. Assuming a 40 hr work week, that is $2080/month. Many minimum wage workers are working 2 jobs so if they do another part time (say 20 hrs/week), that adds another $1040 /month (total $3120/month). If you have a couple in the household doing this (pretty much required), that's $6240/month for 2 people working 60 hrs/week at minimum wage & thus 56% spent towards housing (assuming that $3500/month figure). And this is also assuming they are not in subsidized housing (like the kind that Crazy Carson threatened to raise the rents on).

But note, many minimum wage employees are not working "full time" for any one job (the employers often do this to keep them part time and thus not have to provide health benefits), so the situation really is dire.

thesquanderer

(11,990 posts)If you make $150k a year, you can afford to spend a much greater percent of your income on housing than you can if you make $15k a year, and still have enough left to eat, dress, and get around.

BumRushDaShow

(129,103 posts)https://www.census.gov/housing/census/publications/who-can-afford.pdf

thesquanderer

(11,990 posts)BumRushDaShow

(129,103 posts)thesquanderer

(11,990 posts)With no car payments/insurance/gas/repairs/parking costs, and instead only much more affordable bus/subway fares for the stuff you can't walk to, in theory, one could afford to put more of your income toward housing than can someone who has those other expenses because of where they live... and again, the 30% figure would not take that into account.

BumRushDaShow

(129,103 posts)but then (at least for places like NYC) food and other costs are ridiculous, although not quite rising to the level of trying to maintain a car, but still taking a good chunk out just the same.

thesquanderer

(11,990 posts)Last edited Thu Jun 14, 2018, 09:31 AM - Edit history (1)

but also because if a minimum wage earner *could* easily afford a two bedroom apartment, there would basically be no reason for there to be 1 bedroom apartments or studio apartments or rented rooms. That's like saying that an average wage owner can't afford a Mercedes or BMW. That's okay, that's why there are Chevys and Kias, including used ones. Who would expect minimum wage to offer all the comforts? Minimum wage is not designed for that, it is after all a *minimum*. No surprise you should expect to only be able to afford to live in a small place.

oberliner

(58,724 posts)In any case, I agree with your analysis.

YOHABLO

(7,358 posts)BumRushDaShow

(129,103 posts)in the U.S. until recently, the reverse occurred where the cities were abandoned and left to rot (dubbed "ghettos" or "slums" or "inner cities" ) while the suburbs were developed in order to provide brand new homes and brand new schools and brand new shopping malls to the fortunate majority population (i.e., non-minority, because POC were not allowed to live there).

Now the 'burbs are worn out and in decay, where the wells have gone dry and the septic tanks have exploded underground...the overgrown and un-maintained trees fall on the power lines and the strip malls are boarded up... So now the "rust" is suddenly being scraped off the "Rust Belt" cities revealing shiny new steel underneath. And right on cue, POC are now "welcome" to move to the 'burbs while being priced out of their generational homes in the cities.

pnwmom

(108,980 posts)I couldn't even afford a studio, in a rural area of Virginia.

Schedule

(29 posts)No minimum wage person can afford a 1 bedroom while paying for electricity, food, health insurance, transportation, etc.

TexasBushwhacker

(20,202 posts)In a real world scenario, I think anyone who works full time should be able to afford a basic 1 BR apartment on 30% of their income. The 30% standard may seem arbitrary but it isn't. Most landlords Require that you spend no more than 30 to 35% on rent or you can't sign a lease.

haele

(12,660 posts)When you look at most of the houses and apartments built from the late 40's through the 60's, they were for the average Boomer family, with the "starter" home at 2 bedroom/1 bath at between 800 and 1000 sq. ft.. The starter apartment of 1 bedroom was typically for singles or couples starting out, and was usually a rental, not something that was bought.

As long term housing is an issue more for families than for singles (who apparently can more easily find accommodations - "couch surf", move in with parents, find shelters, join the military, etc...) I suspect that the HUD/VA lender's "2 Bedroom" standard for the average family home is being used for reports on housing affordability.

Haele

KPN

(15,646 posts)to it -- or stuff like it, e.g., minimum wage vs actual cost of living, really though, average income v cost of living. Good to see the media moving away from negligence a bit.

Hekate

(90,714 posts)That was in the late 1960s in Honolulu. I'm sorry, but min wage equals poverty and it sucks. Yes, we need a higher wage in this country, everywhere, and pretty much always have.

Eyeball_Kid

(7,432 posts)Kaleva

(36,312 posts)Nobody making minimum wage or slightly higher is in the market for a 2 bedroom apartment that costs $2,000 a month to rent so why include such places in a state average?

According to SmartAsset, the average rent for a two bedroom apartment in Michigan is $972. Remember, that's an average. So for every $2,000 a month apartment factored in the average, there are many that rent for far less then the average.

And why would any single person making minimum wage rent a two bedroom apartment for? If you're going to a get a 2 bedroom apartment, then might as well get a roommate who can share costs.

