Yahoo Finance September jobs report: Economy adds back disappointing 194,000 jobs, unemployment rate

Source: Yahoo!Finance

U.S. employers unexpectedly hired at a slower pace in September than in August.

The Labor Department released its September jobs report Friday morning. Here were the main metrics from the report, compared to consensus estimates compiled by Bloomberg:

Change in non-farm payrolls, September: +194,000 vs. +500,000 expected, +235,000 in August Unemployment rate: 4.8% vs. 5.1% expected, 5.2% in August Average hourly earnings, month-over-month: 0.6% vs. 0.4% expected, 0.6% in August Average hourly earnings, year-over-year: 4.6% vs. 4.6% expected, 4.3% in August

Non-farm payrolls were expected to pick up from August's much weaker-than-expected print, when renewed fears over the coronavirus deterred more workers from reentering the labor market. The September report also showed a ninth consecutive month of net payroll gains in the U.S. economy. But even after months of growth, total employment has yet to return to pre-pandemic levels. The civilian labor force was still down by 2.9 million individuals compared to February 2020 as of August.

Read more: https://finance.yahoo.com/news/september-jobs-report-labor-department-hiring-covid-2021-191337923.html

Friday again and hopefully our DU economic analysts will be along to fill in the details. Bit difference between reality and expectations as I think their "models" are failing in this unprecedented situation of a pandemic (something that hasn't happened to this degree since 1918 before the "modern" economic era).

mahatmakanejeeves

(57,436 posts)Good morning. Here are the placeholder Yahoo! Finance alert and the article Emily McCormick had in place, waiting for the embargo to be lifted:

September jobs report: Payroll gains set to accelerate to 500,000

Check back for results at 8:30 a.m. ET

-- -- -- -- -- --

September jobs report preview: Payroll gains set to accelerate to 500,000 as jobless rate falls further

Emily McCormick · Reporter

Thu, October 7, 2021, 3:13 PM

U.S. employers likely hired at a stronger rate in September after a disappointing August, with more individuals returning to the workforce as new coronavirus infections slowed and other pressures on the labor market at least temporarily abated.

The Labor Department is set to release its September jobs report Friday morning. Here are the main metrics expected from the report, compared to consensus estimates compiled by Bloomberg:

• Change in non-farm payrolls, September: +500,000 expected, +235,000 in August

• Unemployment rate: 5.1% expected, 5.2% in August

• Average hourly earnings, month-over-month: 0.4% expected, 0.6% in August

• Average hourly earnings, year-over-year: 4.6% expected, 4.3% in August

Non-farm payrolls are expected to pick up from August's much weaker-than-expected print, when renewed fears over the coronavirus deterred more workers from reentering the labor market.

The September report is also expected to show a ninth consecutive month of net payroll gains in the U.S. economy. But even after months of growth, total employment has yet to return to pre-pandemic levels. The civilian labor force is still down by 2.9 million individuals, compared to February 2020.

{snip}

BumRushDaShow

(128,925 posts)I think they need to throw out their statistical models and start over because they are not accurately capturing the variables that this pandemic has caused.

TGIF!

pwb

(11,261 posts)They read pukey to me?

BumRushDaShow

(128,925 posts)But they are non-paywall and beat out WaPo and NYT for the update (and Yahoo! is now owned by Verizon).

The Fifty Stateman

(76 posts)Then again, what isn't???

Bengus81

(6,931 posts)But that report should make those Trump humpers who haven't DIED yet from Covid very happy. After all that IS the plan they have had for not getting vaccinated.

Eh....Big deal

BumRushDaShow

(128,925 posts)None of their "prediction" models are factoring in the pandemic. Hell... the U.S. is rapidly approaching 3/4 million people who have died from this pandemic in less than 2 years and countless millions (among the some 44 million who have been infected) are probably experiencing some type of long COVID and might not be able to work in the types of jobs they used to.

This is not counting those who are now refusing to work for piddling wages and no benefits let alone the "border closures" and deportation of all the people who were working (and often dying) in the meat plants or at orchards and on farms during harvest season.

mahatmakanejeeves

(57,436 posts)Wed Oct 6, 2021: Links to earlier reports:

Fri Sep 3, 2021: Links to earlier reports:

Thu Sep 2, 2021 (in the Friday, August 6, BLS thread): Links to earlier reports:

Wed Aug 4, 2021: Links to earlier reports:

Sat Jul 10, 2021: Links to earlier reports:

Wed Jun 30, 2021: Links to earlier reports:

Fri Jun 4, 2021: Links to earlier reports:

Thu Jun 3, 2021: Links to earlier reports:

Fri May 7, 2021: Links to earlier reports:

Wed May 5, 2021: Links to earlier reports:

Fri Apr 2, 2021: Links to earlier reports:

