GameStop stock roars back after Robinhood lifts trading freeze

Source: Washington Post

GameStop shares spiked more than 60 percent Friday, setting the stage for another tumultuous day on Wall Street in a week marked by a captivating drama about money, power and a tech-fueled rebellion. The surge came after Robinhood announced that it would allow “limited buys” of GameStop and other heavily shorted stocks to resume on Friday amid reports that the popular trading app had raised $1 billion overnight from investors to comply with federally mandated capital requirements.

Robinhood shocked investors Thursday morning when it abruptly restricted purchases of GameStop, AMC Entertainment, BlackBerry and certain other volatile stocks. The equities have drawn intense interest from regular investors on the Reddit forum r/WallStreetBets and other online trading communities, driving share prices to astronomical heights and alarming regulators and brokerage firms

Other trading platforms, including Interactive Brokers and E-Trade, similarly blocked their customers from buying GameStop and the other “meme stocks” on Thursday. But Robinhood, owing to its popularity, its namesake and its branding as a democratizing force in the world of high finance, drew the ire of customers and public officials for shutting its customers out in the middle of the trading frenzy. GameStop shares plummeted Thursday, shedding more than 60 percent at the closing bell. AMC shares followed suit, losing 56 percent of its value. AMC has not fully recovered but bounced back 55 percent Friday morning.

In a blog post Thursday afternoon, Robinhood said its decision to limit buying was necessary to conform with financial regulations, “including SEC net capital obligations and clearinghouse deposits,” which can heighten in times of substantial volatility. “These requirements exist to protect investors and the markets and we take our responsibilities to comply with them seriously, including through the measures we have taken today,” the company said.

Read more: https://www.washingtonpost.com/business/2021/01/29/gamestop-stocks-robinhood-reddit/

PSPS

(15,283 posts)bucolic_frolic

(54,657 posts)The hedge fund that blew up had its countertrade countertraded

And some brokers halted trading in everything much of the day, according to one post I read it was an issue with APEX clearing which services many firms. Don't know if it was a liquidity issue, but the OP cites "SEC net capital obligations and clearinghouse deposits" so that kind of confirms it.

BusyBeingBest

(9,173 posts)trading--but now I want to know why hedge funders were still allowed to operate unrestricted. They had an unfair advantage that was created by either the trading platforms or regulators or both.

jmbar2

(7,850 posts)The brokerage itself doesn't have the money. It uses a clearinghouse or middleman to cover the flow of funds during that time lag. When the trades exceed their their ability to cover, they have to shut it down.

A brokerage like ETrade is backed by JPMorgan, so they can get the money fast. Robinhood is an independent, so they had to go out and raise capital to cover the increased transactions and inflated stock prices caused by this movement. They are required by law to be able to cover those transactions, or close until they can.

As an analogy, if everyone went to their bank and tried to withdraw all their funds, the bank doesn't actually have that much money on hand. They would have to get it from somewhere else, which would take time. The bank would have to close its doors for awhile until it had the capital it needed to operate.

As I understand it, a lot of these rules were put into place after the 2008 financial crash.

jmbar2

(7,850 posts)Some hedgefunds will be bankrupted by it. Others will severely curtain their activities in a heightened risk environment. Not sure if this is all good or bad. We're in uncharted waters.

keithbvadu2

(40,915 posts)Bengus81

(9,995 posts)Last edited Fri Jan 29, 2021, 06:10 PM - Edit history (1)

Tough SHIT boys. You bet your wad on Game Stop going down and you lost. Wall St. fat cats don't shed tears when Joe Blow loses a grand going long on a transaction and it tanks.

So why all the crying by Wall St. and many brokers when it goes south the other way?? Yeah...I hope OAC investigates the hell of this.

marie999

(3,334 posts)Sgent

(5,858 posts)the other brokers (that didn't use Apex as their clearing firm) increased margin requirements to 100%, and required that you use settled funds. Only Apex clients (most notably RH) prevented all purchases.