Decoy of Fenris

(1,954 posts)In my local area even assuming a two-family household and all expenses (electric, heat, internet) it barely crests 30%, and that's not to rent, that's to own with almost no down payment. Rent is far cheaper. Cities just drive up the average; there's plenty of places all throughout America with dirt-cheap rents and aren't hellholes. Problem is, these types of studies don't factor in the rural/urban divide, resulting in numbers that look far more catastrophic than they actually are.

Unless they are assuming there are children.

I am not saying rents should not be more affordable, but my first apartment years ago was a standard one bedroom in the suburbs I shared with my eventual husband. We shared costs and rent and commuted to the city for work. Most of my near minimum wage coworkers, like me, had apartments with roommates. I knew some singles that preferred living alone in smaller studio apartments. I would not really expect minimum wage to support all expenses plus a two bedroom apartment now or back then, but it should be enough for basic needs of food, clothing, and shelter/basic housing.

oberliner

(58,724 posts)treestar

(82,383 posts)to be factored in. Their taxes would be a lot less, and they would get food stamps or even Section 8 might apply.

oberliner

(58,724 posts)This isn't the most effective study/graphic to get the point across about minimum wage.

haele

(12,660 posts)And most property management companies don't take the vouchers for those on the waiting list for approved housing. A prospective renter with a section 8 voucher has to depend on the mercy of individual landlords or the few slum-lord management companies that might take vouchers if it's sweetened with something else - like turning a blind eye to code violations or additional "fees" or maintenance work under the table.

Most working families, or single parents, or disabled individuals need to find stable places to live out "on the town" or with friends with what little they're able to scrape together for years until they are able to get one of those magical Section 8 units.

The last time we were renting - 3 years ago - our grown daughter, her husband, and her baby were living with us in a little (900 sq. ft.) 3 bdrm/1 bath 1950's "ranch house" because the Section 8 waiting list in San Diego is 5 years with nothing left for emergency housing; there were several other houses in the neighborhood where there were multiple families in equally small 2 or 3 bedroom house - working families on the waiting list who had moved back home with a generous grandparent stuffed three or four to a bedroom or living in an enclosed porch or modified garage.

Our rent was $1575 a month, going up yearly by 3%. And that's not including utilities. And rent was only that low because we were living in gang central - the intersection down the street was where four gang "turfs" met, so there was always something going on. A mortgage on an affordable house (< $300K)in the same neighborhood would have been far more affordable - that is, if we had the 20% down payment.

Haele

oneshooter

(8,614 posts)Last one did $30,000 damage to a 1400sq ft 3 bdrm, 2 bath house.

haele

(12,660 posts)Many renters, section 8 or not, have issues with taking care of a property they don't feel they have a stake in. They can just move if it gets too bad, right? And then there's the issue with children - especially small ones who are "exploring"" and teenagers in the throughs of adolescent hormones and rages. They're often worse then pets.

Once the stepdaughter hit puberty, we never got our deposit back - she was so full of rage and took it out on the cave she turned her bedroom into.

Haele

oneshooter

(8,614 posts)the Government made it so that it took 6 MONTHS to get them out.

LanternWaste

(37,748 posts)"And why would any single person making minimum wage rent a two bedroom apartment for?"

Single parent with kids. The largest demographic at my complex.

Kaleva

(36,312 posts)They would also qualify for subsidized day care and SNAP.

RobinA

(9,893 posts)when it comes to rent. I live in PA. I could probably find a two bedroom in my state for $972, but it would be an hour from the nearest employment, and that employment wouldn't allow me to afford a $972 without a second income. Where I live, I might be able to find a studio for that in an area where I could safely sit on my front steps. Might. I suspect Michigan is the same, as it combines low rent rural areas that are miles from anywhere, seriously low rent urban areas, and fairly upscale areas near professional employment.

Kaleva

(36,312 posts)I've bought 5 houses here in the lifetime, I still own 2 which are payed for in full, and the monthly mortgage payment wasn't over $300 on any of them.

A veteran, who wouldn't have to put 20% down, could purchase the below for that amount:

https://www.realtor.com/realestateandhomes-detail/934-Sherman-St_Marquette_MI_49855_M40929-78978?view=qv

a la izquierda

(11,795 posts)Unless I wanted to live way outside town, with my student loan hanging over my head, and the market here being as crazy as it is, I, a university professor, can’t afford a house on my income alone.

Kaleva

(36,312 posts)Monthly payments which include escrow run around $500.

a la izquierda

(11,795 posts)I’ve looked at 50+ houses in 4 years, but it’s no matter since I won’t be there another year. Want to know what a foundation looks like in that part of the world if it hasn’t been maintained?

Kaleva

(36,312 posts)Appliances included

a la izquierda

(11,795 posts)Have you been to Morgantown? No? Good. Let me tell you about it.

It’s usually ranked as the Number 1 party school. The traffic is horrendous. It is something like 14% higher than he national average (last I checked) for housing. Gas and groceries are more expensive. There are maybe three neighborhoods that aren’t overrun by students, whom I teach every day and I feel no obligation or desire to be near them at any other point in my day. I walk through downtown Friday and Saturday mornings dodging piles of vomit and puke. My car has been broken into three times- know what it costs to replace broken automatic windows? House in my “nice” neighborhood have been robbed or targeted for home invasions. I’ve walked out of my house to find used syringes on my walkway. I can’t run in the parks or along the river without pepper spray.