Wed Mar 31, 2021: Links to earlier reports:

Fri Mar 5, 2021: Links to earlier reports:

Wed Mar 3, 2021: Links to earlier reports:

Fri Feb 5, 2021: Links to earlier reports:

Wed Feb 3, 2021: Links to earlier reports:

Fri Jan 8, 2021: Links to earlier reports:

Wed Jan 6, 2021: Links to earlier reports:

Fri Dec 4, 2020: Links to earlier reports:

Wed Dec 2, 2020: Links to earlier reports:

Fri Nov 6, 2020: Links to earlier reports:

Wed Nov 4, 2020: Links to earlier reports:

Fri Oct 2, 2020: Links to earlier reports:

Wed Sep 30, 2020: Links to earlier reports:

Fri Sep 4, 2020: Links to earlier reports:

Wed Sep 2, 2020: Links to earlier reports:

Updated from this post of Friday, December 6, 2019: Good morning. Links to earlier reports:

-- -- -- -- -- --

[center]Past Performance is Not a Guarantee of Future Results.[/center]

Nonetheless, what is important is not this month's results, but the trend. Let’s look at some earlier numbers:

Bureau of Labor Statistics, for employment in September 2021 (this one):

Yahoo Finance September jobs report: Economy adds back disappointing 194,000 jobs, unemployment rate

ADP® (Automatic Data Processing), for employment in September 2021 (last Wednesday's)

September private payrolls rose by 568,000, topping estimates: ADP

Bureau of Labor Statistics, for employment in August 2021:

August jobs report: Payrolls rise by disappointing 235,000 while unemployment rate falls to 5.2%

ADP® (Automatic Data Processing), for employment in August 2021:

August private payrolls rose by 374,000, missing estimates: ADP

Bureau of Labor Statistics, for employment in July 2021:

July jobs report: Economy adds back 943,000 payrolls, unemployment rate falls to 5.4%

ADP® (Automatic Data Processing), for employment in July 2021:

Private payrolls rose by 330,000 in July, missing estimates: ADP

Bureau of Labor Statistics, for employment in June 2021:

U.S. economy added 850,000 jobs in June as labor market showed renewed strength

ADP® (Automatic Data Processing), for employment in June 2021:

Private payrolls increased by 692,000 in June, beating expectations: ADP

Bureau of Labor Statistics, for employment in May 2021:

U.S. economy adds 559,000 jobs in May, as the recovery shows signs of strength

ADP® (Automatic Data Processing), for employment in May 2021:

Private-sector employment increased by 978,000 from April to May, on a seasonally adjusted basis.

Bureau of Labor Statistics, for employment in April 2021:

Economy picked up 266,000 jobs in April, fewer than expected as economy tries to rebound

ADP® (Automatic Data Processing), for employment in April 2021:

Private-sector employment increased by 742,000 from March to April, on a seasonally adjusted basis.

Bureau of Labor Statistics, for employment in March 2021:

The U.S. economy added 916,000 jobs in March as recovery gains steam again

ADP® (Automatic Data Processing), for employment in March 2021:

Private employers added back 517,000 jobs in March, missing expectations: ADP

Bureau of Labor Statistics, for employment in February 2021:

The economy added 379,000 jobs in February

ADP® (Automatic Data Processing), for employment in February 2021:

ADP National Employment Report: Private Sector Employment Increased by 117,000 Jobs in February

Bureau of Labor Statistics, for employment in January 2021:

Unemployment rate falls to 6.3% in January; payroll employment changes little (+49,000)

ADP® (Automatic Data Processing), for employment in January 2021:

ADP National Employment Report: Private Sector Employment Increased by 174,000 Jobs in January

Bureau of Labor Statistics, for employment in December 2020:

The economy lost 140,000 jobs in December

ADP® (Automatic Data Processing), for employment in December 2020:

Private-sector employment decreased by 123,000 from November to December, seasonally adjusted

Bureau of Labor Statistics, for employment in November 2020:

Job Growth Slows Sharply As Pandemic Takes Toll On Economy

ADP® (Automatic Data Processing), for employment in November 2020:

Private-sector employment increased by 307,000 from October to November, on a seasonally adjusted

Bureau of Labor Statistics, for employment in October 2020:

U.S. added 638,000 jobs in October, unemployment rate slides to 6.9%

ADP® (Automatic Data Processing), for employment in October 2020:

Private-sector employment increased by 365,000 from September to October, on a seasonally adjusted

Bureau of Labor Statistics, for employment in September 2020:

September jobs report: US economy gains 661,000 payrolls, unemployment rate ticks down to 7.9%

ADP® (Automatic Data Processing), for employment in September 2020:

Private-sector employment increased by 749,000 from August to September on seasonally adjusted basis

bucolic_frolic

(43,149 posts)Shopping last Saturday morning was slow. Surprised me. Walmart at 10 am was 1/2 as crowded as 5 am March 2020. I have the sense that people have stocked up preparing for inflation, and now will sit tight until Black Friday. There are bills to pay.