BumRushDaShow

(167,791 posts)Chamath Palihapitiya who appears often on CNBC, was in the middle of this, and has a unrolled twitter thread on it - https://threadreaderapp.com/thread/1354883147523997697.html

1. If you are "smart money" you are allowed to take your $1 and leverage it up to $15+

2. You can now buy $15 of stock AND if you promise to short companies, you can short $15 of stock as well

3. In finance language, this means that you are $30 "gross" ($15 of longs + $15 of shorts) but $0 net (+$15 of longs -$15 of shorts). This makes everyone feel good because it feels like you are taking zero risk...but in reality, your $1 is exposed to $30 of risk.

4. Now you go around and tell your friends about both your longs and your shorts and when you do it at a restaurant vs on Reddit, its called an "ideas dinner".

5. You also publish your longs on a quarterly lag via an SEC rule. You don't have to tell anyone about your shorts.

6. Now the less cool people who weren't invited to the ideas dinners, start copying your longs based on your report.

7. You realize that publicizing your shorts is also a good idea so instead of only selling stocks, you also BUY options (puts) which has to be reported.

8. Now everyone can see both your longs and your shorts and if you have a hot hand, you can likely predict that the cool people from the dinner as well as the less cool people monitoring your filings will copy you.

9. But then an outsider notices that the math is way off!

10. Apparently, some of these shorts that you own represent more than 100% of the entire stock of the company. Huh?

11. So he grabs his chicken fingers and champagne and buys, starts a massive short squeeze.

12. Other's see what's happening and they jump in.

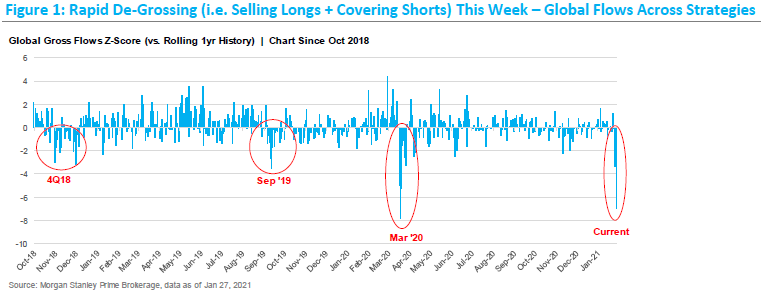

13. Now a massive short squeeze starts. You have to cover your shorts ASAP. But the banks also notice that you don't have enough credit to cover the $30 they lent you and ask for more collateral. You now also have to sell your long positions. It looks like this:

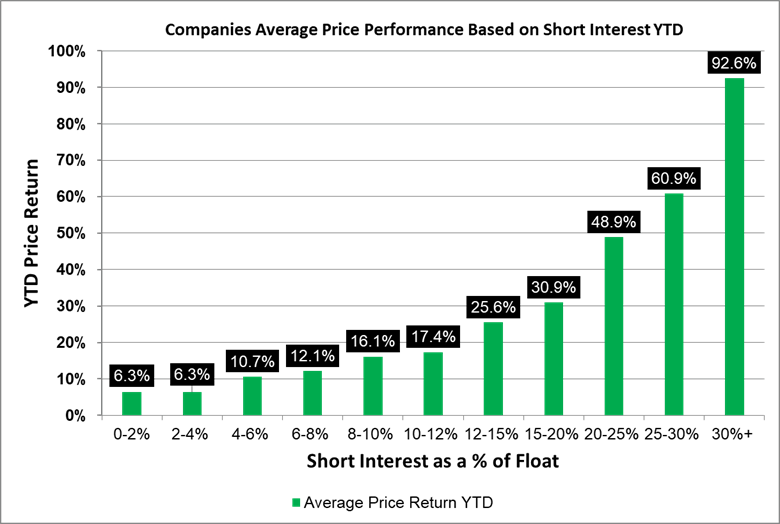

14. What happens next is that a cascade of short covering and long selling starts driving some stocks to the moon and others way down. Which stocks went up? Basically the ones that were the most heavily shorted by you and your buddies in the first place.