So no, I’m not buying a poorly built condo where my students party and where junkies get high. I’m not spending $150K for a 900 square foot house that needs probably $60K of work. I’ll move to suburban Pittsburgh (or god willing, out of this dying country) and put my money elsewhere.

Kaleva

(36,312 posts)Here is what you said in your first post:

"Unless I wanted to live way outside town, with my student loan hanging over my head, and the market here being as crazy as it is, I, a university professor, can’t afford a house on my income alone."

I resond with a post where I say that there's numerous homes listed in Morgantown listed for much less then the price of the home I first posted about. You then respond with this:

"I’ve looked at 50+ houses in 4 years, but it’s no matter since I won’t be there another year. Want to know what a foundation looks like in that part of the world if it hasn’t been maintained?"

First you say there's nothing in your price range but now you changed it to that everything in your price range (must have been quite a few of those as you say you looked at over 50+ homes which outright refutes your first post) is debilitated or in a shit area or both. So, I go back to look at real estate listings and see a nice, recently built in 2008, 2 BR condo for $104k located right in downtown Morgantown. Now you laughably respond with this statement "Have you been to Morgantown? No? Good. Let me tell you about it.

It’s usually ranked as the Number 1 party school. The traffic is horrendous. It is something like 14% higher than he national average (last I checked) for housing. Gas and groceries are more expensive...."

Every step of the way, you refute your own previous statement!

This is fun and I'm really enjoying this!

Let's keep this game going by you naming the three neighborhoods in Morgantown that aren't run over by students!

Edit: I don't know why you posted in this thread in the first place. A discussion about affordable housing. Your issues are with Morgantown's college life, traffic conditions, cost of gas and groceries in the town, drug problems and your contempt for college students and not with cost of housing.

Anon-C

(3,430 posts)...or Bloomberg?

Perhaps on Marketplace they will respond to "Tyrone" from South LA as they have in the past to better explain why this is Best Economy Ever with no inflation and such high levels of employment that we've effectively cured poverty, homelessness, and housing discrimination and can probably just shut down HUD entirely.

![]()

treestar

(82,383 posts)but what about a one bedroom apartment? And this is a single person, right? Or at minimum wage, what about a roommate? Could two minimum wage earners afford the 2 bedroom apartment?

TexasBushwhacker

(20,202 posts)Net pay for minimum wage after FICA is taken out is $6.70 an hour. Since an employer who pays minimum wage is not going to want to pay overtime, let's say they work 38 hours per week. They probably won't get paid holidays or vacation either, so figure they work 1900 a year, and that's being generous. 2 people making that much will clear about $2100 a month and 33% of that for rent would be $700. IF they can get a 2 bedroom for that in a city it's going to be a godforsaken hell hole. They might be able to rent a 2 BR in a small town though. More likely they would have to share a 1 BR.

I'm in Houston and pay $747 for my 1 BR. I like my apartment, but it's a 40 year old building so it's not the best. 2 BR go for $987.

Kaleva

(36,312 posts)The home has a large yard, attatched garage and full basement.

TexasBushwhacker

(20,202 posts)There are always exceptions. Where is he getting this bargain?

backtoblue

(11,343 posts)A decent two bedroom apartment will run around 700-800 in my area. Add no public transportation, rising gas prices, and a gop-held government hell bent on privatizing. The food pantry lines are long even in the most rural areas.

The income gap is staggering here as well. You have million dollar homes overlooking housing authorities, slums, and trailer parks.

It's a paradise for rich retirees. Not so much for the working poor.

dlk

(11,569 posts)The decline in American wages coincides with the decline in the number of unions. There's a connection and in this case, correlation is causation.

appalachiablue

(41,146 posts)ck4829

(35,077 posts)zanana1

(6,122 posts)My house has to be sold because since my husband died I just can't afford the mortgage and utilities. I'm living off his life insurance payout which will be gone by late summer. I'm looking for a one bedroom apartment and I can't find anything below $1,000 a month. Actually that amount would only get me a dump in the inner city. I've applied for Title 8 housing but the waiting list is eight years long.

I may be literally on the street if I don't find something quick.

appalachiablue

(41,146 posts)The scarcity of affordable apartments is real, like the shortage and very long wait times for Title 8 housing which some people think is the easy answer. There are veterans in Arlington, Va., in the shadow of the capitol, some disabled who have been on a wait list for housing for years. This, in the wealthiest country in the world. The only suggestion I have which you've probably considered is renting a room in a house if available and at the price you want. Take care and all the best with these challenges and your upcoming relocation.

zanana1

(6,122 posts)Kaleva

(36,312 posts)Since you are selling and moving, you may want to consider moving to an area where housing is affordable.

If you are retired, you could look into rural communities here where very nice homes can be purchased for about $50k to $70k. With 20% down, your monthly payment on such a home would be less then $300 a month.