I think I read recently Yahoo has been sold off again to Private Equity. Verizon got something like 7 billion. I see email providers who sub off Yahoo email space I think, are suddenly in a panic over clicks. So fees are coming. Time to move everything to Google. https://www.thedenverchannel.com/news/national/yahoo-and-aol-sold-again-for-5b-as-verizon-exits-media-business

This is feeling most like the 1970s to me. After 12-20 years of under 3% interest rates we've rung all the growth out of everything and now have to deal with overcapacity. See any new strip malls in your neck of the woods? Despite 1/2 the old ones being empty?

I watch a guy from UK who visits their cities. Everything's well 55% of it, is boarded up. Check your own baggage. Any excess in your house, closet? How does it compare with 1985?

BumRushDaShow

(128,925 posts)because with all the "backed up ships" out west, eventually the warehouses may empty again. Problem is, "waiting for Black Friday" may mean "delivery in January or later". I keep hearing news stories that implore for people to "buy now or forget it". It's pretty frustrating. The Atlantic had a somewhat dire article yesterday about it -

The global supply chain is slowing down at the very moment when Americans are demanding that it go into overdrive.

By Derek Thompson

October 7, 2021

Is it just me, or does it feel like America is running out of everything?I visited CVS last week to pick up some at-home COVID-19 tests. They’d been sold out for a week, an employee told me. So I asked about paper towels. “We’re out of those too,” he said. “Try Walgreens.” I drove to a Walgreens that had paper towels. But when I asked a pharmacist to fill some very common prescriptions, he told me the store had run out. “Try the Target up the road,” he suggested. Target’s pharmacy had the meds, but its front area was alarmingly barren, like the canned-food section of a grocery store one hour before a hurricane makes landfall. This is the economy now. One-hour errands are now multi-hour odysseys. Next-day deliveries are becoming day-after-next deliveries. That car part you need? It’ll take an extra week, sorry. The book you were looking for? Come back in November. The baby crib you bought? Make it December. Eyeing a new home-improvement job that requires several construction workers? Haha, pray for 2022.

The U.S. economy isn’t yet experiencing a downturn akin to the 1970s period of stagflation. This is something different, and quite strange. Americans are settling into a new phase of the pandemic economy, in which GDP is growing but we’re also suffering from a dearth of a shocking array of things—test kits, car parts, semiconductors, ships, shipping containers, workers. This is the Everything Shortage. The Everything Shortage is not the result of one big bottleneck in, say, Vietnamese factories or the American trucking industry. We are running low on supplies of all kinds due to a veritable hydra of bottlenecks. The coronavirus pandemic has snarled global supply chains in several ways.

Pandemic checks sent hundreds of billions of dollars to cabin-fevered Americans during a fallow period in the service sector. A lot of that cash has flowed to hard goods, especially home goods such as furniture and home-improvement materials. Many of these materials have to be imported from or travel through East Asia. But that region is dealing with the Delta variant, which has been considerably more deadly than previous iterations of the virus. Delta has caused several shutdowns at semiconductor factories across Asia just as demand for cars and electronics has started to pick up. As a result, these stops along the supply chain are slowing down at the very moment when Americans are demanding that they work in overdrive.

The most dramatic expression of this snarl is the purgatory of loaded cargo containers stacked on ships bobbing off the coast of Los Angeles and Long Beach. Just as a normal traffic jam consists of too many drivers trying to use too few lanes, the traffic jam at California ports has been exacerbated by extravagant consumer demand slamming into a shortage of trucks, truckers, and port workers. Because ships can’t be unloaded, not enough empty containers are in transit to carry all of the stuff that consumers are trying to buy. So the world is getting a lesson in Econ 101: High demand plus limited supply equals prices spiraling to the moon. Before the pandemic, reserving a container that holds roughly 35,000 books cost $2,500. Now it costs $25,000.

(snip)

https://www.theatlantic.com/ideas/archive/2021/10/america-is-choking-under-an-everything-shortage/620322/

Yahoo! was mostly bought by Verizon about 4 years ago and whatever was left (their financial services stuff) was sold to some private equity recently.

Deminpenn

(15,286 posts)fully to the workforce is the childcare issue. Even though schools are back to in person learning for the most part, it's still not 100% that schools won't occassionally close and return to online classes if covid cases recur in large enough numbers in any specific school.