So the outsider won?

It's not clear. You and your buddies are strong, rich and have a lot of influence so you need to do whatever you can to keep the rules in your favor.

Maybe the SEC will ask for an open inquiry?

Maybe Congress will hold hearings?

Let's see...now go to bed.

• • •

AntiFascist

(13,747 posts)BumRushDaShow

(167,791 posts)David Gelles

By David Gelles

Jan. 29, 2021Updated 2:30 p.m. ET

Just weeks before Elon Musk became the richest person in the world thanks to the soaring value of Tesla shares, the eccentric billionaire reflected on the fickle nature of the public markets. “The stock market is a strange thing,” Mr. Musk said in an interview with Business Insider in December. “It’s like having a manic depressive who’s constantly telling you how much your company’s worth. And sometimes they have a good day, and sometimes they have a bad day, but the company is basically the same. The public markets are crazy.”

A month later, Mr. Musk has inserted himself into one of the most confounding stock market dramas in years — the multibillion-dollar battle over GameStop being waged between elite hedge funds and retail investors communicating on Reddit. On Tuesday, as GameStop shares skyrocketed, Mr. Musk weighed in with a one-word tweet — “Gamestonk!!” — and a link to the Reddit forum where much of the discussion has unfolded. Mr. Musk’s message was seen as an endorsement of sorts from one of the most powerful figures on the web, and in the days that followed, investors bid up the price of GameStop to new highs.

It is a spectacle tailor made for Mr. Musk’s live-wire online persona. He is at once a capitalist hero, a glossy magazine celebrity and a bomb-throwing troll with 44 million Twitter followers, inhabiting his role as the chief executive of two major companies with a bravado that most corporate leaders wouldn’t dream of. The richest man in the world is also, somehow, a hero to the anti-establishment crowd, riling up the digital masses one tweet at a time.

(snip)

Mr. Musk does not appear to be one of the traders bidding up GameStop. He told Business Insider that the only public company stock he owned was Tesla, and that he planned to use his wealth to colonize the cosmos.

https://www.nytimes.com/2021/01/29/business/elon-musk-gamestop-twitter.html

AntiFascist

(13,747 posts)about Musk's initial investment and plans for Gamestop? I wonder if he has also "gamed" Google.

BumRushDaShow

(167,791 posts)Published Thu, Jan 28 20216:11 PM ESTUpdated Thu, Jan 28 202111:42 PM EST

Michael Sheetz

The U.S. Department of Justice is investigating Elon Musk’s SpaceX over whether the company discriminates against non-U.S. citizens in its hiring, according to court documents filed on Thursday. The DOJ’s Immigrant and Employee Rights Section said it received a complaint of employment discrimination from a non-U.S. citizen in May and said SpaceX refused to comply with a subpoena for relevant documents related to hiring.

The DOJ is requesting an order from the court to require SpaceX to comply with its subpoena within two weeks. The U.S. Department of Justice is investigating SpaceX over whether the company discriminates against non-U.S. citizens in its hiring practices and said Elon Musk’s company is stonewalling a subpoena for information, court documents revealed Thursday. The DOJ’s Immigrant and Employee Rights Section received a complaint of employment discrimination from a non-U.S. citizen claiming that the company discriminated against him based on his citizenship status.

“The charge alleges that on or about March 10, 2020, during the Charging Party’s interview for the position of Technology Strategy Associate, SpaceX made inquiries about his citizenship status and ultimately failed to hire him for the position because he is not a U.S. citizen or lawful permanent resident,” DOJ attorney Lisa Sandoval wrote in a court document filed Thursday. The document was a request for a judge to order SpaceX to comply with an administrative subpoena for documents related to how the company hires. SpaceX did not immediately respond to CNBC’s request for comment. The Department of Justice declined to comment.

https://www.cnbc.com/2021/01/28/doj-investigating-spacex-after-hiring-discrimination-complaint-.html