The theory was people would jump back into the workforce once the extra UI benefits stopped, but that hasn't happened yet making it appear that theory of "making too much on unemployment than they do working" might not be correct.

mahatmakanejeeves

(57,436 posts)Weak September jobs report underscores Fed’s misdiagnosis of delta variant’s toll on the economy

Some economists and Fed watchers say the central bank underestimated delta’s threats to job growth, inflation and global supply chains going into the fall

By Rachel Siegel

Today at 1:08 p.m. EDT

The weak September jobs report offered the latest sign of the coronavirus pandemic’s hold on major sectors of the economy, conflicting with the type of recovery the Federal Reserve forecast back when the nation was entering its recent surge in cases.

A growing number of economists and experts acknowledge that the nation’s top economic policymakers underestimated the delta variant’s threat to job growth, inflation, global supply chains and people’s own comfort levels going into the fall. In recent months, the delta variant of the coronavirus tore through communities with low vaccination rates, spurred sweeping new workplace rules from the Biden administration and rattled consumer sentiment.

“I think there’s a common thread to the mistake in the Fed’s forecast, which is how the pandemic is going to impact the economy even after we got through the worst of it in 2020,” said Skanda Amarnath of Employ America, a left-leaning think tank that advocates for the Fed to let the economy run hot.

Just 10 weeks ago, Federal Reserve Chair Jerome H. Powell explained the Fed’s rosier forecast by saying the delta variant could have fewer implications for the economy if it followed the pattern of previous covid surges. Powell said in late July that with much of the country vaccinated and there being less of a likelihood for shutdowns, “we’re not experts on this but — it seems like a good, going-in estimate would be that the effects [of the delta surge] will probably be less.”

Figures released Friday by the Labor Department underscore how off-base that assessment turned out to be. The labor market in September added the lowest number of jobs this year, and more than 300,000 women over age 20 dropped out of the labor force last month, because they quit work or halted their job searches.

{snip}

By Rachel Siegel

Rachel Siegel is an economics reporter covering the Federal Reserve. She previously covered breaking news for the Post's financial section and local politics for the Post's Metro desk. Before joining the Post in June 2017, Rachel contributed to The Marshall Project and The Dallas Morning News. Twitter https://twitter.com/rachsieg

BumRushDaShow

(128,925 posts)that was actually predicted years ago but COVID-19 might have given it the kick enough to start to come to pass...

Something published by BLS just over 20 years ago (PDF) with dire predictions - https://www.bls.gov/opub/mlr/2000/07/art2full.pdf

Yet just a couple years ago, that prediction was confirmed as being upended -

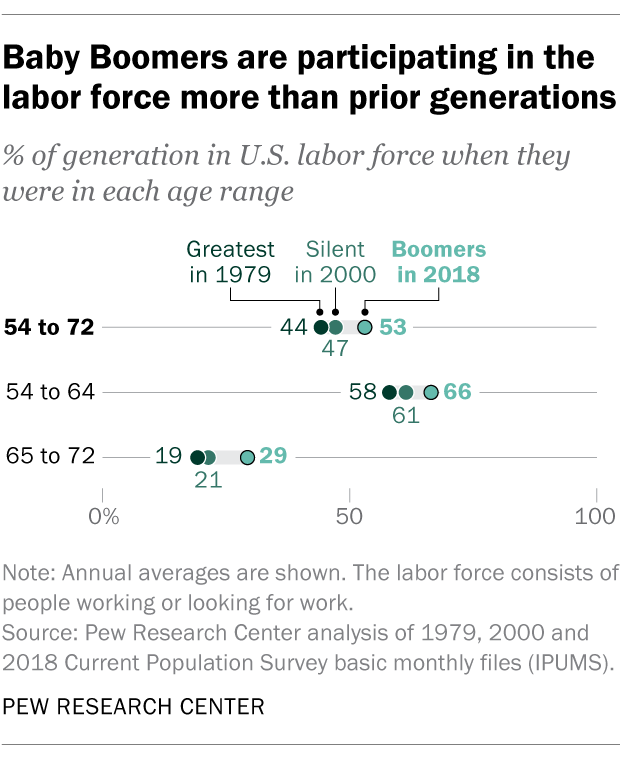

Baby Boomers are staying in the labor force at rates not seen in generations for people their age

By Richard Fry

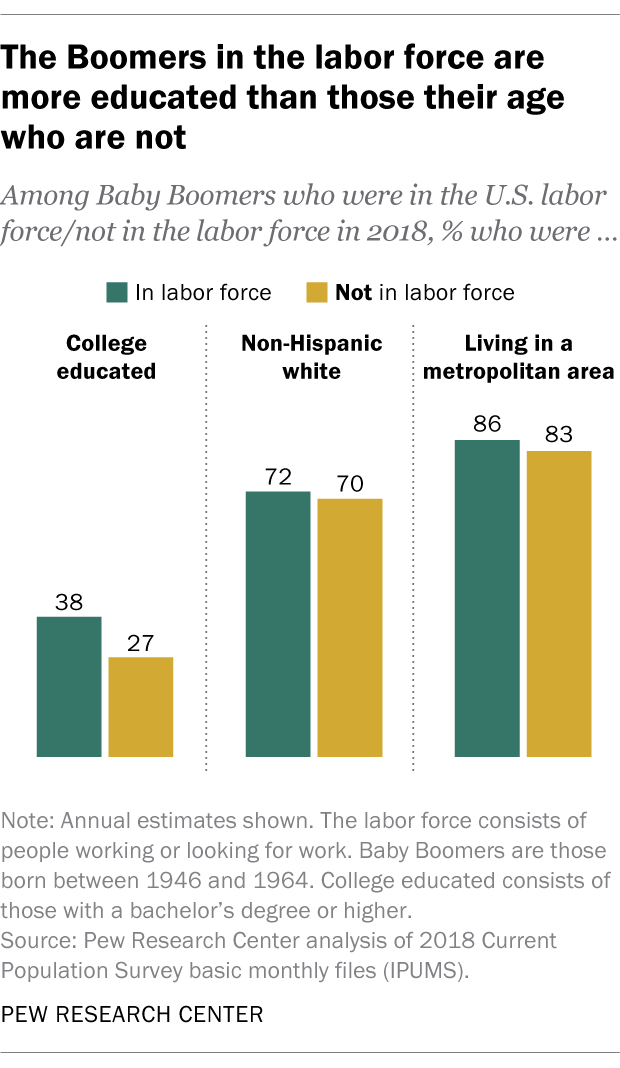

The majority of Baby Boomers (U.S. adults born 1946 to 1964) are still in the labor force, and the oldest among them are staying in the labor force at the highest annual rate for people their age in more than half a century. In 2018, 29% of Boomers ages 65 to 72 were working or looking for work, outpacing the labor market engagement of the Silent Generation (21%) and the Greatest Generation (19%) when they were the same age, according to a new Pew Research Center analysis of official labor force data.

The modern high rate of older Boomers staying in the labor force is attributable to both Boomer women and men. Throughout adulthood, Boomer women have been more likely to be in the labor force than earlier generations, paving the way for their high labor force participation at the ages of 65 to 72 (25%). At the same time, 34% of Boomer men ages 65 to 72 were in the labor force in 2018. Older men have not participated in the labor force at that rate since the early 1970s. Looking at younger Baby Boomers, 66% of adults ages 54 to 64 were in the labor force in 2018.

Though surpassing the Silent and Greatest generations when they were the same age, that is not a modern record since a similar portion of this age group was in the labor force during the Great Recession. The high rate of Boomer labor force participation – relative to recent generations – is consistent with workers’ rising expectations that they will work past age 65. The Employee Benefit Research Institute found in a 2016 survey that 45% of workers ages 55 and older expected to retire after age 65, up from 15% of such workers in the 1996 survey.

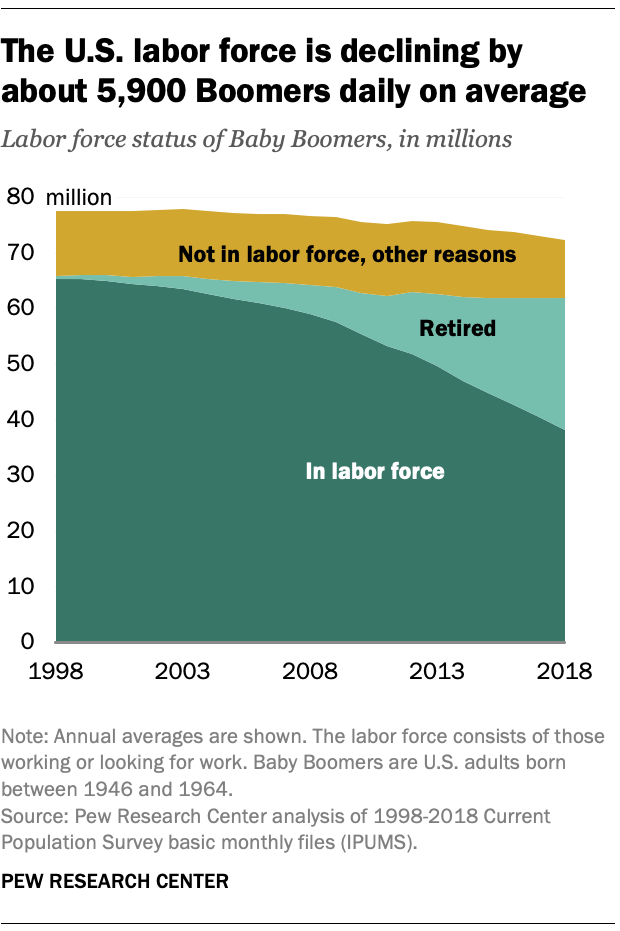

Between 2011 (when the oldest Baby Boomer reached age 65) and 2029 (when the youngest Boomer turns age 65), roughly 3.8 million Boomers are expected to turn 65 each year, or about 10,000 daily. However, in part because of older Boomers’ robust participation rates, 10,000 Boomers are not exiting the labor force every day. Rather, the Boomer labor force has been declining by 2.2 million on average each year since 2010, or about 5,900 daily.

(snip)

https://www.pewresearch.org/fact-tank/2019/07/24/baby-boomers-us-labor-force/

I think Delta became a catalyst for an exit strategy.

ProfessorGAC

(65,013 posts)They have not properly modeled the slow but steady recovery from 20% of the economy being turned off for months.

And, the headline is junk.

To strengthen your point about the models:

Change in non-farm payrolls, September: +194,000 vs. +500,000 expected, +235,000 in August

Unemployment rate: 4.8% vs. 5.1% expected, 5.2% in August

Average hourly earnings, month-over-month: 0.6% vs. 0.4% expected, 0.6% in August

Average hourly earnings, year-over-year: 4.6% vs. 4.6% expected, 4.3% in August

They expected 500k new jobs, got 194k. But(!), the UE rate is 4.8% vs. an expected 5.1%. So UE rate fell by MORE THAN EXPECTED, but expected 2.5 times the new jobs. If 194k caused a 0.4% drop, a half-million would have caused 1%. Expected should have been 4.2%, not 5.1%.

Unless there's a typo in the article, that math makes no sense.

BumRushDaShow

(128,925 posts)I had posted this image -

https://www.democraticunderground.com/?com=view_post&forum=1014&pid=2803255

(in fact, we had a little discussion about that then too ![]() )

)

I think there are some "new variables" that are making it harder to nail down. I know Deminpenn mentioned a lack of "childcare" providers and that is a real issue too.

I recently saw an article where many of the truck-driving schools had shut down last year until recently, so trying to get new drivers on-boarded right away has been difficult (it can take months to get trained and certified) and if the older drivers have hung up the driver caps, then you have a bottleneck that impacts a number of things downstream.

mahatmakanejeeves

(57,436 posts)Yeah, I'm a few days late this month.

Payroll employment rises by 194,000 in September; unemployment rate declines to 4.8%

Employment Situation Summary

Transmission of material in this news release is embargoed until 8:30 a.m. (ET) Friday, October 8, 2021

Technical information:

Household data: (202) 691-6378 * cpsinfo@bls.gov * www.bls.gov/cps

Establishment data: (202) 691-6555 * cesinfo@bls.gov * www.bls.gov/ces

Media contact: (202) 691-5902 * PressOffice@bls.gov

THE EMPLOYMENT SITUATION -- SEPTEMBER 2021

Total nonfarm payroll employment rose by 194,000 in September, and the unemployment rate fell by 0.4 percentage point to 4.8 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing. Employment in public education declined over the month.

This news release presents statistics from two monthly surveys. The household survey measures labor force status, including unemployment, by demographic characteristics. The establishment survey measures nonfarm employment, hours, and earnings by industry. For more information about the concepts and statistical methodology used in these two surveys, see the Technical Note.

Household Survey Data

The unemployment rate fell by 0.4 percentage point to 4.8 percent in September. The number of unemployed persons fell by 710,000 to 7.7 million. Both measures are down considerably from their highs at the end of the February-April 2020 recession. However, they remain above their levels prior to the coronavirus (COVID-19) pandemic (3.5 percent and 5.7 million, respectively, in February 2020). (See table A-1. See the box note at the end of this news release for more information about how the household survey and its measures were affected by the coronavirus pandemic.)

Among the major worker groups, the unemployment rates for adult men (4.7 percent), adult women (4.2 percent), Whites (4.2 percent), and Blacks (7.9 percent) declined in September. The jobless rates for teenagers (11.5 percent), Asians (4.2 percent), and Hispanics (6.3 percent) showed little change over the month. (See tables A-1, A-2, and A-3.)

Among the unemployed, the number of permanent job losers declined by 236,000 to 2.3 million in September but is 953,000 higher than in February 2020. The number of persons on temporary layoff, at 1.1 million, changed little in September. This measure is down considerably from the high of 18.0 million in April 2020 but is 374,000 above the February 2020 level. The number of reentrants to the labor force decreased by 198,000 in September to 2.3 million, after increasing by a similar amount in August. (Reentrants are persons who previously worked but were not in the labor force prior to beginning their job search.) (See table A-11.)

The number of long-term unemployed (those jobless for 27 weeks or more) decreased by 496,000 in September to 2.7 million but is 1.6 million higher than in February 2020. The long-term unemployed accounted for 34.5 percent of the total unemployed in September. The number of persons jobless less than 5 weeks, at 2.2 million, changed little. (See table A-12.)

The labor force participation rate was little changed at 61.6 percent in September and has remained within a narrow range of 61.4 percent to 61.7 percent since June 2020. The participation rate is 1.7 percentage points lower than in February 2020. The employment-population ratio, at 58.7 percent, edged up in September. This measure is up from its low of 51.3 percent in April 2020 but remains below the figure of 61.1 percent in February 2020. (See table A-1.)

In September, the number of persons employed part time for economic reasons, at 4.5 million, was essentially unchanged for the second month in a row. There were 4.4 million persons in this category in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. (See table A-8.)

The number of persons not in the labor force who currently want a job was 6.0 million in September, little changed over the month but up by 959,000 since February 2020. These individuals were not counted as unemployed because they were not actively looking for work during the last 4 weeks or were unavailable to take a job. (See table A-1.)

Among those not in the labor force who wanted a job, the number of persons marginally attached to the labor force edged up to 1.7 million in September, following a decline in the prior month. These individuals wanted and were available for work and had looked for a job sometime in the prior 12 months but had not looked for work in the 4 weeks preceding the survey. The number of discouraged workers, a subset of the marginally attached who believed that no jobs were available for them, was 450,000 in September, little changed from the previous month. (See Summary table A.)

Household Survey Supplemental Data

In September, 13.2 percent of employed persons teleworked because of the coronavirus pandemic, little changed from the prior month. These data refer to employed persons who teleworked or worked at home for pay at some point in the last 4 weeks specifically because of the pandemic.

In September, 5.0 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic--that is, they did not work at all or worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is down from 5.6 million in August. Among those who reported in September that they were unable to work because of pandemic-related closures or lost business, 15.5 percent received at least some pay from their employer for the hours not worked, little changed from the prior month.

Among those not in the labor force in September, 1.6 million persons were prevented from looking for work due to the pandemic, little changed from August. (To be counted as unemployed, by definition, individuals must be either actively looking for work or on temporary layoff.)

These supplemental data come from questions added to the household survey beginning in May 2020 to help gauge the effects of the pandemic on the labor market. The data are not seasonally adjusted. Tables with estimates from the supplemental questions for all months are available online at www.bls.gov/cps/effects-of-the-coronavirus-covid-19-pandemic.htm.

Establishment Survey Data

Total nonfarm payroll employment increased by 194,000 in September. Thus far this year, monthly job growth has averaged 561,000. Nonfarm employment has increased by 17.4 million since a recent trough in April 2020 but is down by 5.0 million, or 3.3 percent, from its pre-pandemic level in February 2020. In September, notable job gains occurred in leisure and hospitality, in professional and business services, in retail trade, and in transportation and warehousing. Employment in public education declined over the month. (See table B-1. See the box note at the end of this news release for more information about how the establishment survey and its measures were affected by the coronavirus pandemic.)

Employment in leisure and hospitality increased by 74,000 in September, with continued job growth in arts, entertainment, and recreation (+43,000). Employment in food services and drinking places changed little for the second consecutive month, compared with an average monthly gain of 197,000 from January through July. Employment in leisure and hospitality is down by 1.6 million, or 9.4 percent, since February 2020.

Professional and business services added 60,000 jobs in September. Employment continued to increase in architectural and engineering services (+15,000), management and technical consulting services (+15,000), and computer systems design and related services (+9,000). Employment in professional and business services is 385,000 below its level in February 2020.

In September, employment in retail trade rose by 56,000, following 2 months of little change. Over the month, employment gains occurred in clothing and clothing accessories stores (+27,000), general merchandise stores (+16,000), and building material and garden supply stores (+16,000). These gains were partially offset by a loss in food and beverage stores (-12,000). Retail trade employment is 202,000 lower than its level in February 2020.

Employment in transportation and warehousing increased by 47,000 in September, in line with gains in the prior 2 months. In September, job gains continued in warehousing and storage (+16,000), couriers and messengers (+13,000), and air transportation (+10,000). Employment in transportation and warehousing is 72,000 above its pre-pandemic level in February 2020.

Employment in the information industry increased by 32,000 in September. Gains occurred in motion picture and sound recording industries (+14,000); in publishing industries, except Internet (+11,000); and in data processing, hosting, and related services (+6,000). Employment in information is down by 108,000 since February 2020.

In September, social assistance added 30,000 jobs, led by a gain in child day care services (+18,000). Employment in social assistance is 204,000 lower than in February 2020.

Employment in manufacturing increased by 26,000 in September, with gains in fabricated metal products (+8,000), machinery (+6,000), and printing and related support activities (+4,000). These gains were partially offset by a decline of 6,000 in motor vehicles and parts. Manufacturing employment is down by 353,000 since February 2020.

Construction employment rose by 22,000 in September but has shown little net change thus far this year. Employment in construction is 201,000 below its February 2020 level.

In September, employment in wholesale trade increased by 17,000, almost entirely in the durable goods component (+16,000). Employment in wholesale trade is down by 159,000 since February 2020.

Mining employment continued to trend up in September (+5,000), reflecting growth in support activities for mining (+4,000). Mining employment has risen by 59,000 since a trough in August 2020 but is 93,000 below a peak in January 2019.

In September, employment decreased by 144,000 in local government education and by 17,000 in state government education. Employment changed little in private education (-19,000). Most back-to-school hiring typically occurs in September. Hiring this September was lower than usual, resulting in a decline after seasonal adjustment. Recent employment changes are challenging to interpret, as pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns. Since February 2020, employment is down by 310,000 in local government education, by 194,000 in state government education, and by 172,000 in private education.

Employment in health care changed little in September (-18,000). Job losses occurred in nursing and residential care facilities (-38,000) and hospitals (-8,000), while ambulatory health care services added jobs (+28,000). Employment in health care is down by 524,000 since February 2020, with nursing and residential care facilities accounting for about four-fifths of the loss.

In September, employment showed little change in financial activities and in other services.

Average hourly earnings for all employees on private nonfarm payrolls rose by 19 cents to $30.85 in September, following large increases in the prior 5 months. In September, average hourly earnings of private-sector production and nonsupervisory employees rose by 14 cents to $26.15. The data for recent months suggest that the rising demand for labor associated with the recovery from the pandemic may have put upward pressure on wages. However, because average hourly earnings vary widely across industries, the large employment fluctuations since February 2020 complicate the analysis of recent trends in average hourly earnings. (See tables B-3 and B-8.)

In September, the average workweek for all employees on private nonfarm payrolls increased by 0.2 hour to 34.8 hours. In manufacturing, the average workweek was unchanged at 40.4 hours, and overtime edged up by 0.1 hour to 3.3 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.1 hour to 34.2 hours. (See tables B-2 and B-7.)

The change in total nonfarm payroll employment for July was revised up by 38,000, from +1,053,000 to +1,091,000, and the change for August was revised up by 131,000, from +235,000 to +366,000. With these revisions, employment in July and August combined is 169,000 higher than previously reported. (Monthly revisions result from additional reports received from businesses and government agencies since the last published estimates and from the recalculation of seasonal factors.)

_____________

The Employment Situation for October is scheduled to be released on Friday, November 5, 2021, at 8:30 a.m. (ET).

* * * * *

[center]Facilities for Sensory Impaired[/center]

Information from these releases will be made available to sensory impaired individuals upon request. Voice phone: 202-691-5200, Federal Relay Services: 1-800-877-8339.

calimary

(81,238 posts)mahatmakanejeeves

(57,436 posts)Column: Unemployment benefits weren't what kept workers home. The latest crummy jobs report proves it

Michael Hiltzik

Tue, October 12, 2021, 9:00 AM

The latest jobs report from the federal government, covering September employment, had some bad news and, so to speak, some better news.

The report, issued Oct. 8 by the Bureau of Labor Statistics, was a big miss compared with expectations — nonfarm employment rose by only 194,000, the bureau said, while economists were projecting 500,000 — and the weakest so far this year.

What was more encouraging about the generally dismal picture was that it ruled out a theme favored by conservative politicians and pundits. They had asserted that the federal boost to state unemployment benefits — which came to $300 a week this year, down from last year's $600 a week — had kept workers glued to their living room couches instead of going out and getting a job.

{snip}

But the latest job figures point to different forces keeping workers at home. One explanation is surely the rise of the Delta variant of the coronavirus, which led to a resumption of business closures and renewed safety fears among workers in jobs requiring close contact with the public, such as retail and restaurant employees.

Delta-related school closings may also have placed a particular burden on working women. About 309,000 women ages 20 and older dropped out of the workforce in September. With a loss of about 40,000 women in August, the female civilian workforce declined by about 350,000, or 0.5%, in those two months, the first such declines in a year.

There are also signs that workers are showing new reluctance to return to lousy jobs, whether defined by low pay, abusive or hazardous workplaces, or limited opportunities for advancement.

Some economists conjecture that savings from the higher unemployment benefits are giving these workers some breathing room to look for better work. That might be interpreted as justifying the impression that unemployment payments kept workers off the job, but in those cases the main result is still a job search, merely a more discerning one.

The government's latest monthly Job Openings and Labor Turnover Summary, the so-called JOLTS report, underscores that the slow job recovery has much to do with workers looking for better work. According to the report, 4.3 million workers, or 2.9% of the labor force, quit their jobs in August. That's the highest rate since the BLS began tracking the data in December 2000.

{snip}